Filed Pursuant to Rule 424(b)(5)

Registration No. 333-267595

PROSPECTUS

SUPPLEMENT

(To Prospectus

dated October 14, 2022)

Up to $40,000,000 of Common Stock

We have entered into a Sales Agreement (the “Sales

Agreement”) with Stifel, Nicolaus & Company, Incorporated (“Stifel”, and collectively with any other such

agents as may be designated by us from time to time, the “Agents” and each, an “Agent”), as sales agent, relating

to the shares of our common stock, par value $0.001 per share, offered by this prospectus supplement and the accompanying prospectus.

In accordance with the terms of the Sales Agreement, we may, from time to time, issue and sell shares of our common stock having an aggregate

offering price of up to $40,000,000 through or to the Agents. All references to “Agents” in this prospectus supplement refer

initially to Stifel, and thereafter to Stifel and such other agents as may be designated by us from time to time in the future.

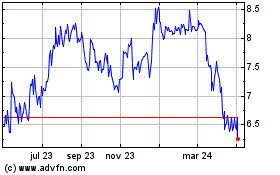

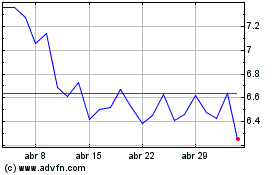

Our common stock is currently listed on The Nasdaq

Global Select Market (“Nasdaq”) under the trading symbol “ISSC”. On September 21, 2023, the last reported

sale price of our common stock was $7.81 per share.

Sales of the common stock, if any, made by the

Agents, as our sales agents, as contemplated by this prospectus supplement and the accompanying prospectus, may be made by means of transactions

that are deemed to be “at the market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the

“Securities Act”). Accordingly, an indeterminate number of shares of our common stock may be sold, if any, but in no event

will we issue and sell common stock with an aggregate sales price of more than $40,000,000 pursuant to the Sales Agreement. We will pay

each Agent, acting as sales agent, an aggregate commission of up to 3.0% of the gross sales price per share of our common stock sold through

such Agent, under the Sales Agreement. In connection with the sale of shares of our common stock on our behalf, the Agents will be deemed

to be “underwriters” within the meaning of the Securities Act, and the compensation of the Agents will be deemed to be underwriting

commissions or discounts.

The Agents are not required to sell any specific

number or dollar amount of our common stock but will use their commercially reasonable efforts, consistent with their normal sales and

trading practice, as our sales agent, and on the terms and subject to the conditions of the Sales Agreement, to sell the common stock

offered on terms agreed by the Agents and us. We cannot predict the number of shares that we may sell hereby or if any shares will be

sold. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. The net proceeds we receive from the

sale of shares of our common stock to which this prospectus supplement relates will be the gross proceeds received from such sales less

the commissions or discounts and any other expenses we may incur in issuing the shares of our common stock. See “Use of Proceeds”

and “Plan of Distribution” for further information.

Investing in our securities involves risks.

You should carefully consider the risks described or referred to under “Risk Factors” on page S-4 of this prospectus

supplement and on page 4 of the accompanying prospectus, in our most recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q (which descriptions are incorporated by reference herein) and any amendment or update thereto reflected in subsequent

filings with the U.S. Securities and Exchange Commission (“SEC”) and incorporated by reference in this prospectus supplement

and the accompanying prospectus, as well as in the other information contained or incorporated by reference in this prospectus supplement

hereto and the accompanying prospectus, before making a decision to invest in our securities.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The date of this prospectus supplement is September 22,

2023

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

You should rely only on the information contained in or incorporated

by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different

information. We are not making an offer of these securities in any state or jurisdiction where the offer is not permitted. You should

not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date other

than the date on the front of this prospectus supplement.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the

accompanying prospectus that is also a part of this document. This prospectus supplement and the accompanying prospectus are part of a

registration statement on Form S-3 that we filed with the Securities and Exchange Commission using a “shelf” registration

process. This prospectus supplement and the accompanying prospectus contain specific information about us and the terms on which we are

offering and selling shares of our common stock. To the extent that any statement made in this prospectus supplement is inconsistent with

statements made in the prospectus, the statements made in the prospectus will be deemed modified or superseded by those made in this prospectus

supplement. Before you purchase shares of our common stock, you should carefully read this prospectus supplement, the accompanying prospectus

and the registration statement, together with the documents incorporated by reference in this prospectus supplement and the accompanying

prospectus.

You should rely only on the information incorporated

by reference or set forth in this prospectus supplement and the accompanying prospectus. We have not authorized anyone else to provide

you with additional or different information. You should not assume that the information in this prospectus supplement, the accompanying

prospectus or any other offering material is accurate as of any date other than the dates on the front of those documents.

References in this prospectus supplement to “we,”

“us,” “our,” “IS&S” or the “Company” are to Innovative Solutions and Support, Inc.

Unless otherwise defined herein, certain capitalized terms used in this prospectus supplement have the meaning ascribed to them in the

accompanying prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement

contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based largely

on current expectations and projections about future events and trends affecting the business, are not guarantees of future performance,

and involve a number of risks, uncertainties and assumptions that are difficult to predict. In this prospectus supplement, the words “anticipates,”

“believes,” “may,” “will,” “estimates,” “continues,” “anticipates,”

“intends,” “forecasts,” “expects,” “plans,” “could,” “should,”

“would,” “is likely” and similar expressions, as they relate to the business or to its management, are intended

to identify forward-looking statements, but they are not exclusive means of identifying them. Unless the context otherwise requires, all

references herein to “IS&S,” the “Company,” “we,” “us” or “our” are to

Innovative Solutions and Support, Inc. and its consolidated subsidiaries.

The

forward-looking statements in this prospectus supplement are only predictions, and actual events or results may differ materially. In

evaluating such statements, a number of risks, uncertainties and other factors could cause actual results, performance, financial condition,

cash flows, prospects and opportunities to differ materially from those expressed in, or implied by, the forward-looking statements. These

risks, uncertainties and other factors include those set forth in “Risk Factors”

on page S-4 of this prospectus supplement, in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports

on Form 10-Q (which descriptions are incorporated by reference herein) and any amendment or update thereto reflected in subsequent

filings with the U.S. Securities and Exchange Commission, and the following factors:

| · |

market

acceptance of the Company’s ThrustSense® full-regime Autothrottle, Vmca

Mitigation, FPDS, NextGen Flight Deck and COCKPIT/IP® or other planned products or product enhancements; |

| · |

continued

market acceptance of the Company’s air data systems and products; |

| · |

the

competitive environment and new product offerings from competitors; |

| · |

difficulties

in developing, producing or improving the Company’s planned products or product enhancements; |

| · |

the

deferral or termination of programs or contracts for convenience by customers; |

| · |

the

ability to service the international market; |

| · |

the

availability of government funding; |

| · |

the

availability and efficacy of vaccines (including vaccine boosters) and their global deployment in response to the COVID-19 pandemic

(including as a result of the impact of any newer variants or strains of SARS-CoV-2); |

| · |

the

impact of general economic trends on the Company’s business, including as a result of inflation and rising interest rates; |

| · |

disruptions

in the Company’s supply chain, customer base and workforce, including as a result of the COVID-19 pandemic; |

| · |

the

ability to gain regulatory approval of products in a timely manner; |

| · |

delays

in receiving components from third-party suppliers; |

| · |

the

bankruptcy or insolvency of one or more key customers; |

| · |

protection

of intellectual property rights; |

| · |

the

ability to respond to technological change; |

| · |

failure

to retain/recruit key personnel; |

| · |

risks

related to succession planning; |

| · |

a cyber

security incident; |

| · |

risks

related to our self-insurance program; |

| · |

ability

to successfully manage and integrate key acquisitions, mergers, and other transactions, such as the recent asset acquisition of certain

Inertial, Communication and Navigation product lines from Honeywell International, Inc., as well as the failure to realize expected

synergies and benefits anticipated when we make an acquisition; |

| · |

potential

future acquisitions or dispositions; |

| · |

the

costs of compliance with present and future laws and regulations; |

| · |

changes

in law, including changes to corporate tax laws in the United States and the availability of certain tax credits; and |

| · |

other

factors disclosed from time to time in the Company’s filings with the SEC. |

Except as expressly required

by the federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise after the date of this prospectus. Results of operations in any past period

should not be considered indicative of the results to be expected for future periods. Fluctuations in operating results may result in

fluctuations in the price of the Company’s common stock.

Readers are cautioned not

to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. The Company does not

undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events, circumstances or changes

in expectations after the date of this prospectus, or to reflect the occurrence of unanticipated events. The forward-looking statements

in this prospectus are intended to be subject to the safe harbor protection provided by Sections 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Investors should also be

aware that while the Company, from time to time, communicates with securities analysts, it is against its policy to disclose any material

non-public information or other confidential commercial information. Accordingly, shareholders should not assume that the Company agrees

with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, the Company has

a policy against issuing or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by

securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of the Company.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information

contained in this prospectus supplement. It does not contain all of the information that you should consider before investing in our common

stock. You should read carefully the more detailed information in our Registration Statement on Form S-3 of which this prospectus

supplement and the accompanying prospectus form a part, our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports

on Form 10-Q (which descriptions are incorporated by reference herein), as well as the other information contained or incorporated

by reference in this prospectus supplement before making a decision to invest in our common stock.

Overview

Innovative Solutions and Support, Inc. (the

“Company,” “IS&S,” “we” or “us”) operates in one business segment as a systems integrator

that designs, develops, manufactures, sells and services air data equipment, engine display systems, standby equipment, primary flight

guidance, autothrottles and cockpit display systems for retrofit applications and original equipment manufacturers (“OEMs”).

The Company supplies integrated Flight Management Systems (“FMS”), Flat Panel Display Systems (“FPDS”), FPDS with

Autothrottle, air data equipment, Integrated Standby Units (“ISU”), ISU with Autothrottle and advanced GPS receivers

that enable reduced carbon footprint navigation.

The Company has continued to position itself as

a system integrator, which capability provides the Company with the potential to generate more substantive orders over a broader product

base. This strategy, as both a manufacturer and integrator, is designed to leverage the latest technologies developed for the computer

and telecommunications industries into advanced and cost-effective solutions for the general aviation, commercial air transport, United

States Department of Defense (“DoD”)/governmental and foreign military markets. This approach, combined with the Company’s

industry experience, is designed to enable IS&S to develop high-quality products and systems, to reduce product time to market, and

to achieve cost advantages over products offered by its competitors.

For several years the Company has been working

with advances in technology to provide pilots with more information to enhance both the safety and efficiency of flying, and has developed

its COCKPIT/IP® Cockpit Information Portal (“CIP”) product line, that incorporates proprietary technology, low cost, reduced

power consumption, decreased weight, and increased functionality. The Company has incorporated Electronic Flight Bag functionality, such

as charting and mapping systems, into its FPDS product line.

The Company has developed an FMS that combines

the savings long associated with in-flight fuel optimization in enroute flight management combined with the precision of satellite-based

navigation required to comply with the regulatory environments of both domestic and international markets. The Company believes that the

FMS, alongside its FPDS and CIP product lines, is well suited to address market demand driven by certain regulatory mandates, new technologies,

and the high cost of maintaining aging and obsolete equipment on aircraft that will be in service for up to fifty years. The shift in

the regulatory and technological environment is illustrated by the dramatic increase in the number of Space Based Augmentation System

(“SBAS”) or Wide Area Augmentation System (“WAAS”) approach qualified airports, particularly as realized through

Localizer Performance with Vertical guidance (“LPV”) navigation procedures. Aircraft equipped with the Company’s FMS,

FPDS and SBAS/WAAS/LPV enabled navigator, will be qualified to land at such airports and will comply with Federal Aviation Administration

(“FAA”) mandates for Required Navigation Performance, and Automatic Dependent Surveillance-Broadcast navigation. IS&S

believes this will further increase the demand for the Company’s products. The Company’s FMS/FPDS product line is designed

for new production and retrofit applications into general aviation, commercial air transport and military transport aircraft. In addition,

the Company offers what we believe to be a state-of-the-art ISU, integrating the full functionality of the primary and navigation displays

into a small backup-powered unit. This ISU builds on the Company’s legacy air data computer to form a complete next-generation cockpit

display and navigation upgrade offering to the commercial and military markets.

The Company has developed and received certification

from the FAA on its NextGen Flight Deck featuring its ThrustSense® Integrated PT6 Autothrottle (“ThrustSense® Autothrottle”)

for retrofit in the Pilatus PC-12. The NextGen Flight Deck features Primary Flight and Multi-Function Displays and ISUs, as well as an

Integrated FMS and EFB System. The innovative avionics suite includes dual flight management systems, autothrottles, synthetic vision

and enhanced vision. The NextGen enhanced avionics suite is available for integration into other business aircraft with Non-FADEC and

FADEC engines.

The Company has developed its FAA-certified ThrustSense®

Autothrottle for retrofit in the King Air, dual turbo prop PT6 powered aircraft. The autothrottle is designed to automate the power management

for speed and power control including go-around. ThrustSense® also ensures aircraft envelope protection and engine protection during

all phases of flight thereby reducing pilot workload and increasing safety. The Company has signed a multi-year agreement with Textron

Aviation, Inc. (“Textron”) to supply ThrustSense® on the King Air 360 and King Air 260. ThrustSense® is also

available for retrofit on King Airs aircraft through Textron service centers and third-party service centers. The Company has also developed

an FAA-certified safety mode feature for its King Airs aircraft ThrustSense® Autothrottle, LifeGuard™, which provides critical

Vmca protection that proportionally reduces engine power to maintain directional control during an engine-out condition.

We believe the ThrustSense® Autothrottle is

innovative in that it is the first autothrottle developed for a turbo prop that allows a pilot to automatically control the power setting

of the engine. The autothrottle computes and controls appropriate power levels, thereby reducing overall pilot workload. The system computes

thrust, holds selected speed/torque, and implements appropriate speed and engine limit protection. When engaged by the pilot, the autothrottle

system adjusts the throttles automatically to achieve and hold the selected airspeed guarded by a torque/temperature limit mode. The autothrottle

system takes full advantage of the integrated cockpit and utilizes weight and balance information to determine optimal control settings

and enable safety functions like a turbulence control mode.

The Company sells to both the OEM and the retrofit

markets. Customers include various OEMs, commercial air transport carriers and corporate/general aviation companies, DoD and its commercial

contractors, aircraft operators, aircraft modification centers, government agencies, and foreign militaries. Occasionally, IS&S

sells its products directly to DoD; however, the Company sells its products primarily to commercial customers for end use in DoD programs.

Sales to defense contractors are generally made on commercial terms, although some of the termination and other provisions of government

contracts are applicable to these contracts. The Company’s retrofit projects are generally pursuant to either a direct contract

with a customer or a subcontract with a general contractor to a customer (including government agencies).

On the other hand, the Company believes that in

adverse economic conditions, customers that may have otherwise elected to purchase newly manufactured aircraft may be interested instead

in retrofitting existing aircraft as a cost-effective alternative, thereby creating a market opportunity for IS&S.

On June 30, 2023, the Company entered into

an Asset Purchase and License Agreement with Honeywell International, Inc. (“Honeywell”) whereby Honeywell sold, certain

assets and granted perpetual license rights to manufacture and sell licensed products related to its inertial, communication and navigation

product lines to the Company (the “Transaction”). The Transaction involved a sale of certain inventory, equipment and customer-related

documents; an assignment of certain customer contracts; and a grant of exclusive and non-exclusive licenses to use certain Honeywell intellectual

property related to its inertial, communication and navigation product lines to repair, overhaul, manufacture sell, import, export and

distribute certain products to the Company. Concurrent with the Transaction, the Company entered into a transition services agreement

with Honeywell, at no additional costs, to receive certain transitional services and technical support during the transition service period.

Corporate Information

The Company was incorporated in Pennsylvania on

February 12, 1988. Our principal executive office is located at 720 Pennsylvania Drive, Exton, Pennsylvania 19341, and our telephone

number is (610) 646-9800. Our website address is http://www.innovative-ss.com. No information found on our website is part of this prospectus.

Also, this prospectus may include the names of various government agencies or the trade names of other companies. Unless specifically

stated otherwise, the use or display by us of such other parties’ names and trade names in this prospectus is not intended to and

does not imply a relationship with, or endorsement or sponsorship of us by, any of these other parties.

THE OFFERING

| Issuer |

|

Innovative Solutions and Support, Inc. |

| |

|

|

| Common Stock Offered by Us |

|

Shares of our common stock representing an aggregate offering price of up to $40,000,000. |

| |

|

|

| Manner of Offering |

|

“At the market offering,” as defined in Rule 415 promulgated under the Securities Act, that may be made from time to time through or to Stifel as sales agent using commercially reasonable efforts. See the section entitled “Plan of Distribution” on page S-6 in this prospectus supplement. |

| |

|

|

| Use of Proceeds |

|

We plan to use the net proceeds from this offering for general corporate purposes, which may include, among other things, repayment or refinancing of outstanding debt, financing acquisitions or investments, product development, and general working capital purposes. See the section entitled “Use of Proceeds” on page S-6 in this prospectus supplement. |

| |

|

|

| Listing |

|

Our common stock is currently traded on Nasdaq under the symbol “ISSC.” |

| |

|

|

| Risk Factors |

|

Investing in our common stock involves risks. You should carefully read and consider the risks described or referred to under “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 4 of the accompanying prospectus, in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q (which descriptions are incorporated by reference herein), as well as in the other information contained or incorporated by reference in this prospectus supplement, before making a decision to invest in our common stock. |

RISK FACTORS

In evaluating an investment in our common stock,

you should carefully consider the following risk factors and the risk factors described under the caption “Risk Factors” in

the accompanying prospectus, our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q (which

descriptions are incorporated by reference herein), and any amendment or update thereto reflected in subsequent filings with the SEC and

incorporated by reference in this prospectus supplement and the accompanying prospectus, as well as in the other information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus and any amendment or update to our risk factors

reflected in subsequent filings with the SEC, before making a decision to invest in our securities.

You may experience immediate dilution in the book value per share

of the common stock you purchase in this offering.

The price per share of our common stock in this

offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Therefore, if you purchase

shares of our common stock in this offering, you may pay a price per share that substantially exceeds our net tangible book value per

share after this offering.

You may experience future dilution as a result of future issuances

of shares of our common stock or securities convertible into or exchangeable for our common stock.

To raise additional capital, we may in the future

offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may

not be the same as the price per share in this offering. We may sell shares or other securities

in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing shareholders. In addition, the exercise of outstanding

stock options could result in further dilution of your investment.

The common stock offered under this prospectus supplement and

the accompanying prospectus may be sold in “at the market offerings,” and investors who buy shares at different times will

likely pay different prices.

Investors who purchase shares under this prospectus

supplement and the accompanying prospectus at different times will likely pay different prices, and so may experience different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold.

Investors may experience declines in the value of their shares as a result of share sales made at prices lower than the prices they paid.

A large number of shares may be

sold in the market following this offering, which may depress the market price of our common stock.

Sales

of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our

common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market

price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and

sellers remain willing to sell the shares. All of the shares sold in this offering will be freely tradable without restriction or further

registration under the Securities Act.

We will have broad discretion in the use of the net proceeds

to us from this offering; we may not use the offering proceeds that we receive effectively.

Our management will have broad discretion in the

application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our business, financial condition,

or results of operations. You may not agree with our decisions, and our use of the proceeds may not yield any return on your investment.

We intend to use the proceeds from this offering for general corporate purposes. Our general corporate purposes may include, among other

things, repayment or refinancing of outstanding debt, financing acquisitions or investments, product development, and general working

capital purposes. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our

management will have broad discretion over the allocation of the net proceeds.

Because of

the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary

substantially from their currently intended use. Our failure to apply the net proceeds of this offering effectively could compromise our

ability to pursue our growth strategy, and we might not be able to yield a significant return, if any, on our investment of these net

proceeds. You will not have the opportunity to influence our decisions on how to use the net proceeds from this offering. The failure

by our management to apply these funds effectively could result in financial losses that could harm our business and cause the price of

our common stock to decline. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income

or that loses value.

We are selling

the securities offered in this prospectus on a “best efforts” basis and may not be able to sell any of the securities offered

herein.

We

have engaged the agents to act as sales agents in connection with this offering. While the agents will use their reasonable best efforts

to arrange for the sale of the securities, they are under no obligation to purchase any of the securities. As a result, there are no firm

commitments to purchase any of the securities in this offering. Consequently, there is no guarantee that we will be capable of selling

all, or any, of the securities being offered hereby.

It is not possible to predict the actual number of shares we

will sell under the Sales Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the Sales Agreement

and compliance with applicable law, we have the discretion to deliver a placement notice to the sales agent at any time throughout the

term of the Sales Agreement. The number of shares that are sold through the sales agent after delivering a placement notice will fluctuate

based on a number of factors, including the market price of the common stock during the sales period, the limits we set with the sales

agent in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share of

each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold

or the gross proceeds to be raised in connection with those sales, if any.

Our common stock may be affected by

limited trading volume and may fluctuate significantly.

Our

common stock is traded on Nasdaq. Although an active trading market has developed for our common stock, there can be no assurance that

an active trading market for our common stock will be sustained. Failure to maintain an active trading market for our common stock may

adversely affect our shareholders’ ability to sell our common stock in short time periods, or at all. Our common stock has experienced,

and may experience in the future, significant price and volume fluctuations, which could adversely affect the market price of our common

stock.

Our common stock has experienced and may continue to experience

price fluctuations, which could cause you to lose a significant portion of your investment and interfere with our efforts to grow our

business.

Stock markets are subject to significant price

fluctuations that may be unrelated to the operating performance of particular companies, and accordingly the market price of our common

stock may frequently and meaningfully change. In addition, the market price of our common stock has fluctuated and may continue to fluctuate

substantially due to a variety of other factors. Possible exogenous incidents and trends may also impact the capital markets generally

and our common stock prices specifically. For example, the ongoing war between Russia and Ukraine and resulting economic sanctions imposed

by many countries on Russia have led to disruption, instability and volatility in the U.S. and global markets and industries and are expected

to have a negative impact on the U.S. and broader global economies. The timing of your purchase and sale of our common stock relative

to fluctuations in its trading price may result in you losing a significant portion of your investment.

Because we do not intend to declare

cash dividends on our shares of common stock in the foreseeable future, shareholders must rely on appreciation of the value of our common

stock for any return on their investment.

We

currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate

declaring or paying any cash dividends in the foreseeable future. In addition, the terms of any future debt agreements may preclude us

from paying dividends. As a result, we expect that only appreciation of the price of our common stock, if any, will provide a return to

investors in this offering for the foreseeable future.

USE OF PROCEEDS

We currently intend to use the net proceeds from

the sale of the securities described in this prospectus supplement for general corporate purposes. Our general corporate purposes may

include, among other things, repayment or refinancing of outstanding debt, financing acquisitions or investments, product development,

and general working capital purposes. We have not determined the amount of net proceeds to be used specifically for such purposes. As

a result, management will retain broad discretion over the allocation of net proceeds.

PLAN OF DISTRIBUTION

Under the terms of the Sales Agreement, we may,

from time to time, propose to issue and sell our common stock having an aggregate offering price of up to $40,000,000 through or to the

Agents, as agent or principal. Pursuant to the Sales Agreement, we may add new Agents as parties to the Sales Agreement in the future

with the consent of such new Agents, but without the consent of the other Agents.

Sales, if any, of our

common stock made through or to the Agents, as our sales agent or principal, as contemplated by this prospectus supplement and the

accompanying prospectus, may be made by means of transactions that are deemed to be “at the market offerings” as defined

in Rule 415 under the Securities Act, including sales made directly on or through The Nasdaq Global Select Market or any other

existing trading market for shares of our common stock, in negotiated transactions at market prices prevailing at the time of sale

or at prices related to such prevailing market prices and/or any other method permitted by law.

The Agents are not required to sell any specific

number or dollar amount of our common stock but have agreed to use their commercially reasonable efforts, consistent with their normal

trading and sales practices, on the terms and subject to the conditions of the Sales Agreement, to sell the common stock offered on terms

agreed upon by the Agents and us. If we choose to offer our common stock, we will instruct the Agent as to the number of shares to be

sold by them, the minimum or average minimum price per share and the date or dates on which such shares are to be sold. We may instruct

the Agents not to sell our common stock if the sales cannot be effected at or above a price designated by us. The Agents may decline to

accept any such instructions that we may provide to them from time to time. We or the Agents may suspend the offering of common stock

by the Agents upon notice to the other party.

If shares of our common stock are sold by the Agents

in an at the market offering, the Agents have agreed to confirm to us in writing the number of shares sold on the applicable trading day

and the related gross sales price and net sales price of those shares on the immediately following trading day. We will report at least

quarterly the number of shares of our common stock sold through the Agents under the Sales Agreement, information concerning the net proceeds

from those sales and the aggregate compensation paid to the Agents with respect to such sales.

The Agents will not engage in any transactions

that stabilize or maintain the market price of our common stock in connection with any offers or sales of our common stock as our sales

agent pursuant to the Sales Agreement.

We will pay each Agent acting as our sales agent

an aggregate commission of up to 3.0% of the gross sales price per share of common stock sold through such Agent, under the Sales Agreement.

The remaining sales proceeds, after deducting any transaction fees, transfer taxes or similar taxes or fees imposed by any governmental,

regulatory or self-regulatory organization in respect of the sale of the common stock, will be our net proceeds (before the expenses referred

to in the next paragraph) from the sale of the common stock in the offering. We have also agreed to reimburse the Agents for certain specified

expenses, including the fees and disbursements of its legal counsel in an amount not to exceed $75,000, as provided in the Sales Agreement.

We estimate that the total expenses payable by

us in connection with the establishment of the program to offer our common stock described in this prospectus supplement, excluding commissions

and any discounts payable to the Agents and any other deductions described in the paragraph above, will be approximately $200,000.

We will not issue common stock having aggregate

sales proceeds of more than $40,000,000 pursuant to the Sales Agreement. We cannot predict the number of shares that we may sell hereby

or if any shares will be sold.

Settlement for sales of shares in return for payment

of the net proceeds to us is expected to occur on the second business day that is also a trading day following the trade date on which

such sales were made, in either case unless another date shall be agreed to in writing by us and the Agents. There is no arrangement for

funds to be received in an escrow, trust or similar arrangement.

The offering of common stock pursuant to the Sales

Agreement will terminate upon the earlier of (1) the sale of all of the common stock subject to the Sales Agreement and (2) the

termination of the Sales Agreement by us or the Agents. The Sales Agreement may be terminated either by us or the Agents upon the giving

of ten (10) days prior written notice to the other party and in the sole discretion of us or the Agents, as the case may be.

We have agreed to provide indemnification and contribution

to the Agents against certain liabilities, including liabilities under the Securities Act.

The Agents shall be under no obligation to purchase

our shares on a principal basis pursuant to the Sales Agreement.

In connection with the sale of common stock on

our behalf, the Agents will be deemed to be “underwriters” within the meaning of the Securities Act, and the compensation

paid to the Agents will be deemed to be underwriting commissions or discounts. The Agents shall have no obligation to offer or sell any

of our shares in the event such an offer or sale of the shares as agents on our behalf may, in the reasonable judgment of the Agents,

constitute a “distribution” within the meaning of Rule 100 of Regulation M or the Agents reasonably believe they may

be deemed an “underwriter” within the meaning of the Securities Act in a transaction that is other than by means of ordinary

brokers’ transactions on Nasdaq that qualify for delivery of a prospectus to Nasdaq in accordance with Rule 153 of the Securities

Act.

LEGAL MATTERS

Certain legal matters will be passed upon for us

by Holland & Knight LLP, Miami, Florida. Goodwin Procter LLP, New York, New York, will act as legal counsel to the Agents.

EXPERTS

The audited financial statements of Innovative Solutions & Support, Inc. and subsidiaries as of September 30, 2022 and 2021, incorporated

by reference in this prospectus supplement and elsewhere in the registration statement have been so incorporated by reference in reliance

upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting

and auditing.

The audited abbreviated financial statements of the Acquired Honeywell Product Lines (the “Product Lines”), which comprise

the statements of assets acquired as of December 31, 2022 and 2021, and the statements of revenue and direct expenses for the year ended

December 31, 2022 and 2021, incorporated by reference in this prospectus supplement and elsewhere in the registration statement have been

so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent certified public accountants, upon the authority

of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement, of which

this prospectus supplement is a part, covering the securities offered hereby. As allowed by SEC rules, this prospectus supplement does

not contain all of the information set forth in the registration statement and the exhibits thereto. We refer you to the registration

statement and the exhibits thereto for further information. This prospectus supplement is qualified in its entirety by such other information.

Our SEC filings, including our registration statement, are also available to you on the SEC’s website at www.sec.gov.

We file reports, proxy statements and other information with the SEC as required by the Exchange Act. Those reports, proxy statements

and other information are available on the SEC’s website referred to above.

We maintain a website on the Internet with the

address of https://innovative-ss.com/. We are not incorporating by reference into this prospectus supplement the information

on our website, and you should not consider our website to be a part of this prospectus supplement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC’s rules allow us to “incorporate

by reference” information into this prospectus supplement filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus supplement from the date of filing those documents. Any reports filed by us with the SEC on or

after the date of this prospectus supplement will automatically update and, where applicable, supersede any information contained in this

prospectus supplement or incorporated by reference in this prospectus supplement. We have filed the documents listed below with the SEC

under the Exchange Act, and these documents are incorporated herein by reference (other than information in such documents that is furnished

and not deemed to be filed):

| · | Our Quarterly Reports on Form 10-Q for the quarter ended June 30, 2023, filed on August 11, 2023; the quarter ended

March 31, 2023, filed on May, 8, 2023; and the quarter ended December 31, 2022, filed on February 14, 2023; |

All documents we file pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus supplement and prior to the termination of the offering

of the securities to which this prospectus supplement relates (other than information in such documents that is furnished and not deemed

to be filed) shall be deemed to be incorporated by reference into this prospectus supplement and to be a part hereof from the date of

filing of those documents. All documents we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date

of the initial registration statement that contains the accompanying prospectus and prior to the effectiveness of the registration statement

shall be deemed to be incorporated by reference into the prospectus and to be a part hereof from the date of filing those documents.

We will provide to each person, including any beneficial

owner, to whom a copy of this prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by

reference in this prospectus supplement but not delivered with this prospectus supplement (other than the exhibits to such documents which

are not specifically incorporated by reference therein); we will provide this information at no cost to the requester upon written or

oral request to: Chief Financial Officer, Innovative Solutions and Support, Inc., 720 Pennsylvania Drive, Exton, Pennsylvania

19341, or (610) 646-9800.

PROSPECTUS

Innovative Solutions and Support, Inc.

$100,000,000 of Common Stock

Innovative Solutions and Support, Inc., a

Pennsylvania corporation (the “Company,” “IS&S,” “we” or “us”)

may offer and sell from time to time, in one or more series or issuances and on terms that we will determine at the time of the offering,

shares of our common stock, par value $0.001 per share (“Common Stock”) described in this prospectus, up to an aggregate

amount of $100,000,000.

This prospectus provides you with a general description

of the securities offered. Each time we offer and sell securities, we will file a prospectus supplement to this prospectus that contains

specific information about the offering and, if applicable, the amounts, prices and terms of the securities. Such supplements may also

add, update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus

supplement before you invest in any of our securities. This prospectus may not be used to consummate sales of securities unless accompanied

by a prospectus supplement.

We may offer and sell the securities described

in this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our behalf or

through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale of any of these

securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any applicable fees, commission

or discounts.

Our Common Stock is currently quoted on The Nasdaq

Global Select Market under the trading symbol “ISSC”. On September 22, 2022, the last reported sale price of our Common

Stock was $9.01 per share.

Investing in our securities involves a high

degree of risk. See the section entitled “Risk Factors” on page 4 of this prospectus and in the documents we filed with

the U.S. Securities and Exchange Commission that are incorporated in this prospectus by reference for certain risks and uncertainties

you should consider.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

This prospectus is dated October 14, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus of Innovative

Solutions and Support, Inc., a Pennsylvania corporation (collectively with all of its subsidiaries, the “Company,”

“IS&S,” “we” or “us”) is a part of a registration statement on Form S-3

that we filed with the U.S. Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration

process. Under this shelf registration process, we may, from time to time, sell the securities described in this prospectus in one or

more offerings up to a total dollar amount of $100,000,000 as described in this prospectus.

The registration statement

of which this prospectus is a part provides additional information about us and the securities offered under this prospectus. The registration

statement, including the exhibits and the documents incorporated herein by reference, can be read on the SEC website or at the SEC offices

mentioned under the heading “Where You Can Find More Information.”

We will provide a prospectus

supplement containing specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus

supplement may add, update or change information in this prospectus. If the information in the prospectus is inconsistent with a prospectus

supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and, if applicable,

any prospectus supplement. See “Where You Can Find More Information” for more information.

You should rely only on the

information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not making offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation is

not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful

to make an offer or solicitation. You should not assume that the information in this prospectus or any prospectus supplement, as well

as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement,

is accurate as of any date other than the date of such document. Our business, financial condition, results of operations and prospects

may have changed since those dates.

PROSPECTUS

SUMMARY

The items in the following summary are described

in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in

our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning on page 4 and

the financial statements incorporated by reference.

Company Overview

Innovative

Solutions and Support, Inc. (the “Company,” “IS&S,” “we” or “us”)

operates in one business segment as a systems integrator that designs, develops, manufactures, sells and services air data equipment,

engine display systems, standby equipment, primary flight guidance, autothrottles and cockpit display systems for retrofit applications

and original equipment manufacturers (“OEMs”). The Company supplies integrated Flight Management Systems (“FMS”),

Flat Panel Display Systems (“FPDS”), FPDS with Autothrottle, air data equipment, Integrated Standby Units (“ISU”), ISU

with Autothrottle and advanced GPS receivers that enable reduced carbon footprint navigation.

The

Company has continued to position itself as a system integrator, which capability provides the Company with the potential to generate

more substantive orders over a broader product base. This strategy, as both a manufacturer and integrator, is designed to leverage the

latest technologies developed for the computer and telecommunications industries into advanced and cost-effective solutions for the general

aviation, commercial air transport, United States Department of Defense (“DoD”)/governmental and foreign military markets.

This approach, combined with the Company’s industry experience, is designed to enable IS&S to develop high-quality products

and systems, to reduce product time to market, and to achieve cost advantages over products offered by its competitors.

For

several years the Company has been working with advances in technology to provide pilots with more information to enhance both the safety

and efficiency of flying, and has developed its COCKPIT/IP® Cockpit Information Portal (“CIP”) product line, that

incorporates proprietary technology, low cost, reduced power consumption, decreased weight, and increased functionality. The Company has

incorporated Electronic Flight Bag (“EFB”) functionality, such as charting and mapping systems, into its FPDS product

line.

The

Company has developed an FMS that combines the savings long associated with in-flight fuel optimization in enroute flight management combined

with the precision of satellite-based navigation required to comply with the regulatory environments of both domestic and international

markets. The Company believes that the FMS, alongside its FPDS and CIP product lines, is well suited to address market demand driven by

certain regulatory mandates, new technologies, and the high cost of maintaining aging and obsolete equipment on aircraft that will be

in service for up to fifty years. The shift in the regulatory and technological environment is illustrated by the dramatic increase in

the number of Space Based Augmentation System (“SBAS”) or Wide Area Augmentation System (“WAAS”)

approach qualified airports, particularly as realized through Localizer Performance with Vertical guidance (“LPV”)

navigation procedures. Aircraft equipped with the Company’s FMS, FPDS and SBAS/WAAS/LPV enabled navigator, will be qualified to

land at such airports and will comply with Federal Aviation Administration (“FAA”) mandates for Required Navigation

Performance, and Automatic Dependent Surveillance-Broadcast navigation. IS&S believes this will further increase the demand for the

Company’s products. The Company’s FMS/FPDS product line is designed for new production and retrofit applications into general

aviation, commercial air transport and military transport aircraft. In addition, the Company offers what we believe to be a state-of-the-art

ISU, integrating the full functionality of the primary and navigation displays into a small backup-powered unit. This ISU builds on the

Company’s legacy air data computer to form a complete next-generation cockpit display and navigation upgrade offering to the commercial

and military markets.

The

Company has developed and received certification from the FAA on its NextGen Flight Deck featuring its ThrustSense® Integrated PT6

Autothrottle (“ThrustSense® Autothrottle”) for retrofit in the Pilatus PC-12. The NextGen Flight Deck features

Primary Flight and Multi-Function Displays and ISUs, as well as an Integrated FMS and EFB System. The innovative avionics suite includes

dual flight management systems, autothrottles, synthetic vision and enhanced vision. The NextGen enhanced avionics suite is available

for integration into other business aircraft with Non-FADEC and FADEC engines.

The

Company has developed its FAA-certified ThrustSense® Autothrottle for retrofit in the King Air, dual turbo prop PT6 powered aircraft.

The autothrottle is designed to automate the power management for speed and power control including go-around. ThrustSense® also ensures

aircraft envelope protection and engine protection during all phases of flight reducing pilot workload and increasing safety. The Company

has signed a multi-year agreement with Textron Aviation, Inc. (“Textron”) to supply ThrustSense® on the King

Air 360 and King Air 260. ThrustSense® is also available for retrofit on King Airs through Textron service centers and third-party

service centers. The Company has also developed an FAA-certified safety mode feature for its King Air ThrustSense® Autothrottle, LifeGuard™,

which provides critical Vmca protection that proportionally reduces engine power to maintain directional control during an engine-out

condition.

We

believe the ThrustSense® Autothrottle is innovative in that it is the first autothrottle developed for a turbo prop that allows a

pilot to automatically control the power setting of the engine. The autothrottle computes and controls appropriate power levels, thereby

reducing overall pilot workload. The system computes thrust, holds selected speed/torque, and implements appropriate speed and engine

limit protection. When engaged by the pilot, the autothrottle system adjusts the throttles automatically to achieve and hold the selected

airspeed guarded by a torque/temperature limit mode. The autothrottle system takes full advantage of the integrated cockpit utilizing

weight and balance information for optimal control settings and enabling safety functions like a turbulence control mode.

The

Company sells to both the OEM and the retrofit markets. Customers include various OEMs, commercial air transport carriers and corporate/general

aviation companies, DoD and its commercial contractors, aircraft operators, aircraft modification centers, government agencies, and foreign

militaries. Occasionally, IS&S sells its products directly to DoD; however, the Company sells its products primarily to commercial

customers for end use in DoD programs. Sales to defense contractors are generally made on commercial terms, although some of the termination

and other provisions of government contracts are applicable to these contracts. The Company’s retrofit projects are generally pursuant

to either a direct contract with a customer or a subcontract with a general contractor to a customer (including government agencies).

Corporate Information

The Company was incorporated

in Pennsylvania on February 12, 1988. Our principal executive office is located at 720 Pennsylvania Drive, Exton, Pennsylvania 19341,

and our telephone number is (610) 646-9800. Our website address is http://www.innovative-ss.com. No information found on our website is

part of this prospectus. Also, this prospectus may include the names of various government agencies or the trade names of other companies.

Unless specifically stated otherwise, the use or display by us of such other parties’ names and trade names in this prospectus is

not intended to and does not imply a relationship with, or endorsement or sponsorship of us by, any of these other parties.

RISK FACTORS

An investment in our Common

Stock involves significant risks. You should carefully consider the risk factors contained in this prospectus and in our filings with

the SEC, as well as all of the information contained in any prospectus supplement, free writing prospectus and amendments thereto, before

you decide to invest in our Common Stock. Our business, prospects, financial condition and results of operations may be materially and

adversely affected as a result of any of such risks. The value of our Common Stock could decline as a result of any of these risks. You

could lose all or part of your investment in our Common Stock. Some of our statements in sections entitled “Risk Factors”

are forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial condition and results

of operations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

within the meaning of the federal securities laws. These forward-looking statements are based largely on current expectations and projections

about future events and trends affecting the business, are not guarantees of future performance, and involve a number of risks, uncertainties

and assumptions that are difficult to predict. In this prospectus, the words “anticipates,” “believes,” “may,”

“will,” “estimates,” “continues,” “anticipates,” “intends,” “forecasts,”

“expects,” “plans,” “could,” “should,” “would,” “is likely” and

similar expressions, as they relate to the business or to its management, are intended to identify forward-looking statements, but they

are not exclusive means of identifying them. Unless the context otherwise requires, all references herein to “IS&S,”

the “Registrant,” the “Company,” “we,” “us” or “our”

are to Innovative Solutions and Support, Inc. and its consolidated subsidiaries.

The forward-looking statements in this prospectus

are only predictions, and actual events or results may differ materially. In evaluating such statements, a number of risks, uncertainties

and other factors could cause actual results, performance, financial condition, cash flows, prospects and opportunities to differ materially

from those expressed in, or implied by, the forward-looking statements. These risks, uncertainties and other factors include those set

forth in Item 1A (Risk Factors) of our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 and

the following factors:

| · |

market

acceptance of the Company’s ThrustSense® full-regime Autothrottle, Vmca

Mitigation, FPDS, NextGen Flight Deck and COCKPIT/IP® or other planned products or product enhancements; |

| · |

continued

market acceptance of the Company’s air data systems and products; |

| · |

the

competitive environment and new product offerings from competitors; |

| · |

difficulties

in developing, producing or improving the Company’s planned products or product enhancements; |

| · |

the

deferral or termination of programs or contracts for convenience by customers; |

| · |

the

ability to service the international market; |

| · |

the

availability of government funding; |

| · |

the

availability and efficacy of vaccines (including vaccine boosters) and their global deployment in response to the COVID-19 pandemic

(including as a result of the impact of any newer variants or strains of SARS-CoV-2); |

| · |

the

impact of general economic trends on the Company’s business, including as a result of inflation and rising interest rates; |

| · |

disruptions

in the Company’s supply chain, customer base and workforce, including as a result of the COVID-19 pandemic; |

| · |

the

ability to gain regulatory approval of products in a timely manner; |

| · |

delays

in receiving components from third-party suppliers; |

| · |

the

bankruptcy or insolvency of one or more key customers; |

| · |

protection

of intellectual property rights; |

| · |

the

ability to respond to technological change; |

| · |

failure

to retain/recruit key personnel; |

| · |

risks

related to succession planning; |

| · |

a cyber

security incident; |

| · |

risks

related to our self-insurance program; |

| · |

potential

future acquisitions; |

| · |

the

costs of compliance with present and future laws and regulations; |

| · |

changes

in law, including changes to corporate tax laws in the United States and the availability of certain tax credits; and |

| · |

other

factors disclosed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”). |

Except as expressly required by the federal

securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result

of new information, future events, or otherwise after the date of this prospectus. Results of operations in any past period should not

be considered indicative of the results to be expected for future periods. Fluctuations in operating results may result in fluctuations

in the price of the Company’s common stock.

Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the date of this prospectus. The Company does not undertake any obligation

to publicly release any revisions to these forward-looking statements to reflect events, circumstances or changes in expectations after

the date of this prospectus, or to reflect the occurrence of unanticipated events. The forward-looking statements in this prospectus are

intended to be subject to the safe harbor protection provided by Sections 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Investors should also be aware that while the

Company, from time to time, communicates with securities analysts, it is against its policy to disclose any material non-public information

or other confidential commercial information. Accordingly, shareholders should not assume that the Company agrees with any statement or

report issued by any analyst irrespective of the content of the statement or report. Furthermore, the Company has a policy against issuing

or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain

any projections, forecasts or opinions, such reports are not the responsibility of the Company.

USE OF PROCEEDS

Unless otherwise specified

in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities described in this prospectus

for growing the businesses of the Company through the acquisition of product lines, companies or businesses and for general corporate

purposes, which may include, among other things, working capital, capital expenditures and other anticipated growth opportunities. The

applicable prospectus supplement will provide more details on the use of proceeds of any specific offering.

DESCRIPTION OF OUR COMMON STOCK

The

following description of our Common Stock is based upon our Company’s Amended and Restated Articles of Incorporation (the “A&R

Charter”), as modified by that certain Statement with Respect to Shares for Series B Junior Participating Preferred Stock

(the “Statement” and, our A&R Charter, as modified by the Statement, the “Charter”), which was

filed with the Department of State of the Commonwealth of Pennsylvania on September 12, 2022, and Amended and Restated Bylaws (the

“Bylaws”). The Company’s Charter and Bylaws are each incorporated by reference as an exhibit to the Annual Report on Form 10-K for the fiscal year ended September 30, 2021 that we filed with the SEC on December 22, 2021

(the “Annual Report”). The Statement was filed as an exhibit to the Current Report on Form 8-K that we filed with the SEC on September 12, 2022 to disclose our entry into that certain Rights

Agreement (the “Rights Agreement”), dated September 12, 2022, between the Company and Broadridge Corporate Issuer

Solutions, Inc., as Rights Agent.

The following description

is not meant to be a complete description of our Common Stock and is qualified by reference to our Charter, our Bylaws and the Rights

Agreement. For additional information, please read the Company’s Charter and Bylaws, the Rights Agreement and the applicable provisions

of the Pennsylvania Business Corporation Law (the “PBCL”).

General

The Company’s authorized

capital stock consists of (1) 75,000,000 shares of Common Stock, $0.001 par value (“Common Stock”), and (2) 10,000,000

shares of Preferred Stock, $0.001 par value, of which 200,000 shares are authorized as Series A Convertible Preferred Stock (“Series A

Preferred Stock”) and 50,000 shares are authorized as Series B Junior Participating Preferred Stock (“Series B

Preferred Stock” and, together with the Series A Preferred Stock, “Preferred Stock”). As of July 29,

2022, there were 17,276,213 issued and outstanding shares of Common Stock and no issued or outstanding shares of Preferred Stock.

Preferred Share Purchase Rights

On September 11, 2022,

the Company’s Board of Directors (the “Board”) declared a dividend of one preferred share purchase right (a “Right”),

payable on September 27, 2022, for each share of Common Stock outstanding on September 27, 2022 to the stockholders of record

on that date. Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series B Preferred

Stock at a price of $41.57 per one one-thousandth of a share of Series B Preferred Stock represented by a Right, subject to adjustment.

Each share of Series B Preferred Stock will entitle the holder thereof to the same dividends and liquidation rights as if the holder

held one share of Common Stock and will be treated the same as a share of Common Stock in the event of a merger, consolidation or other

share exchange. Under certain circumstances, as further described in the Rights Agreement, the Rights may be convertible or exchangeable

into shares of Common Stock. Until a Right is exercised, converted or exchanged for shares of the Company’s capital stock, the holder

thereof, as such, will have no rights as a stockholder of the Company, including, without limitation, the right to vote or to receive

dividends.

The Board declared the dividend

of the Rights and entered into the Rights Agreement in order to promote the fair and equal treatment of all Company stockholders and ensure

that no person or group can gain control of the Company through open market accumulation or other tactics without paying a control premium

and potentially disadvantaging the interests of all stockholders. The issuance of the Rights and the Company’s entry into the Rights

Agreement is not intended to deter offers that are fair and otherwise in the best interest of the Company’s stockholders.

Voting

The Company does not have

any other classes of voting stock outstanding other Common Stock, but may in the future have outstanding shares of Series B Preferred

Stock in the event any of the Rights are exercised in accordance with the terms of the Rights Agreement. Each share of Common Stock is

entitled to one (1) vote, and share of Series B Preferred Stock is entitled to one thousand (1,000) votes. There are no cumulative

voting rights when voting for directors.

Conversion Rights

Holders of the Company’s

Common Stock do not have conversion rights. Shares of the Company’s Series A Preferred Stock can be converted, at the option

of the holder, into fully paid and nonassessable shares of Common Stock pursuant to and in accordance with Art. IV, § B(4) of

the Company’s Charter. Shares of the Company’s Series B Preferred Stock can, under certain circumstances, be converted

into or exchange for fully paid and nonassessable shares of Common Stock pursuant to and in accordance with the Statement and the Rights

Agreement.

Preemptive and Redemption Rights

Stockholders do not have (1) preemptive

rights to purchase additional shares of the Company’s capital stock (except as may be expressly set forth in a separate agreement

between the Company and one or more holders of Preferred Stock) or (2) redemption rights.

Dividends

The declaration and payment

of any dividends is within the discretion of the Board.

Liquidation and Dissolution

In the event of any liquidation,

dissolution or winding up of the Company, the holders of the Company’s Common Stock are entitled to share ratably in all assets

remaining after payment of liabilities, subject to prior distribution rights of Preferred Stock, if any, then outstanding, including the

rights of the holders of shares of Series B Preferred Stock to receive $1,000 per share, plus an amount equal to accrued and unpaid

dividends and distributions thereon, whether or not declared, to the date of such payment, before any distribution of assets to the holders

of the Company’s Common Stock.

Listing

The Company’s Common

Stock is listed on The Nasdaq Global Select Market under the symbol “ISSC”.

Securities Authorized for Issuance Under Equity

Compensation Plans

The Company has two share-based

compensation plans: (1) the 2009 Stock-Based Incentive Compensation Plan, which terminated with respect to the grant of any new awards

on January 20, 2019, and (2) the 2019 Stock-Based Incentive Compensation Plan, under which 100,000 stock options have been granted

as of September 23, 2022. For the complete terms of each of the foregoing share-based compensation plans, please refer to the copies

thereof which are incorporated by reference as exhibits to our Annual Report.

Anti-Takeover Provisions of the Company’s

Charter and Bylaws and Pennsylvania Law

Some sections of the Company’s

Charter and Bylaws and provisions of Pennsylvania law may discourage certain transactions involving a change in control of the Company.

For example, the PBCL permits the Board to consider the interests of constituencies other than the shareholders when deciding what will

be in the best interests of the Company. In addition, under the Company’s Charter, the Board has the power to alter, amend, and

repeal the Company’s Bylaws without shareholder approval, except as to any subjects that are expressly committed to the shareholders

by the terms of the Company’s Bylaws, by Section 1504 of the PBCL or otherwise.

Certain other provisions of

the Company’s Charter and Bylaws could have the effect of preventing or delaying a change in control of the Company, including (1) the

advance notification procedures governing certain shareholder nominations of candidates for the Board and for certain other shareholder

business to be conducted at an annual meeting, (2) the absence of authority for shareholders to call special shareholders meetings,

except as may be required by law, and (3) the absence of authority for shareholder action by written consent, except as may be required

by law. In particular, certain provisions in the Statement (together with certain aspects of the Rights) could have the effect of preventing

or delaying a change in control of the Company that is not approved by the Board.

While as of June 30,

2022, the end of our most recently completed fiscal quarter, no shares of authorized Preferred Stock are currently outstanding, the Company’s

Charter permits the Board to, without shareholder approval, establish and issue classes of Preferred Stock with voting, conversion or

other rights that could dilute the voting power or rights of the holders of the Company’s Common Stock. For example, the shares

of Series B Preferred Stock issuable upon exercise of the Rights have superior voting rights compared to shares of Common Stock.

The issuance of Preferred Stock such as the Series B Preferred Stock, while potentially providing flexibility in connection with

possible acquisitions and other corporate purposes, could, among other things, have the effect of preventing or delaying a change in control

of the Company and may adversely affect the market price of the Company’s Common Stock and the voting and other rights of the holders

of the Company’s Common Stock.

PLAN OF DISTRIBUTION

We may sell the securities

described in this prospectus on a continuous or delayed basis directly to purchasers, through underwriters, broker-dealers or agents that

may receive compensation in the form of discounts, concessions or commissions from us or the purchasers of the securities, in “at

the market offerings” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into

an existing trading market, on an exchange, or otherwise or through a combination of any such methods of sale. Discounts, concessions

or commissions as to any particular underwriter, broker-dealer or agent may be in excess of those customary in the types of transactions

involved.

The securities may be sold

from time to time in one or more transactions at fixed prices, which may be changed from time to time, at prevailing market prices at