LSI Acquires EMI Industries for $50 Million in

Accretive, All-Cash Transaction

Transaction Expands Display Solutions

Capabilities Within Grocery, Convenience Store & Restaurant

Markets

LSI to Host EMI Industries Acquisition

Conference Call at 11 a.m. ET on April 19, 2024

LSI Industries Inc. (NASDAQ: LYTS, “LSI” or the “Company”), a

leading U.S. based manufacturer of commercial lighting and display

solutions, today announced the acquisition of privately held EMI

Industries (“EMI”) for an all-cash purchase price of $50

million.

Florida-based EMI is an award-winning metal and millwork

manufacturer of standard and customized fixtures, displays, and

food equipment for the convenience store, grocery, and restaurant

industries. For more than 40 years, EMI has worked closely with

customers to develop innovative custom solutions that drive

in-store customer traffic, elevate brand identity, and enhance the

shopping experience. EMI serves a diverse, well-established

customer base ranging in size from regional brands with several

hundred site locations to national and international brands

operating thousands of sites. EMI designs and manufactures products

from five production facilities across the United States.

“LSI continues to build the premier commercial lighting and

retail display solutions business in North America,” stated James

A. Clark, President and Chief Executive Officer. “The addition of

EMI serves to broaden our product and services capabilities within

retail fixtures, displays and food equipment. Consistent with our

Fast Forward strategy introduced last year, the acquisition

positions us to further capitalize on the ongoing, multi-year

investment cycle evident across the grocery, refueling/c-store, and

restaurant markets.

“As we bring together our complementary products, services, and

technologies, there are significant cross-selling opportunities

that enable us to be a single-source provider to more customers

throughout North America,” continued Clark. “The combination

represents a major step forward in our ability to serve a growing

portfolio of national retail chains that value our integrated,

solutions-based approach, which emphasizes quality, reliability,

and deep technical expertise.”

“EMI has established one of the most respected fixture and

equipment brands in our industry,” stated Clark. At LSI, we share

EMI’s customer-centric commitment to performance excellence and

look forward to leveraging our combined capabilities as we enter

the next phase of strategic growth. We are excited to welcome the

more than 300 employees and experienced leadership to the LSI

team.”

Alan Harvill, President and CEO of EMI Industries, stated, “LSI

is an industry leader with a proven record of growth and value

creation. We are proud to become the newest part of the LSI team

and look forward to unlocking the powerful potential of the

combined businesses.”

Clark concluded, “As outlined within our Fast Forward strategic

plan, LSI intends to drive net sales growth by more than 60%

between fiscal year 2023 and fiscal year 2028, with approximately

half of this growth supported by acquisition-related contributions.

Looking ahead, we will continue to develop leading positions within

growing, high-value market verticals that expand our capabilities

and reach while continuing to scale our solutions-based platform as

we drive long-term value creation for our shareholders.”

FINANCIAL AND TRANSACTION OVERVIEW

In the full year calendar 2023, EMI reported total revenue and

adjusted EBITDA of approximately $87.0 million and $5.5 million,

respectively. Upon closing, the transaction will be immediately

accretive to LSI on an adjusted earnings per share basis.

LSI funded the acquisition of EMI utilizing cash and

availability under its existing credit facility. At closing, LSI

anticipates that its pro-forma ratio of net debt outstanding to

trailing twelve-month adjusted EBITDA will be approximately 1.3x.

LSI intends to significantly reduce net leverage within the

business during the next 24 months, supported by anticipated growth

in pro-forma free cash flow from the combined entities.

As part of the transaction, the Company will welcome EMI’s more

than 300 employees to LSI, while retaining EMI’s experienced

leadership team, including President and CEO Alan Harvill, together

with each of its five facilities. Following the closing of the

transaction, EMI will remain an independent brand, given its

established commercial presence in the market. LSI anticipates EMI

will become part of LSI’s display solutions segment on a reporting

basis moving forward.

COMPELLING TRANSACTION RATIONALE

- EMI further establishes LSI as a market-leading business of

scale within the retail display solutions market. Following the

successful acquisition of JSI Store Fixtures in 2021, EMI

significantly expands LSI’s presence in the grocery, convenience

store and QSR/restaurant verticals. The combined business provides

considerable commercial and operational synergies to be realized

over the next several years.

- Business combination provides a one-stop, end-to-end

integrated solution to LSI customers. The addition of EMI

positions LSI to further enhance its unique value proposition with

customers across the full continuum of product design, manufacture,

installation, and post-sale support. LSI believes its integrated

approach will further entrench its value as a trusted partner

equipped to support the full project management lifecycle.

- Complementary EMI and LSI customer lists provide for

significant commercial synergy potential. While the two

companies share specific customers, many do not overlap,

representing a significant cross-selling opportunity for LSI. The

business combination also expands our capability to attract new

customers in existing markets.

- Transaction capitalizes on a multi-year investment cycle

within key vertical markets. EMI is one of the largest

privately held retail fixture and food equipment companies in the

North America, with a diverse base of recurring, long-term

customers. LSI believes its acquisition of EMI will position it to

further capitalize on the ongoing, multi-year capital investment

programs within the convenience store, grocery, and restaurant

industries as operators seek to adapt to evolving consumer

preferences and behaviors

- Transaction is immediately accretive to LSI’s adjusted

earnings per share. EMI is expected to deliver adjusted

earnings per share accretion to LSI upon closing of the

transaction, excluding acquisition-related revenue and cost

synergies. On a post-synergy basis, LSI believes it will steadily

expand EMI’s margin performance in future years, positioning LSI to

deliver double-digit EBITDA margin within the legacy EMI business

within the first 24 months following the close of the

transaction.

- Transaction is consistent with inorganic growth priorities

outlined within LSI’s Fast Forward strategy. LSI’s Fast Forward

Strategy seeks to deliver sustained commercial expansion,

operational excellence, and disciplined capital allocation,

consistent with the Company’s focus on long-term value creation. As

outlined within the Fast Forward strategy, LSI remains focused on

adding scale and competencies within both new and existing vertical

markets. By fiscal year 2028, LSI projects net sales growth of more

than 60%, Adjusted EBITDA growth of more than 100% and Adjusted

EBITDA margin expansion of approximately 250+ basis points, or

12.5% of net sales, as supported through a balance of organic and

inorganic investments.

EMI INDUSTRIES ACQUISITION CONFERENCE CALL

A conference call will be held tomorrow, April 19, 2024, at 11

a.m. ET to review LSI’s acquisition of EMI Industries and conduct a

question-and-answer session.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

LSI Industries’ website at www.lsicorp.com. Individuals can also

participate by teleconference dial-in. To listen to a live

broadcast, go to the site at least 15 minutes prior to the

scheduled start time to register, download and install any

necessary audio software.

Details of the conference call are as follows:

Live Call Dial-In:

877-407-4018

Call Replay:

844-512-2921

Replay ID:

13745502

ABOUT LSI INDUSTRIES

Headquartered in Cincinnati, LSI Industries (NASDAQ: LYTS)

specializes in the creation of advanced lighting, graphics, and

display solutions. The Company’s American-made products, which

include lighting, print graphics, digital graphics, refrigerated,

and custom displays, are engineered to elevate brands in

competitive markets. With a workforce of 1,600 employees and 11

facilities throughout North America, LSI is dedicated to providing

top-quality solutions to its clients. Additional information about

LSI is available at www.lsicorp.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements.

Forward-looking statements may be identified by words such as

“estimates,” “anticipates,” “encourage,” “projects,” “plans,”

“expects,” “can,” “intends,” “believes,” “seeks,” “may,” “will,”

“should,” or the negative versions of those words and similar

expressions and by the context in which they are used. Such

statements, whether expressed or implied, are based upon current

expectations of the Company and speak only as of the date made.

Actual results could differ materially from those contained in or

implied by such forward-looking statements as a result of a variety

of risks and uncertainties over which the Company may have no

control. These risks and uncertainties include, but are not limited

to, risks that the benefits from the transaction may not be fully

realized or may take longer to realize than expected, including as

a result of changes in general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations

and their enforcement, and the degree of competition in the

geographic and business areas in which LSI and EMI operate;

uncertainties regarding the ability of LSI and EMI to promptly and

effectively integrate their businesses; uncertainties regarding the

reaction to the transaction of the companies’ respective customers,

employees, and counterparties; and risks relating to the diversion

of management time on transaction-related issues. For details on

additional risks and uncertainties that may cause our actual

results to be materially different than those expressed in our

forward-looking statements, visit https://investors.lsicorp.com as

well as our Annual Reports on Form 10-K and Quarterly Reports on

Form 10-Q which contain risk factors. The Company does not

undertake and hereby disclaims any duty to update any

forward-looking statements to reflect subsequent events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418876900/en/

INVESTOR & MEDIA CONTACT Noel Ryan, IRC 720.778.2415

LYTS@vallumadvisors.com

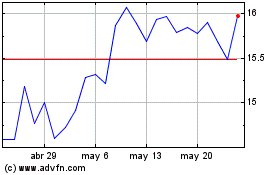

LSI Industries (NASDAQ:LYTS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

LSI Industries (NASDAQ:LYTS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024