false000183003300018300332023-08-082023-08-080001830033us-gaap:CommonStockMember2023-08-082023-08-080001830033us-gaap:WarrantMember2023-08-082023-08-080001830033us-gaap:MemberUnitsMember2023-08-082023-08-08

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

| | | | | | | | |

| PureCycle Technologies, Inc. | |

| (Exact Name of Registrant as Specified in its Charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-40234 | | 86-2293091 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| 5950 Hazeltine National Drive, | Suite 300, | Orlando | | 32822 |

| Florida | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| Common Stock, par value $0.001 per share | | PCT | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | | PCTTW | | The Nasdaq Stock Market LLC |

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | | PCTTU | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2023, the Company issued a press release, attached hereto as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for the second quarter ended June 30, 2023, and certain other information.

The information contained in Item 7.01 concerning the presentation to the Company’s investors is hereby incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

The slide presentation attached hereto as Exhibit 99.2, and incorporated herein by reference, will be presented to certain investors of the Company on August 9, 2023 and may be used by the Company in various other presentations to investors.

Item 8.01. Other Events.

Pursuant to Section 2.4(b)(vi)(C)(I) of the loan agreement dated as of October 1, 2020, by and between the Southern Ohio Port Authority (“SOPA”) and PureCycle: Ohio LLC (“PCO”) (as amended, the “Loan Agreement”), PCO, an indirect wholly-owned subsidiary of the Company, posted to the Electronic Municipal Market Access (“EMMA”) site materials which include PCO’s interim financial statements for the fiscal quarter ending June 30, 2023 (the “Quarterly Reporting Package”). The Quarterly Reporting Package is filed as Exhibit 99.3 to this current report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit Number | Description of Exhibit |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PURECYCLE TECHNOLOGIES, INC.

By: /s/ Lawrence Somma____________________

Name: Lawrence Somma

Title: Chief Financial Officer

Date: August 8, 2023

Exhibit 99.1

PureCycle Technologies Provides Second Quarter 2023 Update

- Achieved first two bondholder milestones - mechanical completion and PIR pellet production

-Successfully tested and validated core technologies of the PureCycle purification process at scale

-Closed on the land rights with the Development Authority of Augusta, GA for up to eight purification lines. We expect to begin site construction activities on the first line in the fourth quarter of 2023.

-Extended $150 million revolving line of credit through March 31, 2025

(ORLANDO, Florida – August 8, 2023) – PureCycle Technologies, Inc. (“PureCycle” or “the Company”) (NASDAQ: PCT), a U.S.-based company revolutionizing plastic recycling, today, announced a corporate update and financial results for the second quarter ending June 30, 2023.

Management Commentary

Dustin Olson, PureCycle’s Chief Executive Officer, said, “After successfully producing polypropylene resin pellets from post-industrial feedstock at our flagship purification facility in Ironton, Ohio (“Ironton”), we initiated a series of activities to evaluate, adjust, and in some cases, replace or repair certain equipment in the purification process subsystems. We recently initiated a re-start of Ironton, and the facility is operational. After achieving the first two bondholder milestones in the second quarter, we expect to achieve our next milestone of operating at 50% capacity for a month by the end of September.

The commissioning of Ironton is progressing well due to the dedication, focus, and grit of the local team. We have the experience and technical expertise to identify and resolve challenges during startup. We remain dedicated to completing the next steps in the commissioning process in a methodical, purposeful, and focused manner.”

Larry Somma, PureCycle’s Chief Financial Officer, added, “As we prepare for our first shipment to customers, PureCycle will begin the transition from a pre-revenue company to a revenue-generating company. We anticipate operating margins to be in line with 2023 budgeted expectations. Equally important, now that Ironton is operational, we can restart the process of raising long-term project financing for construction of our next purification facility in Augusta, Georgia. We are actively evaluating equipment financing term sheets of our PreP equipment until we are able to close on the longer term project financing transaction. We are also appreciative of Sylebra Capital for extending our $150 million line of credit until March 31, 2025.”

Ironton Update

After initial pellet production in June, we focused on commissioning operations to improve the processes and core technologies in preparation of full capacity operations. Now that we are operational, the next step in the start-up process is increasing capacity gradually while scaling up feedstock deliveries and offtake shipments. Management remains committed to achieving PureCycle’s next bondholder milestone of producing 4.45 million pounds of UPR resin in a month by September 30, 2023. We currently have more than 10 million pounds of feedstock available for Ironton operations.

Expansion Update

PureCycle continued to make progress on its various development projects since its last update. The Company closed on the Augusta Bonds with the Development Authority of Augusta, Georgia (“AEDA”) and is in the final stage of the selection process for an EPC partner for the Augusta site. PureCycle is targeting site development and construction activities to begin in the fourth quarter of 2023.

Updates on our three international development projects include: (i) the PureCycle team in Belgium has continued site engineering work at the Port of Antwerp to support the permitting process, which is expected to be completed by late 2024; (ii) our joint venture team in South Korea progressed engineering plans and is evaluating various feed sources in accordance with the priorities defined by the joint venture; and (iii) we continued to advance our joint venture agreement discussions with Mitsui, which is expected to be executed in the fourth quarter of 2023. The teams continue to narrow down the list of purification plant locations in Japan.

Liquidity and Capital Resources

As of June 30, 2023, PureCycle had total liquidity of $366.3 million including $28.9 million of cash and cash equivalents, $187.4 million in restricted cash and $150 million of undrawn revolving credit. PureCycle also had $309.7 million in Long-term debt and Related party notes payable, less $19.5 million of discount and issuance costs at quarter-end.

As of June 30, 2023, PureCycle estimated that there was $10.0 -$22.5 million remaining investment in 2023 to complete the Ironton facility inclusive of a performance guarantee payment due after successful completion of a performance testing milestone. This range is dependent upon various contract contingencies and their ultimate resolution. PureCycle expects to successfully negotiate at least some of these contingencies, which would reduce the remaining 2023 investment to the lower end of the range.

Conference Call

The Company will hold a conference call Wednesday, August 9th at 11:00 a.m. EST to provide an update on recent corporate developments, including activity from the second quarter and updated future strategic plans.

Second Quarter 2023 Conference Call Details

Date: Wednesday, August 9, 2023

Time: 11:00 a.m. EST

Participant Registration: [Click Here]

Please register for the conference call using the above link in advance of the call start time. If you have any difficulty connecting with the conference call, please contact PureCycle Investor Relations at (689) 233-3595.

The conference call will have a live Q&A session and be available for replay [Click Here] and on the Company’s website at www.purecycle.com. Please note there will no longer be a telephonic replay.

A replay of the conference call will be available after 2:00 p.m. EST on the day of the call through August 8, 2024.

###

Forward-Looking Statements

This press release contains forward-looking statements, including statements about the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, entitled “Risk Factors,” those discussed and identified in other public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT (including PCT’s Quarterly Report on Form 10-Q for the current quarterly period) and the following:

•PCT's ability to obtain funding for its operations and future growth and to continue as a going concern;

•PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPR resin in food grade applications (including in the United States, Europe, Asia and other future international locations );

•PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and future international locations);

•Expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives;

• the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) appropriately certified by Leidos Engineering, LLC, following certain performance and other tests, and commence full-scale commercial operations to be appropriately certified by Leidos in a timely and cost-effective manner;

•PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia (the “Augusta Facility”); (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner;

•PCT’s ability to sort and process polypropylene plastic waste at its plastic waste prep (“Feed PreP”) facilities;

•PCT’s ability to maintain exclusivity under the Procter & Gamble Company (“P&G”) license;

•the implementation, market acceptance and success of PCT’s business model and growth strategy;

•the success or profitability of PCT’s offtake arrangements;

•the ability to source feedstock with a high polypropylene content at a reasonable cost;

•PCT’s future capital requirements and sources and uses of cash;

•developments and projections relating to PCT’s competitors and industry;

• the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action case;

•geopolitical risk and changes in applicable laws or regulations;

•the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts;

•turnover or increases in employees and employee-related costs;

•changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PureCycle’s ability to obtain them in a timely and cost-effective manner;

•any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine);

•the potential impact of climate change on the company, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and

•operational risk;

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this press release. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

About PureCycle Technologies

PureCycle Technologies LLC., a subsidiary of PureCycle Technologies, Inc., holds a global license for the only patented solvent-driven purification recycling technology, developed by The Procter & Gamble Company (P&G), that is designed to transform polypropylene plastic waste (designated as No. 5 plastic) into a continuously renewable resource. The unique purification process is designed to remove color, odor, and other impurities from No. 5 plastic waste resulting in an ultra-pure recycled (UPR) plastic that can be recycled and reused multiple times, changing our relationship with plastic. www.purecycle.com

Investor Relations Contact:

Charles Place

cplace@purecycle.com

689.233.3595

Media Contact:

Christian Bruey

cbruey@purecycle.com

352.745.6120

1 Second Quarter 2023 Corporate Update August 9, 2023 Exhibit 99.2

2 Forward-Looking Statements Certain statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”). Forward-looking statements generally relate to future events or our future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 entitled “Risk Factors,” those discussed and identified in other public filings made with the U.S. Securities and Exchange Commission (the “SEC”) by PCT and the following: PCT’s ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT's UPR resin in food grade applications (including in the United States, Europe, Asia and other international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT's facilities (including in the United States, Europe, Asia and future international locations); expectations and changes regarding PCT's strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT's ability to invest in growth initiatives; the ability of PCT's first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) appropriately certified by Leidos Engineering, LLC, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner; PCT's ability to complete the necessary funding with respect to, and complete the construction of t, (i) its first U.S. multi-line facility, located in Augusta, Georgia (the “Augusta Facility”); (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT's ability to sort and process polypropylene plastic waste at its plastic waste prep ("Feed PreP") facilities; PCT's ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT's business model and growth strategy; the success or profitability of PCT's offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT's future capital requirements and sources and uses of cash; developments and projections relating to PCT's competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the securities class action case; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PCT's ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Presentation. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

3 Ironton is Operational The technology works at scale It’s all about our team!

4 Improving Plant Performance Every Day Overview Ironton Growth Finance Digital Controls • Very strong process controls across facility with successful internal remote support • Born Digital benefits achieved through commissioning and problem identification Purification • Core technology operational and tested at commercial scale • Significant gains in operator knowledge & operating procedures Utilities • Successfully commissioned all technologies • Successfully operated to benchmark rates • No operational constraints PreP • Successfully commissioned all technologies • Identified small projects to process lower yield PP bales • Over 10M lbs of feedstock in inventory

5 Our Core Technology Works at Scale z Melt & Filter Mix & Extract Mix & Settle Filter Purify Separate Pelletize Equipment, infant mortality problems solved Works as expected Works as expected Works as expected Minor process redesign Works as expected Improved equipment design Ironton is operational and on track to achieving key milestones Overview Ironton Growth Finance

6 PureCycle Growth and Finance Update GROWTH FINANCE • Ramping up technical education with distribution partner for application support • Working closely with core partner brands to finalize consumer applications for UPR • Ramping up efforts to market UPR for international offtake customers • Secured the Augusta site • Initial site development in Augusta expected in 4Q23 • South Korea, Belgium, and Japan projects continue to progress • Extended $150M LOC through March 31, 2025 • Evaluating term sheets for incremental equipment financing • Expect to restart the project financing process of our Augusta site with a target closing date by year-end • Evaluating multiple financing options for Antwerp project Overview Ironton Growth Finance

7 Q2 2023 Liquidity Update Unrestricted Cash Changes: ▪ ($29.2M) Augusta and PreP ▪ ($5.8M) Ironton construction ▪ ($9.9M) Payroll/benefits including delayed payment of STI bonus ▪ ($12.5M) Ironton working capital, general corporate, insurance ▪ Access to additional liquidity through a $150M undrawn revolving credit facility Restricted Cash Changes: ▪ ($25.2M) Ironton construction ▪ ($9.0M) Interest payment ▪ ($8.1M) net Augusta construction ▪ $2.2M Augusta AEDA LOC ▪ $2.0M increase in other reserves Summary of Liquidity Changes PureCycle received $47.6M net financing proceeds during Q2 2023 (in millions) Mar 31, 2023 June 30, 2023 change Total Unrestricted $38.4 $28.9 ($9.5) Restricted Cash Plant 1 Project Fund (Ironton, OH) $25.2 - ($25.2) Augusta Construction Escrow 24.4 16.3 (8.1) Other Corporate Requirements 1.3 3.5 2.2 Reserve Requirements per Revenue Bonds General Liquidity Reserve 100.9 101.7 0.8 Capitalized Interest and Debt Reserves 50.2 41.2 (9.0) Other Required Reserves 23.5 24.7 1.2 Total Restricted $225.5 $187.4 ($38.1) Total Available $263.9 $216.3 ($47.6) Overview Ironton Global Finance

8 PureCycle Q2 Highlights 1 2 3 4 5 Extended our $150 million revolving line of credit thru March 31, 2025 Ironton technology questions are answered Closed on AEDA land transaction on June 30, 2023 Continue to advance Antwerp, Ulsan and Japan projects Completed two milestones with bondholders ahead of schedule

Exhibit 99.3

Unaudited Consolidated Financial Statements

PureCycle Technologies, LLC

June 30, 2023

PureCycle Technologies, LLC.

QUARTERLY SUBMISSION SUMMARY

| | | | | |

| Delivery Requirement: | Submission Compliance |

| Interim Financial Statements (Guarantor) | See Form 10-Q for the period ended 6/30/2023 as filed with the SEC. |

| Interim Financial Statements (Company) | Included herein |

| Compliance Certificates | Included herein for Guarantor and Company |

Operating Statements

a) Budget to Actual for the period

b) Total product sold

c) Amount of Product sold under offtake contracts (in total) and amount of other products sold (with information about sale/purchaser)

d) Production Yield and values by weight/value

e) Supplied waste processed by weight / values

f) IHS/Chemical Data indices used

g) Terms/ extensions / replacements of Offtake or Feedstock contracts

h) Additional production capacity under development

i) hours of operation for the Project |

a) Refer to budget to actual

b) Not applicable for Q2. There has been no product sold.

c) Not applicable for Q2. There has been no product sold under Offtake Contracts or of other Products which require disclosure.

d) Not applicable as only one production run executed at the end of Q2.

e) Not applicable for Q2.

f) IHS Average Price for Q2 = $0.6033/lb Chemical Market Data Q2 = $0.6033/lb

g) None other than those previously disclosed.

h) Not applicable. There have been no changes to production capacity.

i) Not applicable for Q2; only one production run in June |

| Reconciliation Statements (Operating Revenue Fund) | Not applicable for Q2. |

PureCycle Technologies, LLC.

TABLE OF CONTENTS

| | | | | |

| Page |

| |

Balance Sheets as of June 30, 2023 (Unaudited) and December 31, 2022 | 4 |

| |

Unaudited Statements of Member's Equity for the Six months ended June 30, 2023 and 2022 | 6 |

| |

Comparison of Actual to Budgeted Results for the Three Months Ended June 30, 2023 and 2022 | |

Covenant Compliance for the Three Months Ended June 30, 2023 | |

PureCycle Technologies, LLC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (Unaudited) | | |

| (in thousands) | June 30, 2023 | | December 31, 2022 |

| CURRENT ASSETS | | | |

| Cash and cash equivalents | $ 1,480 | | $ 50,928 |

| Restricted cash - current | 19,827 | | 29,389 |

| Prepaid expense and other current assets | 5,276 | | 1,612 |

| Total current assets | 26,583 | | 81,929 |

| | | |

| Restricted cash - noncurrent | 147,777 | | 93,415 |

| Property, plant and equipment, net | 431,719 | | 373,848 |

| Operating lease right-of-use assets | 5,008 | | 5,042 |

| Other long term assets | 4,322 | | 4,206 |

| TOTAL ASSETS | $ 615,409 | | $ 558,440 |

| | | |

| LIABILITIES AND MEMBER'S EQUITY |

| CURRENT LIABILITIES | | | |

| Accounts payable | $ 3,736 |

| $ 816 |

| Accrued expenses | 21,799 |

| 26,715 |

| Accrued interest | 1,532 |

| 1,532 |

| Current portion of long-term debt | 3,425 |

| — |

| Total current liabilities | 30,492 |

| 29,063 |

| |

| |

| Deferred revenue | 5,000 |

| 5,000 |

| Bonds payable | 230,624 |

| 233,513 |

| Operating lease right-of-use liabilities | 3,876 |

| 3,956 |

| Other Liabilities | 1,072 |

| 1,117 |

| Due to parent | 267,157 | | 188,989 |

| TOTAL LIABILITIES | $ 538,221 | | $ 461,638 |

| | | |

| MEMBER'S EQUITY | | | |

| LLC Member Interest | 223,387 |

| 223,387 |

| Accumulated deficit | (146,199) | | (126,585) |

| TOTAL MEMBERS' EQUITY | $ 77,188 |

| $ 96,802 |

| |

| |

| TOTAL LIABILITIES AND MEMBERS' EQUITY | $ 615,409 | | $ 558,440 |

PureCycle Technologies, LLC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | |

| Three months ended June 30, |

| 2023 | | 2022 |

| (in thousands) | | | |

| Costs and expenses | | | |

| Operating costs | $ 10,026 | | $ 3,265 |

| Research and development | 47 | | 483 |

| Selling, general and administrative | 2,318 | | 3,335 |

| Total operating costs and expenses | 12,391 | | 7,083 |

| Interest expense (income), net | $ 525 | | $ 908 |

| Other expense | 13 | | 32 |

Total other expense | $ 538 | | $ 940 |

| Net loss | $ (12,929) | | $ (8,023) |

PureCycle Technologies, LLC.

CONSOLIDATED STATEMENTS OF MEMBER'S EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | For the six months ended June 30, 2023 |

| (in thousands) | | LLC Member Interest | | Accumulated deficit | | Total Member's Equity |

| Balance, December 31, 2022 | | $ 223,387 | | $ (126,585) | | $ 96,802 |

| Net Loss | | — | | (19,614) | | (6,685) |

| Balance, March 31, 2023 | | $ 223,387 | | $ (133,270) | | $ 90,117 |

| Net Loss | | — | | $ (12,929) | | (12,929) |

| Balance, June 30, 2023 | | $ 223,387 | | $ (146,199) | | $ 77,188 |

| | | | | | |

| | For the six months ended June 30, 2022 |

| (in thousands) | | LLC Member Interest | | Accumulated deficit | | Total Member's Equity |

| Balance, December 31, 2021 | | $ 223,387 | | $ (104,276) | | $ 119,111 |

| Net Loss | | — | | (10,939) | | (5,480) |

| Balance, March 31, 2022 | | $ 223,387 | | $ (109,756) | | $ 113,631 |

| Net Loss | | — | | (8,023) | | (8,023) |

| Balance, June 30, 2022 | | $ 223,387 | | $ (117,779) | | $ 105,608 |

PureCycle Technologies, LLC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | Six months ended June 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities | | | | |

Net loss |

| $ | (19,614) | |

| $ | (10,939) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | |

| Depreciation expense |

| 4,361 | | | 1,385 | |

| Accretion of debt instrument discounts |

| 126 | | | 116 | |

| Amortization of debt issuance costs | | 409 | | | 375 | |

| Operating lease amortization | | 611 | | | 35 | |

| Changes in operating assets and liabilities: | | | | |

| Prepaid expenses and other current assets |

| (3,664) | | | (1,132) | |

| Prepaid expenses and other non-current assets |

| (116) | | | (65) | |

| Accounts payable |

| 1,482 | | | 1,145 | |

Accrued expenses | | 555 | | | 1,430 | |

| Operating right-of-use liabilities | | (448) | | | (40) | |

| Net cash used in operating activities |

| $ | (16,298) | | | $ | (7,690) | |

| Cash flows from investing activities |

| | | |

| Purchases of property, plant and equipment |

| (66,480) | | (80,200) |

| Net cash used in investing activities |

| $ | (66,480) | | | $ | (80,200) | |

| Cash flows from financing activities |

| | | |

Due to Parent |

| 78,168 | | | 97,620 | |

Payments on capital leases |

| (38) | |

| (21) | |

| Net cash used in financing activities | | $ | 78,130 | | | $ | 97,599 | |

| Net (decrease) increase in cash and restricted cash |

| (4,648) | |

| 9,709 | |

| Cash and restricted cash, beginning of year |

| 173,732 | |

| 229,561 | |

| Cash and restricted cash, end of year |

| $ | 169,084 | |

| $ | 239,270 | |

| Supplemental disclosure of cash flow information |

|

|

|

|

| Non-cash operating activities: |

|

|

|

|

| Interest paid during the period, net of capitalized interest |

| $ | 650 | |

| $ | — | |

| Non-cash investing activities: |

|

|

|

|

| Additions to property, plant, and equipment in accounts payable |

| $ | 1,953 | |

| $ | 1,598 | |

Additions to property, plant, and equipment in accrued expenses |

| $ | 19,241 | |

| $ | 19,743 | |

PureCycle Technologies, LLC.

BUDGET TO ACTUAL

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended June 30, 2023 |

| Actual | | Budget | | $ Variance | | % Variance | | Explanations |

| (in thousands) | | | | | favorable / (unfavorable) | | |

| Costs and expenses | | | | | | | | | |

| Operating costs | $ | 10,026 | | | $ | 12,461 | | | $ | 2,435 | | | 20 % | | Favorable due to variable costs tied to production lower due to construction delays (e.g. water, electricity, transportation, etc.) and items in inventory not expensed through COGS, partially offset by unbudgeted post-construction engineering services commissioning costs |

| Research and development | 47 | | | 40 | | | (7) | | | (18) % | | immaterial for review |

| Selling, general and administrative | 2,318 | | | 925 | | | (1,393) | | | (151) % | | ~$1.5MM in corporate overhead allocation for shared services (allocation of some corporate costs is required under GAAP) |

| Total operating costs and expenses | 12,391 | | | 13,426 | | | 1,035 | | | 8 % | | |

| Interest expense, net | $ | 525 | | | $ | 4,866 | | | $ | 4,341 | | | 89 % | | 1 month of interest expense beginning in June, offset by interest income for the quarter |

| Other expense | 13 | | | — | | | (13) | | | 100 % | | immaterial for review |

| Total other expense, net | $ | 538 | | | $ | 4,866 | | | $ | 4,328 | | | 89 % | | |

| Net loss | $ | (12,929) | | | $ | (18,292) | | | $ | 5,363 | | | 29 % | | |

PureCycle Technologies, LLC.

COVENANT COMPLIANCE

| | | | | | | | |

| Days Cash on Hand: >75 | As of June 30, 2023 | |

| Cash on Hand1 | $ 51,903 | |

| Operating Expenses2 | (8,857) | |

| Debt Service for Period3 | — | |

| Total Operating Expenses + Debt Service | $ (8,857) | |

| Daily Cash Required4 | 97 | |

| Days Cash on Hand | 533 | pass |

| | | | | | | | |

| Minimum Cash Required (at least $100M) | As of June 30, 2023 | |

| Cash & cash equivalents | $ 1,480 | |

| Liquidity Escrow Reserve | 50,972 | |

| PureCycle Trustee Account | 50,423 | |

| Operating Revenue Escrow Fund | 3 | |

| Total Cash | $ 102,878 | pass |

1 Cash on hand includes the following amounts: Unrestricted cash & cash equivalents, the PureCycle Trustee Account, and the Operating Revenue Fund

2 Operating expenses include all operating costs except for depreciation and amortization

3 None for Q2 2023

4 Daily cash required = (total operating expenses + debt service) / days in period

v3.23.2

Cover

|

Aug. 08, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

PureCycle Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40234

|

| Entity Tax Identification Number |

86-2293091

|

| Entity Address, Address Line One |

5950 Hazeltine National Drive,

|

| Entity Address, Address Line Two |

Suite 300,

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32822

|

| City Area Code |

877

|

| Local Phone Number |

648-3565

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001830033

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share

|

| Trading Symbol |

PCTTW

|

| Security Exchange Name |

NASDAQ

|

| Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant

|

| Trading Symbol |

PCTTU

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_MemberUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

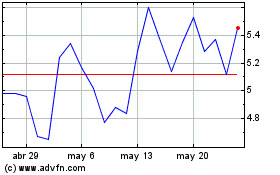

PureCycle Technologies (NASDAQ:PCT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

PureCycle Technologies (NASDAQ:PCT)

Gráfica de Acción Histórica

De May 2023 a May 2024