Helix Announces Pricing of Senior Notes Offering

16 Noviembre 2023 - 5:55PM

Business Wire

Helix Energy Solutions Group, Inc. (NYSE: HLX) announced today

it has priced $300 million in principal amount of 9.750% Senior

Notes due 2029 (the “Notes”). Helix intends to use the net proceeds

from the offering, together with cash on hand and shares of its

common stock, as necessary, to pay the cost of extinguishing its

obligations with respect to its outstanding 6.75% Convertible

Senior Notes due 2026 (the “2026 Convertible Notes”), which may

include privately negotiated transactions and payments in

settlement of redemptions or conversion of such 2026 Convertible

Notes. Helix intends to use the remainder of the net proceeds from

the offering, if any, for general corporate purposes, which may

include repayment of other indebtedness. Helix reserves the right

to settle and extinguish the 2026 Convertible Notes in cash, shares

of its common stock, or any combination thereof. Helix expects to

close the offering of the Notes on or about December 1, 2023,

subject to the satisfaction of customary closing conditions.

The Notes will bear interest from December 1, 2023 at an annual

rate of 9.750% payable on March 1 and September 1 of each year,

beginning on March 1, 2024. The Notes will mature on March 1,

2029.

The Notes and the related guarantees are being offered only to

persons reasonably believed to be qualified institutional buyers in

reliance on the exemption from registration set forth in Rule 144A

of the Securities Act and, outside of the United States, to

non-U.S. persons in reliance on Regulation S under the Securities

Act. The Notes and the related guarantees have not been registered

under the Securities Act, or the securities laws of any state or

other jurisdiction, and may not be offered or sold in the United

States without registration or an applicable exemption from the

Securities Act and applicable state securities or blue sky

laws.

This announcement shall not constitute an offer to sell or the

solicitation of an offer to buy any securities nor shall there be

any sale of any securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Helix

Helix Energy Solutions Group, Inc., headquartered in Houston,

Texas, is an international offshore energy services company that

provides specialty services to the offshore energy industry, with a

focus on well intervention, robotics and full field decommissioning

operations. Its services are centered on a three-legged business

model well positioned for a global energy transition by maximizing

production of remaining oil and gas reserves, decommissioning

end-of-life oil and gas fields and supporting renewable energy

developments.

Forward-Looking Statements

This press release contains forward-looking statements that

involve risks, uncertainties and assumptions that could cause our

results to differ materially from those expressed or implied by

such forward-looking statements. All statements, other than

statements of historical fact, are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including, without limitation, any statements regarding

the Notes, including their timing and issuance, terms and the use

of proceeds therefrom, including the extinguishment of the 2026

Convertible Notes; any statements regarding our strategy; any

statements regarding our business model or the global energy

transition; and any statements of assumptions underlying any of the

foregoing. The forward-looking statements are subject to a number

of known and unknown risks, uncertainties and other factors that

could cause results to differ materially from those in the

forward-looking statements, including but not limited to the

potential effects of the transactions described in this press

release; actions by governments, customers, suppliers and partners

with respect thereto; market conditions; results from acquired

properties; demand for our services; the performance of contracts

by suppliers, customers and partners; actions by governmental and

regulatory authorities; operating hazards and delays, which

includes delays in delivery, chartering or customer acceptance of

assets or terms of their acceptance; our ultimate ability to

realize current backlog; employee management issues; complexities

of global political and economic developments; geologic risks;

volatility of oil and gas prices and other risks described from

time to time in our reports filed with the Securities and Exchange

Commission (the “SEC”), including Helix’s most recently filed

Annual Report on Form 10-K and in Helix’s other filings with the

SEC, which are available free of charge on the SEC’s website at

www.sec.gov. We assume no obligation and do not intend to update

these forward-looking statements, which speak only as of their

respective dates, except as required by the securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231116269251/en/

Erik Staffeldt, Executive Vice President and CFO email:

estaffeldt@helixesg.com Ph: 281-618-0465

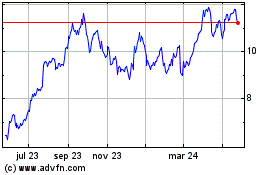

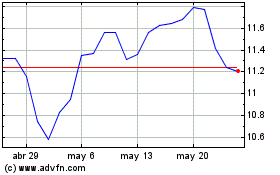

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Helix Energy Solutions (NYSE:HLX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024