Hilton Worldwide Holdings Inc. ("Hilton," "the Company," "we,"

"us" or "our") (NYSE: HLT) today reported its third quarter 2024

results. Highlights include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241023756181/en/

- Diluted EPS was $1.38 for the third quarter, and diluted

EPS, adjusted for special items, was $1.92

- Net income was $344 million for the third quarter

- Adjusted EBITDA was $904 million for the third

quarter

- System-wide comparable RevPAR increased 1.4 percent, on a

currency neutral basis, for the third quarter compared to the same

period in 2023

- Approved 27,500 new rooms for development during the third

quarter, bringing our development pipeline to 492,400 rooms as of

September 30, 2024, representing growth of 8 percent from September

30, 2023

- Added a record 36,600 rooms to our system in the third

quarter, resulting in 33,600 net additional rooms for the third

quarter, contributing to a record net unit growth of 7.8 percent

from September 30, 2023

- Repurchased 3.3 million shares of Hilton common stock during

the third quarter; bringing total capital return, including

dividends, to $764 million for the quarter and $2,422 million year

to date through October

- Issued $1.0 billion aggregate principal amount of 5.875%

Senior Notes due 2033 in September 2024

- Full year 2024 system-wide RevPAR is projected to increase

between 2.0 percent and 2.5 percent on a comparable and currency

neutral basis compared to 2023; full year net income is projected

to be between $1,405 million and $1,429 million; full year Adjusted

EBITDA is projected to be between $3,375 million and $3,405

million

- Full year 2024 capital return is projected to be

approximately $3.0 billion

- Net unit growth for 2025 is expected to be between 6.0

percent and 7.0 percent

Overview

Christopher J. Nassetta, President & Chief Executive Officer

of Hilton, said, "We were pleased to deliver continued strong

bottom line results that exceeded our guidance, despite slower top

line growth which was driven by modestly slower macro trends,

weather impacts and unfavorable calendar shifts. We continued to

demonstrate the strength of our model, opening more rooms than any

other quarter in our history, surpassing 8,000 hotels and achieving

net unit growth of 7.8 percent."

For the three months ended September 30, 2024, system-wide

comparable RevPAR increased 1.4 percent compared to the same period

in 2023 due to increases in both occupancy and ADR, and management

and franchise fee revenues increased 8.3 percent compared to the

same period in 2023.

For the nine months ended September 30, 2024, system-wide

comparable RevPAR increased 2.4 percent compared to the same period

in 2023 due to increases in both occupancy and ADR, and management

and franchise fee revenues increased 10.7 percent compared to the

same period in 2023.

For the three months ended September 30, 2024, diluted EPS was

$1.38 and diluted EPS, adjusted for special items, was $1.92

compared to $1.44 and $1.67, respectively, for the three months

ended September 30, 2023. Net income and Adjusted EBITDA were $344

million and $904 million, respectively, for the three months ended

September 30, 2024, compared to $379 million and $834 million,

respectively, for the three months ended September 30, 2023.

For the nine months ended September 30, 2024, diluted EPS was

$4.09 and diluted EPS, adjusted for special items, was $5.36

compared to $3.74 and $4.53, respectively, for the nine months

ended September 30, 2023. Net income and Adjusted EBITDA were

$1,034 million and $2,571 million, respectively, for the nine

months ended September 30, 2024, compared to $1,001 million and

$2,286 million, respectively, for the nine months ended September

30, 2023.

Development

In the third quarter of 2024, we opened 531 hotels, totaling

36,600 rooms, resulting in 33,600 net room additions.(1) During the

quarter, NoMad, Graduate by Hilton and Small Luxury Hotels of the

World ("SLH") became available for reservations on our booking

channels. The addition of SLH hotels brings our hotel portfolio to

ten additional countries and territories, allowing our guests to

book, earn and redeem Honors points in more sought after

destinations. We continued to expand our portfolio in the Asia

Pacific market, surpassing 900 hotels in the region and opening our

700th hotel in China. Additionally, our Spark by Hilton brand

continues to grow, with more than 20 hotels opening during the

third quarter, including the debut of the first Spark hotel in

Canada.

We added 27,500 rooms to the development pipeline during the

third quarter, and, as of September 30, 2024, our development

pipeline totaled 3,525 hotels representing 492,400 rooms throughout

120 countries and territories, including 28 countries and

territories where Hilton had no existing hotels.(2) Additionally,

of the rooms in the development pipeline, 235,400 were under

construction and 280,700 were located outside of the U.S.

____________

(1)

Excluding hotels from our strategic

partner arrangements, we added 18,300 rooms to our system during

the third quarter, and, as of September 30, 2024, our hotel system

would have totaled 7,800 hotels representing 1,213,800 rooms,

growing 6.1% from September 30, 2023 and 1.3% from the prior

quarter.

(2)

Excluding hotels from our strategic

partner arrangements, we added 26,400 rooms to the development

pipeline during the third quarter, and, as of September 30, 2024,

our development pipeline would have totaled 3,514 hotels and

491,900 rooms, representing 8% growth from September 30, 2023 and

consistent with total development pipeline rooms excluding hotels

from our strategic partner arrangements as of June 30, 2024.

Balance Sheet and

Liquidity

As of September 30, 2024, we had $11.3 billion of debt

outstanding, excluding the deduction for deferred financing costs

and discounts, with a weighted average interest rate of 4.84

percent. Excluding all finance lease liabilities and other debt of

our consolidated variable interest entities, we had $11.1 billion

of debt outstanding with a weighted average interest rate of 4.83

percent and no scheduled maturities until 2027, other than $500

million of outstanding Senior Notes due May 2025. We believe that

we have sufficient sources of liquidity and access to debt

financing to address the Senior Notes due May 2025 at or prior to

their maturity date. As of September 30, 2024, no debt amounts were

outstanding under our $2.0 billion senior secured revolving credit

facility (the "Revolving Credit Facility"), which had an available

borrowing capacity of $1,913 million after considering $87 million

of outstanding letters of credit. Total cash and cash equivalents

were $1,655 million as of September 30, 2024, including $75 million

of restricted cash and cash equivalents.

In September 2024, we issued $1 billion aggregate principal

amount of 5.875% Senior Notes due 2033. We intend to use the net

proceeds from the issuance for general corporate purposes.

In September 2024, we paid a quarterly cash dividend of $0.15

per share of common stock, for a total of $37 million, bringing

total dividend payments for the year to $113 million. In October

2024, our board of directors authorized a regular quarterly cash

dividend of $0.15 per share of common stock to be paid on December

27, 2024 to holders of record of our common stock as of the close

of business on November 15, 2024.

During the three months ended September 30, 2024, we repurchased

3.3 million shares of Hilton common stock at an average price per

share of $217.15, for a total of $727 million. For the nine months

ended September 30, 2024, we repurchased 10.2 million shares of

Hilton common stock at an average price per share of $206.29,

returning $2,226 million of capital to shareholders, including

dividends. Total capital return to shareholders including dividends

year-to-date through October was $2,422 million.

The number of shares outstanding as of October 18, 2024 was

243.8 million.

Outlook

Share-based metrics in Hilton's outlook include actual share

repurchases through the third quarter but do not include the effect

of potential share repurchases thereafter.

Full Year 2024

- System-wide comparable RevPAR, on a currency neutral basis, is

projected to increase between 2.0 percent and 2.5 percent compared

to 2023.

- Diluted EPS is projected to be between $5.58 and $5.68.

- Diluted EPS, adjusted for special items, is projected to be

between $6.93 and $7.03.

- Net income is projected to be between $1,405 million and $1,429

million.

- Adjusted EBITDA is projected to be between $3,375 million and

$3,405 million.

- Contract acquisition costs and capital expenditures, excluding

amounts reimbursed by third parties, are projected to be between

$200 million and $250 million.

- Capital return is projected to be approximately $3.0

billion.

- General and administrative expenses are projected to be between

$415 million and $430 million.

- Net unit growth is projected to be between 7.0 percent and 7.5

percent.

Fourth Quarter 2024

- System-wide comparable RevPAR, on a currency neutral basis, is

projected to increase between 1.0 percent and 2.0 percent compared

to the fourth quarter of 2023.

- Diluted EPS is projected to be between $1.49 and $1.59.

- Diluted EPS, adjusted for special items, is projected to be

between $1.57 and $1.67.

- Net income is projected to be between $371 million and $395

million.

- Adjusted EBITDA is projected to be between $804 million and

$834 million.

Conference Call

Hilton will host a conference call to discuss third quarter of

2024 results on October 23, 2024 at 9:00 a.m. Eastern Time.

Participants may listen to the live webcast by logging on to the

Hilton Investor Relations website at

https://ir.hilton.com/events-and-presentations. A replay and

transcript of the webcast will be available within 24 hours after

the live event at https://ir.hilton.com/financial-reporting.

Alternatively, participants may listen to the live call by

dialing 1-888-317-6003 in the United States ("U.S.") or

1-412-317-6061 internationally using the conference ID 6226859.

Participants are encouraged to dial into the call or link to the

webcast at least fifteen minutes prior to the scheduled start time.

A telephone replay will be available for seven days following the

call. To access the telephone replay, dial 1-877-344-7529 in the

U.S. or 1-412-317-0088 internationally using the conference ID

6850988.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

statements related to our expectations regarding the performance of

our business, future financial results, liquidity and capital

resources and other non-historical statements. In some cases, you

can identify these forward-looking statements by the use of words

such as "outlook," "believes," "expects," "forecasts," "potential,"

"continues," "may," "will," "should," "could," "seeks," "projects,"

"predicts," "intends," "plans," "estimates," "anticipates" or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties including, among others, risks inherent to the

hospitality industry; macroeconomic factors beyond our control,

such as inflation, changes in interest rates, challenges due to

labor shortages or disputes and supply chain disruptions; the loss

of key senior management personnel; competition for hotel guests

and management and franchise contracts; risks related to doing

business with third-party hotel owners; performance of our

information technology systems; growth of reservation channels

outside of our system; risks of doing business outside of the U.S.;

risks associated with conflicts in Eastern Europe and the Middle

East and other geopolitical events; and our indebtedness.

Additional factors that could cause our results to differ

materially from those described in the forward-looking statements

can be found under the section entitled "Part I—Item 1A. Risk

Factors" of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, which is filed with the Securities and

Exchange Commission (the "SEC") and is accessible on the SEC's

website at www.sec.gov. Accordingly, there are or will be important

factors that could cause actual outcomes or results to differ

materially from those indicated in these statements. These factors

should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in this press release and in our filings with the SEC. We undertake

no obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

Definitions

See the "Definitions" section for the definition of certain

terms used within this press release, including within the

schedules.

Non-GAAP Financial

Measures

We refer to certain financial measures that are not recognized

under U.S. generally accepted accounting principles ("GAAP") in

this press release, including: net income, adjusted for special

items; diluted EPS, adjusted for special items; EBITDA; Adjusted

EBITDA; Adjusted EBITDA margin; net debt; and net debt to Adjusted

EBITDA ratio. See the schedules to this press release, including

the "Definitions" section, for additional information and

reconciliations of such non-GAAP financial measures, as well as the

most comparable GAAP financial measures.

About Hilton

Hilton (NYSE: HLT) is a leading global hospitality company with

a portfolio of 24 world-class brands comprising more than 8,300

properties and over 1.25 million rooms, in 138 countries and

territories. Dedicated to fulfilling its founding vision to fill

the earth with the light and warmth of hospitality, Hilton has

welcomed over 3 billion guests in its more than 100-year history,

was named the No.1 World's Best Workplace by Great Place to Work

and Fortune and has been recognized as a global leader on the Dow

Jones Sustainability Indices for seven consecutive years. Hilton

has introduced industry-leading technology enhancements to improve

the guest experience, including Digital Key Share, automated

complimentary room upgrades and the ability to book confirmed

connecting rooms. Through the award-winning guest loyalty program

Hilton Honors, the more than 200 million Hilton Honors members who

book directly with Hilton can earn Points for hotel stays and

experiences money can't buy. With the free Hilton Honors app,

guests can book their stay, select their room, check in, unlock

their door with a Digital Key and check out, all from their

smartphone. Visit stories.hilton.com for more information, and

connect with Hilton on facebook.com/hiltonnewsroom,

x.com/hiltonnewsroom, linkedin.com/company/hilton,

instagram.com/hiltonnewsroom and youtube.com/hiltonnewsroom.

HILTON WORLDWIDE HOLDINGS

INC.

EARNINGS RELEASE

SCHEDULES

TABLE OF CONTENTS

Condensed Consolidated Statements of

Operations

Comparable and Currency Neutral

System-Wide Hotel Operating Statistics

Property Summary

Capital Expenditures and Contract

Acquisition Costs

Reconciliations of Non-GAAP Financial

Measures

Definitions

HILTON WORLDWIDE HOLDINGS

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in millions, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenues

Franchise and licensing fees

$

698

$

643

$

1,958

$

1,769

Base and other management fees

88

81

287

247

Incentive management fees

66

63

204

197

Owned and leased hotels

330

335

922

924

Other revenues

58

45

179

126

1,240

1,167

3,550

3,263

Other revenues from managed and franchised

properties

1,627

1,506

4,841

4,363

Total revenues

2,867

2,673

8,391

7,626

Expenses

Owned and leased hotels

288

301

833

849

Depreciation and amortization

37

40

107

114

General and administrative

101

96

318

298

Other expenses

26

26

93

80

452

463

1,351

1,341

Other expenses from managed and franchised

properties

1,790

1,557

5,164

4,460

Total expenses

2,242

2,020

6,515

5,801

Gain (loss) on sales of assets, net

(2

)

—

5

—

Operating income

623

653

1,881

1,825

Interest expense

(140

)

(113

)

(412

)

(340

)

Loss on foreign currency transactions

(3

)

(7

)

(5

)

(13

)

Loss on investments in unconsolidated

affiliate

—

—

—

(92

)

Other non-operating income (loss), net

11

15

(17

)

38

Income before income taxes

491

548

1,447

1,418

Income tax expense

(147

)

(169

)

(413

)

(417

)

Net income

344

379

1,034

1,001

Net income attributable to redeemable

and nonredeemable noncontrolling interests

—

(2

)

(4

)

(7

)

Net income attributable to Hilton

stockholders

$

344

$

377

$

1,030

$

994

Weighted average shares

outstanding:

Basic

246

260

249

264

Diluted

249

262

252

266

Earnings per share:

Basic

$

1.40

$

1.45

$

4.13

$

3.77

Diluted

$

1.38

$

1.44

$

4.09

$

3.74

Cash dividends declared per

share

$

0.15

$

0.15

$

0.45

$

0.45

HILTON WORLDWIDE HOLDINGS

INC.

COMPARABLE AND CURRENCY

NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS

BY REGION, BRAND AND

SEGMENT

(unaudited)

Three Months Ended September

30,

Occupancy

ADR

RevPAR

2024

vs. 2023

2024

vs. 2023

2024

vs. 2023

System-wide

75.3

%

0.3

%

pts.

$

161.18

1.0

%

$

121.40

1.4

%

Region

U.S.

75.4

%

0.2

%

pts.

$

169.59

0.8

%

$

127.83

1.0

%

Americas (excluding U.S.)

72.7

0.4

155.80

3.9

113.22

4.4

Europe

81.3

2.3

179.46

4.3

145.89

7.3

Middle East & Africa

70.5

2.3

143.94

(0.1

)

101.48

3.3

Asia Pacific

73.2

(0.5

)

107.81

(2.8

)

78.97

(3.4

)

Brand

Waldorf Astoria Hotels & Resorts

62.5

%

1.9

%

pts.

$

457.66

2.2

%

$

285.89

5.3

%

Conrad Hotels & Resorts

75.6

1.5

257.53

1.1

194.63

3.2

LXR Hotels & Resorts

63.8

1.2

596.79

(6.8

)

380.49

(5.0

)

Canopy by Hilton

73.0

1.3

227.44

1.3

166.14

3.2

Hilton Hotels & Resorts

73.8

0.7

190.33

1.2

140.44

2.2

Curio Collection by Hilton

74.3

2.9

231.13

0.1

171.77

4.1

DoubleTree by Hilton

72.2

0.2

145.63

0.7

105.19

1.0

Tapestry Collection by Hilton

71.9

1.0

189.79

1.5

136.47

2.9

Embassy Suites by Hilton

76.4

0.8

186.47

0.5

142.45

1.7

Motto by Hilton

80.6

0.4

212.37

1.0

171.14

1.5

Hilton Garden Inn

74.7

0.8

148.96

0.3

111.28

1.4

Hampton by Hilton

75.8

(0.6

)

136.47

1.0

103.38

0.3

Tru by Hilton

74.9

0.7

133.72

0.5

100.14

1.5

Homewood Suites by Hilton

82.2

—

163.52

0.5

134.40

0.6

Home2 Suites by Hilton

81.0

0.6

141.89

1.2

114.92

1.9

Segment

Management and franchise

75.2

%

0.3

%

pts.

$

160.32

0.9

%

$

120.61

1.3

%

Ownership(1)

82.3

2.7

224.27

3.0

184.52

6.5

HILTON WORLDWIDE HOLDINGS

INC.

COMPARABLE AND CURRENCY

NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS

BY REGION, BRAND AND

SEGMENT

(unaudited)

Nine Months Ended September

30,

Occupancy

ADR

RevPAR

2024

vs. 2023

2024

vs. 2023

2024

vs. 2023

System-wide

72.8

%

0.7

%

pts.

$

159.92

1.5

%

$

116.37

2.4

%

Region

U.S.

73.5

%

0.3

%

pts.

$

167.83

0.9

%

$

123.27

1.4

%

Americas (excluding U.S.)

69.9

1.1

156.53

4.2

109.46

5.9

Europe

74.7

2.6

166.42

3.9

124.34

7.7

Middle East & Africa

70.9

2.5

176.25

6.3

125.03

10.2

Asia Pacific

69.5

0.6

108.98

0.6

75.69

1.5

Brand

Waldorf Astoria Hotels & Resorts

63.6

%

3.3

%

pts.

$

506.54

0.5

%

$

321.93

5.9

%

Conrad Hotels & Resorts

74.0

3.5

270.50

3.6

200.08

8.6

LXR Hotels & Resorts

62.4

5.0

592.74

(5.1

)

369.96

3.1

Canopy by Hilton

72.0

2.4

225.84

1.0

162.67

4.5

Hilton Hotels & Resorts

71.2

1.5

191.47

2.1

136.29

4.3

Curio Collection by Hilton

71.4

3.5

231.15

0.4

164.97

5.5

DoubleTree by Hilton

69.7

1.1

144.11

1.2

100.50

2.8

Tapestry Collection by Hilton

68.5

1.4

183.76

0.8

125.89

2.9

Embassy Suites by Hilton

75.2

1.5

186.06

0.7

139.91

2.7

Motto by Hilton

79.9

2.3

207.62

(0.3

)

165.79

2.6

Hilton Garden Inn

72.1

0.8

146.31

0.2

105.47

1.3

Hampton by Hilton

72.6

(0.6

)

132.56

1.2

96.25

0.4

Tru by Hilton

72.7

0.6

131.19

0.8

95.41

1.6

Homewood Suites by Hilton

80.2

—

160.18

0.7

128.49

0.8

Home2 Suites by Hilton

78.9

0.4

140.73

1.0

111.07

1.5

Segment

Management and franchise

72.7

%

0.6

%

pts.

$

159.17

1.4

%

$

115.75

2.3

%

Ownership(1)

77.0

3.1

216.81

4.7

166.88

9.2

____________

(1)

Includes hotels owned or leased by

entities in which we own a noncontrolling financial interest.

HILTON WORLDWIDE HOLDINGS

INC.

PROPERTY SUMMARY

As of September 30,

2024

Owned / Leased(1)

Managed

Franchised / Licensed

Total

Properties

Rooms

Properties

Rooms

Properties

Rooms

Properties

Rooms

Waldorf Astoria Hotels & Resorts

2

463

32

8,345

—

—

34

8,808

Conrad Hotels & Resorts

2

779

43

13,920

4

2,496

49

17,195

LXR Hotels & Resorts

—

—

5

935

8

1,463

13

2,398

NoMad

—

—

1

91

—

—

1

91

Signia by Hilton

—

—

3

2,526

—

—

3

2,526

Canopy by Hilton

—

—

10

1,634

32

5,731

42

7,365

Hilton Hotels & Resorts

46

15,921

294

125,978

273

84,122

613

226,021

Curio Collection by Hilton

—

—

29

6,275

146

26,508

175

32,783

Graduate by Hilton

—

—

—

—

34

5,788

34

5,788

DoubleTree by Hilton

—

—

168

46,036

526

110,793

694

156,829

Tapestry Collection by Hilton

—

—

5

694

134

16,012

139

16,706

Embassy Suites by Hilton

—

—

40

10,551

230

51,700

270

62,251

Tempo by Hilton

—

—

1

661

2

436

3

1,097

Motto by Hilton

—

—

—

—

8

1,727

8

1,727

Hilton Garden Inn

—

—

122

24,102

918

129,317

1,040

153,419

Hampton by Hilton

—

—

53

8,526

3,008

332,341

3,061

340,867

Tru by Hilton

—

—

—

—

274

26,779

274

26,779

Spark by Hilton

—

—

—

—

67

6,073

67

6,073

Homewood Suites by Hilton

—

—

9

1,142

533

60,935

542

62,077

Home2 Suites by Hilton

—

—

2

210

721

78,413

723

78,623

Strategic partner hotels(2)

—

—

—

—

400

18,825

400

18,825

Other(3)

—

—

3

1,414

12

2,916

15

4,330

Total hotels

50

17,163

820

253,040

7,330

962,375

8,200

1,232,578

Hilton Grand Vacations(4)

—

—

—

—

101

17,928

101

17,928

Total system

50

17,163

820

253,040

7,431

980,303

8,301

1,250,506

Owned / Leased(1)

Managed

Franchised / Licensed

Total

Properties

Rooms

Properties

Rooms

Properties

Rooms

Properties

Rooms

U.S.

—

—

188

81,924

5,628

728,192

5,816

810,116

Americas (excluding U.S.)

1

405

72

18,067

380

52,677

453

71,149

Europe

39

11,604

109

27,513

652

82,266

800

121,383

Middle East & Africa

4

1,991

110

30,478

36

6,021

150

38,490

Asia Pacific

6

3,163

341

95,058

634

93,219

981

191,440

Total hotels

50

17,163

820

253,040

7,330

962,375

8,200

1,232,578

Hilton Grand Vacations(4)

—

—

—

—

101

17,928

101

17,928

Total system

50

17,163

820

253,040

7,431

980,303

8,301

1,250,506

____________

(1)

Includes hotels owned or leased by

entities in which we own a noncontrolling financial interest.

(2)

Includes hotels that are part of the

AutoCamp and Small Luxury Hotels of the World portfolios, which are

included in our booking channels and participate in the Hilton

Honors guest loyalty program through strategic partnership

arrangements.

(3)

Includes other hotels in our system that

are not distinguished by a specific Hilton brand.

(4)

Includes properties under our timeshare

brands including Hilton Club, Hilton Grand Vacations Club and

Hilton Vacation Club.

HILTON WORLDWIDE HOLDINGS

INC.

CAPITAL EXPENDITURES AND

CONTRACT ACQUISITION COSTS

(dollars in millions)

(unaudited)

Three Months Ended

September 30,

Increase / (Decrease)

2024

2023

$

%

Capital expenditures for property and

equipment(1)

$

17

$

35

(18

)

(51.4)

Capitalized software costs(2)

30

26

4

15.4

Total capital expenditures

47

61

(14

)

(23.0)

Contract acquisition costs, net of

refunds

10

25

(15

)

(60.0)

Total capital expenditures and contract

acquisition costs

$

57

$

86

(29

)

(33.7)

Nine Months Ended

September 30,

Increase / (Decrease)

2024

2023

$

%

Capital expenditures for property and

equipment(1)

$

48

$

109

(61

)

(56.0)

Capitalized software costs(2)

71

68

3

4.4

Total capital expenditures

119

177

(58

)

(32.8)

Contract acquisition costs, net of

refunds(3)

87

164

(77

)

(47.0)

Total capital expenditures and contract

acquisition costs

$

206

$

341

(135

)

(39.6)

____________

(1)

Represents expenditures for hotels,

corporate and other property and equipment, which include amounts

reimbursed by third parties of $8 million and $10 million for the

three months ended September 30, 2024 and 2023, respectively, and

$21 million and $14 million for the nine months ended September 30,

2024 and 2023, respectively. Excludes expenditures for FF&E

replacement reserves of $14 million and $17 million for the three

months ended September 30, 2024 and 2023, respectively, and $38

million and $40 million for the nine months ended September 30,

2024 and 2023, respectively.

(2)

Includes $28 million and $24 million of

expenditures that were reimbursed to us by third parties for the

three months ended September 30, 2024 and 2023, respectively, and

$66 million and $63 million for the nine months ended September 30,

2024 and 2023, respectively.

(3)

The decrease during the nine months ended

September 30, 2024 was primarily due to the timing of certain

strategic hotel developments supporting our growth resulting in

higher contract acquisition costs during the prior period.

HILTON WORLDWIDE HOLDINGS

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

NET INCOME AND DILUTED EPS,

ADJUSTED FOR SPECIAL ITEMS

(in millions, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net income attributable to Hilton

stockholders, as reported

$

344

$

377

$

1,030

$

994

Diluted EPS, as reported

$

1.38

$

1.44

$

4.09

$

3.74

Special items:

Net other expenses from managed and

franchised properties

$

163

$

51

$

323

$

97

Purchase accounting amortization(1)

1

12

4

34

Loss on investments in unconsolidated

affiliate(2)

—

—

—

92

Loss on debt guarantees(3)

—

—

50

—

FF&E replacement reserves

14

17

38

40

Loss (gain) on sales of assets, net

2

—

(5

)

—

Tax-related adjustments(4)

—

2

(4

)

(6

)

Other adjustments(5)

(4

)

(3

)

13

6

Total special items before taxes

176

79

419

263

Income tax expense on special items

(43

)

(17

)

(101

)

(53

)

Total special items after taxes

$

133

$

62

$

318

$

210

Net income, adjusted for special items

$

477

$

439

$

1,348

$

1,204

Diluted EPS, adjusted for special

items

$

1.92

$

1.67

$

5.36

$

4.53

____________

(1)

Amounts represent the amortization expense

related to finite-lived intangible assets that were recorded at

fair value in 2007 when the Company became a wholly owned

subsidiary of affiliates of Blackstone Inc. The majority of the

related assets were fully amortized as of December 31, 2023, some

of which became fully amortized during the three months ended

December 31, 2023.

(2)

Amount includes losses recognized related

to equity and debt financing that we had previously provided to an

unconsolidated affiliate with underlying investments in certain

hotels that we currently manage or franchise.

(3)

Amount includes losses on debt guarantees

for certain hotels that we manage, which were recognized in other

non-operating income (loss), net.

(4)

Amounts include income tax expenses

(benefits) related to the enactment of new tax laws and certain

changes in unrecognized tax benefits.

(5)

Amount for the nine months ended September

30, 2024 primarily relates to restructuring costs related to one of

our leased properties, which was recognized in owned and leased

hotels expenses, transaction costs incurred for acquisitions, which

were recognized in general and administrative expenses, and

transaction costs incurred for the amendment of our senior secured

term loan facility (the "Term Loans"), which were recognized in

other non-operating income (loss), net. Amounts for all periods

include net losses (gains) related to certain of our investments in

unconsolidated affiliates, other than the loss included separately

in "loss on investments in unconsolidated affiliate," which were

recognized in other non-operating income (loss), net.

HILTON WORLDWIDE HOLDINGS

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

NET INCOME MARGIN AND

ADJUSTED EBITDA AND ADJUSTED

EBITDA MARGIN

(dollars in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$

344

$

379

$

1,034

$

1,001

Interest expense

140

113

412

340

Income tax expense

147

169

413

417

Depreciation and amortization expenses

37

40

107

114

EBITDA

668

701

1,966

1,872

Loss (gain) on sales of assets, net

2

—

(5

)

—

Loss on foreign currency transactions

3

7

5

13

Loss on investments in unconsolidated

affiliate(1)

—

—

—

92

Loss on debt guarantees(2)

—

—

50

—

FF&E replacement reserves

14

17

38

40

Share-based compensation expense

44

48

140

133

Amortization of contract acquisition

costs

12

11

37

32

Net other expenses from managed and

franchised properties

163

51

323

97

Other adjustments(3)

(2

)

(1

)

17

7

Adjusted EBITDA

$

904

$

834

$

2,571

$

2,286

____________

(1)

Amount includes losses recognized related

to equity and debt financing that we had previously provided to an

unconsolidated affiliate with underlying investments in certain

hotels that we manage or franchise.

(2)

Amount includes losses on debt guarantees

for certain hotels that we manage, which were recognized in other

non-operating income (loss), net.

(3)

Amount for the nine months ended September

30, 2024 primarily relates to restructuring costs related to one of

our leased properties as well as transaction costs resulting from

the amendment of our Term Loans and transaction costs incurred for

acquisitions. Amounts for all periods include net losses (gains)

related to certain of our investments in unconsolidated affiliates,

other than the loss included separately in "loss on investments in

unconsolidated affiliate," severance and other items.

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Total revenues, as reported

$

2,867

$

2,673

$

8,391

$

7,626

Add: amortization of contract acquisition

costs

12

11

37

32

Less: other revenues from managed and

franchised properties

(1,627

)

(1,506

)

(4,841

)

(4,363

)

Total revenues, as adjusted

$

1,252

$

1,178

$

3,587

$

3,295

Net income

$

344

$

379

$

1,034

$

1,001

Net income margin

12.0

%

14.2

%

12.3

%

13.1

%

Adjusted EBITDA

$

904

$

834

$

2,571

$

2,286

Adjusted EBITDA margin

72.2

%

70.8

%

71.7

%

69.4

%

HILTON WORLDWIDE HOLDINGS

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

LONG-TERM DEBT TO NET INCOME

RATIO AND

NET DEBT AND NET DEBT TO

ADJUSTED EBITDA RATIO

(dollars in millions)

(unaudited)

September 30,

December 31,

2024

2023

Long-term debt, including current

maturities

$

11,164

$

9,196

Add: unamortized deferred financing costs

and discounts

90

71

Long-term debt, including current

maturities and excluding the deduction for unamortized deferred

financing costs and discounts

11,254

9,267

Less: cash and cash equivalents

(1,580

)

(800

)

Less: restricted cash and cash

equivalents

(75

)

(75

)

Net debt

$

9,599

$

8,392

Nine Months Ended

Year Ended

TTM Ended

September 30,

December 31,

September 30,

2024

2023

2023

2024

Net income

$

1,034

$

1,001

$

1,151

$

1,184

Interest expense

412

340

464

536

Income tax expense

413

417

541

537

Depreciation and amortization expenses

107

114

147

140

EBITDA

1,966

1,872

2,303

2,397

Gain on sales of assets, net

(5

)

—

—

(5

)

Loss on foreign currency transactions

5

13

16

8

Loss on investments in unconsolidated

affiliate(1)

—

92

92

—

Loss on debt guarantees(2)

50

—

—

50

FF&E replacement reserves

38

40

63

61

Share-based compensation expense

140

133

169

176

Impairment losses(3)

—

—

38

38

Amortization of contract acquisition

costs

37

32

43

48

Net other expenses from managed and

franchised properties

323

97

337

563

Other adjustments(4)

17

7

28

38

Adjusted EBITDA

$

2,571

$

2,286

$

3,089

$

3,374

Long-term debt

$

11,164

Long-term debt to net income ratio

9.4

Net debt

$

9,599

Net debt to Adjusted EBITDA ratio

2.8

____________

(1)

Amount includes losses recognized related

to equity and debt financing that we had previously provided to an

unconsolidated affiliate with underlying investments in certain

hotels that we manage or franchise.

(2)

Amount includes losses on debt guarantees

for certain hotels that we manage, which were recognized in other

non-operating income (loss), net.

(3)

Amounts for the year ended December 31,

2023 are related to certain hotel properties under operating leases

and are for the impairment of a lease intangible asset, operating

lease ROU assets and property and equipment.

(4)

Amounts for the nine months ended

September 30, 2024 and the year ended December 31, 2023 include

expenses resulting from the amendments of our Term Loans in June

2024 and November 2023, respectively. Amount for the nine months

ended September 30, 2024 also includes transaction costs incurred

for acquisitions and restructuring costs related to one of our

leased properties. Amounts for all periods include net losses

(gains) related to certain of our investments in unconsolidated

affiliates, other than the loss included separately in "loss on

investments in unconsolidated affiliate," severance and other

items.

HILTON WORLDWIDE HOLDINGS

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

OUTLOOK: NET INCOME AND

DILUTED EPS, ADJUSTED FOR SPECIAL ITEMS

(in millions, except per share

data)

(unaudited)

Three Months Ending

December 31, 2024

Low Case

High Case

Net income attributable to Hilton

stockholders

$

368

$

392

Diluted EPS(1)

$

1.49

$

1.59

Special items(2):

FF&E replacement reserves

$

20

$

20

Purchase accounting amortization

1

1

Other adjustments

4

4

Total special items before taxes

25

25

Income tax expense on special items

(5

)

(5

)

Total special items after taxes

$

20

$

20

Net income, adjusted for special items

$

388

$

412

Diluted EPS, adjusted for special

items(1)

$

1.57

$

1.67

Year Ending

December 31, 2024

Low Case

High Case

Net income attributable to Hilton

stockholders

$

1,398

$

1,422

Diluted EPS(1)

$

5.58

$

5.68

Special items(2):

Net other expenses from managed and

franchised properties

$

323

$

323

Purchase accounting amortization

5

5

Loss on debt guarantees

50

50

FF&E replacement reserves

58

58

Gain on sales of assets, net

(5

)

(5

)

Tax related adjustments

(4

)

(4

)

Other adjustments

17

17

Total special items before taxes

444

444

Income tax expense on special items

(106

)

(106

)

Total special items after taxes

$

338

$

338

Net income, adjusted for special items

$

1,736

$

1,760

Diluted EPS, adjusted for special

items(1)

$

6.93

$

7.03

____________

(1)

Does not include the effect of potential

share repurchases.

(2)

See "—Net Income and Diluted EPS, Adjusted

for Special Items" for details of these special items.

HILTON WORLDWIDE HOLDINGS

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

OUTLOOK: ADJUSTED

EBITDA

(in millions)

(unaudited)

Three Months Ending

December 31, 2024

Low Case

High Case

Net income

$

371

$

395

Interest expense

155

155

Income tax expense

164

175

Depreciation and amortization expenses

37

37

EBITDA

727

762

FF&E replacement reserves

20

20

Share-based compensation expense

34

34

Amortization of contract acquisition

costs

13

13

Other adjustments(1)

10

5

Adjusted EBITDA

$

804

$

834

Year Ending

December 31, 2024

Low Case

High Case

Net income

$

1,405

$

1,429

Interest expense

567

567

Income tax expense

577

588

Depreciation and amortization expenses

144

144

EBITDA

2,693

2,728

Gain on sales of assets, net

(5

)

(5

)

Loss on foreign currency transactions

5

5

Loss on debt guarantees

50

50

FF&E replacement reserves

58

58

Share-based compensation expense

174

174

Amortization of contract acquisition

costs

50

50

Net other expenses from managed and

franchised properties

323

323

Other adjustments(1)

27

22

Adjusted EBITDA

$

3,375

$

3,405

____________

(1)

See "—Net Income Margin and Adjusted

EBITDA and Adjusted EBITDA Margin" for details of these

adjustments.

HILTON WORLDWIDE HOLDINGS INC.

DEFINITIONS

Trailing Twelve Month Financial

Information

This press release includes certain unaudited financial

information for the trailing twelve months ("TTM") ended September

30, 2024, which is calculated as the nine months ended September

30, 2024 plus the year ended December 31, 2023 less the nine months

ended September 30, 2023. This presentation is not in accordance

with GAAP. However, we believe that this presentation provides

useful information to investors regarding our recent financial

performance, and we view this presentation of the four most

recently completed fiscal quarters as a key measurement period for

investors to assess our historical results. In addition, our

management uses TTM information to evaluate our financial

performance for ongoing planning purposes.

Net Income (Loss), Adjusted for Special

Items, and Diluted EPS, Adjusted for Special Items

Net income (loss), adjusted for special items, and diluted

earnings (loss) per share ("EPS"), adjusted for special items, are

not recognized terms under GAAP and should not be considered as

alternatives to net income (loss), diluted EPS or other measures of

financial performance or liquidity derived in accordance with GAAP.

In addition, our definition of net income (loss), adjusted for

special items, and diluted EPS, adjusted for special items, may not

be comparable to similarly titled measures of other companies.

Net income (loss), adjusted for special items, and diluted EPS,

adjusted for special items, are included to assist investors in

performing meaningful comparisons of past, present and future

operating results and as a means of highlighting the results of our

ongoing operations.

EBITDA, Adjusted EBITDA, Net Income (Loss)

Margin and Adjusted EBITDA Margin

EBITDA reflects net income (loss), excluding interest expense, a

provision for income tax benefit (expense) and depreciation and

amortization expenses. Adjusted EBITDA is calculated as EBITDA, as

previously defined, further adjusted to exclude certain items,

including gains, losses, revenues and expenses in connection with:

(i) asset dispositions for both consolidated and unconsolidated

investments; (ii) foreign currency transactions; (iii) debt

restructurings and retirements; (iv) furniture, fixtures and

equipment ("FF&E") replacement reserves required under certain

lease agreements; (v) share-based compensation; (vi)

reorganization, severance, relocation and other expenses; (vii)

non-cash impairment; (viii) amortization of contract acquisition

costs; (ix) the net effect of our cost reimbursement revenues and

expenses included in other revenues and other expenses from managed

and franchised properties; and (x) other items.

Net income (loss) margin represents net income (loss) as a

percentage of total revenues. Adjusted EBITDA margin represents

Adjusted EBITDA as a percentage of total revenues, adjusted to

exclude the amortization of contract acquisition costs and other

revenues from managed and franchised properties.

We believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA

margin provide useful information to investors about us and our

financial condition and results of operations for the following

reasons: (i) these measures are among the measures used by our

management team to evaluate our operating performance and make

day-to-day operating decisions and (ii) these measures are

frequently used by securities analysts, investors and other

interested parties as a common performance measure to compare

results or estimate valuations across companies in our industry.

Additionally, these measures exclude certain items that can vary

widely across different industries and among competitors within our

industry. For instance, interest expense and income taxes are

dependent on company specifics, including, among other things,

capital structure and operating jurisdictions, respectively, and,

therefore, could vary significantly across companies. Depreciation

and amortization expenses, as well as amortization of contract

acquisition costs, are dependent upon company policies, including

the method of acquiring and depreciating assets and the useful

lives that are assigned to those depreciating or amortizing assets

for accounting purposes. For Adjusted EBITDA, we also exclude items

such as: (i) FF&E replacement reserves for leased hotels to be

consistent with the treatment of capital expenditures for property

and equipment, where depreciation of such capitalized assets is

reported within depreciation and amortization expenses; (ii)

share-based compensation, as this could vary widely among companies

due to the different plans in place and the usage of them; and

(iii) other items that are not reflective of our operating

performance, such as amounts related to debt restructurings and

debt retirements and reorganization and related severance costs, to

enhance period-over-period comparisons of our ongoing operations.

Further, Adjusted EBITDA excludes the net effect of our cost

reimbursement revenues and expenses, classified in other revenues

from managed and franchised properties and other expenses from

managed and franchised properties, respectively, as we

contractually do not operate the related programs to generate a

profit or loss over the life of these programs. The direct

reimbursements from hotel owners are billable and reimbursable as

the costs are incurred and have no net effect on net income (loss).

The fees we recognize related to the indirect reimbursements may be

recognized before or after the related expenses are incurred,

causing timing differences between the recognition of the costs

incurred and the related reimbursement from hotel owners, with the

net effect impacting net income (loss) in the reporting period.

However, the expenses incurred related to the indirect

reimbursements are expected to equal the revenues earned from the

indirect reimbursements over time, and, therefore, the net effect

of our cost reimbursement revenues and expenses is not used by

management to evaluate our operating performance or make operating

decisions.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not

recognized terms under GAAP and should not be considered as

alternatives, either in isolation or as a substitute, for net

income (loss), net income (loss) margin or other measures of

financial performance or liquidity, including cash flows, derived

in accordance with GAAP. Further, EBITDA, Adjusted EBITDA and

Adjusted EBITDA margin have limitations as analytical tools, may

not be comparable to similarly titled measures of other companies

and should not be considered as other methods of analyzing our

results as reported under GAAP.

Net Debt, Long-Term Debt to Net Income

Ratio and Net Debt to Adjusted EBITDA Ratio

Long-term debt to net income ratio is calculated as the ratio of

Hilton's long-term debt, including current maturities, to net

income. Net debt is calculated as: long-term debt, including

current maturities and excluding the deduction for unamortized

deferred financing costs and discounts; reduced by: (i) cash and

cash equivalents and (ii) restricted cash and cash equivalents. Net

debt to Adjusted EBITDA ratio is calculated as the ratio of

Hilton's net debt to Adjusted EBITDA. Net debt and net debt to

Adjusted EBITDA ratio, presented herein, are non-GAAP financial

measures that the Company uses to evaluate its financial

leverage.

Net debt should not be considered as a substitute to debt

presented in accordance with GAAP, and net debt to Adjusted EBITDA

ratio should not be considered as an alternative to measures of

financial condition derived in accordance with GAAP. Net debt and

net debt to Adjusted EBITDA ratio may not be comparable to

similarly titled measures of other companies. We believe net debt

and net debt to Adjusted EBITDA ratio provide useful information

about our indebtedness to investors as they are frequently used by

securities analysts, investors and other interested parties to

compare the indebtedness between companies.

Comparable Hotels

We define our comparable hotels as those that: (i) were active

and operating in our system for at least one full calendar year,

have not undergone a change in brand or ownership type during the

current or comparable periods and were open January 1st of the

previous year; and (ii) have not undergone large-scale capital

projects, sustained substantial property damage, encountered

business interruption or for which comparable results were not

available. We exclude strategic partner hotels from our comparable

hotels. Of the 8,200 hotels in our system as of September 30, 2024,

400 hotels were strategic partner hotels and 6,150 hotels were

classified as comparable hotels. Our 1,650 non-comparable hotels as

of September 30, 2024 included (i) 844 hotels that were added to

our system after January 1, 2023 or that have undergone a change in

brand or ownership type during the current or comparable periods

reported and (ii) 806 hotels that were removed from the comparable

group for the current or comparable periods reported because they

underwent or are undergoing large-scale capital projects, sustained

substantial property damage, encountered business interruption or

comparable results were otherwise not available.

Occupancy

Occupancy represents the total number of room nights sold

divided by the total number of room nights available at a hotel or

group of hotels for a given period. Occupancy measures the

utilization of available capacity at a hotel or group of hotels.

Management uses occupancy to gauge demand at a specific hotel or

group of hotels in a given period. Occupancy levels also help

management determine achievable Average Daily Rate ("ADR") pricing

levels as demand for hotel rooms increases or decreases.

ADR

ADR represents hotel room revenue divided by the total number of

room nights sold for a given period. ADR measures the average room

price attained by a hotel, and ADR trends provide useful

information concerning the pricing environment and the nature of

the customer base of a hotel or group of hotels. ADR is a commonly

used performance measure in the industry, and we use ADR to assess

pricing levels that we are able to generate by type of customer, as

changes in rates charged to customers have different effects on

overall revenues and incremental profitability than changes in

occupancy, as described above.

Revenue per Available Room

("RevPAR")

RevPAR is calculated by dividing hotel room revenue by the total

number of room nights available to guests for a given period. We

consider RevPAR to be a meaningful indicator of our performance as

it provides a metric correlated to two primary and key drivers of

operations at a hotel or group of hotels, as previously described:

occupancy and ADR. RevPAR is also a useful indicator in measuring

performance over comparable periods for comparable hotels.

References to occupancy, ADR and RevPAR are presented on a

comparable basis, based on the comparable hotels as of September

30, 2024, and references to ADR and RevPAR are presented on a

currency neutral basis, unless otherwise noted. As such,

comparisons of these hotel operating statistics for the three and

nine months ended September 30, 2024 and 2023 use the foreign

currency exchange rates used to translate the results of the

Company's foreign operations within its unaudited condensed

consolidated financial statements for the three and nine months

ended September 30, 2024, respectively.

Pipeline

Rooms under construction include rooms for hotels under

construction or in the process of conversion to our system.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023756181/en/

Investor Contact Jill Chapman +1 703 883 1000

Media Contact Kent Landers +1 703 883 3246

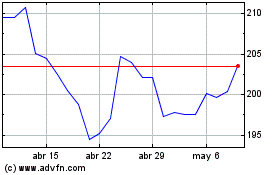

Hilton Worldwide (NYSE:HLT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Hilton Worldwide (NYSE:HLT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024