SECOND-QUARTER 2024 PERFORMANCE REVIEW

David Calhoun President and Chief Executive Officer Brian West Executive Vice President and Chief Financial Officer July 31, 2024 Filed by The Boeing Company Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule

14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Spirit AeroSystems Holdings, Inc. Commission File No. 001-33160 Date: July 31, 2024

FORWARD-LOOKING STATEMENTS This document

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “should,” “expects,” “intends,”

“projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and other similar words or expressions, or the negative thereof, generally can be used to help identify

these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current

fact. Forward-looking statements are based on expectations and assumptions that we believe to be reasonable when made, but that may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in

circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are risks related to: (1) general conditions in the economy and our

industry, including those due to regulatory changes; (2) our reliance on our commercial airline customers; (3) the overall health of our aircraft production system, production quality issues, commercial airplane production rates, our ability to

successfully develop and certify new aircraft or new derivative aircraft, and the ability of our aircraft to meet stringent performance and reliability standards; (4) our pending acquisition of Spirit AeroSystems Holdings, Inc. (Spirit), including

the satisfaction of closing conditions in the expected timeframe or at all, (5) changing budget and appropriation levels and acquisition priorities of the U.S. government, as well as significant delays in U.S. government appropriations; (6) our

dependence on our subcontractors and suppliers, as well as the availability of highly skilled labor and raw materials; (7) work stoppages or other labor disruptions; (8) competition within our markets; (9) our non-U.S. operations and sales to

non-U.S. customers; (10) changes in accounting estimates; (11) realizing the anticipated benefits of mergers, acquisitions, joint ventures/strategic alliances or divestitures, including anticipated synergies and quality improvements related to our

pending acquisition of Spirit; (12) our dependence on U.S. government contracts; (13) our reliance on fixed-price contracts; (14) our reliance on cost-type contracts; (15) contracts that include in-orbit incentive payments; (16) unauthorized access

to our, our customers’ and/or our suppliers' information and systems; (17) potential business disruptions, including threats to physical security or our information technology systems, extreme weather (including effects of climate change) or

other acts of nature, and pandemics or other public health crises; (18) potential adverse developments in new or pending litigation and/or government inquiries or investigations; (19) potential environmental liabilities; (20) effects of climate

change and legal, regulatory or market responses to such change; (21) credit rating agency actions and changes in our ability to obtain debt financing on commercially reasonable terms, at competitive rates and in sufficient amounts; (22) substantial

pension and other postretirement benefit obligations; (23) the adequacy of our insurance coverage; and (24) customer and aircraft concentration in our customer financing portfolio. Additional information concerning these and other factors can be

found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement speaks only as of the date on which

it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Additional Information and Where to Find

It Boeing will file with the U.S. Securities and Exchange Commission (SEC) a registration statement on Form S-4, which will include a proxy statement of Spirit Aerosystems Holdings, Inc. (Spirit) that also constitutes a prospectus of Boeing, and any

other documents in connection with the transaction. The definitive proxy statement/prospectus will be sent to the holders of common stock of Spirit. INVESTORS AND SHAREHOLDERS OF SPIRIT AND BOEING ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND

ANY OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BOEING, SPIRIT, THE TRANSACTION AND RELATED MATTERS. The registration statement and

proxy statement/prospectus and other documents filed by Boeing or Spirit with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov. Alternatively, investors and stockholders may obtain free copies of

documents that are filed or will be filed with the SEC by Boeing, including the registration statement and the proxy statement/prospectus, on Boeing’s website at www.boeing.com/investors, and may obtain free copies of documents that are filed

or will be filed with the SEC by Spirit, including the proxy statement/prospectus, on Spirit’s website at https://investor.spiritaero.com/corporate-profile/default.aspx. The information included on, or accessible through, Boeing’s or

Spirit’s website is not incorporated by reference into this document. No Offer or Solicitation This document is not intended to and shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the Solicitation Boeing and certain of its directors, executive officers and other employees, and Spirit and its directors and

certain of Spirit’s, executive officers and other employees, may be deemed to be participants in the solicitation of proxies from Spirit’s stockholders in connection with the proposed transaction. A description of participants’

direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus relating to the proposed transaction when it is filed with the SEC. Information regarding Boeing’s directors and executive

officers is contained in Boeing’s SEC filings, including the “Proxy Summary – Leadership Changes,” “Election of Directors (Item 1),” “Corporate Governance,” “Compensation Discussion and

Analysis,” “Compensation of Executive Officers” and “Stock Ownership Information” sections of the definitive proxy statement for Boeing’s 2024 annual meeting of shareholders, filed with the SEC on April 5, 2024,

in Item 10 of Boeing’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on January 31, 2024, and in Boeing’s Current Reports on Form 8-K filed with the SEC on December 11, 2023, March 25, 2024,

and May 17, 2024, as well as in Boeing’s February 22, 2024 press release, available on Boeing’s investor relations website at www.boeing.com/investors, relating to the appointment of a new Chief Human Resources Officer. Information

regarding Spirit’s directors and executive officers is contained in the “Proposal 1 – Election of Directors,” “Corporate Governance,” “Director Compensation,” “Stock Ownership” and

“Compensation Discussion and Analysis” sections of Spirit’s definitive proxy statement for its 2024 annual meeting of stockholders, filed with the SEC on March 12, 2024, under the heading “Executive Officers of the

Registrant” in Part I of Spirit’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 22, 2024, in Item 5.07 of Spirit’s Current Report on Form 8-K filed with the SEC on April 29,

2024, and in Spirit’s Current Report on Form 8-K filed with the SEC on June 5, 2024. Additional information regarding ownership of Boeing’s securities by its directors and executive officers and of Spirit’s securities by its

directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4. These documents and the other SEC filings described in this paragraph may be obtained free of charge as described above under the heading

“Additional Information and Where to Find It.”

BUSINESS UPDATE Focused on safety and

quality

SPIRIT ACQUISITION Improves safety,

quality and stability Announced agreement to acquire Spirit AeroSystems in July; expect mid-2025 closing Acquiring substantially all Boeing-related commercial and certain other operations Total estimated value of ~$8.3 billion, including all-stock

transaction valued at ~$4.7 billion Aligns commercial production systems and optimizes resources to meet long-term demand Leverages Boeing enterprise engineering and manufacturing capabilities Maintains continuity for key U.S. defense and national

security programs Supports supply chain stability and critical manufacturing workforce

SECOND-QUARTER FINANCIAL RESULTS Results

primarily reflect lower commercial delivery volume and losses on fixed-price development programs * Non-GAAP measure. See slides 12 & 13 additional information on non-GAAP measures. Second Quarter 2024 2023 Revenue $16.9B $19.8B Core Operating

Margin* (8.3)% (2.0)% Core Loss Per Share* ($2.90) ($0.82) Free Cash Flow* ($4.3B) $2.6B

COMMERCIAL AIRPLANES Focused on safety,

quality and operational stability Submitted safety and quality plan to the FAA Obtained 777X type inspection authorization and began FAA certification flight testing in July Delivered 92 airplanes Backlog of $437B; over 5,400 airplanes Revenue

(billions) Revenues and Operating Margins Op Margin: (4.3)% (11.9)%

DEFENSE, SPACE & SECURITY Recorded

losses of $1B on certain fixed-price development programs Captured an award for seven MH-139A helicopters from the U.S. Air Force Delivered the first CH-47F Block II Chinook to the U.S. Army Orders valued at $4B; backlog of $59B Revenue (billions)

Revenues and Operating Margins Focused on production stability and development program execution Op Margin: (8.5)% (15.2)%

GLOBAL SERVICES Results reflect higher

commercial volume and mix Secured an Apache performance-based logistics contract from the U.S. Army Captured FliteDeck Pro service contracts with Hainan Airlines and Ryanair Orders valued at $4B; backlog of $19B Revenue (billions) Revenues and

Operating Margins Continued strong performance…focused on meeting customer commitments Op Margin: 18.0% 17.8%

CASH AND DEBT BALANCES $10.0 billion

issuance of new debt partially offset by the usage of free cash flow Billions S&P: BBB- Moody’s: Baa3 Fitch: BBB- Billions Cash and Marketable Securities Consolidated Debt

NON-GAAP MEASURE DISCLOSURE The tables

provided below reconcile the non-GAAP financial measures Core operating loss, Core operating margin, and Core loss per share with the most directly comparable GAAP financial measures of Loss from operations, operating margin, and diluted loss per

share. See page 5 of the company’s earnings press release dated July 31, 2024 for additional information on the use of these non-GAAP financial measures. (Dollars in millions, except per share data) Second Quarter 2024 Second Quarter 2023 $

millions Per Share $ millions Per Share Revenues 16,866 19,751 Loss from operations (GAAP) (1,090) (99) Operating margins (GAAP) (6.5)% (0.5)% FAS/CAS service cost adjustment: Pension FAS/CAS service cost adjustment (230) (222) Postretirement

FAS/CAS service cost adjustment (72) (69) FAS/CAS service cost adjustment (302) (291) Core operating loss (non-GAAP) ($1,392) ($390) Core operating margins (non-GAAP) (8.3)% (2.0)% Diluted loss per share (GAAP) ($2.33) ($0.25) Pension FAS/CAS

service cost adjustment ($230) (0.37) ($222) (0.37) Postretirement FAS/CAS service cost adjustment (72) (0.12) (69) (0.11) Non-operating pension expense (122) (0.20) (134) (0.22) Non-operating postretirement expense (19) (0.03) (14) (0.02) Provision

for deferred income taxes on adjustments 1 93 0.15 92 0.15 Subtotal of adjustments ($350) ($0.57) ($347) ($0.57) Core loss per share (non-GAAP) ($2.90) ($0.82) Weighted average diluted shares (in millions) 616.6 605.5 1 The income tax impact is

calculated using the U.S. corporate statutory tax rate.

The table provided below reconciles

the non-GAAP financial measure free cash flow with the most directly comparable GAAP financial measure operating cash flow. See page 5 of the company’s earnings press release dated July 31, 2024 for additional information on the use of free

cash flow as a non-GAAP financial measure. NON-GAAP MEASURE DISCLOSURE Table 2. Cash Flow Second Quarter (Millions) 2024 2023 Operating cash flow ($3,923) $2,875 Less additions to property, plant & equipment ($404) ($296) Free cash flow ($4,327)

$2,579

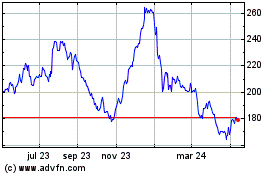

Boeing (NYSE:BA)

Gráfica de Acción Histórica

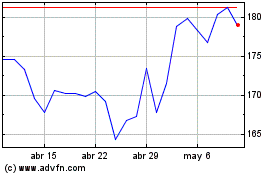

De Jul 2024 a Jul 2024

Boeing (NYSE:BA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024