0001650372FALSE00016503722024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 1, 2024

ATLASSIAN CORPORATION

(Exact Name of Registrant as Specified in its Charter)

_________________ | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Delaware | | 001-37651 | | 88-3940934 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

350 Bush Street, Floor 13

San Francisco, California 94104

(Address of principal executive offices and Zip Code)

(415) 701-1110

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | |

☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

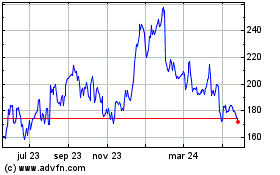

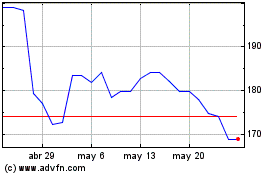

Class A Common Stock, par value $0.00001 per share | | TEAM | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 1, 2024, Atlassian Corporation (the “Company”) issued a press release announcing its results for the quarter and fiscal year ended June 30, 2024 (the “Press Release”). A copy of the Press Release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein. The Company also published a letter to its shareholders announcing its financial results for the quarter and fiscal year ended June 30, 2024 (the “Shareholder Letter”). The full text of the Shareholder Letter is attached as Exhibit 99.2 to this current report on Form 8-K and is incorporated by reference herein.

The information in this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

|

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | ATLASSIAN CORPORATION | |

| | | |

Date: | August 1, 2024 | | By: | | /s/ Joseph Binz |

| | | | | Joseph Binz |

| | | | | Chief Financial Officer |

Atlassian Announces Fourth Quarter and Fiscal Year 2024 Results

Quarterly revenue of $1,132 million, up 20% year-over-year

Quarterly subscription revenue of $1,069 million, up 34% year-over-year

Quarterly GAAP operating margin of (6)% and non-GAAP operating margin of 20%

Quarterly cash flow from operations of $426 million and free cash flow of $413 million

Team Anywhere/San Francisco (August 1, 2024) — Atlassian Corporation (NASDAQ: TEAM), a leading provider of team collaboration and productivity software, today announced financial results for its fourth quarter and fiscal year 2024. A shareholder letter was posted on Atlassian’s Work Life blog at http://atlassian.com/blog/announcements/shareholder-letter-q4fy24 and in the Investor Relations section of Atlassian’s website at https://investors.atlassian.com.

Fourth Quarter Fiscal Year 2024 Earnings Results

“This past year we’ve once again proved to ourselves that we can accomplish big things. We grew revenue to $4.4 billion, generated free cash flow of over $1.4 billion, and surged past 300,000 customers.

“We announced transformative innovations for our customers like Rovo, the latest human-AI technology reshaping the way we work. We achieved significant milestones like FedRAMP’s “In Process” status, a huge step towards supporting the U.S. public sector in the cloud, and we wound down support for Server,” said Mike Cannon-Brookes, Atlassian’s co-founder and co-CEO.

“With this setup, we feel tremendously optimistic about what is ahead of us. We’re excited to build on this momentum and get cracking on FY25,” concluded Cannon-Brookes.

“When I look back on the last 23 years, I am filled with pride at what two mates from Australia built,” said Scott Farquhar, Atlassian’s co-founder and co-CEO. “We created a global company with over 12,000 employees, tens of thousands of champions across the Atlassian ecosystem, and over 300,000 customers. We’ve helped companies big and small all over the world solve some of the most interesting and challenging problems - from the development of electric vehicles and life-saving medical advancements to space exploration. And yet our best days are still ahead.

“I leave the co-CEO role knowing Atlassian is incredibly well-positioned to capitalize on the huge opportunities ahead and live its mission of unleashing the potential of every team. I look forward to continuing along the journey, albeit from a slightly different seat,” concluded Farquhar.

Fourth Quarter Fiscal Year 2024 Financial Highlights:

On a GAAP basis, Atlassian reported:

•Revenue: Total revenue was $1,131.6 million for the fourth quarter of fiscal year 2024, up 20% from $939.1 million for the fourth quarter of fiscal year 2023.

•Operating Loss and Operating Margin: Operating loss was $67.0 million for the fourth quarter of fiscal year 2024, compared with operating loss of $50.4 million for the fourth quarter of fiscal year 2023. Operating margin was (6%) for the fourth quarter of fiscal year 2024, compared with (5%) for the fourth quarter of fiscal year 2023.

•Net Loss and Net Loss Per Diluted Share: Net loss was $196.9 million for the fourth quarter of fiscal year 2024, compared with net loss of $59.0 million for the fourth quarter of fiscal year 2023. Net loss per diluted share was $0.76 for the fourth quarter of fiscal year 2024, compared with net loss per diluted share of $0.23 for the fourth quarter of fiscal year 2023.

•Balance Sheet: Cash and cash equivalents plus marketable securities at the end of the fourth quarter of fiscal year 2024 totaled $2.3 billion.

On a non-GAAP basis, Atlassian reported:

•Operating Income and Operating Margin: Operating income was $222.0 million for the fourth quarter of fiscal year 2024, compared with operating income of $202.8 million for the fourth quarter of fiscal year 2023. Operating margin was 20% for the fourth quarter of fiscal year 2024, compared with 22% for the fourth quarter of fiscal year 2023.

•Net Income and Net Income Per Diluted Share: Net income was $171.4 million for the fourth quarter of fiscal year 2024, compared with net income of $147.0 million for the fourth quarter of fiscal year 2023. Net income per diluted share was $0.66 for the fourth quarter of fiscal year 2024, compared with net income per diluted share of $0.57 for the fourth quarter of fiscal year 2023.

•Free Cash Flow: Cash flow from operations was $426.2 million and free cash flow was $413.2 million for the fourth quarter of fiscal year 2024. Free cash flow margin for the fourth quarter of fiscal year 2024 was 37%.

Fiscal Year 2024 Financial Highlights:

On a GAAP basis, Atlassian reported:

•Revenue: Total revenue was $4.4 billion for fiscal year 2024, up 23% from $3.5 billion for fiscal year 2023.

•Operating Loss and Operating Margin: Operating loss was $117.1 million for fiscal year 2024, compared with operating loss of $345.2 million for fiscal year 2023. Operating margin was (3)% for fiscal year 2024, compared with (10)% for fiscal year 2023.

•Net Loss and Net Loss Per Diluted Share: Net loss was $300.5 million for fiscal year 2024, compared with net loss of $486.8 million for fiscal year 2023. Net loss per diluted share was $1.16 for fiscal year 2024, compared with net loss per diluted share of $1.90 for fiscal year 2023.

On a non-GAAP basis, Atlassian reported:

•Operating Income and Operating Margin: Operating income was $1,014.1 million for fiscal year 2024, compared with operating income of $722.6 million for fiscal year 2023. Operating margin was 23% for fiscal year 2024, compared with 20% for fiscal year 2023.

•Net Income and Net Income Per Diluted Share: Net income was $762.4 million for fiscal year 2024, compared with net income of $492.3 million for fiscal year 2023. Net income per diluted share was $2.93 for fiscal year 2024, compared with net income per diluted share of $1.92 for fiscal year 2023.

•Free Cash Flow: Cash flow from operations was $1,448.2 million and free cash flow was $1,415.6 million for fiscal year 2024. Free cash flow margin for fiscal year 2024 was 32%.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the financial statement tables included in this press release. An explanation of these measures is also included below, under the heading “About Non-GAAP Financial Measures.”

Recent Business Highlights:

•Atlassian Team ’24 Recap: Atlassian held its flagship Team '24 conference in Las Vegas from April 30, 2024, through May 2, 2024. Thousands of customers and partners gathered in person, as thousands more joined virtually from around the world to hear announcements on new product innovation. A replay of the breakout sessions can be found at https://events.atlassian.com/team-digital/sessions. Some of the significant announcements at Team '24 included:

◦Rovo, an AI-powered teammate designed to assist in finding, learning, and acting on data-driven insights derived from both first and third-party applications. With Rovo, teams will be able to find information through comprehensive enterprise search capabilities, learn in context with AI-driven insights and conversational chat, and take action through agents that bring deep knowledge and skills to a wide variety of workflows.

◦A unified Jira, the combination of Jira Software and Jira Work Management into one Jira, to streamline collaboration across teams, increase flexibility, and provide a cohesive experience across an organization's workflows. This evolution of Jira is designed to provide a shared place for every team to align on goals and priorities, track and collaborate on work, and get the insights they need to build something incredible, together.

◦Guard, an advanced security solution designed to enhance user and data protection, visibility, and auditing across Atlassian cloud products.

◦30+ New Atlassian Intelligence Capabilities that deliver game-changing innovation to customers in the cloud, with features such as natural language input for rule creation in Automation, AI issue smart summaries in Jira, and sentiment analysis for Jira Service Management.

•Achieved FedRAMP® “In Process” Designation: Atlassian achieved FedRAMP “In Process” designation and is now listed on the FedRAMP marketplace, an important milestone that brings the company one step closer to achieving FedRAMP Moderate Authority to Operate. The company also announced, Atlassian Government Cloud, its FedRAMP moderate offering which will initially include Jira, Confluence, and Jira Service

Management and will empower government customers to adopt the innovative features in Atlassian’s cloud products.

•Customers with >$10,000 in Cloud ARR: Atlassian ended its fourth quarter and fiscal year 2024 with 45,842 customers with greater than $10,000 in Cloud annualized recurring revenue (Cloud ARR), an increase of 18% year-over-year.

•Enterprise Momentum: The number of Atlassian customers who spend more than $1 million annually grew by 48% year-over-year, underscoring Atlassian’s momentum in serving enterprise customers while maintaining its uniquely efficient go-to-market model.

•Expanded Board of Directors: Atlassian appointed Scott Belsky to its board of directors. Scott is the Chief Strategy Officer and Executive Vice President, Design & Emerging Products at Adobe Inc. Prior to this, Scott founded his own company, Behance. Scott has deep experience in strategy and product across companies at different scale – from start-up, to enterprise – which we believe will be extremely valuable in helping Atlassian accelerate in key areas like Enterprise and AI as it enters this next phase of growth.

Leadership Changes:

Atlassian has line of sight to surpass $10 billion in annual revenue within the next five years. To help accelerate this journey and unlock the massive opportunity with enterprise customers, Atlassian announced today that a search is underway for a Chief Revenue Officer with a strong track record of leading enterprise sales transformations.

In conjunction with this announcement, Kevin Egan, Atlassian’s Chief Sales Officer, has decided to leave the company and pursue other opportunities. Kevin will remain in his role through the end of August.

“Scott and I thank Kevin for his leadership of the Sales team, and his many contributions to Atlassian over the last three years,” said Mike Cannon-Brookes.

Financial Targets:

Atlassian is providing its financial targets as follows:

First Quarter Fiscal Year 2025:

•Total revenue is expected to be in the range of $1,149 million to $1,157 million.

•Cloud revenue growth year-over-year is expected to be approximately 27.0%.

•Data Center revenue growth year-over-year is expected to be approximately 35.0%.

•Other revenue growth year-over-year is expected to be approximately 13.0%.

•Gross margin is expected to be approximately 81.0% on a GAAP basis and approximately 83.5% on a non-GAAP basis.

•Operating margin is expected to be approximately (7.0%) on a GAAP basis and approximately 19.0% on a non-GAAP basis.

Fiscal Year 2025:

•Total revenue growth year-over-year is expected to be approximately 16.0%.

•Cloud revenue growth year-over-year is expected to be approximately 23.0%.

•Data Center revenue growth year-over-year is expected to be approximately 20.0%.

•Other revenue growth year-over-year is expected to be approximately 5.0%.

•Gross margin is expected to be approximately 81.0% on a GAAP basis and approximately 83.5% on a non-GAAP basis.

•Operating margin is expected to be approximately (6.0%) on a GAAP basis and approximately 21.5% on a non-GAAP basis.

For additional commentary regarding financial targets, please see Atlassian’s fourth quarter fiscal year 2024 shareholder letter dated August 1, 2024.

With respect to Atlassian’s expectations under “Financial Targets” above, a reconciliation of GAAP to non-GAAP gross margin and operating margin has been provided in the financial statement tables included in this press release.

Shareholder Letter and Webcast Details:

A detailed shareholder letter is available on Atlassian’s Work Life blog at https://atlassian.com/blog/announcements/shareholder-letter-q4fy24, and the Investor Relations section of Atlassian’s website at https://investors.atlassian.com. Atlassian will host a webcast to answer questions today:

•When: Thursday, August 1, 2024 at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

•Webcast: A live webcast of the call can be accessed from the Investor Relations section of Atlassian’s website at https://investors.atlassian.com. Following the call, a replay will be available on the same website.

Atlassian has used, and will continue to use, its Investor Relations website at https://investors.atlassian.com as a means of making material information public and for complying with its disclosure obligations.

About Atlassian

Atlassian unleashes the potential of every team. Our software development, service management and work management software helps teams organize, discuss, and complete shared work. The majority of the Fortune 500 and over 300,000 companies of all sizes worldwide - including NASA, Audi, Kiva, Deutsche Bank and Dropbox - rely on our solutions to help their teams work better together and deliver quality results on time. Learn more about our products, including Jira, Confluence and Jira Service Management at https://atlassian.com.

Investor Relations Contact

Martin Lam

IR@atlassian.com

Media Contact

Marie-Claire Maple

press@atlassian.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, which statements involve substantial risks and uncertainties. In some cases, you can identify these statements by forward-looking words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations, but these words are not the exclusive means for identifying such statements. All statements other than statements of historical fact could be deemed forward looking, including risks and uncertainties related to statements about our products, product features, including AI capabilities, customers, executive and director transitions, FedRAMP authorization, enterprise sales, macroeconomic environment, anticipated growth, outlook, technology, and other key strategic areas, and our financial targets such as total revenue, Cloud, Data Center, and Other revenue, and GAAP and non-GAAP financial measures including gross margin and operating margin.

We undertake no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made.

Further information on these and other factors that could affect our financial results is included in filings we make with the Securities and Exchange Commission (the “SEC”) from time to time, including the section titled “Risk Factors” in our most recently filed Forms 10-K and 10-Q. These documents are available on the SEC Filings section of the Investor Relations section of our website at https://investors.atlassian.com.

About Non-GAAP Financial Measures

In addition to the measures presented in our consolidated financial statements, we regularly review other measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), defined as non-GAAP financial measures by the SEC, to evaluate our business, measure our performance, identify trends, prepare financial forecasts and make strategic decisions. The key measures we consider are non-GAAP gross profit and non-GAAP gross margin, non-GAAP operating income and non-GAAP operating margin, non-GAAP net income, non-GAAP net income per diluted share and free cash flow (collectively, the “Non-GAAP Financial Measures”). These Non-GAAP Financial Measures, which may be different from similarly titled non-GAAP measures used by other companies, provide supplemental information regarding our operating performance on a non-GAAP basis that excludes certain gains,

losses and charges of a non-cash nature or that occur relatively infrequently and/or that management considers to be unrelated to our core operations. Management believes that tracking and presenting these Non-GAAP Financial Measures provides management, our board of directors, investors and the analyst community with the ability to better evaluate matters such as: our ongoing core operations, including comparisons between periods and against other companies in our industry; our ability to generate cash to service our debt and fund our operations; and the underlying business trends that are affecting our performance.

Our Non-GAAP Financial Measures include:

•Non-GAAP gross profit and non-GAAP gross margin. Excludes expenses related to stock-based compensation, amortization of acquired intangible assets, and restructuring charges.

•Non-GAAP operating income and non-GAAP operating margin. Excludes expenses related to stock-based compensation, amortization of acquired intangible assets, and restructuring charges.

•Non-GAAP net income and non-GAAP net income per diluted share. Excludes expenses related to stock-based compensation, amortization of acquired intangible assets, restructuring charges, gain on a non-cash sale of a controlling interest of a subsidiary, and the related income tax adjustments.

•Free cash flow. Free cash flow is defined as net cash provided by operating activities less capital expenditures, which consists of purchases of property and equipment.

We understand that although these Non-GAAP Financial Measures are frequently used by investors and the analyst community in their evaluation of our financial performance, these measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. We compensate for such limitations by reconciling these Non-GAAP Financial Measures to the most comparable GAAP financial measures. We encourage you to review the tables in this press release titled “Reconciliation of GAAP to Non-GAAP Results” and “Reconciliation of GAAP to Non-GAAP Financial Targets” that present such reconciliations.

Customers with >$10,000 in Cloud ARR

We define the number of customers with Cloud ARR greater than $10,000 at the end of any particular period as the number of organizations with unique domains with an active Cloud subscription for two or more seats and greater than $10,000 in Cloud ARR.

We define Cloud ARR as the annualized recurring revenue run-rate of Cloud subscription agreements at a point in time. We calculate Cloud ARR by taking the Cloud monthly recurring revenue (“Cloud MRR”) run-rate and multiplying it by 12. Cloud MRR for each month is calculated by aggregating monthly recurring revenue from committed contractual amounts at a point in time. Cloud ARR and Cloud MRR should be viewed independently of revenue and do not represent our revenue under GAAP, as they are operational metrics that can be affected by contract start and end dates and renewal rates.

Atlassian Corporation

Consolidated Statements of Operations

(U.S. $ and shares in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Subscription | $ | 1,068,871 | | | $ | 799,713 | | | $ | 3,924,389 | | | $ | 2,922,576 | |

| Maintenance | — | | | 85,925 | | | 177,230 | | | 399,738 | |

| Other | 62,719 | | | 53,460 | | | 256,984 | | | 212,333 | |

| Total revenues | 1,131,590 | | | 939,098 | | | 4,358,603 | | | 3,534,647 | |

| Cost of revenues (1) (2) | 217,505 | | | 169,776 | | | 803,495 | | | 633,765 | |

| Gross profit | 914,085 | | | 769,322 | | | 3,555,108 | | | 2,900,882 | |

| Operating expenses: | | | | | | | |

| Research and development (1) (2) | 589,104 | | | 474,855 | | | 2,184,111 | | | 1,869,881 | |

| Marketing and sales (1) (2) | 239,603 | | | 202,621 | | | 877,497 | | | 769,861 | |

| General and administrative (1) | 152,328 | | | 142,235 | | | 610,577 | | | 606,362 | |

| Total operating expenses | 981,035 | | | 819,711 | | | 3,672,185 | | | 3,246,104 | |

Operating loss | (66,950) | | | (50,389) | | | (117,077) | | | (345,222) | |

| Other income (expense), net | (6,952) | | | (7,096) | | | (30,916) | | | 14,501 | |

| Interest income | 27,430 | | | 20,579 | | | 96,663 | | | 49,732 | |

| Interest expense | (7,647) | | | (8,540) | | | (34,077) | | | (30,147) | |

| Loss before provision for income taxes | (54,119) | | | (45,446) | | | (85,407) | | | (311,136) | |

| Provision for income taxes | (142,800) | | | (13,506) | | | (215,112) | | | (175,625) | |

| Net loss | $ | (196,919) | | | $ | (58,952) | | | $ | (300,519) | | | $ | (486,761) | |

| | | | | | | |

| | | | | | | |

| Net loss per share attributable to Class A and Class B common stockholders: | | | | | | | |

| Basic | $ | (0.76) | | | $ | (0.23) | | | $ | (1.16) | | | $ | (1.90) | |

| Diluted | $ | (0.76) | | | $ | (0.23) | | | $ | (1.16) | | | $ | (1.90) | |

| Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders: | | | | | | | |

| Basic | 260,326 | | | 257,389 | | | 259,133 | | | 256,307 | |

| Diluted | 260,326 | | | 257,389 | | | 259,133 | | | 256,307 | |

(1)Amounts include stock-based compensation as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 17,817 | | | $ | 17,166 | | | $ | 71,691 | | | $ | 63,913 | |

| Research and development | 183,822 | | | 156,836 | | | 712,409 | | | 604,301 | |

| Marketing and sales | 33,515 | | | 33,817 | | | 137,347 | | | 131,739 | |

| General and administrative | 38,334 | | | 37,425 | | | 159,986 | | | 148,134 | |

(2)Amounts include amortization of acquired intangible assets, as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 11,706 | | | $ | 5,763 | | | $ | 36,988 | | | $ | 22,853 | |

| Research and development | 93 | | | 93 | | | 374 | | | 374 | |

| Marketing and sales | 3,663 | | | 2,524 | | | 12,386 | | | 9,900 | |

Atlassian Corporation

Consolidated Balance Sheets

(U.S. $ in thousands)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | June 30, 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,176,930 | | | $ | 2,102,550 | |

| Marketable securities | 161,973 | | | 10,000 | |

| Accounts receivable, net | 628,049 | | | 477,678 | |

| | | |

| | | |

| Prepaid expenses and other current assets | 109,312 | | | 146,136 | |

| Total current assets | 3,076,264 | | | 2,736,364 | |

| Non-current assets: | | | |

| Property and equipment, net | 86,315 | | | 81,402 | |

| Operating lease right-of-use assets | 172,468 | | | 184,195 | |

| Strategic investments | 223,221 | | | 225,538 | |

| Intangible assets, net | 299,057 | | | 69,072 | |

| Goodwill | 1,288,756 | | | 727,211 | |

| Deferred tax assets | 3,934 | | | 9,945 | |

| Other non-current assets | 62,118 | | | 73,052 | |

| Total assets | $ | 5,212,133 | | | $ | 4,106,779 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 177,545 | | | $ | 159,293 | |

| Accrued expenses and other current liabilities | 577,359 | | | 423,131 | |

| Deferred revenue, current portion | 1,806,269 | | | 1,362,736 | |

| Operating lease liabilities, current portion | 48,953 | | | 44,930 | |

| Debt, current portion | — | | | 37,500 | |

| | | |

| | | |

| Total current liabilities | 2,610,126 | | | 2,027,590 | |

| Non-current liabilities: | | | |

| Deferred revenue, net of current portion | 308,467 | | | 182,743 | |

| Operating lease liabilities, net of current portion | 214,474 | | | 237,835 | |

| Debt, net of current portion | 985,911 | | | 962,093 | |

| Deferred tax liabilities | 20,387 | | | 10,669 | |

| Other non-current liabilities | 39,917 | | | 31,177 | |

| Total liabilities | 4,179,282 | | | 3,452,107 | |

| Stockholders’ equity | | | |

| Common stock | 3 | | | 3 | |

| | | |

| | | |

| Additional paid-in capital | 4,212,064 | | | 3,130,631 | |

| Accumulated other comprehensive income | 25,300 | | | 34,002 | |

| Accumulated deficit | (3,204,516) | | | (2,509,964) | |

| Total stockholders’ equity | 1,032,851 | | | 654,672 | |

| Total liabilities and stockholders’ equity | $ | 5,212,133 | | | $ | 4,106,779 | |

Atlassian Corporation

Consolidated Statements of Cash Flows

(U.S. $ in thousands)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (196,919) | | | $ | (58,952) | | | $ | (300,519) | | | $ | (486,761) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 23,178 | | | 15,304 | | | 78,738 | | | 60,923 | |

| Stock-based compensation | 273,488 | | | 245,244 | | | 1,081,433 | | | 948,087 | |

| Impairment charges for leases and leasehold improvements | — | | | — | | | — | | | 61,098 | |

| Deferred income taxes | 217 | | | 4,305 | | | 119 | | | 10,613 | |

| | | | | | | |

| Amortization of debt discount and issuance cost | 566 | | | 118 | | | 919 | | | 471 | |

| Gain on a non-cash sale of a controlling interest of a subsidiary | — | | | — | | | (1,378) | | | (45,158) | |

| Amortization of interest rate swap contracts | (4,166) | | | — | | | (4,166) | | | — | |

| Net loss on strategic investments | 1,587 | | | 2,143 | | | 13,337 | | | 19,407 | |

| Net foreign currency loss (gain) | 2,159 | | | (4,608) | | | 2,301 | | | (10,613) | |

| Other | 41 | | | 230 | | | 386 | | | 1,488 | |

| Changes in operating assets and liabilities, net of business combinations: | | | | | | | |

| Accounts receivable, net | 18,025 | | | (131,495) | | | (148,469) | | | (169,526) | |

| Prepaid expenses and other assets | 56,406 | | | 2,300 | | | (3,122) | | | (38,230) | |

| | | | | | | |

| Accounts payable | (10,700) | | | 56,868 | | | 18,150 | | | 78,902 | |

| Accrued expenses and other liabilities | 103,165 | | | (6,444) | | | 158,123 | | | 74,611 | |

| Deferred revenue | 159,172 | | | 147,762 | | | 552,307 | | | 362,799 | |

| Net cash provided by operating activities | 426,219 | | | 272,775 | | | 1,448,159 | | | 868,111 | |

| Cash flows from investing activities: | | | | | | | |

| Business combinations, net of cash acquired | (3,040) | | | (5,175) | | | (847,767) | | | (5,775) | |

| Purchases of intangible assets | (535) | | | (160) | | | (535) | | | (160) | |

| Purchases of property and equipment | (13,055) | | | (2,425) | | | (32,577) | | | (25,652) | |

| Purchases of strategic investments | (6,150) | | | (1,000) | | | (14,400) | | | (19,450) | |

| Purchases of marketable securities | (35,207) | | | (14,800) | | | (248,897) | | | (24,800) | |

| Proceeds from maturities of marketable securities | 37,387 | | | — | | | 116,537 | | | 73,950 | |

| | | | | | | |

| Proceeds from sales of marketable securities and strategic investments | 2,501 | | | — | | | 63,893 | | | 629 | |

| Net cash used in investing activities | (18,099) | | | (23,560) | | | (963,746) | | | (1,258) | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| Repayment of Term Loan Facility | (975,000) | | | — | | | (1,000,000) | | | — | |

| Proceeds from issuance of debt, net of issuance costs | 987,039 | | | — | | | 987,039 | | | — | |

| | | | | | | |

| | | | | | | |

| Repurchases of Class A Common Stock | (192,227) | | | (118,258) | | | (395,256) | | | (150,006) | |

| Proceeds from other financing arrangements | — | | | 187 | | | — | | | 1,585 | |

| Net cash used in financing activities | (180,188) | | | (118,071) | | | (408,217) | | | (148,421) | |

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash | (3) | | | (809) | | | (1,989) | | | (1,805) | |

| Net increase in cash, cash equivalents, and restricted cash | 227,929 | | | 130,335 | | | 74,207 | | | 716,627 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 1,950,193 | | | 1,973,580 | | | 2,103,915 | | | 1,386,686 | |

| Net decrease in cash and cash equivalents included in assets held for sale | — | | | — | | | — | | | 602 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 2,178,122 | | | $ | 2,103,915 | | | $ | 2,178,122 | | | $ | 2,103,915 | |

Atlassian Corporation

Revenues by Deployment Options

(U.S. $ in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cloud | $ | 738,006 | | | $ | 563,229 | | | $ | 2,698,899 | | | $ | 2,085,498 | |

| Data Center | 326,663 | | | 232,208 | | | 1,208,498 | | | 819,251 | |

| Server | — | | | 86,149 | | | 177,645 | | | 400,519 | |

| Marketplace and other (1) | 66,921 | | | 57,512 | | | 273,561 | | | 229,379 | |

| Total revenues | $ | 1,131,590 | | | $ | 939,098 | | | $ | 4,358,603 | | | $ | 3,534,647 | |

(1) Included in Marketplace and other is premier support revenue. Premier support is a subscription-based arrangement for a higher level of support across different deployment options. Premier support is recognized as subscription revenue on the Consolidated Statements of Operations as the services are delivered over the term of the arrangement.

Atlassian Corporation

Reconciliation of GAAP to Non-GAAP Results

(U.S. $ and shares in thousands, except percentage and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Fiscal Year Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Gross profit | | | | | | | |

| GAAP gross profit | $ | 914,085 | | | $ | 769,322 | | | $ | 3,555,108 | | | $ | 2,900,882 | |

| Plus: Stock-based compensation | 17,817 | | | 17,166 | | | 71,691 | | | 63,625 | |

| Plus: Amortization of acquired intangible assets | 11,706 | | | 5,763 | | | 36,988 | | | 22,853 | |

| Plus: Restructuring charges (1) | — | | | (55) | | | — | | | 9,192 | |

| Non-GAAP gross profit | $ | 943,608 | | | $ | 792,196 | | | $ | 3,663,787 | | | $ | 2,996,552 | |

| Gross margin | | | | | | | |

| GAAP gross margin | 81% | | 82% | | 82% | | 82% |

| Plus: Stock-based compensation | 1 | | 2 | | 1 | | 2 |

| Plus: Amortization of acquired intangible assets | 1 | | — | | 1 | | 1 |

| Plus: Restructuring charges (1) | — | | — | | — | | — |

| Non-GAAP gross margin | 83% | | 84% | | 84% | | 85% |

| | | | | | | |

| Operating income | | | | | | | |

| GAAP operating loss | $ | (66,950) | | | $ | (50,389) | | | $ | (117,077) | | | $ | (345,222) | |

| Plus: Stock-based compensation | 273,488 | | | 245,718 | | | 1,081,433 | | | 937,812 | |

| Plus: Amortization of acquired intangible assets | 15,462 | | | 8,380 | | | 49,748 | | | 33,127 | |

| Plus: Restructuring charges (1) | — | | | (954) | | | — | | | 96,894 | |

| Non-GAAP operating income | $ | 222,000 | | | $ | 202,755 | | | $ | 1,014,104 | | | $ | 722,611 | |

| Operating margin | | | | | | | |

| GAAP operating margin | (6%) | | (5%) | | (3%) | | (10%) |

| Plus: Stock-based compensation | 25 | | 26 | | 25 | | 26 |

| Plus: Amortization of acquired intangible assets | 1 | | 1 | | 1 | | 1 |

| Plus: Restructuring charges (1) | — | | — | | — | | 3 |

| Non-GAAP operating margin | 20% | | 22% | | 23% | | 20% |

| Net income | | | | | | | |

| GAAP net loss | $ | (196,919) | | | $ | (58,952) | | | $ | (300,519) | | | $ | (486,761) | |

| Plus: Stock-based compensation | 273,488 | | | 245,718 | | | 1,081,433 | | | 937,812 | |

| Plus: Amortization of acquired intangible assets | 15,462 | | | 8,380 | | | 49,748 | | | 33,127 | |

| Plus: Restructuring charges (1) | — | | | (954) | | | — | | | 96,894 | |

| | | | | | | |

| Less: Gain on a non-cash sale of a controlling interest of a subsidiary | — | | | — | | | (1,378) | | | (45,158) | |

| Less: Income tax adjustments (2) | 79,396 | | | (47,172) | | | (66,875) | | | (43,659) | |

| Non-GAAP net income | $ | 171,427 | | | $ | 147,020 | | | $ | 762,409 | | | $ | 492,255 | |

| Net income per share | | | | | | | |

| GAAP net loss per share - diluted | $ | (0.76) | | | $ | (0.23) | | | $ | (1.16) | | | $ | (1.90) | |

| Plus: Stock-based compensation | 1.05 | | | 0.95 | | | 4.16 | | | 3.66 | |

| Plus: Amortization of acquired intangible assets | 0.06 | | | 0.03 | | | 0.19 | | | 0.13 | |

| Plus: Restructuring charges (1) | — | | | — | | | — | | | 0.38 | |

| | | | | | | |

| Less: Gain on a non-cash sale of a controlling interest of a subsidiary | — | | | — | | | (0.01) | | | (0.18) | |

| Less: Income tax adjustments (2) | 0.31 | | | (0.18) | | | (0.25) | | | (0.17) | |

| Non-GAAP net income per share - diluted | $ | 0.66 | | | $ | 0.57 | | | $ | 2.93 | | | $ | 1.92 | |

| Weighted-average diluted shares outstanding | | | | | | | |

| Weighted-average shares used in computing diluted GAAP net loss per share | 260,326 | | | 257,389 | | | 259,133 | | | 256,307 | |

| Plus: Dilution from dilutive securities (3) | 484 | | | 447 | | | 1,076 | | | 554 | |

| Weighted-average shares used in computing diluted non-GAAP net income per share | 260,810 | | | 257,836 | | | 260,209 | | | 256,861 | |

| Free cash flow | | | | | | | |

| GAAP net cash provided by operating activities | $ | 426,219 | | | $ | 272,775 | | | $ | 1,448,159 | | | $ | 868,111 | |

| Less: Capital expenditures | (13,055) | | | (2,425) | | | (32,577) | | | (25,652) | |

| | | | | | | |

| Free cash flow | $ | 413,164 | | | $ | 270,350 | | | $ | 1,415,582 | | | $ | 842,459 | |

(1) Restructuring charges include stock-based compensation expense related to the rebalancing of resources for the three months and fiscal year ended June 30, 2023.

(2) In fiscal year 2024, we began to utilize a fixed long-term projected non-GAAP tax rate in our computation of the non-GAAP income tax adjustments in order to provide better consistency across interim reporting periods. In projecting this long-term non-GAAP tax rate, we utilized a three-year financial projection that excludes the direct and indirect income tax effects of the other non-GAAP adjustments reflected above. Additionally, we considered our current operating structure and other factors such as our existing tax positions in various jurisdictions and key legislation in major jurisdictions where we operate. For fiscal year 2024, we determined the projected non-GAAP tax rate to be 27%. This fixed long-term projected non-GAAP tax rate eliminates the effects of non-recurring and period specific items which can vary in size and frequency. Examples of the non-recurring and period specific items include but are not limited to changes in the valuation allowance related to deferred tax assets, effects resulting from acquisitions, and unusual or infrequently occurring items. We will periodically re-evaluate this long-term rate, as necessary, for significant events. The rate could be subject to change for a variety of reasons, for example, significant changes in the geographic earnings mix or fundamental tax law changes in major jurisdictions where the company operates.

(3) The effects of these dilutive securities were not included in the GAAP calculation of diluted net loss per share for the three months and fiscal years ended June 30, 2024 and 2023, because the effect would have been anti-dilutive.

Atlassian Corporation

Reconciliation of GAAP to Non-GAAP Financial Targets

| | | | | | | |

| | Three Months Ending

September 30, 2024 | | |

| | | |

| | | |

| GAAP gross margin | 81.0% | | |

| Plus: Stock-based compensation | 1.5 | | |

| Plus: Amortization of acquired intangible assets | 1.0 | | |

| Non-GAAP gross margin | 83.5% | | |

| | | |

| GAAP operating margin | (7.0%) | | |

| Plus: Stock-based compensation | 25.0 | | |

| Plus: Amortization of acquired intangible assets | 1.0 | | |

| Non-GAAP operating margin | 19.0% | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| | Fiscal Year Ending

June 30, 2025 | | |

| | | |

| | | |

| GAAP gross margin | 81.0% | | |

| Plus: Stock-based compensation | 1.5 | | |

| Plus: Amortization of acquired intangible assets | 1.0 | | |

| Non-GAAP gross margin | 83.5% | | |

| | | |

| GAAP operating margin | (6.0%) | | |

| Plus: Stock-based compensation | 26.5 | | |

| Plus: Amortization of acquired intangible assets | 1.0 | | |

| Non-GAAP operating margin | 21.5% | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Q4 FY24 Fellow shareholders, FY24 was another big year in Atlassian’s mission to unleash the potential of every team. Reflecting on the fiscal year that was, we put in the hard yards, executed against our long-term goals, and achieved a number of significant milestones. We rolled out Atlassian Intelligence, Compass, and Virtual Agents for Jira Service Management to general availability, and welcomed Loom to the Atlassian family. We successfully wound down support for Server; introduced Rovo, taking human and AI collaboration to the next level; and ushered in the next era of a unified Jira. We added data residency capabilities in six additional regions, and took another big step forward in our support for government customers by achieving FedRAMP® “In Process” status, continuing the momentum with our cloud platform. We grew annual revenue to $4.4 billion, including our first ever $1 billion revenue quarter; delivered free cash flow of over $1 billion in a year for the first time, and surged past 300,000 customers. All of this is a testament to the hard work and dedication of 12,000+ Atlassians around the world. We’re proud of everything we achieved in a challenging environment, and once again proved that we can accomplish big things. And from that, we continue to learn, build muscle in new areas, and evolve as a company - as we have always done for the last 23 years. As we turn our attention to FY25 and beyond, we feel tremendously optimistic about the setup ahead of us. We have a massive $67 billion total serviceable addressable market that’s growing 13% annually, across three large markets: software development, service management, and work management. And we are incredibly well-positioned in each of these three markets. Software continues to eat the world at a rapid pace, the lines between dev and IT continue to blur, and we have a strong track record of bridging business and technical teams across our platform, which is central to the digital transformation taking place in organizations around the world. With the Atlassian platform, we have the right building blocks in place to prime our strategic growth initiatives and drive durable growth in the coming years. We’re ready to build on the momentum from FY24 and get cracking on FY25. Our priorities are clear - we’re continuing our advancements in AI, delivering innovation across our entire product portfolio, and accelerating our evolution into a world-class enterprise company. We’re raring to go. From the CEOs 2

Q4 FY24 Unleashing the potential of every team As we moved past the Server era, we have been increasing our focus on three strategic priorities- enterprise cloud, AI and the System of Work. These are multi-team and multi-year efforts that allow us to grow, thrive, and deepen our competitive position. The rewards on the other side are immense. Most importantly, they’re critical in helping us achieve our mission of unleashing the potential of every team. Enterprise Cloud Enterprises are increasingly looking to Atlassian’s solutions as they navigate a complex, ever- changing world. Breaking down siloes, working cross-functionally, and driving alignment toward unified company goals are critical to business success. And we know the opportunity is huge. Within our existing enterprise customer base alone, we have identified $14 billion of revenue potential. Today, 84% of the Fortune 500 are Atlassian customers, yet they represent only 10% of our total business. We’ve made tremendous progress in recent years to unlock this segment, investing in building out enterprise-grade capabilities across product and go-to-market (GTM) to help our largest customers realize the value of the Atlassian platform. These investments have already yielded strong results as the number of customers spending over $1 million annually with Atlassian grew to 524 at the end of FY24, an increase of 48% year-over-year, with a logo retention rate of 98%+. As we engage deeper with our largest customers, the message has been consistent: they want more from Atlassian to solve their collaboration challenges. This reinforces our conviction in our strategy, and we will continue to charge forward - building and delivering solutions and capabilities enterprises want, and further evolving our GTM motion to unlock the massive opportunity in front of us - including deepening our customer relationships and evolving the way we sell to enterprise. 3 $1M+ Customers 100 200 300 400 500 600 FY20 FY21 FY22 FY23 FY24 524 353 232 178 104 4 8 % Y/ Y

Q4 FY24 In order to capitalize on our enterprise momentum, we are focusing on the following key areas: • Unblocking Data Center customers so they can move to Cloud and reap the full potential of the Atlassian platform; • Cross-selling Jira Service Management, as well as emerging products like Jira Product Discovery, Compass, Loom, and Rovo; • Facilitating wall-to-wall adoption of our Teamwork Foundations of Jira, Confluence, and Loom; and • Upselling to higher-value editions of our Cloud products. Over the last few years we’ve spoken frequently about migrating customers to Cloud as a top company priority. The Server migration was primarily comprised of smaller customers who could make the switch to Cloud in a day. However, the Data Center customer base consists of large enterprises with more complex, integrated instances. As we’ve turned our focus to this next cohort of customers, we’ve shifted our mindset from “cloud first” to “enterprise first.” Many of these enterprise customers will move to Cloud over a multi-year period, and an increasing number will adopt a hybrid approach of both Data Center and Cloud as they shift their teams and users over time. As a result, you’ll hear us speak more about enterprise as a top strategic growth initiative in the years to come, encompassing the Data Center to Cloud journey. 4 In Q4, we continued to deliver in service of our enterprise priority. We increased scale in Jira to support enterprises with up to 50,000 users on a single instance. We also launched Atlassian Guard, our most advanced security solution, offering proactive controls, actionable detections, and quick remediations to keep our customers’ data secure.

Q4 FY24 As we closed out the quarter, we reached two key milestones. We believe this recognition by Forrester validates our multi-year platform strategy and enterprise focus. It reinforces our belief that we will continue to win in IT because of the power of the full Atlassian portfolio. Enterprises, in particular, have taken note of our platform progress and investments to mature our service management capabilities. We’re proud to have enabled 55,000+ organizations to deliver top-notch service experiences at high velocity. Secondly, Atlassian achieved FedRAMP “In Process” status. Today, you'll find our Atlassian Government Cloud offering listed on the FedRAMP marketplace, featuring Jira, Confluence, and Jira Service Management. These tools empower agencies with secure, cutting-edge cloud capabilities to boost productivity and data-driven decision-making. This is a significant milestone in supporting the U.S. public sector and customers who work closely with federal government agencies, in the cloud. With all our progress and momentum in the enterprise segment, we feel more bullish than ever about our long-term opportunity in this space. We want to accelerate our path to $10 billion+ in annual revenue, seize the opportunity in front of us, and further set Atlassian up for success for years to come. We already have a large and growing base of enterprise customers and have built an enterprise- grade platform to underpin our product portfolio. Now we need to continue to evolve how we market, sell, implement, support, and deepen our relationships with these customers. To help accelerate us on this path, we have a search underway for a Chief Revenue Officer with a strong track record of leading enterprise sales transformations. In conjunction with this, Kevin Egan, Atlassian’s Chief Sales Officer, has decided to leave the company and pursue other opportunities. Kevin will remain in his role through the end of August. We thank Kevin for his leadership of the sales team and his many contributions to Atlassian over the last three years. 5 1 Forrester. “Vendors Move to Dominate IT Management Software” Charles Betz, Julie Mohr. 11 July 2024. Firstly, Forrester cited Atlassian as one of two companies that “have reached dominant positions as center-of-gravity IT management platforms,” and have achieved “critical mass that competitors will find hard to match.” 1 F O R R E S T E R R E P O R T

Q4 FY24 Artificial Intelligence Atlassian’s 20+ years of data and insights into how all types of teams plan, track, and deliver work, uniquely positions us to unlock and deliver differentiated value. Our customers are leveraging these powers in capabilities like Virtual Service Agents, natural language querying in JQL, and insights generated through summaries across our cloud products. Monthly active usage of Atlassian Intelligence is up nearly 3x quarter-over-quarter as customers tap these powers to drive even more efficiencies across their work. Customers like Sonos are using Atlassian Intelligence and have reported that features such as AI summaries and the GenAI Editor have allowed them to streamline documentation and cut review times, earning positive team feedback and boosting project efficiency. We are also realizing the power of AI internally with roughly two-thirds of all Atlassians using AI at least weekly, including over 80% of our sales team. 6 ATLASSIAN + CLEARWATER ANALYTICS “Rolling out Atlassian Intelligence across our enterprise has been a game-changer. It has made AI more accessible to our teams, simplifying engagement and reducing complexities. Features like Natural Language to JQL have minimized the need for external tools in Jira Software leading to quicker incident resolutions and increased efficiency. We’ve seen increased operational efficiency from its adoption, allowing our teams to focus more on critical tasks.” Erica Larson Process Engineer, Clearwater Analytics Through the power of our platform and Atlassian Intelligence, we’re delivering game-changing innovation and value to customers in the cloud. We have announced over 30 Atlassian Intelligence features for our cloud products, with more than 15 being delivered this quarter alone, such as page summaries through Smartlinks and customer sentiment analysis in Jira Service Management. The power of generative AI, combined with the extensive first-party and third-party data of the Teamwork Graph allows us to build and ship high-value features that weren’t possible in the past. S M A R T L I N K S U M M A R I E S

Q4 FY24 As an R&D-led organization, we have the unique ability to put more weight behind AI relative to many other software companies. We believe this is a competitive differentiation and as we’ve reallocated talent towards AI, we’ve seen the innovation follow. At Team ’24, we announced our latest innovation for the AI era - Atlassian Rovo. Rovo is an entirely new product that takes human-AI collaboration to the next level by integrating contextual information, conversational AI, and agents into workflows. We believe Rovo is a transformative technology that’s going to re-shape how work gets done. With Rovo, teams can find information from different tools and platforms - without leaving Atlassian products. They can learn in context with AI-driven insights and conversational chat, and take action through agents that bring deep knowledge and skills to a wide variety of workflows. 7 Out-of-the-box Build yourself Marketplace Rovo Agents Rovo is an always-on teammate, ready to answer questions, find data, and tackle various tasks, allowing our customers to focus on the highest value work. Rovo recently entered a closed beta program with select customers and partners exploring its unique capabilities, including enterprises across the technology, education, and gaming industries. We know that with our breadth of users and team-centric data, we are in a unique position to realize the huge opportunities that open up with AI.

Q4 FY24 System of Work At Team ’24, we introduced our vision of teamwork and collaboration, which we call the System of Work. And it immediately resonated with customers. Our customers consistently tell us how they are slowed down by having different teams in their organization working in different tools. They’re frustrated by this sprawl, lack of alignment, increased costs, and security risks. We know that CIOs want to consolidate, and are increasingly looking to Atlassian as a strategic partner - eager for us to show them what great collaboration looks like. Our System of Work vision is pushing more of these conversations to the foreground. Our products power collaboration for tens of millions of users across teams of all types and sizes. Our strong track record of bridging technical and business teams, combined with our unified platform and the breadth of our collaborative portfolio, means Atlassian is well-positioned to provide solutions that address the needs of all teams in an organization. Customers recognize this, and our conversations are shifting from focusing on individual products to discussing how Atlassian serves as the obvious System of Work to power their entire organization. Customers tell us that our collection of products adds significant value and sets Atlassian apart from our peers. Teams using Atlassian products report a 50% reduction in time spent searching, a 35% reduction in irrelevant interruptions, and project success rates increased by 18%. This is the beginning of our journey towards delivering on the System of Work and we’re excited about the immense opportunity. We delivered the first example of this evolution of our portfolio at Team ’24, where we announced that we would be bringing Jira Software together with Jira Work Management to create a unified Jira. Our customers have been telling us they want one product to bridge technical teams and business teams - and we responded. This evolution of Jira provides a shared place for every team to align on goals and priorities, track and collaborate on work, and get the insights they need to build something incredible, together. For us, it’s a pivotal moment to accelerate Jira for business users and means further opportunity for our customers, particularly our largest enterprises, to consolidate their myriad of tools onto the Atlassian platform. A philosophy of how technology-driven organizations should work, and how to connect technology and business teams to achieve impact that would be impossible alone Portfolio Platform Teamwork Foundations Enterprise Strategy and Planning World-Class Software Development High-Velocity Service Management Mercury (coming soon) Jira Confluence Loom Rovo 8 S Y S T E M O F W O R K Rovo was announced in May 2024 and is not yet generally available

Q4 FY24 Centralizing, streamlining, and saving: The Rivian experience When Rivian migrated to Enterprise Cloud, they successfully consolidated five existing tools to standardize on Atlassian Cloud. Their decision to embrace the cloud was easy. They wanted to enable over 90 teams across their company to continue operating independently, while benefitting from shared infrastructure and efficiencies that come with a standardized way of working. In making the move, Rivian has reported saving $2.5 million annually. Since standardizing on Atlassian, Rivian has also found new use cases for their business teams, such as procurement. By using Jira for purchasing reviews, they have been able to dismantle operational silos, automate repetitive workflows, integrate with their third-party payment vendor, and establish a reliable source of truth to support their scaling business. And with Jira Cloud they are harnessing the power of platform capabilities like automation and analytics to drive savings and generate insights to make more informed decisions. “It made the most sense to centralize on Atlassian. The tools solved user needs, and a lot of people were using Jira already. We just needed to streamline miscellaneous project management needs onto that platform. With Atlassian Automation, each stakeholder in this process is saving up to 60 hours every month on administrative work. Using Automation isn’t just about time savings, it’s about freedom. We can spend our time more wisely.” Emily Novak Product Manager, Digital Workspace and Solutions ATLASSIAN + RIVIAN 9

Q4 FY24 10 Farewelling our Co-CEO Scott Farquhar We can’t close out this quarter without recognizing outgoing Co-Founder and Co-CEO Scott Farquhar. Words cannot do justice to the immeasurable impact Scott has had over the last 23 years in founding, building and making Atlassian the company it is today. We are thankful that his contribution continues as a board member and in his special advisor role - but more than that, in the thousands of employees and hundreds of thousands of customers through whom his leadership and legacy will live. A well-known ‘Scott-ism’ is a phrase he shares with all new starters: “We want you to leave Atlassian better than you found it.”

No truer statement can be made of his own time here. He is leaving Atlassian far, far better than when he founded it. On behalf of every team who has been able to unleash their potential, we thank you, Scott. Starting the next chapter of growth FY25 is a pivotal year as we accelerate our efforts in our top three priorities - enterprise cloud, AI, and the System of Work. The opportunities in front of Atlassian have never been greater. We have incredible products, an incredible customer base, and an incredibly talented team. We’ve never been more convinced of our mission to unleash the potential of every team - or the potential of our technology to help us deliver on it. Mike Cannon-Brookes Co-founder and co-CEO Scott Farquhar Co-founder and co-CEO MIKE & SCOT T

Q4 FY24 11 Fourth quarter and fiscal year 2024 financial summary (U.S. $ in thousands, except percentages and per share data) Fourth quarter fiscal year 2024 highlights We closed out FY24 with better-than-expected operating income and margin driven by healthy revenue growth combined with disciplined hiring and cost management. Total revenue for the quarter was in line with our expectations and we delivered strong billings, fueled by an increase in annual and multi-year agreements, further underscoring customer commitment to the Atlassian platform. As we look to the future, we remain focused on helping our over 300,000 customers unleash the potential of every team in their organization. Investments across our top strategic priorities of serving enterprise customers, AI, and System of Work allow us to continue to deliver differentiated and mission-critical solutions that will drive durable revenue growth and operating margin expansion over the next three years. A reconciliation of GAAP to non-GAAP measures is provided within the tables at the end of this letter, in our earnings press release, and on our Investor Relations website. Joe Binz Chief Financial Officer Financial highlights 5R WL T E WI EQH JM GEO ( , JMQEQGMEO PPE U T a M P % QdOQ Q TM Q PM M M P Q OQ MSQ $ BL II RQWL 4QHIH QI +(% 5M GEO DIE 4QHIH QI +(% ( , ( + ( , ( + 00> I OW FQbQ aQ % , %.2) 2,2%)21 -%,.1%/), ,%.,-%/-0 RU 2 -%)1. 0/2%, ,%...% )1 %2))%11 YM SU . %. . % . %, .(% C Q M U S //%2.)$ .)%,12$ 0%)00$ ,-.% $ C Q M U S YM SU % % (%- %. BQ 2/%2 2$ .1%2. $ ,))%. 2$ -1/%0/ $ BQ Q TM Q & PU a QP )'0/$ )' ,$ ' /$ '2)$ 8M T R c R Y Q M U - /% 2 0 %00. %--1% .2 1/1% RQ 00> I OW RU 2-,%/)1 02 % 2/ ,%//,%010 %22/%.. YM SU .)% . % . % . %. C Q M U S U O YQ %))) ) %0.. %) -% )- 0 %/ C Q M U S YM SU %, ( %, ()%) ( % BQ U O YQ 0 %- 0 -0%) ) 0/ %-)2 -2 % .. BQ U O YQ Q TM Q & PU a QP )'// )'.0 '2, '2 ; QQ OM T R c - ,% /- 0)%,.) %- .%.1 1- %-.2 )

Q4 FY24 5R WL T E WI RJ JM GEO ( , IYIQ I I OW U T a M P % QdOQ Q OQ MSQ$ , , , + DIE RYI IE R WL IYIQ I F W SI GaN O U U %)/1%10 022%0 , ,- AMU Q M OQ i 1.%2 . )) $ C TQ / %0 2 .,%-/) 0 M QbQ aQ % , %.2) 2,2%)21 ) , , , + DIE RYI IE R WL IYIQ I F HISOR PIQW 8 aP 0,1%))/ ./,% 2 , 9M M 8Q Q , /%//, , % )1 - GQ bQ i 1/% -2 )) $ AM WQ MOQ M P TQ //%2 .0%. / M QbQ aQ % , %.2) 2,2%)21 ) , , , + DIE RYI IE R WL IYIQ I F IR ESLMG I MRQ 6YQ UOM ..0%)1. -0)%-2 1 :A:6 --0%/)0 ,/ %--1 , 6 UM DMOURUO /%121 )/% .1 ) M QbQ aQ % , %.2) 2,2%)21 ) � Highlights for Q4’24 include: All growth comparisons below relate to the corresponding period of last year, unless otherwise noted. • Revenue of $1,132 million increased 20% driven by growth in our Cloud and Data Center offerings, partially offset by the end of maintenance revenue following Server end-of- support (EoS) in Q3’24. • GAAP gross margin of 81% and non-GAAP gross margin of 83% decreased 1 percentage point driven by the continued revenue mix shift to Cloud. • GAAP operating loss was $67 million and GAAP operating margin of (6%) decreased less than 1 percentage point. Non-GAAP operating income was $222 million and non-GAAP operating margin of 20% decreased 2 percentage points driven by the decline in gross margin and growth in investments across our strategic priorities. • Operating cash flow of $426 million increased 56% driven primarily by collections on strong billings. Free cash flow of $413 million increased 53%. Revenue (U.S. $ in thousands, except percentage data) 12

Q4 FY24 13 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 $30 $69 $79 $86 $94 $67$92 $63 $51 $58 $65 $327$364 $275 $243 $232 $222 $738$703$653$605$563$535 Cloud Data Center Marketplace and other Server Revenues by deployment (1) Note: revenue totals may not foot due to rounding (U.S. $ in millions, except percentage data) $1,132 $1,189 $1,060 $978 $939$915 Year-over-year growth % Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 Cloud 34% 30% 27% 27% 31% 31% Data Center 47% 46% 42% 41% 64% 41% Marketplace and other 12% 17% 9% 5% 43% 16% Server (29%) (27%) (31%) (35%) (69%) (100%) Total revenues 24% 24% 21% 21% 30% 20% Included in Marketplace and other is premier support revenue. Premier support is a subscription-based arrangement for a higher level of support across different deployment options. Premier support is recognized as subscription revenue on the Consolidated Statements of Operations as the services are delivered over the term of the arrangement. (1) Revenue growth in Q4 was driven by subscription revenue, which grew 34%. Cloud revenue growth of 31% was driven by paid seat expansion in existing customers, migrations, and cross-sell of additional products. This result was slightly below our expectations driven by the timing of enterprise deals that landed later than expected in the quarter and slightly lower than expected Data Center migrations. The rate of paid seat expansion in the quarter was in line with our expectations and consistent with Q3 but remained below prior-year levels. All other Cloud revenue drivers, including cross-sell, adoption of higher-value editions, top- of-funnel performance, and customer retention were also in line with our expectations.

Q4 FY24 14 Data Center revenue growth of 41% was in line with our expectations and driven by prior-period Server migrations, as well as expansion within existing customers and price increases. Marketplace and other revenue growth of 16% exceeded our expectations, driven by stronger- than-expected third-party app purchasing related to the Cloud and Data Center billings in the quarter. Lastly, deferred revenue increased 37% year-over-year to $2.1 billion driven by growth in annual and multi-year customer commitments. Margins, operating expenses, and operating income (loss) (U.S. $ in thousands, except percentage data) GAAP operating expenses increased 20% year-over-year driven by higher employment costs, including bonus and stock-based compensation expenses. Headcount at the end of Q4’24 was 12,157, an increase of 255 from the prior quarter driven by hiring in R&D and sales as we continue to invest in key strategic priorities such as serving our enterprise customers, AI, and delivering innovation across our product portfolio. Non-GAAP operating expenses increased 22% year-over-year and were lower than expected driven by lower employment costs and discretionary spending. 5R WL T E WI RJ JM GEO ( , PE MQ EQH RSI EWMQ I SIQ I PPE U T a M P % QdOQ Q TM Q PM M M P Q OQ MSQ$ , , , + R PE MQ g g 66D S YM SU . %. . % B & 66D S YM SU .)% . % BRWEO RSI EWMQ I SIQ I 66D Q M U S Qd Q Q 21 %),. 1 2%0 B & 66D Q M U S Qd Q Q 0 %/)1 .12%-- I IE GL EQH HIYIORSPIQW I SIQ I 66D Q QM OT M P PQbQ YQ Qd Q Q .12% )- -0-%1.. B & 66D Q QM OT M P PQbQ YQ Qd Q Q -).% 12 , 0%2 1 F F6 AG ) %. ))% E NIWMQ EQH EOI I SIQ I 66D YM WQ U S M P M Q Qd Q Q ,2%/), ) %/ B & 66D YM WQ U S M P M Q Qd Q Q ) %- . //%.)- F F6 AG -% -%- IQI EO EQH EHPMQM W EWMYI I SIQ I 66D SQ Q M M P MPYU U M UbQ Qd Q Q . %, 1 - % ,. B & 66D SQ Q M M P MPYU U M UbQ Qd Q Q ,%22- ).%) 2 F F6 AG % %( SI EWMQ MQGRPI 66D Q M U S //%2.)$ .)%,12$ B & 66D Q M U S U O YQ %))) ) %0.. F F6 AG %, ( %,

Q4 FY24 Net income (U.S. $ in thousands, except per share data) Free cash flow (U.S. $ in thousands, except percentage data) Net cash provided by operating activities and free cash flow in Q4’24 include $38 million from the unwinding of interest rate swaps related to our term loan credit facility, which was fully repaid in the quarter. Excluding this impact, free cash flow margin in the quarter would have been 33%. Customers with >$10,000 in Cloud ARR We continue to make progress on our Cloud roadmap, achieving important milestones like “In- Process” designation for FedRAMP, unlocking new data residency regions, and delivering increased scale and performance. Consistently delivering on innovation and meeting our public roadmap commitments strengthens customer confidence in further adopting our Cloud products. We ended FY24 with 45,842 customers with greater than $10,000 in Cloud annualized recurring revenue (“Cloud ARR”), an increase of 18% year-over-year. These customers represent over 80% of total Cloud ARR and continue to grow as a proportion of our overall cloud business. For each period ended 15 5R WL T E WI RJ JM GEO ( , IW QGRPI U T a M P % QdOQ Q TM Q PM M$ , , , + 00> I OW BQ 2/%2 2$ .1%2. $ BQ Q TM Q & PU a QP )'0/$ )' ,$ RQ 00> I OW BQ U O YQ 0 %- 0 -0%) ) BQ U O YQ Q TM Q & PU a QP )'// )'.0 5R WL T E WI RJ JM GEO ( , 5 II 2E L 5OR U T a M P % QdOQ Q OQ MSQ$ , , , + 5 II GE L JOR 66D Q OM T bUPQP Ne Q M U S MO UbU UQ - /% 2 0 %00. @Q 3 8M U M Qd Q PU a Q ,%)..$ %- .$ ; QQ OM T R c - ,% /- 0)%,.) F F6 AG ),% (.%. � , 5R WL T E WI RJ JM GEO ( , IW QGRPI U T a M P % QdOQ Q TM Q PM M$ , , , + 00> I OW BQ 2/%2 2$ .1%2. $ Q TM Q & PU a QP )'0/$ )' ,$ RQ 00> I OW BQ U O YQ 0 %- 0 -0%) ) U O Q TM Q & PU a QP )'// )'.0 5R WL T E WI RJ JM GEO ( , 5 II 2E L 5OR U T a M P % Qd Q Q OQ MSQ$ , , , + 5 II GE L JOR 66D Q OM T bUPQP Ne Q M U S MO UbU UQ - /% 2 0 %00. @Q 3 8M U M Qd Q PU a Q , )..$ - $ ; Q OM T R c - /- 0) ,.) F F6 AG ),% (.%. � , Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 Q2’24 Q3’24 Q4’24 45,84244,33642,864 40,10338,72637,33636,191 34,01132,355 We define the number of customers with Cloud ARR greater than $10,000 at the end of any particular period as the number of organizations with unique domains with an active Cloud subscription and greater than $10,000 in Cloud ARR. We define Cloud ARR as the annualized recurring revenue run-rate of Cloud subscription agreements at a point in time. We calculate Cloud ARR by taking the Cloud monthly recurring revenue (“Cloud MRR”) run-rate and multiplying it by 12. Cloud MRR for each month is calculated by aggregating monthly recurring revenue from committed contractual amounts at a point in time. Cloud ARR and Cloud MRR should be viewed independently of revenue and do not represent our revenue under GAAP, as they are operational metrics that can be affected by contract start and end dates and renewal rates.

Q4 FY24 Financial targets (U.S. $) Q1’25 FY25 FY25 Outlook TOTAL REVENUE We expect total company revenue growth of approximately 16% year-over-year in FY25. In setting our outlook, we have taken what we believe to be an appropriately prudent and risk- adjusted approach based on two primary factors. First, given the uncertain macroeconomic outlook, we have accounted for macro-related factors that negatively impact key growth drivers across our business such as seat expansion, cross-sell, upsell, and customer retention. Second, our outlook also allows for execution risk in the ongoing evolution of our enterprise go- to-market motion, particularly given the upcoming transition in sales leadership. Despite these factors, we expect FY25 to set a strong foundation for accelerated revenue growth in FY26 and we remain confident in our long-term outlook. We continue to expect total revenue over the next three years to grow at a compounded annual growth rate in excess of 20% driven by a combination of cross-sell, seat expansion and edition upgrades in the enterprise customer segment, pricing, and the net tailwind of Data Center to Cloud migrations. 5MQEQGMEO BE IW ���������������������������������� 00> BL II RQWL 4QHMQ AISWIPFI +(% ( , FQbQ aQ % -2 YU U % .0 YU U 8 aP QbQ aQ S c T eQM & bQ &eQM $ M d' 0 9M M 8Q Q QbQ aQ S c T eQM & bQ &eQM $ M d' ,. C TQ QbQ aQ S c T eQM & bQ &eQM $ M d' , YM SU 1 ') C Q M U S YM SU 0') $ RQ 00> BL II RQWL 4QHMQ AISWIPFI +(% ( , YM SU 1,'. C Q M U S YM SU 2') ��������������������������������� 00> 6M GEO D EU 5Q MQ 8 Q ) ( ( FQbQ aQ S c T eQM & bQ &eQM $ M d' / 8 aP QbQ aQ S c T eQM & bQ &eQM $ ETT S % () 9M M 8Q Q QbQ aQ S c T eQM & bQ &eQM $ M d' ) C TQ QbQ aQ S c T eQM & bQ &eQM $ M d' . YM SU 1 ') C Q M U S YM SU /') $ RQ 00> 6M GEO D EU 5Q MQ 8 Q ) ( ( YM SU 1,'. C Q M U S YM SU '. - 5MQEQGMEO BE IW ���������������������������������� 00> BL II RQWL 4QHMQ AISWIPFI +(% ( , FQbQ aQ % -2 YU U % .0 YU U 8 aP QbQ aQ S c T eQM & bQ &eQM $ M d' 0 9M M 8Q Q QbQ aQ S c T eQM & bQ &eQM $ M d' ,. C TQ QbQ aQ S c T eQM & bQ &eQM $ M d' , YM SU 1 ') C Q M U S YM SU 0') $ RQ 00> BL II RQWL 4QHMQ AISWIPFI +(% ( , YM SU 1,'. C Q M U S YM SU 2') ��������������������������������� 00> 6M GEO D EU 5Q MQ 8 Q ) ( ( FQbQ aQ S c T eQM & bQ &eQM $ M d' / 8 aP QbQ aQ S c T eQM & bQ &eQM $ ETT S % () 9M M 8Q Q QbQ aQ S c T eQM & bQ &eQM $ M d' ) C TQ QbQ aQ S c T eQM & bQ &eQM $ M d' . YM SU 1 ') C Q M U S YM SU /') $ RQ 00> 6M GEO D EU 5Q MQ 8 Q ) ( ( YM SU 1,'. C Q M U S YM SU '. - 16

Q4 FY24 17 Further detail and expected trends are provided below: SUBSCRIPTION REVENUE Cloud revenue We expect Cloud revenue growth of approximately 23% year-over-year in FY25. Our outlook assumes migrations will drive a mid-single-digit contribution to growth, a decrease from FY24 due primarily to the end of Server migrations. We also expect our larger, more complex Data Center customers will migrate over a multi-year period and increasingly adopt hybrid deployment strategies. In terms of seasonality, we expect Cloud revenue growth rates will decelerate in the second half of the year as we lap the impact of the Loom acquisition. As outlined at our Investor Day in May, we have significant long-term growth opportunities in the Cloud. We expect to drive greater sales penetration in our enterprise customer segment and facilitate more wall-to-wall adoption of our solutions, which will positively impact net paid seat expansion over time. Additionally, we expect a greater proportion of our Cloud revenue growth to come through increased focus on cross-selling solutions like Jira Service Management, as well as emerging products like Jira Product Discovery, Compass, Loom, and Rovo. Lastly, we expect to continue to see healthy uptake of Premium and Enterprise editions of our products as Data Center customers migrate to Cloud over the coming years. Data Center revenue We expect Data Center revenue growth of approximately 20% year-over-year in FY25 driven by pricing, seat expansion, and cross-sell of additional products, partially offset by continued migrations to Cloud. In terms of seasonality, we also expect growth rates to decrease throughout the year, particularly in Q3, as we lap the benefit of event-driven purchasing from Server EoS and drive increasing migrations to Cloud. OTHER REVENUE We expect Other revenue, which is primarily comprised of Marketplace revenue, to grow approximately 5% year-over-year in FY25. The deceleration in growth from FY24 is driven by the challenging year-over-year comparison related to the event-driven purchasing from Server EoS in Q3, as well as continued sales mix shift to Cloud apps. As a reminder, there is currently a lower Marketplace take rate on third-party Cloud apps relative to Data Center apps to incentivize further cloud app development. We expect Marketplace revenue growth to reaccelerate in FY26 as we lap the impact of Server EoS and continue to focus on driving strong third-party Cloud app attach to our first-party Cloud solutions.

Q4 FY24 18 GROSS MARGIN We expect GAAP gross margin to be approximately 81.0% and non-GAAP gross margin to be approximately 83.5% in FY25, a decrease from the prior year driven by continued revenue mix shift to Cloud. OPERATING AND FREE CASH FLOW MARGIN We expect GAAP operating margin to be approximately (6.0%) and non-GAAP operating margin to be approximately 21.5% in FY25. Operating margins in FY24 benefited by 2 percentage points from the event-driven revenue outperformance related to Server EoS in Q3. Normalizing for this, FY25 non-GAAP operating margin is expected to be roughly flat year-over-year. Operating expense growth in FY25 will continue to be driven by our investments in R&D and sales and marketing to support our strategic priorities of enterprise, AI, and delivering innovation across the product portfolio, partially offset by continued efficiency gains in G&A as we scale. We remain confident in our ability to expand operating margin over time and are committed to delivering non-GAAP operating margin in excess of 25% by FY27 driven by durable revenue growth and a continued focus on realizing operating efficiencies across the business. Over time, we also expect stock-based compensation as a percentage of revenue to decrease with a longer-term goal of achieving GAAP profitability. As a reminder, our free cash flow margin has quarter-to-quarter seasonality throughout the year, with Q1 being the lowest margin driven by the timing of employee bonus payouts. SHARE COUNT We continue to expect diluted share count to increase by less than 2% in FY25.