false

0000716605

0000716605

2024-06-03

2024-06-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

The Securities Exchange Act of 1934

June 3, 2024

Date of Report (Date of earliest event reported)

PENNS WOODS BANCORP, INC.

(Exact name of registrant as specified in

its charter)

| Pennsylvania |

|

000-17077 |

|

23-2226454 |

(State or

other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Ident. No.) |

| |

|

|

|

|

| 300

Market Street, P.O.

Box 967, Williamsport,

Pennsylvania |

|

17703-0967 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

(570)

322-1111

Registrant’s

telephone number, including area code |

| |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $5.55 par value |

PWOD |

The

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Amendment to Employment Agreement

On June 4, 2024, Penns Woods Bancorp, Inc.

(the “Company”) and Richard A. Grafmyre, Chief Executive Officer of the Company, entered into an Amendment No. 3,

dated as of June 3, 2024 (the “Amendment”), to Mr. Grafmyre’s existing Amended and Restated Employment

Agreement, dated March 9, 2021, as amended by an Amendment No. 1, dated July 15, 2022, and an Amendment No. 2, dated

December 12, 2023 (as so amended, the “Employment Agreement”). The Amendment, which is effective as of June 3,

2024, amends the Employment Agreement to (i) eliminate the provision of the Employment Agreement providing for payments for unused

time-off, commencing January 1, 2024, (ii) reduce Mr. Grafmyre’s annual base salary to $850,000, annualized commencing

with the first pay period for June 2024, and (iii) cap Mr. Grafmyre’s maximum annual potential bonus amount under

the Company’s incentive bonus plan at $325,000.

Except as modified by the Amendment, the Employment

Agreement remains in effect in accordance with its terms. A copy of the Amendment is attached hereto as Exhibit 10.4. The foregoing

description of the Amendment is qualified by reference to the Amendment.

Incentive Bonus Plan Metrics for 2024

The Board of Directors has revised the Company’s

annual incentive bonus plan to incorporate the following metrics for the period ending December 31, 2024: return on average equity,

return on average assets, earnings per share, asset growth, and credit quality (net charge-offs as a percentage of average loans). As

with the changes to Mr. Grafmyre’s compensation reflected in the Amendment, changes to the metrics for the annual incentive

bonus plan are the result of a review of peer and industry practices and feedback received from shareholders. The bonus metrics will complement

the historical and continued focus on tangible book value plus dividend growth (139% versus peer 124% from December 31, 2013 to 2023),

loan portfolio growth ($455 million from December 31, 2018 to 2023), and credit quality (cumulative net charge-offs to average loans

of 0.5% versus all banks 2.1% for the period of December 31, 2018 to 2023).

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PENNS WOODS BANCORP, INC. |

| |

|

|

| Dated: June 4, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Brian L. Knepp |

| |

|

Brian L. Knepp |

| |

|

President and Chief Financial Officer |

Exhibit 10.4

AMENDED

AND RESTATED

EMPLOYMENT AGREEMENT

(Amendment No. 3)

THIS AMENDMENT NO. 3 TO AMENDED AND RESTATED EMPLOYMENT

AGREEMENT, dated as of June 3, 2024, between PENNS WOODS BANCORP, INC. (“Penns Woods”), a Pennsylvania business

corporation, and RICHARD A. GRAFMYRE, an adult individual (“Executive”).

WITNESSETH:

WHEREAS, Penns Woods and Executive are parties

to an amended and restated employment agreement, dated March 9, 2021, as amended by an Amendment No. 1 to Employment Agreement,

dated July 15, 2022 (“Amendment No. 1 to Employment Agreement”), and an Amendment No. 2 to Employment

Agreement, dated December 12, 2023 (“Amendment No. 2 to Employment Agreement”)(as so amended, the “Employment

Agreement”); and

WHEREAS, Penns Woods and Executive desire to further

amend the Employment Agreement as provided herein.

NOW, THEREFORE, the parties hereto, intending to

be legally bound, agree as follows:

1. Amendment to Section 4(a) of Employment

Agreement. Section 4(a) of the Employment Agreement is hereby amended and restated in its entirety to read as follows:

“(a) Salary. Executive shall be paid a base

salary at the rate of $850,000 per year, annualized commencing with the first pay period for June 2024, payable at such times as

salaries are paid to other executive officers of Penns Woods. The Board of Directors of Penns Woods shall review Executive’s base

salary annually and may, from time to time, in its discretion increase Executive’s base salary. Any and all such increases in base

salary shall be deemed to constitute amendments to this subsection to reflect the increased amounts, effective as of the dates established

for such increases by appropriate corporate action.”

2. Amendment to Section 4(b) of Employment

Agreement. Section 4(b) of the Employment Agreement is hereby amended and restated in its entirety to read as follows:

“(b) Discretionary Bonus. Executive shall

be entitled to participate in an equitable manner with other senior management employees of Penns Woods in such annual or other periodic

bonus programs (if any) as may be maintained from time to time by Penns Woods for its executive officers; provided, however, that Executive’s

bonus under such programs (if any) shall in no event exceed $325,000 in cash for any calendar year. At the discretion of the Compensation

Committee of the Penns Wood Board, (i) up to fifty percent (50%) of the aggregate amount of any discretionary bonus payable to Executive

with respect to any year may be paid in Penns Woods common stock issued under the Penns Woods 2020 Equity Incentive Plan in lieu of cash

and (ii), with respect to any year in which a portion of the discretionary bonus is payable in Penns Woods common stock, any portion of

the remaining bonus amount otherwise payable in cash for such year (up to 100% of the aggregate bonus amount payable for such year) may

be payable in the form of Penns Woods common stock with the consent of Executive. The aggregate number of shares of Penns Woods common

stock issuable with respect to any year shall be subject to any limitations on the total number of shares that may be issued to any individual

under any plan, program, or policy of Penns Woods then in effect. Any shares of Penns Woods common stock issued to Executive under this

Section shall be subject to the same restrictions on transfer as are applicable shares issued under the 2020 Non-Employee Director

Compensation Plan; provided, however, that (i) when Executive attains age 71 no more than a one (1) year transfer restriction

shall apply to any such shares and (ii) when Executive attains age 72, all transfer restrictions then applicable to any such shares

shall lapse.

3. Amendment to Section 4(c) of Employment

Agreement. Section 4(c) of the Employment Agreement is hereby amended and restated in its entirety to read as follows:

(c) Vacation and Sick Leave. Executive shall be

entitled to such paid time off as may be determined in accordance with the personnel policies of Penns Woods from time to time in effect

(currently thirty-four (34) days for Executive). Executive shall not receive any payments for unused paid time off.

4. Ratification of Employment Agreement.

Except as amended by this Amendment No. 3 to Amended and Restated Employment Agreement, all terms and conditions of the Employment

Agreement remain in full force and effect, and nothing contained in this Amendment No. 3 to Amended and Restated Employment Agreement

shall be deemed to alter or amend any provision of the Employment Agreement except as specifically provided herein. References in the

Employment Agreement to the "Agreement" shall be deemed to be references to the Employment Agreement (as amended by Amendment

No. 1 to Employment Agreement and Amendment No. 2 to Employment Agreement) as further amended hereby.

5. Notices. Except as otherwise provided

in this Amendment No. 3 to Amended and Restated Employment Agreement, any notice required or permitted to be given under this Amendment

No. 3 to Amended and Restated Employment Agreement shall be deemed properly given if in writing and if mailed by registered or certified

mail, postage prepaid with return receipt requested, to Executive’s residence (as then reflected in the personnel records of the

Employer), in the case of notices to Executive, and to the then principal offices of Penns Woods, in the case of notices to the Employer.

6. Waiver. No provision of this Amendment

No. 3 to Amended and Restated Employment Agreement may be modified, waived, or discharged unless such waiver, modification, or discharge

is agreed to in writing and signed by Executive and the Employer. No waiver by any party hereto at any time of any breach by the other

party hereto of, or compliance with, any condition or provision of this Amendment No. 3 to Amended and Restated Employment Agreement

to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior

or subsequent time.

7. Assignment. This Amendment No. 3

to Amended and Restated Employment Agreement shall not be assignable by any party, except by Penns Woods to any of its affiliated companies

or to any successor in interest to its businesses.

8. Entire Agreement; Effect on Prior Agreements.

This Amendment No. 3 to Amended and Restated Employment Agreement contains the entire agreement of the parties relating to the subject

matter hereof, and supersedes and replaces any prior agreement relating to the subject matter hereof.

9. Validity. The invalidity or unenforceability

of any provision of this Amendment No. 3 to Amended and Restated Employment Agreement shall not affect the validity or enforceability

of any other provision hereof, which shall remain in full force and effect.

10. Applicable Law. This Amendment No. 3

to Amended and Restated Employment Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania,

without regard to its conflict of laws principles.

11. Headings. The section headings of this

Amendment No. 3 to Amended and Restated Employment Agreement are for convenience only and shall not control or affect the meaning

or construction, or limit the scope or intent, of any of the provisions hereof.

12. Number. Words used herein in the singular

form shall be construed as being used in the plural form, as the context requires, and vice versa.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this

Amendment No. 3 to Amended and Restated Employment Agreement as of the date set forth below.

| PENNS

WOODS BANCORP, INC. |

|

| |

|

| By: |

R. Edward Nestlerode, Jr. |

Date:

June 3, 2024 |

| |

Chairman |

|

| |

(“Penns Woods”) |

|

| |

|

| /s/

Richard A. Grafmyre |

Date:

June 3, 2024 |

| RICHARD

A. GRAFMYRE |

|

| (“Executive”) |

|

Exhibit 99.1

PENNS WOODS BANCORP, INC. AMENDS CEO GRAFMYRE

CONTRACT

Williamsport,

PA – June 4, 2024 Penns Woods Bancorp, Inc. (NASDAQ:PWOD) announced today that a mutual agreement has been

reached with its Chief Executive Officer, Richard A. Grafmyre CFP®, to amend Mr. Grafmyre’s employment agreement. The amendment

was agreed upon after conducting a review of reported compensation data for the Company’s peer group, industry compensation analysis,

and discussions with shareholders. The amendment, effective June 3, 2024 removes the provision for Mr. Grafmyre to be compensated

for unused paid time off (beginning with paid time off earned during the 2024 annual period), reduces Mr. Grafmyre’s base salary

to $850,000, and sets his maximum annual potential bonus amount at $325,000. These changes will reduce the maximum total annual compensation

for Mr. Grafmyre by approximately $150,000 and will place a greater emphasis on at-risk compensation to better reflect the changes

being seen within the Company’s peer group.

The Company’s bonus plan has been revised

to incorporate the following metrics for the 2024 period: return on average equity, return on average assets, earnings per share, asset

growth, and credit quality (net charge-offs as a percentage of average loans). As with the changes to Mr. Grafmyre’s compensation,

these changes are the result of a review of peer and industry practices and feedback received from shareholders. The bonus metrics will

complement the historical and continued focus on tangible book value plus dividend growth (139% versus peer 124% from December 31,

2013 to 2023), loan portfolio growth ($455 million from December 31, 2018 to 2023), and credit quality (cumulative net charge-offs

to average loans of 0.5% versus all banks 2.1% for the period of December 31, 2018 to 2023).

The Company’s Board of Directors believes

the employment agreement amendment and the revised bonus plan metrics will more closely align compensation to performance while incorporating

peer and industry standards with a greater percentage of total compensation considered at-risk. Executive compensation and the bonus plan

metrics and design will continue to be reviewed annually.

About Penns Woods Bancorp, Inc.

Penns Woods Bancorp, Inc. is the bank holding company for Jersey

Shore State Bank and Luzerne Bank. The banks serve customers in North Central and North Eastern Pennsylvania through their retail banking,

commercial banking, mortgage services and financial services divisions. Penns Woods Bancorp, Inc. stock is listed on the NASDAQ National

Market under the symbol PWOD.

Previous press releases and additional information

can be obtained from the company’s website at www.pwod.com.

| Contact: | Richard A. Grafmyre, Chief Executive Officer |

| | 300 Market Street, Williamsport, PA, 17701 |

| | (570) 322-1111 |

| | (888) 412-5772 |

| | pwod@pwod.com |

| | www.pwod.com |

v3.24.1.1.u2

Cover

|

Jun. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity File Number |

000-17077

|

| Entity Registrant Name |

PENNS WOODS BANCORP, INC.

|

| Entity Central Index Key |

0000716605

|

| Entity Tax Identification Number |

23-2226454

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Address, Address Line One |

300

Market Street

|

| Entity Address, Address Line Two |

P.O.

Box 967

|

| Entity Address, City or Town |

Williamsport

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

17703-0967

|

| City Area Code |

570

|

| Local Phone Number |

322-1111

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $5.55 par value

|

| Trading Symbol |

PWOD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

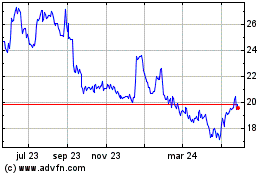

Penns Woods Bancorp (NASDAQ:PWOD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

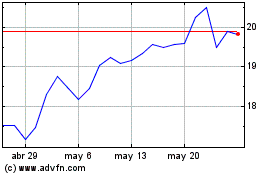

Penns Woods Bancorp (NASDAQ:PWOD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024