UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-37381

XYLO TECHNOLOGIES LTD.

(Translation of registrant’s name into English)

10 HaNechoshet Street

Tel-Aviv, 6971072, Israel

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXPLANATORY NOTE

Xylo Technologies Ltd., or

the Company, hereby furnishes the following documents:

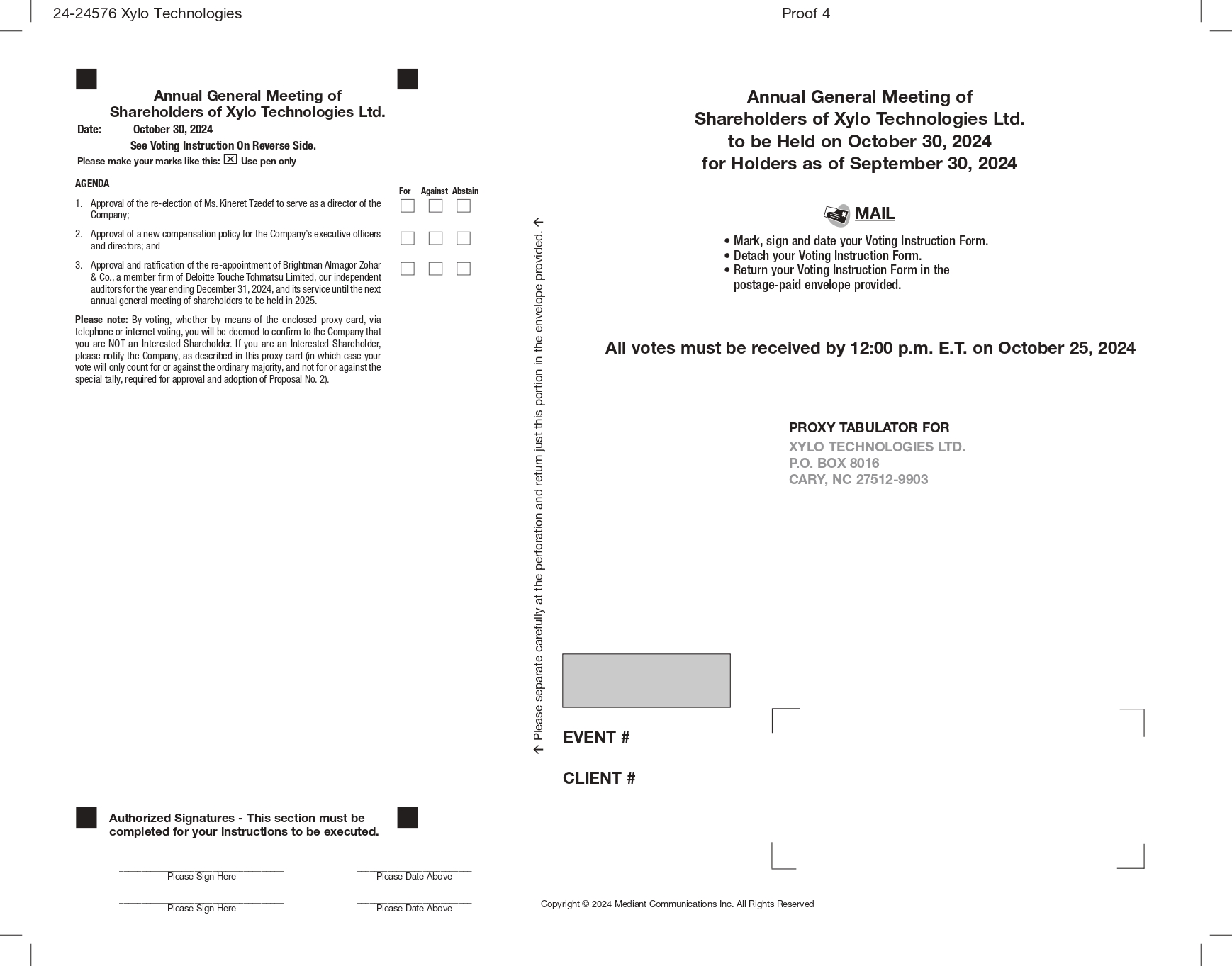

| (i) | Notice and Proxy

Statement with respect to the Company’s annual general meeting of the shareholders to be held on October 30, 2024, describing

the proposals to be voted upon at the meeting, the procedure for voting in person or by proxy at the meeting and various other details

related to the meeting. |

| (ii) | a Proxy Card whereby holders of American depository shares,

evidenced by American depositary receipts, of the Company may vote at the meeting without attending in person. |

This Form 6-K is incorporated

by reference into the Company’s Registration Statements on Form F-3 (File No. 333-271984) and Form S-8 (File No. 333-274190, File

No. 333-258624, File No. 333-206803, No. 333-221019 and No. 333-229429).

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

XYLO TECHNOLOGIES LTD. |

| |

|

|

| Date: September 25, 2024 |

By: |

/s/ Tali Dinar |

| |

|

Tali Dinar |

| |

|

Chief Financial Officer |

Exhibit 99.1

HaNechoshet 10, Tel-Aviv, 6971072

Israel

| Dear Shareholder: |

September 25, 2024 |

You are cordially invited

to attend the annual general meeting (the “Meeting”) of the shareholders of Xylo Technologies Ltd. (the “Company”),

to be held on October 30, 2024, beginning at 5:00 PM, Israel time (10:00 AM Eastern time), at the offices of at the offices of the Company,

HaNechoshet 10, Tel-Aviv, 6971072, Israel, or at any adjournments thereof.

The Company’s formal

notice of the Meeting and the proxy statement for the Meeting (the “Proxy Statement”) appearing on the following pages,

describe in detail the matters to be acted upon at the Meeting.

Only shareholders who held

shares at the close of business on September 30, 2024, are entitled to notice of, and to vote at, the Meeting and any adjournments thereof.

The Company’s board of directors recommends a vote “FOR” all of the matters set forth in the notice.

Whether or not you plan

to attend the Meeting, it is important that your shares be represented and voted at the Meeting. Accordingly, after reading the enclosed

Notice of Annual General Meeting of Shareholders and accompanying Proxy Statement, please sign, date and mail the enclosed proxy card

in the envelope provided or vote by telephone or over the Internet in accordance with the instructions on your proxy card.

We look forward to seeing

as many of you as can attend the Meeting.

|

Very truly yours, |

| |

Eliyahu Yoresh |

| |

Chairman of the Board of Directors |

XYLO TECHNOLOGIES LTD.

HaNechoset 10, Tel-Aviv, 6971072, Israel

PROXY STATEMENT

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on October 30, 2024

Notice is hereby given to

the holders of ordinary shares, of no par value (the “Ordinary Shares”), and to holders of American depository shares,

evidenced by American depositary receipts, each representing forty (40) Ordinary Shares, issued by The Bank of New York Mellon (“ADSs”

and “ADRs”, respectively), of Xylo Technologies Ltd. (the “Company”) in connection with the solicitation

by the board of directors (the “Board”) of proxies for use at the annual general meeting of shareholders (the “Meeting”),

to be held on October 30, 2024, at 5:00 PM Israel time (10:00 AM Eastern time) at the offices of at the offices of the Company, HaNechoshet

10, Tel-Aviv, 6971072, Israel, or at any adjournments thereof.

The agenda for the Meeting

is to consider the approval of the following:

| |

1. |

Approval of the re-election of Ms. Kineret Tzedef to serve as a director of the Company; |

| |

2. |

Approval of a new compensation policy for the Company’s executive officers and directors; and |

| |

3. |

Approval and ratification of the re-appointment of Brightman Almagor Zohar & Co., a member firm of Deloitte Touche Tohmatsu Limited, our independent auditors for the year ending December 31, 2024, and its service until the next annual general meeting of shareholders to be held in 2025. |

In addition, shareholders

at the Meeting will have an opportunity to review and ask questions regarding the consolidated financial statements of the Company for

the fiscal year ended December 31, 2023.

The Company is currently unaware

of any other matters that may be raised at the Meeting. Should any other matters be properly raised at the Meeting, the persons designated

as proxies shall vote according to their own judgment on those matters.

Under Israeli law, one or

more shareholders holding at least 1% of the voting rights at the general meeting of the shareholders may request that the board of directors

include a matter in the agenda of a general meeting of the shareholders to be convened in the future, provided that it is appropriate

to discuss such a matter at the general meeting. Notwithstanding the foregoing, as a company listed on an exchange outside of Israel,

a matter relating to the appointment or removal of a director may only be requested by one or more shareholders holding at least 5% of

the voting rights at the general meeting of the shareholders. Our Articles of Association contain procedural guidelines and disclosure

items with respect to the submission of shareholder proposals for general meetings.

The last date for submitting

a request to include a Proposal in accordance with Section 66(b) of the Israeli Companies Law, 5759-1999, is October 2,

2024. To the extent that there are any additional agenda items that our Board determines to add as a result of any such submission, the

Company will publish an updated agenda and proxy card with respect to the Meeting, no later than October 9, 2024, which will be furnished

to the U.S. Securities and Exchange Commission (the “Commission”), on a Report of Foreign Private Issuer on

Form 6-K, and will be made available to the public on the Commission’s website at http://www.sec.gov.

The Board recommends that

shareholders vote in favor of each of the above proposals, which will be described in the proxy statement to be made available to the

Company’s shareholders.

Only shareholders and ADR

holders of record at the close of business on September 30, 2024, shall be entitled to receive notice of and to vote at the Meeting.

Whether or not you plan to

attend the Meeting, it is important that your shares be represented. Accordingly, shareholders and ADR holders who will not attend the

Meeting in person are urged to vote with respect to proposals by means of a proxy card. Holders of Ordinary Shares must submit their proxies

to the Company’s offices no later than 5:00 PM (Israel time) on October 29, 2024) with a proof of ownership on the Record Date in

accordance with the Israel Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting), 5760-2000. ADR holders

should return their proxies by the date set forth on the form of proxy. Execution of a proxy will not in any way affect a shareholder’s

right to attend the Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised.

A proxy statement describing

the various matters to be voted upon at the Meeting along with a proxy card enabling the shareholders to indicate their vote on each matter

was furnished to the Commission under cover of Form 6-K and is available on the Commission’s website at www.sec.gov. Such proxy

statement will also be available on the Company’s website at www.medigus.com.

The wording of the resolutions

to be voted at the Meeting and relevant documents thereto may be inspected at the Company’s offices during normal business hours

and by prior coordination with Ms. Tali Dinar (Tel: +972-3-689-9124).

| |

By Order of the Board of Directors, |

| |

Eliyahu Yoresh |

| |

Chairman of the Board of Directors |

Tel-Aviv, Israel

September 25, 2024

XYLO TECHNOLOGIES LTD.

HaNechoshet 10, Tel-Aviv, 6971072, Israel

Tel: +972-3-689-9124

PROXY STATEMENT

General Information

This

proxy statement (the “Proxy Statement”) is furnished to the holders of ordinary shares, of no par value (the “Ordinary

Shares”), and to holders of American depository shares evidenced by American depositary receipts, each representing forty (40)

Ordinary Shares, issued by The Bank of New York Mellon ((“ADSs”) and “ADRs”, respectively), of Xylo

Technologies Ltd. (the “Company”) in connection with the solicitation by the board of directors (the “Board”)

of proxies for use at the annual general meeting of shareholders (the “Meeting”), to be held on October 30, 2024, at

5:00 PM Israel time (10:00 AM Eastern time) at the offices of at the offices of the Company, HaNechoshet 10, Tel-Aviv, 6971072, Israel,

or at any adjournments thereof.

Record Date; Shareholders Entitled to Vote

Only

holders of Ordinary Shares and ADR holders of record at the close of business on September 30, 2024 (the “Record Date”),

shall be entitled to receive notice of and to vote at the Meeting. At the close of business on September 23, 2024, the Company had 29,282,912

outstanding Ordinary Shares, each of which is entitled to one vote for each of the matters to be presented at the Meeting.

Proxies

Whether

or not you plan to attend the Meeting, it is important that your shares be represented. Accordingly, holders of Ordinary Shares and ADR

holders who will not attend the Meeting in person are urged to vote with respect to proposals by means of a proxy card. Holders of Ordinary

Shares must submit their proxies to the Company’s offices no later than 5:00 PM (Israel time) on October 29, 2024). ADR holders

should return their proxies by the date set forth on the form of proxy. Execution of a proxy will not in any way affect a shareholder’s

right to attend the Meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised.

The

Proxy Statement describing the various matters to be voted upon at the Meeting along with a proxy card enabling the shareholders to indicate

their vote on each matter was furnished to the Commission under cover of Form 6-K and is available on the Commission’s website at

www.sec.gov. The Proxy Statement will also be available on the Company’s website at www.medigus.com.

All

shares represented by properly executed proxies received prior to or at the Meeting and not revoked prior to, or at, the Meeting in accordance

with the procedures described in the proxy statement, will be voted as specified in the instructions indicated in such proxies. Subject

to applicable law and the rules of the Nasdaq Stock Market, in the absence of instructions, the shares represented by properly executed

and received proxies will be voted “FOR” all of the proposed resolutions to be presented at the Meeting for which the Board

recommends a “FOR”.

Holders

of Ordinary Shares and ADR holders may revoke their proxies at any time before the deadline for receipt of proxies by filing with the

Company, in the case of holders of Ordinary Shares, or with the ADR depositary, in the case of holders of ADRs, a written notice of revocation

or duly executed proxy bearing a later date.

Expenses and Solicitation

The

Board is soliciting proxies for use at the Meeting. The Company expects to mail this Proxy Statement and the accompanying proxies to ADR

holders on or about October 4, 2024. In addition to solicitation of proxies to ADR holders by mail, certain officers, directors,

employees and agents of the Company, none of whom shall receive additional compensation therefor, may solicit proxies by telephone or

other personal contact. The Company shall bear the cost of the solicitation of the proxies, including postage, printing and handling and

shall reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Ordinary Shares

or ADRs.

Quorum

Discussion

at the Meeting will be commenced if a quorum is present. A quorum is constituted by two or more shareholders who are present in person

or by proxy, and who hold or represent shares holding in the aggregate at least ten percent (10%) of the voting rights in the Company.

If a quorum is not present within half an hour of the time designated for the Meeting, the Meeting will be adjourned October 31, 2024,

at the same time and place. At the adjourned Meeting, if a quorum is not present within half an hour, any number of shareholders who are

present in person or proxy, or who have delivered a proxy card, will constitute a quorum.

Required Vote and Voting Procedures

The

approval of each of the Proposals requires the affirmative vote of the Company’s shareholders holding at least a majority of the

Company’s Ordinary Shares present, in person or by proxy, and voting on the matter.

Proposal No. 2 is subject

to the fulfillment of one of the following additional voting requirements:

| |

(i) |

the majority of the shares that are voted at the Meeting in favor of the Proposal, excluding abstentions, includes a majority of the votes of shareholders who are not controlling shareholders and do not have a personal interest in the Proposal (each, an “Interested Shareholder”); or |

| |

(ii) |

the total number of shares of the shareholders mentioned in clause (i) above that are voted against the Proposal does not exceed two percent (2%) of the total voting rights in the Company. |

For this purpose, a “controlling

shareholder” is any shareholder that has the ability to direct the Company’s activities (other than by means of being

a director or office holder of the Company). A person is presumed to be a controlling shareholder if he or she holds or controls, by himself

or together with others, one half or more of any one of the “means of control” of a company. “Means of control”

is defined as any one of the following: (i) the right to vote at a general meeting of a company, or (ii) the right to appoint directors

of a company or its chief executive officer. A “personal interest” of a shareholder in an action or transaction of

a company includes a personal interest of any of the shareholder’s relatives (i.e. spouse, brother or sister, parent, grandparent,

child as well as child, brother, sister or parent of such shareholder’s spouse or the spouse of any of the above) or an interest

of a company with respect to which the shareholder or the shareholder’s relative (as defined above) holds 5% or more of such company’s

issued shares or voting rights, in which any such person has the right to appoint a director or the chief executive officer or in which

any such person serves as director or the chief executive officer, including the personal interest of a person voting pursuant to a proxy

which the proxy grantor has a personal interest, whether or not the person voting pursuant to such proxy has discretion with regards to

the vote; and excludes an interest arising solely from the ownership of shares of a company.

Under Israeli law, every

voting shareholder is required to notify the Company whether such shareholder is an Interested Shareholder. To avoid confusion, every

shareholder voting by means of the enclosed proxy card or voting instruction form, or via telephone or internet voting, will be deemed

to confirm that such shareholder is NOT an Interested Shareholder. If you are an Interested Shareholder (in which case your vote will

only count for or against the ordinary majority, and not for or against the special tally under Proposal No. 2), please notify Ms. Tali

Dinar, Chief Financial Officer, at c/o Xylo Technologies Ltd, 10 HaNechoshet Street, Tel – Aviv, Israel, telephone: +972-3-689-9124

, or by email talid@xylotech.ai. If your ordinary shares are held in “street name” by your broker, bank or other nominee and

you are an Interested Shareholder, you should notify your broker, bank or other nominee of that status, and they in turn should notify

the Company as described in the preceding sentence.

In connection with Proposal

No. 2, the Companies Law allows our Board to approve such proposal even if the general meeting of shareholders has voted against its approval,

provided that the Company’s compensation committee, and thereafter its Board, each determines to approve it, based on detailed arguments

that the proposed resolutions are in the best interests of the Company despite the opposition of the shareholders, and after having reconsidered

the matters.

The lack of a required majority

for the adoption of any resolution presented shall not affect the adoption of any other resolutions for which the required majority was

obtained.

THE BOARD RECOMMENDS THAT

YOU VOTE “FOR” EACH OF THE PROPOSALS.

Reporting Requirements

The

Company is subject to the information reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), applicable to foreign private issuers. The Company fulfills these requirements by filing reports with the Commission.

Our filings with the Commission may be inspected without charge at the Commission’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the Commission at 1-800-SEC-0330.

Our filings are also available to the public on the Commission’s website at www.sec.gov.

As

a foreign private issuer, the Company is exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements.

The circulation of this notice and proxy statement should not be taken as an admission that the Company is subject to the proxy rules

under the Exchange Act.

Meeting Agenda

In

accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company holding at least one percent

of the outstanding voting rights of the Company for the meeting may submit to the Company a proposed additional agenda item for the meeting,

to the Company’s offices at 10 HaNechoshet, Tel-Aviv 6971072, Israel, Attention: Ms. Tali Dinar, Chief Financial Officer, facsimile

number 972-3-689-9124, e-mail address: talid@xylotech.ai no later than October 2, 2024.

Notwithstanding

the foregoing, as a company listed on an exchange outside of Israel, a matter relating to the appointment or removal of a director may

only be requested by one or more shareholders holding at least 5% of the voting rights at the general meeting of the shareholders. Our

Articles of Association contain procedural guidelines and disclosure items with respect to the submission of shareholder proposals for

general meetings.

To

the extent that there are any additional agenda items that the Board determines to add as a result of any such submission, the Company

will publish an updated agenda and proxy card with respect to the Meeting, no later than October 9, 2024, which will be furnished to the

Commission on Form 6-K, and will be made available to the public on the Commission’s website at www.sec.gov.

The

wording of the resolutions to be voted at the Meeting and relevant documents thereto may be inspected at the Company’s offices during

normal business hours and by prior coordination with Ms. Tali Dinar (Tel: +972-3-689-9124).

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

For

information regarding compensation granted to our five most highly compensated office holders (as defined in the Companies Law) during

or with respect to the year ended December 31, 2023, please see Item 6 B. of our Annual Report for the year ended December 31, 2023, filed

on Form 20-F with the Commission on April 22, 2024, and accessible through the Commission’s website at www.sec.gov.

DIRECTOR INDEPENDENCE

Our

Board has determined that each of our directors satisfies the independent director requirements under the Nasdaq corporate governance

requirements. As such, the Board is solely comprised of independent directors as such term is defined in the Nasdaq Rules.

Our

Board has further determined that each member of our audit committee is independent as such term is defined in Rule 10A-3 under the Securities

Exchange Act of 1934, as amended, and that each member of our audit committee and compensation committee satisfies the additional requirements

applicable under the Nasdaq Rules to members of audit committees and compensation committees, respectively.

BOARD DIVERSITY (as of September 1,

2024)

| Country of Principal Executive Offices |

Israel |

| Foreign Private Issuer |

Yes |

| Disclosure Prohibited Under Home Country Law |

No |

| Total Number of Directors |

4 |

| Part I: Gender Identity |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

| Directors |

1 |

3 |

0 |

0 |

| Part II: Demographic Background |

|

| Underrepresented Individual in Home Country Jurisdiction |

0 |

| LGBTQ+ |

0 |

| Did Not Disclose Demographic Background |

2 |

PROPOSAL NO. 1

APPROVAL OF THE RE-ELECTION OF MS. KINERET TZEDEF

AS A DIRECTOR OF THE COMPANY

Background

The Board currently has four

directors, who are divided into three classes with staggered three-year terms as follows:

| |

● |

the Class I directors consist of Mr. Eli Cohen and his term will expire at our annual general meeting of shareholders to be held in 2026; |

| |

● |

the Class II directors consist of Ms. Kineret Tzedef and her term expires at the Meeting; and |

| |

● |

the Class III directors consist of Mr. Eliyahu Yoresh and Mr. Ronen Rosenbloom and their terms will expire at our annual general meeting of shareholders to be held in 2025. |

At each annual general meeting

of our shareholders, the election or re-election of directors following the expiration of the term of office of the directors of that

class, will be for a term of office that expires on the date of the third annual general meeting following such election or re-election.

At the Meeting, shareholders

will be asked to approve the re-election of Ms. Kineret Tzedef as a director of the Company to hold office until the close of the annual

general meeting to be held in 2027.

Herein below are details on

Ms. Kineret Tzedef, standing for re-election:

Kineret Tzedef has

served as member of our Board since June 2019. Ms. Tzedef also serves as a director of sports division and served in other positions at

Hapoel Organization (Israeli Sport Federation) since 2007. Ms. Tzedef serves as an external director at Upsellon Brands Holdings Ltd.

(TASE: UPSL), and as an external director of Augwind Energy Tech Storage Ltd. (TASE: AUGN). Ms. Tzedef was admitted to the Israel Bar

Association in 2014. Ms. Tzedef holds a LL.B. from the Academic Center for Law and Science, Israel and a B.Ed. in Law Study from the Academic

College at Wingate, Israel.

Proposal

At the Meeting, it is proposed

that the following resolution be adopted:

“RESOLVED, to

approve the re-election of Ms. Kineret Tzedef as a director of the Company to hold office until the close of the annual general meeting

to be held in 2027, or her earlier resignation or removal, as applicable.”

The Board recommends shareholders vote

“FOR” Proposal No. 1

|

PROPOSAL NO. 2

APPROVAL OF A NEW COMPENSATION POLICY FOR THE

COMPANY’S EXECUTIVE

OFFICERS AND DIRECTORS

Background

At the Meeting, shareholders

will be asked to approve a new compensation policy regarding the terms of office and employment of our executive officers and directors.

As required by the Companies Law, we have adopted a compensation policy regarding the terms of office and employment of our executive

officers and directors. Our current compensation policy (the “Compensation Policy”) became effective on July 26, 2021,

following its approval by our shareholders.

Pursuant to the Companies

Law, our Compensation Policy must be reviewed from time to time by our compensation committee of the Board (the “Compensation

Committee”) and the Board, to ensure its alignment with the Company’s compensation philosophy and to consider its appropriateness

for the Company. The Compensation Policy must generally be re-approved once every three years by the Board, after considering the recommendations

of the Compensation Committee, and by the Company’s shareholders.

Following a review of the

Current Compensation Policy by our Compensation Committee and Board, our Compensation Committee and the Board propose adopting a new compensation

policy (the “Proposed Compensation Policy”), in the form attached to this Proxy Statement as Annex A.

The Proposed Compensation

Policy, if approved by our shareholders, will become effective immediately following the Meeting, for a period of three years. If the

Proposed Compensation Policy is not approved by our shareholders, our Compensation Committee and Board may nonetheless approve the Proposed

Compensation Policy, following re-discussion of the matter and for specified reasons, provided such approval is in the best interests

of the Company.

The Proposed Compensation

Policy is intended to incentivize individual excellence to align the interests of our office holders with the Company’s short and

long-term goals and performance, and as a result, with those of our shareholders and is substantially identical to the Compensation Policy

currently in effect.

The following overview is

qualified in its entirety by reference to the full text of the Proposed Compensation Policy, which is attached as Annex A hereto.

Variable vs. Fixed Compensation of Executive

Officers:

The total annual variable

compensation — consisting of target bonus and target equity-based compensation (based on the fair market value, in accordance with

the methodology to be set by our Company, at the time of grant) — of each executive officer will not exceed 95% of the total

compensation package of that executive officer for a given year.

Annual Cash Bonus:

Executive Officers (other than the CEO):

The target annual cash bonus

for an executive officer, other than our chief executive officer (the “CEO”), for any given calendar year, will not

exceed 100% of such executive officer’s annual base salary.

The maximum annual cash bonus

— including for overachievement performance — that an executive officer, other than the CEO, will be entitled to actually

receive for any given fiscal year, will not exceed 200% of such executive officer’s annual base salary.

In accordance with the First

Appendix to the Companies Law, the Compensation Policy provides that our Company may determine that whether a cash bonus

will be paid or not to an executive officer who is subordinate to the CEO may be based in whole or in part on a discretionary evaluation

of his or her performance.

CEO:

The target annual cash bonus

for the CEO for any given calendar year will not exceed 100% of his or her annual base salary.

The maximum annual cash bonus—

including for overachievement performance — that the CEO will be entitled to actually receive for any given calendar year, will

not exceed 200% of his or her annual base salary.

A portion of the annual cash

bonus granted to our CEO — not exceeding 30% of the annual cash bonus of the CEO’s monthly base salary payments — may

be based on a discretionary evaluation of the CEO’s overall performance by the Compensation Committee and the Board based on quantitative

and qualitative criteria.

Non-Material Changes to Compensation:

The Companies Law regulations

allow for a non-material change in the terms of compensation of an executive officer other than the CEO to be approved by the CEO alone.

According to the Compensation Policy non-material change in the terms of compensation of an executive officer other than the CEO to be

approved by the CEO alone so long as the annual total cost to our Company from that change does not exceed an amount equal to

two (2) monthly base salary payments of the relevant employee.

Automatic Update

Based on Updates to Companies Law:

The

Compensation Policy includes a general provision allowing the Company to rely on any amendment to provisions of the Companies

Law and any other applicable rules and regulations that facilitates our ability to more readily approve or pay executive officer

or director compensation, even if that amendment contradicts the principles of the Compensation Policy.

We

believe that the proposed executive compensation framework under the Compensation Policy will be effective in achieving our objectives

of:

| |

● |

To closely align the interests of the executive officers with those of the Company’s shareholders in order to enhance shareholder value; |

| |

● |

To align a significant portion of the executive officers’ compensation with the Company’s short and long-term goals and performance; |

| |

● |

To provide the executive officers with a structured compensation package, including competitive salaries, performance-motivating cash and equity incentive programs and benefits, and to be able to present to each executive officer an opportunity to advance in a growing organization; |

| |

● |

To strengthen the retention and the motivation of executive officers in the long-term; |

| |

● |

To provide appropriate awards in order to incentivize superior individual excellence and corporate performance; and |

| |

● |

To maintain consistency in the way executive officers are compensated. |

Annual Equity Awards:

The

total fair market value of an annual equity-based compensation award at the time of grant (not including bonuses paid in equity in lieu

of cash) shall not exceed: (i) with respect to the CEO - the higher of (w) 300% of his or her annual base salary or (x) 2% of the Company’s

fair market value at the time of approval of the grant by the Board; and (ii) with respect to each of the other Executive Officers - the

higher of (y) 100% of his or her annual base salary or (z) 0.5% of the Company’s fair market value at the time of approval

of the grant by the Board.

The

fair market value of the equity-based compensation for the Executive Officers will be determined by using by multiplying the number of

shares underlying the grant by the market price of Xylo’s ordinary shares on or around the time of the grant or according to other

acceptable valuation practices at the time of grant, in each case, as determined by the Compensation Committee and the Board.

The

equity-based compensation shall be granted from time to time and be individually determined and awarded according to the performance,

educational background, prior business experience, qualifications, corporate role and the personal responsibilities of the Executive Officer.

Compensation for Directors:

The

Compensation Policy also governs the compensation of our Board members and provides that our chairperson and non-employee directors will

be entitled to an annual cash fee retainer, up to the limits set forth in the Compensation Policy.

Under

the Compensation Policy, our Board members may also be awarded annual equity-based compensation up to the limits set forth in the Compensation

Policy, as shall be determined from time to time and approved by the Compensation Committee, the Board and the Company’s shareholders,

which will be subject to a vesting schedule over several years. In addition, our directors will be entitled to reimbursement of expenses

incurred in the performance of their duties to the Company.

Clawback:

In

accordance with the amendment to Rule 10D-1 under the Securities Exchange Act of 1934, as amended, in the event of an accounting restatement,

we will be entitled to recover from our executive officers the bonus compensation or performance-based equity compensation in the amount

by which that compensation exceeded what would have been paid under our financial statements, as restated.

Proposal

At the Meeting, it is proposed

that the following resolution be adopted:

“RESOLVED, to

approve the compensation policy for the Company’s officers and directors, as detailed in the Proxy Statement, dated September 25,

2024.”

|

The Board recommends shareholders vote

“FOR” Proposal No. 2

|

PROPOSAL NO. 3

APPROVAL OF THE REAPPOINTMENT OF AUDITORS

Background

At the Meeting, following

the approval of our audit committee and Board, shareholders will be asked to approve the re-appointment of Brightman Almagor Zohar &

Co., a member firm of Deloitte Touche Tohmatsu Limited, as the Company’s independent auditors for the year ending December 31, 2024,

and to serve until the annual general meeting of shareholders to be held in 2025. Brightman Almagor Zohar & Co. has no relationship

with the Company or with any affiliate of the Company except as auditors.

Under the Companies Law and

our Articles of Association, the shareholders of the Company are authorized to appoint the Company’s independent auditors. In addition,

under our Articles of Association, the Board is authorized to determine the independent auditor’s remuneration. The Listing Rules

of the Nasdaq Stock Market require that the Company’s audit committee approve the reappointment and remuneration of the independent

auditor.

For

information regarding the total compensation that was paid by the Company and its subsidiaries to its independent auditors, please see

Item 16C of our Annual Report for the year ended December 31, 2023, filed on Form 20-F with the Commission on April 22, 2024, and accessible

through the Commission’s website at www.sec.gov.

Proposal

At the Meeting, it is proposed

that the following resolution be adopted:

“RESOLVED, to

approve and ratify the appointment of Brightman Almagor Zohar & Co., a member firm of Deloitte Touche Tohmatsu Limited, as the Company’s

independent auditors for the year ending December 31, 2024, and its service until the next annual general meeting of shareholders to be

held in 2025.”

The Board recommends shareholders vote

“FOR” Proposal No. 3

|

OTHER BUSINESS

Management knows of no other

business to be acted upon at the Meeting. However, if any other business properly comes before the Meeting, the persons named in the enclosed

proxy will vote upon such matters in accordance with their best judgment.

| |

By the Order of the Board of Directors, |

| |

Eliyahu Yoresh |

| |

Chairman of the Board of Directors of the Company |

| |

Dated: September 25, 2024 |

Annex A

August 2024

COMPENSATION POLICY

XYLO TECHNOLOGEIS LTD.

Compensation Policy for Executive Officers and

Directors

(As Adopted on [_____], 2024)

A. Overview and Objectives

This

document sets forth the Compensation Policy for Executive Officers and Directors (this “Compensation

Policy” or “Policy”)

of Xylo Technologies Ltd. (“Xylo”

or the “Company”), in accordance

with the requirements of the Companies Law, 5759-1999 and the regulations promulgated thereunder (the

“Companies Law”).

Compensation is a key component of

Xylo’s overall human capital strategy to attract, retain, reward, and motivate highly skilled

individuals that will enhance Xylo’s value and otherwise assist Xylo

to reach its business and financial long-term goals. Accordingly, the structure of this Policy is established to tie the compensation

of each officer to Xylo’s goals and performance.

For purposes of this Policy, “Executive

Officers” shall mean “Office Holders” as such term is defined in Section 1 of the Companies Law, excluding, unless otherwise

expressly indicated herein, Xylo’s directors.

This policy is subject to applicable

law and is not intended, and should not be interpreted as limiting or derogating from, provisions of applicable law to the extent not

permitted.

This Policy shall apply to compensation

agreements and arrangements which will be approved after the date on which this Policy is adopted and shall serve as Xylo’s

Compensation Policy for three (3) years, commencing as of its adoption, unless amended earlier.

The Compensation Committee and the

Board of Directors of Xylo (the “Compensation Committee” and the “Board”,

respectively) shall review and reassess the adequacy of this Policy from time to time, as required by the Companies Law.

Xylo’s

objectives and goals in setting this Policy are to attract, motivate and retain experienced and talented leaders who will contribute to

Xylo’s success and enhance shareholder value, while demonstrating professionalism in an

achievement-oriented and merit-based culture that rewards long-term excellence, and embedding and modeling Xylo’s

core values as part of a motivated behavior. To that end, this Policy is designed, among other things:

| 2.1. | to closely align the interests of the Executive Officers

with those of Xylo’s shareholders in order to enhance shareholder value; |

| 2.2. | to align a significant portion of the Executive

Officers’ compensation with Xylo’s

short and long-term goals and performance; |

| 2.3. | to provide the Executive Officers with a structured compensation package, including competitive salaries,

performance-motivating cash and equity incentive programs and benefits, and to be able to present to each Executive Officer an opportunity

to advance in a growing organization; |

| 2.4. | to strengthen the retention and the motivation of Executive Officers in the long-term; |

| 2.5. | to provide appropriate awards in order

to incentivize superior individual excellence and

corporate performance; and |

| 2.6. | to maintain consistency in the way Executive Officers are compensated. |

| 3. | Compensation Instruments |

Compensation instruments

under this Policy may include the following:

| 3.4. | equity based compensation; |

| 3.5. | change of control provisions; and |

| 3.6. | retirement and termination terms. |

| 4. | Overall Compensation - Ratio Between Fixed and Variable Compensation |

| 4.1. | This Policy aims to balance the mix of “Fixed

Compensation” (comprised of base salary and benefits) and “Variable

Compensation” (comprised of cash bonuses and equity-based compensation) in order to, among other things, appropriately incentivize

Executive Officers to meet Xylo’s short and long-term goals while taking into consideration

the Company’s need to manage a variety of business risks. |

| 4.2. | The total annual target bonus and equity-based compensation per vesting annum (based on the fair market

value at the time of grant calculated on a linear basis) of each Executive Officer shall not exceed 95% of such Executive Officer’s

total compensation package for such year. |

| 5. | Inter-Company Compensation Ratio |

| 5.1. | In the process of drafting this Policy, Xylo’s Board and

Compensation Committee have examined the ratio between employer cost associated with the engagement of the Executive Officers, including

directors, and the average and median employer cost associated with the engagement of Xylo’s

other employees (including contractor employees as defined in the Companies Law) (the “Ratio”). |

| 5.2. | The possible ramifications of the Ratio on the daily working environment in Xylo

were examined and will continue to be examined by Xylo from time to time in order to ensure

that levels of executive compensation, as compared to the overall workforce will not have a negative impact on work relations in Xylo. |

B.

Base Salary and Benefits

| 6.1. | A base salary provides stable compensation to Executive Officers and allows Xylo

to attract and retain competent executive talent and maintain a stable management team. The base salary varies among Executive

Officers, and is individually determined according to the educational background, prior vocational

experience, qualifications, corporate role, business responsibilities and past performance of each Executive Officer. |

| 6.2. | Since a competitive base salary is essential to Xylo’s

ability to attract and retain highly skilled professionals, Xylo will seek to establish a base

salary that is competitive with base salaries paid to Executive Officers in a peer group of other companies operating in sectors that

are as much as possible similar in their characteristics to Xylo, the list of which shall be

reviewed and approved by the Compensation Committee. To that end, Xylo shall utilize comparative

market data and practices as a reference, including a survey comparing and analyzing the level of the overall compensation package offered

to an Executive Officer of the Company with compensation packages for persons serving in similar positions (to that of the relevant officer)

in the peer group. Such compensation survey may be conducted internally or through an external independent consultant. |

| 6.3. | The Compensation Committee and the Board may periodically consider and approve base salary adjustments

for Executive Officers. The main considerations for salary adjustment will be similar to those used in initially determining the base

salary, but may also include change of role or responsibilities, recognition for professional achievements, regulatory or contractual

requirements, budgetary constraints or market trends. The Compensation Committee and the Board will also consider the previous and existing

compensation arrangements of the Executive Officer whose base salary is being considered for adjustment. Any limitation herein based on

the annual base salary shall be calculated based on the monthly base salary applicable at the time of consideration of the respective

grant or benefit. |

| 7.1. | The following benefits may be granted to the Executive Officers in order, among other things, to comply

with legal requirements: |

| 7.1.1. | vacation days in accordance with market practice; |

| 7.1.2. | sick days in accordance with market practice; |

| 7.1.3. | convalescence pay according to applicable law; |

| 7.1.4. | monthly remuneration for a study fund, as allowed by applicable law and with reference to Xylo’s

practice and the practice in peer group companies (including contributions on bonus payments); |

| 7.1.5. | Xylo shall contribute on behalf of the Executive Officer to an

insurance policy or a pension fund, as allowed by applicable law and with reference to Xylo’s

policies and procedures and the practice in peer group companies (including contributions on bonus payments); and |

| 7.1.6. | Xylo shall contribute on behalf of the Executive Officer towards

work disability insurance, as allowed by applicable law and with reference to Xylo’s policies

and procedures and to the practice in peer group companies. |

| 7.2. | Non-Israeli Executive Officers may receive other similar, comparable or customary benefits as applicable

in the relevant jurisdiction in which they are employed. Such customary benefits shall be determined based on the methods described in

Section 6.2 of this Policy (with the necessary changes and adjustments). |

| 7.3. | In the events of relocation and/or repatriation of an Executive Officer to another geography, such Executive

Officer may receive other similar, comparable or customary benefits as applicable in the relevant jurisdiction in which he or she is employed

or additional payments to reflect adjustments in the cost of living. Such benefits may include reimbursement for out-of-pocket one-time

payments and other ongoing expenses, such as a housing allowance, a car allowance, home leave visit, etc. |

| 7.4. | Xylo may

offer additional benefits to its Executive Officers, which will be comparable to customary market practices, such as, but not limited

to: cellular and land line phone benefits, company car and travel benefits, reimbursement of business travel including a daily stipend

when traveling and other business related expenses, insurances, other benefits (such

as newspaper subscriptions, academic and professional studies), etc.,

provided, however, that such additional benefits shall be determined in accordance with Xylo’s

policies and procedures. |

C. Cash Bonuses

| 8. | Annual Cash Bonuses - The Objective |

| 8.1. | Compensation in the form of an annual cash bonus is an important element in aligning the Executive Officers’

compensation with Xylo’s objectives and business goals. Therefore, annual cash bonuses

will reflect a pay-for-performance element, with payout eligibility and levels determined based on actual financial and operational results,

in addition to other factors the Compensation Committee may determine, including individual performance. |

| 8.2. | An annual cash bonus may be awarded to Executive Officers upon the attainment of pre-set periodical objectives

and individual targets determined by the Compensation Committee (and, if required by law, by the Board) for each fiscal year, or in connection

with such officer’s engagement, in case of newly hired Executive Officers, taking into account Xylo’s

short and long-term goals, as well as its compliance and risk management policies. The Compensation Committee and the Board shall also

determine applicable minimum thresholds that must be met for entitlement to the annual cash bonus (all or any portion thereof) and the

formula for calculating any annual cash bonus payout, with respect to each fiscal year, for each Executive Officer. In special circumstances,

as determined by the Compensation Committee and the Board (e.g., regulatory changes, significant changes in Xylo’s

business environment, a significant organizational change, significant merger and acquisition events, etc.), the Compensation Committee

and the Board may modify the objectives and/or their relative weight during the fiscal year, or may modify payouts following the conclusion

of the year. |

| 8.3. | In the event that the employment of an Executive Officer is terminated prior to the end of a fiscal year,

the Company may (but shall not be obligated to) pay such Executive Officer an annual cash bonus (which may or may not be pro-rated) assuming

the Executive Officer is otherwise entitled to an annual cash bonus. |

| 8.4. | The actual annual cash bonus to be paid to Executive Officers shall be approved by the Compensation Committee

and the Board. |

| 9. | Annual Cash Bonuses - The Formula |

Executive Officers other

than the CEO

| 9.1. | The performance objectives for the annual cash bonus of Xylo’s

Executive Officers, other than the chief executive officer (the “CEO”), may be approved by Xylo’s

CEO (in lieu of the Compensation Committee) and may be based on company, division/ departmental/business unit and individual objectives.

Measurable performance objectives, which include the objectives and the weight to be assigned to each achievement in the overall evaluation,

which will be based on actual financial and operational results, such as (by way of example and not by way of limitation) revenues, operating

income and cash flows and may further include, divisional or personal objectives which may include operational objectives, such as (by

way of example and not by way of limitation) market share, initiation of new markets and operational efficiency, customer focused objectives,

project milestones objectives and investment in human capital objectives, such as (by way of example and not by way of limitation) employee

satisfaction, employee retention and employee training and leadership programs. The Company may also grant annual cash bonuses to Xylo’s

Executive Officers, other than the CEO, on a discretionary basis. |

| 9.2. | The target annual cash bonus that an Executive Officer, other than the CEO, will be entitled to receive

for any given fiscal year, will not exceed 100 % of such Executive Officer’s annual base salary. |

| 9.3. | The maximum annual cash bonus, including for overachievement performance, that an Executive Officer, other

than the CEO, will be entitled to receive for any given fiscal year, will not exceed 200% of such Executive Officer’s annual base

salary. |

CEO

| 9.4. | The annual cash bonus of Xylo’s CEO will be mainly based

on measurable performance objectives and subject to minimum thresholds as provided in Section 8.2 above. Such measurable performance objectives

will be determined annually by Xylo’s Compensation Committee (and, if required by law,

by Xylo’s Board) and will be based on company and personal objectives. These measurable

performance objectives, which include the objectives and the weight to be assigned to each achievement in the overall evaluation, will

be based on overall company performance measures, which are based on actual financial and operational results, such as (by way of example

and not by way of limitation) revenues, sales, operating income, cash flow or the Company’s annual operating plan and long-term

plan. |

| 9.5. | The less significant part of the annual cash bonus granted to Xylo’s

CEO, and in any event not more than 30% of the annual cash bonus, may be based on a discretionary evaluation of the CEO’s overall

performance by the Compensation Committee and the Board based on quantitative and qualitative criteria. |

| 9.6. | The target annual cash bonus that the CEO will be entitled to receive for any given fiscal year, will

not exceed 100% of his or her annual base salary. |

| 9.7. | The maximum annual cash bonus including for overachievement performance that the CEO will be entitled

to receive for any given fiscal year, will not exceed 200% of his or her annual base salary. |

| 10.1. | Special Bonus. Xylo

may grant its Executive Officers a special bonus as an award for special achievements (such as in connection with mergers and acquisitions,

offerings, achieving target budget or business plan objectives under exceptional circumstances, or

special recognition in case of retirement) or as a retention award at the CEO’s discretion for Executive Officers other than the

CEO (and in the CEO’s case, at the Compensation Committee’s and the Board’s discretion), subject to any additional approval

as may be required by the Companies Law (the “Special Bonus”).

Any such Special Bonus will not exceed 200% of the Executive Officer’s annual base salary. A Special Bonus can be paid, in whole

or in part, in equity in lieu of cash and the value of any such equity component of a Special Bonus shall be determined in accordance

with Section 13.3 below. |

| 10.2. | Signing Bonus. Xylo

may grant a newly recruited Executive Officer a signing bonus. Any such signing bonus shall be granted and determined at the CEO’s

discretion for Executive Officers other than the CEO (and in the CEO’s case, at the Compensation Committee’s and the Board’s

discretion), subject to any additional approval as may be required by the Companies Law (the “Signing

Bonus”). Any such Signing Bonus will not exceed 100% of the

Executive Officer’s annual base salary. |

| 10.3. | Relocation/ Repatriation Bonus. Xylo may grant its Executive

Officers a special bonus in the event of relocation or repatriation of an Executive Officer to another geography (the “Relocation

Bonus”). Any such Relocation bonus will include customary benefits associated with such relocation and its monetary value will

not exceed 100% of the Executive Officer’s annual base salary. |

| 11. | Compensation Recovery (“Clawback”) |

| 11.1. | In the event of an accounting restatement, Xylo shall be entitled

to recover from its Executive Officers the bonus compensation or performance-based equity compensation in accordance with the clawback

policy adopted by the Company from time to time under the applicable stock exchange rules. |

| 11.2. | Nothing in this Section 11 derogates from any other “Clawback” or similar provisions

regarding disgorging of profits imposed on Executive Officers by virtue of applicable securities laws or a separate contractual obligation. |

D. Equity

Based Compensation

| 12.1. | The equity-based compensation for Xylo’s Executive Officers

will be designed in a manner consistent with the underlying objectives of the Company in determining the base salary and the annual cash

bonus, with its main objectives being to enhance the alignment between the Executive Officers’ interests with the long-term interests

of Xylo and its shareholders, and to strengthen the retention and the motivation of Executive

Officers in the long term. In addition, since equity-based awards are structured to vest over several years, their incentive value to

recipients is aligned with longer-term strategic plans. |

| 12.2. | The equity-based compensation offered by Xylo is intended to

be in the form of share options and/or other equity-based awards, such as restricted shares, RSUs or performance stock units, in accordance

with the Company’s equity incentive plan in place as may be updated from time to time. |

| 12.3. | All equity-based incentives granted to Executive Officers (other than bonuses paid in equity in lieu of

cash) shall normally be subject to vesting periods in order to promote long-term retention of the awarded Executive Officers. Unless determined

otherwise in a specific award agreement or in a specific compensation plan approved by the Compensation Committee and the Board, grants

to Executive Officers other than non-employee directors shall vest based on time, gradually over a period of at least 2-4 years, or based

on performance. The exercise price of options shall be determined in accordance with Xylo’s

policies, the main terms of which shall be disclosed in the annual report of Xylo. |

| 12.4. | All other terms of the equity awards shall be in accordance with Xylo’s

incentive plans and other related practices and policies. Accordingly, the Board may, following approval by the Compensation Committee,

make modifications to such awards consistent with the terms of such incentive plans, subject to any additional approval as may be required

by the Companies Law. |

| 13. | General Guidelines for the Grant of Awards |

| 13.1. | The equity-based compensation shall be granted from time to time and be individually determined and awarded

according to the performance, educational background, prior business experience, qualifications, corporate role and the personal responsibilities

of the Executive Officer. |

| 13.2. | In determining the equity-based compensation

granted to each Executive Officer, the Compensation Committee and the Board shall consider the factors specified in Section 13.1 above,

and in any event, the total fair

market value of an annual equity-based compensation award

at the time of grant (not including bonuses paid in equity in lieu of cash) shall not exceed: (i) with respect to the CEO - the higher

of (w) 300% of his or her annual base salary or (x) 2% of the Company’s fair market value at the time of approval of the grant by

the Board; and (ii) with respect to each of the other Executive Officers - the higher of (y) 100% of his or her annual base salary

or (z) 0.5% of the Company’s fair market value at the time of approval of the grant by the Board. |

| 13.3. | The fair market value of the equity-based compensation for the Executive Officers will be determined by

multiplying the number of shares underlying the grant by the market price of Xylo’s ordinary shares on or around the time of the

grant or according to other acceptable valuation practices at the time of grant, in each case, as determined by the Compensation Committee

and the Board. |

| 13.4. | The Company may satisfy tax withholding obligations related to equity-based compensation by net issuance,

sale to cover or any other mechanism as determined by the Board from time to time. |

E. Retirement and Termination of Service

Arrangements

| 14. | Advanced Notice Period |

Xylo

may provide an Executive Officer, on the basis of his/her seniority

in the Company, his/her contribution to the Company’s goals and achievements and the circumstances of his/her retirement prior

notice of termination of up to twelve (12) months in the case of the CEO and six (6) months in the case of other Executive Officers, during

which the Executive Officer may be entitled to all of the compensation

elements, and to the continuation of vesting of his/her equity-based compensation.

Such advance notice may or may not be provided in addition to severance, provided, however, that the Compensation Committee shall take

into consideration the Executive Officer’s entitlement to advance notice in establishing any entitlement to severance and vice versa.

Xylo

may provide an additional adjustment period of up

to six (6) months to the CEO or to any other Executive

Officer according to his/her seniority in the Company, his/her contribution to the Company’s goals and achievements and the

circumstances of retirement, during which the Executive Officer may be entitled to all of the compensation elements, and to the continuation

of vesting of his/her equity-based compensation.

| 16. | Additional Retirement and Termination Benefits |

Xylo

may provide additional retirement and terminations benefits and payments as may be required by applicable law (e.g., mandatory

severance pay under Israeli labor laws), or which will be comparable to customary market practices.

Upon termination of employment and

subject to applicable law, Xylo may grant to its

Executive Officers a non-compete grant as an incentive to refrain from competing with Xylo

for a defined period of time. The terms and conditions of the non-compete grant shall be decided by the Board and

shall not exceed such Executive Officer’s monthly base salary multiplied by twelve (12). The Board shall consider the existing entitlements

of the Executive Officer in connection with the consideration of any non-compete grant.

| 18. | Limitation Retirement and Termination of Service Arrangements |

The total non-statutory payments under

Section 14-17 above for a given Executive Officer shall not exceed the Executive Officer’s monthly base salary multiplied by twenty-four

(24). The limitation under this Section 18 does not apply to benefits and payments provided under other chapters of this Policy.

F. Exculpation, Indemnification and Insurance

Each

and every Director and Executive Officer may be exempted in advance for all or any of his/her liability for damage in consequence

of a breach of the duty of care, to the fullest extent permitted by applicable law.

| 20. | Insurance and Indemnification |

| 20.1. | Xylo may indemnify its directors and Executive Officers to the

fullest extent permitted by applicable law, for any liability and expense that may be imposed on the director or the Executive Officer,

as provided in the indemnity agreement between such individuals and Xylo, all subject to applicable

law and the Company’s articles of association. |

| 20.2. | Xylo will provide directors’ and officers’ liability

insurance (the “Insurance Policy”) for its directors and Executive Officers as follows: |

| 20.2.1. | the limit of liability of the insurer

shall not exceed the greater of $50 million or 50% of the Company’s shareholders

equity based on the most recent financial statements of the Company at the time of approval of the Insurance Policy by the Compensation

Committee; and |

| 20.2.2. | the Insurance Policy, as well as the limit of liability and the premium for each extension or renewal

shall be approved by the Compensation Committee (and, if required by law, by the Board) which shall determine that the sums are reasonable

considering Xylo’s exposures, the scope of

coverage and the market conditions and that the Insurance Policy reflects the current market conditions and that it shall not materially

affect the Company’s profitability, assets or liabilities. |

| 20.3. | Upon circumstances to be approved by the Compensation Committee (and, if required by law, by the Board),

Xylo shall be entitled to enter into a “run off” Insurance Policy (the “Run-Off

Policy”) of up to seven (7) years, with the same insurer or any other insurance, as follows: |

| 20.3.1. | The limit of liability of the insurer

shall not exceed the greater of $50 million or 50% of the Company’s shareholders

equity based on the most recent financial statements of the Company at the time of approval by the Compensation Committee; and |

| 20.3.2. | The Run-Off Policy, as well as the limit of liability and the premium for each extension or renewal shall

be approved by the Compensation Committee (and, if required by law, by the Board) which shall determine that the sums are reasonable considering

the Company’s exposures covered under such policy, the scope of coverage and the market conditions and that the Run-Off Policy reflects

the current market conditions and that it shall not materially affect the Company’s profitability, assets or liabilities. |

| 20.4. | Xylo may extend an

Insurance Policy in effect to include coverage for liability pursuant to a future public offering of securities as follows: |

| 20.4.1. | The Insurance Policy, as well as the additional premium shall be approved by the Compensation Committee

(and if required by law, by the Board) which shall determine that the sums are reasonable considering the exposures pursuant to such public

offering of securities, the scope of coverage and the market conditions and that the Insurance Policy reflects the current market conditions,

and that it does not materially affect the Company’s profitability, assets or liabilities. |

G. Arrangements upon Change of Control

| 21. | The following benefits may be granted to the Executive Officers (in addition to, or in lieu

of, the benefits applicable in the case of any retirement or termination of service) upon or in connection with a “Change

of Control” or, where applicable, in the event of a Change of Control following which the employment of the Executive

Officer is terminated or adversely adjusted in a material way: |

| 21.1. | acceleration of vesting of outstanding options or other equity-based awards; |

| 21.2. | extension of the exercise period of equity-based grants for Xylo’s

Executive Officers for a period of up to one (1) year, following the date of termination of employment; and |

| 21.3. | up to an additional six (6) months of continued

base salary and benefits following the date of termination of employment,

or twelve (12) months in the case of the CEO (the “Additional Adjustment Period”). For avoidance of doubt, such additional

Adjustment Period may be in addition to the advance notice and adjustment periods pursuant to Sections 14 and

15 of this Policy, but subject to the limitation set forth in Section

18 of this Policy; and |

| 21.4. | a cash bonus not to exceed 200% of the Executive Officer’s annual base salary in case of an Executive

Officer other than the CEO and 250% in case of the CEO. |

H. Board of Directors Compensation

| 22. | All Xylo’s

non-employee Board members may be entitled to an annual cash fee retainer of up to $40,000 (and up to $240,000 for the chairperson

of Xylo’s Board or lead independent director),

The chairperson of Xylo's Board may be paid an annual bonus of up to $120,000. |

| 23. | The compensation of the Company’s external

directors, if any are required and elected, shall be in accordance with the Companies Regulations (Rules Regarding the Compensation and

Expenses of an External Director), 5760-2000, as amended by the Companies Regulations (Relief for Public Companies Traded in Stock Exchange

Outside of Israel), 5760-2000, as such regulations may be amended from time to time. |

| 24. | Notwithstanding the provisions of Section 22 above, in special circumstances, such as in the case of a

professional director, an expert director or a director who makes a unique contribution to the Company, such director’s compensation

may be different than the compensation of all other directors and may be greater than the maximum amount allowed under Section 22. |

| 25. | Each non-employee member of Xylo’s

Board may be granted equity-based compensation. The total fair market value of a “welcome” or an annual equity-based compensation

at the time of grant shall not exceed the higher of (i) $120,000 or (x) 0.5% of the Company’s fair market value at

the time of approval of the grant by the Board. ; and in the case of the chairperson of the Board - the higher of (i) 300%

of his or her annual base salary or (ii) 2% of the Company’s fair market value at the time of approval of the grant by the Board. |

| 27. | All other terms of the equity awards shall be in accordance with Xylo’s

incentive plans and other related practices and policies. Accordingly, the Board may, following approval by the Compensation Committee,

make modifications to such awards consistent with the terms of such incentive plans, subject to any additional approval as may be required

by the Companies Law. In addition, the Company may satisfy tax withholding obligations related

to equity-based compensation granted to directors by net issuance, sale to cover or any other mechanism as determined by the Board

from time to time. |

| 28. | In addition, members of Xylo’s Board may be entitled to

reimbursement of expenses in connection with the performance of their duties. |

| 29. | The compensation (and limitations) stated under Section H will not apply to directors who serve as Executive

Officers. |

I. Miscellaneous

| 30. | Nothing in this Policy shall be deemed to grant

to any of Xylo’s Executive Officers, employees, directors, or any third party any right

or privilege in connection with their employment by or service to the Company, nor deemed to require Xylo

to provide any compensation or benefits to any person. Such rights and privileges shall be governed by applicable personal employment

agreements or other separate compensation arrangements entered into between Xylo and the recipient

of such compensation or benefits. The Board may determine that none or only part of the payments, benefits and perquisites detailed

in this Policy shall be granted, and is authorized to cancel or suspend a compensation package or any part of it. |

| 31. | An Immaterial Change in the Terms of Employment of an

Executive Officer other than the CEO may be approved by the CEO, provided that the amended terms of employment are in accordance with

this Policy. An “Immaterial Change in the Terms of Employment” means a change in the terms of employment of an Executive

Officer with an annual total cost to the Company not exceeding an amount equal to two (2) monthly base salaries of such employee. |

| 32. | In the event that new regulations or law amendment in connection with Executive Officers’ and directors’

compensation will be enacted following the adoption of this Policy, Xylo

may follow such new regulations or law amendments, even if such new regulations are in contradiction to the compensation terms

set forth herein. |

*********************

This

Policy is designed solely for the benefit of Xylo and none of the provisions thereof are intended

to provide any rights or remedies to any person other than Xylo.

Exhibit 99.2

Xylo Technology (NASDAQ:XYLO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Xylo Technology (NASDAQ:XYLO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024