Badger Meter, Inc. (NYSE: BMI) today reported record results for

the second quarter ended June 30, 2023.

Second Quarter 2023 Highlights

- Total sales of $175.9 million, 28% higher than the prior year’s

$137.8 million.

- Operating profit increased 34% year-over-year, with operating

profit margins expanding 80 basis points to 16.8% from 16.0%.

- Diluted earnings per share (EPS) increased 33% to $0.76, up

from $0.57 in the comparable prior year quarter.

- Robust demand environment continued with book to bill ratio

greater than one.

- Released 2022 Sustainability Report illustrating powerful

combination of strong ESG and financial performance.

“As our record second quarter results demonstrate, Badger Meter

continues to benefit from the adoption of our differentiated smart

water solutions, favorable market conditions and sound execution.

In addition to our record sales performance, we delivered strong

operating profit margin expansion, record EPS and solid cash flow,”

said Kenneth C. Bockhorst, Chairman, President and Chief Executive

Officer. “Another quarter of book to bill above one points to

resilient demand within our markets, and we are confident in our

ability to continue to capitalize on the constructive industry

fundamentals. I want to thank our employees for their steadfast

commitment to serving our customers.”

Second Quarter Operating

Results

Utility water sales increased 32% year-over-year with

broad-based growth across the comprehensive suite of smart water

offerings. This includes robust adoption of our cellular AMI

solution, including higher ORION® Cellular endpoint and BEACON®

Software as a Service (SaaS) revenues, coupled with increased meter

volumes, notably E-Series® Ultrasonic meters. Easing supply chain

conditions and the addition of Syrinix also contributed to the

year-over-year sales increase.

Sales of flow instrumentation products increased 6%

year-over-year, with steady order demand across the water-focused

end markets including wastewater and HVAC, which more than offset

modest growth in the varied other industrial markets.

Gross margin dollars increased $14.7 million year-over-year, and

gross margin as a percent of sales was 39.5%, at the higher end of

the Company’s normalized range and sequentially in line with the

first quarter of 2023. Gross margin continues to benefit from

structural sales mix trends including higher SaaS revenues,

production efficiencies resulting from improving supply chain

conditions, value-based pricing and stabilization of inflationary

pressures.

Selling, engineering and administrative (SEA) expenses in the

second quarter of 2023 were $39.9 million, with SEA as a percent of

sales improving 100 basis points to 22.7% versus 23.7% in the

comparable prior year quarter. The $7.2 million year-over-year

increase in SEA spend included higher personnel-related costs such

as headcount, salaries, sales and management incentives and travel

expenses as well as the addition of Syrinix, including the

associated intangible asset amortization.

Operating profit margin was 16.8% in the second quarter of 2023,

an 80 basis point improvement from the prior year’s 16.0%.

The tax rate for the second quarter of 2023 was 25.8%, 140 basis

points higher than the prior year’s 24.4%. As such, EPS was a

record $0.76, up 33% compared to $0.57 in the comparable prior year

period.

Outlook

Bockhorst continued, “Based on first half results, it’s clear we

are on track for yet another year of exceptional performance. Our

innovative and tailorable smart water solutions portfolio, which

enables customers to be more efficient, resilient and sustainable,

paired with our outstanding team focused on exceptional customer

support, continues to build momentum.

“Our business model provides for durable growth despite

macro-economic uncertainty given the support of our backlog,

secular demand drivers and our technologically differentiated

portfolio of solutions which address increasing water challenges.

While we face tougher comparisons in the second half of 2023, we

continue to expect benefits from stabilizing supply chain and

inflation dynamics for the balance of the year.

“We issued our 2022 Sustainability Report last month

highlighting our continuous improvement efforts across a variety of

ESG matters. Among other accomplishments, we outlined our strong

progress in reducing energy, greenhouse gas (GHG) emissions and

water usage. We have surpassed our original GHG intensity reduction

goal and have established a new goal along with a roadmap of

tactics we believe will lead to further improvements. We remain

proud of our track record of delivering both strong financial and

ESG-related performance.”

Bockhorst concluded, “Badger Meter is well-positioned to sustain

its pattern of profitable growth enhanced by our innovative

offerings, end market resiliency and proven execution. Along with

our strong balance sheet and exceptional team, we are poised to

continue to improve shareholder value while furthering our vision

to preserve and protect the world’s most precious resource.”

Conference Call and Webcast

Information

Badger Meter management will hold a conference call to discuss

the Company’s second quarter 2023 results today, Thursday July 20,

2023 at 10:00 AM Central/11:00 AM Eastern time. The webcast and

related presentation can be accessed via the Investor section of

our website. Individuals wishing to participate in the call should

use this online registration link:

https://www.netroadshow.com/events/login?show=bf59de12&confld=52890

Safe Harbor Statement

Certain statements contained in this news release, as well as

other information provided from time to time by Badger Meter, Inc.

(the “Company”) or its employees, may contain forward-looking

statements that involve risks and uncertainties that could cause

actual results to differ materially from those statements. The

Company’s results are subject to general economic conditions,

variation in demand from customers, continued market acceptance of

new products, the successful integration of acquisitions,

competitive pricing and operating efficiencies, supply chain risk,

material and labor cost increases, tax reform and foreign currency

risk. See the Company’s Annual Report on Form 10-K filed with the

Securities and Exchange Commission for further information

regarding risk factors, which are incorporated herein by reference.

Badger Meter disclaims any obligation to publicly update or revise

any forward-looking statements as a result of new information,

future events or any other reason.

About Badger Meter

With more than a century of water technology innovation, Badger

Meter is a global provider of industry leading water solutions

encompassing flow measurement, quality and other system parameters.

These offerings provide our customers with the data and analytics

essential to optimize their operations and contribute to the

sustainable use and protection of the world’s most precious

resource. For more information, visit www.badgermeter.com.

BADGER METER, INC. CONSOLIDATED

CONDENSED STATEMENTS OF OPERATIONS (in thousands, except share and

earnings per share data)

Three Months Ended June 30,

Six Months Ended June 30,

2023

2022

2023

2022

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Net sales

$

175,858

$

137,833

$

334,959

$

270,235

Cost of sales

106,424

83,073

202,709

164,752

Gross margin

69,434

54,760

132,250

105,483

Selling, engineering and administration

39,932

32,672

77,702

64,533

Operating earnings

29,502

22,088

54,548

40,950

Interest (income) expense, net

(827

)

9

(1,449

)

22

Other pension and postretirement costs

33

33

65

65

Earnings before income taxes

30,296

22,046

55,932

40,863

Provision for income taxes

7,803

5,382

14,024

9,839

Net earnings

$

22,493

$

16,664

$

41,908

$

31,024

Earnings per share:

Basic

$

0.77

$

0.57

$

1.43

$

1.06

Diluted

$

0.76

$

0.57

$

1.42

$

1.06

Shares used in computation of earnings

per share: Basic

29,272,693

29,210,444

29,264,166

29,204,535

Diluted

29,447,525

29,344,351

29,434,467

29,353,708

BADGER METER, INC. CONSOLIDATED CONDENSED BALANCE

SHEETS (in thousands)

Assets

June 30,

December 31,

2023

2022

(Unaudited)

Cash and cash equivalents

$

141,805

$

138,052

Receivables

84,020

76,651

Inventories

144,749

119,856

Other current assets

18,013

13,273

Total current assets

388,587

347,832

Net property, plant and equipment

74,706

73,542

Intangible assets, at cost less accumulated amortization

57,512

53,607

Other long-term assets

24,650

26,805

Goodwill

113,797

101,261

Total assets

$

659,252

$

603,047

Liabilities

and Shareholders' Equity

Payables

$

81,104

$

71,440

Accrued compensation and employee benefits

17,491

20,513

Other current liabilities

20,319

18,359

Total current liabilities

118,914

110,312

Deferred income taxes

6,661

4,648

Long-term employee benefits and other

58,085

45,665

Shareholders' equity

475,592

442,422

Total liabilities and shareholders' equity

$

659,252

$

603,047

BADGER METER, INC.

'CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

'(in thousands)

Three Months Ended June 30,

Six Months Ended June 30,

2023

2022

2023

2022

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Operating activities: Net earnings

$

22,493

$

16,664

$

41,908

$

31,024

Adjustments to reconcile net earnings to net cash provided by

operations: Depreciation

2,775

2,862

5,438

5,622

Amortization

4,132

3,817

8,416

7,833

Deferred income taxes

(366

)

50

(376

)

16

Noncurrent employee benefits

(185

)

48

(222

)

(64

)

Stock-based compensation expense

1,601

851

2,607

1,466

Changes in: Receivables

340

481

(6,503

)

(12,028

)

Inventories

(12,314

)

(9,260

)

(23,753

)

(13,024

)

Payables

1,145

9,379

8,104

20,128

Prepaid expenses and other assets

(2,847

)

(5,249

)

(4,980

)

(8,153

)

Other current liabilities

5,995

59

10,100

(3,908

)

Total adjustments

276

3,038

(1,169

)

(2,112

)

Net cash provided by operations

22,769

19,702

40,739

28,912

Investing activities:

Property, plant and equipment expenditures

(2,664

)

(1,631

)

(6,935

)

(2,773

)

Acquisitions, net of cash acquired

(75

)

-

(17,127

)

-

Net cash used for investing activities

(2,739

)

(1,631

)

(24,062

)

(2,773

)

Financing activities:

Dividends paid

(6,591

)

(5,843

)

(13,217

)

(11,712

)

Proceeds from exercise of stock options

-

-

58

-

Repurchase of treasury stock

-

(427

)

-

(427

)

Net cash used for financing activities

(6,591

)

(6,270

)

(13,159

)

(12,139

)

Effect of foreign exchange rates on cash

5

(810

)

235

(964

)

Increase in cash and cash equivalents

13,444

10,991

3,753

13,036

Cash and cash equivalents - beginning of period

128,361

89,219

138,052

87,174

Cash and cash equivalents - end of period

$

141,805

$

100,210

$

141,805

$

100,210

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230720259704/en/

Karen Bauer (414) 371-7276 kbauer@badgermeter.com

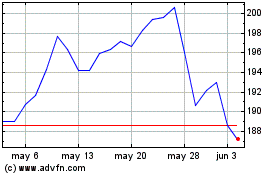

Badger Meter (NYSE:BMI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Badger Meter (NYSE:BMI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025