Form 8-K - Current report

06 Noviembre 2024 - 6:39AM

Edgar (US Regulatory)

0001992243false00019922432024-11-062024-11-060001992243freyr:OrdinarySharesWithoutNominalValueMember2024-11-062024-11-060001992243freyr:WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

FREYR Battery, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-274434 | | 93-3205861 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6&8 East Court Square, Suite 300,

Newnan, Georgia 30263

| | | | | | | | |

| | |

| (Address of principal executive offices, including zip code) |

| | | |

Registrant’s telephone number, including area code: (678) 632-3112

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | FREY | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 | | FREY WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, FREYR Battery, Inc., a Delaware corporation, issued a press release announcing its financial results for the third quarter ended September 30, 2024.

The information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

The information in this Item 2.02, including the Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | FREYR BATTERY, INC. |

| | |

Date: November 6, 2024 | By: | /s/ Joseph Evan Calio |

| | Name: | Joseph Evan Calio |

| | Title: | Chief Financial Officer |

News Release

FREYR Battery Reports Third Quarter 2024 Results

New York, Oslo, and Newnan, GA, November 6, 2024, FREYR Battery, Inc. (NYSE: FREY) (“FREYR” or the “Company”), a developer of sustainable clean energy capacity and solutions, today reported financial results for the third quarter of 2024.

Results Overview, Financing, and Liquidity

•FREYR reported a net loss attributable to stockholders for the third quarter of 2024 of $(27.5) million, or $(0.20) per diluted share compared to a net loss for the third quarter of 2023 of $(9.8) million or $(0.07) per diluted share. The increase in net loss in the third quarter of 2024 was primarily due to a $1.1 million warrant liability fair value adjustment for the three months ended September 30, 2024, compared to $24.4 million for the three months ended September 30, 2023, and a restructuring charge of $4.5 million for the three months ended September 30, 2024 compared to none for the three months ended September 30, 2023.

•As of September 30, 2024, FREYR had cash, cash equivalents, and restricted cash of $184.1 million, and no debt.

1 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news-and-media

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| | |

| ASSETS |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 181,851 | | | $ | 253,339 | |

| Restricted cash | | 2,202 | | | 22,403 | |

| Prepaid assets | | 2,838 | | | 2,168 | |

| Other current assets | | 12,583 | | | 34,044 | |

| Total current assets | | 199,474 | | | 311,954 | |

| | | | |

| Property and equipment, net | | 368,342 | | | 366,357 | |

| Intangible assets, net | | 2,700 | | | 2,813 | |

| Long-term investments | | 21,819 | | | 22,303 | |

| | | | |

| Right-of-use asset under operating leases | | 22,640 | | | 24,476 | |

| Other long-term assets | | 10 | | | 4,282 | |

| Total assets | | $ | 614,985 | | | $ | 732,185 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | | |

| Accounts payable | | $ | 10,080 | | | $ | 18,113 | |

| Accrued liabilities and other | | 21,254 | | | 30,790 | |

| | | | |

| | | | |

| Share-based compensation liability | | 19 | | | 281 | |

| Total current liabilities | | 31,353 | | | 49,184 | |

| | | | |

| Warrant liability | | 721 | | | 2,025 | |

| Operating lease liability | | 16,775 | | | 18,816 | |

| Other long-term liabilities | | 27,446 | | | 27,444 | |

| | | | |

| Total liabilities | | 76,295 | | | 97,469 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders’ equity: | | | | |

Preferred stock, $0.01 par value, 10,000 shares authorized, none issued and outstanding as of both September 30, 2024 and December 31, 2023 | | — | | | — | |

Common stock, $0.01 par value, 355,000 shares authorized as of both September 30, 2024 and December 31, 2023; 140,490 issued and outstanding as of September 30, 2024; and 139,705 issued and outstanding as of December 31, 2023 | | 1,405 | | | 1,397 | |

| | | | |

| Additional paid-in capital | | 929,324 | | | 925,623 | |

| | | | |

| Accumulated other comprehensive loss | | (34,035) | | | (18,826) | |

| Accumulated deficit | | (358,004) | | | (274,999) | |

| Total stockholders' equity | | 538,690 | | | 633,195 | |

| | | | |

| Non-controlling interests | | — | | | 1,521 | |

| Total equity | | 538,690 | | | 634,716 | |

| | | | |

| Total liabilities and equity | | $ | 614,985 | | | $ | 732,185 | |

2 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news-and-media

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | Nine months ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating expenses: | | | | | | | | |

| General and administrative | | $ | 18,515 | | | $ | 27,772 | | | $ | 61,386 | | | $ | 85,405 | |

| Research and development | | 8,616 | | | 7,086 | | | 30,854 | | | 18,295 | |

| Restructuring charge | | 4,507 | | | — | | | 4,644 | | | — | |

| Share of net loss of equity method investee | | 150 | | | 153 | | | 484 | | | 208 | |

| Total operating expenses | | 31,788 | | | 35,011 | | | 97,368 | | | 103,908 | |

| Loss from operations | | (31,788) | | | (35,011) | | | (97,368) | | | (103,908) | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Warrant liability fair value adjustment | | 1,096 | | | 24,399 | | | 1,294 | | | 23,248 | |

| | | | | | | | |

| | | | | | | | |

| Interest income, net | | 1,074 | | | 1,284 | | | 3,627 | | | 6,042 | |

| | | | | | | | |

| Foreign currency transaction (loss) gain | | (110) | | | (3,213) | | | 1,245 | | | 20,546 | |

| Other income, net | | 2,172 | | | 2,537 | | | 7,806 | | | 6,103 | |

| Total other income | | 4,232 | | | 25,007 | | | 13,972 | | | 55,939 | |

| Loss before income taxes | | (27,556) | | | (10,004) | | | (83,396) | | | (47,969) | |

| Income tax expense | | — | | | — | | | (11) | | | (341) | |

| Net loss | | (27,556) | | | (10,004) | | | (83,407) | | | (48,310) | |

| Net loss attributable to non-controlling interests | | 81 | | | 219 | | | 402 | | | 517 | |

| Net loss attributable to stockholders | | $ | (27,475) | | | $ | (9,785) | | | $ | (83,005) | | | $ | (47,793) | |

| | | | | | | | |

| | | | | | | | |

| Weighted average shares outstanding - basic and diluted | | 140,490 | | | 139,705 | | | 140,102 | | | 139,705 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share attributable to stockholders - basic and diluted | | $ | (0.20) | | | $ | (0.07) | | | $ | (0.59) | | | $ | (0.34) | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive (loss) income: | | | | | | | | |

| Net loss | | $ | (27,556) | | | $ | (10,004) | | | $ | (83,407) | | | $ | (48,310) | |

| Foreign currency translation adjustments | | 5,973 | | | 6,134 | | | (15,209) | | | (48,009) | |

| Total comprehensive loss | | $ | (21,583) | | | $ | (3,870) | | | $ | (98,616) | | | $ | (96,319) | |

| Comprehensive loss attributable to non-controlling interests | | 81 | | | 219 | | | 402 | | | 517 | |

| Comprehensive loss attributable to stockholders | | $ | (21,502) | | | $ | (3,651) | | | $ | (98,214) | | | $ | (95,802) | |

| | | | | | | | |

3 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news-and-media

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine months ended

September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (83,407) | | | $ | (48,310) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | | |

| Share-based compensation expense | | 6,449 | | | 7,859 | |

| Depreciation and amortization | | 7,028 | | | 1,922 | |

| | | | |

| Reduction in the carrying amount of right-of-use assets | | 1,282 | | | 1,005 | |

| Warrant liability fair value adjustment | | (1,294) | | | (23,248) | |

| | | | |

| | | | |

| Share of net loss of equity method investee | | 484 | | | 208 | |

| | | | |

| Foreign currency transaction net unrealized gain | | (1,075) | | | (19,346) | |

| Other | | — | | | (929) | |

| Changes in assets and liabilities: | | | | |

| Prepaid assets and other current assets | | 13 | | | 1,672 | |

| | | | |

| Accounts payable, accrued liabilities and other | | (429) | | | 28,401 | |

| | | | |

| | | | |

| | | | |

| Operating lease liability | | (1,626) | | | (3,212) | |

| Net cash used in operating activities | | (72,575) | | | (53,978) | |

| | | | |

| Cash flows from investing activities: | | | | |

| Proceeds from the return of property and equipment deposits | | 22,735 | | | — | |

| Proceeds from property related grants | | — | | | 3,500 | |

| Purchases of property and equipment | | (34,683) | | | (168,811) | |

| Investments in equity method investee | | — | | | (1,655) | |

| Purchases of other long-term assets | | — | | | (1,000) | |

| Net cash used in investing activities | | (11,948) | | | (167,966) | |

| | | | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Payment for non-controlling interest | | (4,130) | | | — | |

| Net cash used in financing activities | | (4,130) | | | — | |

| | | | |

| Effect of changes in foreign exchange rates on cash, cash equivalents, and restricted cash | | (3,036) | | | (13,240) | |

| Net decrease in cash, cash equivalents, and restricted cash | | (91,689) | | | (235,184) | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 275,742 | | | 563,045 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 184,053 | | | $ | 327,861 | |

| | | | |

| Supplementary disclosure for non-cash activities: | | | | |

| Accrued purchases of property and equipment | | $ | 6,133 | | | $ | 11,187 | |

| | | | |

| | | | |

| Reconciliation to condensed consolidated balance sheets: | | | | |

| Cash and cash equivalents | | $ | 181,851 | | | $ | 299,419 | |

| Restricted cash | | 2,202 | | | 28,442 | |

| Cash, cash equivalents, and restricted cash | | $ | 184,053 | | | $ | 327,861 | |

4 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news-and-media

Investor contact:

Jeffrey Spittel

Senior Vice President, Investor Relations and Corporate Development

jeffrey.spittel@freyrbattery.com

Tel: (+1) 409-599-5706

Media contact:

Amy Jaick

Global Head of Communications

amy.jaick@freyrbattery.com

Tel: (+1) 973 713-5585

5 | News Release | FREYR Battery, Inc. | www.freyrbattery.com/news-and-media

Cover

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

FREYR Battery, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-274434

|

| Entity Address, Address Line One |

6&8 East Court Square, Suite 300

|

| Entity Address, Postal Zip Code |

30263

|

| Entity Address, City or Town |

Newnan

|

| City Area Code |

678

|

| Local Phone Number |

632-3112

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

93-3205861

|

| Entity Central Index Key |

0001992243

|

| Amendment Flag |

false

|

| Entity Address, State or Province |

GA

|

| OrdinarySharesWithoutNominalValueMember |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FREY

|

| Security Exchange Name |

NYSE

|

| WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

FREY WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_OrdinarySharesWithoutNominalValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=freyr_WarrantsEachWholeWarrantExercisableForOneOrdinaryShareAtAnExercisePriceOf1150Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

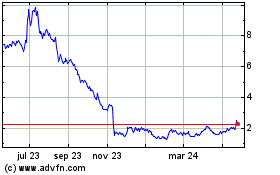

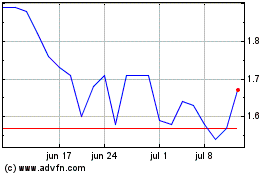

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024