UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-38077

Bright Scholar Education Holdings Limited

No. 1, Country Garden Road

Beijiao Town, Shunde District, Foshan, Guangdong

528300

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Bright Scholar Education Holdings Limited |

| |

|

|

| Date: November 26, 2024 |

By: |

/s/ Hui Zhang |

| |

Name: |

Hui Zhang |

| |

Title: |

Chief Financial Officer |

EXHIBIT INDEX

2

Exhibit 99.1

Bright Scholar Announces Unaudited Financial

Results for the Fourth Quarter and Fiscal Year 2024

Gross Profit from continuing operations increased

7.7% YoY and gross margin from continuing operations grew 2.3 ppts for fiscal year 2024

Management to hold a conference call today at

7:00 a.m. Eastern Time

CAMBRIDGE, England and FOSHAN, China, November

25, 2024 /PRNewswire/—Bright Scholar Education Holdings Limited (“Bright Scholar,” the “Company,” “we”

or “our”) (NYSE: BEDU), a global premier education service company, today announced its unaudited financial results for its

fourth quarter and fiscal year 2024 ended August 31, 2024.

FOURTH QUARTER OF FISCAL 2024 FINANCIAL HIGHLIGHTS

| ● | Revenue

from continuing operations was RMB358.3 million, compared to RMB442.2 million for the same quarter last fiscal year. |

| ● | Revenue

from Overseas Schools was RMB185.1 million, representing a 0.2% increase from RMB184.8 million for the same quarter last fiscal year. |

| ● | Loss

from continuing operations was RMB954.8 million, compared to RMB285.1 million for the same quarter last fiscal year. Adjusted net loss1

narrowed by 24.3% to RMB92.0 million from RMB121.4 million for the same quarter last fiscal year. |

Revenue from continuing operations by Segment

| | |

For the fourth quarter ended

August 31, | | |

YoY | | |

% of total revenue in | |

| (RMB in millions except for percentage) | |

2024 | | |

2023 | | |

% Change | | |

F4Q2024 | |

| Overseas Schools | |

| 185.1 | | |

| 184.8 | | |

| 0.2 | % | |

| 51.7 | % |

| Complementary Education Services2 | |

| 129.8 | | |

| 161.7 | | |

| -19.7 | % | |

| 36.2 | % |

| Domestic Kindergartens & K-12 Operation Services3 | |

| 43.4 | | |

| 95.7 | | |

| -54.7 | % | |

| 12.1 | % |

| Total | |

| 358.3 | | |

| 442.2 | | |

| -19.0 | % | |

| 100.0 | % |

| 1. | Adjusted net income/(loss) is defined as net income/(loss) excluding

share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss

on goodwill, impairment loss on intangible assets, impairment loss on property and equipment, impairment loss on the long-term investments,

and income/(loss) from discontinued operations, net of tax. |

| 2. | The Complementary Education Services business comprises, overseas

study counselling, art training, camps and others. |

| 3. | The Domestic Kindergartens & K-12 Operation Services business

comprises operation services for students of domestic K-12 schools, including catering and procurement services. For more information

on these adjusted financial measures, please see the section captioned “Non-GAAP Financial Measures” and the tables captioned

“Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this release. |

FISCAL YEAR 2024 FINANCIAL HIGHLIGHTS

| ● | Revenue

from continuing operations was RMB1,755.2 million, compared to RMB1,772.1 million for the last fiscal year. |

| ● | Revenue

from Overseas Schools was RMB951.2 million, representing an increase of 17.5% from the last fiscal year. |

| ● | Gross

profit from continuing operations was RMB503.6 million, representing an increase of 7.7% from RMB467.4 million for the last fiscal year.

Gross margin from continuing operations increased to 28.7% from 26.4% for the last fiscal year. |

| ● | Loss

from continuing operations was RMB869.1 million, compared to RMB358.9 million for the last fiscal year. Adjusted net income was RMB1.1

million, compared to adjusted net loss of RMB192.6 for the last fiscal year. |

Revenue from continuing operations by Segment

| | |

For the fiscal year ended

August 31, | | |

YoY | | |

% of total revenue in | |

| (RMB in millions except for percentage)

| |

2024 | | |

2023 | | |

% Change | | |

FY24 | |

| Overseas Schools | |

| 951.2 | | |

| 809.5 | | |

| 17.5 | % | |

| 54.2 | % |

| Complementary Education Services | |

| 495.1 | | |

| 519.2 | | |

| -4.7 | % | |

| 28.2 | % |

| Domestic Kindergartens & K-12 Operation Services | |

| 308.9 | | |

| 443.4 | | |

| -30.3 | % | |

| 17.6 | % |

| Total | |

| 1,755.2 | | |

| 1,772.1 | | |

| -1.0 | % | |

| 100.0 | % |

MANAGEMENT COMMENTARY

Mr. Robert Niu, Chief Executive Officer of Bright

Scholar, commented, “Throughout the year, we bolstered our global business and operations, strengthening our foundation for future

advancement. Despite macro challenges, we achieved rapid progress in our overseas business while further enhancing our senior leadership

team to help advance our near-term expansion goals in overseas markets. Our Overseas Schools business maintained its double-digit year-over-year

revenue growth for the fiscal year. As we focused our resources on strengthening our high-growth core business, we have completed divesting

non-core business from our Complementary Education Services segment by the end of the fiscal quarter. Moving into fiscal year 2025, we

plan to reinforce our “dual-engine” growth strategy by focusing on the continued expansion of our overseas school business

while propelling our global recruitment initiatives for prospective international students. We are well-positioned to drive further expansion

and capture more of the sizeable market opportunities that will support our sustainable development over the long term.”

Ms. Cindy Zhang, Chief Financial Officer of Bright

Scholar, added, “Ongoing development across our core businesses drove our healthy financial results for the fiscal year. Our total

revenues for fiscal year 2024 remained stable year over year, with Overseas Schools revenue increasing by 18%. We continued to streamline

our operations and improve operational efficiency. Notably, our gross profit increased by 7.7% and gross margin by 2.3 percentage points

year-over-year. Meanwhile, we significantly enhanced our cash position, increasing our cash and cash equivalents and restricted cash by

20% for the fiscal year. Looking ahead, supported by our healthy balance sheet and the effective implementation of our “dual-engine”

growth strategy, we are confident we can solidify our competitive edge while also driving long-term growth and profitability.”

UNAUDITED

FINANCIAL RESULTS for THE fourth FISCAL QUARTER ENDED august 31, 2024

Revenue from Continuing Operations

Revenue was RMB358.3 million, compared to RMB442.2

million for the same quarter last fiscal year.

Overseas Schools: Revenue contribution

was RMB185.1 million, representing a 0.2% increase from RMB184.8 million for the same quarter last fiscal year.

Complementary Education Services: Revenue

contribution was RMB129.8 million, compared to RMB161.7 million for the same quarter last fiscal year. The decrease was mainly attributable

to a reduction in extracurricular programs and study tours.

Domestic Kindergartens & K-12 Operation

Services: Revenue contribution was RMB43.4 million, compared to RMB95.7 million for the same quarter last fiscal year.

Cost of Revenue from Continuing Operations

Cost of revenue was RMB322.4 million, or 90.0%

of revenue, compared to RMB362.4 million, or 81.9%, for the same quarter last fiscal year.

Gross Profit, Gross Margin and Adjusted Gross Profit from Continuing

Operations

Gross profit was RMB35.9 million, compared to

RMB79.8 million for the same quarter last fiscal year. Gross margin was 10.0%, compared to 18.1% for the same quarter last fiscal year.

Adjusted gross profit4

was RMB36.9 million, compared to RMB80.9 million for the same quarter last fiscal year.

Selling, General and Administrative (SG&A)

Expenses from Continuing Operations

Total SG&A expenses were RMB119.3 million,

representing an 18.3% decrease from RMB146.0 million for the same quarter last fiscal year. This improvement was mainly due to our continuous

efforts to streamline our operations and improve operational efficiency in our headquarters.

Operating Loss/Income, Operating Margin and

Adjusted Operating Income from Continuing Operations

Operating loss was RMB941.8 million, compared

to RMB227.6 million for the same quarter last fiscal year. Operating loss margin was 262.9%, compared to 51.5% for the same quarter last

fiscal year.

Adjusted operating loss5

was RMB78.8 million, compared to RMB64.0 million for the same quarter last fiscal year.

Net Loss and Adjusted Net Income/Loss

Net loss was RMB1,004.7 million, compared to RMB340.3

million for the same quarter last fiscal year.

Adjusted net loss was RMB92.0 million, compared

to RMB121.4 million for the same quarter last fiscal year.

| 4 | Adjusted gross profit from continuing operations is defined

as gross profit from continuing operations excluding amortization of intangible assets. |

| 5. | Adjusted operating income/(loss) from continuing operations

is defined as operating income/(loss) from continuing operations excluding share-based compensation expenses, amortization of intangible

assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, and impairment

loss on the long-term investments. |

Adjusted EBITDA6

Adjusted EBITDA loss was RMB81.8 million, compared

to RMB55.0 million for the same quarter last fiscal year.

Net Loss per Ordinary Share/ADS and Adjusted

Net Earnings/Loss per Ordinary Share/ADS

Basic and diluted net loss per ordinary share

attributable to ordinary shareholders from continuing operations were RMB7.90 each, compared to RMB2.41 each for the same quarter last

fiscal year.

Basic and diluted net loss per ordinary share

attributable to ordinary shareholders from discontinued operations were RMB0.42 each, compared to RMB0.50 each for the same quarter last

fiscal year.

Adjusted basic and diluted net loss per ordinary

share7 attributable to ordinary shareholders were RMB0.75 each, compared to RMB1.03

each for the same quarter last fiscal year.

Basic and diluted net loss per ADS attributable

to ADS holders from continuing operations were RMB31.60 each, compared to RMB9.64 each for the same quarter last fiscal year.

Basic and diluted net loss per ADS attributable

to ADS holders from discontinued operations were RMB1.68 each, compared to RMB2.00 each for the same quarter last fiscal year.

Adjusted basic and diluted net loss per ADS8

attributable to ADS holders were RMB3.00 each, compared to RMB4.12 each for the same quarter last fiscal year.

UNAUDITED

FINANCIAL RESULTS for THE FISCAL Year ENDED august 31, 2024

Revenue from Continuing Operations

Revenue was RMB1,755.2 million, compared to RMB1,772.1

million for the last fiscal year.

Overseas Schools: Revenue contribution

was RMB951.2 million, representing a 17.5% increase from RMB809.5 million for the last fiscal year. The increase was mainly attributable

to increases in both the number of students enrolled and the average tuition fees of overseas schools.

Complementary Education Services: Revenue

contribution was RMB495.1 million, compared to RMB519.2 million for the last fiscal year. The decrease was mainly attributable to a reduction

in extracurricular programs and study tours.

Domestic Kindergartens & K-12 Operation

Services: Revenue contribution was RMB308.9 million, compared to RMB443.4 million for the last fiscal year.

| 6. | Adjusted EBITDA is defined as net income/(loss) excluding interest

income/(expense), net, income tax expense/benefit, depreciation and amortization, share-based compensation expenses, impairment loss

on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments

and income/(loss) from discontinued operations, net of tax. |

| 7 | Adjusted basic and diluted earnings/(loss) per share is defined

as adjusted net income/(loss) attributable to ordinary shareholders (net income/(loss) attributable to ordinary shareholders excluding

share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible assets, impairment loss

on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on the long-term investments

and income/(loss) from discontinued operations, net of tax) divided by the weighted average number of basic and diluted ordinary shares. |

| 8. | Adjusted basic and diluted earnings/(loss) per American Depositary

Share (“ADS”) is defined as adjusted net income/(loss) attributable to ADS shareholders (net income/(loss) attributable to

ADS shareholders excluding share-based compensation expenses, amortization of intangible assets, tax effect of amortization of intangible

assets, impairment loss on property and equipment, impairment loss on goodwill, impairment loss on intangible assets, impairment loss

on the long-term investments and income/(loss) from discontinued operations, net of tax) divided by the weighted average number of basic

and diluted ADSs. |

Cost of Revenue from Continuing Operations

Cost of revenue was RMB1,251.6 million, or 71.3%

of revenue, compared to RMB1,304.7 million, or 73.6%, for the last fiscal year. The improvement was mainly attributable to cost-saving

measures.

Gross Profit, Gross Margin and Adjusted Gross Profit from Continuing

Operations

Gross profit was RMB503.6 million, representing

a 7.7% increase from RMB467.4 million for the last fiscal year. The increase was mainly attributable to the revenue growth in Overseas

Schools. Gross margin increased to 28.7% from 26.4% for the last fiscal year.

Adjusted gross profit was RMB507.8 million, representing

a 7.6% increase from RMB471.8 million for the last fiscal year.

Selling, General and Administrative (SG&A)

Expenses from Continuing Operations

Total SG&A expenses were RMB469.0 million,

representing an 8.1% decrease from RMB510.3 million for the last fiscal year. This improvement was mainly due to our continuous efforts

to streamline our global operations and improve operational efficiency in our headquarters.

Operating Loss/Income, Operating Margin and

Adjusted Operating Income from Continuing Operations

Operating loss was RMB820.4 million, compared

to RMB161.7 million for the last fiscal year. Operating loss margin was 46.7%, compared to 9.1% for the last fiscal year.

Adjusted operating income increased by 856.3%

to RMB50.5 million, from RMB5.3 million for the last fiscal year.

Net Loss and Adjusted Net Income/Loss

Net loss was RMB1,032.9 million, compared to RMB386.8

million for the last fiscal year.

Adjusted net income was RMB1.1 million, compared

to adjusted net loss of RMB192.6 million for the last fiscal year.

Adjusted EBITDA

Adjusted EBITDA increased by 44.1% to RMB80.7

million, from RMB56.0 million for the last fiscal year.

Net Loss per Ordinary Share/ADS and Adjusted

Net Earnings/Loss per Ordinary Share/ADS

Basic and diluted net loss per ordinary share

from continuing operations attributable to ordinary shareholders were RMB7.18 each, compared to RMB3.03 each for the last fiscal year.

Basic and diluted net loss per ordinary share

from discontinued operations attributable to ordinary shareholders were RMB1.22 each, compared to RMB0.30 each for the last fiscal year.

Adjusted basic and diluted net income per ordinary

share attributable to ordinary shareholders were RMB0.04 each, compared to net loss per ordinary share attributable to ordinary shareholders

of RMB1.63 each for the last fiscal year.

Basic and diluted net loss per ADS from continuing

operations attributable to ADS holders were RMB28.72 each, compared to RMB12.12 each for the last fiscal year.

Basic and diluted net loss per ADS from discontinued

operations attributable to ADS holders were RMB4.88 each, compared to RMB1.20 each for the last fiscal year.

Adjusted basic and diluted net income per ADS

attributable to ADS holders were RMB0.16 each, compared to net loss per ADS attributable to ADS holders were RMB6.52 each for the last

fiscal year.

Cash and Working Capital

As of August 31, 2024, the Company had cash and

cash equivalents and restricted cash of RMB505.8 million (US$71.3 million), compared to RMB419.9 million as of August 31, 2023.

Conference

Call

The Company’s management will host an earnings

conference call at 7:00 a.m. U.S. Eastern Time (8:00 p.m. Beijing/Hong Kong Time) on November 25, 2024.

Dial-in details for the earnings conference call

are as follows:

| Mainland China: |

4001-201203 |

| Hong Kong: |

800-905945 |

| United States: |

1-888-346-8982 |

| International: |

1-412-902-4272 |

Participants should dial in at least 5 minutes

before the scheduled start time and ask to be connected to the call for “Bright Scholar Education Holdings Limited.”

Additionally, a live and archived webcast of the

conference call will be available on the Company’s investor relations website at http://ir.brightscholar.com/.

A replay of the conference call will be accessible after the conclusion

of the live call until December 2, 2024, by dialing the following telephone numbers:

| United States Toll Free: |

1-877-344-7529 |

| International: |

1-412-317-0088 |

| Replay Passcode: |

7352870 |

CONVENIENCE TRANSLATION

The Company’s reporting currency is Renminbi (“RMB”).

However, periodic reports made to shareholders will include current period amounts translated into U.S. dollars using the prevailing exchange

rates at the balance sheet date for the convenience of readers. Translations of balances in the condensed consolidated balance sheets,

and the related condensed consolidated statements of operations, and cash flows from RMB into U.S. dollars as of and for the quarter ended

August 30, 2024 are solely for the convenience of the readers and were calculated at the rate of US$1.00=RMB7.0900,

representing the noon buying rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on August 30, 2024. No representation

is made that the RMB amounts could have been, or could be, converted, realized or settled into US$ at that rate on August 30, 2024, or

at any other rate.

NON-GAAP FINANCIAL MEASURES

In evaluating our business, we consider and use

certain non-GAAP measures, including primarily adjusted EBITDA, adjusted net income/(loss), adjusted gross profit/(loss), adjusted operating

income/(loss), adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders basic and diluted as supplemental

measures to review and assess our operating performance. The presentation of these non-GAAP financial measures is not intended to be considered

in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define adjusted

gross profit/(loss) from continuing operations as gross profit/(loss) from continuing operations excluding amortization of intangible

assets. We define adjusted EBITDA as net income/(loss) excluding interest income/(expense), net, income tax expense/benefit, depreciation

and amortization, share-based compensation expenses, impairment loss on property and equipment, impairment loss on goodwill, impairment

loss on intangible assets, impairment loss on the long-term investments and income/(loss) from discontinued operations, net of tax. We

define adjusted net income/(loss) as net income/(loss) excluding share-based compensation expenses, amortization of intangible assets,

tax effect of amortization of intangible assets, impairment loss on goodwill, impairment loss on intangible assets, impairment loss on

property and equipment, impairment loss on the long-term investments, and income/(loss) from discontinued operations, net of tax. We define

adjusted operating income/(loss) from continuing operations as operating income/(loss) from continuing operations excluding share-based

compensation expenses, amortization of intangible assets, impairment loss on property and equipment, impairment loss on goodwill, impairment

loss on intangible assets and impairment loss on the long-term investments. Additionally, we define adjusted net earnings/(loss) per share

attributable to ordinary shareholders/ADS holders, basic and diluted, as adjusted net income/(loss) attributable to ordinary shareholders/ADS

holders (net income/(loss) to ordinary shareholders/ADS holders excluding share-based compensation expenses, amortization of intangible

assets, tax effect of amortization of intangible assets, impairment loss on goodwill, impairment loss on intangible assets,, impairment

loss on property and equipment, impairment loss on the long-term investments, and income/(loss) from discontinued operations, net of tax)

divided by the weighted average number of basic and diluted ordinary shares or ADSs.

We incur amortization expense of intangible assets

related to various acquisitions that have been made in recent years. These intangible assets are valued at the time of acquisition and

are then amortized over a period of several years after the acquisition. We believe that exclusion of these expenses allows greater comparability

of operating results that are consistent over time for the Company’s newly-acquired and long-held business as the related intangibles

do not have significant connection to the growth of the business. Therefore, we provide exclusion of amortization of intangible assets

to define adjusted gross profit from continuing operations, adjusted operating income/(loss) from continuing operations, adjusted net

income/(loss), and adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders, basic and diluted. In addition,

the strategic move to dispose of the non-core businesses is viewed as discontinued operations, which is a non-recurring item. The exclusion

facilitates comparisons of our operating performance on a period-to-period basis. Therefore, we provide exclusion of income/(loss) from

discontinued operations, net of tax, to define adjusted net income/(loss), adjusted EBITDA, adjusted net earnings/(loss) per share attributable

to ordinary shareholders/ADS holders, basic and diluted.

We present the non-GAAP financial measures because

they are used by our management to evaluate our operating performance and formulate business plans. Such non-GAAP measures include adjusted

EBITDA, adjusted net income/(loss), adjusted gross profit/(loss) from continuing operations, adjusted operating income/(loss) from continuing

operations, adjusted net earnings/(loss) per share attributable to ordinary shareholders/ADS holders basic and diluted. Non-GAAP financial

measures enable our management to assess our operating results without considering the impact of non-cash charges, including depreciation

and amortization and share-based compensation expenses, and without considering the impact of non-operating items such as interest income/(expense),

net; income tax expense/benefit; share-based compensation expenses; amortization of intangible assets, tax effect of amortization of intangible

assets, and without considering the impact of non-recurring item, i.e. income/(loss) from discontinued operations. We also believe that

the use of these non-GAAP measures facilitates investors’ assessment of our operating performance.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools.

One of the key limitations of using these non-GAAP financial measures is that they do not reflect all items of income and expense that

affect our operations. Interest income/(expense), net; income tax expense/benefit; depreciation and amortization; share-based compensation

expense; tax effect of amortization of intangible assets have been and may continue to be incurred in our business and are not reflected

in the presentation of these non-GAAP measures, including adjusted EBITDA or adjusted net income/(loss). Further, these non-GAAP measures

may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

About Bright Scholar Education Holdings Limited

Bright Scholar is a premier global education service

Group. The Company primarily provides quality international education to global students and equips them with the critical academic foundation

and skillsets necessary to succeed in the pursuit of higher education.

For more information, please visit: https://ir.brightscholar.com/.

Safe Harbor Statement

This announcement contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s business plans and development,

which can be identified by terminology such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. Such statements are based upon management’s current expectations and

current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all

of which are difficult to predict and many of which are beyond the Company’s control, which may cause the Company’s actual

results, performance or achievements to differ materially from those in the forward-looking statements. Further information regarding

these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission.

The Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or

otherwise, except as required under law.

IR Contact:

Email: BEDU@thepiacentegroup.com

Phone: +86 (10) 6508-0677/ +1-212-481-2050

Media Contact:

Email: media@brightscholar.com

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

| | |

As of | |

| | |

August 31, | | |

August 31, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 410,086 | | |

| 493,377 | | |

| 69,588 | |

| Restricted cash | |

| 9,521 | | |

| 12,167 | | |

| 1,716 | |

| Accounts receivable, net | |

| 13,800 | | |

| 18,793 | | |

| 2,651 | |

| Amounts due from related parties, net | |

| 183,468 | | |

| 14,417 | | |

| 2,033 | |

| Other receivables, deposits and other assets, net | |

| 116,807 | | |

| 123,860 | | |

| 17,470 | |

| Inventories | |

| 1,183 | | |

| 1,160 | | |

| 164 | |

| Current assets belong to discontinued operations | |

| 192,534 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Total current assets | |

| 927,399 | | |

| 663,774 | | |

| 93,622 | |

| | |

| | | |

| | | |

| | |

| Restricted cash - non-current | |

| 250 | | |

| 250 | | |

| 35 | |

| Property and equipment, net | |

| 390,006 | | |

| 349,349 | | |

| 49,273 | |

| Intangible assets, net | |

| 310,022 | | |

| 49,598 | | |

| 6,995 | |

| Goodwill, net | |

| 1,110,802 | | |

| 527,297 | | |

| 74,372 | |

| Long-term investments, net | |

| 32,732 | | |

| 24,421 | | |

| 3,444 | |

| Prepayments for construction contracts | |

| 1,712 328 | | |

| 46 | | |

| | |

| Deferred tax assets, net | |

| 1,644 | | |

| 1,920 | | |

| 271 | |

| Other non-current assets, net | |

| 9,424 | | |

| 9,106 | | |

| 1,284 | |

| Operating lease right-of-use assets - non current | |

| 1,490,009 | | |

| 1,419,406 | | |

| 200,198 | |

| Non-current assets belong to discontinued operations | |

| 345,510 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Total non-current assets | |

| 3,692,111 | | |

| 2,381,675 | | |

| 335,918 | |

| | |

| | | |

| | | |

| | |

| TOTAL ASSETS | |

| 4,619,510 | | |

| 3,045,449 | | |

| 429,540 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS-CONTINUED

(Amounts in thousands)

| | |

As of | |

| | |

August 31, | | |

August 31, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | |

| LIABILITIES AND EQUITY | |

| | |

| | |

| |

| Current liabilities | |

| | |

| | |

| |

| Accounts payable | |

| 94,481 | | |

| 91,843 | | |

| 12,954 | |

| Amounts due to related parties | |

| 244,259 | | |

| 78,365 | | |

| 11,053 | |

| Accrued expenses and other current liabilities | |

| 233,053 | | |

| 191,222 | | |

| 26,971 | |

| Income tax payable | |

| 88,460 | | |

| 78,986 | | |

| 11,140 | |

| Contract liabilities - current | |

| 428,617 | | |

| 445,715 | | |

| 62,865 | |

| Refund liabilities - current | |

| 10,129 | | |

| 9,872 | | |

| 1,392 | |

| Operating lease liabilities - current | |

| 104,905 | | |

| 106,325 | | |

| 14,996 | |

| Current liabilities belong to discontinued operations | |

| 276,499 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Total current liabilities | |

| 1,480,403 | | |

| 1,002,328 | | |

| 141,371 | |

| Non-current contract liabilities | |

| 971 | | |

| 866 | | |

| 122 | |

| Deferred tax liabilities, net | |

| 34,755 | | |

| 31,174 | | |

| 4,397 | |

| Operating lease liabilities - non current | |

| 1,461,255 | | |

| 1,404,973 | | |

| 198,163 | |

| Non-current liabilities belong to discontinued operations | |

| 70,470 | | |

| - | | |

| - | |

| Total non-current liabilities | |

| 1,567,451 | | |

| 1,437,013 | | |

| 202,682 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 3,047,854 | | |

| 2,439,341 | | |

| 344,053 | |

| | |

| | | |

| | | |

| | |

| EQUITY | |

| | | |

| | | |

| | |

| Share capital | |

| 8 | | |

| 8 | | |

| 1 | |

| Additional paid-in capital | |

| 1,697,370 | | |

| 1,783,490 | | |

| 251,550 | |

| Statutory reserves | |

| 20,155 | | |

| 16,535 | | |

| 2,332 | |

| Accumulated other comprehensive income | |

| 172,230 | | |

| 191,397 | | |

| 26,995 | |

| Accumulated deficit | |

| (473,154 | ) | |

| (1,474,619 | ) | |

| (207,986 | ) |

| | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| 1,416,609 | | |

| 516,811 | | |

| 72,892 | |

| Non-controlling interests | |

| 155,047 | | |

| 89,297 | | |

| 12,595 | |

| | |

| | | |

| | | |

| | |

| TOTAL EQUITY | |

| 1,571,656 | | |

| 606,108 | | |

| 85,487 | |

| | |

| | | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

| 4,619,510 | | |

| 3,045,449 | | |

| 429,540 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except for shares and per

share data)

| | |

Three Months Ended August 31 | | |

Year Ended August 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Continuing operations | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| 442,187 | | |

| 358,271 | | |

| 50,532 | | |

| 1,772,127 | | |

| 1,755,206 | | |

| 247,561 | |

| Cost of revenue | |

| (362,354 | ) | |

| (322,407 | ) | |

| (45,473 | ) | |

| (1,304,699 | ) | |

| (1,251,620 | ) | |

| (176,533 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 79,833 | | |

| 35,864 | | |

| 5,059 | | |

| 467,428 | | |

| 503,586 | | |

| 71,028 | |

| Selling, general and administrative expenses | |

| (145,996 | ) | |

| (119,253 | ) | |

| (16,820 | ) | |

| (510,269 | ) | |

| (469,047 | ) | |

| (66,156 | ) |

| Impairment loss on goodwill | |

| (147,116 | ) | |

| (593,748 | ) | |

| (83,744 | ) | |

| (147,116 | ) | |

| (593,748 | ) | |

| (83,744 | ) |

| Impairment loss on intangible assets | |

| - | | |

| (258,326 | ) | |

| (36,435 | ) | |

| - | | |

| (258,326 | ) | |

| (36,435 | ) |

| Impairment loss on property and equipment | |

| (12,891 | ) | |

| (6,607 | ) | |

| (932 | ) | |

| (12,891 | ) | |

| (6,607 | ) | |

| (932 | ) |

| Impairment loss on the long-term investments | |

| (2,613 | ) | |

| - | | |

| - | | |

| (2,613 | ) | |

| - | | |

| - | |

| Other operating income | |

| 1,162 | | |

| 316 | | |

| 45 | | |

| 43,783 | | |

| 3,699 | | |

| 522 | |

| Operating loss | |

| (227,621 | ) | |

| (941,754 | ) | |

| (132,827 | ) | |

| (161,678 | ) | |

| (820,443 | ) | |

| (115,717 | ) |

| Interest income/(expense), net | |

| 2,124 | | |

| 392 | | |

| 55 | | |

| (5,452 | ) | |

| (1,315 | ) | |

| (185 | ) |

| Investment loss | |

| (25 | ) | |

| (182 | ) | |

| (26 | ) | |

| (807 | ) | |

| (2,516 | ) | |

| (355 | ) |

| Other expenses | |

| (4,316 | ) | |

| (5,591 | ) | |

| (790 | ) | |

| (7,380 | ) | |

| (4,012 | ) | |

| (567 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes and share of equity in profit/(loss) of unconsolidated affiliates | |

| (229,838 | ) | |

| (947,135 | ) | |

| (133,588 | ) | |

| (175,317 | ) | |

| (828,286 | ) | |

| (116,824 | ) |

| Income tax (expense)/ benefit | |

| (55,301 | ) | |

| 337 | | |

| 48 | | |

| (183,208 | ) | |

| (32,908 | ) | |

| (4,641 | ) |

| Share of equity in profit/(loss) of unconsolidated affiliates | |

| 61 | | |

| (7,957 | ) | |

| (1,122 | ) | |

| (339 | ) | |

| (7,876 | ) | |

| (1,111 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss from continuing operations | |

| (285,078 | ) | |

| (954,755 | ) | |

| (134,662 | ) | |

| (358,864 | ) | |

| (869,070 | ) | |

| (122,576 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations, net of tax | |

| (55,240 | ) | |

| (49,929 | ) | |

| (7,042 | ) | |

| (27,959 | ) | |

| (163,791 | ) | |

| (23,102 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (340,318 | ) | |

| (1,004,684 | ) | |

| (141,704 | ) | |

| (386,823 | ) | |

| (1,032,861 | ) | |

| (145,678 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income/(loss) attributable to non-controlling interests | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| 334 | | |

| (16,761 | ) | |

| (2,364 | ) | |

| 823 | | |

| (17,296 | ) | |

| (2,439 | ) |

| Discontinued operations | |

| 3,957 | | |

| (60 | ) | |

| (8 | ) | |

| 7,488 | | |

| (19,286 | ) | |

| (2,720 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| (285,412 | ) | |

| (937,994 | ) | |

| (132,298 | ) | |

| (359,687 | ) | |

| (851,774 | ) | |

| (120,137 | ) |

| Discontinued operations | |

| (59,197 | ) | |

| (49,869 | ) | |

| (7,034 | ) | |

| (35,447 | ) | |

| (144,505 | ) | |

| (20,382 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to

ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| (2.41 | ) | |

| (7.90 | ) | |

| (1.11 | ) | |

| (3.03 | ) | |

| (7.18 | ) | |

| (1.01 | ) |

| Discontinued operations | |

| (0.50 | ) | |

| (0.42 | ) | |

| (0.06 | ) | |

| (0.30 | ) | |

| (1.22 | ) | |

| (0.17 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in calculating net loss per ordinary share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| Discontinued operations | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss per ADS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic and diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| (9.64 | ) | |

| (31.60 | ) | |

| (4.44 | ) | |

| (12.12 | ) | |

| (28.72 | ) | |

| (4.04 | ) |

| Discontinued operations | |

| (2.00 | ) | |

| (1.68 | ) | |

| (0.24 | ) | |

| (1.20 | ) | |

| (4.88 | ) | |

| (0.68 | ) |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands)

| | |

Three Months Ended August 31 | | |

Twelve Months Ended August 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net cash generated from operating activities | |

| 6,923 | | |

| 104,041 | | |

| 14,674 | | |

| 22,261 | | |

| 126,394 | | |

| 17,827 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash used in investing activities | |

| (20,003 | ) | |

| (128,015 | ) | |

| (18,056 | ) | |

| (52,949 | ) | |

| (98,004 | ) | |

| (13,823 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net cash used in financing activities | |

| (208,397 | ) | |

| (1,201 | ) | |

| (169 | ) | |

| (298,794 | ) | |

| (85,459 | ) | |

| (12,053 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents, and restricted cash | |

| 23,319 | | |

| (6,270 | ) | |

| (884 | ) | |

| 38,934 | | |

| (4,373 | ) | |

| (617 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net change in cash and cash equivalents, and restricted cash | |

| (198,158 | ) | |

| (31,445 | ) | |

| (4,435 | ) | |

| (290,548 | ) | |

| (61,442 | ) | |

| (8,666 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash at beginning of the period | |

| 765,394 | | |

| 537,239 | | |

| 75,774 | | |

| 857,784 | | |

| 567,236 | | |

| 80,005 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash at end of the period | |

| 567,236 | | |

| 505,794 | | |

| 71,339 | | |

| 567,236 | | |

| 505,794 | | |

| 71,339 | |

BRIGHT SCHOLAR EDUCATION HOLDINGS LIMITED

Reconciliations of GAAP and Non-GAAP Results

(Amounts in thousands, except for shares and per

share data)

| | |

Three Months Ended August 31 | | |

Year Ended August 31 | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Gross profit from continuing operations | |

| 79,833 | | |

| 35,864 | | |

| 5,059 | | |

| 467,428 | | |

| 503,586 | | |

| 71,028 | |

| Add: Amortization of intangible assets | |

| 1,050 | | |

| 1,050 | | |

| 148 | | |

| 4,341 | | |

| 4,184 | | |

| 590 | |

| Adjusted gross profit from continuing operations | |

| 80,883 | | |

| 36,914 | | |

| 5,207 | | |

| 471,769 | | |

| 507,770 | | |

| 71,618 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating loss from continuing operations | |

| (227,621 | ) | |

| (941,754 | ) | |

| (132,827 | ) | |

| (161,678 | ) | |

| (820,443 | ) | |

| (115,717 | ) |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 457 | | |

| - | | |

| 8,101 | | |

| 1,143 | |

| Add: Amortization of intangible assets | |

| 1,050 | | |

| 1,050 | | |

| 148 | | |

| 4,341 | | |

| 4,184 | | |

| 590 | |

| Add: Impairment loss on goodwill | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | |

| Add: Impairment loss on intangible assets | |

| - | | |

| 258,326 | | |

| 36,435 | | |

| - | | |

| 258,326 | | |

| 36,435 | |

| Add: Impairment loss on property and equipment | |

| 12,891 | | |

| 6,607 | | |

| 932 | | |

| 12,891 | | |

| 6,607 | | |

| 932 | |

| Add: Impairment loss on the long-term investments | |

| 2,613 | | |

| - | | |

| - | | |

| 2,613 | | |

| - | | |

| - | |

| Adjusted operating (loss)/income from continuing operations | |

| (63,951 | ) | |

| (78,783 | ) | |

| (11,111 | ) | |

| 5,283 | | |

| 50,523 | | |

| 7,127 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (340,318 | ) | |

| (1,004,684 | ) | |

| (141,704 | ) | |

| (386,823 | ) | |

| (1,032,861 | ) | |

| (145,678 | ) |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 457 | | |

| - | | |

| 8,101 | | |

| 1,143 | |

| Add: Amortization of intangible assets | |

| 1,050 | | |

| 1,050 | | |

| 148 | | |

| 4,341 | | |

| 4,184 | | |

| 590 | |

| Add: Tax effect of amortization of intangible assets | |

| (41 | ) | |

| (209 | ) | |

| (29 | ) | |

| (670 | ) | |

| (833 | ) | |

| (117 | ) |

| Add: Impairment loss on goodwill | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | |

| Add: Impairment loss on intangible assets | |

| - | | |

| 258,326 | | |

| 36,435 | | |

| - | | |

| 258,326 | | |

| 36,435 | |

| Add: Impairment loss on property and equipment | |

| 12,891 | | |

| 6,607 | | |

| 932 | | |

| 12,891 | | |

| 6,607 | | |

| 932 | |

| Add: Impairment loss on the long-term investments | |

| 2,613 | | |

| - | | |

| - | | |

| 2,613 | | |

| - | | |

| - | |

| Less: Loss from discontinued operations, net of tax | |

| (55,240 | ) | |

| (49,929 | ) | |

| (7,042 | ) | |

| (27,959 | ) | |

| (163,791 | ) | |

| (23,102 | ) |

| Adjusted net (loss)/income | |

| (121,449 | ) | |

| (91,993 | ) | |

| (12,975 | ) | |

| (192,573 | ) | |

| 1,063 | | |

| 151 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| (344,608 | ) | |

| (987,863 | ) | |

| (139,332 | ) | |

| (395,134 | ) | |

| (996,279 | ) | |

| (140,519 | ) |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 457 | | |

| - | | |

| 8,101 | | |

| 1,143 | |

| Add: Amortization of intangible assets | |

| 1,050 | | |

| 1,050 | | |

| 148 | | |

| 4,341 | | |

| 4,184 | | |

| 590 | |

| Add: Tax effect of amortization of intangible assets | |

| (41 | ) | |

| (209 | ) | |

| (29 | ) | |

| (670 | ) | |

| (833 | ) | |

| (117 | ) |

| Add: Impairment loss on goodwill | |

| 147,116 | | |

| 579,827 | | |

| 81,781 | | |

| 147,116 | | |

| 579,827 | | |

| 81,781 | |

| Add: Impairment loss on intangible assets | |

| - | | |

| 258,326 | | |

| 36,435 | | |

| - | | |

| 258,326 | | |

| 36,435 | |

| Add: Impairment loss on property and equipment | |

| 12,891 | | |

| 6,607 | | |

| 932 | | |

| 12,891 | | |

| 6,607 | | |

| 932 | |

| Add: Impairment loss on the long-term investments | |

| 2,613 | | |

| - | | |

| - | | |

| 2,613 | | |

| - | | |

| - | |

| Less: Loss from discontinued operations, net of tax | |

| (59,197 | ) | |

| (49,869 | ) | |

| (7,034 | ) | |

| (35,447 | ) | |

| (144,505 | ) | |

| (20,382 | ) |

| Adjusted net (loss)/income attributable to ordinary shareholders | |

| (121,782 | ) | |

| (89,153 | ) | |

| (12,574 | ) | |

| (193,396 | ) | |

| 4,438 | | |

| 627 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (340,318 | ) | |

| (1,004,684 | ) | |

| (141,704 | ) | |

| (386,823 | ) | |

| (1,032,861 | ) | |

| (145,678 | ) |

| Add: Interest expense, net | |

| (2,124 | ) | |

| (392 | ) | |

| (55 | ) | |

| 5,452 | | |

| 1,315 | | |

| 185 | |

| Add: Income tax expense | |

| 55,301 | | |

| (337 | ) | |

| (48 | ) | |

| 183,208 | | |

| 32,908 | | |

| 4,641 | |

| Add: Depreciation and amortization | |

| 14,293 | | |

| 11,808 | | |

| 1,665 | | |

| 63,598 | | |

| 48,796 | | |

| 6,882 | |

| Add: Share-based compensation expenses | |

| - | | |

| 3,240 | | |

| 457 | | |

| - | | |

| 8,101 | | |

| 1,143 | |

| Add: Impairment loss on goodwill | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | | |

| 147,116 | | |

| 593,748 | | |

| 83,744 | |

| Add: Impairment loss on intangible assets | |

| - | | |

| 258,326 | | |

| 36,435 | | |

| - | | |

| 258,326 | | |

| 36,435 | |

| Add: Impairment loss on property and equipment | |

| 12,891 | | |

| 6,607 | | |

| 932 | | |

| 12,891 | | |

| 6,607 | | |

| 932 | |

| Add: Impairment loss on the long-term investments | |

| 2,613 | | |

| - | | |

| - | | |

| 2,613 | | |

| - | | |

| - | |

| Less: Loss from discontinued operations, net of tax | |

| (55,240 | ) | |

| (49,929 | ) | |

| (7,042 | ) | |

| (27,959 | ) | |

| (163,791 | ) | |

| (23,102 | ) |

| Adjusted EBITDA | |

| (54,988 | ) | |

| (81,755 | ) | |

| (11,532 | ) | |

| 56,014 | | |

| 80,731 | | |

| 11,386 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in

calculating adjusted net (loss)/income per ordinary share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic and Diluted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Continuing operations | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| Discontinued operations | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | | |

| 118,669,795 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net (loss)/income per share

attributable to ordinary shareholders | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| —Basic | |

| (1.03 | ) | |

| (0.75 | ) | |

| (0.11 | ) | |

| (1.63 | ) | |

| 0.04 | | |

| 0.01 | |

| —Diluted | |

| (1.03 | ) | |

| (0.75 | ) | |

| (0.11 | ) | |

| (1.63 | ) | |

| 0.04 | | |

| 0.01 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted net (loss)/income per ADS | |

| | |

| | |

| | |

| | |

| | |

| |

| —Basic | |

| (4.12 | ) | |

| (3.00 | ) | |

| (0.44 | ) | |

| (6.52 | ) | |

| 0.16 | | |

| 0.04 | |

| —Diluted | |

| (4.12 | ) | |

| (3.00 | ) | |

| (0.44 | ) | |

| (6.52 | ) | |

| 0.16 | | |

| 0.04 | |

14

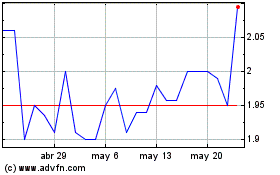

Bright Scholar Education (NYSE:BEDU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Bright Scholar Education (NYSE:BEDU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024