Proxy Advisory Service ISS Acknowledges “Existential Issues” Facing GrafTech

29 Abril 2024 - 7:06PM

Nilesh Undavia, one of the largest shareholders of GrafTech

International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”), today

made the following statement in connection with the election of

directors to the Company’s board of directors (the “Board”) at the

Company’s 2024 annual meeting of shareholders (the “Annual

Meeting”), which is scheduled to be held on May 9, 2024:

On April 26, 2024, independent proxy advisory

firm Institutional Shareholder Services Inc. (“ISS”) published a

report regarding the upcoming election.1

- ISS acknowledges that our campaign

“has successfully highlighted some of the [C]ompany’s many pressing

and existential issues” and agrees with us that, “the

issues facing the [C]ompany are serious, and if not adequately

handled, may soon prove to be existential.”

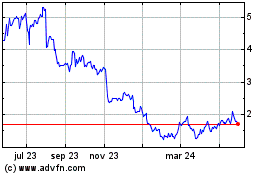

- ISS emphasizes, as did we, that

GrafTech’s Total Shareholder Return (TSR) “trails its peer median

and the relevant index over the past one-, three- and five- year

periods… and since the [C]ompany’s April 19, 2018 IPO,” displaying

the massive destruction of shareholder value under this Board and

management team.

Agreeing with many of our concerns, in its

report, ISS also notes the following:

- Revenue: “The

[C]ompany’s shrinking share of ex-China industry revenues is

greater cause for alarm, as this share has declined from 13.2

percent in 2019 to 4.7 percent in 2023. The [C]ompany has

clearly not been able to replace the ‘captive’ revenue that it once

had from LTAs.”

- Customers: “Year

to date, the [C]ompany’s management has met with customers

representing over 75 percent of the [C]ompany’s electrode sales

volume in the Americas. The corresponding figure for this portion

of 2023 was approximately 20 percent, ISS learned in engagement

with the [C]ompany. Given the disparity of customer

outreach between the two years, it is reasonable for shareholders

to question the intensity of effort involved in this campaign in

its early years.”

- Strategic Review:

“[A]round 18 months ago, the [B]oard began a strategic review aimed

at identifying opportunities in the battery anode space. The

campaign was not announced at the time, the Board explained in

engagement with ISS, because the [C]ompany did not want to disrupt

customer relationships. While this may be a valid concern,

it is unclear that the [B]oard made the right decision in

keeping this information from shareholders. The first

disclosure of this review appears to be in a [C]ompany presentation

filed on April 17, 2024, well after this proxy contest began.”

- ISS also observed that management

has not addressed concerns about the Company’s liquidity for

periods after 2024.

We are therefore baffled that—despite

recognizing massive shareholder value destruction, declaring the

issues facing GrafTech are “existential,” and questioning the

Board’s credibility and transparency regarding client outreach and

the commencement of a strategic review—ISS somehow concluded that

the same Board should be trusted to turn things around at the

Company.

Rather than hold the Board accountable for its

failures, it appears that ISS chose to focus on the personal

attacks, distractions and red herrings presented by GrafTech, such

as a couple of inadvertent errors in Mr. Undavia’s response to a

33-page director questionnaire, which were promptly corrected.

We urge investors to ask themselves a simple

question: How can Mr. Taccone, the incumbent nominee, be a better

steward of shareholder interests than Mr. Undavia? As a director

since 2018, Mr. Taccone:

- oversaw over $4 billion of

shareholder value destruction;

- failed to re-position GrafTech’s

business after claiming intimate knowledge of GrafTech’s

customers;

- oversaw the hiring of former CEO

Marcel Kessler, who lacked the necessary background and

qualifications; and

- has not bought even a single share

of GrafTech stock in the past four years.

In stark contrast, Nilesh Undavia has been an

exemplary fiduciary of client capital at Wellington Management

(“Wellington”), one of the world’s largest asset managers, is

intimately familiar with GrafTech’s industry, has concrete

solutions to solve the myriad challenges faced by GrafTech, and has

invested millions of dollars of his personal capital.

- Mr. Undavia has over a two-decade

track record as a partner and portfolio manager at Wellington.

- In his role at Wellington, Mr.

Undavia embodied its code of ethics, which demands that “clients’

interests must always come first; they cannot and will not be

compromised.”

- He continuously exhibited diligence

and exercised “duty of care” as a fiduciary for client assets in

the tens of billions of dollars.

- We find it absurd to question

whether Mr. Undavia would apply the same “duty of care” to the

interests of fellow GrafTech shareholders, especially given he has

invested millions of dollars of his own capital.

For these reasons, we believe Mr.

Undavia represents a better choice for GrafTech’s

Boardroom.

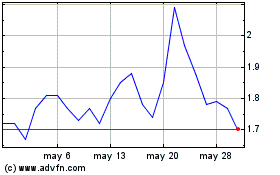

Last Week’s 1Q 2024 Earnings Report Was

DisappointingAnother clear sign that the Company continues

failing to meet investor expectations is the 17% drop in stock

price during the earnings conference call, ending down 2% for the

day, compared to the 0.5% jump in the NYSE Arca Steel

Index.

We attribute the fall in the stock price to

GrafTech’s continued failure to address the following

challenges:

- The implicit indication that the

Company’s financial performance would remain muted or could

potentially deteriorate in 2024 due to weakening pricing and

stagnant volumes;

- A significant portion of the cost

reductions announced in response to our campaign, were due to

accounting factors;

- No mention of a strategy or path to

regain market share; and

- Zero progress being reported by the

Company on incremental customer engagement for electric vehicle

battery producers, something it has been talking about for seven

quarters.

We patiently waited in the queue to ask

questions on the call, hoping to gain clarity on many of the issues

plaguing the Company. Unfortunately, GrafTech did not give us—one

of its largest shareholders—the chance to do so, further

demonstrating its utter disregard for shareholders.

Independent Analyst Recognizes the

Urgent Need for Change In a letter to the Board, dated

April 11, 20242, John Tumazos, a steel industry analyst for the

past 45 years, of Very Independent Research—a firm advising

institutional clients in the U.S. and Canada—wrote the

following:3

- “The irony of GrafTech suffering a

50% volume decline as new electric arc furnaces sprout like Spring

tulips made me very curious. …. [we] ask[ed] steel melters why they

buy from your competitors more than GrafTech. It shocked me

that GrafTech was visibly absent from [a recent] Louisville, KY

gathering of your customers.

- GrafTech’s marketing efforts lag

competitors.... [for example] Tokai Carbon told us afterwards that

it made 3 sales at the program, where GrafTech did not

embrace this opportunity to join its customers and was not even

listed as a donor to AIST.

- [I]t is urgent to repair and

improve your business relationship with Nucor, whose alumni are key

decision-makers at STLD, Big River Steel or elsewhere. Recently

they prefer Tokai Carbon or Resonac, where simply winning one-third

of Nucor’s business would add over 1/10th to your volumes.

The relationship appears ‘estranged’…

- The most important criteria in

selecting the new key executives should be existing relationships

with key customers, the ability to win new sales and repair

relations with key customers lost. The Board’s selection of

the prior CEO Marcel Kessler baffles me, where his prior employment

at McKinsey or as CEO of Pason Systems data firm reselling wellhead

data back to oil producers suggests no relevance or market

knowledge to sell electrodes to steelmakers. Marcel Kessler’s

tenure coincided with several setbacks.

- It saddens me that you rejected

Nilesh Undavia’s offer to join your board, where a 6% personal

ownership from a veteran institutional investor is a wonderful

endorsement. Further, it confuses me that you spend probably close

to $1 mm of shareholder funds opposing his proxy campaign, where

shareholder funds are precious as losses loom.”

In Conclusion, Vote FOR Nilesh

UndaviaIn concluding its report, ISS wrote: “If [GrafTech]

continues to struggle in the future, the points that the dissident

has made in this campaign could well serve as a foundation for a

more successful case for change at the board level, at that time.”

We are dumbfounded by this conclusion. Why wait for the Company to

get into a more precarious financial situation and destroy even

more shareholder value before adding a new highly qualified,

independent director with significant skin in the game?

Shareholders need to act now by

electing a director who will represent their interests with an

owner’s perspective and a deep commitment to shareholder value. To

achieve much-needed change in the GrafTech Boardroom, shareholders

should vote on the BLUE universal proxy card

FOR Nilesh Undavia.

Additional Information and Where to Find

It

Mr. Undavia and certain family trusts

(collectively, the “Undavia Group”) are participants in the

solicitation of proxies from shareholders of the Company in favor

of Mr. Undavia’s nomination for the Board at the Annual Meeting. On

April 2, 2024, the Undavia Group filed with the U.S. Securities and

Exchange Commission (the “SEC”) its definitive proxy statement and

accompanying BLUE universal proxy card in

connection with its solicitation of proxies from the shareholders

of the Company for the Annual Meeting. ALL SHAREHOLDERS OF

THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING

BLUE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE

SOLICITATION OF PROXIES BY THE UNDAVIA GROUP, AS THEY CONTAIN

IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO

THE UNDAVIA GROUP AND ITS DIRECT OR INDIRECT INTERESTS IN THE

COMPANY, BY SECURITY HOLDINGS OR OTHERWISE. Investors and

security holders may obtain copies of the definitive proxy

statement, BLUE universal proxy card and other

documents filed with the SEC by the Undavia Group free of charge

through the website maintained by the SEC at http://www.sec.gov/.

Copies of the definitive proxy statement and accompanying

BLUE universal proxy card filed with the SEC by

the Undavia Group are also available free of charge by accessing

the website at https://www.icomproxy.com/EAF.

19 Old Kings Highway S. – Suite 130Darien, CT 06820Toll Free

(877) 972-0090Banks and Brokers call collect (203)

972-9300info@investor-com.com

1 Permission to use quotations from the ISS report was neither

sought nor obtained.2

https://icomproxy.com/UPLOADBLOGSDIR/44/files/sites/44/2024/04/GrafTech-Letter-041124.pdf3

Permission to quote from his letter was granted by Mr. Tumazos.

GrafTech (NYSE:EAF)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

GrafTech (NYSE:EAF)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024