SMART Global Holdings, Inc. (“SGH,” “we” or the “Company”)

(Nasdaq: SGH) today announced the pricing of $175.0 million in

aggregate principal amount of convertible senior notes due 2030

(the “Notes”) to be offered and sold to qualified institutional

buyers as defined in Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”). The aggregate principal amount of

the offering was increased from the previously announced offering

size of $150.0 million. The Company has granted the initial

purchasers of the Notes an option to purchase, for settlement

within a period of 13 days from, and including, the date the Notes

are first issued, up to an additional $25.0 million aggregate

principal amount of Notes. The offering is expected to close on or

about August 6, 2024, subject to customary closing conditions.

The Notes will be senior, unsecured obligations of the Company

and will accrue interest at a rate of 2.00% per year, payable

semi-annually in arrears on February 15 and August 15 of each year,

beginning on February 15, 2025. The Notes will mature on August 15,

2030, unless earlier converted, redeemed or repurchased. Prior to

February 15, 2030, the Notes will be convertible at the option of

the holders only upon satisfaction of certain conditions and during

certain periods. On or after February 15, 2030, the Notes will be

convertible at the option of the holders at any time prior to the

close of business on the second scheduled trading day immediately

before the maturity date. The Company will settle conversions by

paying or delivering, as applicable, cash and, if applicable,

ordinary shares, based on the applicable conversion rate(s). The

initial conversion rate of the Notes is 35.7034 ordinary shares per

$1,000 principal amount of Notes (which is equivalent to an initial

conversion price of approximately $28.01 per share and represents a

conversion premium of approximately 30% above the closing price of

the Company’s ordinary shares on August 1, 2024, which was $21.545

per share). The conversion rate is subject to adjustment upon the

occurrence of certain events.

The Notes will be redeemable, in whole or in part, for cash at

SGH’s option at any time, and from time to time, on or after August

20, 2027 and on or before the 31st scheduled trading day

immediately before the maturity date, but only if the last reported

sale price per ordinary share of the Company exceeds 130% of the

conversion price for a specified period of time. In addition, the

Notes will be redeemable, in whole and not in part, at SGH’s option

at any time in connection with certain changes in tax law. The

redemption price will be equal to the principal amount of the Notes

to be redeemed, plus accrued and unpaid interest, if any, to, but

excluding, the redemption date.

If certain corporate events that constitute a “fundamental

change” (as defined in the indenture for the Notes) occur, then,

subject to a limited exception, noteholders may require SGH to

repurchase their Notes for cash. The repurchase price will be equal

to the principal amount of the Notes to be repurchased, plus

accrued and unpaid interest, if any, to, but excluding, the

applicable repurchase date.

SGH estimates that the net proceeds from the offering will be

approximately $168.7 million (or approximately $193.0 million if

the initial purchasers fully exercise their option to purchase

additional Notes), after deducting the initial purchasers’

discounts and commissions and estimated offering expenses.

SGH expects to use (i) approximately $14.3 million of the net

proceeds to fund the cost of entering into the capped call

transactions described below and (ii) approximately $100.6 million

of the net proceeds from the offering to repurchase up to

approximately $80 million aggregate principal amount of SGH’s

existing 2.25% convertible senior notes due 2026 (the “Existing

Convertible Notes”) in privately negotiated transactions effected

through one of the initial purchasers or its affiliate, as SGH’s

agent, concurrently with the pricing of the offering. SGH intends

to use the remainder of the net proceeds from the offering to repay

certain amounts outstanding under SGH’s term loan credit facility,

dated as of February 7, 2022, among the Company, SMART Modular

Technologies, Inc., a wholly-owned subsidiary of SGH, the lenders

party thereto, Citizens Bank, N.A., as administrative agent and

collateral agent and the other parties thereto, as amended (the

“Credit Agreement”).

If the initial purchasers exercise their option to purchase

additional Notes, SGH intends to use a portion of the net proceeds

from the sale of the additional Notes to pay the cost of additional

capped call transactions, and any remaining net proceeds from the

sale of the additional Notes will be used to repay additional

amounts under SGH’s Credit Agreement, as described above.

Holders of the Existing Convertible Notes that are repurchased

in the concurrent repurchases described above may purchase ordinary

shares of the Company in the open market to unwind any hedge

positions they may have with respect to the Existing Convertible

Notes. These activities may affect the trading price of SGH’s

ordinary shares and the initial conversion price of the Notes SGH

is offering.

In connection with the pricing of the Notes, the Company has

entered into privately negotiated capped call transactions with an

affiliate of one of the initial purchasers and certain other

financial institutions (the “Option Counterparties”). The capped

call transactions will cover, subject to anti-dilution adjustments

substantially similar to those applicable to the Notes, the number

of the Company’s ordinary shares that will initially underlie the

Notes. If the initial purchasers exercise their option to purchase

additional Notes, the Company expects to enter into additional

capped call transactions with the Option Counterparties.

The cap price of the capped call transactions will initially be

approximately $37.70 per share, which represents an approximately

75% premium over the closing price of the Company’s ordinary shares

on August 1, 2024, and is subject to certain adjustments under the

terms of the capped call transactions.

The capped call transactions are expected generally to reduce

the potential dilution to holders of ordinary shares of the Company

upon any conversion of the Notes and/or offset any cash payments

SGH is required to make in excess of the principal amount of

converted Notes, as the case may be, with such reduction and/or

offset subject to a cap based on the cap price of the capped call

transactions.

In connection with establishing their initial hedge positions

with respect to the capped call transactions, the Option

Counterparties and/or their respective affiliates expect to

purchase ordinary shares and/or enter into various derivative

transactions with respect to the ordinary shares concurrently with,

or shortly after, the pricing of the Notes. These hedging

activities could increase (or reduce the size of any decrease in)

the market price of the ordinary shares or the Notes at that

time.

In addition, the Option Counterparties and/or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivative transactions with respect to the

ordinary shares and/or purchasing or selling the ordinary shares or

other securities of the Company in secondary market transactions

following the pricing of the Notes and prior to the maturity of the

Notes (and are likely to do so during any observation period

related to a conversion of the Notes). This activity could also

cause or avoid an increase or a decrease in the market price of the

ordinary shares or the Notes, which could affect the ability of

holders to convert their Notes, and, to the extent the activity

occurs following conversion or during any observation period

related to a conversion of the Notes, it could affect the amount

and value of the consideration that holders will receive upon

conversion of their Notes.

The offer and sale of the Notes and the ordinary shares issuable

upon conversion of the Notes, if any, have not been and will not be

registered under the Securities Act or the securities laws of any

other jurisdiction and may not be offered or sold in the United

States absent registration or an applicable exemption from such

registration requirements.

This press release shall not constitute an offer to sell or a

solicitation of an offer to purchase any of these securities, in

the United States or elsewhere, and shall not constitute an offer,

solicitation or sale of the Notes or ordinary shares of the Company

in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful. This press release does not constitute

an offer to purchase or a notice of redemption with respect to the

Existing Convertible Notes, and SGH reserves the right to elect not

to proceed with the repurchase.

Use of Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act, Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. All statements contained

in this press release that do not relate to matters of historical

fact should be considered forward-looking statements. These

statements include, but are not limited to, statements regarding

the completion of the offering of the Notes, the expected amount

and intended use of the net proceeds from the offering, including

the repurchase transactions described above, and the effects of

entering into the capped call transactions and the actions of the

Option Counterparties and their respective affiliates.

Forward-looking statements often use words such as “anticipate,”

“target,” “expect,” “estimate,” “intend,” “plan,” “believe,”

“could,” “will,” “may” and other words of similar meaning. These

forward-looking statements are based on current expectations and

preliminary assumptions that are subject to factors and

uncertainties that could cause actual results to differ materially

from those described in these forward-looking statements. These

forward-looking statements are subject to a number of risks,

uncertainties and other factors, many of which are outside SGH’s

control, including, among others, failure to realize opportunities

relating to the company’s growth and stakeholder value, whether the

offering will be consummated, including the satisfaction of the

closing conditions related to the offering, whether the capped call

transactions will become effective and other factors and risks

detailed in SGH’s filings with the U.S. Securities and Exchange

Commission (which include SGH’s most recent Annual Report on Form

10-K), including SGH’s future filings. Such factors and risks as

outlined above and in such filings do not constitute all factors

and risks that could cause actual results of SGH to be materially

different from SGH’s forward-looking statements. Accordingly,

investors are cautioned not to place undue reliance on any

forward-looking statements. These forward-looking statements are

made as of the date of this press release, and SGH does not intend,

and has no obligation, to update or revise any forward-looking

statements in order to reflect events or circumstances that may

arise after the date of this press release, except as required by

law.

About SGH

At SGH, we design, build, deploy and manage high-performance,

high-availability enterprise solutions that help our customers

solve for the future. Across our computing, memory, and LED lines

of business, we focus on serving our customers by providing deep

technical knowledge and expertise, custom design engineering,

build-to-order flexibility and a commitment to best-in-class

quality.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801383084/en/

Investor Contact Suzanne Schmidt Investor Relations

+1-510-360-8596 ir@sghcorp.com PR Contact Maureen O’Leary

Director, Communications +1-602-330-6846 pr@sghcorp.com

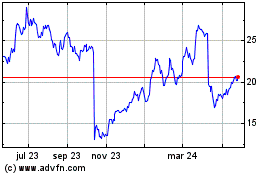

SMART Global (NASDAQ:SGH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

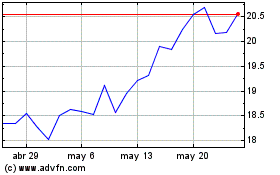

SMART Global (NASDAQ:SGH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024