Fiserv Small Business Index™ Holds Steady in August: Transaction Growth Accelerates as Restaurant and Retail Sales Trend Upward

03 Septiembre 2024 - 7:30AM

Business Wire

Fiserv Small Business Index is unchanged at

141

Small business sales grew 1.6% year over year,

and declined 0.3% month over month; transactions grew 5.7% year

over year, and 1.3% month over month

Fiserv, Inc. (NYSE: FI), a leading global provider of payments

and financial services technology, has published the Fiserv Small

Business Index for August 2024. The Fiserv Small Business Index is

an indicator of the pace and mix of consumer spending at small

businesses in the United States at national, state and industry

levels.

“At the beginning of each month, the Fiserv Small Business Index

provides first-to-market insight into consumer spending at small

businesses,” said Jennifer LaClair, Head of Merchant Solutions at

Fiserv. “This monthly view of consumer spending has become an

important economic indicator, providing a timely understanding of

small business performance so we can better serve clients and

partners across the small business ecosystem.”

Nationally, the seasonally adjusted Fiserv Small Business Index

in August was 141, unchanged from July. On a year-over-year basis,

both small business sales (+1.6%) and total transactions (+5.7%)

grew compared to August 2023, pointing to healthy consumer foot

traffic. Month-over-month sales declined slightly (-0.3%) compared

to July despite transactions growing (+1.3%). Transaction growth

outpacing total sales can partly be attributed to recent declines

in inflation, including July 2024 marking the lowest inflation rate

since early 2021.

“Consumers made notable shifts to their spending patterns in

August, resulting in restaurant and retail – including grocery, gas

stations, and clothing – all trending upward in the month,” said

Prasanna Dhore, Chief Data Officer at Fiserv. “Meanwhile, many

service-based businesses, including specialty trade contractors and

professional services, saw growth rates slow.”

Retail Growth Continues

The Small Business Retail Index rose one point in August to 147.

Year-over-year sales (+3.0%) and transactions (+7.3%) grew

significantly as average ticket sizes saw a noticeable decline

(-4.3%) compared to 2023. Back-to-school shopping, favorable

pricing trends and a recently reported rise in consumer confidence

contributed to this growth. Year over year, the fastest growing

retail categories were General Merchandise (+8.8%), Food and

Beverage Stores (+7.9%) and Sporting Goods (+5.6%).

Following the yearly trend, month-over-month retail sales

(+1.0%) and transactions (+1.5%) both grew as average ticket sizes

declined (-0.5%). Monthly growth highlighted a different mix of

consumer priorities, with Clothing (+2.1%), Food and Beverage

(+1.9%) and Furniture (+1.3%) seeing the most growth compared to

July.

Restaurants Reverse Trend

Food Services and Drinking Places, which includes restaurants,

indexed at 126 in August, a 3-point gain compared to July. The

upward swing in spend marked a notable turnaround compared to

July’s index, when spend slowed on both an annual and monthly

basis. Gains were widespread across the U.S., with nearly every

state in the country seeing increased restaurant patronage in

August.

Year over year, restaurants saw strong growth in both total

sales (+4.9%) and foot traffic (+4.2%); average ticket size grew

slightly (+0.7%). Month-over-month restaurant sales (+2.7%) and

transactions (+1.1%) increased compared to July, reversing a streak

of two consecutive months of slowing restaurant sales and foot

traffic. Average ticket size also grew (+1.5%) month over

month.

Other Industry Movers

- Professional, Scientific, and Technical Services continues

seeing significant growth in sales (+9.6%) and transactions (+8.5%)

year over year, despite sales (-1.0%) and transactions (-2.8%)

slowing slightly compared to July. Demand for a wide variety of

professional services was healthy in August, with veterinary,

legal, advertising and general business services among the

strongest.

- Specialty Trade Contractor sales (-0.9%) declined year over

year while transactions grew (+1.5%). Month-over-month sales

(-2.2%) also slowed while transactions remained steady (+0.2%).

Demand for HVAC and plumbing services saw the biggest decline

compared to August 2023, while electricians, roofers and concrete

contractors had modest gains.

- Additional year-over-year sales growth categories included

Amusement/Gambling/Recreation (+14.1%), Web Search, Libraries and

Information Services (+12.7%), and Food Manufacturing (+12.8%); the

sharpest annual sales declines were in Real Estate (-15.2%),

Hospitals (-7.7%) and Educational Services (-6.8%).

- Truck Transportation (+4.4%), Food Manufacturing, (+3.9%), and

Performing Arts Spectator Sports and Related Industries (+3.1%)

sales all saw month-over-month growth; Educational Services

(-5.5%), Insurance (-4.3%) and Ambulatory Healthcare (-3.4%) sales

saw the largest month-over-month declines.

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first

week of every month and differentiated by its direct aggregation of

consumer spending activity within the U.S. small business

ecosystem. Rather than relying on survey or sentiment data, the

Fiserv Small Business Index is derived from point-of-sale

transaction data, including card, cash, and check transactions

in-store and online across approximately 2 million U.S. small

businesses, including hundreds of thousands leveraging the Clover

point-of-sale and business management platform.

Benchmarked to 2019, the Fiserv Small Business Index provides a

numeric value measuring consumer spending, with an accompanying

transaction index measuring customer traffic. Through a simple

interface, users can access data by region, state, and/or across

business types categorized by the North American Industry

Classification System (NAICS). Computing a monthly index for 16

sectors and 34 sub-sectors, the Fiserv Small Business Index

provides a timely, reliable and consistent measure of small

business performance even in industries where large businesses

dominate.

To access the full Fiserv Small Business Index, visit

fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move

money and information in a way that moves the world. As a global

leader in payments and financial technology, the company helps

clients achieve best-in-class results through a commitment to

innovation and excellence in areas including account processing and

digital banking solutions; card issuer processing and network

services; payments; e-commerce; merchant acquiring and processing;

and the Clover® cloud-based point-of-sale and business management

platform. Fiserv is a member of the S&P 500® Index and has been

recognized as one of Fortune® World’s Most Admired Companies™ for 9

of the last 10 years. Visit fiserv.com and follow on social media

for more information and the latest company news.

FI-G

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903902015/en/

Chase Wallace Director, Communications Fiserv, Inc. +1

470-481-2555 chase.wallace@fiserv.com

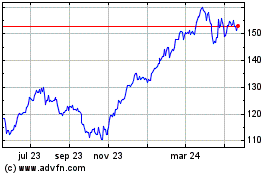

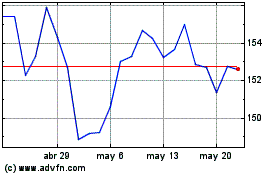

Fiserv (NYSE:FI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Fiserv (NYSE:FI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024