UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13E-3

RULE

13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E)

OF THE SECURITIES ACT OF 1934

Thoughtworks Holding, Inc.

(Name of the Issuer)

Thoughtworks

Holding, Inc.

Turing EquityCo II L.P.

Apax IX GP Co. Limited

Apax

IX EUR GP L.P. Inc.

Apax

IX EUR L.P.

Apax

IX - AIV EUR L.P.

Apax

IX EUR Co-Investment L.P.

Apax

IX USD GP L.P. Inc.

Apax

IX USD L.P.

Apax

IX - AIV USD L.P.

Apax

IX USD Co-Investment L.P.

Apax

XI GP Co. Limited

Apax

XI EUR GP L.P. Inc.

Apax

XI USD GP L.P. Inc.

Apax

XI (Guernsey) USD AIV L.P.

Apax

XI EUR L.P.

Apax

XI EUR 1 L.P.

Apax

XI EUR SCSp

Apax

XI USD L.P.

Apax

XI USD 2 L.P.

Apax

XI USD SCSp

Apax

XI GP SARL

Tasmania

Midco, LLC

Tasmania

Merger Sub, Inc.

Tasmania

Parent, Inc.

Tasmania

Holdco, Inc.

Tasmania

GP Co. Limited

Hobart

Equity Holdco, LP

Erin

Cummins

Rachel

Laycock

Ramona

Mateiu

Christopher

Murphy

Michael

Sutcliff

Sudhir

Tiwari

(Name

of Persons Filing Statement)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

88546E105

(CUSIP

Number of Class of Securities)

Thoughtworks

Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Salim

Nathoo

Rohan

Haldea

c/o

Apax Partners LLP

1

Knightsbridge

London

SW1X

7LX

United

Kingdom

+44-20-7872-6300

|

|

Erin

Cummins

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Rachel

Laycock

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

|

Ramona

Mateiu

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

|

Christopher

Murphy

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

Michael

Sutcliff

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Sudhir

Tiwari

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

|

(Name, Address, and Telephone Numbers of Person

Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With

copies to:

Eduardo

Gallardo

Paul

Hastings LLP

200

Park Avenue

New

York, NY 10166

(212)

318-6000 |

Srinivas

S. Kaushik, P.C.

Joshua

N. Korff, P.C.

Kirkland

& Ellis LLP

601

Lexington Avenue

New

York, NY 10022

(212)

446-4800 |

This

statement is filed in connection with (check the appropriate box): ☐

| a. |

☒ |

The filing of solicitation

materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act

of 1934. |

| b. |

☐ |

The filing of a registration

statement under the Securities Act of 1933. |

| c. |

☐ |

A tender offer. |

| d. |

☐ |

None of the above. |

Check

the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies:

☒

Check

the following box if the filing is a final amendment reporting the results of the transaction: ☐

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon

the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on

Schedule 13E-3. Any representation to the contrary is a criminal offense.

INTRODUCTION

This

Transaction Statement on Schedule 13E-3 (the “Transaction Statement”) is being filed with the U.S. Securities and Exchange

Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing Persons”):

(1) Thoughtworks Holding, Inc., a Delaware corporation (“Thoughtworks” or the “Company”) and the issuer of the

Common Stock, par value $0.001 per share (the “Company Common Stock”) that is the subject of the Rule 13e-3 transaction;

(2) Turing EquityCo II L.P., a Guernsey limited partnership; (3) Apax IX GP Co. Limited, a Guernsey limited company; (4) Apax IX EUR

GP L.P. Inc., a Guernsey incorporated limited partnership; (5) Apax IX EUR L.P., a Guernsey limited partnership (6) Apax IX - AIV EUR

L.P, a Delaware limited partnership.; (7) Apax IX EUR Co-Investment L.P., a Guernsey limited partnership; (8) Apax IX USD GP L.P. Inc.,

a Guernsey incorporated limited partnership; (9) Apax IX USD L.P., a Guernsey limited partnership; (10) Apax IX - AIV USD L.P., a Delaware

limited partnership; (11) Apax IX USD Co-Investment L.P., a Guernsey limited partnership; (12) Apax XI GP Co. Limited, a Guernsey limited

company; (13) Apax XI EUR GP L.P. Inc., a Guernsey incorporated limited partnership; (14) Apax XI USD GP L.P. Inc., a Guernsey incorporated

limited partnership; (15) Apax XI (Guernsey) USD AIV L.P., a Guernsey limited partnership; (16) Apax XI EUR L.P., a Guernsey limited

partnership; (17) Apax XI EUR 1 L.P., a Guernsey limited partnership; (18) Apax XI EUR SCSp, a Luxembourg special limited partnership;

(19) Apax XI USD L.P., a Guernsey limited partnership; (20) Apax XI USD 2 L.P., a Guernsey limited partnership; (21) Apax XI USD SCSp,

a Luxembourg special limited partnership; (22) Apax XI GP SARL, a Luxembourg limited liability company; (23) Tasmania Midco, LLC, a Delaware

limited liability company; (24) Tasmania Merger Sub, Inc., a Delaware corporation; (25) Tasmania Parent, Inc., a Delaware corporation;

(26) Tasmania Holdco, Inc., a Delaware corporation; (27) Tasmania GP Co. Limited, a Guernsey limited company; (28) Hobart Equity Holdco,

LP, a Guernsey limited partnership; (29) Erin Cummins; (30) Rachel Laycock; (31) Ramona Mateiu; (32) Christopher Murphy; (33) Michael

Sutcliff; and (34) Sudhir Tiwari.

This

Transaction Statement relates to the Agreement and Plan of Merger, dated as of August 5, 2024 (as amended or otherwise modified in accordance

with its terms, the “Merger Agreement”), by and among the Company, Tasmania Midco, LLC, a Delaware limited liability company

(“Parent”) and Tasmania Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”).

Pursuant to the Merger Agreement, Merger Sub will merge with and into the Company, with the Company surviving such merger as a wholly

owned subsidiary of Parent (the “Merger”). Parent and Merger Sub are affiliates of Turing EquityCo II L.P. (the “Significant

Company Stockholder”), the holder of a majority of the issued and outstanding shares of Company Common Stock and an affiliate of

certain investment funds advised by Apax Partners LLP (the transactions contemplated by the Merger Agreement, including the Merger, collectively,

the “Transactions”).

Subject

to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger (the “Effective Time”),

each share of Company Common Stock issued and outstanding immediately prior to the Effective Time will be cancelled and converted into

the right to receive $4.40 in cash, without interest thereon (the “Per Share Price”), less any applicable tax withholdings.

However, the Per Share Price will not be paid, nor will any distribution be made, in respect of (1) any shares of the Company Common

Stock that are held by us as treasury shares or owned directly or indirectly by Parent or Merger Sub immediately prior to the Effective

Time, which at the Effective Time will automatically be cancelled and extinguished and (2) any shares of Company Common Stock outstanding

immediately prior to the Effective Time and held by a holder who has neither voted in favor of the Merger nor consented to the Merger

in writing and who has properly and validly exercised (and not withdrawn) their statutory rights of appraisal in respect of such shares

in accordance with Section 262 (such shares, the “Dissenting Company Shares”). Treatment of outstanding equity awards under

the Company’s equity incentive plans and award agreements is described in greater detail in the Information Statement (defined

below) under the sections entitled “Summary—Treatment of Equity Awards in the Merger” and “The Special

Factors – Interests of our Directors and Executive Officers in the Merger”.

Parent

has also entered into separate rollover agreements (each, a “Rollover Agreement”) with (1) Tasmania Parent, Inc. (“Topco”),

which will become the indirect parent of the Company following the Merger, and certain of its affiliates, on the one hand, and (2) each

of the Significant Company Stockholder and certain members of Company management (each holder, a “Rollover Stockholder”),

on the other hand. Pursuant to the Rollover Agreements, on the closing date of the Merger prior to the Effective Time, all shares of

Company Common Stock held by the Significant Company Stockholder and certain shares of Company Common Stock held by the other Rollover

Stockholders (each, a “Rollover Share”) will be contributed to Topco in exchange for a number of newly issued shares of Topco

(a “Topco Share”) having an aggregate value equal to the Per Share Price multiplied by the aggregate number of Rollover Shares.

Each Rollover Stockholder who is a member of Company management also agreed to invest a portion of the after-tax proceeds that would

otherwise be received by such Rollover Stockholder in the Merger in respect of certain Company equity awards in exchange for newly issued

Topco Shares, and the assumption and conversion of certain Company equity awards into equity awards having comparable value that are

convertible into Topco Shares, all in accordance with the terms of their Rollover Agreement.

As

a result of the Merger Agreement and the Rollover Agreements, following the Merger the Company will be indirectly owned by the Rollover

Stockholders. Other stockholders of the Company prior to the Effective Time will have no continuing interest in the Company, other than

the right to receive the Per Share Price and rights of appraisal solely with respect to the Dissenting Company Shares. The Company Common

Stock will cease to be listed on Nasdaq and registration of the Company Common Stock under the Exchange Act will be terminated and/or

suspended.

As

more fully described in the Information Statement, having undertaken a thorough review of, and carefully considered, information concerning

the Merger, and a fairness opinion from Lazard, and after consulting with experienced, qualified and independent financial and legal

advisors, a Special Committee of the Company’s board of directors comprised of Robert Brennan, Jane Chwick, William Parrett, and

Roxanne Taylor (the “Special Committee”) unanimously: (1) determined that the Merger Agreement, the Merger and the other

transactions contemplated by the Merger Agreement (together with the Merger, the “Transactions”), upon the terms and conditions

set forth in the Merger Agreement and the applicable provisions of the DGCL, are advisable, fair to and in the best interests of the

Company and the Unaffiliated Stockholders (as defined in the accompanying Information Statement and the Merger Agreement), (2) recommended

to our board of directors (the “Company Board”) that the Company Board (a) approve and declare advisable the Merger Agreement

and the Transactions, including the Merger, and (b) determine that the Merger Agreement and the Transactions, including the Merger, are

advisable, fair to and in the best interests of the Company and the Unaffiliated Stockholders, and (3) recommended that, subject to Company

Board approval, the Company Board submit the Merger Agreement to the Company’s stockholders for their adoption by written consent

in lieu of a meeting and recommend that the Company’s stockholders adopt the Merger Agreement in accordance with the DGCL.

Acting

upon the recommendation of the Special Committee, the Company Board unanimously: (1) determined that the Merger Agreement and the Transactions,

including the Merger, are advisable, fair to and in the best interests of the Company and the Company’s stockholders, including

the Unaffiliated Stockholders, (2) approved and declared advisable the Merger Agreement and the Transactions, including the Merger, (3)

approved and declared advisable the execution and delivery by the Company of the Merger Agreement, the performance by the Company of

the covenants and agreements contained therein and the consummation of the Transactions, including the Merger, upon the terms and subject

to the conditions contained therein, (4) directed that the adoption of the Merger Agreement be submitted to the Company’s stockholders

for their adoption by written consent in lieu of a meeting, and (5) recommended that the Company’s stockholders adopt the Merger

Agreement in accordance with the DGCL. The Company Board, on behalf of the Company, believes that the Merger is fair to the Company’s

“unaffiliated security holders,” as such term is defined in Rule 13e-3 under the Exchange Act.

Concurrently

with the filing of this Transaction Statement, Thoughtworks is filing a notice of written consent and appraisal rights and information

statement (the “Information Statement”) under Regulation 14C of the Exchange Act with the SEC. A copy of the Information

Statement is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached to the Information Statement as Annex A. As

of the date hereof, the Information Statement is in preliminary form, and is subject to completion or amendment. Terms used but not defined

in this Transaction Statement have the meanings assigned to them in the Information Statement. The consummation of the Merger and other

Transactions requires the adoption of the Merger Agreement by affirmative vote of the holders of a majority of the outstanding shares

of Company Common Stock entitled to vote to adopt the Merger Agreement (the “Requisite Stockholder Approval”) pursuant to

Section 228 and Section 251 of the DGCL. On August 5, 2024, following the execution and delivery of the Merger Agreement, the Significant

Company Stockholder, who held shares of Company Common Stock representing approximately 61.2% of the voting power of the outstanding

shares of Company Common Stock (i.e., based on 323,160,161 shares of Company Common Stock outstanding) as of August 4, 2024 (which was

the record date for determining stockholders entitled to consent to the adoption of the Merger Agreement), delivered a written consent

(the “Stockholder Consent”), which is attached to the Information Statement as Annex B, constituting the Requisite Stockholder

Approval. No further approval of the holders of Company Common Stock is required to approve and

adopt the Merger Agreement and the Transactions.

Pursuant

to General Instruction F to Schedule 13E-3, the information contained in the Information Statement, including all annexes thereto, is

expressly incorporated by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the

information contained in the Information Statement and the annexes thereto. The cross-references below are being supplied pursuant to

General Instruction G to Schedule 13E-3 and show the location in the Information Statement of the information required to be included

in response to the items of Schedule 13E-3.

The

information concerning Thoughtworks contained in, or incorporated by reference into, this Transaction Statement and the Information Statement

was supplied by Thoughtworks. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference

into, this Transaction Statement and the Information Statement was supplied by such Filing Person. No Filing Person, including Thoughtworks,

is responsible for the accuracy of any information supplied by any other Filing Person.

ITEM 1. |

SUMMARY TERM SHEET |

The

information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

| ITEM 2. |

SUBJECT COMPANY INFORMATION

|

(a)

Name and Address. The information set forth in the Information Statement under the following caption is incorporated herein by reference:

“The

Parties to the Merger Agreement”

(b)

Securities. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

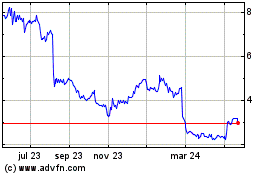

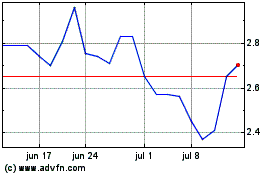

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Security

Ownership of Certain Beneficial Owners and Management”

(c)

Trading Market and Price. The information set forth in the Information Statement under the following caption is incorporated herein

by reference:

“Market

Information, Dividends and Certain Transactions in the Common Stock”

(d)

Dividends. The information set forth in the Information Statement under the following caption is incorporated herein by reference:

“The

Merger Agreement – Conduct of Business by the Company Prior to Consummation of the Merger”

“Market Information, Dividends and Certain Transactions in the Common Stock”

(e)

Prior Public Offerings. The information set forth in the Information Statement under the following captions is incorporated herein

by reference:

“Summary”

“Market

Information, Dividends and Certain Transactions in the Common Stock”

(f)

Prior Stock Purchases. The information set forth in the Information Statement under the following caption is incorporated herein

by reference:

“Market

Information, Dividends and Certain Transactions in the Common Stock”

| ITEM 3. |

IDENTITY AND BACKGROUND

OF FILING PERSONS |

(a)–(c)

Name and Address; Business and Background of Entities; Business and Background of Natural Persons. The information set forth in the

Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The

Parties to the Merger Agreement”

“Directors,

Executive Officers and Controlling Persons of the Company”

“Where

You Can Find More Information”

| ITEM 4. |

TERMS OF THE TRANSACTION

|

(a)(1)

Material Terms – Tender Offers. Not applicable.

(a)(2)

Material Terms – Merger or Similar Transactions. The information set forth in the Information Statement under the following

captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Requisite Stockholder Approval for the Merger”

“The

Special Factors – Opinion and Materials of Lazard”

“The

Special Factors – Certain Company Financial Forecasts”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Accounting Treatment”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Material U.S. Federal Income Tax Consequences of the Merger”

“The

Merger Agreement”

“Annex

A: The Merger Agreement”

“Annex

C: Opinion of Lazard”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

(c)

Different Terms. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Merger Agreement – Consideration to be Received in the Merger”

“The

Merger Agreement – Treatment of Equity Awards in the Merger”

Annex

E: Turing Rollover Agreement

Annex

F: Form of Rollover and Reinvestment Agreement

(d)

Appraisal Rights. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary

– Appraisal Rights”

“Questions

and Answers about the Merger”

“The

Merger Agreement – Dissenting Company Shares”

“Appraisal

Rights”

“Annex

G: DGCL § 262 Appraisal Rights”

(e)

Provisions for Unaffiliated Security Holders. The information set forth in the Information Statement under the following captions

is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“Provisions

for Unaffiliated Stockholders”

“Appraisal

Rights”

(f)

Eligibility for Listing or Trading. Not applicable.

| ITEM 5. |

PAST CONTACTS, TRANSACTIONS,

NEGOTIATIONS AND AGREEMENTS |

(a)

Transactions. The information set forth in the Information Statement under the following caption is incorporated herein by reference:

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Where You Can Find More Information”

(b)–(c)

Significant Corporate Events; Negotiations or Contacts. The information set forth in the Information Statement under the following

captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Requisite Stockholder Approval for the Merger”

“The

Special Factors – Financing”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Fees and Expenses”

“The

Merger Agreement – Form and Effects of the Merger; Certificate of Incorporation and Bylaws; Directors and Officers”

“The

Merger Agreement – Consummation and Effectiveness of the Merger”

“The

Merger Agreement – Consideration to be Received in the Merger”

“The

Merger Agreement – Treatment of Equity Awards in the Merger”

“The

Merger Agreement – Stockholder Consent”

“The

Merger Agreement – Financing of the Merger; Equity Commitment Letter”

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Annex

A: The Merger Agreement”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Information Statement under the following

captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Requisite Stockholder Approval for the Merger”

“The

Special Factors – Financing”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Fees and Expenses”

“The

Merger Agreement – Form and Effects of the Merger; Certificate of Incorporation and Bylaws; Directors and Officers”

“The

Merger Agreement – Consummation and Effectiveness of the Merger”

“The

Merger Agreement – Consideration to be Received in the Merger”

“The

Merger Agreement – Treatment of Equity Awards in the Merger”

“The

Merger Agreement – Stockholder Consent”

“The

Merger Agreement – Financing of the Merger; Equity Commitment Letter”

“The

Merger Agreement – Other Covenants and Agreements”

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Annex

A: The Merger Agreement”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

Director

Nomination Agreement, dated as of September 17, 2021, by and among the Company and the other signatories party thereto, attached

hereto as Exhibit (d)(vi).

| ITEM 6. |

PURPOSES OF THE TRANSACTION

AND PLANS OR PROPOSALS |

(b)

Use of Securities Acquired. The information set forth in the Information Statement under the following captions is incorporated herein

by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Plans for the Company After the Merger”

“The

Merger Agreement – Form and Effects of the Merger; Certificate of Incorporation and Bylaws; Directors and Officers”

“The

Merger Agreement – Consideration to be Received in the Merger”

“The

Merger Agreement – Treatment of Equity Awards in the Merger”

(c)(1)–(8)

Plans. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Plans for the Company After the Merger”

“The

Special Factors – Fees and Expenses”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Merger Agreement”

“Annex

A: The Merger Agreement”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

| ITEM 7. |

PURPOSES, ALTERNATIVES,

REASONS AND EFFECTS |

(a)

Purposes. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Plans for the Company After the Merger”

(b)

Alternatives. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Opinion and Materials of Lazard”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Alternatives to the Merger”

(c)

Reasons. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

(d)

Effects. The information set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Financing”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – The Company’s Net Book Value and Net Earnings”

“The

Special Factors – Accounting Treatment”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Special Factors – Delisting and Deregistration of Company Common Stock”

“The

Special Factors – Plans for the Company After the Merger”

“The

Special Factors – Material U.S. Federal Income Tax Consequences of the Merger”

“The

Special Factors – Fees and Expenses”

“The

Merger Agreement – Form and Effects of the Merger; Certificate of Incorporation and Bylaws; Directors and Officers”

“The

Merger Agreement – Consummation and Effectiveness of the Merger”

“The

Merger Agreement – Consideration to be Received in the Merger”

“The

Merger Agreement – Treatment of Equity Awards in the Merger”

“The

Merger Agreement – Dissenting Company Shares”

“The

Merger Agreement – Directors’ and Officers’ Indemnification and Insurance”

“The

Merger Agreement – Financing of the Merger; Equity Commitment Letter”

“The

Merger Agreement – Continuing Employee Matters”

“Appraisal

Rights”

“Annex

A: The Merger Agreement”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

“Annex

G: DGCL § 262 Appraisal Rights”

Equity

Commitment Letter, dated as of August 5, 2024 by and among Apax XI EUR L.P., Apax XI EUR 1 L.P., APAX XI EUR SCSp, Apax XI USD L.P.,

Apax XI USD 2 L.P. and APAX XI USD SCSp and Parent, attached hereto as Exhibit (b)(i).

| ITEM 8. |

FAIRNESS OF THE TRANSACTION

|

(a)–(b)

Fairness; Factors Considered in Determining Fairness. The information set forth in the Information Statement under the following

captions is incorporated herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Opinion and Materials of Lazard”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Apax Entities in Connection with the Merger”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“Annex

C: Opinion of Lazard”

The

confidential discussion materials prepared by Lazard Frères & Co. LLC and provided to the Special Committee, dated May 10,

2023, May 26, 2023, May 30, 2023, June 15, 2023, June 30, 2023, April 26, 2024, May 8, 2024, May 13, 2024, May 16, 2024, May 30, 2024,

June 4, 2024, June 10, 2024 (regarding a discounted cash flow analysis), June 10, 2024 (regarding sensitivity analyses), June 18, 2024,

June 19, 2024, July 1, 2024, August 1, 2024 and August 4, 2024, are attached hereto as Exhibits (c)(ii) through and including (c)(xix)

and, in each case, are incorporated by reference herein.

(c)

Approval of Security Holders. The information set forth in the Information Statement under the following captions is incorporated

herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Requisite Stockholder Approval for the Merger”

“The

Merger Agreement – Stockholder Consent”

“Annex

A: The Merger Agreement”

“Annex

B: Stockholder Consent”

(d)

Unaffiliated Representative. Not applicable.

(e)

Approval of Directors. The information set forth in the Information Statement under the following captions is incorporated herein

by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Special Factors – Purposes and Reasons of the Company in Connection with the Merger”

(f)

Other Offers. The information set forth in the Information Statement under the following captions is incorporated by reference:

“Summary”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Merger Agreement – No Solicitation; Superior Proposal and Adverse Recommendation Change”

| ITEM 9. |

REPORTS, OPINIONS, APPRAISALS

AND NEGOTIATIONS |

(a)–(c)

Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents. The information

set forth in the Information Statement under the following captions is incorporated herein by reference:

“Summary”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Opinion and Materials of Lazard”

“The

Special Factors – Certain Company Financial Forecasts”

“The

Special Factors – Position of the Company in Connection with the Merger”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“Annex

C: Opinion of Lazard”

The

confidential discussion materials prepared by Lazard Frères & Co. LLC and provided to the Special Committee, dated May 10,

2023, May 26, 2023, May 30, 2023, June 15, 2023, June 30, 2023, April 26, 2024, May 8, 2024, May 13, 2024, May 16, 2024, May 30, 2024,

June 4, 2024, June 10, 2024 (regarding a discounted cash flow analysis), June 10, 2024 (regarding sensitivity analyses), June 18, 2024,

June 19, 2024, July 1, 2024, August 1, 2024 and August 4, 2024, are attached hereto as Exhibits (c)(ii) through and including (c)(xix)

and, in each case, are incorporated by reference herein.

The

reports, opinions or appraisals referenced in this Item 9 are filed herewith or incorporated by reference herein and will be made available

for inspection and copying at the principal executive offices of Thoughtworks during its regular business hours by any interested holder

of Company Common Stock or representative who has been designated in writing, and copies may be obtained by requesting them in writing

from Thoughtworks at the email address provided under the caption “Where You Can Find More Information” in the Information

Statement, which is incorporated herein by reference.

| ITEM 10. |

SOURCE AND AMOUNTS OF FUNDS

OR OTHER CONSIDERATION |

(a)–(b)

Source of Funds; Conditions. The information set forth in the Information Statement under the following captions is incorporated

herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Financing”

“The

Special Factors – Position of the Apax Entities and Designated Executives in Connection with the Merger”

“The

Merger Agreement – Consummation and Effectiveness of the Merger”

“The

Merger Agreement – Financing of the Merger; Equity Commitment Letter”

“Annex

A – The Merger Agreement”

(c)

Expenses. The information set forth in the Information Statement under the following caption is incorporated herein by reference:

“The

Special Factors – Fees and Expenses”

(d)

Borrowed Funds.

“Summary”

“The

Special Factors – Financing”

“The

Merger Agreement – Financing of the Merger; Equity Commitment Letter”

| ITEM 11. |

INTEREST IN SECURITIES OF

THE SUBJECT COMPANY |

(a)

Securities Ownership. The information set forth in the Information Statement under the following caption is incorporated herein by

reference:

“Summary”

“Directors, Executive Officers and Controlling Persons of the Company”

“Security

Ownership of Certain Beneficial Owners and Management”

(b)

Securities Transactions. The information set forth in the Information Statement under the following captions is incorporated herein

by reference:

“The

Special Factors – Background of the Merger”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Merger Agreement”

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Annex

A: The Merger Agreement”

“Annex

E: Turing Rollover Agreement”

“Annex

F: Form of Rollover and Reinvestment Agreement”

| ITEM 12. |

THE SOLICITATION OR RECOMMENDATION

|

(d)

Intent to Tender or Vote in a Going-Private Transaction. Not applicable.

(e)

Recommendations of Others. Not applicable.

| ITEM 13. |

FINANCIAL STATEMENTS |

(a)

Financial Statements. The audited financial statements set forth in Thoughtworks’ Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, originally filed on February 27, 2024, are incorporated by reference herein (see pages 56 to 90 therein).

The unaudited financial statements set forth in Thoughtworks’ Quarterly Report on Form 10-Q for the period ended June 30, 2024,

originally filed on August 6, 2024, are incorporated by reference herein (see pages 6 to 19 therein). The information is set forth in

the Information Statement under the following caption is incorporated herein by reference:

“Summary

Financial Information”

“Market

Information, Dividends and Certain Transactions in the Common Stock”

“Where

You Can Find More Information”

(b)

Pro Forma Information. Not applicable.

| ITEM 14. |

PERSONS/ASSETS, RETAINED,

EMPLOYED, COMPENSATED OR USED |

(a)

Solicitations or Recommendations. Not applicable.

(b)

Employees and Corporate Assets. The information set forth in the Information Statement under the following captions is incorporated

herein by reference:

“Summary”

“Questions

and Answers about the Merger”

“The

Special Factors – Background of the Merger”

“The

Special Factors – Recommendation of the Special Committee; Reasons for the Merger”

“The

Special Factors – Recommendation of the Company Board; Reasons for the Merger”

“The

Special Factors – Opinion and Materials of Lazard”

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

“The

Special Factors – Fees and Expenses”

| ITEM 15. |

ADDITIONAL INFORMATION |

(b)

Golden Parachute Compensation. The information set forth in the Information Statement under the following caption is incorporated

herein by reference:

“The

Special Factors – Interests of our Directors and Executive Officers in the Merger”

(c)

Other Material Information. The information set forth in the Information Statement, including all annexes thereto, is incorporated

herein by reference.

The

following exhibits are filed herewith:

| Exhibit No. |

|

|

| (a)(i) |

|

Preliminary Information Statement of Thoughtworks Holding, Inc, incorporated herein by reference to the Information Statement. |

| (a)(ii) |

|

Notice of Written Consent and Appraisal Rights (included in the Information Statement and incorporated herein by reference). |

| (b)(i) |

|

Equity Commitment Letter, dated as of August 5, 2024 by and among Apax XI EUR L.P., Apax XI EUR 1 L.P., APAX XI EUR SCSp, Apax XI USD L.P., Apax XI USD 2 L.P., APAX XI USD SCSp and Tasmania Midco, LLC. |

| (c)(i) |

|

Opinion of Lazard Frères & Co. LLC, dated August 4, 2024 (included as Annex C to the Information Statement and incorporated herein by reference). |

| (c)(ii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 10, 2023. |

| (c)(iii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 26, 2023. |

| (c)(iv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 30, 2023. |

| (c)(v) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 15, 2023. |

| (c)(vi) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 30, 2023. |

| (c)(vii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated April 26, 2024. |

| (c)(viii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 8, 2024. |

| (c)(ix) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 13, 2024. |

| (c)(x) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 16, 2024. |

| (c)(xi) |

|

Confidential

discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of

Thoughtworks Holdings, Inc., dated May 30, 2024. |

| (c)(xii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 4, 2024. |

| (c)(xiii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 10, 2024 (regarding a discounted cash flow analysis). |

| (c)(xiv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., June 10, 2024 (regarding sensitivity analyses). |

| (c)(xv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 18, 2024. |

| (c)(xvi) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 19, 2024. |

| (c)(xvii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated July 1, 2024. |

| (c)(xviii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated August 1, 2024. |

| (c)(xix) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated August 4, 2024. |

| (d)(i) |

|

Agreement and Plan of Merger, dated August 5, 2024, by and among, Tasmania Midco, LLC, Tasmania Merger Sub, Inc. and Thoughtworks Holding, Inc. (included as Annex A to the Information Statement and incorporated herein by reference). |

| (d)(ii) |

|

Turing Rollover Agreement (included as Annex E to the Information Statement and incorporated herein by reference). |

| (d)(iii)* |

|

Form of Rollover and Reinvestment Agreement (included as Annex F to the Information Statement and incorporated herein by reference). |

| (d)(iv) |

|

Amendment to Thoughtworks Inc. Employment Agreement, dated as of July 31, 2024, by and between Thoughtworks Inc. and Michael R. Sutcliff. |

| (d)(v)* |

|

Investment Agreement, dated as of August 5, 2024, by and between Tasmania Parent, Inc. and Michael Sutcliff. |

| (d)(vi) |

|

Director Nomination Agreement, dated as of September 17, 2021, by and among the Company and the other signatories party thereto, incorporated herein by reference to Exhibit 10.10 in the quarterly report on Form 10-Q of Thoughtworks Holding, Inc. filed with the SEC on November 15, 2021. |

| (d)(vii) |

|

Thoughtworks Inc. Employment Agreement, dated as of May 2, 2024, by and between Thoughtworks Inc. and Michael R. Sutcliff, incorporated herein by reference to Exhibit 10.1 in the quarterly report on Form 10-Q of Thoughtworks Holding, Inc. filed with the SEC on August 6, 2024. |

| (f) |

|

Section 262 of the General Corporation Law of the State of Delaware (included as Annex G to the Information Statement and incorporated herein by reference). |

| (g) |

|

None. |

| 107 |

|

Filing Fee Table. |

| * | Schedule

or exhibit omitted pursuant to Item 1016 of Regulation M-A. The Company agrees to furnish supplementally a copy of any omitted schedule

or exhibit to the SEC upon request. |

SIGNATURES

After

due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information

set forth in this statement is true, complete and correct.

Dated

as of September 3, 2024

| THOUGHTWORKS

HOLDING, INC. |

|

| |

|

|

|

| By: |

/s/

Michael Sutcliff |

|

| |

Name: |

Michael

Sutcliff |

|

| |

Title: |

Chief

Executive Officer |

|

| |

|

|

|

| TURING

EQUITYCO II L.P. |

|

| |

|

|

|

| By: |

Turing

GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

| By: |

/s/

Mark Babbe |

|

| |

Name: |

Mark Babbe |

|

| |

Title: |

Director |

|

| |

|

|

|

| APAX

IX GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX

IX EUR GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

[Signature Page to SC

13E-3]

| APAX

IX EUR L.P. |

|

| |

|

|

|

| By: |

Apax

IX EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

|

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey Limited as

Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX

IX – AIV EUR L.P. |

|

| |

|

|

|

| By: |

Apax

IX EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey Limited as

Company Secretary to Apax IX GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX IX EUR CO-INVESTMENT L.P. |

|

| |

|

|

|

| By: |

Apax IX EUR GP L.P. Inc. |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

Apax IX GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX IX USD GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax IX GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX IX USD L.P. |

|

| |

|

|

|

| By: |

Apax IX USD GP L.P. Inc. |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

Apax IX GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX IX – AIV USD L.P. |

|

| |

|

|

|

| By: |

Apax IX USD GP L.P. Inc. |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

Apax IX GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX IX USD CO-INVESTMENT L.P. |

|

| |

|

|

|

| By: |

Apax IX USD GP L.P. Inc. |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

Apax IX GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax IX GP Co. Limited |

|

| |

|

|

|

| APAX XI GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/ Paul Meader |

|

| |

Name: |

Paul

Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

XI EUR GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Paul Meader |

|

| |

Name: |

Paul Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI USD GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Paul Meader |

|

| |

Name: |

Paul Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI (GUERNSEY) USD AIV L.P. |

|

| |

|

|

|

| By: |

Apax

XI USD GP L.P. Inc. |

| Its: |

General

Partner |

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Paul Meader |

|

| |

Name: |

Paul Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

XI EUR L.P. |

|

| |

|

|

|

| By: |

Apax

XI EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Paul Meader |

|

| |

Name: |

Paul Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI EUR 1 L.P. |

|

| |

|

|

|

| By: |

Apax

XI EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Paul Meader |

|

| |

Name: |

Paul

Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

| APAX XI EUR SCSP |

|

| |

|

|

|

| By: |

Apax XI GP SARL |

|

| Its: |

Managing General Partner |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey

Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pierre Weimerskirch |

|

| |

Name: |

Pierre Weimerskirch |

|

| |

Title: |

Manager |

|

[Signature

Page to SC 13E-3]

| APAX XI USD L.P. |

|

| |

|

|

|

| By: |

Apax XI USD GP L.P. Inc. |

|

| Its: |

General Partner |

|

| By: |

Apax XI GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Paul Meader |

|

| |

Name: |

Paul Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX XI USD 2 L.P. |

|

| |

|

|

|

| By: |

Apax XI USD GP L.P. Inc. |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

Apax XI GP Co. Limited |

|

| Its: |

General Partner |

|

| |

|

|

|

| By: |

/s/ Paul Meader |

|

| |

Name: |

Paul

Meader |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners Guernsey

Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX XI USD SCSP |

|

| |

|

|

|

| By: |

Apax XI GP SARL |

|

| Its: |

Managing General Partner |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pierre Weimerskirch |

|

| |

Name: |

Pierre Weimerskirch |

|

| |

Title: |

Manager |

|

| |

|

|

|

| Apax XI GP SARL |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pierre Weimerskirch |

|

| |

Name: |

Pierre Weimerskirch |

|

| |

Title: |

Manager |

|

| |

|

|

|

| TASMANIA MIDCO, LLC |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

President and Secretary |

|

| |

|

|

|

| TASMANIA MERGER SUB, INC. |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

Vice President and Secretary |

|

| |

|

|

|

| TASMANIA HOLDCO, INC. |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

President |

|

[Signature

Page to SC 13E-3]

| TASMANIA PARENT, INC. |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

Vice President and Secretary |

|

| TASMANIA

GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/ Mark Babbe |

|

| |

Name: |

Mark Babbe |

|

| |

Title: |

Director |

|

| |

|

|

|

| HOBART

EQUITY HOLDCO, LP |

|

| |

|

|

|

| By: |

Tasmania

GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Mark Babbe |

|

| |

Name: |

Mark Babbe |

|

| |

Title: |

Director |

|

| ERIN

CUMMINS |

|

| |

|

|

| /s/ Erin Cummins |

|

| Name: |

Erin Cummins |

|

| |

|

|

| RACHEL LAYCOCK |

|

| |

|

|

| /s/ Rachel Laycock |

|

| Name: |

Rachel Laycock |

|

| |

|

|

| RAMONA MATEIU |

|

| |

|

|

| /s/ Ramona Mateiu |

|

| Name: |

Ramona Mateiu |

|

| |

|

|

| CHRISTOPHER MURPHY |

|

| |

|

|

| /s/ Christopher Murphy |

|

| Name: |

Christopher Murphy |

|

| |

|

|

| MICHAEL SUTCLIFF |

|

| |

|

|

| /s/ Michael Sutcliff |

|

| Name: |

Michael Sutcliff |

|

| |

|

|

| SUDHIR TIWARI |

|

| |

|

|

| /s/ Sudhir Tiwari |

|

| Name: |

Sudhir Tiwari |

|

[Signature

Page to SC 13E-3]

Exhibit (b)(i)

EQUITY COMMITMENT LETTER

August 5, 2024

Tasmania Midco, LLC

c/o Apax Partners LLP

1 Knightsbridge

London SW1X 7LX

United Kingdom

Re: Project Tasmania

Ladies and Gentlemen:

This letter agreement sets

forth the commitment of Apax XI EUR L.P., Apax XI EUR 1 L.P., APAX XI EUR SCSp, Apax XI USD L.P., Apax XI USD 2 L.P. and APAX XI USD SCSp

(each, an “Investor” and, collectively, the “Investors”), subject to the terms and conditions contained

herein, to purchase, or cause the purchase of, directly or indirectly, certain Equity Securities of Tasmania Midco, LLC, a Delaware limited

liability company (“Parent”). It is contemplated that pursuant to the Agreement and Plan of Merger (as it may be amended,

supplemented or modified from time to time, the “Merger Agreement”), dated as of the date hereof, by and among Parent,

Tasmania Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and Thoughtworks

Holding, Inc., a Delaware corporation (the “Company”), Merger Sub will merge with and into the Company, with the Company

surviving such Merger (the “Merger”, and together with the other transactions contemplated by the Merger Agreement,

the “Transactions”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the

Merger Agreement.

1. Closing

Commitment. Upon the terms and subject to the conditions set forth herein, including in Section 2, the Investors hereby

severally (and not jointly or jointly and severally) commit to Parent to purchase, or cause the purchase of, directly or indirectly,

at the Closing, Equity Securities of Parent for an aggregate amount in immediately available cash funds of $600,000,000 (the

“Closing Commitment”), which Closing Commitment shall be used by Parent and Merger Sub to pay all Required

Amounts, and not for any other purpose. The aggregate obligation of the Investors to fund any amounts pursuant to this Section

1 shall in no event exceed the Closing Commitment in the aggregate (or, in the case of each Investor, its Pro Rata Percentage

(as such term is defined below) of such amount) (the “Closing Commitment Cap”). The Investors may effect the

purchase of Equity Securities of Parent directly or indirectly through one or more affiliated entities; provided that no such action

will relieve the Investors of their obligations and liabilities hereunder. The obligation of the Investors to fund any portion of

the Closing Commitment may be reduced by the Investors only (i) to the extent that such lesser amount of the Closing Commitment is

sufficient to (and the full amount of the Closing Commitment is not required to) fund all of the Required Amounts, or (ii) on a

dollar for dollar basis for purchases of securities of Parent by an assignee or transferee permitted by Section 6 of this

letter agreement made at or prior to the Closing.

2. Conditions to

Closing Commitment. The Investors’ obligations under this letter agreement to fund the Closing Commitment are subject only

to (a) the satisfaction, or waiver by Parent, of each of the conditions to the obligations of Parent and Merger Sub to consummate

the Merger set forth in Sections 7.1 and 7.2 of the Merger Agreement (other than those conditions that by their terms are to be

satisfied at the Closing, but subject to the satisfaction or waiver (to the extent permitted under the Merger Agreement) of such

conditions at Closing) and (b) the substantially contemporaneous consummation of the Closing in accordance with the terms of the

Merger Agreement, including Section 2.3 thereof, in each case, as contemplated by the Merger Agreement.

3. Damages

Commitment. Upon the terms and subject to the conditions set forth herein, the Investors hereby agree that if (i) the Merger

Agreement is terminated by the Company pursuant to Section 8.1(g) of the Merger Agreement under circumstances where Parent may be

liable for damages with respect to a Willful Breach by Parent or Merger Sub of the Merger Agreement or fraud by Parent or Merger

Sub, in each case, prior to or in connection with such termination and in accordance with, and subject to the conditions set forth

in, Section 8.2(b) of the Merger Agreement (“Qualifying Termination”) and (ii) damages with respect to such

Qualifying Termination (the “Parent Liability”) have been (x) finally agreed pursuant to a final written

settlement agreement between Parent and the Company or (y) awarded by a court having jurisdiction under Section 9.10 of the Merger