false

0001734713

0001734713

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

BrightView Holdings, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-38579 |

|

46-4190788 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

980 Jolly Road

Blue Bell, Pennsylvania 19422

(484) 567-7204

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, $0.01 par value |

BV |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously disclosed, the

Company announced on February 23, 2024, that the employment as an executive officer of Jamie C. Gollotto, President, Seasonal (Maintenance

Services), ended effective at the close of business on February 19, 2024 (the “Transition Date”) and that he will provide

services as a non-executive employee until March 29, 2024 (the “Separation Date”).

On February 27, 2024, the

Company and Mr. Gollotto entered into a Transition Services and Separation Agreement (the “Transition Agreement”) which, in

exchange for a release of claims, agreeing to certain post-employment restrictive covenants set forth in the Transition Agreement and

other valuable consideration, provides that Mr. Gollotto will be employed full-time as a non-executive employee during the period beginning

on Transition Date and continuing until the Separation Date (the “Transition Period”), unless earlier terminated under the

Transition Agreement. The Transition Agreement supersedes and replaces Mr. Gollotto’s employment letter agreement dated July 1,

2020 (the “Employment Letter”).

During the Transition Period,

Mr. Gollotto will (i) receive an annual base salary at his current rate of $425,000; (ii) have an opportunity to earn an annual incentive

bonus for fiscal year 2024, subject to the terms and conditions of the Company’s annual bonus plan, with a target annual bonus equal

to 85% of his base salary; and (iii) continue to be eligible to participate in the employee benefit plans generally available to employees

of the Company.

Under the Transition Agreement,

if Mr. Gollotto terminates employment on the Separation Date, or is earlier terminated without “cause” (as defined in the

Employment Letter) (each a “Qualifying Termination”) then, subject to his timely execution and non-revocation of a release

of claims and continued compliance with the restrictive covenants set forth in the Transition Agreement, he will be eligible to receive

the following severance benefits:

| · | a severance payment equal to his annual base salary as in effect prior to the Transition Date payable

over the 12-month period following the Separation Date; |

| · | prorated annual bonus for the fiscal year ending September 2024 based on the Company’s actual achievement

of applicable performance metrics, which bonus will be paid at such time as bonuses are paid to other senior executives with respect to

such fiscal year; |

| · | continuation of COBRA coverage at active employee rates (with the Company paying the remainder of the

premium) for up to 18 months following termination; and |

| · | outplacement services for 12 months following termination in an amount not to exceed $7,500. |

These severance benefits

are the same severance benefits provided by Mr. Gollotto’s Employment Letter.

As additional consideration,

if Mr. Gollotto experiences a Qualifying Termination then, subject to Mr. Gollotto’s timely execution and non-revocation of a release

of claims and continued compliance with the restrictive covenants set forth in the Transition Agreement, he will be entitled to the following

additional severance benefits:

| · | The following tranches of time-vesting restricted stock units (“RSUs”) held by Mr. Gollotto

will remain outstanding and eligible to vest on the applicable vesting date: (i) 3,742 RSUs granted in fiscal year 2020 will vest on November

19, 2024, (ii) 4,089 RSUs granted in fiscal year 2021 will vest on November 18, 2024, (iii) 14,372 RSUs granted in fiscal year 2022 will

vest on November 18, 2024, (iv) 12,463 RSUs granted in fiscal year 2023 will vest on June 1, 2024, (v) 12,463 RSUs granted in fiscal year

2023 will vest on December 1, 2024 and (vi) 8,854 RSUs granted in fiscal year 2023 will vest on November 17, 2024. |

| · | Any vested options held by Mr. Gollotto will remain exercisable for 90 days following the Separation Date

(or any earlier termination of employment). |

| · | Mr. Gollotto’s cash retention award will remain outstanding, with 50% becoming vested and payable

on June 1, 2024, and the remaining 50% becoming vested and payable on December 1, 2024. |

Except as provided above, any unvested equity

awards held by Mr. Gollotto as of the Separation Date (or such earlier termination date) will be forfeited.

The foregoing description

of the Transition Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the

Transition Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

| Item 9.01. | Financial

Statements and Exhibits |

(d) Exhibits. The following exhibits

are filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BrightView Holdings, Inc. |

| |

|

| Date: March 1, 2024 |

By: |

/s/ Jonathan M. Gottsegen |

| |

|

Jonathan M. Gottsegen |

| |

|

Executive Vice President, Chief Legal Officer and Corporate Secretary |

| |

|

Exhibit 10.1

TRANSITION SERVICES AND SEPARATION AGREEMENT

This Transition Services and

Separation Agreement (this “Agreement”), is made and entered into effective as of February 27, 2024 (the “Effective

Date”), is made by and among BrightView Landscapes, LLC (the “Company”), Jamie C. Gollotto (“Employee”),

and, solely for purposes of Section 4(b)(i)C) and Section 9, BrightView Holdings, Inc. (“Parent”).

WHEREAS,

Employee was employed as President, Seasonal (Maintenance Services) of the Company pursuant to the terms of an employment letter agreement

dated as of July 1, 2020 (the “Employment Letter”);

WHEREAS,

as of the close of business on February 19, 2024 (the “Transition Date”), Employee stepped down as President,

Seasonal (Maintenance Services), and voluntarily resigned from any and all executive-level positions with Parent, the Company and their

respective subsidiaries and affiliates (collectively, the “Company Group”);

WHEREAS,

following the Transition Date, Employee remains employed by the Company as a non-executive employee through, and will separate from service

with the Company Group at, the close of business on March 29, 2024 (the “Separation Date”); and

WHEREAS,

Employee and the Company Group desire to enter into this Agreement to clarify Employee’s services and related compensation during

the remainder of the Transition Period (as defined below) and upon the Separation Date.

NOW,

THEREFORE, in consideration of the recitals, promises, and other good and valuable consideration specified herein, the receipt

and sufficiency of which is hereby acknowledged, Employee and the Company hereby agree as follows:

| 1. | Transition Period. Effective as of the Effective Date, this Agreement supersedes and replaces

in its entirety the Employment Letter. Employee’s last day of employment as an executive officer of the Company and Parent was the

Transition Date. During the period beginning on the Transition Date, and continuing until the close of business on March 29, 2024,

unless earlier terminated in accordance with the terms of this Agreement (the “Transition Period”), Employee shall

be employed as a non-executive employee of the Company. Subject to the terms and conditions set forth herein, Employee shall at all times

be an “at will” employee. The Company and Employee currently expect that Employee shall not have a “separation from

service” for purposes of Section 409A (as defined below) until the Separation Date. |

| 2. | Duties. During the Transition Period, Employee will assist the Company in transitioning

his former duties and responsibilities as President, Seasonal (Maintenance Services) to his successor and/or other Company Group employees,

and Employee will provide such other advisory services and transition assistance as may be reasonably requested by the Company. |

| (a) | Base Salary. Beginning on the Effective Date and continuing until the Separation Date (unless earlier

terminated in accordance with the terms of this Agreement), Employee shall receive an annual base salary of $425,000 (the “Base

Salary”). The Base Salary shall be paid in accordance with the Company’s standard payroll practice. Employee’s Base

Salary may be prorated to reflect any partial year of employment with the Company. |

| (b) | FY24 Bonus Opportunity. For the fiscal year ending September 2024, Employee shall be eligible

to earn an annual incentive bonus, subject to terms and conditions of the Company’s annual bonus plan, which may from time to time,

and at any time, be amended, modified or terminated. Employee’s target bonus amount for fiscal year 2024 is 85% of Employee’s

Base Salary as in effect on the Transition Date. |

| (c) | Employee Benefits. During the Transition Period, Employee will continue to be eligible to participate

employee benefits programs offered by the Company Group, in accordance with Company policy and subject to the terms and conditions of

such programs, which programs may from time to time, and at any time, be amended, modified or terminated. |

| (d) | Vacation. Employee shall be eligible for paid vacation days each year in accordance with the Company’s

vacation policy, as may be in effect from time to time (as prorated to reflect any partial year of employment with the Company). |

| 4. | Termination of Employment; Severance Payment. |

| (a) | Separation Date and Termination of Employment. Effective as of the Separation Date (unless earlier

terminated in accordance with the terms of this Agreement), Employee’s employment with the Company, including all offices and positions

Employee holds with the Company Group, shall terminate. Employee acknowledges and agrees that Employee shall execute any necessary documents

to effectuate the foregoing. |

| (b) | Severance Payment; Severance Entitlements. |

| (i) | Termination on Separation Date; Termination without Cause Before the Separation Date. In connection

with Employee’s termination of employment (a) on the Separation Date, or (b) by the Company before the Separation Date

for any reason other than (1) for “Cause” (as defined in the Employment Letter) or (2) by reason of Employee’s

death, injury, illness or incapacity (either such event, a “Qualifying Termination”), Employee is entitled to: |

| A. | (i) any accrued but unpaid base salary through the Separation Date, (ii) unused but accrued

vacation as of the date of such termination of employment in accordance with Company policy, (iii) any unpaid or unreimbursed business

expenses incurred as of the date of such termination of employment in accordance with Company policy, and (iv) any benefits as provided

under the terms of any employee benefit plan of the Company Group (excluding any employee benefit plan providing severance or similar

benefits) (collectively, the “Accrued Obligations”), in each case, in accordance with the terms of such plan and applicable

law. |

| B. | In addition, in accordance with this Section 4(b)(i), Employee shall be provided with the

following severance benefits (collectively, the “Severance Benefits”): |

| (1) | cash severance (the “Severance Payments”) equal to $425,000, which Severance Payments

shall be payable in accordance with the Company’s usual payroll practices in substantially equal bi-weekly installments over the

twelve (12)-month period following the date of the Qualifying Termination (the “Severance Period”) commencing within

sixty (60) days following date of the Qualifying Termination, with the first payment being made on the first regularly scheduled payroll

date that occurs after the revocation period for the Release (as defined below) has expired without Employee revoking such Release;

provided, that if the sixty (60) day period spans two calendar years, then such payment shall not commence until the second calendar

year if the portion of such payment that would be payable within such sixty (60) day period is subject to the requirements of Section 409A

(as defined below); |

| (2) | prorated annual bonus for the fiscal year ending September 2024 based on the Company’s actual

achievement of applicable performance metrics, which bonus shall be paid to Employee at such time as bonuses are paid to other senior

executives of the Company with respect to such fiscal year (not later than December 31, 2024); |

| (3) | if Employee and any of Employee’s eligible dependents, in each case, who participate in the Company’s

medical plan as of the date of termination, timely elect COBRA coverage under such plan, the Company shall pay directly, or reimburse

Employee for, a portion of such COBRA premiums (on a monthly basis) equal to the employer portion of the premium for active employees

for an additional period equal to the lesser of (I) eighteen (18) months following the Separation Date and (II) the date on

which Employee becomes eligible for coverage under the medical plan of a subsequent employer with respect to the corresponding benefit

provided hereunder. Employee agrees and acknowledges that the severance payments and benefits provided for in this Section 4(b) (other

than the Accrued Obligations) are in lieu of any other severance payments or benefits under the Employment Letter or any Company severance

pay plan generally applicable to the Company employees; and |

| (4) | outplacement services for a period of twelve (12) months following the Separation Date at a level commensurate

with Employee’s prior position in accordance with the Company’s practices as in effect on the Separation Date, in an amount

not to exceed $7,500. |

| C. | As additional consideration for this Agreement, including for the release set forth in Section 5

and the post-employment covenants set forth in Section 9, Employee will be entitled to: |

| (1) | Continued vesting of the tranches of the outstanding time-vesting restricted stock units set forth on

Exhibit A that are scheduled to vest on the dates specified on Exhibit A. Except as set forth in this Section 4(b)(i)(C),

any unvested equity compensation award held by Employee as of the Separation Date (or such earlier Qualifying Termination date) shall

be forfeited. Employee will have ninety (90) days after the Separation Date (or such earlier Qualifying Termination date) to exercise

any vested stock options in accordance with the terms of the applicable award agreements. |

| (2) | Continued vesting of Employee’s cash retention award (“Retention Award”). The

Retention Award shall be payable to Employee in two equal installments. The first installment shall be paid on June 1, 2024, and

the second installment shall be paid on December 1, 2024. |

| D. | Employee also agrees and acknowledges that the severance payments and benefits provided for in this Section 4(b) (other

than the Accrued Obligations) are expressly conditioned upon Employee’s (A) execution within forty-five (45) days of the Separation

Date (or such earlier Qualifying Termination date) and non-revocation of a release and waiver of claims in a form acceptable to the Company

(the “Release”) and (B) continued compliance with the provisions of this Agreement, including the Restrictive

Covenants (as defined below) and the requirements of Sections 10 and 11 set forth herein. |

| (ii) | Termination For Any Reason Other Than Without Cause Before the Separation Date. Should (i) Employee

resign from employment with the Company, or (ii) the Company terminate Employee’s employment for any reason other than a termination

by the Company without Cause (e.g., for Cause or by reason of Employee’s death, injury, illness or incapacity) prior to the Separation

Date, Employee shall be entitled to the Accrued Obligations, but shall not be entitled to any other payments or benefits. |

| (c) | Taxes. Employee shall be responsible for the payment of any and all required federal, state, local

and foreign taxes incurred, or to be incurred, in connection with any amounts payable, or benefits provided, to Employee under this Agreement.

Notwithstanding any other provision of this Agreement, the Company may withhold from amounts payable under this Agreement all federal,

state, local and foreign taxes that are required to be withheld by applicable laws and regulations with respect to any amounts payable,

or benefits provided, to Employee under this Agreement and report on any applicable federal, state, local or foreign tax reporting form

any income to Employee determined by the Company as resulting from such amounts payable or benefits provided hereunder. |

| (d) | Satisfaction of Claims. The receipt and satisfaction of the payment obligations described in this

Section 4(b) is acknowledged as full and final payment, accord and satisfaction of any and all potential claims described

in Section 5 of this Agreement against the Company Releasees (as defined below), except for those claims not being released

by Employee under Section 5. |

| (a) | For and in consideration of the entitlements and payments described in Section 4(b)(b)(i) of

this Agreement, Employee hereby agrees on behalf of himself, his agents, assignees, attorneys, successors, assigns, heirs and executors,

to, and Employee does hereby, fully and completely forever release the Company Group and its past, current and future affiliates, predecessors

and successors and all of their respective past and/or present officers, directors, partners, members, managing members, managers, employees,

agents, representatives, administrators, attorneys, insurers and fiduciaries, in their individual and/or representative capacities (hereinafter

collectively referred to as the “Company Releasees”), from any and all causes of action, suits, agreements, promises,

damages, disputes, controversies, contentions, differences, judgments, claims, debts, dues, sums of money, accounts, reckonings, bonds,

bills, specialties, covenants, contracts, variances, trespasses, extents, executions and demands of any kind whatsoever, which Employee

or his agents, assignees, attorneys, successors, assigns, heirs and executors ever had, now have or may have against the Company Releasees

or any of them, in law, admiralty or equity, whether known or unknown to Employee, for, upon, or by reason of, any matter, action, omission,

course or thing whatsoever occurring up to the date this Agreement is signed by Employee, including, without limitation, in connection

with or in relationship to Employee’s employment or other service relationship with the Company, and any applicable employment,

compensatory or equity arrangement with the Company (including, without limitation, the Employment Letter), any claims of breach of contract,

wrongful termination, retaliation, fraud, defamation, infliction of emotional distress or national origin, race, age, sex, sexual orientation,

disability, medical condition or other discrimination or harassment, (such released claims are collectively referred to herein as the

“Released Claims”); provided, that, Employee does not waive or release (i) any claims with respect to the

right to enforce this Agreement or as a shareholder of Parent or the holder of vested options under the BrightView Holdings, Inc.

2018 Omnibus Incentive Plan, (ii) claims with respect to any vested right Employee may have under any employee pension or welfare

benefit plan of the Company or any of its affiliates, (iii) any rights Employee may have for indemnification (including advancement

of expenses) from Parent, the Company or any of its affiliates and coverage under that certain Indemnification Agreement between Parent

and Employee, dated September 1, 2023, Parent’s bylaws, as amended from time to time, the Company’s operating agreement,

as amended from time to time, and any applicable insurance including directors’ and officers’ liability insurance policies,

and (iv) any claims that may not be waived by law. |

| (b) | Notwithstanding the generality of Section 5((a)) above, the Released Claims include, without

limitation, (i) any and all claims under Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act of 1967

(the “ADEA,” a law which prohibits discrimination on the basis of age), the Civil Rights Act of 1971, the Civil Rights

Act of 1991, the Fair Labor Standards Act, Employee Retirement Income Security Act of 1974, the Americans with Disabilities Act, the Family

and Medical Leave Act of 1993, the National Labor Relations Act, the Equal Pay Act, the Securities Act of 1933, the Securities Exchange

Act of 1934, the Rehabilitation Act of 1973, the Worker Adjustment and Retraining Notification Act or the Pennsylvania Human Relations

Act, all as amended, and any and all other federal, state or local laws, statutes, rules and regulations pertaining to employment

or otherwise, and (b) any claims for wrongful discharge, breach of contract, fraud, misrepresentation or any compensation claims,

or any other claims under any statute, rule or regulation or under the common law, including compensatory damages, punitive damages,

attorney’s fees, costs, expenses and all claims for any other type of damage or relief. |

| (c) | THIS MEANS THAT, BY SIGNING THIS AGREEMENT, EMPLOYEE WILL HAVE WAIVED ANY RIGHT EMPLOYEE MAY HAVE

HAD TO BRING A LAWSUIT OR MAKE ANY CLAIM AGAINST THE COMPANY RELEASEES BASED ON ANY ACTS OR OMISSIONS OF THE COMPANY RELEASEES UP TO THE

DATE OF THE SIGNING OF THIS AGREEMENT EXCEPT WITH RESPECT TO CLAIMS NOT RELEASED BY EMPLOYEE IN THIS SECTION 5. NOTWITHSTANDING

THE ABOVE, NOTHING IN THIS SECTION 5 SHALL PREVENT EMPLOYEE FROM (1) INITIATING OR CAUSING TO BE INITIATED ON HIS BEHALF

ANY COMPLAINT, CHARGE, CLAIM OR PROCEEDING AGAINST THE COMPANY BEFORE ANY LOCAL, STATE OR FEDERAL AGENCY, COURT OR OTHER BODY CHALLENGING

THE VALIDITY OF THE WAIVER OF HIS CLAIMS UNDER ADEA CONTAINED IN THIS SECTION 5 (BUT NO OTHER PORTION OF SUCH WAIVER); OR

(2) INITIATING OR PARTICIPATING IN (BUT NOT BENEFITING FROM) AN INVESTIGATION OR PROCEEDING CONDUCTED BY THE EQUAL EMPLOYMENT OPPORTUNITY

COMMISSION WITH RESPECT TO ADEA. |

| (d) | Employee represents that he has read carefully and fully understands the terms of this Agreement, and

that Employee has been advised to consult with an attorney and has availed himself of the opportunity to consult with an attorney prior

to signing this Agreement. Employee acknowledges and agrees that he is executing this Agreement willingly, voluntarily and knowingly,

of his own free will, in exchange for the entitlements and payments described in Section 3 of this Agreement, and that he

has not relied on any representations, promises or agreements of any kind made to him in connection with his decision to accept the terms

of this Agreement, other than those set forth in this Agreement. This Agreement shall not be executed by Employee before the Separation

Date. Employee acknowledges that he could take up to twenty-one (21) days after the date this Agreement has been delivered to him to

consider whether he wants to sign this Agreement and that the ADEA gives him the right to revoke this Agreement within seven (7) days

after it is signed, and Employee understands that he will not receive any payments or benefits under this Agreement until such seven (7) day

revocation period has passed and then, only if he has not revoked this Agreement. To the extent Employee has executed this Agreement within

less than twenty-one (21) days after its delivery to him, Employee hereby waives the twenty-one (21) day period and acknowledges that

his decision to execute this Agreement prior to the expiration of such twenty-one (21) day period was entirely voluntary. |

| 6. | Sole Right to Claims; No Other Claims. Employee represents and warrants that no other person

or entity had or has any interest in the claims referred to in this Agreement; that Employee has the sole right and exclusive authority

to execute this Agreement; that Employee has not sold, assigned, transferred, conveyed or otherwise disposed of any claim or demand relating

to any matter covered by this Agreement; that Employee has not filed any claims, complaints, or actions of any kind against the Company

with any court of law, or local, state, or federal government or agency; that Employee has been properly paid for all hours worked for

the Company with the exception of the final payroll for the period through and including the Separation Date (or any earlier termination

date); that, other than the payments referred to herein, Employee has received all commissions, bonuses and other compensation due to

Employee and Employee has not engaged in any unlawful conduct relating to the Company’s business. |

| 7. | No Admission of Liability. Employee acknowledges and understands that the consideration

referred to herein is provided without admission or concession by the Company of any violation of any law or liability to Employee; and

that said consideration provides Employee with valuable benefits in addition to any to which Employee already is entitled under the Company’s

employee benefit plans or otherwise. |

| 8. | No Other Consideration; Return of Property. Employee acknowledges and agrees that no consideration

other than as provided for in this Agreement has been or will be paid or furnished by the Company (other than any payments or benefits

not released by Employee in Section 5 of this Agreement); Employee will make no claim and hereby waives any right Employee

may now have or may hereafter have, based upon any alleged oral alteration, amendment, modification or any other alleged change in this

Agreement; and that Employee understands and has freely and voluntarily entered into and executed this Agreement. By the Separation Date,

Employee must return all property of the Company and its affiliates, including identification cards or badges, user logins and passwords

for the Company’s subscription services, issued devices, keys, laptops, mobile phones, hand-held electronic devices, credit cards,

electronically stored documents or files, physical files such as research binders, and any work product in Employee’s possession

obtained or created pursuant to Employee’s employment with the Company over the years. |

| 9. | Restrictive Covenants. In consideration of this Agreement including, but not limited to,

the additional Severance Benefits provided in Section 4(b)(i)(C) not otherwise required by the Letter Agreement, Employee

agrees as follows: |

| (a) | Non-Compete. For a period of two (2) years after the Separation Date, Employee will not, within

the Geographic Area (as defined below), directly or indirectly own, manage, operate, finance, or be connected as an officer, director,

employee, partner, agent or consultant with any business or enterprise which, directly or through an affiliated subsidiary organization,

provides (a) landscape maintenance services (including work orders for such services), (b) landscape enhancement, design and

build services (e.g., landscape construction), (c) snow and ice removal services (including sanding and salting), (d) irrigation

installation and maintenance services, (e) chemical application services for lawn and plant care or (f) any other business activity

that is competitive with the business, activities, products or services of the type conducted, authorized, offered, or provided by the

Company Group, or with respect to which the Company Group has spent significant time or resources analyzing for the purposes of assessing

expansion opportunities by the Company Group, during the twenty-four (24) month period prior to the Separation Date. For purposes of this

Agreement, the term “Geographic Area” means any state in which the Company Group is maintaining a business office as

of Separation Date. |

| (b) | Non-Solicitation. For a period of two (2) years after the Separation Date, Employee shall

not, either directly or indirectly: |

| (i) | call on or solicit any person, firm, corporation or other entity who or which as of the Separation Date

was, or within one (1) year prior thereto had been, a customer of the Company Group within the Geographic Area in connection with

any of the business activities referred to in Section 9(a) above; |

| (ii) | solicit, induce or encourage any employee of the Company Group to leave the employment of the Company

Group; or |

| (iii) | solicit the employment of any person who was employed by the Company Group on a full or part time basis

on the Separation Date or within the six (6) month period prior thereto. |

| (c) | Confidentiality. Employee agrees to keep confidential any non-public information relating to the

Company Group, including, without limitation, information and knowledge pertaining to products and services in development, pricing information,

innovations, new product designs, computer programs and data, ideas, trade secrets, proprietary information, advertising, distribution

and sales methods and systems, sales and profit figures, and customer and provider information and lists (“Confidential Information”).

Employee acknowledges that such Confidential Information is a valuable and unique asset and covenant that Employee will not disclose any

such Confidential Information to any person for any reason whatsoever without the prior written authorization of the Board of Directors

of Parent (the “Board”), unless such information is in the public domain through no fault of Employee or except as

may be required by law. Employee acknowledges and agrees that any disclosure of any information contrary to the provisions of this Agreement

shall be a breach of this Agreement. Employee likewise acknowledges and agrees to abide by the provisions of any and all confidentiality

agreements Employee executed with the Company Group thereof, the terms of which shall remain in full force and effect; provided, however,

that pursuant to 18 U.S.C. § 1833(b), Employee may not be held criminally or civilly liable under any federal or state trade secret

law for disclosure of a trade secret: (i) made in confidence to a government official, either directly or indirectly, or to an attorney,

solely for the purpose of reporting or investigating a suspected violation of law; and/or (ii) in a complaint or other document filed

in a lawsuit or other proceeding, if such filing is made under seal. Additionally, Employee may disclose a trade secret to his/her attorney

and use the trade secret information in a court proceeding in a suit for retaliation based on the reporting of a suspected violation of

law, so long as any document containing the trade secret is filed under seal and the individual does not disclose the trade secret except

pursuant to court order. Upon receipt of any subpoena, court order or other legal process compelling the disclosure of any confidential

information or documents, Employee agrees to give prompt written notice to the Company so as to permit it to protect the Company’s

confidentiality interests to the fullest extent possible. |

| (i) | Employee acknowledges and agrees that all Inventions (as defined below), and all intellectual property

rights arising therein or thereto, are and shall be the sole and exclusive property of the Company Group. Employee further acknowledges

and agrees that any rights arising in any invention, discovery, improvement or innovation made, conceived or first actually reduced to

practice by Employee, whether alone or jointly with others, during the one (1)-year period following the Separation Date and relating

in any way to work performed by Employee for the Company Group during Employee’s employment with the Company Group (“Post-employment

Inventions”), shall also be the sole and exclusive property of the Company Group. For consideration acknowledged and received

under this Agreement, Employee hereby irrevocably assigns, conveys and sets over to the Company Group all of Employee’s right, title

and interest in and to the Inventions and Post-employment Inventions, including without limitation all intellectual property rights arising

therein or thereto. Employee further agrees to disclose in writing to the Board any such Inventions or Post-employment Inventions, promptly

following their conception or reduction to practice. Such disclosure shall be sufficiently complete in technical detail and appropriately

illustrated by sketch or diagram to convey to one skilled in the art of which the Invention or Post-employment Invention pertains, a clear

understanding of the nature, purpose, operations, and, to the extent known, the physical, chemical, biological or other characteristics

of the Invention or Post-employment Invention. Employee agrees to execute and deliver such deeds of assignment or other documents of conveyance

and transfer as the Company Group may request to confirm in the Company Group the ownership of the Inventions and Post-employment Inventions,

without compensation beyond that provided in this Agreement. Employee further agrees, upon the request of the Company Group and at its

expense, that Employee will execute any other instrument and document necessary or desirable in applying for and obtaining patents in

the United States and in any foreign country with respect to any Invention or Post-employment Invention. Employee further agrees to cooperate

to the extent and in the manner reasonably requested by the Company Group in the prosecution or defense of any claim involving a patent

covering any Invention or Post-employment Invention or any litigation or other claim or proceeding involving any Invention or Post-employment

Invention covered by this Agreement, but all reasonable expenses thereof shall be paid by the Company Group or its designee. Employee

shall not, on or after the date of this Agreement, directly or indirectly challenge the validity, enforceability or scope of the ownership

by the Company Group of any Invention or Post-employment Invention, including without limitation any patent issued on, or patent application

filed in respect of, an Invention or Post-employment Invention. For purposes of this Agreement, “Invention” means any

invention, discovery, improvement or innovation with regard to any facet of the business of the Company Group, whether or not patentable,

made, conceived, or first actually reduced to practice by Employee, alone or jointly with others, in the course of, in connection with,

or as a result of Employee’s employment or other service with the Company Group, including any art, method, process, machine, manufacture,

design or composition of matter, or any improvement thereof. |

| (ii) | Employee also acknowledges and agrees that all works of authorship, in any format or medium, and whether

published or un-published, created wholly or in part by Employee, whether alone or jointly with others, in the course of performing Employee’s

duties for the Company Group, or while using the facilities, equipment or other resources of the Company Group, whether or not during

Employee’s work hours (“Works”), are works made for hire as defined under United States copyright law, and that

the Works (and all copy-rights arising in the Works) are owned exclusively by the Company. To the extent any such Works are not deemed

to be works made for hire, for consideration acknowledged and received, Employee hereby irrevocably assigns, transfers, conveys and sets

over to the Company, without compensation beyond that provided in this Agreement, all right, title and interest in and to such Works,

including without limitation all rights of copyright arising therein or thereto, and further agrees to execute such assignments or other

deeds of conveyance and transfer as the Company may request to vest in the Company or its nominee all right, title and interest in and

to such Works, including all rights of copyright arising in or related to the Works. |

| (e) | Acknowledgements Regarding Covenants. Employee acknowledges that the provisions set forth in this

Section 9 (the “Restrictive Covenants”) are reasonable and necessary to protect the legitimate interests

of the Company Group, and that a violation of any of those provisions will cause irreparable harm to the Company Group. Employee acknowledges

that the Company Group may seek injunctive relief for Employee’s violation of such provisions. Employee represents that Employee’s

experience and capabilities are such that the provisions contained in this Section 9 will not prevent Employee from obtaining

employment or otherwise earning a living at the same general level of economic benefit as earned with the Company Group. In the event

that any of the provisions of this Agreement should ever be adjudicated to exceed the time, geographic, product or service, or other limitations

permitted by applicable law in any jurisdiction, then the affected provisions shall be deemed reformed in such jurisdiction. |

| (f) | Whistleblower Protection. Notwithstanding anything to the contrary contained in this Agreement

or the Letter Agreement, nothing in this Agreement or the Letter Agreement shall prohibit or impede Employee from communicating, cooperating

or filing a complaint with any U.S. federal, state or local governmental or law enforcement branch, agency or entity (each, a “Governmental

Entity”) with respect to possible violation of any U.S. federal, state or local law or regulation, or otherwise making disclosures

to any Governmental Entity, in each case, that are protected under the whistleblower provisions of any such law or regulation; provided,

that in each case such communications and disclosures are consistent with the applicable law. Employee understands and acknowledges that

an individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade

secret that is made (i) in confidence to a federal, state, or local government official or to any attorney solely for the purpose

of reporting or investigating a suspected violation of law, or (ii) in a complaint or other document filed in a lawsuit or other

proceeding, if such filing is made under seal. Employee understands and acknowledges further that an individual who files a lawsuit for

retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual

and use the trade secret information in the court proceeding, if the individual files any document containing the trade seal under seal

and does not disclose the trade secret, except pursuant to court order. Employee does not need the prior authorization of (or give notice

to) any member of the Company Group regarding any such communication or disclosure. Notwithstanding the foregoing, under no circumstance

is Employee authorized to disclose any information covered by any member of the Company Group’s attorney-client privilege or attorney

work product without prior written consent of such member of the Company Group. |

| 10. | Non-Disparagement. Employee agrees not to make any negative comments regarding or otherwise

disparage any member of the Company Group or any of their officers, directors, employees, shareholders, agents or products and services

and the Company shall use its commercially reasonable efforts to cause the members of the Company Group and their senior officers to not

make negative comments regarding Employee. The foregoing is subject to Section 9(f) above and shall not be violated by

truthful statements in response to legal process, required governmental testimony or filings, or administrative or arbitral proceedings

(including, without limitation, depositions in connection with such proceedings). |

| 11. | Cooperation. Employee agrees that, upon the Company’s reasonable request following

the Separation Date and provided such cooperation is not adverse to Employee’s legal interests, Employee will use reasonable efforts

to assist and cooperate with the Company Group in connection with the defense or prosecution of any claim with respect to which Employee

may have knowledge that may be helpful to the Company Group that is made against or by the Company Group (other than by or against Employee),

or in connection with any ongoing or future investigation by, or any proceeding before, any arbitral, administrative, regulatory, self-regulatory,

judicial, legislative, or other body or agency involving the Company Group. The Company will pay reasonable out-of-pocket expense (including

travel expenses and the costs of counsel to the extent reasonably necessary) incurred in connection with providing such assistance. |

| 12. | Acknowledgement. Employee acknowledges and agrees that he shall continue to abide by all

policies and procedures of the Company during and after the Transition Period, as applicable. Among such policies and procedures, the

Company expects Employee to remain subject to the Company’s insider trading policy through May 6, 2024. Any proposed transaction

in Parent securities by Employee should be pre-cleared by the Company in accordance with such policy. |

| (a) | Section 409A. Notwithstanding any provision to the contrary, all provisions of this Agreement

are intended to be construed and interpreted to comply with section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”),

to the extent applicable. Accordingly, all provisions herein, or incorporated by reference, shall be construed and interpreted to comply

with Section 409A and, if necessary, any such provision shall be deemed amended to comply with Section 409A and the regulations

thereunder. Severance Benefits under this Agreement are intended to be exempt from Section 409A under the “short-term deferral”

exception, to the maximum extent applicable, and any remaining amount is intended to be exempt from Section 409A under the “separation

pay” exception, to the maximum extent applicable. All payments to be made upon a termination of employment under this Agreement

that constitute deferred compensation subject to Section 409A will only be paid upon a “separation from service” within

the meaning of Section 409A. For purposes of Section 409A, each payment under this Agreement is treated as a separate payment

and the right to a series of installment payments is treated as the right to a series of separate payments. In no event may Employee,

directly or indirectly, designate the calendar year of payment. No action or failure to act pursuant to this Section shall subject

the Company nor any affiliate thereof to any claim, liability or expense, and none of the Company nor any affiliate thereof shall have

any obligation to indemnify or otherwise protect Employee from the obligation to pay any taxes pursuant to Section 409A. |

| (b) | Withholding. All payments hereunder shall be subject to applicable withholding taxes as required

by law. The Company’s obligation to make any such payments may be satisfied by any member of the Company Group. |

| 14. | Clawback Policy. In consideration for the payments hereunder, Employee agrees to be subject

to (a) any compensation clawback, recoupment or similar policies of the Company Group that may be in effect from time to time, whether

adopted before or after the date of this Agreement (including, without limitation, any clawback policy adopted to comply with the requirements

of the Dodd-Frank Wall Street Reform and Consumer Protection Act and any rules or regulations promulgated thereunder), and (b) such

other compensation clawbacks as may be required by applicable law ((a) and (b) together, the “Clawback Provisions”).

Employee acknowledges that the Clawback Provisions are not limited in their application to amounts payable pursuant to this Agreement. |

| 15. | Applicable Law; Forum; Waiver of Jury Trial. ALL ISSUES AND QUESTIONS CONCERNING THE APPLICATION,

CONSTRUCTION, VALIDITY, INTERPRETATION AND ENFORCEMENT OF THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH,

THE LAWS OF THE COMMONWEALTH OF PENNSYLVANIA, WITHOUT GIVING EFFECT TO ANY CHOICE OF LAW OR CONFLICT OF LAW RULES OR PROVISIONS (WHETHER

OF THE COMMONWEALTH OF PENNSYLVANIA OR ANY OTHER JURISDICTION) THAT WOULD CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER

THAN THE COMMONWEALTH OF PENNSYLVANIA. EACH OF THE PARTIES HERETO HEREBY (I) IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF

ANY COURT LOCATED IN THE COMMONWEALTH OF PENNSYLVANIA FOR THE PURPOSES OF ANY SUIT, ACTION OR OTHER PROCEEDING ARISING OUT OF THIS AGREEMENT;

(II) AGREES THAT THE SERVICE OF ANY PROCESS, SUMMONS, NOTICE OR DOCUMENT BY U.S. REGISTERED MAIL TO SUCH PERSON’S ADDRESS SET

FORTH HEREIN SHALL BE EFFECTIVE SERVICE OF PROCESS FOR ANY ACTION, SUIT OR PROCEEDING IN THE COMMONWEALTH OF PENNSYLVANIA WITH RESPECT

TO ANY MATTERS TO WHICH IT HAS SUBMITTED TO JURISDICTION AS SET FORTH HEREIN IN THE IMMEDIATELY PRECEDING CLAUSE (I); AND (III) IRREVOCABLY

AND UNCONDITIONALLY WAIVES (AND AGREES NOT TO PLEAD OR CLAIM) ANY OBJECTION TO THE LAYING OF VENUE OF ANY ACTION, SUIT OR PROCEEDING ARISING

OUT OF THIS AGREEMENT IN ANY STATE OR FEDERAL COURT LOCATED IN THE COMMONWEALTH OF PENNSYLVANIA, OR THAT ANY SUCH ACTION, SUIT OR PROCEEDING

BROUGHT IN ANY SUCH COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM. EACH OF THE PARTIES TO THIS AGREEMENT HEREBY IRREVOCABLY WAIVES,

AND SHALL CAUSE ITS AFFILIATES TO WAIVE, ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING

TO THIS AGREEMENT OR THE OTHER AGREEMENTS AND INSTRUMENTS DELIVERED HEREUNDER OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. |

| 16. | Severability. In case any provision of this Agreement shall be determined to be invalid,

illegal, or unenforceable for any reason, the remaining provisions of this Agreement shall be unaffected and unimpaired thereby and shall

remain in full force and effect to the fullest extent permitted by law. |

| 17. | Voluntary Execution of Agreement. This Agreement is executed voluntarily and without any

duress or undue influence on the part or behalf of the parties hereto, with the full intent of releasing all claims. Employee hereby acknowledges

that (a) Employee has read this Agreement, (b) Employee has been represented in the preparation, negotiation, and execution

of this Agreement by legal counsel of Employee’s own choice or that Employee has voluntarily declined to seek such counsel, (c) Employee

understands the terms and consequences of this Agreement and of the releases it contains, and (d) Employee is fully aware of the

legal and binding effect of this Agreement. |

| 18. | Counterparts. This Agreement may be signed in counterpart originals with the same force

and effect as though a single original were executed. |

| 19. | Entire Agreement. This Agreement constitutes the entire agreement of the parties hereto

with respect to the subject matter of the Agreement, and the Agreement supersedes all prior agreements among the parties with respect

to the subject matter covered herein, whether written or oral. |

* * * *

[Signature pages follow]

IN WITNESS WHEREOF, the parties have executed this

Agreement as of the date first above written.

| |

BRIGHTVIEW LANDSCAPES, LLC |

| |

|

| |

By: |

/s/ Amanda Orders |

| |

|

Name: Amanda Orders |

| |

|

Title: Chief Human Resources Officer |

| |

|

| |

Solely for purposes of Section 4(b)(i)(C) and Section 9: |

| |

|

| |

BRIGHTVIEW HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Amanda Orders |

| |

|

Name: Amanda Orders |

| |

|

Title: Chief Human Resources Officer |

[Signature Page to Transition Services and Separation Agreement]

| |

EMPLOYEE |

| |

|

| |

/s/ Jamie C. Gollotto |

| |

Jamie C. Gollotto |

[Signature Page to Transition Services and Separation Agreement]

EXHIBIT A

Restricted Stock Unit Awards

| Grant Cycle |

Grant Date |

Tranche Vest Date |

Tranche Shares |

| NOV20RSU |

11/19/2020 |

11/19/2024 |

3,742 |

| NOV21RSU |

11/18/2021 |

11/18/2024 |

4,089 |

| OFF23RSU |

6/1/2023 |

6/1/2024

12/1/2024 |

12,463

12,463 |

| NOV23ARSU |

11/17/2023 |

11/17/2024 |

8,854 |

| NOV22ARSU |

11/18/2022 |

11/18/2024 |

14,372 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

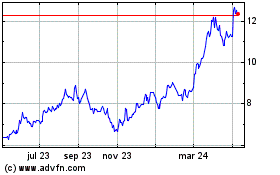

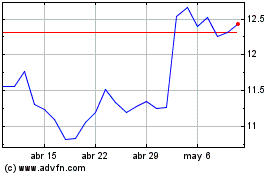

BrightView (NYSE:BV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

BrightView (NYSE:BV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024