0001635282false00016352822024-05-082024-05-080001635282us-gaap:CommonStockMember2024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | | | | | | | |

| May 8, 2024 (May 6, 2024) | |

| Date of Report (date of earliest event reported) |

Rimini Street, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37397 | 36-4880301 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

1700 S. Pavilion Center Drive, Suite 330

Las Vegas, NV 89135

(Address of principal executive offices) (Zip Code)

(702) 839-9671

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, par value $0.0001 per share | | RMNI | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2) of this chapter.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

| ITEM 5.02 | DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

2024 Long-Term Incentive Plan

Effective as of May 6, 2024 (the “Date of Grant”), the Compensation Committee (the “Committee”) of the Rimini Street, Inc. (the “Company”) Board of Directors, with the input of the Committee’s independent compensation consultant, Willis Towers Watson (“WTW”), approved the Company’s 2024 Long-Term Incentive Plan (the “2024 LTI Plan”), consisting of awards of performance units (“PSUs”), restricted stock units (“RSUs”) and options to purchase shares of the Company’s common stock (“Stock Options”) under the terms of the Company’s 2013 Equity Incentive Plan (the “2013 Equity Plan”), as amended. The participants in the 2024 LTI Plan are the Company’s named executive officers (“NEOs”) as identified in the table below.

2024 LTI Plan Award Allocation Mix (PSUs/RSUs/Stock Options)

For Mr. Ravin, the percentage allocation (based on targeted grant value) of his 2024 LTI Plan awards was as follows: 50% PSUs, 30% RSUs and 20% Stock Options. For each of Ms. Lyskawa and Messrs. Perica, Maddock and Rowe, the percentage allocation (based on targeted grant value) of their respective 2024 LTI Plan awards was as follows: 40% PSUs, 40% RSUs and 20% Stock Options. Below is a summary of the 2024 LTI Plan awards as of the Date of Grant:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Underlying Shares as of the Date of Grant | | |

| Name | | PSUs(1) | | RSUs(1) | | Stock Options(2)(3) | | Equity Awards

(Targeted Grant Value) |

Seth A. Ravin President, Chief Executive Officer and Chairman of the Board | | 485,829 | | 291,497 | | 309,997 | | $ | 2,400,000 | |

Michael L. Perica Executive Vice President and Chief Financial Officer | | 161,943 | | 161,943 | | 129,165 | | $ | 1,000,000 | |

Kevin Maddock Executive Vice President and Chief Recurring Revenue Officer | | 48,582 | | 48,582 | | 38,749 | | $ | 300,000 | |

Nancy Lyskawa Executive Vice President and Chief Client Officer | | 48,582 | | 48,582 | | 38,749 | | $ | 300,000 | |

David Rowe Chief Product Officer & Executive Vice President, Global Transformation | | 48,582 | | 48,582 | | 38,749 | | $ | 300,000 | |

________________________

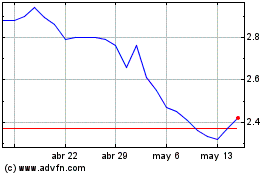

(1) The number of PSUs and RSUs granted to each of our NEOs on the Date of Grant was determined by dividing the respective targeted grant values of each award by $2.47, the closing sales price of the Company’s common stock on the Date of Grant, and rounding down to the nearest whole share.

(2) The number of Stock Options granted to each NEO on the Date of Grant was determined by reference to the Black-Scholes pricing model and valuation assumptions used by the Company in accounting for Stock Options as of the Date of Grant, rounding down to the nearest whole share. With the exception of Mr. Ravin, the Stock Options awarded to our executive officers under the 2024 LTI Plan were incentive Stock Options. Under the terms of our 2013 Equity Plan, because Mr. Ravin beneficially owned more than 10% of our outstanding common stock on the Date of Grant, he was not eligible to receive incentive Stock Options unless the exercise price equaled 110% of the closing price of a share of Company common stock on the Date of Grant and the Stock Options had a stated expiration date of five (versus 10) years, so he received non-qualified Stock Options.

(3) The per share exercise price of the Stock Options is $2.47, the closing sales price of the Company’s common stock on the Date of Grant.

The component awards under the 2024 LTI Plan are generally subject to the terms and conditions of the 2013 Equity Plan and the following vesting and other conditions:

•Performance Units. The PSUs awarded under the 2024 LTI Plan (the “Target PSUs”) will be earned over a one-year performance period beginning on January 1, 2024 and ending on December 31, 2024 (the “Performance Period”) but will remain subject to a continued service-based vesting requirement, as explained further below. Fifty percent (50%) of the PSUs awarded will be eligible to vest based on the Company’s achievement against a target adjusted EBITDA1 goal for the Performance Period, and fifty percent (50%) of the PSUs awarded will be will be eligible to vest based on the Company’s achievement against a target total revenue goal for the Performance Period. The ultimate number of PSUs that may vest (as calculated, the “Earned PSUs”) range from zero to 200% of the Target PSUs. Under the terms of the 2024 LTI Plan, the Earned PSUs will vest in equal annual installments on the first, second and third anniversaries of the Date of Grant, generally subject to the awardee continuing to be a Service Provider (as such term is defined under the 2013 Equity Plan) through the applicable vesting date. The form of award agreement for the PSUs was previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K dated April 6, 2023 (the “Form PSU Agreement”).

As with all Company equity awards to Mr. Ravin, the PSUs awarded to Mr. Ravin under the 2024 LTI Plan are subject to the accelerated vesting provisions contained in his Amended and Restated Employment Agreement dated January 6, 2017, as amended by the First Amendment thereto dated as of June 3, 2020 and the Second Amendment thereto dated as of April 1, 2023 (as amended, the “Employment Agreement”). Under the 2024 LTI Plan, to the extent that Mr. Ravin’s Employment Agreement provides for accelerated vesting of the PSUs upon his cessation of service to the Company, the number of PSUs that vest shall be (i) the Target PSUs, if cessation of service occurs prior to the end of the Performance Period, and (ii) the Earned PSUs, if cessation of service occurs at or after the end of the Performance Period.

The PSUs awarded to the Company’s other NEOs under the terms of the 2024 LTI Plan are also subject to the terms and conditions of the Form PSU Agreement, with additional provisions providing for accelerated vesting if the awardee is terminated without “cause” or resigns for “good reason” within 24 months following a “change of control” of the Company, with the definitions of “cause,” “good reason,” and “change of control,” generally mirroring how such terms are defined in Mr. Ravin’s Employment Agreement. As with Mr. Ravin, if such events occur prior to the end of the Performance Period, the number of PSUs that vest shall be the Target PSUs, and if such events occur at or after the end of the Performance Period, the number of PSUs that vest shall be the Earned PSUs.

•Restricted Stock Units. The RSUs awarded under the 2024 LTI Plan shall vest in three equal annual installments on the first, second and third anniversaries of the Date of Grant, generally subject to the awardee continuing to be a Service Provider through the applicable vesting date. The form of award agreement for the 2024 LTI Plan RSU awards was previously filed as Exhibit 10.4 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

•Stock Options. The Stock Options awarded under the 2024 LTI Plan shall vest in three equal annual installments on the first, second and third anniversaries of the Date of Grant, generally subject to the awardee continuing to be a Service Provider through the applicable vesting date. The form of award agreement for the 2024 LTI Plan Stock Option awards was previously filed, along with the 2013 Equity Plan, as Exhibit 10.20 to the Amendment to the Company’s Registration Statement on Form S-4 filed on August 9, 2017.

1 EBITDA is the Company’s (i) net income for the Performance Period adjusted to exclude (ii) interest expense, (iii) income tax expense and (iv) depreciation and amortization expense (in each case of (i) through (iv), determined in accordance with generally accepted accounting principles and as to be reported in the Company’s Annual Report on Form 10-K for its fiscal year ending December 31, 2024). Adjusted EBITDA is the Company’s “Adjusted EBITDA” for the Performance Period, as such term is defined in the Company’s fiscal year 2023 earnings press release, a copy of which was furnished as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated February 28, 2024.

| | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Title |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | RIMINI STREET, INC. | | |

| | | | | | |

| | | | | | |

Dated: May 8, 2024 | | By: | /s/ Seth A. Ravin | | |

| | | | Name: Seth A. Ravin | | |

| | | | Title: President and Chief Executive Officer | | |

v3.24.1.u1

Cover

|

May 08, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001635282

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

Rimini Street, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37397

|

| Entity Tax Identification Number |

36-4880301

|

| Entity Address, Address Line One |

1700 S. Pavilion Center Drive

|

| Entity Address, Address Line Two |

Suite 330

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89135

|

| City Area Code |

(702)

|

| Local Phone Number |

839-9671

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

RMNI

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Rimini Street (NASDAQ:RMNI)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

Rimini Street (NASDAQ:RMNI)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024