Kura Oncology Reports Fourth Quarter and Full Year 2023 Financial Results

27 Febrero 2024 - 3:01PM

Kura Oncology, Inc. (Nasdaq: KURA), a clinical-stage

biopharmaceutical company committed to realizing the promise of

precision medicines for the treatment of cancer, today reported

fourth quarter and full year 2023 financial results and provided a

corporate update.

“Given its best-in-class safety and efficacy profile as well as

optimal pharmaceutical properties, we believe ziftomenib is well

positioned to become a cornerstone of therapy for patients with

acute leukemias,” said Troy Wilson, Ph.D., J.D., President and

Chief Executive Officer of Kura Oncology. “This belief is supported

by strong enthusiasm among both physicians and patients, as

evidenced by rapid enrollment across our ongoing ziftomenib

studies. We continue to be encouraged by the rate of enrollment in

KOMET-001, our Phase 2 registration-directed trial of ziftomenib in

patients with relapsed/refractory NPM1-mutant AML, and we remain on

pace to complete enrollment of all 85 patients in the trial by the

middle of this year. We also are seeing robust enrollment in our

ongoing KOMET-007 study, which is investigating ziftomenib in

combination with current standards of care in the frontline and

relapsed/refractory settings. And with our recent financing, we

remain in a strong financial position, which enables us to invest

aggressively in research, development and pre-commercial activities

to maximize the value of ziftomenib and support our other pipeline

assets.”

Recent Highlights

- Encouraging safety and tolerability profile for

ziftomenib in combination with 7+3 and ven/aza – In

January 2024, Kura reported preliminary clinical data from the

first 20 patients in KOMET-007, a Phase 1 dose-escalation trial of

ziftomenib in combination with standards of care, including

cytarabine/daunorubicin (7+3) and venetoclax/azacitidine (ven/aza),

in patients with NPM1-mutant (NPM1-m) and KMT2A-rearranged

(KMT2A-r) AML. The first 20 patients were enrolled between July

2023 and November 2023 and included five newly diagnosed patients

with adverse risk NPM1-m or KMT2A-r AML and 15 patients with

refractory/relapsed (R/R) NPM1-m or KMT2A-r AML. Continuous daily

dosing of ziftomenib at 200 mg was well tolerated, and the safety

profile was consistent with features of underlying disease and

backbone therapies. No differentiation syndrome events of any grade

were reported, and no dose-limiting toxicities, evidence of QTc

prolongation, drug-drug interactions or additive myelosuppression

were observed.

- Encouraging evidence of clinical activity for

ziftomenib combinations in NPM1-m and KMT2A-r AML – As of

the data cutoff on January 11, 2024, all five newly diagnosed

patients treated with ziftomenib and 7+3 achieved a complete

remission with full count recovery, for a complete remission (CR)

rate of 100%. The overall response rate (ORR) among the 15 R/R

patients treated with ziftomenib and ven/aza was 53%, including a

40% ORR in the 10 patients who had received prior venetoclax. The

CR/CRh (CR with partial hematologic recovery) rate among the nine

R/R patients who were menin inhibitor naïve was 56%. As of the data

cutoff, 16 of the first 20 patients remained on trial, including

all 11 NPM1-mutant patients. To date, enrollment at the 400 mg dose

of ziftomenib is ongoing in the R/R ven/aza cohorts and in the

frontline NPM1-mutant 7+3 cohort.

- First patient dosed in KOMET-008 trial of ziftomenib in

combination with additional standards of care in AML –

Yesterday, Kura announced dosing of the first patient in its

KOMET-008 trial of ziftomenib in combination with the FLT3

inhibitor gilteritinib, FLAG-IDA or LDAC for the treatment of

relapsed/refractory NPM1-m or KMT2A-r AML. Roughly half of patients

with relapsed or refractory hNPM1-mutant AML have co-occurring FLT3

mutations, and the prognosis for these patients is poor.

Preclinical data for ziftomenib in combination with FLT3 inhibitors

demonstrate strong synergistic effects compared to either single

agent alone.

- Completion of enrollment in registration-directed trial

of ziftomenib in NPM1-m AML anticipated by mid-2024 – The

KOMET-001 registration-directed trial of ziftomenib in NPM1-m R/R

AML is expected to enroll a total of 85 patients in the U.S. and

Europe. In the Phase 1 trial, ziftomenib demonstrated a 35% CR rate

and 45% overall response rate in 20 patients with NPM1-mutant AML

treated at the recommended Phase 2 dose (RP2D). NPM1-mutant AML

accounts for approximately 30% of new AML cases annually and

represents a disease of significant unmet need for which no

approved targeted therapy exists.

- Addressing the continuum of care for patients with

acute leukemias– Kura remains committed to developing new

treatment options across the continuum of care for patients with

acute leukemias, where poor outcomes and significant unmet medical

need remain. In December 2023, the Company announced that

ziftomenib was selected by the Leukemia & Lymphoma Society for

the Pediatric Acute Leukemia (PedAL) Master Clinical Trial. As part

of the study, ziftomenib will be evaluated in combination with

chemotherapy in pediatric patients with R/R KMT2A-r, NPM1-m or

NUP98-rearranged acute leukemia. In addition, Kura recently began

dosing with ziftomenib in patients with R/R KMT2A-r acute

lymphoblastic leukemia, a relatively small population with a large

unmet medical need.

- Positive results from registration-directed trial of

tipifarnib in HRAS-mutant HNSCC – In October 2023, Kura

presented positive results from its AIM-HN registration-directed

trial of tipifarnib as a monotherapy in patients with HRAS-mutant

head and neck squamous cell carcinoma (HNSCC). The Company

continues to evaluate tipifarnib in combination with alpelisib in

patients with PIK3CA-dependent HNSCC as part of its ongoing

KURRENT-HN dose-escalation trial.

- Dose escalation continues in first-in-human trial of

KO-2806 – In October 2023, Kura announced that the first

patient was dosed in its FIT-001 Phase 1 dose-escalation trial of

its next-generation FTI, KO-2806. Concurrent with dose escalation

as a monotherapy in the FIT-001 trial, the Company also plans to

evaluate KO-2806 in dose-escalation combination cohorts with

cabozantinib in clear cell renal cell carcinoma (ccRCC) and with

adagrasib in KRASG12C-mutated non-small cell lung cancer

(NSCLC).

- Preclinical data support clinical combinations of

KO-2806 with targeted therapies – In October 2023, Kura

presented preclinical data supporting its rationale to combine

KO-2806 with cabozantinib in ccRCC and with adagrasib in

KRASG12C-mutated NSCLC. The new findings illustrate the potential

for FTIs to drive enhanced antitumor activity and address

mechanisms of innate and adaptive resistance to targeted therapies

such as tyrosine kinase inhibitors and KRAS inhibitors.

- Clinical collaboration with Mirati to evaluate KO-2806

and adagrasib in KRASG12C-mutated

NSCLC – In November 2023, Kura announced a clinical

collaboration and supply agreement with Mirati Therapeutics to

evaluate the combination of KO-2806 and adagrasib in patients with

KRASG12C-mutated NSCLC. Kura anticipates dosing the first patients

with KO-2806 and adagrasib in KRASG12C-mutated NSCLC by

mid-2024.

Financial Results

- Research and development (R&D)

expenses for the fourth quarter of 2023 were $32.5 million,

compared to $22.7 million for the fourth quarter of 2022. R&D

expenses for the full year 2023 were $115.2 million, compared to

$92.8 million for the prior year.

- General and administrative (G&A)

expenses for the fourth quarter of 2023 were $14.2 million,

compared to $12.5 million for the fourth quarter of 2022. G&A

expenses for the full year 2023 were $50.6 million, compared to

$47.1 million for the prior year.

- Net loss for the fourth quarter of 2023

was $42.8 million, compared to a net loss of $33.1 million for the

fourth quarter of 2022. Net loss for the full year 2023 was $152.6

million, compared to a net loss of $135.8 million for the prior

year.

- Net loss for the fourth quarter and

full year 2023 included non-cash, share-based compensation expense

of $7.2 million and $28.1 million, respectively. This compares to

$6.8 million and $26.3 million for the same periods in 2022.

- As of December 31, 2023, Kura had cash,

cash equivalents and short-term investments of $424.0 million,

compared to $438.0 million as of December 31, 2022.

- Pro forma for $146 million in

approximate net proceeds from the company’s private placement

completed in January 2024, Kura had $570 million in cash, cash

equivalents and short-term investments at December 31, 2023.

- Based on its operating plan, management

expects that cash, cash equivalents and short-term investments will

fund current operations into 2027.

Forecasted Milestones

- Initiate the post-transplant

maintenance program for ziftomenib in the first quarter of

2024.

- Complete enrollment of 85 patients in

the KOMET-001 registration-directed trial of ziftomenib in NPM1-m

AML by mid-2024.

- Initiate an expansion cohort evaluating

ziftomenib as a monotherapy in patients who have neither

NPM1-mutant nor KMT2A-rearranged AML by mid-2024.

- Determine the RP2D for ziftomenib in

combination with ven/aza and initiate dose validation/expansion in

frontline AML by mid-2024.

- Determine the RP2D for ziftomenib in

combination with 7+3 by mid-2024.

- Dose the first patients in the FIT-001

dose-escalation trial of KO-2806 in combination with cabozantinib

in ccRCC by mid-2024.

- Dose the first patients in the FIT-001

dose-escalation trial of KO-2806 in combination with adagrasib in

KRASG12C-mutated NSCLC by mid-2024.

- Complete enrollment of two expansion

cohorts to support determination of the optimal biologically active

dose for tipifarnib in combination with alpelisib by the end of

2024.

Conference Call and Webcast

Kura’s management will host a webcast and conference call at

4:30 p.m. ET / 1:30 p.m. PT today, February 27, 2024, to discuss

the financial results for the fourth quarter and full year 2023 and

to provide a corporate update. The live call may be accessed by

dialing (888) 886-7786 for domestic callers and (416) 764-8658 for

international callers and entering the conference ID: 02911668. A

live webcast and archive of the call will be available online from

the investor relations section of the company website at

www.kuraoncology.com.

About Kura Oncology

Kura Oncology is a clinical-stage biopharmaceutical company

committed to realizing the promise of precision medicines for the

treatment of cancer. The Company’s pipeline consists of small

molecule drug candidates that target cancer signaling pathways.

Ziftomenib is a once-daily, oral drug candidate targeting the

menin-KMT2A protein-protein interaction for the treatment of

genetically defined AML patients with high unmet need. Kura is

currently enrolling patients in a Phase 2 registration-directed

trial of ziftomenib in NPM1-m R/R AML (KOMET-001). The Company is

also conducting a series of studies to evaluate ziftomenib in

combination with current standards of care, beginning with ven/aza

and 7+3 in NPM1-m and KMT2A-r newly diagnosed and R/R AML

(KOMET-007). Tipifarnib, a potent and selective FTI, is currently

in a Phase 1/2 trial in combination with alpelisib for patients

with PIK3CA-dependent HNSCC (KURRENT-HN). Kura is also evaluating

KO-2806, a next-generation FTI, in a Phase 1 dose-escalation trial

as a monotherapy and in combination with cabozantinib in ccRCC and

with adagrasib in KRASG12C-mutated NSCLC (FIT-001). For additional

information, please visit Kura’s website at www.kuraoncology.com

and follow us on X and LinkedIn.

Forward-Looking Statements

This news release contains certain forward-looking statements

that involve risks and uncertainties that could cause actual

results to be materially different from historical results or from

any future results expressed or implied by such forward-looking

statements. Such forward-looking statements include statements

regarding, among other things, the efficacy, safety and therapeutic

potential of Kura’s product candidates, ziftomenib, tipifarnib and

KO-2806, progress and expected timing of Kura’s drug development

programs and clinical trials and submission of regulatory filings,

the presentation of data from clinical trials, plans regarding

regulatory filings and future clinical trials, the regulatory

approval path for tipifarnib, the strength of Kura’s balance sheet

and the sufficiency of cash, cash equivalents and short-term

investments to fund its current operating plan to 2027. Factors

that may cause actual results to differ materially include the risk

that compounds that appeared promising in early research or

clinical trials do not demonstrate safety and/or efficacy in later

preclinical studies or clinical trials, the risk that Kura may not

obtain approval to market its product candidates, uncertainties

associated with performing clinical trials, regulatory filings,

applications and other interactions with regulatory bodies, risks

associated with reliance on third parties to successfully conduct

clinical trials, the risks associated with reliance on outside

financing to meet capital requirements, and other risks associated

with the process of discovering, developing and commercializing

drugs that are safe and effective for use as human therapeutics,

and in the endeavor of building a business around such drugs. You

are urged to consider statements that include the words “may,”

“will,” “would,” “could,” “should,” “believes,” “estimates,”

“projects,” “promise,” “potential,” “expects,” “plans,”

“anticipates,” “intends,” “continues,” “designed,” “goal,” or the

negative of those words or other comparable words to be uncertain

and forward-looking. For a further list and description of the

risks and uncertainties the Company faces, please refer to the

Company's periodic and other filings with the Securities and

Exchange Commission, which are available at www.sec.gov. Such

forward-looking statements are current only as of the date they are

made, and Kura assumes no obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

| KURA

ONCOLOGY, INC. |

| Statements

of Operations Data |

|

(unaudited) |

| (in

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Year

Ended |

|

|

|

December 31, |

|

December 31, |

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

32,533 |

|

|

$ |

22,668 |

|

|

$ |

115,235 |

|

|

$ |

92,812 |

|

|

General and administrative |

|

|

14,229 |

|

|

|

12,488 |

|

|

|

50,569 |

|

|

|

47,053 |

|

|

Total operating expenses |

|

|

46,762 |

|

|

|

35,156 |

|

|

|

165,804 |

|

|

|

139,865 |

|

|

Other income, net |

|

|

3,976 |

|

|

|

2,042 |

|

|

|

13,173 |

|

|

|

4,025 |

|

|

Net loss |

|

$ |

(42,786 |

) |

|

$ |

(33,114 |

) |

|

$ |

(152,631 |

) |

|

$ |

(135,840 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.55 |

) |

|

$ |

(0.49 |

) |

|

$ |

(2.08 |

) |

|

$ |

(2.03 |

) |

|

Weighted average number of shares used in computing net loss per

share, basic and diluted |

|

|

77,337 |

|

|

|

67,781 |

|

|

|

73,229 |

|

|

|

66,990 |

|

| |

|

|

|

|

|

|

|

|

| KURA

ONCOLOGY, INC. |

|

| Balance

Sheet Data |

|

|

(unaudited) |

|

| (in

thousands) |

|

| |

|

|

|

|

|

| |

|

December

31, |

|

December

31, |

|

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

423,957 |

|

|

$ |

437,985 |

|

|

|

Working capital |

|

|

397,218 |

|

|

|

422,369 |

|

|

|

Total assets |

|

|

448,935 |

|

|

|

456,306 |

|

|

|

Long-term liabilities |

|

|

16,399 |

|

|

|

11,971 |

|

|

|

Accumulated deficit |

|

|

(721,439 |

) |

|

|

(568,808 |

) |

|

|

Stockholders’ equity |

|

|

397,273 |

|

|

|

420,278 |

|

|

| |

|

|

|

|

|

Contacts

Investors: Pete De Spain Executive Vice President, Investor

Relations & Corporate Communications(858) 500-8833

pete@kuraoncology.com

Media:Alexandra WeingartenAssociate Director, Investor Relations

& Corporate Communications(858)

500-8822alexandra@kuraoncology.com

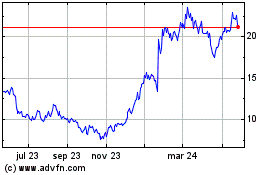

Kura Oncology (NASDAQ:KURA)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

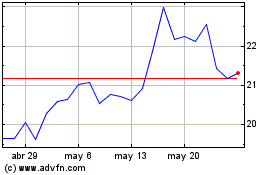

Kura Oncology (NASDAQ:KURA)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025