Viper Energy, Inc., a Subsidiary of Diamondback Energy, Inc., Announces Acquisition

11 Septiembre 2024 - 3:05PM

Viper Energy, Inc. (NASDAQ:VNOM) (“Viper” or the “Company”), a

subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG)

(“Diamondback”), today announced it and its operating subsidiary

Viper Energy Partners LLC (“OpCo”) have entered into a definitive

purchase and sale agreement to acquire certain mineral and royalty

interest- owning subsidiaries of Tumbleweed Royalty IV, LLC in

exchange for $461.0 million of cash and approximately 10.1 million

OpCo units, subject to customary adjustments. The cash portion of

this transaction is expected to be funded through a combination of

cash on hand, borrowings under the Company’s credit facility, and

proceeds from one or more capital markets transactions, subject to

market conditions and other factors. The issuance of OpCo units

will be accompanied by the grant of an option to purchase an equal

number of shares of Class B common stock of the Company. The

purchase agreement also includes a potential additional payment in

Q1 2026 of contingent cash consideration of up to $41.0 million,

based on the average 2025 West Texas Intermediate (“WTI”) price.

This transaction is expected to close in early Q4 2024, subject to

customary closing conditions.

The Company also announced today that it

previously closed two related acquisitions. On September 3, 2024,

OpCo completed the acquisition of certain mineral and royalty

interest-owning entities from Tumbleweed-Q Royalty Partners, LLC

and MC Tumbleweed Royalty, LLC for a combined $189.0 million of

cash consideration, plus potential additional payments in Q1 2026

of contingent cash consideration of up to an aggregate of $9.0

million, based on the average 2025 WTI price. These transactions

were funded with a combination of cash on hand and borrowings under

the Company’s credit facility.

COMBINED ACQUISITION

HIGHLIGHTS

- Approximately 3,727 net royalty

acres ("NRAs") in the Permian Basin

- Highly undeveloped asset with a

focus in the core of the Midland Basin

- High confidence visibility to

near-term production growth results in meaningful accretion to all

relevant financial metrics; accretion expected to grow in

subsequent years due to the highly undeveloped nature of the

asset

- Current production of approximately

2,500 Bo/d (4,000 Boe/d); expected to increase to approximately

4,500 Bo/d for full year 2025 based on only current producing wells

("PDP"), drilled but uncompleted wells ("DUCs"), permits, and

Diamondback's expected development plan

- Viper currently expects Diamondback

to complete roughly 120-140 gross locations beyond existing DUCs

and permits on the acquired properties through year-end 2026 with

an estimated average ~3.0% net revenue interest ("NRI") (3.5 - 4.0

net 100% royalty interest wells); expected to drive an increase in

Diamondback-operated production from an average of approximately

1,000 Bo/d in 2025 to approximately 3,000 Bo/d in 2026

- Increases expected pro forma 2025

per share return of capital to Class A shareholders by an estimated

4-5%, assuming the Company funds a portion of the remaining cash

consideration of the transaction through the successful issuance of

approximately 8.0 million Class A shares of Viper's common

stock

ASSET DETAILS

- Approximately 3,237 NRAs in the Midland Basin and 490 NRAs in

the Delaware Basin with an average 1.0% NRI

- Combined 16 gross (0.3 net) rigs

currently operating on acreage position, led by ExxonMobil (8) and

Diamondback (3)

- Midland Basin:

- Approximately 75% of acreage

operated by Diamondback (~950 NRAs) and ExxonMobil (~1,410

NRAs)

- >70% of acreage in Midland and

Martin counties

- Largely undeveloped acreage that

provides an average ~1.4% NRI across an estimated 96 completely

undeveloped horizontal units normalized to 1,280 gross acres;

represents ~1,640 NRAs and an expected ~23.7 net locations

- 5.7 net DUCs and permits; expected

to be turned to production over the next 12-15 months

- Delaware Basin:

- Approximately 80% of acreage in Lea

and Eddy counties

- Largest exposure to ConocoPhillips

and Mewbourne as primary operators; other notable operators include

Devon, Coterra, Chevron, and EOG

- 0.8 net DUCs and permits; expected

to be turned to production over the next 12-15 months

PRO FORMA VIPER HIGHLIGHTS

- Preliminary average daily

production guidance for Q4 2024 of 29,000 to 30,000 bo/d (51,500 to

53,000 boe/d)

- Preliminary full year 2025 average

daily production guidance of 30,000 to 33,000 bo/d (53,000 to

58,000 boe/d), the midpoint of which is approximately 18% higher

than standalone Viper’s expected Q3 2024 average daily oil

production

- Approximately 35,500 NRAs in the

Permian Basin

- 61 active rigs currently operating

on combined acreage position in the Permian Basin, with an average

1.8% NRI expected in those wells

“The set of acquisitions announced today is a

continuation of Viper’s strategy to consolidate high quality

mineral and royalty assets that not only provide meaningful and

immediate financial accretion, but also provide significant

undeveloped inventory that supports our long-term production

profile. With roughly 50% of the total Midland Basin acreage

representing concentrated interests in potential long-lateral units

that currently have zero existing producing wells or permits, we

expect these assets to deliver significant production growth over

the coming years,” stated Travis Stice, Chief Executive Officer of

Viper.

Mr. Stice continued, “Viper was able to uniquely

execute on this differentiated acquisition opportunity given its

overall size and scale, but also due to the visibility we have into

Diamondback’s expected multi-year development plan. With this

visibility, we expect Diamondback-operated production to increase

from an average of roughly 1,000 Bo/d in 2025 to approximately

3,000 Bo/d in 2026. This production growth, along with the

remaining core inventory primarily operated by ExxonMobil, provide

a high level of confidence to the implied valuation metrics and

expected accretion beyond just the next twelve months of visibility

typically associated with non-operated mineral and royalty

interests.”

Grant Wright, President of Tumbleweed Royalty,

stated, “The Tumbleweed team has built an impressive mineral and

royalty position over the last four years with the support of our

dedicated team and long-term partners. The assets are a natural fit

for Viper, and we look forward to closing the transaction.”

Advisors

Intrepid Partners, LLC is serving as financial advisor to Viper.

Akin Gump Strauss Hauer & Feld LLP and Wachtell, Lipton, Rosen

& Katz are serving as its legal advisors.

Vinson & Elkins LLP and Kirkland & Ellis

LLP are serving as the sellers’ legal advisors.

About Viper Energy, Inc.

Viper is a corporation formed by Diamondback to

own, acquire and exploit oil and natural gas properties in North

America, with a focus on owning and acquiring mineral and royalty

interests in oil-weighted basins, primarily the Permian Basin. For

more information, please visit www.viperenergy.com.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves primarily in

the Permian Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the federal securities laws. All

statements, other than historical facts, that address activities

that Viper assumes, plans, expects, believes, intends or

anticipates (and other similar expressions) will, should or may

occur in the future are forward-looking statements. The

forward-looking statements are based on management’s current

beliefs, based on currently available information, as to the

outcome and timing of future events, including specifically the

statements regarding the pending acquisition and any potential

capital markets transactions and other funding sources for the

pending acquisition. These forward-looking statements involve

certain risks and uncertainties that could cause the results to

differ materially from those expected by the management of Viper.

Information concerning these risks and other factors can be found

in Viper’s filings with the Securities and Exchange Commission,

including its Forms 10-K, 10-Q and 8-K, which can be obtained free

of charge on the Securities and Exchange Commission’s web site at

http://www.sec.gov. Viper undertakes no obligation to update or

revise any forward-looking statement.

Investor Contacts:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Austen Gilfillian+1

432.221.7420agilfillian@diamondbackenergy.com

Source: Viper Energy, Inc.; Diamondback Energy, Inc.

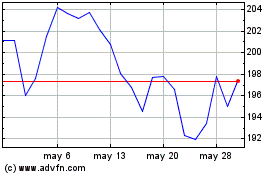

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024