Seacoast Banking Corporation of Florida (“Seacoast” or the

“Company”) (NASDAQ: SBCF) announced that on December 18, 2024, its

Board of Directors (the “Board”) renewed the Company's share

repurchase program, which was set to expire on December 31, 2024.

Under the renewed repurchase program, which will expire on December

31, 2025, the Company may repurchase, from time to time, up to $100

million of its shares of common stock, representing approximately

4% of the Company’s outstanding common stock.

The repurchase program permits shares to be

repurchased in the open market, by block purchase, in privately

negotiated transactions, in one or more transactions from time to

time, or pursuant to any trading plan adopted in accordance with

Rule 10b5-1 of the Securities Exchange Act of 1934 (the “Exchange

Act”). Open market purchases will be conducted in accordance with

the limitations set forth in Rule 10b-18 of the Exchange Act and

other applicable legal and regulatory requirements.

The timing and actual number of shares

repurchased will be made at the Company’s discretion and will

depend on a variety of factors including, without limitation,

price, corporate and regulatory requirements, market conditions,

Seacoast’s financial performance, and bank capital and liquidity

requirements and priorities. The repurchase program does not

obligate the Company to purchase any particular number of

shares.

The repurchase program may be suspended,

terminated or modified by the Board without notice at any time for

any reason, including, without limitation, market conditions, the

cost of repurchasing shares, the availability of alternative

investment opportunities, capital and liquidity objectives, and

other factors deemed appropriate by Seacoast’s management.

About Seacoast Banking Corporation of

Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida is one

of the largest community banks headquartered in Florida with

approximately $15.2 billion in assets and $12.2 billion in deposits

as of September 30, 2024. Seacoast provides integrated financial

services including commercial and consumer banking, wealth

management, and mortgage services to customers at 77 full-service

branches across Florida, and through advanced mobile and online

banking solutions. Seacoast National Bank is the wholly-owned

subsidiary bank of Seacoast Banking Corporation of Florida. For

more information about Seacoast, visit www.SeacoastBanking.com.

Cautionary Notice Regarding

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning, and protections, of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, without

limitation, statements about future financial and operating

results, cost savings, enhanced revenues, economic and seasonal

conditions in the Company’s markets, and improvements to reported

earnings that may be realized from cost controls, tax law changes,

new initiatives and for integration of banks that the Company has

acquired, or expects to acquire, as well as statements with respect

to Seacoast's objectives, strategic plans, expectations and

intentions and other statements that are not historical facts.

Actual results may differ from those set forth in the

forward-looking statements.

Forward-looking statements include statements

with respect to the Company’s beliefs, plans, objectives, goals,

expectations, anticipations, assumptions, estimates and intentions

about future performance and involve known and unknown risks,

uncertainties and other factors, which may be beyond the Company’s

control, and which may cause the actual results, performance or

achievements of Seacoast Banking Corporation of Florida (“Seacoast”

or the “Company”) or its wholly-owned banking subsidiary, Seacoast

National Bank (“Seacoast Bank”), to be materially different from

results, performance or achievements expressed or implied by such

forward-looking statements. You should not expect the Company to

update any forward-looking statements.

All statements other than statements of

historical fact could be forward-looking statements. You can

identify these forward-looking statements through the use of words

such as "may", "will", "anticipate", "assume", "should", "support",

"indicate", "would", "believe", "contemplate", "expect",

"estimate", "continue", "further", "plan", "point to", "project",

"could", "intend", "target" or other similar words and expressions

of the future. These forward-looking statements may not be realized

due to a variety of factors, including, without limitation: the

impact of current and future economic and market conditions

generally (including seasonality) and in the financial services

industry, nationally and within Seacoast’s primary market areas,

including the effects of inflationary pressures, changes in

interest rates, slowdowns in economic growth, and the potential for

high unemployment rates, as well as the financial stress on

borrowers and changes to customer and client behavior and credit

risk as a result of the foregoing; potential impacts of adverse

developments in the banking industry, including those highlighted

by high-profile bank failures, and including impacts on customer

confidence, deposit outflows, liquidity and the regulatory response

thereto (including increases in the cost of our deposit insurance

assessments), the Company's ability to effectively manage its

liquidity risk and any growth plans, and the availability of

capital and funding; governmental monetary and fiscal policies,

including interest rate policies of the Board of Governors of the

Federal Reserve, as well as legislative, tax and regulatory changes

including proposed overdraft and late fee caps, including those

that impact the money supply and inflation; the risks of changes in

interest rates on the level and composition of deposits (as well as

the cost of, and competition for, deposits), loan demand, liquidity

and the values of loan collateral, securities, and interest rate

sensitive assets and liabilities; interest rate risks (including

the impacts of interest rates on macroeconomic conditions, customer

and client behavior, and on our net interest income), sensitivities

and the shape of the yield curve; changes in accounting policies,

rules and practices; changes in retail distribution strategies,

customer preferences and behavior generally and as a result of

economic factors, including heightened inflation; changes in the

availability and cost of credit and capital in the financial

markets; changes in the prices, values and sales volumes of

residential and commercial real estate, especially as they relate

to the value of collateral supporting the Company’s loans; the

Company’s concentration in commercial real estate loans and in real

estate collateral in Florida; Seacoast’s ability to comply with any

regulatory requirements and the risk that the regulatory

environment may not be conducive to or may prohibit or delay the

consummation of future mergers and/or business combinations, may

increase the length of time and amount of resources required to

consummate such transactions, and may reduce the anticipated

benefit; inaccuracies or other failures from the use of models,

including the failure of assumptions and estimates, as well as

differences in, and changes to, economic, market and credit

conditions; the impact on the valuation of Seacoast’s investments

due to market volatility or counterparty payment risk, as well as

the effect of a decline in stock market prices on our fee income

from our wealth management business; statutory and regulatory

dividend restrictions; increases in regulatory capital requirements

for banking organizations generally; the risks of mergers,

acquisitions and divestitures, including Seacoast’s ability to

continue to identify acquisition targets, successfully acquire and

integrate desirable financial institutions and realize expected

revenues and revenue synergies; changes in technology or products

that may be more difficult, costly, or less effective than

anticipated; the Company’s ability to identify and address

increased cybersecurity risks, including those impacting vendors

and other third parties which may be exacerbated by developments in

generative artificial intelligence; fraud or misconduct by internal

or external parties, which Seacoast may not be able to prevent,

detect or mitigate; inability of Seacoast’s risk management

framework to manage risks associated with the Company’s business;

dependence on key suppliers or vendors to obtain equipment or

services for the business on acceptable terms; reduction in or the

termination of Seacoast’s ability to use the online- or

mobile-based platform that is critical to the Company’s business

growth strategy; the effects of war or other conflicts, acts of

terrorism, natural disasters, including hurricanes in the Company’s

footprint, health emergencies, epidemics or pandemics, or other

catastrophic events that may affect general economic conditions

and/or increase costs, including, but not limited to, property and

casualty and other insurance costs; Seacoast’s ability to maintain

adequate internal controls over financial reporting; potential

claims, damages, penalties, fines, costs and reputational damage

resulting from pending or future litigation, regulatory proceedings

and enforcement actions; the risks that deferred tax assets could

be reduced if estimates of future taxable income from the Company’s

operations and tax planning strategies are less than currently

estimated, the results of tax audit findings, challenges to our tax

positions, or adverse changes or interpretations of tax laws; the

effects of competition from other commercial banks, thrifts,

mortgage banking firms, consumer finance companies, credit unions,

non-bank financial technology providers, securities brokerage

firms, insurance companies, money market and other mutual funds and

other financial institutions; the failure of assumptions underlying

the establishment of reserves for expected credit losses; risks

related to, and the costs associated with, environmental, social

and governance matters, including the scope and pace of related

rulemaking activity and disclosure requirements; a deterioration of

the credit rating for U.S. long-term sovereign debt, actions that

the U.S. government may take to avoid exceeding the debt ceiling,

and uncertainties surrounding the federal budget and economic

policy; the risk that balance sheet, revenue growth, and loan

growth expectations may differ from actual results; and other

factors and risks described under “Risk Factors” herein and in any

of the Company's subsequent reports filed with the SEC and

available on its website at www.sec.gov.

All written or oral forward-looking statements

attributable to us are expressly qualified in their entirety by

this cautionary notice, including, without limitation, those risks

and uncertainties described in the Company’s annual report on Form

10-K for the year ended December 31, 2023 and in other periodic

reports that the Company files with the SEC. Such reports are

available upon request from the Company, or from the Securities and

Exchange Commission, including through the SEC's Internet website

at www.sec.gov.

CONTACT:

Chloe Swicegood

chloe@sachsmedia.com

(850) 702-9800

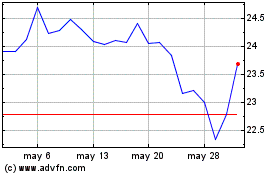

Seacoast Banking Corpora... (NASDAQ:SBCF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Seacoast Banking Corpora... (NASDAQ:SBCF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024