Blackstone Closes First Series of Evergreen Institutional U.S. Direct Lending Fund with $22 Billion of Investable Capital; Brings Global Direct Lending Platform to over $123 Billion in AUM

29 Octubre 2024 - 6:30AM

Business Wire

Blackstone today announced the final close of the first series

of its evergreen institutional U.S. direct lending fund, Blackstone

Senior Direct Lending Fund (“BXD”). Blackstone has closed on

approximately $22 billion of investable capital for the inaugural

series of BXD and related vehicles, including anticipated leverage,

exceeding our $10 billion target. This brings Blackstone’s global

direct lending platform to over $123 billion in assets under

management as of the third quarter.

“This capital raise reflects our long-term strength in private

credit, our global reach across corporates and sponsor-led

transactions, and our ability to add value to the companies with

which we partner,” said Brad Marshall, Global Head of Private

Credit Strategies at Blackstone Credit & Insurance (“BXCI”).

“We believe our scale and breadth of solutions position us

extremely well during what we expect to be an active transaction

environment with declining rates."

BXCI deployed or committed $40 billion in direct lending through

the third quarter, more than double the total for all of 2023. This

includes lead roles in some of the largest deals of the year with

CoreWeave ($7.5B), Squarespace ($2.7B), Fidelis ($2B), and Davies

(£1.5B), as well as recent proprietary middle-market transactions

for Permira’s Acuity Knowledge Partners ($600M), Graham Partners’

Gatekeeper Systems ($550M), and publicly listed Loar ($360M), where

BXCI served as the sole lender.

“Our global platform gives us strength in both the traditional

middle-market and growing opportunity set for larger deals

available to few others," added Gilles Dellaert, Global Head of

BXCI. “Investors and borrowers continue to recognize the benefits

that private capital can provide in direct lending and across the

broader credit markets."

About Blackstone Credit & Insurance Blackstone Credit

& Insurance (“BXCI”) is one of the world’s leading credit

investors. Our investments span the credit markets, including

private investment grade, asset based lending, public investment

grade and high yield, sustainable resources, infrastructure debt,

collateralized loan obligations, direct lending and opportunistic

credit. We seek to generate attractive risk-adjusted returns for

institutional and individual investors by offering companies

capital needed to strengthen and grow their businesses. BXCI is

also a leading provider of investment management services for

insurers, helping those companies better deliver for policyholders

through our world-class capabilities in investment grade private

credit.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029220770/en/

Thomas Clements (646) 482-6088

Thomas.Clements@blackstone.com

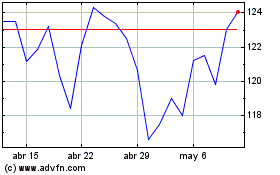

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024