Gaming and Leisure Properties, Inc. (NASDAQ: GLPI) (“GLPI” or

the “Company”) today announced record results for the fourth

quarter and year-ended December 31, 2022.

Financial Highlights

| |

|

Three Months Ended December 31, |

Year Ended December 31, |

|

|

(in millions, except per share data) |

|

2022 Actual |

|

2021 Actual |

2022 Actual |

|

2021 Actual |

|

|

Total Revenue |

|

$ |

336.4 |

|

$ |

298.3 |

$ |

1,311.7 |

|

$ |

1,216.4 |

|

| Income From

Operations |

|

$ |

275.5 |

|

$ |

204.4 |

$ |

1,029.9 |

|

$ |

841.8 |

|

| Net

income |

|

$ |

199.6 |

|

$ |

119.6 |

$ |

703.3 |

|

$ |

534.1 |

|

|

FFO(1) (4) |

|

$ |

258.8 |

|

$ |

178.0 |

$ |

887.3 |

|

$ |

765.7 |

|

|

AFFO(2) (4) |

|

$ |

239.1 |

|

$ |

205.3 |

$ |

924.4 |

|

$ |

812.0 |

|

| Adjusted

EBITDA(3) (4) |

|

$ |

312.0 |

|

$ |

277.2 |

$ |

1,221.7 |

|

$ |

1,096.6 |

|

| Net income, per

diluted common share and OP units(4) |

|

$ |

0.75 |

|

$ |

0.50 |

$ |

2.70 |

|

$ |

2.26 |

|

| FFO, per diluted

common share and OP units(4) |

|

$ |

0.97 |

|

$ |

0.74 |

$ |

3.40 |

|

$ |

3.24 |

|

| AFFO, per diluted

common share and OP units(4) |

|

$ |

0.89 |

|

$ |

0.85 |

$ |

3.55 |

|

$ |

3.44 |

|

(1) Funds from operations ("FFO") is net

income, excluding (gains) or losses from dispositions of property,

net of tax and real estate depreciation as defined by NAREIT.

(2) Adjusted Funds from Operations ("AFFO")

is FFO, excluding, as applicable to the particular period, stock

based compensation expense; the amortization of debt issuance

costs, bond premiums and original issuance discounts; other

depreciation; amortization of land rights; accretion on investment

in leases, financing receivables; non-cash adjustments to financing

lease liabilities; impairment charges; straight-line rent

adjustments; losses or (gains) on sales of operations, net of tax;

losses on debt extinguishment; and provision for credit losses,

net, reduced by capital maintenance expenditures.

(3) Adjusted EBITDA is net income,

excluding, as applicable to the particular period, interest, net;

income tax expense; real estate depreciation; other depreciation;

(gains) or losses from dispositions of property, net of tax;

(gains) or losses on sales of operations, net of tax; stock based

compensation expense; straight-line rent adjustments; amortization

of land rights; accretion on investment in leases, financing

receivables; non-cash adjustments to financing lease liabilities;

impairment charges; losses on debt extinguishment; and provision

for credit losses, net.

(4) Metrics are presented assuming full

conversion of limited partnership units to common shares and

therefore before the income statement impact of non-controlling

interests.

Peter Carlino, Chairman and Chief Executive

Officer of GLPI, commented, “We ended 2022 with record fourth

quarter results and increased dividends as our deep, long-term

knowledge of the gaming sector has allowed us to continually expand

and diversify our tenant base, geographic footprint and rental

streams. Reflecting this ongoing expansion, since our establishment

as the gaming industry’s first REIT, GLPI has grown from being a

landlord with one tenant and 19 properties to become a landlord

with six premiere tenants and 57 properties across 17 states as of

December 31, 2022. Fourth quarter results again highlight the

durability of our rental streams, including the completion of

previously announced agreements in late 2021 and in 2022 with The

Cordish Companies and Bally’s Corporation, combined with our

initiatives to position the Company for further growth through the

active management of all aspects of our business and capital

structure.

“During the fourth quarter, we continued to

successfully and aggressively execute on our long-term strategy to

grow rental cash flows while prudently funding our ongoing growth

and dividend increases. Early in the quarter we announced an

agreement to establish a new master lease for seven PENN

Entertainment (“PENN”) properties, including a funding option to

allow PENN to pursue attractive growth opportunities in several of

its existing markets including Illinois, Ohio and Nevada. The

relocation of PENN’s Aurora and Joliet properties in Illinois to

new land-based locations with expanded amenities will deliver a

superior guest experience at sites with proximity to major

thoroughfares and highly trafficked areas. In Ohio, PENN’s proposed

hotel at Hollywood Casino Columbus is expected to strengthen the

property’s already impressive performance and transform it into a

regional destination. Consistent with the leases in our portfolio,

this new master lease includes attractive rent and financing terms

for both parties under a proven structure that offers GLPI downside

protection, while positioning us to benefit from PENN’s long-term

growth. Our active support of our leading regional gaming operator

tenants through innovative transaction structures has proven to be

mutually beneficial and we are confident that this new master lease

with PENN will extend our record of success on this front.

“Our ongoing pursuit of growth continues in

2023, as earlier this quarter we completed our previously announced

acquisition from Bally's of the real property assets of Bally's

Tiverton Casino & Hotel in Rhode Island ("Bally's Tiverton")

and Bally's Hard Rock Hotel & Casino Biloxi in Mississippi

("Bally's Biloxi") for $635 million, inclusive of $15 million in

the form of OP units, both of which were added to GLPI’s existing

master lease with Bally's. The initial rent for the

lease was increased by $48.5 million on an annualized basis. GLPI

is positioned to benefit from Bally’s long-term growth as we have

the option, subject to receipt by Bally's of required consents, to

acquire the real property assets of Bally's Twin River Lincoln

Casino Resort in Lincoln, RI ("Bally's Lincoln") prior to December

31, 2024 for a purchase price of $771 million and additional rent

of $58.8 million.

“Looking forward, we believe GLPI is well

positioned to deliver long-term growth based on our gaming operator

relationships, our rights and options to participate in select

tenants’ future growth and expansion initiatives, and our ability

to structure and fund innovative transactions at competitive rates.

Our tenants' strength, combined with GLPI’s balance sheet and

liquidity, position the Company to consistently grow its cash flows

and build value for shareholders in 2023 and beyond.”

Recent Developments

- On January 13, 2023, the Company

called for redemption all of the $500 million, 5.375% Senior Notes

(the "Notes") due in 2023. GLPI redeemed all of the Notes on

February 12, 2023 (the "Redemption Date") for $507.5 million which

represented 100% of the principal amount of the Notes plus accrued

interest through the Redemption Date. GLPI funded the redemption of

the Notes primarily from cash on hand.

- On January 3, 2023, the Company

completed its previously announced acquisition from Bally's

Corporation (NYSE: BALY) ("Bally's") of the real property assets of

Bally's Tiverton and Bally's Biloxi for consideration of $635

million, inclusive of $15 million in the form of OP units. These

properties were added to the Company's existing Master Lease with

Bally's. The initial rent for the lease was increased by $48.5

million on an annualized basis, subject to contractual escalations

based on the Consumer Price Index ("CPI"), with a 1% floor and a 2%

ceiling, subject to CPI meeting a 0.5% threshold.In connection with

the closing, a $200 million deposit funded by GLPI in September

2022 was returned to the Company along with a $9.0 million

transaction fee that will be accounted for as a reduction of the

purchase price of the assets acquired with no earnings impact.

Concurrent with the closing, GLPI borrowed $600 million under its

previously structured delayed draw term loan.GLPI continues to have

the option, subject to receipt by Bally's of required consents to

acquire the real property assets of Bally's Lincoln prior to

December 31, 2024, for a purchase price of $771 million and

additional initial rent of $58.8 million.

- In December 2022, the Company

entered into a new continuous equity offering under which the

Company may sell up to $1 billion of its common stock from time to

time through a sales agent in "at the market" ("ATM") offerings.

The Company continues to have the full $1 billion capacity as of

the date of this release.Other Significant

Developments

- On October 10, 2022, the Company

announced that it agreed to create a new master lease with PENN for

seven of PENN's current properties. The Company and PENN also

agreed to a funding mechanism to support PENN's pursuit of

relocation and development opportunities at several of the

properties included in the new master lease. The transaction,

including the creation of the new master lease became effective as

of January 1, 2023. Pursuant to the terms agreed upon by the

parties, the current PENN master lease was amended to remove PENN's

properties in Aurora and Joliet, Illinois, Columbus and Toledo,

Ohio, and Henderson, Nevada. Those properties were added to the new

master lease. In addition, the existing leases for the Hollywood

Casino at The Meadows in Pennsylvania and Hollywood Casino

Perryville in Maryland were terminated and these properties were

transferred to the new master lease. GLPI agreed to fund up to $225

million for the relocation of PENN's riverboat casino in Aurora at

a 7.75% cap rate. GLPI also agreed to fund, at PENN's election, up

to an additional $350 million for the relocation of the Hollywood

Casino Joliet as well as the construction of hotels at Hollywood

Casino Columbus and a second hotel tower at the M Resort Spa Casino

at then current market rates.The terms of the new master lease and

the amended PENN master lease are substantially similar to the

current PENN master lease with the following key differences;

- The new master lease is cross-defaulted and co-terminus with

the existing PENN master lease.

- The initial term of the new master lease expires on October 31,

2033, with three 5-year extensions at PENN’s option.

- All rent in the new master lease is fixed with annual

escalation of 1.50%, with the first escalation occurring for the

lease year beginning on November 1, 2023.

- The rent for the new lease is $232.2 million in base rent. The

rent for the original PENN master lease is $284.1 million,

consisting of $208.2 million of building base rent, $43.0 million

of land base rent, and $32.9 million of percentage rent.

- On September 26, 2022, the Company

closed on its previously announced transaction whereby Bally's

acquired both GLPI's non-land real estate assets and PENN's

outstanding equity interests in Tropicana Las Vegas Hotel and

Casino, Inc. ("Tropicana Las Vegas") for an aggregate cash

acquisition price, net of fees and expenses, of approximately $145

million, which resulted in a pre-tax gain of $67.4 million. GLPI

retained ownership of the land and concurrently entered into a

50-year ground lease with Bally's for an initial annual cash rent

of $10.5 million. The ground lease is supported by a Bally’s

corporate guarantee and cross-defaulted with the Bally’s Master

Lease.

- On August 19, 2022, the Company

entered into a forward sale agreement (the "August 2022 Forward

Sale Agreement"), for up to $105 million. No amounts have been

or will be recorded on the Company's balance sheet with respect to

the August 2022 Forward Sale Agreement until settlement. The

Company settled the August 2022 Forward Sale Agreement in February

2023, utilizing the proceeds of $64.6 million to partially fund the

redemption of the Notes that were redeemed as described above.

- In addition to the ATM shares sold

pursuant to the forward agreement, during the fourth quarter and

third quarter of 2022, the Company sold 3,171,776 shares and

2,034,723 shares of its common stock, respectively, under its

regular way ATM program raising net proceeds of $156.4 million and

$104.4 million, respectively.

- On July 1, 2022, the Company issued

7,935,000 shares of its common stock, generating proceeds of

approximately $350.8 million.

- On May 13, 2022, GLP Capital

terminated its credit facility that was scheduled to mature on May

21, 2023 that was guaranteed by the Company and entered into a new

credit agreement that provides for a $1.75 billion revolving credit

facility with a maturity of four years, subject to two six-month

extensions at GLP Capital's option, and that is guaranteed by the

Company. The Company recorded a debt extinguishment charge of $2.2

million in connection with this transaction.

- On April 1, 2022, GLPI completed

its previously announced acquisition from Bally's of the land and

real estate assets of Bally's three casinos in Black Hawk,

Colorado, and Bally's Quad Cities Casino & Hotel in Rock

Island, Illinois, for total consideration of $150 million. These

properties were added to the Bally's Master Lease, with the rent

for the Bally's Master Lease increased by $12.0 million on an

annual basis. The rent is subject to contractual escalations based

on the CPI, with a 1% floor and a 2% ceiling, subject to the CPI

meeting a 0.5% threshold.

- On March 1, 2022, GLPI completed

the acquisition of the land and real estate assets of Live! Casino

& Hotel Philadelphia ("Live! Philadelphia") and Live! Casino

Pittsburgh ("Live! Pittsburgh") from The Cordish Companies

("Cordish") for total consideration of approximately $689 million

(inclusive of transaction costs). The Company funded the

acquisition by assuming approximately $423 million in debt (which

the Company repaid) and issuing approximately $137 million of

operating partnership units (approximately 3.0 million total

units), with the balance paid from cash on hand, which was in part

generated by its December 2021 issuance of senior unsecured notes

and common stock.

- Simultaneous with the March 1, 2022

closing of the above transaction, the Company entered into a master

lease with Cordish (the "Pennsylvania Live! Master Lease"),

pursuant to which Cordish will continue its ownership, control and

management of the operations of Live! Philadelphia and Live!

Pittsburgh. The Pennsylvania Live! Master Lease has an initial

annual rent of $50.0 million and an initial term of 39 years, with

a maximum term of 60 years, inclusive of tenant renewal options, as

well as a fixed annual lease escalation of 1.75% on the entirety of

rent commencing on the lease's second anniversary.

- On December 29, 2021, the Company

completed the acquisition of the land and real estate assets of

Live! Casino & Hotel Maryland ("Live! Maryland") from Cordish

for total consideration of $1.16 billion (inclusive of transaction

costs). Cordish and the Company entered into a lease with Cordish

(the "Maryland Live! Lease"), pursuant to which Cordish will

continue its ownership, control and management of the operations of

Live! Maryland. The Maryland Live! Lease has an initial annual rent

of $75 million and an initial term of 39 years, with a maximum term

of 60 years, inclusive of tenant renewal options, as well as a

fixed annual lease escalation of 1.75% on the entirety of rent

commencing on the lease's second anniversary. The transaction also

includes a partnership on future Cordish casino developments, as

well as potential financing partnerships between GLPI and Cordish

in other areas of Cordish's portfolio of real estate and operating

businesses. GLPI funded the transaction by assuming $363 million in

debt, which was repaid, and issuing $205 million of operating

partnership units (4.35 million total units), with the balance of

the consideration from cash on hand, which in part was generated by

GLPI's December 2021 issuance of senior unsecured notes and common

stock.

Dividends

On November 23, 2022, the Company's Board of

Directors declared a fourth quarter dividend of $0.705 per share on

the Company's common stock. The dividend was paid on December 23,

2022 to shareholders of record on December 9, 2022.

On February 22, 2023, the Company's Board of

Directors declared a first quarter dividend of $0.72 per share on

the Company's common stock as well as a special earnings and profit

dividend of $0.25 per share related to the sale of the Tropicana

Las Vegas building. These dividends will be payable on March 24,

2023 to shareholders of record on March 10, 2023.

2023 Guidance

Reflecting the current operating and competitive

environment, the Company is providing AFFO guidance for the full

year 2023 based on the following assumptions and other factors:

- The guidance does not include the

impact on operating results from any pending or possible future

acquisitions or dispositions, future capital markets activity, or

other future non-recurring transactions.

- The guidance assumes there will be

no material changes in applicable legislation, regulatory

environment, world events, including another COVID-19 or other new

pandemic outbreak, weather, recent consumer trends, economic

conditions, oil prices, competitive landscape or other

circumstances beyond our control that may adversely affect the

Company's results of operations.

The Company estimates AFFO for the year ending

December 31, 2023 will be between $980 million and $997 million, or

between $3.61 and $3.67 per diluted share and OP

units.

The Company does not provide a reconciliation

for non-GAAP estimates on a forward-looking basis, including the

information above, where it is unable to provide a meaningful or

accurate calculation or estimation of reconciling items and the

information is not available without unreasonable

effort. This is due to the inherent difficulty of

forecasting the timing and/or amounts of various items that would

impact net income, which is the most directly comparable

forward-looking GAAP financial measure. This includes, for example,

provision for credit losses, net, acquisition costs and other

non-core items that have not yet occurred, are out of the Company’s

control and/or cannot be reasonably predicted. For the

same reasons, the Company is unable to address the probable

significance of the unavailable information. In

particular, the Company is unable to predict with reasonable

certainty the amount of the change in the provision for credit

losses, net, under ASU No. 2016-13 - Financial Instruments - Credit

Losses ("ASC 326") in future periods. The non-cash

change in the provision for credit losses under ASC 326 with

respect to future periods is dependent upon future events that are

entirely outside of the Company's control and may not be reliably

predicted, including the performance and future outlook of our

tenant's operations for our leases that are accounted for as

investment in leases, financing receivables, as well as broader

macroeconomic factors and future predictions of such

factors. As a result, forward-looking non-GAAP

financial measures provided without the most directly comparable

GAAP financial measures may vary materially from the corresponding

GAAP financial measures.

Portfolio Update

GLPI's primary business consists of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements. As of December 31,

2022, GLPI's portfolio consisted of interests in 57 gaming and

related facilities, the real property associated with 34 gaming and

related facilities operated by PENN, the real property associated

with 7 gaming and related facilities operated by Caesars

Entertainment, Inc. (NASDAQ: CZR), the real property associated

with 4 gaming and related facilities operated by Boyd Gaming

Corporation (NYSE: BYD), the real property associated with 7 gaming

and related facilities operated by Bally's, the real property

associated with 3 gaming and related facilities operated by Cordish

and the real property associated with 2 gaming and related

facilities operated by Casino Queen. These facilities are

geographically diversified across 17 states and contain

approximately 27.8 million square feet of improvements. The figures

above do not reflect the January 3, 2023 acquisition of the real

property assets of Bally's Biloxi and Bally's Tiverton, which added

2.4 million of property square footage and diversified the Company

into Rhode Island.

Conference Call Details

The Company will hold a conference call on

February 24, 2023 at 10:00 a.m. (Eastern Time) to discuss

its financial results, current business trends and market

conditions.

To Participate in the Telephone Conference

Call:Dial in at least five minutes prior to start time.Domestic:

1-877/407-0784International: 1-201/689-8560

Conference Call Playback:Domestic:

1-844/512-2921International: 1-412/317-6671Passcode: 13735382The

playback can be accessed through Friday, March 3, 2023.

WebcastThe conference call will

be available in the Investor Relations section of the Company's

website at www.glpropinc.com. To listen to a live broadcast, go to

the site at least 15 minutes prior to the scheduled start time in

order to register, download and install any necessary software. A

replay of the call will also be available for 90 days thereafter on

the Company’s website.

GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIESConsolidated Statements of

Operations(in thousands, except per share data)

(unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

|

|

|

|

|

|

|

|

Rental income |

$ |

299,246 |

|

|

$ |

285,461 |

|

|

$ |

1,173,376 |

|

|

$ |

1,106,658 |

|

|

Income from investment in leases, financing receivables |

|

37,142 |

|

|

|

— |

|

|

|

138,309 |

|

|

|

— |

|

| Total income from real

estate |

|

336,388 |

|

|

|

285,461 |

|

|

|

1,311,685 |

|

|

|

1,106,658 |

|

|

Gaming, food, beverage and other |

|

— |

|

|

|

12,874 |

|

|

|

— |

|

|

|

109,693 |

|

| Total revenues |

|

336,388 |

|

|

|

298,335 |

|

|

|

1,311,685 |

|

|

|

1,216,351 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Gaming, food, beverage and other |

|

— |

|

|

|

4,965 |

|

|

|

— |

|

|

|

53,039 |

|

|

Land rights and ground lease expense |

|

11,870 |

|

|

|

13,052 |

|

|

|

49,048 |

|

|

|

37,390 |

|

|

General and administrative |

|

11,315 |

|

|

|

15,276 |

|

|

|

51,319 |

|

|

|

61,245 |

|

|

Gains from dispositions |

|

— |

|

|

|

(7,029 |

) |

|

|

(67,481 |

) |

|

|

(21,751 |

) |

|

Impairment charge on land |

|

— |

|

|

|

— |

|

|

|

3,298 |

|

|

|

— |

|

|

Depreciation |

|

59,708 |

|

|

|

59,401 |

|

|

|

238,688 |

|

|

|

236,434 |

|

|

Provision for credit losses, net |

|

(21,961 |

) |

|

|

8,226 |

|

|

|

6,898 |

|

|

|

8,226 |

|

| Total operating expenses |

|

60,932 |

|

|

|

93,891 |

|

|

|

281,770 |

|

|

|

374,583 |

|

| Income from operations |

|

275,456 |

|

|

|

204,444 |

|

|

|

1,029,915 |

|

|

|

841,768 |

|

| |

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

|

Interest expense |

|

(76,538 |

) |

|

|

(71,779 |

) |

|

|

(309,291 |

) |

|

|

(283,037 |

) |

|

Interest income |

|

1,293 |

|

|

|

13 |

|

|

|

1,905 |

|

|

|

197 |

|

|

Insurance gain |

|

— |

|

|

|

3,500 |

|

|

|

— |

|

|

|

3,500 |

|

|

Losses on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

(2,189 |

) |

|

|

— |

|

| Total other expenses |

|

(75,245 |

) |

|

|

(68,266 |

) |

|

|

(309,575 |

) |

|

|

(279,340 |

) |

| |

|

|

|

|

|

|

|

| Income before income

taxes |

|

200,211 |

|

|

|

136,178 |

|

|

|

720,340 |

|

|

|

562,428 |

|

| Income tax provision |

|

624 |

|

|

|

16,551 |

|

|

|

17,055 |

|

|

|

28,342 |

|

| Net

income |

$ |

199,587 |

|

|

$ |

119,627 |

|

|

$ |

703,285 |

|

|

$ |

534,086 |

|

| Less: Net income attributable

to non-controlling interest in Operating Partnership |

|

(5,470 |

) |

|

|

(39 |

) |

|

|

(18,632 |

) |

|

|

(39 |

) |

| Net income

attributable to common shareholders |

$ |

194,117 |

|

|

$ |

119,588 |

|

|

$ |

684,653 |

|

|

$ |

534,047 |

|

| |

|

|

|

|

|

|

|

| Earnings per common

share: |

|

|

|

|

|

|

|

| Basic earnings attributable to

common shareholders |

$ |

0.75 |

|

|

$ |

0.50 |

|

|

$ |

2.71 |

|

|

$ |

2.27 |

|

| Diluted earnings attributable

to common shareholders |

$ |

0.75 |

|

|

$ |

0.50 |

|

|

$ |

2.70 |

|

|

$ |

2.26 |

|

GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIESCurrent Year Revenue

Detail(in thousands) (unaudited)

| Three Months Ended

December 31, 2022 |

Building base rent |

Land base rent |

Percentage rent |

Total cash income |

Straight line rent |

Ground rent in revenue |

Accretion on financing leases |

Other rental revenue |

Total rental income |

|

PENN Master Lease |

$ |

72,198 |

$ |

23,492 |

$ |

23,934 |

$ |

119,624 |

$ |

(3,394 |

) |

$ |

572 |

$ |

— |

$ |

— |

$ |

116,802 |

| Amended Pinnacle Master

Lease |

|

59,095 |

|

17,814 |

|

7,164 |

|

84,073 |

|

1,858 |

|

|

2,204 |

|

— |

|

— |

|

88,135 |

| PENN Meadows Lease |

|

3,953 |

|

— |

|

2,040 |

|

5,993 |

|

572 |

|

|

— |

|

— |

|

183 |

|

6,748 |

| PENN Morgantown Lease |

|

— |

|

762 |

|

— |

|

762 |

|

— |

|

|

— |

|

— |

|

— |

|

762 |

| PENN Perryville Lease |

|

1,479 |

|

486 |

|

— |

|

1,965 |

|

38 |

|

|

— |

|

— |

|

— |

|

2,003 |

| Caesars Master Lease |

|

15,823 |

|

5,933 |

|

— |

|

21,756 |

|

2,394 |

|

|

378 |

|

— |

|

— |

|

24,528 |

| Horseshoe St. Louis Lease |

|

5,844 |

|

— |

|

— |

|

5,844 |

|

472 |

|

|

— |

|

— |

|

— |

|

6,316 |

| Boyd Master Lease |

|

19,674 |

|

2,946 |

|

2,566 |

|

25,186 |

|

574 |

|

|

432 |

|

— |

|

— |

|

26,192 |

| Boyd Belterra Lease |

|

696 |

|

474 |

|

472 |

|

1,642 |

|

151 |

|

|

— |

|

— |

|

— |

|

1,793 |

| Bally's Master Lease |

|

13,260 |

|

— |

|

— |

|

13,260 |

|

— |

|

|

2,537 |

|

— |

|

— |

|

15,797 |

| Maryland Live! Lease |

|

18,750 |

|

— |

|

— |

|

18,750 |

|

— |

|

|

2,155 |

|

3,227 |

|

— |

|

24,132 |

| Pennsylvania Live! Master

Lease |

|

12,500 |

|

— |

|

— |

|

12,500 |

|

— |

|

|

302 |

|

2,112 |

|

— |

|

14,914 |

| Casino Queen Master Lease |

|

5,534 |

|

— |

|

— |

|

5,534 |

|

107 |

|

|

— |

|

— |

|

— |

|

5,641 |

| Tropicana Las Vegas Lease |

|

— |

|

2,625 |

|

— |

|

2,625 |

|

— |

|

|

— |

|

— |

|

— |

|

2,625 |

| Total |

$ |

228,806 |

$ |

54,532 |

$ |

36,176 |

$ |

319,514 |

$ |

2,772 |

|

$ |

8,580 |

$ |

5,339 |

$ |

183 |

$ |

336,388 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Year Ended December

31, 2022 |

Building base rent |

Land base rent |

Percentage rent |

Total cash income |

Straight line rent |

Ground rent in revenue |

Accretion on financing leases |

Other rental revenue |

Total rental income |

| PENN Master Lease |

$ |

285,944 |

$ |

93,969 |

$ |

97,423 |

$ |

477,336 |

$ |

(11,700 |

) |

$ |

2,495 |

$ |

— |

$ |

— |

$ |

468,131 |

| Amended Pinnacle Master

Lease |

|

234,835 |

|

71,256 |

|

28,030 |

|

334,121 |

|

(1,494 |

) |

|

8,173 |

|

— |

|

— |

|

340,800 |

| PENN Meadows Lease |

|

15,811 |

|

— |

|

8,824 |

|

24,635 |

|

2,289 |

|

|

— |

|

— |

|

589 |

|

27,513 |

| PENN Morgantown Lease |

|

— |

|

3,047 |

|

— |

|

3,047 |

|

— |

|

|

— |

|

— |

|

— |

|

3,047 |

| PENN Perryville Lease |

|

5,871 |

|

1,943 |

|

— |

|

7,814 |

|

196 |

|

|

— |

|

— |

|

— |

|

8,010 |

| Caesars Master Lease |

|

62,709 |

|

23,729 |

|

— |

|

86,438 |

|

10,162 |

|

|

1,512 |

|

— |

|

— |

|

98,112 |

| Horseshoe St. Louis Lease |

|

23,161 |

|

— |

|

— |

|

23,161 |

|

2,103 |

|

|

— |

|

— |

|

— |

|

25,264 |

| Boyd Master Lease |

|

78,184 |

|

11,785 |

|

10,124 |

|

100,093 |

|

2,296 |

|

|

1,729 |

|

— |

|

— |

|

104,118 |

| Boyd Belterra Lease |

|

2,764 |

|

1,894 |

|

1,865 |

|

6,523 |

|

— |

|

|

— |

|

— |

|

— |

|

6,523 |

| Bally's Master Lease |

|

49,598 |

|

— |

|

— |

|

49,598 |

|

— |

|

|

9,603 |

|

— |

|

— |

|

59,201 |

| Maryland Live! Lease |

|

75,000 |

$ |

— |

|

— |

|

75,000 |

|

— |

|

|

8,521 |

|

12,569 |

|

— |

|

96,090 |

| Pennsylvania Live! Master

Lease |

|

41,667 |

$ |

— |

|

— |

|

41,667 |

|

— |

|

|

1,001 |

|

6,873 |

|

— |

|

49,541 |

| Casino Queen Master Lease |

|

22,122 |

|

— |

|

— |

|

22,122 |

|

442 |

|

|

— |

|

— |

|

— |

|

22,564 |

| Tropicana Las Vegas Lease |

|

— |

|

2,771 |

|

— |

|

2,771 |

|

— |

|

|

— |

|

— |

|

— |

|

2,771 |

| Total |

$ |

897,666 |

$ |

210,394 |

$ |

146,266 |

$ |

1,254,326 |

$ |

4,294 |

|

$ |

33,034 |

$ |

19,442 |

$ |

589 |

$ |

1,311,685 |

Reconciliation of Net income (GAAP) to FFO, FFO

to AFFO, and AFFO to Adjusted EBITDAGaming and Leisure Properties,

Inc. and SubsidiariesCONSOLIDATED(in thousands,

except per share and share data) (unaudited)

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net

income |

$ |

199,587 |

|

|

$ |

119,627 |

|

|

$ |

703,285 |

|

|

$ |

534,086 |

|

| (Gains) losses from

dispositions of property, net of tax |

|

— |

|

|

|

(206 |

) |

|

|

(52,844 |

) |

|

|

711 |

|

| Real estate depreciation |

|

59,240 |

|

|

|

58,564 |

|

|

|

236,809 |

|

|

|

230,941 |

|

| Funds from

operations |

$ |

258,827 |

|

|

$ |

177,985 |

|

|

$ |

887,250 |

|

|

$ |

765,738 |

|

| Straight-line rent

adjustments |

|

(2,772 |

) |

|

|

(1,449 |

) |

|

|

(4,294 |

) |

|

|

(3,993 |

) |

| Other depreciation(1) |

|

468 |

|

|

|

837 |

|

|

|

1,879 |

|

|

|

5,493 |

|

| Amortization of land

rights |

|

3,289 |

|

|

|

6,445 |

|

|

|

15,859 |

|

|

|

15,616 |

|

| Amortization of debt issuance

costs, bond premiums and original issuance discounts |

|

2,377 |

|

|

|

2,519 |

|

|

|

9,975 |

|

|

|

9,929 |

|

| Accretion on investment in

leases, financing receivables |

|

(5,339 |

) |

|

|

— |

|

|

|

(19,442 |

) |

|

|

— |

|

| Non-cash adjustment to

financing lease liabilities |

|

123 |

|

|

|

— |

|

|

|

483 |

|

|

|

— |

|

| Stock based compensation |

|

4,183 |

|

|

|

3,645 |

|

|

|

20,427 |

|

|

|

16,831 |

|

| Loss (gain) on sale of

operations, net of tax |

|

— |

|

|

|

7,730 |

|

|

|

— |

|

|

|

(3,560 |

) |

| Losses on debt

extinguishment |

|

— |

|

|

|

— |

|

|

|

2,189 |

|

|

|

— |

|

| Impairment charge on land |

|

— |

|

|

|

— |

|

|

|

3,298 |

|

|

|

— |

|

| Provision for credit losses,

net |

|

(21,961 |

) |

|

|

8,226 |

|

|

|

6,898 |

|

|

|

8,226 |

|

| Capital maintenance

expenditures(2) |

|

(57 |

) |

|

|

(615 |

) |

|

|

(159 |

) |

|

|

(2,270 |

) |

| Adjusted funds from

operations |

$ |

239,138 |

|

|

$ |

205,323 |

|

|

$ |

924,363 |

|

|

$ |

812,010 |

|

| Interest, net(3) |

|

74,570 |

|

|

|

71,766 |

|

|

|

304,703 |

|

|

|

282,840 |

|

| Income tax expense |

|

624 |

|

|

|

1,998 |

|

|

|

2,418 |

|

|

|

9,440 |

|

| Capital maintenance

expenditures(2) |

|

57 |

|

|

|

615 |

|

|

|

159 |

|

|

|

2,270 |

|

| Amortization of debt issuance

costs, bond premiums and original issuance discounts |

|

(2,377 |

) |

|

|

(2,519 |

) |

|

|

(9,975 |

) |

|

|

(9,929 |

) |

| Adjusted

EBITDA |

$ |

312,012 |

|

|

$ |

277,183 |

|

|

$ |

1,221,668 |

|

|

$ |

1,096,631 |

|

| |

|

|

|

|

|

|

|

| Net income, per

diluted common shares and OP units |

$ |

0.75 |

|

|

$ |

0.50 |

|

|

$ |

2.70 |

|

|

$ |

2.26 |

|

| FFO, per diluted

common share and OP units |

$ |

0.97 |

|

|

$ |

0.74 |

|

|

$ |

3.40 |

|

|

$ |

3.24 |

|

| AFFO, per diluted

common share and OP units |

$ |

0.89 |

|

|

$ |

0.85 |

|

|

$ |

3.55 |

|

|

$ |

3.44 |

|

| |

|

|

|

|

|

|

|

| Weighted average

number of common shares and OP units outstanding |

|

|

|

|

|

|

|

| Diluted common

shares |

|

260,365,257 |

|

|

|

241,369,486 |

|

|

|

253,846,475 |

|

|

|

236,230,630 |

|

| OP units |

|

7,366,683 |

|

|

|

141,808 |

|

|

|

6,878,857 |

|

|

|

35,743 |

|

| Diluted common shares

and OP units |

|

267,731,940 |

|

|

|

241,511,294 |

|

|

|

260,725,332 |

|

|

|

236,266,373 |

|

(1) Other depreciation includes both real estate

and equipment depreciation from the Company's taxable REIT

subsidiaries.

(2) Capital maintenance expenditures are

expenditures to replace existing fixed assets with a useful life

greater than one year that are obsolete, worn out or no longer cost

effective to repair.

(3) Current year amounts excludes non-cash

interest expense gross up related to the ground lease for the Live!

Maryland property.

Reconciliation of Cash Net Operating IncomeGaming

and Leisure Properties, Inc. and

SubsidiariesCONSOLIDATED(in thousands, except per

share and share data) (unaudited)

| |

Three Months Ended December 31, 2022 |

|

Year Ended December 31, 2022 |

|

Adjusted EBITDA |

$ |

312,012 |

|

|

$ |

1,221,668 |

|

| General and administrative

expenses |

|

11,315 |

|

|

|

51,319 |

|

| Stock based compensation |

|

(4,183 |

) |

|

|

(20,427 |

) |

| Cash net operating

income(1) |

|

319,144 |

|

|

|

1,252,560 |

|

(1) Cash net operating income is rental and

other property income less cash property level expenses.

Gaming and Leisure Properties, Inc.

and SubsidiariesConsolidated Balance

Sheets(in thousands, except share and per share data)

| |

December 31, 2022 |

|

December 31, 2021 |

| |

|

|

|

| Assets |

|

|

|

|

Real estate investments, net |

$ |

7,707,935 |

|

|

$ |

7,777,551 |

|

|

Investment in leases, financing receivables, net |

|

1,903,195 |

|

|

|

1,201,670 |

|

|

Assets held for sale |

|

— |

|

|

|

77,728 |

|

|

Right-of-use assets and land rights, net |

|

834,067 |

|

|

|

851,819 |

|

|

Cash and cash equivalents |

|

239,083 |

|

|

|

724,595 |

|

|

Other assets |

|

246,106 |

|

|

|

57,086 |

|

| Total

assets |

$ |

10,930,386 |

|

|

$ |

10,690,449 |

|

| |

|

|

|

|

Liabilities |

|

|

|

|

Accounts payable, dividend payable and accrued expenses |

$ |

6,561 |

|

|

$ |

63,543 |

|

|

Accrued interest |

|

82,297 |

|

|

|

71,810 |

|

|

Accrued salaries and wages |

|

6,742 |

|

|

|

6,798 |

|

|

Operating lease liabilities |

|

181,965 |

|

|

|

183,945 |

|

|

Financing lease liabilities |

|

53,792 |

|

|

|

53,309 |

|

|

Long-term debt, net of unamortized debt issuance costs, bond

premiums and original issuance discounts |

|

6,128,468 |

|

|

|

6,552,372 |

|

|

Deferred rental revenue |

|

324,774 |

|

|

|

329,068 |

|

|

Other liabilities |

|

27,691 |

|

|

|

39,464 |

|

|

Total liabilities |

|

6,812,290 |

|

|

|

7,300,309 |

|

| |

|

|

|

| Equity |

|

|

|

| |

|

|

|

|

|

|

Preferred stock ($.01 par value, 50,000,000 shares authorized, no

shares issued or outstanding at December 31, 2022 and December 31,

2021) |

|

— |

|

|

|

— |

|

|

Common stock ($.01 par value, 500,000,000 shares authorized,

260,727,030 shares and 247,206,937 shares issued and outstanding at

December 31, 2022 and December 31, 2021, respectively) |

|

2,607 |

|

|

|

2,472 |

|

|

Additional paid-in capital |

|

5,573,567 |

|

|

|

4,953,943 |

|

|

Retained deficit |

|

(1,798,216 |

) |

|

|

(1,771,402 |

) |

|

Total equity attributable to Gaming and Leisure Properties |

|

3,777,958 |

|

|

|

3,185,013 |

|

| Noncontrolling interests in

GLPI's Operating Partnership (7,366,683 units and 4,348,774 units

outstanding at December 31, 2022 and December 31, 2021,

respectively) |

|

340,138 |

|

|

|

205,127 |

|

|

Total equity |

|

4,118,096 |

|

|

|

3,390,140 |

|

| Total liabilities and

equity |

$ |

10,930,386 |

|

|

$ |

10,690,449 |

|

Debt Capitalization

The Company’s debt structure as of December 31, 2022 was as

follows:

| |

|

|

|

| |

|

Years to Maturity |

Interest Rate |

|

Balance |

| |

|

|

|

|

(in thousands) |

|

Unsecured $1,750 Million Revolver Due May 2026 |

|

3.4 |

— |

% |

|

|

— |

|

| Term Loan Credit Facility |

|

4.7 |

— |

% |

|

|

— |

|

| Senior Unsecured Notes Due

November 2023 |

|

0.8 |

5.375 |

% |

|

|

500,000 |

|

| Senior Unsecured Notes Due

September 2024 |

|

1.7 |

3.350 |

% |

|

|

400,000 |

|

| Senior Unsecured Notes Due

June 2025 |

|

2.4 |

5.250 |

% |

|

|

850,000 |

|

| Senior Unsecured Notes Due

April 2026 |

|

3.3 |

5.375 |

% |

|

|

975,000 |

|

| Senior Unsecured Notes Due

June 2028 |

|

5.4 |

5.750 |

% |

|

|

500,000 |

|

| Senior Unsecured Notes Due

January 2029 |

|

6.0 |

5.300 |

% |

|

|

750,000 |

|

| Senior Unsecured Notes Due

January 2030 |

|

7.0 |

4.000 |

% |

|

|

700,000 |

|

| Senior Unsecured Notes Due

January 2031 |

|

8.0 |

4.000 |

% |

|

|

700,000 |

|

| Senior Unsecured Notes due

January 2032 |

|

9.0 |

3.250 |

% |

|

|

800,000 |

|

| Other |

|

3.7 |

4.780 |

% |

|

|

583 |

|

| Total long-term

debt |

|

|

|

|

|

6,175,583 |

|

| Less: unamortized debt

issuance costs, bond premiums and original issuance discounts |

|

|

|

|

|

(47,115 |

) |

| Total long-term debt,

net of unamortized debt issuance costs, bond premiums and original

issuance discounts |

|

|

|

|

$ |

6,128,468 |

|

| Weighted

average |

|

5.1 |

4.660 |

% |

|

|

| |

|

|

|

|

|

Rating Agency Update - Issue Rating

|

Rating Agency |

|

Rating |

|

Standard & Poor's |

|

BBB- |

| Fitch |

|

BBB- |

| Moody's |

|

Ba1 |

Properties (1)

|

Description |

Location |

Date Acquired |

Tenant/Operator |

|

PENN Master Lease (19 Properties) |

|

|

|

| Hollywood Casino

Lawrenceburg |

Lawrenceburg, IN |

11/1/2013 |

PENN |

| Hollywood Casino Aurora |

Aurora, IL |

11/1/2013 |

PENN |

| Hollywood Casino Joliet |

Joliet, IL |

11/1/2013 |

PENN |

| Argosy Casino Alton |

Alton, IL |

11/1/2013 |

PENN |

| Hollywood Casino Toledo |

Toledo, OH |

11/1/2013 |

PENN |

| Hollywood Casino Columbus |

Columbus, OH |

11/1/2013 |

PENN |

| Hollywood Casino at Charles

Town Races |

Charles Town, WV |

11/1/2013 |

PENN |

| Hollywood Casino at Penn

National Race Course |

Grantville, PA |

11/1/2013 |

PENN |

| M Resort |

Henderson, NV |

11/1/2013 |

PENN |

| Hollywood Casino Bangor |

Bangor, ME |

11/1/2013 |

PENN |

| Zia Park Casino |

Hobbs, NM |

11/1/2013 |

PENN |

| Hollywood Casino Gulf

Coast |

Bay St. Louis, MS |

11/1/2013 |

PENN |

| Argosy Casino Riverside |

Riverside, MO |

11/1/2013 |

PENN |

| Hollywood Casino Tunica |

Tunica, MS |

11/1/2013 |

PENN |

| Boomtown Biloxi |

Biloxi, MS |

11/1/2013 |

PENN |

| Hollywood Casino St.

Louis |

Maryland Heights, MO |

11/1/2013 |

PENN |

| Hollywood Gaming Casino at

Dayton Raceway |

Dayton, OH |

11/1/2013 |

PENN |

| Hollywood Gaming Casino at

Mahoning Valley Race Track |

Youngstown, OH |

11/1/2013 |

PENN |

| 1st Jackpot Casino |

Tunica, MS |

5/1/2017 |

PENN |

| Amended Pinnacle

Master Lease (12 Properties) |

|

|

|

| Ameristar Black Hawk |

Black Hawk, CO |

4/28/2016 |

PENN |

| Ameristar East Chicago |

East Chicago, IN |

4/28/2016 |

PENN |

| Ameristar Council Bluffs |

Council Bluffs, IA |

4/28/2016 |

PENN |

| L'Auberge Baton Rouge |

Baton Rouge, LA |

4/28/2016 |

PENN |

| Boomtown Bossier City |

Bossier City, LA |

4/28/2016 |

PENN |

| L'Auberge Lake Charles |

Lake Charles, LA |

4/28/2016 |

PENN |

| Boomtown New Orleans |

New Orleans, LA |

4/28/2016 |

PENN |

| Ameristar Vicksburg |

Vicksburg, MS |

4/28/2016 |

PENN |

| River City Casino &

Hotel |

St. Louis, MO |

4/28/2016 |

PENN |

| Jackpot Properties (Cactus

Petes and Horseshu) |

Jackpot, NV |

4/28/2016 |

PENN |

| Plainridge Park Casino |

Plainridge, MA |

10/15/2018 |

PENN |

| Caesars Master Lease

(6 Properties) |

|

|

|

| Tropicana Atlantic City |

Atlantic City, NJ |

10/1/2018 |

CZR |

| Tropicana Laughlin |

Laughlin, NV |

10/1/2018 |

CZR |

| Trop Casino Greenville |

Greenville, MS |

10/1/2018 |

CZR |

| Belle of Baton Rouge |

Baton Rouge, LA |

10/1/2018 |

CZR |

| Isle Casino Hotel

Bettendorf |

Bettendorf, IA |

12/18/2020 |

CZR |

| Isle Casino Hotel

Waterloo |

Waterloo, IA |

12/18/2020 |

CZR |

| Boyd Master Lease (3

Properties) |

|

|

|

| Belterra Casino Resort |

Florence, IN |

4/28/2016 |

BYD |

| Ameristar Kansas City |

Kansas City, MO |

4/28/2016 |

BYD |

| Ameristar St. Charles |

St. Charles, MO |

4/28/2016 |

BYD |

| Bally's Master Lease (

6 Properties) |

|

|

|

| Tropicana Evansville |

Evansville, IN |

06/03/2021 |

BALY |

| Dover Downs |

Dover, DE |

06/03/2021 |

BALY |

| Black Hawk (Black Hawk North,

West and East casinos) |

Black Hawk, CO |

4/1/2022 |

BALY |

| Quad Cities Casino &

Hotel |

Rock Island, IL |

4/01/2022 |

BALY |

| Casino Queen Master

Lease (2 Properties) |

|

|

|

| Casino Queen |

East St. Louis, IL |

1/23/2014 |

Casino Queen |

| Hollywood Casino Baton

Rouge |

Baton Rouge, LA |

12/17/2021 |

Casino Queen |

| Pennsylvania Live!

Master Lease (2 Properties) |

|

|

|

| Live! Casino & Hotel

Philadelphia |

Philadelphia, PA |

3/01/2022 |

Cordish |

| Live! Casino Pittsburgh |

Greensburg, PA |

3/01/2022 |

Cordish |

| |

|

|

|

| Single Asset

Leases |

|

|

|

| Belterra Park Gaming &

Entertainment Center |

Cincinnati, OH |

10/15/2018 |

BYD |

| Horseshoe St. Louis |

St. Louis, MO |

10/1/2018 |

CZR |

| Hollywood Casino at the

Meadows |

Washington, PA |

9/9/2016 |

PENN |

| Hollywood Casino

Morgantown |

Morgantown, PA |

10/1/2020 |

PENN |

| Hollywood Casino

Perryville |

Perryville, MD |

7/1/2021 |

PENN |

| Live! Casino & Hotel

Maryland |

Hanover, MD |

12/29/2021 |

Cordish |

| Tropicana Las Vegas |

Las Vegas, NV |

4/16/2020 |

BALY |

(1) Table above represents properties owned as

of December 31, 2022 and therefore excludes the January 3, 2023

acquisition of Bally's Tiverton and Bally's Biloxi which were added

to the Bally's Master Lease.

Lease Information

| |

Master Leases |

|

|

|

|

|

PENN Master Lease |

PENN Amended Pinnacle Master Lease |

Caesars Amended and Restated Master Lease |

Boyd Master Lease |

Bally's Master Lease |

Casino Queen Master Lease |

Pennsylvania Live! Master Lease operated by

Cordish |

|

Property Count |

19 |

12 |

6 |

3 |

6 |

2 |

2 |

| Number of States

Represented |

10 |

8 |

5 |

2 |

4 |

2 |

1 |

| Commencement Date |

11/1/2013 |

4/28/2016 |

10/1/2018 |

10/15/2018 |

6/3/2021 |

12/17/2021 |

3/1/2022 |

| Lease Expiration Date |

10/31/2033 |

4/30/2031 |

9/30/2038 |

04/30/2026 |

06/02/2036 |

12/17/2036 |

2/28/2061 |

| Remaining Renewal Terms |

15 (3x5 years) |

20 (4x5 years) |

20 (4x5 years) |

25 (5x5 years) |

20 (4x5 years) |

20 (4x5 years) |

21 (1 X 11 years, 1 X 10 years) |

| Corporate Guarantee |

Yes |

Yes |

Yes |

No |

Yes |

Yes |

No |

| Master Lease with Cross

Collateralization |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Technical Default Landlord

Protection |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Default Adjusted Revenue to

Rent Coverage |

1.1 |

1.2 |

1.2 |

1.4 |

1.35(1) |

1.4 |

1.4 |

| Competitive Radius Landlord

Protection |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Escalator

Details |

|

|

|

|

|

|

|

| Yearly Base Rent Escalator

Maximum |

2% |

2% |

(3) |

2% |

(4) |

(5) |

1.75 (6) |

| Coverage ratio at September

30, 2022(2) |

2.21 |

2.23 |

2.48 |

2.81 |

2.52 |

2.76 |

N/A |

| Minimum Escalator Coverage

Governor |

1.8 |

1.8 |

N/A |

1.8 |

N/A |

N/A |

N/A |

| Yearly Anniversary for

Realization |

November |

May |

October |

May |

June |

December |

March 2024 |

| Percentage Rent Reset

Details |

|

|

|

|

|

|

|

| Reset Frequency |

5 years |

2 years |

N/A |

2 years |

N/A |

N/A |

N/A |

| Next Reset |

November 2023 |

May 2024 |

N/A |

May 2024 |

N/A |

N/A |

N/A |

(1) The Bally's Master Lease ratio declines to 1.20 once

annual rent reaches $60 million.

(2) Information with respect to our

tenants' rent coverage over the trailing twelve months was provided

by our tenants as of September 30, 2022. The Casino Queen Master

Lease is calculated on a proforma basis for the addition of

Hollywood Casino Baton Rouge which occurred in December 2021. GLPI

has not independently verified the accuracy of the tenants'

information and therefore makes no representation as to its

accuracy.

(3) Building base rent shall be increased

by 1.25% annually in the 5th and 6th lease year, 1.75% in the 7th

and 8th lease year, and 2% in the 9th lease year and each year

thereafter.

(4) If the CPI increase is at least 0.5%

for any lease year, then the rent shall increase by the greater of

1% of the rent as of the immediately preceding lease year and the

CPI increase capped at 2%. If the CPI is less than 0.5% for such

lease year, then the rent shall not increase for such lease

year.

(5) Rent increases by 0.5% for the first

six years. Beginning in the seventh lease year through the

remainder of the lease term, if the CPI increases by at least 0.25%

for any lease year then annual rent shall be increased by 1.25%,

and if the CPI is less than 0.25% then rent will remain unchanged

for such lease year. (6) Effective on the second

anniversary of the commencement date of the lease.

Lease Information

| |

|

Single Property Leases |

|

|

|

|

|

|

Belterra Park Lease operated by Boyd |

Meadows Lease operated by PENN |

Horseshoe St. Louis Lease operated by CZR |

Morgantown Ground Lease operated by PENN |

Perryville Lease operated by PENN |

Live! Casino & Hotel- Maryland operated by

Cordish |

Tropicana Las Vegas Ground Lease operated

by BALY |

| Commencement Date |

10/15/2018 |

9/9/2016 |

9/29/2020 |

10/1/2020 |

7/1/2021 |

12/29/2021 |

9/26/2022 |

| Lease Expiration Date |

04/30/2026 |

9/30/2026 |

10/31/2033 |

10/31/2040 |

6/30/2041 |

12/31/2060 |

9/25/2072 |

| Remaining Renewal Terms |

25 (5x5 years) |

19 (3x5years, 1x4 years) |

20 (4x5 years) |

30 (6x5 years) |

15 (3x5 years) |

21 (1x11 years, 1x10 years) |

49 (1 x 24 years, 1 x 25 years) |

| Corporate Guarantee |

No |

Yes |

Yes |

Yes |

Yes |

No |

Yes |

| Technical Default Landlord

Protection |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Default Adjusted Revenue to Rent Coverage |

1.4 |

1.2 |

1.2 |

N/A |

1.2 |

1.4 |

1.4 |

| Competitive Radius Landlord

Protection |

Yes |

Yes |

Yes |

N/A |

Yes |

Yes |

Yes |

| Escalator

Details |

|

|

|

|

|

|

|

| Yearly Base Rent Escalator

Maximum |

2% |

5%(1) |

1.25%(2) |

1.5%(3) |

1.5%(4) |

1.75%(5) |

(6) |

| Coverage ratio at September

30, 2022(7) |

4.31 |

1.85 |

2.30 |

N/A |

3.19 |

N/A |

N/A |

| Minimum Escalator Coverage

Governor |

1.8 |

2.0 |

N/A |

N/A |

N/A |

N/A |

N/A |

| Yearly Anniversary for

Realization |

May |

October |

October |

December |

July |

January 2024 |

October |

| Percentage Rent Reset

Details |

|

|

|

|

|

|

|

| Reset Frequency |

2 years |

2 years |

N/A |

N/A |

N/A |

N/A |

N/A |

| Next Reset |

May 2024 |

October 2024 |

N/A |

N/A |

N/A |

N/A |

N/A |

(1) Meadows contains an annual escalator

for up to 5% of the base rent, if certain rent coverage ratio

thresholds are met, which remains at 5% until the earlier of 10

years or the year in which total rent is $31 million, at which

point the escalator is reduced to 2%.

(2) For the second through fifth lease

years, after which time the annual escalation becomes 1.75% for the

6th and 7th lease years and then 2% for the remaining term of the

lease.

(3) Increases by 1.5% on the opening date

(which occurred on December 22, 2021) and for the first three lease

years. Commencing on the fourth anniversary of the opening date and

for each anniversary thereafter, if the CPI increase is at least

0.5% for any lease year, the rent for such lease year shall

increase by 1.25% of rent as of the immediately preceding lease

year, and if the CPI increase is less than 0.5% for such lease

year, then the rent shall not increase for such lease year.

(4) Building base rent increases for the

second through fourth lease years, after which time the annual

escalation becomes 1.25% to the extent CPI for the preceding lease

year is at least 0.5%.

(5) Effective on the second anniversary of

the commencement date of the lease.

(6) If the CPI increase is at least 0.5%

for any lease year, then the rent shall increase by the greater of

1% of the rent as of the immediately preceding lease year and the

CPI increase capped at 2%. If the CPI is less than 0.5% for such

lease year, then the rent shall not increase for such lease

year.

(7) Information with respect to our

tenants' rent coverage over the trailing twelve months was provided

by our tenants as of September 30, 2022. GLPI has not independently

verified the accuracy of the tenants' information and therefore

makes no representation as to its accuracy.

Disclosure Regarding Non-GAAP Financial

Measures

FFO, FFO per diluted common share and OP units,

AFFO, AFFO per diluted common share and OP units, Adjusted EBITDA

and Cash Net Operating Income ("Cash NOI"), which are detailed in

the reconciliation tables that accompany this release, are used by

the Company as performance measures for benchmarking against the

Company’s peers and as internal measures of business operating

performance, which is used for a bonus metric. These metrics

are presented assuming full conversion of limited partnership units

to common shares and therefore before the income statement impact

of non-controlling interests. The Company believes FFO, FFO per

diluted common share and OP units, AFFO, AFFO per diluted common

share and OP units, Adjusted EBITDA and Cash NOI provide a

meaningful perspective of the underlying operating performance of

the Company’s current business. This is especially true since

these measures exclude real estate depreciation and we believe that

real estate values fluctuate based on market conditions rather than

depreciating in value ratably on a straight-line basis over time.

Cash NOI is rental and other property income, less cash property

level expenses. Cash NOI excludes depreciation, the amortization of

land rights, real estate general and administrative expenses, other

non-routine costs and the impact of certain generally accepted

accounting principles (“GAAP”) adjustments to rental revenue, such

as straight-line rent adjustments and non-cash ground lease income

and expense. It is management's view that Cash NOI is a performance

measure used to evaluate the operating performance of the Company’s

real estate operations and provides investors relevant and useful

information because it reflects only income and operating expense

items that are incurred at the property level and presents them on

an unleveraged basis.

FFO, FFO per diluted common share and OP units,

AFFO, AFFO per diluted common share and OP units, Adjusted EBITDA

and Cash NOI are non-GAAP financial measures that are considered

supplemental measures for the real estate industry and a supplement

to GAAP measures. NAREIT defines FFO as net income (computed

in accordance with GAAP), excluding (gains) or losses from

dispositions of property, net of tax and real estate

depreciation. We have defined AFFO as FFO excluding, as

applicable to the particular period, stock based compensation

expense, the amortization of debt issuance costs, bond premiums and

original issuance discounts, other depreciation, the amortization

of land rights, accretion on investment in leases, financing

receivables, non-cash adjustments to financing lease liabilities,

impairment charges, straight-line rent adjustments, losses or

(gains) on sales of operations, net of tax, losses on debt

extinguishment, and provision for credit losses, net, reduced by

capital maintenance expenditures. We have defined Adjusted

EBITDA as net income excluding, as applicable to the particular

period, interest, net, income tax expense, real estate

depreciation, other depreciation, (gains) or losses from

dispositions of property, net of tax, (gains) or losses on sales of

operations, net of tax, stock based compensation expense,

straight-line rent adjustments, the amortization of land rights,

accretion on investment in leases, financing receivables, non-cash

adjustments to financing lease liabilities, impairment charges,

losses on debt extinguishment, and provision for credit losses,

net. For financial reporting and debt covenant purposes, the

Company includes the amounts of non-cash rents earned in FFO, AFFO,

and Adjusted EBITDA. Finally, we have defined Cash NOI as Adjusted

EBITDA excluding general and administrative expenses and including,

as applicable to the particular period, stock based compensation

expense and (gains) or losses from dispositions of property.

FFO, FFO per diluted common share and OP units,

AFFO, AFFO per diluted common share and OP units, Adjusted EBITDA

and Cash NOI are not recognized terms under GAAP. These

non-GAAP financial measures: (i) do not represent cash flow from

operations as defined by GAAP; (ii) should not be considered as an

alternative to net income as a measure of operating performance or

to cash flows from operating, investing and financing activities;

and (iii) are not alternatives to cash flow as a measure of

liquidity. In addition, these measures should not be viewed as an

indication of our ability to fund all of our cash needs, including

to make cash distributions to our shareholders, to fund capital

improvements, or to make interest payments on our indebtedness.

Investors are also cautioned that FFO, FFO per diluted common

share, AFFO, AFFO per diluted common share, Adjusted EBITDA and

Cash NOI, as presented, may not be comparable to similarly titled

measures reported by other real estate companies, including REITs,

due to the fact that not all real estate companies use the same

definitions. Our presentation of these measures does not replace

the presentation of our financial results in accordance with

GAAP.

About Gaming and Leisure

Properties

GLPI is engaged in the business of acquiring,

financing, and owning real estate property to be leased to gaming

operators in triple-net lease arrangements, pursuant to which the

tenant is responsible for all facility maintenance, insurance

required in connection with the leased properties and the business

conducted on the leased properties, taxes levied on or with respect

to the leased properties and all utilities and other services

necessary or appropriate for the leased properties and the business

conducted on the leased properties.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including our expectations regarding our 2023

AFFO guidance and the Company being positioned to deliver long-term

growth through portfolio expansion and diversification and to

benefit from Bally's and PENN's long-term growth. Forward-looking

statements can be identified by the use of forward-looking

terminology such as “expects,” “believes,” “estimates,” “intends,”

“may,” “will,” “should” or “anticipates” or the negative or other

variation of these or similar words, or by discussions of future

events, strategies or risks and uncertainties. Such forward looking

statements are inherently subject to risks, uncertainties and

assumptions about GLPI and its subsidiaries, including risks

related to the following: the effect of pandemics, such as

COVID-19, on GLPI as a result of the impact such pandemics may have

on the business operations of GLPI's tenants and their continued

ability to pay rent in a timely manner or at all; the potential

negative impact of recent high levels of inflation (which have been

exacerbated by the armed conflict between Russia and Ukraine) on

our tenants' operations; the availability of and the ability to

identify suitable and attractive acquisition and development

opportunities and the ability to acquire and lease those properties

on favorable terms; the ability to receive, or delays in obtaining,

the regulatory approvals required to own and/or operate its

properties, or other delays or impediments to completing

acquisitions or projects; GLPI's ability to maintain its status as

a REIT; our ability to access capital through debt and equity

markets in amounts and at rates and costs acceptable to GLPI; the

impact of our substantial indebtedness on our future operations;

changes in the U.S. tax law and other state, federal or local laws,

whether or not specific to REITs or to the gaming or lodging

industries; and other factors described in GLPI’s Annual Report on

Form 10-K for the year ended December 31, 2022, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, each as filed

with the Securities and Exchange Commission. All subsequent written

and oral forward-looking statements attributable to GLPI or persons

acting on GLPI’s behalf are expressly qualified in their entirety

by the cautionary statements included in this press release. GLPI

undertakes no obligation to publicly update or revise any

forward-looking statements contained or incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by law. In light of these risks,

uncertainties and assumptions, the forward-looking events discussed

in this press release may not occur as presented or at all.

|

Contact: |

|

| Gaming and Leisure Properties, Inc. |

Investor Relations |

| Matthew Demchyk, Chief Investment Officer |

Joseph Jaffoni, Richard Land, James Leahy at JCIR |

| 610/401-2900 |

212/835-8500 |

| |

glpi@jcir.com |

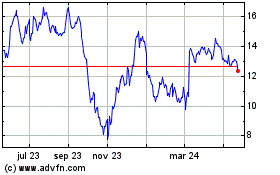

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

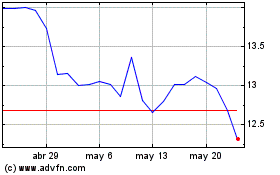

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025