Lyra Therapeutics, Inc. (Nasdaq: LYRA) (“Lyra” or the “Company”), a

clinical-stage biotechnology company developing long-acting

anti-inflammatory therapies for the localized treatment of chronic

rhinosinusitis (CRS), today reported its financial results for the

third quarter ended September 30, 2023 and provided a corporate

update.

The Company also announced additional positive data from the

BEACON Phase 2 clinical trial of LYR-220 that demonstrated

statistically significant, objective improvement and sustained

symptomatic improvement in CRS patients who have had prior ethmoid

sinus surgery and further support the positive topline results

reported in September 2023:

- Data evaluating computed tomography (CT) scans, a pre-specified

secondary endpoint, demonstrated statistically significant

improvement in ethmoid sinus opacification in patients who received

LYR-220, compared to sham control at week 24 (p=0.035). These data

provide objective radiological evidence of improvement with LYR-220

treatment.

- At End of Study, Week 28, patients receiving LYR-220 showed

continued symptomatic improvement compared to sham control in both

Sino-Nasal Outcome Test (SNOT-22) score (-17.6 points; p=0.007) and

in a composite of the 3 cardinal symptoms of CRS (nasal

obstruction, nasal discharge, facial pain/pressure; 3CS) (-1.28;

p=0.063).

The Company plans to submit results of the BEACON study for

presentation at an upcoming medical meeting.

“We believe Lyra is on track to develop a robust CRS product

portfolio based on the continued progress of our clinical programs,

including the recently reported positive results of the BEACON

Phase 2 trial of LYR-220 in post-surgical CRS patients and the

completion of enrollment in the ENLIGHTEN I pivotal trial of

LYR-210 in pre-surgical CRS patients,” said Maria Palasis, Ph.D.,

President and CEO of Lyra. “Our optimism continues for LYR-220 with

the additional positive CT data from the BEACON trial announced

today that demonstrated objective improvement in CRS patients. We

believe these findings provide additional confidence in the ongoing

ENLIGHTEN pivotal Phase 3 program of LYR-210 in CRS patients who

have not had ethmoid sinus surgery, for which we anticipate topline

data will be available in the first half of 2024.”

LYR-210 and LYR-220 are bioresorbable nasal implants designed to

deliver six months of continuous anti-inflammatory medication

(mometasone furoate; MF) to the sinonasal passages for the

treatment of CRS.

Program Highlights

BEACON Phase 2 Clinical Trial of LYR-220 in CRS Patients

who Have Had Prior Ethmoid Sinus Surgery

- In September 2023, Lyra announced positive topline results from

the BEACON Phase 2 clinical trial of LYR-220 in adult patients with

CRS, with and without polyps, who have recurrent symptoms despite

prior ethmoid sinus surgery. The study met its primary safety

endpoint, with no serious adverse events observed. LYR-220

demonstrated statistically significant and clinically relevant

improvements in SNOT-22 (-16.8; p=0.007) scores and 3CS (-1.50;

p=0.02) compared to sham control at 24 weeks, with statistically

significant improvement observed as early as week 2 in SNOT-22 and

at week 4 in 3CS. The most commonly reported adverse events

included sinusitis, nasopharyngitis, bronchitis, and COVID-19.

The Phase 2 BEACON trial is a randomized, controlled,

parallel-group study intended to evaluate the safety and placement

feasibility of the LYR-220 (7500µg MF) matrix, over a 28-week

period, in symptomatic CRS patients who have had prior ethmoid

sinus surgery. The study consists of two parts: Part 1 was designed

primarily to assess the feasibility and tolerability of two 7500µg

MF matrix designs; in Part 2, 42 patients were randomized 1:1 to

receive LYR-220 or sham control.

ENLIGHTEN Pivotal Program of LYR-210 in CRS Patients who

have not had Ethmoid Sinus Surgery

- In August 2023, Lyra announced completion of enrollment in the

pivotal Phase 3 ENLIGHTEN I clinical trial.

- Topline results from the ENLIGHTEN I clinical trial are

anticipated in the first half of 2024.

- Enrollment is ongoing in the second pivotal Phase 3 trial,

ENLIGHTEN II; enrollment completion is expected in the second half

of 2024.

The ENLIGHTEN program consists of two pivotal Phase 3 clinical

trials, ENLIGHTEN I and ENLIGHTEN II, to evaluate the efficacy and

safety of LYR-210 for the treatment of CRS. The Company designed

each trial to evaluate 180 CRS patients who have failed medical

management and have not had prior ethmoid sinus surgery, randomized

2:1 to either LYR-210 (7500µg mometasone furoate (MF)) or control

over 24 weeks. The goal of the two pivotal trials is to support a

New Drug Application to the U.S. Food and Drug Administration for

LYR-210.

Third Quarter 2023 Financial Highlights

Cash, cash equivalents and short-term investments as of

September 30, 2023 were $102.6 million, compared with $116.2

million at June 30, 2023. Based on our current business plan, we

anticipate that our cash, cash equivalents and short-term

investment balance is sufficient to fund our operating expenses and

capital expenditures into the first quarter of 2025.

Research and development expenses for the quarter ended

September 30, 2023 were $12.4 million compared to $10.1 million for

the same period in 2022. During the quarter ended September 30,

2023, clinical development costs increased by $2.4 million as we

continued to enroll patients in our ENLIGHTEN I and ENLIGHTEN II

Phase 3 clinical trials, employee related costs increased by $1.0

million, associated allocated costs increased by $0.4 million as we

increased our headcount to support increased research and

development activities and professional and consulting fees

increased by $0.1 million. These increases were partially offset by

decreased product development and manufacturing costs of $1.2

million related to bringing production efforts in house, and

decreased depreciation costs of $0.4

million.

General and administrative expenses for the quarter ended

September 30, 2023 were $5.0 million compared to $5.1 million for

the same period in 2022. The decrease in general and administrative

expenses for the three months ended September 30, 2023 was

primarily attributable to decreased employee related costs of $0.6

million, of which $0.5 million was related to stock-based

compensation, and decreased allocated costs of $0.4 million, as

well as the decrease in public company-related costs of $0.1

million. This decrease was partially offset by increased

professional and consulting costs of $0.6 million and increased

support costs of $0.4 million.

Net loss for the quarter ended September 30, 2023 was $15.7

million compared to $14.8 million for the same period in

2022.

About Lyra TherapeuticsLyra Therapeutics, Inc.

is a clinical-stage biotechnology company developing long-acting

anti- inflammatory therapies for the localized treatment of

patients with chronic rhinosinusitis (CRS). Lyra has two

investigational product candidates, LYR-210 and LYR-220, in

late-stage development for CRS, a highly prevalent inflammatory

disease of the paranasal sinuses which leads to debilitating

symptoms and significant morbidities. LYR-210 and LYR-220 are

bioresorbable nasal implants designed to be inserted in an

in-office procedure and are intended to deliver six months of

continuous mometasone furoate drug therapy (7500µg MF) to the

sinonasal passages. LYR-210 is designed for patients who have not

had sinus surgery and is being evaluated in the ENLIGHTEN Phase 3

clinical program, while LYR-220, an enlarged implant, is being

evaluated in the BEACON Phase 2 clinical trial in patients who have

recurrent symptoms despite prior ethmoid sinus surgery. These two

product candidates are designed to treat the estimated four million

CRS patients in the United States who fail medical management each

year. For more information, please

visit www.lyratx.com and follow us on LinkedIn.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking statements, including statements

regarding the Company’s cash runway into the first quarter of 2025,

the timing, enrollment and success of the Company’s clinical

programs, the timing for reporting data from the Company’s clinical

trials, the safety and efficacy of the Company’s product

candidates, the Company’s participation and presentation of results

from the BEACON study at an upcoming medical meeting and the

Company’s development of a robust CRS product portfolio. These

statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that

may cause the Company's actual results, performance or achievements

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following: the fact

that the Company has incurred significant losses since inception

and expects to incur additional losses for the foreseeable future;

the Company's need for additional funding, which may not be

available; the Company’s limited operating history; the fact that

the Company has no approved products; the fact that the Company’s

product candidates are in various stages of development; the fact

that the Company has never scaled up an in-house manufacturing

facility for clinical or commercial use; or the fact that the

Company may not be successful in its efforts to successfully

commercialize its product candidates; the fact that clinical trials

required for the Company’s product candidates are expensive and

time-consuming, and their outcomes are uncertain; the fact that the

FDA may not conclude that certain of the Company’s product

candidates satisfy the requirements for the Section 505(b)(2)

regulatory approval pathway; the Company’s inability to obtain

required regulatory approvals; effects of recently enacted and

future legislation; the possibility of system failures or security

breaches; effects of significant competition; the fact that the

successful commercialization of the Company’s product candidates

will depend in part on the extent to which governmental authorities

and health insurers establish coverage, adequate reimbursement

levels and pricing policies; failure to achieve market acceptance;

product liability lawsuits; the fact that the Company must scale

its in-house manufacturing capabilities or rely on third parties

for the manufacture of materials for its research programs,

pre-clinical studies and clinical trials and commercial supply; the

Company's reliance on third parties to conduct its preclinical

studies and clinical trials; the Company's inability to succeed in

establishing and maintaining collaborative relationships; the

Company's reliance on certain suppliers critical to its production;

failure to obtain and maintain or adequately protect the Company's

intellectual property rights; failure to retain key personnel or to

recruit qualified personnel; difficulties in managing the Company's

growth; effects of natural disasters, international terrorism,

conflicts and wars; the fact that the global pandemic caused by

COVID-19 could adversely impact the Company's business and

operations, including the Company's clinical trials; the fact that

the price of the Company's common stock may be volatile and

fluctuate substantially; significant costs and required management

time as a result of operating as a public company and any

securities class action litigation. These and other important

factors discussed under the caption "Risk Factors" in the Company's

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission (the “SEC”) on November 7, 2023 and its other

filings with the SEC could cause actual results to differ

materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements

represent management's estimates as of the date of this press

release. While the Company may elect to update such forward-looking

statements at some point in the future, it disclaims any obligation

to do so, even if subsequent events cause its views to change.

|

LYRA THERAPEUTICS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(in thousands, except share and per share

data) |

|

|

|

|

Three Months

EndedSeptember 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Collaboration revenue |

$ |

544 |

|

|

$ |

359 |

|

|

$ |

1,412 |

|

|

$ |

1,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

12,368 |

|

|

|

10,048 |

|

|

|

35,763 |

|

|

|

29,346 |

|

|

General and administrative |

|

5,003 |

|

|

|

5,137 |

|

|

|

14,700 |

|

|

|

13,157 |

|

|

Loss on impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

1,592 |

|

|

|

— |

|

| Total

operating expenses |

|

17,371 |

|

|

|

15,185 |

|

|

|

52,055 |

|

|

|

42,503 |

|

| Loss

from operations |

|

(16,827 |

) |

|

|

(14,826 |

) |

|

|

(50,643 |

) |

|

|

(41,151 |

) |

| Other

income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

1,192 |

|

|

|

60 |

|

|

|

3,161 |

|

|

|

108 |

|

| Total

other income |

|

1,192 |

|

|

|

60 |

|

|

|

3,161 |

|

|

|

108 |

|

| Loss

before income tax expense |

|

(15,635 |

) |

|

|

(14,766 |

) |

|

|

(47,482 |

) |

|

|

(41,043 |

) |

| Income

tax expense |

|

(16 |

) |

|

|

— |

|

|

|

(42 |

) |

|

|

— |

|

| Net

loss |

|

(15,651 |

) |

|

|

(14,766 |

) |

|

|

(47,524 |

) |

|

|

(41,043 |

) |

| Other

comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized holding gain (loss) on short-term investments, net of

tax |

|

20 |

|

|

|

— |

|

|

|

(17 |

) |

|

|

— |

|

|

Comprehensive loss |

$ |

(15,631 |

) |

|

$ |

(14,766 |

) |

|

$ |

(47,541 |

) |

|

$ |

(41,043 |

) |

| Net loss

per share attributable to common stockholders— basic and

diluted |

$ |

(0.27 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.04 |

) |

|

$ |

(1.47 |

) |

|

Weighted-average common shares outstanding—basic and diluted |

|

56,953,685 |

|

|

|

36,826,364 |

|

|

|

45,894,643 |

|

|

|

28,014,434 |

|

| |

|

LYRA THERAPEUTICS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS(in thousands, except

share and per share data) |

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

24,850 |

|

|

$ |

32,550 |

|

|

Short-term investments |

|

77,700 |

|

|

|

65,344 |

|

|

Prepaid expenses and other current assets |

|

2,370 |

|

|

|

2,935 |

|

|

Total current assets |

|

104,920 |

|

|

|

100,829 |

|

| Property

and equipment, net |

|

726 |

|

|

|

2,243 |

|

|

Operating lease right-of-use assets |

|

6,074 |

|

|

|

2,223 |

|

|

Restricted cash |

|

1,392 |

|

|

|

1,392 |

|

| Other

assets |

|

7,463 |

|

|

|

3,281 |

|

|

Total assets |

$ |

120,575 |

|

|

$ |

109,968 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

5,054 |

|

|

$ |

2,616 |

|

|

Accrued expenses and other current liabilities |

|

11,052 |

|

|

|

9,030 |

|

|

Operating lease liabilities |

|

1,403 |

|

|

|

1,549 |

|

|

Deferred revenue |

|

1,726 |

|

|

|

1,275 |

|

|

Total current liabilities |

|

19,235 |

|

|

|

14,470 |

|

|

Operating lease liabilities, net of current portion |

|

4,887 |

|

|

|

667 |

|

| Deferred

revenue, net of current portion |

|

12,214 |

|

|

|

14,077 |

|

|

Total liabilities |

|

36,336 |

|

|

|

29,214 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value, 10,000,000 shares authorized at

September 30, 2023 and December 31, 2022; no shares issued and

outstanding at September 30, 2023 and December 31, 2022 |

|

— |

|

|

|

— |

|

| Common

stock, $0.001 par value; 200,000,000 shares authorized at September

30, 2023 and December 31, 2022; 49,545,559 and 31,827,659 shares

issued and outstanding at September 30, 2023 and December 31, 2022,

respectively |

|

50 |

|

|

|

32 |

|

|

Additional paid-in capital |

|

380,395 |

|

|

|

329,387 |

|

|

Accumulated other comprehensive (loss) income, net of tax |

|

(7 |

) |

|

|

10 |

|

|

Accumulated deficit |

|

(296,199 |

) |

|

|

(248,675 |

) |

|

Total stockholders’ equity |

|

84,239 |

|

|

|

80,754 |

|

|

Total liabilities and stockholders’ equity |

$ |

120,575 |

|

|

$ |

109,968 |

|

|

|

Contact Information:

Ellen Cavaleri, Investor Relations

615.618.6228

ecavaleri@lyratx.com

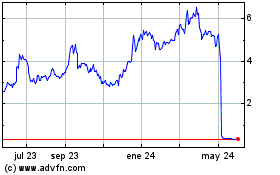

Lyra Therapeutics (NASDAQ:LYRA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

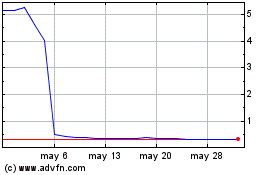

Lyra Therapeutics (NASDAQ:LYRA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025