Blackstone (NYSE: BX) and Retail Opportunity Investments Corp.

(Nasdaq: ROIC) (“ROIC” or the “Company”) today announced that they

have entered into a definitive agreement under which Blackstone

Real Estate Partners X will acquire all outstanding common shares

of ROIC for $17.50 per share in an all-cash transaction valued at

approximately $4 billion, including outstanding debt. ROIC’s

portfolio consists of 93 high-quality, grocery-anchored retail

properties totaling 10.5 million square feet concentrated in Los

Angeles, Seattle, San Francisco and Portland.

The purchase price represents a premium of 34% to ROIC’s closing

share price on July 29, 2024, the last trading day prior to news

reports of a potential sale.

“We are pleased to reach this agreement with Blackstone, as it

will provide significant and certain value to our stakeholders,”

said Stuart A. Tanz, President and Chief Executive Officer of ROIC.

“This transaction represents the culmination of the steadfast

commitment and extraordinary dedication of our talented team and

their tireless efforts over the past 15 years. We are confident

that Blackstone will position ROIC’s portfolio for continued growth

and success.”

Jacob Werner, Co-Head of Americas Acquisitions at Blackstone

Real Estate, said, “This transaction reflects our strong conviction

in necessity-based, grocery anchored shopping centers in densely

populated geographies. The sector is experiencing accelerating

fundamentals, benefiting from nearly a decade of virtually no new

construction, while demand for brick-and-mortar grocery stores,

restaurants, fitness and other lifestyle retailers remains healthy.

We are pleased to be acquiring ROIC, which owns a unique collection

of high-quality assets in some of the most desirable West Coast

markets.”

The transaction has been approved by ROIC’s Board of Directors

and is expected to close in the first quarter of 2025, subject to

customary closing conditions, including the approval of the

Company’s common stockholders.

J.P. Morgan acted as ROIC’s exclusive financial advisor.

Clifford Chance US LLP served as ROIC’s legal counsel. BofA

Securities, Morgan Stanley & Co. LLC, Newmark, and Eastdil

Secured acted as Blackstone’s financial advisors. Simpson Thacher

& Bartlett LLP served as Blackstone’s legal counsel.

About Retail Opportunity Investments Corp.

Retail Opportunity Investments Corp. (NASDAQ: ROIC), is a

fully-integrated, self-managed real estate investment trust (REIT)

that specializes in the acquisition, ownership and management of

grocery-anchored shopping centers located in densely-populated,

metropolitan markets across the West Coast. As of September 30,

2024, ROIC owned 93 shopping centers encompassing approximately

10.5 million square feet. ROIC is the largest publicly-traded,

grocery-anchored shopping center REIT focused exclusively on the

West Coast. ROIC is a member of the S&P SmallCap 600 Index and

has investment-grade corporate debt ratings from Moody’s Investor

Services, S&P Global Ratings and Fitch Ratings, Inc. Additional

information is available at: www.roireit.net.

About Blackstone Real Estate

Blackstone is a global leader in real estate investing.

Blackstone’s real estate business was founded in 1991 and has US

$325 billion of investor capital under management. Blackstone is

the largest owner of commercial real estate globally, owning and

operating assets across every major geography and sector, including

logistics, data centers, residential, office and hospitality. Our

opportunistic funds seek to acquire undermanaged, well-located

assets across the world. Blackstone’s Core+ business invests in

substantially stabilized real estate assets globally, through both

institutional strategies and strategies tailored for income-focused

individual investors including Blackstone Real Estate Income Trust,

Inc. (BREIT). Blackstone Real Estate also operates one of the

leading global real estate debt businesses, providing comprehensive

financing solutions across the capital structure and risk spectrum,

including management of Blackstone Mortgage Trust (NYSE: BXMT).

Forward-Looking Statements. Certain information contained

in this press-release (the “Material”) constitutes “forward-looking

statements,” which can be identified by the use of forward-looking

terminology or the negatives thereof. These may include statements

about plans, objectives and expectations with respect to future

operations. Such forward‐looking statements are inherently

uncertain and there are or may be important factors that could

cause actual outcomes or results to differ materially from those

indicated in such statements. Blackstone believes these factors

include, but are not limited to, those described under the section

entitled “Risk Factors” in its Annual Report on Form 10‐K for the

most recent fiscal year, and any such updated factors included in

its periodic filings with the Securities and Exchange Commission,

which are accessible on the SEC’s website at www.sec.gov. These

factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in the Materials and in the filings. Blackstone undertakes no

obligation to publicly update or review any forward‐looking

statement, whether as a result of new information, future

developments or otherwise.

Opinions. Opinions expressed reflect the current opinions

of the named persons or Blackstone where indicated, as of the date

appearing in the Material only and are based on opinions of the

current market environment, which are subject to change. Certain

information contained in this Material discusses general market

activity, industry or sector trends, or other broad-based economic,

market or political conditions and should not be construed as

research or investment advice.

Third Party Information. Certain information contained in

this Material has been obtained from sources outside Blackstone,

which in certain cases have not been updated through the date

hereof. While such information is believed to be reliable for

purposes used herein, no representations are made as to the

accuracy or completeness thereof and none of Blackstone, its funds,

nor any of their affiliates takes any responsibility for, and has

not independently verified, any such information.

ROIC Forward Looking Statements. This communication

includes certain disclosures from ROIC (as used in this paragraph

only, the “Company”) which contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and in Section 21F of the Securities and Exchange Act of

1934, as amended, including but not limited to those statements

related to the transaction, including financial estimates and

statements as to the expected timing, completion and effects of the

transaction. When used herein, the words “believes,” “anticipates,”

“projects,” “should,” “estimates,” “expects,” “guidance” and

similar expressions are intended to identify forward-looking

statements. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results to differ materially from future results expressed

or implied by such forward-looking statements. Important factors,

risks and uncertainties that could cause actual results to differ

materially from such plans, estimates or expectations include but

are not limited to: (i) the parties’ ability to complete the

transaction on the anticipated terms and timing, or at all,

including the Company’s ability to obtain the required stockholder

approval, and the parties’ ability to satisfy the other conditions

to the completion of the transaction; (ii) potential litigation

relating to the transaction that could be instituted against the

Company or its directors, managers or officers, including the

effects of any outcomes related thereto; (iii) the risk that

disruptions from the transaction will harm the Company’s business,

including current plans and operations, including during the

pendency of the transaction; (iv) the ability of the Company to

retain and hire key personnel; (v) potential adverse reactions or

changes to business relationships resulting from the announcement

or completion of the transaction; (vi) legislative, regulatory and

economic developments; (vii) potential business uncertainty,

including changes to existing business relationships, during the

pendency of the transaction that could affect the Company’s

financial performance; (viii) certain restrictions during the

pendency of the transaction that may impact the Company’s ability

to pursue certain business opportunities or strategic transactions;

(ix) unpredictability and severity of catastrophic events,

including but not limited to acts of terrorism, outbreaks of war or

hostilities or pandemic, as well as management’s response to any of

the aforementioned factors; (x) the possibility that the

transaction may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; (xi) the

occurrence of any event, change or other circumstance that could

give rise to the termination of the transaction, including in

circumstances requiring the Company to pay a termination fee; (xii)

those risks and uncertainties set forth under the headings

“Statements Regarding Forward-Looking Information” and “Risk

Factors” in the Company’s most recent Annual Report on Form 10-K,

as such risk factors may be amended, supplemented or superseded

from time to time by other reports filed by the Company with the

Securities and Exchange Commission (the “SEC”) from time to time,

which are available via the SEC’s website at www.sec.gov; and

(xiii) those risks that will be described in the proxy statement

that will be filed with the SEC and available from the sources

indicated below.

These risks, as well as other risks associated with the

transaction, will be more fully discussed in the proxy statement

that will be filed by the Company with the SEC in connection with

the transaction. There can be no assurance that the transaction

will be completed, or if it is completed, that it will close within

the anticipated time period. These factors should not be construed

as exhaustive and should be read in conjunction with the other

forward-looking statements. The forward-looking statements relate

only to events as of the date on which the statements are made. The

Company and Blackstone do not undertake any obligation to publicly

update or review any forward-looking statement except as required

by law, whether as a result of new information, future developments

or otherwise. If one or more of these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, our actual results may vary materially from what

we may have expressed or implied by these forward-looking

statements. We caution that you should not place undue reliance on

any of our forward-looking statements. You should specifically

consider the factors identified in this communication that could

cause actual results to differ. Furthermore, new risks and

uncertainties arise from time to time, and it is impossible for us

to predict those events or how they may affect the Company or

Blackstone.

Information regarding such risks and factors is described in

ROIC’s filings with the SEC, including its most recent Annual

Report on Form 10-K, which is available at: www.roireit.net.

Important Additional Information and Where to Find It

This communication is being made in connection with the

transaction. In connection with the transaction, the Company will

file a proxy statement on Schedule 14A and certain other documents

regarding the transaction with the SEC. Promptly after filing its

definitive proxy statement with the SEC, the definitive proxy

statement will be mailed to stockholders of the Company. This

communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION, COMPANY STOCKHOLDERS ARE URGED TO

READ THE PROXY STATEMENT THAT WILL BE FILED BY THE COMPANY WITH THE

SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION.

Company stockholders will be able to obtain, free of charge, copies

of such documents filed by the Company when filed with the SEC in

connection with the transaction at the SEC’s website

(http://www.sec.gov). In addition, the Company’s stockholders will

be able to obtain, free of charge, copies of such documents filed

by the Company at the Company’s website (www.roireit.net).

Alternatively, these documents, when available, can be obtained

free of charge from the Company upon written request to the Company

at 11250 El Camino Real, Suite 200, San Diego, CA 92130.

Participants in the Solicitation

The Company and certain of its directors, executive officers and

other employees may be deemed to be participants in the

solicitation of proxies from stockholders of the Company in

connection with the transaction. Additional information regarding

the identity of the participants, and their respective direct and

indirect interests in the transaction, by security holdings or

otherwise, will be set forth in the proxy statement and other

relevant materials to be filed with the SEC in connection with the

transaction (if and when they become available). You may obtain

free copies of these documents using the sources indicated

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106366347/en/

ROIC Stuart A. Tanz (858) 255-4901 stanz@roireit.net

Blackstone Claire Keyte (646) 482-8753

Claire.Keyte@Blackstone.com

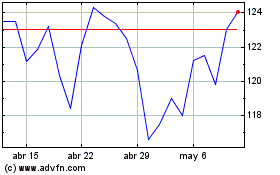

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024