Toro Corp. (NASDAQ: TORO) (“Toro”, or the “Company”), an

international energy transportation services company, announces the

agreement to provide a $100 million senior term loan facility to

Castor Maritime Inc. (the “Term Loan”). The Term Loan is secured by

10 vessels wholly owned by Castor which are currently valued at

approximately $235 million based on third party valuations, has a

tenor of 5 years and bears interest at SOFR plus 1.80% per annum.

Furthermore, Toro announces that on December 12,

2024, has agreed to increase by 50,000 preferred shares its

investment in Castor’s 5.00% Series D cumulative perpetual

convertible preferred shares, par value $0.001 per share (the

“Series D Preferred Shares”), for an aggregate consideration of $50

million in cash. As a result of this transaction Toro will hold

100,000 Series D Preferred Shares in total.

Castor is a Nasdaq listed maritime entity,

controlled by Petros Panagiotidis, CEO of Toro.

The terms of the Term Loan and Series D

Preferred Shares were approved by the independent and disinterested

members of the Boards of Toro and Castor, respectively, following

the negotiation and recommendation by special committees of the

independent and disinterested directors of the Boards of Toro and

Castor, respectively. The special committee was advised by an

independent financial advisor in its negotiation and recommendation

of the above-mentioned transactions.

About Toro Corp.

Toro Corp. is an international energy

transportation services company with a fleet of tankers and LPG

carriers that carry crude oil, petroleum products and petrochemical

gases worldwide. Toro Corp. currently owns a fleet of five vessels

with an aggregate capacity of 0.1 million dwt, which consists of

one Handysize tanker and four 5,000 cbm LPG carriers.

Toro is incorporated under the laws of the

Republic of the Marshall Islands. The Company's common shares trade

on the Nasdaq Capital Market under the symbol “TORO”.

For more information, please visit the Company’s

website at www.torocorp.com. Information on our website does not

constitute a part of this press release.

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance (including with respect to our share repurchase

program), and underlying assumptions and other statements, which

are other than statements of historical facts. We are including

this cautionary statement in connection with this safe harbor

legislation. The words “believe”, “anticipate”, “intend”,

“estimate”, “forecast”, “project”, “plan”, “potential”, “will”,

“may”, “should”, “expect”, “pending” and similar expressions

identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, our management’s examination of current or historical

operating trends, data contained in our records and other data

available from third parties. Although we believe that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, we cannot assure you that we will achieve or

accomplish these forward-looking statements, including these

expectations, beliefs or projections. In addition to these

important factors, other important factors that, in our view, could

cause actual results to differ materially from those discussed in

the forward‐looking statements include generally: the effects of

our spin-off from Castor Maritime Inc., our business strategy,

expected capital spending and other plans and objectives for future

operations, including our ability to expand our business as a new

entrant to the tanker and liquefied petroleum gas shipping

industry, market conditions and trends, including volatility and

cyclicality in charter rates (particularly for vessels employed in

the spot voyage market or pools), factors affecting supply and

demand for vessels, such as fluctuations in demand for and the

price of the products we transport, fluctuating vessel values,

changes in worldwide fleet capacity, opportunities for the

profitable operations of vessels in the segments of the shipping

industry in which we operate and global economic and financial

conditions, including interest rates, inflation and the growth

rates of world economies, our ability to realize the expected

benefits of vessel acquisitions or sales and the effects of any

change in our fleet’s size or composition, increased transactions

costs and other adverse effects (such as lost profit) due to any

failure to consummate any sale of our vessels, our future financial

condition, operating results, future revenues and expenses, future

liquidity and the adequacy of cash flows from our operations, our

relationships with our current and future service providers and

customers, including the ongoing performance of their obligations,

dependence on their expertise, compliance with applicable laws, and

any impacts on our reputation due to our association with them, the

availability of debt or equity financing on acceptable terms and

our ability to comply with the covenants contained in agreements

relating thereto, in particular due to economic, financial or

operational reasons, our continued ability to enter into time

charters, voyage charters or pool arrangements with existing and

new customers and pool operators and to re-charter our vessels upon

the expiry of the existing charters or pool agreements, any failure

by our contractual counterparties to meet their obligations,

changes in our operating and capitalized expenses, including bunker

prices, dry-docking, insurance costs, costs associated with

regulatory compliance and costs associated with climate change, our

ability to fund future capital expenditures and investments in the

acquisition and refurbishment of our vessels (including the amount

and nature thereof and the timing of completion thereof, the

delivery and commencement of operations dates, expected downtime

and lost revenue), instances of off-hire, fluctuations in interest

rates and currencies, including the value of the U.S. dollar

relative to other currencies, any malfunction or disruption of

information technology systems and networks that our operations

rely on or any impact of a possible cybersecurity breach, existing

or future disputes, proceedings or litigation, future sales of our

securities in the public market, our ability to maintain compliance

with applicable listing standards or the delisting of our common

shares, volatility in our share price, potential conflicts of

interest involving members of our board of directors, senior

management and certain of our service providers that are related

parties, general domestic and international political conditions,

such as political instability, events or conflicts (including armed

conflicts, such as the war in Ukraine and the conflict in the

Middle East), acts of piracy or maritime aggression, such as recent

maritime incidents involving vessels in and around the Red Sea,

sanctions “trade wars” and potential governmental requisitioning of

our vessels during a period of war or emergency, global public

health threats and major outbreaks of disease, any material

cybersecurity incident, changes in seaborne and other

transportation, including due to the maritime incidents in and

around the Red Sea, fluctuating demand for tanker and LPG carriers

and/or disruption of shipping routes due to accidents, political

events, international sanctions, international hostilities and

instability, piracy, smuggling or acts of terrorism, changes in

governmental rules and regulations or actions taken by regulatory

authorities, including changes to environmental regulations

applicable to the shipping industry and to vessel rules and

regulations, as well as changes in inspection procedures and import

and export controls, inadequacies in our insurance coverage,

developments in tax laws, treaties or regulations or their

interpretation in any country in which we operate and changes in

our tax treatment or classification, the impact of climate change,

adverse weather and natural disasters, accidents or the occurrence

of other unexpected events, including in relation to the

operational risks associated with transporting crude oil and/or

refined petroleum products and any other factors described in our

filings with the SEC.

The information set forth herein speaks only as

of the date hereof, and we disclaim any intention or obligation to

update any forward‐looking statements as a result of developments

occurring after the date of this communication, except to the

extent required by applicable law. New factors emerge from time to

time, and it is not possible for us to predict all or any of these

factors. Further, we cannot assess the impact of each such factor

on our business or the extent to which any factor, or combination

of factors, may cause actual results to be materially different

from those contained in any forward-looking statement. Please see

our filings with the Securities Exchange Commission for a more

complete discussion of these foregoing and other risks and

uncertainties. These factors and the other risk factors described

in this press release are not necessarily all of the important

factors that could cause actual results or developments to differ

materially from those expressed in any of our forward-looking

statements. Given these uncertainties, prospective investors are

cautioned not to place undue reliance on such forward-looking

statements.

CONTACT DETAILS

For further information please contact:

Petros PanagiotidisToro Corp. Email:

ir@torocorp.com

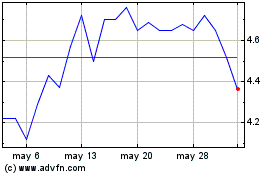

Toro (NASDAQ:TORO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Toro (NASDAQ:TORO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025