Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

14 Agosto 2024 - 3:42PM

Edgar (US Regulatory)

| | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 |

|

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| |

| ALLETE, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

The following update was provided to employees of ALLETE, Inc. and its subsidiaries on August 14, 2024.

Reminder to vote on proposed transaction

ALLETE recently filed its definitive proxy statement with the SEC. As described in the proxy statement, the special meeting for shareholders to vote on the proposed transaction will be held on Aug. 21, 2024, at 10:30 a.m. Central Daylight Time. Below is some important information on the shareholder vote and process for employees:

If you are a shareholder, you should have received copies of the proxy materials between July 19 and July 25, 2024, by email or other method, depending on how you hold your shares. For those receiving their proxy materials electronically, proxy materials should have come from the email address ALLETE, INC. <id@proxyvote.com>, with the subject heading: “ALLETE, INC Special Meeting.” The link contained in the email communication will be unique to the ALLETE stock held by each employee shareholder and will allow the shareholder to vote on the proposal with just a few clicks in a web browser. In addition, shareholders may obtain free copies of the proxy statement as described below under “Additional Information and Where to Find It.”

Employee shareholders are encouraged to submit their proxies online or by telephone by following the procedures described in the proxy statement. The board recommends a vote “FOR” all proposals to be presented at the special meeting. As more fully described in the proxy statement, the failure to submit a vote will have the same effect as a vote “AGAINST” the proposal to approve the Merger Agreement and the transactions contemplated thereby.

We continue to operate as usual and thank you all for your unwavering focus and hard work. Please stay tuned to the Stream where we will continue to post important updates for employees, and our transaction website at www.ALLETEforward.com. If you have any additional questions, please do not hesitate to reach out to your leader.

Per company policy, please refer all media inquiries to Amy Rutledge at arutledge@allete.com and all analyst and shareholder inquiries to Vince Meyer at vmeyer@allete.com.

Additional information and where to find it

In connection with the proposed transaction, ALLETE has filed with the Securities and Exchange Commission (“SEC”) a definitive proxy statement on July 10, 2024 (the “Proxy Statement”). ALLETE may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the Proxy Statement or any other document which ALLETE may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and other documents that are filed or will be filed with the SEC by ALLETE through the website maintained by the SEC at www.sec.gov, ALLETE’s investor relations website at https://investor.allete.com or by contacting the ALLETE’s Shareholder Services at (218) 355-3114.

Participants in the solicitation

ALLETE and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. ALLETE shareholders may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the proposed transaction, including the interests of ALLETE directors and executive officers in the transaction, which may be different than those of ALLETE shareholders generally, by reading the Proxy Statement and any other relevant documents that are filed or will be filed with the SEC relating to the transaction. You may obtain free copies of these documents using the sources indicated above.

Forward-looking statements disclaimer

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward looking statements, are described in greater detail in the Proxy Statement, under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made.

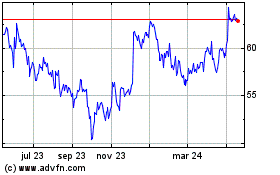

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

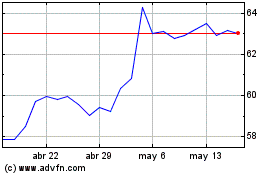

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024