false

0000722313

0000722313

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August

8, 2024

NORTECH

SYSTEMS INCORPORATED

(Exact

name of registrant as specified in charter)

| Minnesota |

|

0-13257 |

|

41-1681094 |

| (State

or other jurisdiction |

|

(Commission |

|

IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

7550

Meridian Circle N, Maple

Grove, MN

55369

(Address

of principal executive offices)

(952)

345-2244

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed from last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered: |

| Common

Stock, par value $.01 per share |

|

NSYS |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

The

Registrant issued a news release on August 8, 2024, entitled “Nortech Systems Reports Second Quarter Results” regarding its

consolidated results and financial condition for second quarter ended June 30, 2024. A copy of this news release is attached hereto as

Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date:

August 8, 2024

| |

Nortech

Systems Incorporated |

| |

(Registrant) |

| |

|

| |

/s/

Andrew D. C. LaFrence |

| |

Andrew

D. C. LaFrence

Chief

Financial Officer and SVP Finance |

Exhibit 99.1

Nortech

Systems Reports Second Quarter Results

MINNEAPOLIS

– August 8, 2024 — Nortech Systems Incorporated (Nasdaq: NSYS) (“Nortech” or the “Company”), a leading

provider of engineering and manufacturing solutions for complex electromedical and electromechanical products serving the medical, industrial

and defense markets, reported second quarter ended June 30, 2024 financial results.

2024

Q2 Highlights:

| |

● |

Net

sales of $33.9 million |

| |

● |

Net

income of $157 thousand, or $0.06 per diluted share |

| |

● |

Adjusted

earnings before interest, taxes, depreciation, and amortization (“EBITDA”) of $919 thousand |

| |

● |

90-day

backlog of $30.1 million as of June 30, 2024 |

Management

Commentary

“We

are working closely with our customers to optimize post Covid supply chain strategies which includes continued near-shoring activities

and the development of customer specific collaborations to further reduce lead times,” said Jay D. Miller, President and CEO of

Nortech. “We believe that these actions will further strengthen our customer relationships which are key to our achieving our long-term

strategic objectives.”

“We

continue to effectively manage operating expenses while focusing on long-term growth,” Miller noted. “During the quarter

we have rapidly implemented the announced optimization of our Minnesota facilities by the end of 2024. While having a short-term negative

impact on our financials, we anticipate these actions will significantly improve our efficiency and reduce our cost structure by at least

$1.6 million in 2025 and beyond and position Nortech for improved top and bottom-line growth.”

Summary

Financial Information

The

following table provides summary financial information comparing the second quarter 2024 (“Q2 2024”) financial results to

the same quarter in 2023 (“Q2 2023”) as well as the six-month ended June 30, 2024 (“YTD 24”) information to the

same period in 2023 (“YTD 2023”).

| ($ in thousands) | |

Q2 24 | | |

Q2 23 | | |

% Change | | |

YTD 24 | | |

YTD 23 | | |

% Change | |

| Net sales | |

$ | 33,891 | | |

$ | 35,021 | | |

| (3.2 | )% | |

$ | 68,106 | | |

$ | 69,909 | | |

| (2.6 | )% |

| Gross profit | |

$ | 4,617 | | |

$ | 5,474 | | |

| (15.7 | )% | |

$ | 10,065 | | |

$ | 10,958 | | |

| (8.1 | )% |

| Operating expenses | |

$ | 4,273 | | |

$ | 4,375 | | |

| (2.3 | )% | |

$ | 8,566 | | |

$ | 8,806 | | |

| (2.7 | )% |

| Net income | |

$ | 157 | | |

$ | 634 | | |

| (75.2 | )% | |

$ | 922 | | |

$ | 1,315 | | |

| (29.9 | )% |

| EBITDA | |

$ | 828 | | |

$ | 1,622 | | |

| (49.0 | )% | |

$ | 2,465 | | |

$ | 3,180 | | |

| (22.5 | )% |

| Adjusted EBITDA | |

$ | 919 | | |

$ | 1,622 | | |

| (43.3 | )% | |

$ | 2,556 | | |

$ | 3,180 | | |

| (19.6 | )% |

Conference

Call

The

Company will hold a live conference call and webcast at 7:30 a.m. central time on Thursday, August 8, 2024, to discuss the Company’s

2024 second quarter results. The call will be hosted by Jay D. Miller, Chief Executive Officer and President and Andrew D. C. LaFrence,

Chief Financial Officer. To access the live audio conference call, US participants may call 888-506-0062 and international participants

may call 973-528-0011. Participant Access Code: 394178. Participants may also access the call via webcast at: https://www.webcaster4.com/Webcast/Page/2814/50979.

###

About

Nortech Systems Incorporated

Nortech

Systems is a leading provider of design and manufacturing solutions for complex electromedical devices, electromechanical systems, assemblies,

and components. Nortech primarily serves the medical, aerospace & defense, and industrial markets. Its design services span concept

development to commercial design, and include medical device, software, electrical, mechanical, and biomedical engineering. Its manufacturing

and supply chain capabilities are vertically integrated around wire/cable/interconnect assemblies, printed circuit board assemblies,

as well as system-level assembly, integration, and final test. Headquartered in Maple Grove, Minn., Nortech currently has seven manufacturing

locations and design centers across the U.S., Latin America, and Asia. Nortech Systems is traded on the NASDAQ Stock Market under the

symbol NSYS. Nortech’s website is www.nortechsys.com.

Forward-Looking

Statements

This

press release contains forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform

Act of 1995 including without limitation statements regarding future financial results, nearshoring, customer specific collaboration,

improved efficiency, expense management, and effects of consolidation of our facilities including growth of net sales and profits. While

this release is based on management’s best judgment and current expectations, actual results may differ materially from those expressed

or implied and involve a number of risks and uncertainties. Important factors that could cause actual results to differ materially from

the forward-looking statements include, without limitation: (1) commodity cost increases coupled with challenges in raising prices and/or

customer pressure to reduce prices; (2) supply chain disruptions leading to shortages of critical components; (3) volatility in market

conditions which may affect demand for the Company’s products; (4) increased competition; (5) changes in the reliability and efficiency

of operating facilities or those of third parties; (6) risks related to the availability of labor; (7) the unanticipated loss of any

key member of senior management; (8) geopolitical, economic, financial and business conditions; (9) the Company’s ability to steadily

improve manufacturing output and product quality throughout the remainder of 2024 or (10) the impact of global health epidemics on our

customers, employees, manufacturing facilities, suppliers, the capital markets and our financial condition. Some of the above-mentioned

factors are described in further detail in the section entitled “Risk Factors” in our annual and quarterly reports, as applicable.

You should assume the information appearing in this document is accurate only as of the date hereof, or as otherwise specified, as our

business, financial condition, results of operations and prospects may have changed since such date. Except as required by applicable

law, including the securities laws of the United States and the rules and regulations of the United States Securities and Exchange Commission,

we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future

events or otherwise, to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

Reconciliation

of Generally Accepted Accounting Principles (“GAAP”) Measures to Non-GAAP Financial Measure

EBITDA

is a non-GAAP financial measure used by management that we believe provides useful information to investors because it reflects ongoing

performance excluding certain non-recurring items during comparable periods and facilitates comparisons between peer companies since

interest, taxes, depreciation, and amortization can differ greatly between different organizations as a result of differing capital structures

and tax strategies. EBITDA is defined as net income (loss) plus interest expense, plus income tax expense plus depreciation expense and

amortization expense. EBITDA should be considered in addition to, not as a substitute for, or superior to, financial measures calculated

in accordance with GAAP. It is not a measurement of our financial performance under GAAP and should not be considered an alternative

to revenue or net income, as applicable, or any other performance measures derived in accordance with GAAP and may not be comparable

to other similarly titled measures of other businesses. EBITDA has limitations as an analytical metric, and you should not consider it

in isolation or as a substitute for analysis of our operating results as reported under GAAP.

| | |

THREE MONTHS ENDED | | |

SIX MONTHS ENDED | |

| | |

JUNE 30, | | |

JUNE 30, | |

| INCOME STATEMENTS | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| (in thousands USD, except share and per share amounts) | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 33,891 | | |

$ | 35,021 | | |

$ | 68,106 | | |

$ | 69,909 | |

| Cost of goods sold | |

| 29,274 | | |

| 29,547 | | |

| 58,041 | | |

| 58,951 | |

| Gross profit | |

| 4,617 | | |

| 5,474 | | |

| 10,065 | | |

| 10,958 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling | |

| 909 | | |

| 953 | | |

| 1,714 | | |

| 1,843 | |

| General and administrative | |

| 2,982 | | |

| 3,105 | | |

| 6,152 | | |

| 6,370 | |

| Research and development | |

| 291 | | |

| 317 | | |

| 609 | | |

| 593 | |

| Restructuring charges | |

| 91 | | |

| - | | |

| 91 | | |

| - | |

| Total operating expenses | |

| 4,273 | | |

| 4,375 | | |

| 8,566 | | |

| 8,806 | |

| Income from operations | |

| 344 | | |

| 1,099 | | |

| 1,499 | | |

| 2,152 | |

| Other expense | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (165 | ) | |

| (125 | ) | |

| (332 | ) | |

| (235 | ) |

| Income before income taxes | |

| 179 | | |

| 974 | | |

| 1,167 | | |

| 1,917 | |

| Income tax expense | |

| 22 | | |

| 340 | | |

| 245 | | |

| 602 | |

| Net income | |

$ | 157 | | |

$ | 634 | | |

$ | 922 | | |

$ | 1,315 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic (in dollars per share) | |

$ | 0.06 | | |

$ | 0.23 | | |

$ | 0.34 | | |

$ | 0.49 | |

| Weighted average number of common shares outstanding - basic (in shares) | |

| 2,760,052 | | |

| 2,718,066 | | |

| 2,751,330 | | |

| 2,705,121 | |

| Diluted (in dollars, per share) | |

$ | 0.05 | | |

$ | 0.22 | | |

$ | 0.32 | | |

$ | 0.46 | |

| Weighted average number of common shares outstanding - diluted (in shares) | |

| 2,935,671 | | |

| 2,870,848 | | |

| 2,922,113 | | |

| 2,887,313 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation | |

| (175 | ) | |

| (281 | ) | |

| (358 | ) | |

| (241 | ) |

| Comprehensive income (loss), net of tax | |

$ | (18 | ) | |

$ | 353 | | |

$ | 564 | | |

$ | 1,074 | |

CONDENSED BALANCE SHEET ($ in thousands) | |

JUNE 30, 2024 | | |

DECEMBER 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,542 | | |

$ | 960 | |

| Restricted cash | |

| - | | |

| 715 | |

| Accounts receivable, less allowances of $270 and $358, respectively | |

| 17,577 | | |

| 19,279 | |

| Inventories, net | |

| 22,793 | | |

| 21,660 | |

| Contract assets | |

| 14,957 | | |

| 14,481 | |

| Prepaid assets and other assets | |

| 2,292 | | |

| 1,698 | |

| Total current assets | |

| 59,161 | | |

| 58,793 | |

| Property and equipment, net | |

| 6,001 | | |

| 6,513 | |

| Operating lease assets, net | |

| 8,274 | | |

| 6,917 | |

| Deferred tax assets | |

| 2,640 | | |

| 2,641 | |

| Other intangible assets, net | |

| 183 | | |

| 263 | |

| Total assets | |

$ | 76,259 | | |

$ | 75,127 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Current portion of finance lease obligations | |

$ | 214 | | |

$ | 356 | |

| Current portion of operating lease obligations | |

| 1,169 | | |

| 1,033 | |

| Accounts payable | |

| 12,728 | | |

| 15,924 | |

| Accrued payroll and commissions | |

| 2,612 | | |

| 4,138 | |

| Customer deposits | |

| 5,453 | | |

| 4,068 | |

| Other accrued liabilities | |

| 1,120 | | |

| 1,063 | |

| Total current liabilities | |

| 23,296 | | |

| 26,582 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term line of credit | |

| 8,314 | | |

| 5,815 | |

| Long-term finance lease obligations, net of current portion | |

| 146 | | |

| 209 | |

| Long-term operating lease obligations, net of current portion | |

| 7,949 | | |

| 6,763 | |

| Other long-term liabilities | |

| 409 | | |

| 414 | |

| Total long-term liabilities | |

| 16,818 | | |

| 13,201 | |

| Total liabilities | |

| 40,114 | | |

| 39,783 | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred stock, $1 par value; 1,000,000 shares authorized; 250,000 shares issued and outstanding | |

| 250 | | |

| 250 | |

| Common stock - $0.01 par value; 9,000,000 shares authorized; 2,747,678 and 2,740,178 shares issued and outstanding, respectively | |

| 28 | | |

| 27 | |

| Additional paid-in capital | |

| 17,165 | | |

| 16,929 | |

| Accumulated other comprehensive loss | |

| (890 | ) | |

| (532 | ) |

| Retained earnings | |

| 19,592 | | |

| 18,670 | |

| Total shareholders’ equity | |

| 36,145 | | |

| 35,344 | |

| Total liabilities and shareholders’ equity | |

$ | 76,259 | | |

$ | 75,127 | |

| | |

SIX MONTHS ENDED | |

| CASH FLOW STATEMENTS | |

JUNE 30, | |

| ($ in thousands) | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income | |

$ | 922 | | |

$ | 1,315 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 966 | | |

| 1,027 | |

| Compensation on stock-based awards | |

| 206 | | |

| 192 | |

| Change in inventory reserves | |

| 113 | | |

| (53 | ) |

| Change in accounts receivable allowances | |

| (88 | ) | |

| (31 | ) |

| Other, net | |

| (59 | ) | |

| (116 | ) |

| Changes in current operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 1,690 | | |

| (1,580 | ) |

| Employee retention credit receivable | |

| - | | |

| 2,650 | |

| Inventories | |

| (1,288 | ) | |

| 1,350 | |

| Contract assets | |

| (476 | ) | |

| (1,620 | ) |

| Prepaid expenses and other current assets | |

| (531 | ) | |

| (1,042 | ) |

| Accounts payable | |

| (2,546 | ) | |

| 586 | |

| Accrued payroll and commissions | |

| (1,516 | ) | |

| (1,788 | ) |

| Customer deposits | |

| 1,385 | | |

| (195 | ) |

| Other accrued liabilities | |

| (236 | ) | |

| (414 | ) |

| Net cash (used in) provided by operating activities | |

| (1,458 | ) | |

| 281 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Proceeds from sale of property and equipment | |

| 9 | | |

| - | |

| Purchases of property and equipment | |

| (1,020 | ) | |

| (956 | ) |

| Net cash used in investing activities | |

| (1,011 | ) | |

| (956 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds from line of credit | |

| 68,323 | | |

| 65,886 | |

| Payments to line of credit | |

| (65,809 | ) | |

| (65,726 | ) |

| Principal payments on financing leases | |

| (202 | ) | |

| (189 | ) |

| Stock option exercises | |

| 31 | | |

| 173 | |

| Net cash provided by financing activities | |

| 2,343 | | |

| 144 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash | |

| (7 | ) | |

| (35 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (133 | ) | |

| (566 | ) |

| Cash and cash equivalents - beginning of period | |

| 1,675 | | |

| 2,481 | |

| Cash and cash equivalents - end of period | |

$ | 1,542 | | |

$ | 1,915 | |

| | |

| | | |

| | |

| Reconciliation of cash and restricted cash reported within the condensed consolidated balance sheets: | |

| | | |

| | |

| Cash | |

$ | 1,542 | | |

$ | 781 | |

| Restricted cash | |

| - | | |

| 1,134 | |

| Total cash and restricted cash reported in the condensed consolidated statements of cash flows | |

$ | 1,542 | | |

$ | 1,915 | |

| | |

THREE MONTHS ENDED June 30, | | |

SIX MONTHS ENDED June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| RECONCILIATION OF NET INCOME TO EBITDA | |

| | |

| | |

| | |

| |

| ($ in thousands) | |

| | |

| | |

| | |

| |

| Net Income | |

$ | 157 | | |

$ | 634 | | |

$ | 922 | | |

$ | 1,315 | |

| Interest | |

| 165 | | |

| 125 | | |

| 332 | | |

| 235 | |

| Taxes | |

| 22 | | |

| 340 | | |

| 245 | | |

| 602 | |

| Depreciation | |

| 444 | | |

| 483 | | |

| 886 | | |

| 948 | |

| Amortization | |

| 40 | | |

| 40 | | |

| 80 | | |

| 80 | |

| EBITDA | |

| 828 | | |

| 1,622 | | |

| 2,465 | | |

| 3,180 | |

| Restructuring Charges | |

| 91 | | |

| - | | |

| 91 | | |

| - | |

| ADJUSTED EBITDA | |

$ | 919 | | |

$ | 1,622 | | |

$ | 2,556 | | |

$ | 3,180 | |

Adjustment

to EBITDA in 2024 includes ($ in thousands):

| |

● |

In

the second quarter of 2024, we announced the closure of our Blue Earth, Minnesota facility by the end of 2024. In connection with

this action, we accrued $91 of retention bonus and other expenses in both the three and six-months ended June 30, 2024, which expense

amount is not included in Adjusted EBITDA. |

There

were no adjustments to EBITDA in 2022 and 2023.

Adjustments

to EBITDA in 2021 include ($ in thousands):

| |

● |

In

the third quarter of 2021, we recognized $5,209 related to the CARES Act Employee Retention Credit (ERC) as a reduction of costs

of goods sold of $4,670, selling expense of $125, and general and administrative expense of $414. Nortech received ERC cash payment

in two installments, the first in December 2022 and the second in May 2023. |

| |

● |

CARES

Act Paycheck Protection Program (PPP) loan forgiveness gain of $6,170 recorded in the fourth quarter of 2021. |

| |

● |

Restructuring

expense in 2021 of $327 related to the consolidation of our printed circuit board production capabilities into our center of excellence

in Mankato, Minnesota and closure of our Merrifield, Minnesota plant. |

| |

● |

Gain

on sale of assets in 2021 of $141 related to the closure of our Merrifield, Minnesota plant. |

| |

● |

Loss

on abandonment of intangible assets in 2021 of $560 related to abandonment of the Devicix tradename. |

| ($ in millions) | |

Last Twelve Months (LTM) Ended in Quarter | |

| | |

Q3 2021 | | |

Q4 2021 | | |

Q1 2022 | | |

Q2 2022 | | |

Q3 2022 | | |

Q4 2022 | | |

Q1 2023 | | |

Q2 2023 | | |

Q3 2023 | | |

Q4 2023 | | |

Q1 2024 | | |

Q2 2024 | |

| Net Sales | |

$ | 105.5 | | |

$ | 115.2 | | |

$ | 123.8 | | |

$ | 126.1 | | |

$ | 132.0 | | |

$ | 134.1 | | |

$ | 138.3 | | |

$ | 140.8 | | |

$ | 138.9 | | |

$ | 139.3 | | |

$ | 138.7 | | |

$ | 137.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit $ - Adjusted | |

| 10.3 | | |

| 11.2 | | |

| 13.7 | | |

| 15.1 | | |

| 18.1 | | |

| 20.5 | | |

| 21.9 | | |

| 22.4 | | |

| 21.4 | | |

| 23.1 | | |

| 23.1 | | |

| 22.2 | |

| Gross Margin % - Adjusted | |

| 9.7 | % | |

| 9.7 | % | |

| 11.0 | % | |

| 12.0 | % | |

| 13.7 | % | |

| 15.3 | % | |

| 15.8 | % | |

| 15.9 | % | |

| 15.4 | % | |

| 16.6 | % | |

| 16.6 | % | |

| 16.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA - Adjusted | |

$ | (0.7 | ) | |

$ | (0.2 | ) | |

$ | 1.9 | | |

$ | 2.5 | | |

$ | 4.2 | | |

$ | 5.8 | | |

$ | 6.7 | | |

$ | 6.8 | | |

$ | 6.0 | | |

$ | 8.0 | | |

$ | 8.1 | | |

$ | 7.3 | |

Contact

Andrew

D. C. LaFrence

Chief Financial Officer and Senior Vice President of Finance

alafrence@nortechsys.com

952-345-2243

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

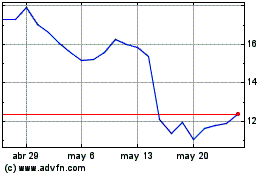

Nortech Systems (NASDAQ:NSYS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Nortech Systems (NASDAQ:NSYS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025