false

0001680379

0001680379

2024-12-18

2024-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 18, 2024

STERLING

BANCORP, INC.

(Exact name of

registrant as specified in its charter)

| Michigan |

|

001-38290 |

|

38-3163775 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

One

Towne Square, Suite 1900

Southfield,

Michigan 48076

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including

area code: (248) 355-2400

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

Title

of each

class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common

Stock |

SBT |

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

As previously disclosed, on September 15,

2024, Sterling Bancorp, Inc. (the “Company” or “Sterling”) entered into a definitive

Stock Purchase Agreement (the “Stock Purchase Agreement”) by and among the Company, Sterling Bank and Trust,

F.S.B. (the “Bank”) and EverBank Financial Corp, a Delaware corporation (“EverBank”),

pursuant to which EverBank will acquire all of the issued and outstanding shares of capital stock of the Bank from the Company (the “Transaction”)

for a fixed purchase price of $261,000,000 to be paid to the Company. In connection with its approval of the Transaction, Sterling also

adopted a Plan of Dissolution (“Plan of Dissolution”) for the Company following closing of the Transaction.

Item 5.07. Submission of Matters to a Vote of Security Holders.

(a) On

December 18, 2024, Sterling held a special meeting of shareholders virtually via the internet (the “Special Meeting”)

at which the shareholders considered and voted upon (i) the Stock Purchase Agreement and the transactions contemplated thereby, including

the sale of all of the issued and outstanding shares of capital stock of the Bank (the “Stock Purchase Agreement Proposal”),

(ii) the Plan of Dissolution approved and adopted by the board of directors of the Company on September 15, 2024 (the “Plan

of Dissolution Proposal”), and (iii) (on an advisory, non-binding basis) the compensation that will or may be paid

to the named executive officers of the Company in connection with the transactions contemplated by the Stock Purchase Agreement (the “Compensation

Proposal”), each of which is more fully described in the Company’s proxy statement dated November 8, 2024.

A proposal to adjourn the Special Meeting to solicit additional proxies

if there were not sufficient votes at the time of the Special Meeting to approve the Stock Purchase Agreement Proposal and the Plan of

Dissolution Proposal or if adjournment was necessary or appropriate to ensure that any supplement or amendment to the proxy statement

was timely provided to the Company’s shareholders was not voted upon at the Special Meeting since neither of those circumstances

existed at the time of the Special Meeting.

(b) As

of the close of business on November 4, 2024 (the “Record Date”), there were 51,061,386 shares of

common stock outstanding and entitled to vote. Holders of a total of 37,858,157 shares of common stock were present at the Special

Meeting in person or by proxy constituting a quorum.

(c) The

results of the voting are shown below.

Proposal 1—The Stock Purchase Agreement Proposal

| VOTES FOR | |

AGAINST | |

ABSTAIN | |

BROKER

NON-VOTES |

| 37,818,429 | |

39,638 | |

90 | |

0 |

Proposal 2—The Plan of Dissolution Proposal

| VOTES FOR | |

AGAINST | |

ABSTAIN | |

BROKER

NON-VOTES |

| 37,818,561 | |

39,596 | |

0 | |

0 |

Proposal 3— The Compensation Proposal

| VOTES FOR | |

AGAINST | |

ABSTAIN | |

BROKER

NON-VOTES |

| 35,051,032 | |

2,558,808 | |

248,317 | |

0 |

Item 8.01. Other Events

On December 18, 2024, Sterling issued a press

release announcing the results of the Special Meeting. A copy of the press release is attached as Exhibit 99.1 and is incorporated

herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

Sterling Bancorp, Inc. |

| |

|

| |

By: |

/s/ Karen Knott |

| |

|

Karen Knott |

| |

|

Chief Financial Officer |

Date: December 19, 2024

Exhibit 99.1

Sterling Bancorp Announces Shareholder Approval

of Sale of Sterling Bank and Trust, F.S.B. to EverBank Financial Corp and Approval of Plan of Dissolution

Southfield,

Michigan, December 18, 2024 — Sterling Bancorp, Inc. (NASDAQ: SBT) (“Sterling” or the “Company”),

the holding company of Sterling Bank and Trust, F.S.B. (the “Bank”), today reported that its shareholders have approved (i) the

sale of all of the issued and outstanding shares of capital stock of the Bank to EverBank Financial Corp and (ii) the Plan of Dissolution

approved and adopted by the board of directors of the Company on September 15, 2024. The shareholders also approved, on an advisory,

non-binding basis, the compensation that will or may be paid to the named executive officers of the Company in connection with the sale

transaction.

Following the special meeting of the Company shareholders held this

morning, Mr. Thomas O’Brien, President and Chief Executive Officer stated, “We are very pleased with the overwhelming

support for the sale and dissolution by our shareholders, as evidenced by the outcome of the meeting held today. More than 99% of the

votes cast at our meeting, and 74% of the outstanding shares, were voted in favor of the sale and the dissolution.”

Completion of the sale transaction remains subject to the satisfaction

of the remaining customary closing conditions, including receipt of regulatory approvals. Assuming such conditions are satisfied,

the Company currently expects to complete the sale transaction in the first calendar quarter of 2025.

The full results of the Special Meeting will be reported in the Company’s

Form 8-K expected to be filed on or about December 20, 2024.

About

Sterling Bancorp, Inc.

Sterling

Bancorp, Inc. is a unitary thrift holding company. Its wholly owned subsidiary, Sterling Bank and Trust, F.S.B., has primary branch

operations in San Francisco and Los Angeles, California and New York City. Sterling offers a range of loan products as well as retail

and business banking services. Sterling also has an operations center and a branch in Southfield, Michigan. For additional information,

please visit the Company’s website at http://www.sterlingbank.com.

Investor Contact:

Sterling Bancorp, Inc.

Karen Knott

Executive Vice President and Chief Financial Officer

(248) 359-6624

kzaborney@sterlingbank.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

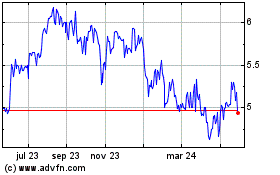

Sterling Bancorp (NASDAQ:SBT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

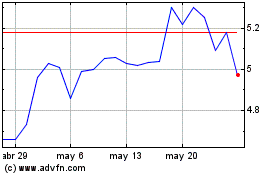

Sterling Bancorp (NASDAQ:SBT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024