- First quarter GAAP earnings per share was $0.62 in 2024,

compared to $0.65 in 2023

- Reaffirming 2024 earnings guidance range of $2.99 - $3.13

per share

Alliant Energy Corporation (NASDAQ: LNT) today announced U.S.

generally accepted accounting principles (GAAP) consolidated

unaudited earnings per share (EPS) for the three months ended March

31 as follows:

GAAP EPS

2024

2023

Utilities and Corporate Services

$

0.62

$

0.65

American Transmission Company (ATC)

Holdings

0.04

0.04

Non-utility and Parent

(0.04

)

(0.04

)

Alliant Energy Consolidated

$

0.62

$

0.65

“We had a solid start to the year in light of historically mild

weather,” said Lisa Barton, Alliant Energy President and CEO. “Our

results were in line with our expectations, allowing us to reaffirm

our 2024 earnings guidance and positioning us well to reach our

long-term growth objectives. We remain focused on growth and

ensuring we are executing on our strategic priorities. We are

approaching a significant milestone in diversifying our energy mix,

with the successful commissioning of the final project in our 1.1

gigawatt solar investment in Wisconsin.”

Utilities and Corporate Services -

Alliant Energy’s Utilities and Alliant Energy Corporate Services,

Inc. (Corporate Services) operations generated $0.62 per share of

GAAP EPS in the first quarter of 2024, which was $0.03 per share

lower than the first quarter of 2023. The primary drivers of lower

EPS were lower retail electric and gas sales due to impacts of

warmer than normal temperatures and higher financing and

depreciation expenses. These items were partially offset by higher

revenue requirements from capital investments at Wisconsin Power

and Light Company (WPL).

Details regarding GAAP EPS variances between the first quarters

of 2024 and 2023 for Alliant Energy are as follows:

Variance

Revenue requirements from capital

investments at WPL

$

0.11

Estimated temperature impact on retail

electric and gas sales

(0.04

)

Higher financing expense

(0.04

)

Higher depreciation expense

(0.04

)

Other

(0.02

)

Total

($

0.03

)

Revenue requirements from capital

investments at WPL - In December 2023, WPL received an order

from the Public Service Commission of Wisconsin authorizing annual

base rate increases of $49 million and $13 million for its retail

electric and gas rate review covering the 2024/2025 Test Period.

WPL recognized a $0.11 per share increase in the first quarter of

2024 due to higher revenue requirements from increasing rate base,

including investments in solar generation and battery storage.

Estimated temperature impact on retail

electric and gas sales - Alliant Energy’s retail electric

and gas sales decreased an estimated $0.08 and $0.04 per share in

the first quarter of 2024 and 2023, respectively, due to impacts of

warmer than normal temperatures on customer demand.

2024 Earnings Guidance

Alliant Energy is reaffirming its consolidated EPS guidance for

2024 of $2.99 - $3.13. Assumptions for Alliant Energy’s 2024 EPS

guidance include, but are not limited to:

- Ability of Interstate Power and Light Company (IPL) and WPL to

earn their authorized rates of return

- Normal temperatures in its utility service territories

- Constructive and timely regulatory outcomes from regulatory

proceedings

- Stable economy and resulting implications on utility sales

- Execution of capital expenditure and financing plans

- Execution of cost controls

- Consolidated effective tax rate of (7%)

The 2024 earnings guidance does not include the impacts of any

material non-cash valuation adjustments, regulatory-related charges

or credits, reorganizations or restructurings, future changes in

laws, regulations or regulatory policies, adjustments made to

deferred tax assets and liabilities from valuation allowances

including further corporate tax rate changes in Iowa, changes in

credit loss liabilities related to guarantees, pending lawsuits and

disputes, settlement charges related to pension and other

postretirement benefit plans, federal and state income tax audits

and other Internal Revenue Service proceedings, impacts from

changes to the authorized return on equity for ATC, or changes in

GAAP and tax methods of accounting that may impact the reported

results of Alliant Energy.

Earnings Conference Call

A conference call to review the first quarter 2024 results is

scheduled for Friday, May 3, 2024 at 9 a.m. central time. Alliant

Energy Executive Chairman John Larsen, President and Chief

Executive Officer Lisa Barton, and Executive Vice President and

Chief Financial Officer Robert Durian will host the call. The

conference call is open to the public and can be accessed in two

ways. Interested parties may listen to the call by dialing

800-225-9448 (Toll-Free) or 203-518-9708 (International), passcode

ALLIANTQ1. Interested parties may also listen to a webcast at

www.alliantenergy.com/investors. In conjunction with the

information in this earnings announcement and the conference call,

Alliant Energy posted supplemental materials on its website. An

archive of the webcast will be available on the Company’s website

at www.alliantenergy.com/investors for 12 months.

About Alliant Energy Corporation

Alliant Energy is the parent company of two public utility

companies - Interstate Power and Light Company and Wisconsin Power

and Light Company - and of Alliant Energy Finance, LLC, the parent

company of Alliant Energy’s non-utility operations. Alliant Energy,

whose core purpose is to serve customers and build stronger

communities, is an energy-services provider with utility

subsidiaries serving approximately 1,000,000 electric and 425,000

natural gas customers. Providing its customers in the Midwest with

regulated electricity and natural gas service is the Company’s

primary focus. Alliant Energy, headquartered in Madison, Wisconsin,

is a component of the S&P 500 and is traded on the Nasdaq

Global Select Market under the symbol LNT. For more information,

visit the Company’s website at www.alliantenergy.com.

Forward-Looking Statements

This press release includes forward-looking statements. These

forward-looking statements can be identified by words such as

“forecast,” “expect,” “guidance,” or other words of similar import.

Similarly, statements that describe future financial performance or

plans or strategies are forward-looking statements. Such forward

looking statements are subject to certain risks and uncertainties

that could cause actual results to differ materially from those

expressed in, or implied by, such statements. Actual results could

be materially affected by the following factors, among others:

- the direct or indirect effects resulting from cybersecurity

incidents or attacks on Alliant Energy, IPL, WPL, or their

suppliers, contractors and partners, or responses to such

incidents;

- the impact of customer- and third party-owned generation,

including alternative electric suppliers, in IPL’s and WPL’s

service territories on system reliability, operating expenses and

customers’ demand for electricity;

- economic conditions and the impact of business or facility

closures in IPL’s and WPL’s service territories;

- the impact of energy efficiency, franchise retention and

customer disconnects on sales volumes and operating income;

- the impact that price changes may have on IPL’s and WPL’s

customers’ demand for electric, gas and steam services and their

ability to pay their bills;

- changes in the price of delivered natural gas, transmission,

purchased electricity and delivered coal, particularly during

elevated market prices, and any resulting changes to counterparty

credit risk, due to shifts in supply and demand caused by market

conditions, regulations and Midcontinent Independent System

Operator, Inc.’s (MISO’s) seasonal resource adequacy process;

- IPL’s and WPL’s ability to obtain adequate and timely rate

relief to allow for, among other things, the recovery of and/or the

return on costs, including fuel costs, operating costs,

transmission costs, capacity costs, deferred expenditures, deferred

tax assets, tax expense, interest expense, capital expenditures,

and remaining costs related to electric generating units (EGUs)

that may be permanently closed and certain other retired assets,

decreases in sales volumes, earning their authorized rates of

return, payments to their parent of expected levels of dividends,

and the impact of rate design on current and potential customers’

demand for energy in their service territories;

- weather effects on utility sales volumes and operations;

- the ability to obtain deferral treatment for the recovery of

and a return on prudently incurred costs in between rate

reviews;

- the ability to obtain regulatory approval for construction

projects with acceptable conditions;

- the ability to complete construction of renewable generation

and storage projects by planned in-service dates and within the

cost targets set by regulators due to cost increases of and access

to materials, equipment and commodities, which could result from

tariffs, duties or other assessments, such as any additional

tariffs resulting from U.S. Department of Commerce investigations

into and any decisions made regarding the sourcing of solar project

materials and equipment from certain countries, labor issues or

supply shortages, the ability to successfully resolve warranty

issues or contract disputes, the ability to achieve the expected

level of tax benefits based on tax guidelines, project costs and

the level of electricity output generated by qualifying generating

facilities, and the ability to efficiently utilize the renewable

generation and storage project tax benefits for the benefit of

customers;

- WPL’s ability to obtain rate relief to allow for the return on

costs of solar generation projects that exceed initial cost

estimates;

- the impacts of changes in the tax code, including tax rates,

minimum tax rates, adjustments made to deferred tax assets and

liabilities, and changes impacting the availability of and ability

to transfer renewable tax credits;

- the ability to utilize tax credits generated to date, and those

that may be generated in the future, before they expire, as well as

the ability to transfer tax credits that may be generated in the

future at adequate pricing;

- disruptions to ongoing operations and the supply of materials,

services, equipment and commodities needed to construct solar

generation, battery storage and electric and gas distribution

projects, which may result from geopolitical issues, supplier

manufacturing constraints, regulatory requirements, labor issues or

transportation issues, and thus affect the ability to meet capacity

requirements and result in increased capacity expense;

- inflation and higher interest rates;

- the future development of technologies related to

electrification, and the ability to reliably store and manage

electricity;

- federal and state regulatory or governmental actions, including

the impact of legislation, and regulatory agency orders and changes

in public policy;

- employee workforce factors, including the ability to hire and

retain employees with specialized skills, impacts from employee

retirements, changes in key executives, ability to create desired

corporate culture, collective bargaining agreements and

negotiations, work stoppages or restructurings;

- disruptions in the supply and delivery of natural gas,

purchased electricity and coal;

- changes to the creditworthiness of, or performance of

obligations by, counterparties with which Alliant Energy, IPL and

WPL have contractual arrangements, including participants in the

energy markets and fuel suppliers and transporters;

- the impact of penalties or third-party claims related to, or in

connection with, a failure to maintain the security of personally

identifiable information, including associated costs to notify

affected persons and to mitigate their information security

concerns;

- impacts that terrorist attacks may have on Alliant Energy’s,

IPL’s and WPL’s operations and recovery of costs associated with

restoration activities, or on the operations of Alliant Energy’s

investments;

- any material post-closing payments related to any past asset

divestitures, including the transfer of renewable tax credits and

the sale of Whiting Petroleum, which could result from, among other

things, indemnification agreements, warranties, guarantees or

litigation;

- continued access to the capital markets on competitive terms

and rates, and the actions of credit rating agencies;

- changes to MISO’s resource adequacy process establishing

capacity planning reserve margin and capacity accreditation

requirements that may impact how and when new and existing

generating facilities, including IPL’s and WPL’s additional solar

generation, may be accredited with energy capacity, and may require

IPL and WPL to adjust their current resource plans, to add

resources to meet the requirements of MISO’s process, or procure

capacity in the market whereby such costs might not be recovered in

rates;

- issues associated with environmental remediation and

environmental compliance, including compliance with all

environmental and emissions permits and future changes in

environmental laws and regulations, including the Coal Combustion

Residuals Rule, Cross-State Air Pollution Rule and federal, state

or local regulations for greenhouse gases emissions reductions from

new and existing fossil-fueled EGUs under the Clean Air Act, and

litigation associated with environmental requirements;

- increased pressure from customers, investors and other

stakeholders to more rapidly reduce greenhouse gases

emissions;

- the ability to defend against environmental claims brought by

state and federal agencies, such as the U.S. Environmental

Protection Agency and state natural resources agencies, or third

parties, such as the Sierra Club, and the impact on operating

expenses of defending and resolving such claims;

- the direct or indirect effects resulting from breakdown or

failure of equipment in the operation of electric and gas

distribution systems, such as mechanical problems and explosions or

fires, and compliance with electric and gas transmission and

distribution safety regulations, including regulations promulgated

by the Pipeline and Hazardous Materials Safety Administration;

- issues related to the availability and operations of EGUs,

including start-up risks, breakdown or failure of equipment,

availability of warranty coverage and successful resolution of

warranty issues or contract disputes for equipment breakdowns or

failures, performance below expected or contracted levels of output

or efficiency, operator error, employee safety, transmission

constraints, compliance with mandatory reliability standards and

risks related to recovery of resulting incremental operating,

fuel-related and capital costs through rates;

- impacts that excessive heat, excessive cold, storms, wildfires,

or natural disasters may have on Alliant Energy’s, IPL’s and WPL’s

operations and construction activities, and recovery of costs

associated with restoration activities, or on the operations of

Alliant Energy’s investments;

- Alliant Energy’s ability to sustain its dividend payout ratio

goal;

- changes to costs of providing benefits and related funding

requirements of pension and other postretirement benefits plans due

to the market value of the assets that fund the plans, economic

conditions, financial market performance, interest rates, timing

and form of benefits payments, life expectancies and

demographics;

- material changes in employee-related benefit and compensation

costs, including settlement losses related to pension plans;

- risks associated with operation and ownership of non-utility

holdings;

- changes in technology that alter the channels through which

customers buy or utilize Alliant Energy’s, IPL’s or WPL’s products

and services;

- impacts on equity income from unconsolidated investments from

changes in valuations of the assets held, as well as potential

changes to ATC LLC’s authorized return on equity;

- impacts of IPL’s future tax benefits from Iowa rate-making

practices, including deductions for repairs expenditures,

allocation of mixed service costs and state depreciation, and

recoverability of the associated regulatory assets from customers,

when the differences reverse in future periods;

- current or future litigation, regulatory investigations,

proceedings or inquiries;

- reputational damage from negative publicity, protests, fines,

penalties and other negative consequences resulting in regulatory

and/or legal actions;

- the direct or indirect effects resulting from pandemics;

- the effect of accounting standards issued periodically by

standard-setting bodies;

- the ability to successfully complete tax audits and changes in

tax accounting methods with no material impact on earnings and cash

flows; and

- other factors listed in the “2024 Earnings Guidance” section of

this press release.

For more information about potential factors that could

affect Alliant Energy’s business and financial results, refer to

Alliant Energy’s most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission (SEC),

including the sections therein titled “Risk Factors,” and its other

filings with the SEC.

Without limitation, the expectations with respect to 2024

earnings guidance in this press release are forward-looking

statements and are based in part on certain assumptions made by

Alliant Energy, some of which are referred to in the

forward-looking statements. Alliant Energy cannot provide any

assurance that the assumptions referred to in the forward-looking

statements or otherwise are accurate or will prove to be correct.

Any assumptions that are inaccurate or do not prove to be correct

could have a material adverse effect on Alliant Energy’s ability to

achieve the estimates or other targets included in the

forward-looking statements. The forward-looking statements included

herein are made as of the date hereof and, except as required by

law, Alliant Energy undertakes no obligation to update publicly

such statements to reflect subsequent events or circumstances.

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding

Alliant Energy’s financial results, this press release includes

reference to certain non-GAAP financial measures.

Alliant Energy included in this press release IPL; WPL;

Corporate Services; Utilities and Corporate Services; ATC Holdings;

and Non-utility and Parent EPS for the three months ended March 31,

2024 and 2023. Alliant Energy believes these non-GAAP financial

measures are useful to investors because they facilitate an

understanding of segment performance and trends, and provide

additional information about Alliant Energy’s operations on a basis

consistent with the measures that management uses to manage its

operations and evaluate its performance.

Note: Unless otherwise noted, all “per share” references

in this release refer to earnings per diluted share.

ALLIANT ENERGY

CORPORATION

EARNINGS SUMMARY

(Unaudited)

The following tables provide a summary of

Alliant Energy’s results for the three months ended March 31:

EPS:

GAAP EPS

2024

2023

IPL

$

0.25

$

0.29

WPL

0.36

0.35

Corporate Services

0.01

0.01

Subtotal for Utilities and Corporate

Services

0.62

0.65

ATC Holdings

0.04

0.04

Non-utility and Parent

(0.04

)

(0.04

)

Alliant Energy Consolidated

$

0.62

$

0.65

Earnings (in

millions):

GAAP Income (Loss)

2024

2023

IPL

$

63

$

72

WPL

92

88

Corporate Services

4

3

Subtotal for Utilities and Corporate

Services

159

163

ATC Holdings

9

9

Non-utility and Parent

(10

)

(9

)

Alliant Energy Consolidated

$

158

$

163

ALLIANT ENERGY

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (Unaudited)

Three Months Ended March 31,

2024

2023

(in millions, except per share

amounts)

Revenues:

Electric utility

$

791

$

768

Gas utility

205

276

Other utility

13

11

Non-utility

22

22

1,031

1,077

Operating expenses:

Electric production fuel and purchased

power

163

157

Electric transmission service

152

146

Cost of gas sold

114

181

Other operation and maintenance:

Energy efficiency costs

14

20

Non-utility Travero

17

16

Other

129

138

Depreciation and amortization

189

166

Taxes other than income taxes

31

31

809

855

Operating income

222

222

Other (income) and deductions:

Interest expense

107

94

Equity income from unconsolidated

investments, net

(15

)

(17

)

Allowance for funds used during

construction

(19

)

(19

)

Other

1

3

74

61

Income before income taxes

148

161

Income tax benefit

(10

)

(2

)

Net income attributable to Alliant

Energy common shareowners

$

158

$

163

Weighted average number of common

shares outstanding:

Basic

256.2

251.2

Diluted

256.5

251.4

Earnings per weighted average common

share attributable to Alliant Energy common shareowners (basic and

diluted)

$

0.62

$

0.65

ALLIANT ENERGY

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

March 31, 2024

December 31, 2023

(in millions)

ASSETS:

Current assets:

Cash and cash equivalents

$

32

$

62

Other current assets

1,076

1,210

Property, plant and equipment, net

17,354

17,157

Investments

611

602

Other assets

2,175

2,206

Total assets

$

21,248

$

21,237

LIABILITIES AND EQUITY:

Current liabilities:

Current maturities of long-term debt

$

809

$

809

Commercial paper

334

475

Other current liabilities

841

1,020

Long-term debt, net (excluding current

portion)

8,524

8,225

Other liabilities

3,923

3,931

Alliant Energy Corporation common

equity

6,817

6,777

Total liabilities and equity

$

21,248

$

21,237

ALLIANT ENERGY

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited)

Three Months Ended March 31,

2024

2023

(in millions)

Cash flows from operating

activities:

Cash flows from operating activities

excluding accounts receivable sold to a third party

$

430

$

329

Accounts receivable sold to a third

party

(123

)

(141

)

Net cash flows from operating

activities

307

188

Cash flows used for investing

activities:

Construction and acquisition

expenditures:

Utility business

(478

)

(417

)

Other

(32

)

(34

)

Cash receipts on sold receivables

155

173

Proceeds from sale of partial ownership

interest in West Riverside

—

25

Other

2

(10

)

Net cash flows used for investing

activities

(353

)

(263

)

Cash flows from financing

activities:

Common stock dividends

(123

)

(113

)

Proceeds from issuance of long-term

debt

597

862

Payments to retire long-term debt

(300

)

—

Net change in commercial paper and other

short-term borrowings

(141

)

(532

)

Other

(15

)

(5

)

Net cash flows from financing

activities

18

212

Net increase (decrease) in cash, cash

equivalents and restricted cash

(28

)

137

Cash, cash equivalents and restricted

cash at beginning of period

63

24

Cash, cash equivalents and restricted

cash at end of period

$

35

$

161

KEY FINANCIAL AND OPERATING

STATISTICS

March 31, 2024

March 31, 2023

Common shares outstanding (000s)

256,379

251,388

Book value per share

$26.59

$25.17

Quarterly common dividend rate per

share

$0.48

$0.4525

Three Months Ended March

31,

2024

2023

Utility electric sales (000s of

megawatt-hours)

Residential

1,755

1,806

Commercial

1,523

1,554

Industrial

2,532

2,564

Industrial - co-generation customers

179

277

Retail subtotal

5,989

6,201

Sales for resale:

Wholesale

679

698

Bulk power and other

1,670

1,243

Other

15

15

Total

8,353

8,157

Utility retail electric customers (at

March 31)

Residential

849,255

843,367

Commercial

145,826

144,932

Industrial

2,407

2,416

Total

997,488

990,715

Utility gas sold and transported (000s

of dekatherms)

Residential

11,823

13,044

Commercial

7,529

8,500

Industrial

765

766

Retail subtotal

20,117

22,310

Transportation / other

33,908

32,614

Total

54,025

54,924

Utility retail gas customers (at March

31)

Residential

383,769

381,714

Commercial

45,125

45,050

Industrial

322

324

Total

429,216

427,088

Estimated operating income decreases

from impacts of temperatures (in millions) -

Three Months Ended March

31,

2024

2023

Electric

($19)

($9)

Gas

(11)

(6)

Total temperature impact

($30)

($15)

Three Months Ended March

31,

2024

2023

Normal

Heating degree days (HDDs) (a)

Cedar Rapids, Iowa (IPL)

2,850

3,155

3,471

Madison, Wisconsin (WPL)

2,979

3,184

3,554

(a)

HDDs are calculated using a simple average

of the high and low temperatures each day compared to a 65 degree

base. Normal degree days are calculated using a rolling 20-year

average of historical HDDs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502427007/en/

Media Hotline: (608) 458-4040

Investor Relations: Susan Gille (608) 458-3956

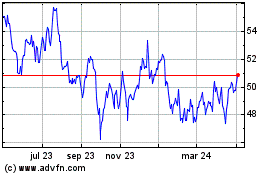

Alliant Energy (NASDAQ:LNT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

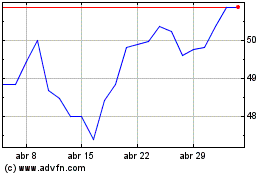

Alliant Energy (NASDAQ:LNT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025