0000924168FALSEENERGY FOCUS, INC/DE00009241682023-05-112023-05-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 13, 2024

ENERGY FOCUS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36583 | | 94-3021850 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 32000 Aurora Road Suite B | Solon, | OH | 44139 |

| (Address of principal executive offices) | (Zip Code) |

(440) 715-1300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | EFOI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2024, Energy Focus, Inc. issued a press release announcing its financial results for the three months ended March 31, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This information, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | |

| Number | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: May 13, 2024 | | |

| | |

| | |

| ENERGY FOCUS, INC. |

| |

| |

| By: | /s/ Chiao Chieh (Jay) Huang |

| Name: | Chiao Chieh (Jay) Huang |

| Title: | Chief Executive Officer |

Exhibit 99.1

Energy Focus, Inc. Reports First Quarter 2024 Financial Results

SOLON, Ohio, May 10, 2024 -- Energy Focus, Inc. (NASDAQ: EFOI), a leader in energy-efficient lighting and control system products for the commercial and military maritime and consumer markets, today announced financial results for its first quarter ended March 31, 2024.

First Quarter 2024 Financial Highlights:

•Net sales of $0.8 million, decreased $0.1 million or 10.4% compared to the first quarter of 2023, driven by a decrease of $ 75 thousand in military maritime sales and $ 22 thousand in commercial sales. As compared to the fourth quarter of 2023, net sales decreased by 65.2%, primarily due to a $1.5 million decrease in military sales, while commercial maritime sales remained flat.

•Gross profit margin was 14.4% of net sales, which increased from 1.8% in the first quarter of 2023 and also from 3.1% in the fourth quarter of 2023. This improvement was primarily driven by our cost reduction plan in freight in and out variances.

•Loss from operations of $0.6 million, compared to a loss from operations of $1.2 million in the first quarter of 2023 and to a loss from operations of $0.8 million in the fourth quarter of 2023.

•Net loss of $0.4 million, or $(0.09) per basic and diluted share of common stock, compared to a net loss of $1.3 million, or $(0.58) per basic and diluted share of common stock, in the first quarter of 2023. Sequentially, the net loss decreased by $0.4 million compared to net loss of $0.8 million, or $(0.20) per basic and diluted share of common stock in the fourth quarter of 2023.

•Cash was $1.0 million as of March 31, 2024 compared to $2.0 million as of December 31, 2023. The changes in the cash movement is due to the payoff of the Streeterville Notes (as defined below) of $1.0 million in cash during the first quarter of 2024.

•On March 28, 2024, Energy Focus, Inc. entered into certain securities purchase agreements with certain accredited investors, pursuant to which the Company agreed to issue and sell in a private placement an aggregate of 283,109 shares of the Company’s common stock, par value $0.0001 per share, for a purchase price per share of $1.59. Aggregate gross proceeds to the Company in respect of the Private Placement is approximately $450,000, excluding the offering expenses paid by the Company. The Private Placement was closed on March 28, 2024.

•On January 18, 2024, the Company and Streeterville Capital,LLC (“Streeterville”) entered into a payoff letter and exchange agreement (the “Agreement”) to pay off a note entered into by and between the Company and Streeterville in 2022 (the 2022 “Streeterville Note ”) early. The Agreement provided that the Company made payments to reduce the outstanding obligations under the 2022 Streeterville Note of $1.0 million in cash by January 19, 2024 and exchanges 94,440 shares of common stocks by January 23, 2024 for the remaining $141,660. In January 2024, the Company paid off the 2022 Streeterville Note in full early. At termination, the Company recognized $187 thousand of other income which was included in other income in the in the Unaudited Condensed Consolidated Statements of Operations.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Management Commentary

“Throughout the first quarter of 2024, Energy Focus has intensified its cost management strategies while maintaining high levels of customer satisfaction and timely delivery of eco-friendly products. Our investments in sustainable energy solutions have empowered us to not only enhance our product quality and services but also to streamline our offerings efficiently. As we advance, our commitment to Environmental, Social, and Governance (ESG) principles is integral to our strategy," stated Chiao-Chieh (Jay) Huang, Chief Executive Officer.

“From our eco-conscious headquarters in Cleveland, Ohio, we capitalize on our global network, including facilities and offices in Taipei, to integrate resources, cater to a diverse clientele, and manage our supply chain. Our forward-looking product strategy pivots on boosting the efficiency and capabilities of our existing product lines through strategic partnerships, innovative technological advancements, and selective acquisitions. We are dedicated to pioneering products that over-perform the market expectations, with a keen focus on sustainability. Additionally, we are actively exploring new markets in the Gulf Cooperation Council (GCC) and Central Asia regions to expand our business landscape.”

“In the fiscal year 2024, the Energy Focus team is united in the ambition to deliver top-tier quality to our customers and to establish value-driven partnerships. Our management team, as a group, endeavor to work our brand to secure global recognition and success, with higher management efficiency and better product supply midst geopolitical tensions, rising inflation, complex supply chain challenges, and increasing cybersecurity threats. We are determined not only to persevere but to thrive. Through comprehensive training and enhanced teamwork at all organizational levels, we uphold our responsibility towards our customers and shareholders. With warmest regards and a message of hope, we anticipate a year filled with growth, innovation, and collective achievement.”

First Quarter 2024 Financial Results:

Net sales were $0.8 million for the first quarter of 2024, compared to $0.9 million in the first quarter of 2023, a decrease of $0.1 million, or 10.4%. Net sales from military maritime products were approximately $0.5 million, or 64.1% of total net sales, for the first quarter of 2024, compared to $0.6 million, or 65.5% of total net sales, in the first quarter of 2023. Net sales from commercial products were approximately $0.3 million, or 35.9% of total net sales, for the first quarter of 2024, as compared to $0.3 million, or 34.5% of total net sales, in the first quarter of 2023. The sales decrease was due to the downward market price adjustments.

Gross profit margin was $120 thousand, or 14.4% of net sales, for the first quarter of 2024. This compares with gross profit margin of $17 thousand, or 1.8% of net sales, in the first quarter of 2023. Sequentially, this compares with gross profit of $75 thousand, or 3.1% of net sales, in the fourth quarter of 2023. The quarter-over-quarter increase for the first quarter of 2024 in gross margin rate was primary driven by (1) a $14 thousand, or 1.3%, decrease in fixed costs such as production salaries (2) favorable freight-in variances of $12 thousand, or 1% of net sales, and (3) favorable price and usage variances for material and labor of $117 thousand, or 15% of net sales.

Operating loss was $0.6 million for the first quarter of 2024, compared to an operating loss of $1.2 million in the first quarter of 2023. Sequentially, this compares to an operating loss of $0.8 million in the fourth quarter of 2023. Net loss was $0.4 million, or $(0.09) per basic and diluted share of common stock, for the first quarter of 2024, compared with a net loss of $1.3 million, or $(0.58) per basic and diluted share of common stock, in the first quarter of 2023. Sequentially,

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

this compares with a net loss of $0.8 million, or $(0.20) per basic and diluted share of common stock, in the fourth quarter of 2023.

Adjusted EBITDA, as defined under “Non-GAAP Measures” below, was a loss of $0.6 million for the first quarter of 2024, compared with a loss of $1.2 million in the first quarter of 2023 and a loss of $0.7 million in the fourth quarter of 2023. The improved adjusted EBITDA loss in the first quarter of 2024, as compared to the adjusted EBITDA loss for the first and fourth quarters of 2023, was due to the lower costs, primarily salaries and related payroll costs.

The substantial decrease in cash used in operating activity in the first three months of 2024 was primarily related to efforts to collect accounts receivable led to during the first three months of 2024, compared to the first three months of 2023; offset by higher accounts payable as of December 31, 2023 and efforts to manage inventory levels, reflecting more purchase activities in the fourth quarter of 2023, led to higher cash outflows in the first quarter of 2024. Net cash provided by financing activities during the three months ended March 31, 2024 was $1.0 million, primarily related to net payments on the 2022 Streeterville Note of $1.0 million.

About Energy Focus:

Energy Focus is an industry-leading innovator of sustainable light-emitting diode (“LED”) lighting and lighting control technologies and solutions. As the creator of the first flicker-free LED lamps, Energy Focus develops high quality LED lighting products and controls that provide extensive energy and maintenance savings, as well as aesthetics, safety, health and sustainability benefits over conventional lighting. Energy Focus is headquartered in Solon, Ohio. For more information, visit our website at www.energyfocus.com.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Forward-Looking Statements:

This press release contains information about the Company’s view of its future expectations, plans and prospects that constitute forward-looking statements. Actual results may differ materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors including, but not limited to, risks and uncertainties associated with its ability to raise additional funding, its ability to maintain and grow its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction of new products and services, the successful integration of acquired companies, technologies and assets into its portfolio of products and services, marketing and other business development initiatives, competition in the industry, general government regulation, economic conditions, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience necessary to meet the requirements of its clients, and its ability to protect its intellectual property. The Company encourages you to review other factors that may affect its future results in the Company’s annual reports and in its other filings with the Securities and Exchange Commission.

###

Investor Contact:

Chiao Chieh (Jay) Huang

Chief Executive Officer

(800) 327-7877

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ 972 | | $ 2,030 |

| Trade accounts receivable, less allowances of $9 and $20, respectively | 396 | | 1,570 |

Trade accounts receivable - related party | — | | 202 |

| Inventories, net | 4,397 | | 4,439 |

| Prepayments to vendors | 516 | | 792 |

| Prepaid and other current assets | 199 | | 156 |

| Total current assets | 6,480 | | 9,189 |

| | | |

| Property and equipment, net | 104 | | 112 |

| Operating lease, right-of-use asset | 833 | | 899 |

| Total assets | $ 7,417 | | $ 10,200 |

| | | |

| LIABILITIES | | | |

| Current liabilities: | | | |

| Accounts payable | $ 1,389 | | $ 1,624 |

Accounts payable - related party | 1,311 | | 2,146 |

| Accrued liabilities | 107 | | 110 |

Accrued legal and professional fees | 111 | | 64 |

| Accrued payroll and related benefits | 164 | | 199 |

| Accrued sales commissions | 26 | | 62 |

| Accrued warranty reserve | 116 | | 150 |

| Operating lease liabilities | 233 | | 223 |

| Advanced capital contribution | — | | 450 |

| Promissory notes payable, net of discounts and loan origination fees | — | | 1,323 |

| Total current liabilities | 3,457 | | 6,351 |

(continued on next page)

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| | | |

| Operating lease liabilities, net of current portion | 735 | | 798 |

| Total liabilities | 4,192 | | 7,149 |

| | | |

| STOCKHOLDERS' EQUITY | | | |

| Preferred stock, par value $0.0001 per share: | | | |

Authorized: 5,000,000 shares (3,300,000 shares designated as Series A Convertible Preferred Stock) at March 31, 2024 and December 31, 2023 | | | |

Issued and outstanding: 876,447 at March 31, 2024 and December 31, 2023 | — | | — |

| Common stock, par value $0.0001 per share: | | | |

Authorized: 50,000,000 shares at March 31, 2024 and December 31, 2023 | | | |

Issued and outstanding: 4,726,149 at March 31, 2024 and 4,348,690 at December 31, 2023 | — | | — |

| Additional paid-in capital | 156,961 | | 156,369 |

| Accumulated other comprehensive loss | (3) | | (3) |

| Accumulated deficit | (153,733) | | (153,315) |

| Total stockholders' equity | 3,225 | | 3,051 |

| Total liabilities and stockholders' equity | $ 7,417 | | $ 10,200 |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Net sales | $ 833 | | $ 2,393 | | $ 930 |

| Cost of sales | 713 | | 2,318 | | 913 |

Gross profit | 120 | | 75 | | 17 |

| | | | | |

| Operating expenses: | | | | | |

| Product development | 128 | | 144 | | 154 |

| Selling, general, and administrative | 591 | | 696 | | 1,066 |

| Total operating expenses | 719 | | 840 | | 1,220 |

| Loss from operations | (599) | | (765) | | (1,203) |

| | | | | |

| Other expenses (income): | | | | | |

Interest income | — | | (57) | | — |

| Interest expense | 5 | | 154 | | 123 |

| Gain on debt extinguishment | (187) | | — | | — |

| Other income | — | | (14) | | — |

| Other expenses | 1 | | (2) | | 7 |

| | | | | |

| Loss before income taxes | (418) | | (846) | | (1,333) |

Provision for income taxes | — | | 3 | | — |

| Net loss | $ (418) | | $ (849) | | $ (1,333) |

| | | | | |

| Net loss per common share attributable to common stockholders - basic: | | | | | |

| From operations | $ (0.09) | | $ (0.20) | | $ (0.58) |

| | | | | |

| Weighted average shares of common stock outstanding: | | | | | |

Basic and diluted* | 4,433 | | 4,349 | | 2,310 |

| | | | | |

* Shares outstanding for prior periods have been restated for the 1-for-7 reverse stock split effective June 16, 2023.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | |

| (unaudited) | | | | | |

| Three months ended |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Cash flows from operating activities: | | | | | |

| Net loss | $ (418) | | $ (849) | | $ (1,333) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Gain on debt extinguishment | (187) | | — | | — |

| Depreciation | 8 | | 9 | | 8 |

| Stock-based compensation | 1 | | 8 | | 26 |

| Reversal of provision for credit losses and sales return | (64) | | (44) | | 29 |

| Provision for slow-moving and obsolete inventories | 67 | | 93 | | (23) |

| Provision for warranties | (34) | | 4 | | (40) |

| Amortization of loan discounts and origination fees | 5 | | 57 | | 62 |

| Changes in operating assets and liabilities (sources / (uses) of cash): | | | | | |

| Accounts receivable | 1,440 | | (682) | | (496) |

Accounts receivable - related party | — | | (202) | | — |

| Inventories | (25) | | 369 | | 562 |

| Prepayments to vendors | 102 | | (60) | | (23) |

| Prepaid and other assets | (43) | | 33 | | 6 |

| Accounts payable | (61) | | (706) | | (27) |

Accounts payable - related party | (835) | | 1,874 | | — |

| Accrued and other liabilities | (27) | | (48) | | 44 |

| Operating lease - ROU and liabilities | 13 | | 75 | | 22 |

| Total adjustments | 360 | | 780 | | 150 |

| Net cash used in operating activities | (58) | | (69) | | (1,183) |

| Cash flows from investing activities: | | | | | |

| Acquisitions of property and equipment | — | | (42) | | — |

| Net cash flows from investing activities | — | | (42) | | — |

(continued on next page)

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Condensed Consolidated Statements of Cash Flows - continued

| | | | | | | | | | | | | | | | | |

| (in thousands) | | | | | |

| (unaudited) | | | | | |

| Three months ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Cash flows from financing activities (sources / (uses) of cash): | | | | | |

| Issuance of common stock and warrants | — | | — | | 3,025 |

| Payments on the 2022 Streeterville Note | (1,000) | | — | | (500) |

Net payments on proceeds from the credit line borrowings - Credit Facilities | — | | 450 | | (1,093) |

| Net cash provided by financing activities | (1,000) | | 450 | | 1,432 |

| | | | | |

Net (decrease) increase in cash | (1,058) | | 339 | | 249 |

| Cash, beginning of period | 2,030 | | 1,691 | | 52 |

| Cash, end of period | $ 972 | | $ 2,030 | | $ 301 |

| | | | | | | | | | | | | | | | | |

Non-cash investing and financing activities: | | | | | |

| Debt-to-equity exchange transactions | $ 591 | | $ 1,716 | | $ — |

| | | | | |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Sales by Product

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three months ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Net sales: | | | | | |

| Commercial | $ 299 | | $ 332 | | $ 321 |

| MMM products | 534 | | 2,061 | | 609 |

| Total net sales | $ 833 | | $ 2,393 | | $ 930 |

Non-GAAP Measures

In addition to the results in this release that are presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), we provide certain non-GAAP measures, which present operating results on an adjusted basis. These non-GAAP measures are supplemental measures of performance that are not required by or presented in accordance with U.S. GAAP and, include:

•total availability, which we define as our ability on the period end date to access additional cash if necessary under our short-term credit facilities, plus the amount of cash on hand on that same date;

•adjusted EBITDA, which we define as net income (loss) before giving effect to financing charges, income taxes, non-cash depreciation, stock compensation, and incentive compensation; and

•adjusted gross margins, which we define as our gross profit margins during the period without the impact from excess and obsolete, in-transit and net realizable value inventory reserve movements that do not reflect current period inventory decisions.

We believe that our use of these non-GAAP financial measures permits investors to assess the operating performance of our business relative to our performance based on U.S. GAAP results and relative to other companies within the industry by isolating the effects of items that may vary from period to period without correlation to core operating performance or that vary widely among similar companies, and to assess liquidity, cash flow performance of the operations, and the product margins of our business relative to our U.S. GAAP results and relative to other companies in the industry by isolating the effects of certain items that do not have a current period impact. However, our presentation of these non-GAAP measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items or that the items for which we have made adjustments are unusual or infrequent or will not recur. Further, there are limitations on the use of these non-GAAP measures to compare our results to other companies within the industry because they are not necessarily standardized or comparable to similarly titled measures used by other companies. We believe that the disclosure of these non-GAAP measures is useful to investors as they form part of the basis for how our management team and Board of Directors evaluate our operating performance.

Total availability, adjusted EBITDA and adjusted gross margins do not represent cash generated from operating activities in accordance with U.S. GAAP, are not necessarily indicative of cash available to fund cash needs and are not intended to and should not be considered as alternatives to cash flow, net income and gross profit margins, respectively, computed in accordance with U.S. GAAP as measures of liquidity or operating performance. Reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP are provided below for total availability, adjusted EBITDA and adjusted gross margins, respectively.

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

| | | | | | | | | | | | | | | | | |

| As of |

| (in thousands) | March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Total borrowing capacity under credit facilities | $ — | | $ — | | $ 500 |

Less: Credit line borrowings, gross(1) | — | | — | | (400) |

Excess availability under credit facilities(2) | — | | — | | 100 |

| Cash | 972 | | 2,030 | | 301 |

Total availability(3) | $ 972 | | $ 2,030 | | $ 401 |

(1)Forms 10-Q and 10-K Balance Sheets reflect the Line of credit net of debt financing costs of $0, $0 and $29, respectively. |

(2)Excess availability under credit facilities - represents difference between maximum borrowing capacity of credit facilities and actual borrowings |

(3)Total availability - represents Company’s ‘access’ to cash if needed at point in time |

| | | | | | | | | | | | | | | | | |

| Three months ended |

| (in thousands) | March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| Net loss | $ (418) | | $ (849) | | $ (1,333) |

| Interest expense | 5 | | 154 | | 123 |

| Gain on debt extinguishment | (187) | | (14) | | — |

| Income tax provision | — | | 3 | | — |

| Depreciation | 8 | | 9 | | 8 |

| Stock-based compensation | 1 | | 8 | | 26 |

| Other Incentive Compensation | 10 | | 9 | | — |

| Adjusted EBITDA | $ (581) | | $ (680) | | $ (1,176) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (in thousands) | March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| ($) | (%) | | ($) | (%) | | ($) | (%) |

| Net sales | $833 | | | $2,393 | | | $930 | |

| Reported gross profit | 120 | 14.4 % | | 75 | 3.1 % | | 17 | 1.8 % |

| Errors and Omissions, in-transit and net realizable value inventory reserve changes | 67 | 8.0 % | | 93 | 3.9 % | | (23) | (2.5) % |

| Adjusted gross margin | $187 | 22.4 % | | $168 | 7.0 % | | $(6) | (0.7) % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

32000 Aurora Road, Solon, OH 44139 • www.energyfocus.com • 800.327.7877

Cover

|

May 11, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 13, 2024

|

| Entity Registrant Name |

ENERGY FOCUS, INC/DE

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36583

|

| Entity Tax Identification Number |

94-3021850

|

| Entity Address, Address Line One |

32000 Aurora Road Suite B

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44139

|

| City Area Code |

440

|

| Local Phone Number |

715-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

EFOI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000924168

|

| Amendment Flag |

false

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

32000 Aurora Road Suite B

|

| Entity Address, Postal Zip Code |

44139

|

| Entity Address, State or Province |

OH

|

| Entity Address, City or Town |

Solon,

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

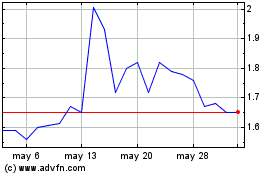

Energy Focus (NASDAQ:EFOI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Energy Focus (NASDAQ:EFOI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024