false

0001680379

0001680379

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): March 6, 2024

STERLING BANCORP, INC.

(Exact

name of registrant as specified in its charter)

| Michigan |

|

001-38290 |

|

38-3163775 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.) |

One Towne Square, Suite 1900

Southfield, Michigan 48076

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number,

including area code: (248) 355-2400

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each

class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common Stock |

SBT |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Amendment to Change of Control Agreement

On March 6, 2024, Sterling Bancorp, Inc.

(the “Company”) and Christine Meredith, the Company’s Chief Risk Officer, entered into a First Amendment

(the “Amendment”) to the Change of Control Agreement, by and between the Company and Ms. Meredith, dated

as of March 10, 2021 (the “Change of Control Agreement”). The Amendment extends the term of the Change

of Control Agreement by three years, through March 10, 2027. All other provisions of the Change of Control Agreement continue in

effect.

The foregoing description of the Amendment is qualified in its entirety

to the terms of the Amendment, filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains certain statements that

are, or may be deemed to be, “forward-looking statements” regarding the Company’s plans, expectations, thoughts, beliefs,

estimates, goals and outlook for the future. These forward-looking statements reflect our current views with respect to, among other things,

future events and our financial performance, including any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions. These statements are often, but not always, made through the

use of words or phrases such as “may,” “might,” “should,” “could,” “believe,”

“expect,” “continue,” “will,” “plan” and “would” or the negative versions

of those words or other comparable words or phrases of a future or forward-looking nature, though the absence of these words does not

mean a statement is not forward-looking. All statements other than statements of historical facts, including but not limited to statements

regarding, the economy and financial markets, government investigations, credit quality, the regulatory scheme governing our industry,

competition in our industry, interest rates, our liquidity, our business and our governance, are forward-looking statements. We have based

the forward-looking statements in this Current Report primarily on our current expectations and projections about future events and trends

that we believe may affect our business, financial condition, results of operations, prospects, business strategy and financial needs.

These forward-looking statements are not historical facts, and they are based on current expectations, estimates and projections about

our industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain

and beyond our control. There can be no assurance that future developments will be those that have been anticipated. We may not actually

achieve the plans, intentions or expectations disclosed in our forward-looking statements. Our statements should not be read to indicate

that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Accordingly, we caution

you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates

and uncertainties that are difficult to predict. The risks, uncertainties and other factors detailed from time to time in our public filings,

including those included in the disclosures under the headings “Cautionary Note Regarding Forward-Looking Statements” in our

Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 9, 2023 and “Risk Factors”

in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2023, subsequent periodic reports

and future periodic reports, could affect future results and events, causing those results and events to differ materially from those

views expressed or implied in the Company’s forward-looking statements. These risks are not exhaustive. Other sections of this Current

Report and our filings with the Securities and Exchange Commission include additional factors that could adversely impact our business

and financial performance. Moreover, we operate in very competitive and rapidly changing environment. New risks and uncertainties emerge

from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking

statements contained in this Current Report. Should one or more of the foregoing risks materialize, or should underlying assumptions prove

incorrect, actual results or outcomes may vary materially from those projected in, or implied by, such forward-looking statements. Accordingly,

you should not place undue reliance on any such forward-looking statements. The Company disclaims any obligation to update, revise, or

correct any forward-looking statements based on the occurrence of future events, the receipt of new information or otherwise.

Item 9.01. Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

Sterling Bancorp, Inc. |

| |

|

| |

By: |

/s/ Karen Knott |

| |

|

Karen Knott |

| |

|

Chief Financial Officer |

Date: March 11, 2024

Exhibit 10.1

FIRST AMENDMENT TO

CHANGE OF CONTROL AGREEMENT

This First Amendment to Change

of Control Agreement (the “Amendment”) is made and entered into as of March 6, 2024 between Sterling Bancorp, Inc.

(the “Company”) and Christine Meredith (the “Officer”).

WHEREAS, the Company and the

Officer previously entered into that certain Change of Control Agreement as of March 10, 2021 (the “Agreement”);

and

WHEREAS, the Company and the

Officer desire to amend the Agreement to extend the Term (as defined in the Agreement) for a period of three years.

NOW, THEREFORE, in consideration

of the promises and mutual covenants herein contained, it is hereby agreed as follows:

| 1. | Section 1(a) of the Agreement is hereby amended and restated to extend the Term for a period

of three years as follows: |

This Agreement shall be in effect during

the period (the “Term”) beginning on March 10, 2021 (the “Effective Date”) and ending on March 10, 2027

or, if earlier, the first anniversary of the Change of Control as defined below.

| 2. | Except as expressly amended herein, all other provisions of the Agreement shall continue in effect and

be unaffected hereby. |

| 3. | Except to the extent preempted by federal law, this Amendment shall be governed by and construed and enforced

in accordance with the laws of the State of Michigan applicable to contracts entered into and to be performed entirely within the State

of Michigan. |

| 4. | This Amendment may be signed in any number of counterparts with the same effect as if the signatures to

each counterpart were upon a single instrument, and all such counterparts together shall be deemed an original of this Amendment. |

IN WITNESS WHEREOF, Sterling

Bancorp, Inc. has caused this Amendment to be executed by its duly authorized officer, and the Officer has signed this Amendment

on the first date set forth herein.

| STERLING

BANCORP, INC. |

|

OFFICER |

| |

|

|

| By: |

/s/ Thomas M. O’Brien |

|

/s/

Christine Meredith |

| Name: |

Thomas M. O’Brien |

|

Christine

Meredith |

Its: President and Chief Executive Officer

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

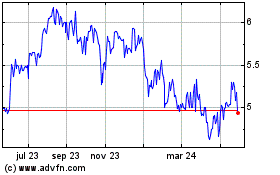

Sterling Bancorp (NASDAQ:SBT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

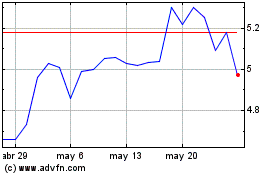

Sterling Bancorp (NASDAQ:SBT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025