CBRE Global Real Estate Income Fund (NYSE: IGR) Announces Terms of Rights Offering

27 Febrero 2023 - 3:05PM

Business Wire

The Board of Trustees (the “Board”) of the CBRE Global Real

Estate Income Fund (NYSE: IGR) (the “Fund”) today announced that it

has approved the terms of the issuance of transferable rights

(“Rights”) to the holders of the Fund’s common shares (par value

$0.001 per share) (“Common Shares”), as of the record date, March

9, 2023 (the “Record Date”), to subscribe for additional Common

Shares at a discount to market price (the “Offer”).

After considering a number of factors, including potential

benefits and costs, the Board and the Fund’s investment advisor,

CBRE Investment Management Listed Real Assets LLC (the “Advisor”),

have determined that it is in the best interests of both the Fund

and its shareholders to conduct the rights offering so that, with

increased assets, the Fund will be well positioned to seek to take

advantage of existing and future investment opportunities in the

global real estate markets that the Advisor considers to be

consistent with the Fund’s primary investment objective of high

current income and secondary investment objective of capital

appreciation.

The Advisor believes this is an attractive time to raise

additional assets for the Fund based on several factors, including,

but not limited to, the following potential benefits:

– Attractive valuations: the Advisor’s

belief that many global real estate securities currently are

trading at historically attractive valuations – Growth

potential: anticipated significant opportunities for investment

in real estate sectors aligned with long-term secular themes

driving above average growth potential – Total return:

potential enhancement of the Fund’s distribution and/or net asset

value (NAV) appreciation – Lower Fund expenses: anticipated

positive impact to the Fund’s total expense ratio by spreading

fixed costs over a larger asset base – Tax-efficiency:

potential reduction in the need to sell existing portfolio

positions, which may reduce taxable events for shareholders

“Global real estate stocks are attractively valued today; we

have not seen valuation levels like this since the global financial

crisis in 2008-2009 and the initial COVID drawdown in March 2020.

Our team’s analysis of historical market environments suggests that

today’s market conditions are favorable for global real estate

stock investment,” said Joseph Smith, Chief Investment Officer of

CBRE Investment Management Strategies and a Portfolio Manager of

the Fund.

Holders of Common Shares as of the Record Date will be entitled

to participate in the Offer, which will include an

over-subscription privilege. Additional information on the Offer is

set forth in a Prospectus Supplement dated February 27, 2023, which

supplements the Fund’s currently effective shelf offering

Prospectus and Statement of Additional Information, which together

list the Fund’s strategies and risks.

The Fund declared a regular monthly distribution payable on

February 28, 2023, and anticipates declaring a regular monthly

distribution payable on March 31, 2023, with respective record

dates of February 21, 2023 and March 20, 2023, which will not be

payable with respect to Shares that are issued pursuant to the

Offer as such issuance will occur after the distribution record

dates. Shares issued pursuant to the Offer will be entitled to

receive the monthly distribution expected to be payable in

April.

Certain key terms of the Offer include:

Title

Subscription Rights to Acquire Common

Shares

Rights Issuance

One Right will be issued for every Common

Share held as of the Record Date

Subscription Ratio

One new Common Share for every five Rights

held (1 for 5)

Subscription Price

Will be determined based upon a formula

equal to 95% of the average of the last reported sales price of a

Common Share on the NYSE on the Expiration Date and each of the

four (4) immediately preceding trading days

Rights

Rights will be transferable and listed on

the NYSE with the symbol “IGR RT”

Offer Period

March 9, 2023 (Record Date) through April

6, 2023 (Expiration Date)

Expected Mailing Date for Certificates

Evidencing the Right to Subscribe

On or about March 13, 2023

For further information and/or to obtain a copy of the

Prospectus Supplement and accompanying Prospectus when available,

contact the Information Agent, Georgeson at 1-866-216-0462.

About CBRE Investment

Management

CBRE Investment Management is a leading global real assets

investment management firm with $149.3 billion in assets under

management* as of December 31, 2022, operating in more than 30

offices and 20 countries around the world. Through its

investor-operator culture, the firm seeks to deliver sustainable

investment solutions across real assets categories, geographies,

risk profiles and execution formats so that its clients, people and

communities thrive.

CBRE Investment Management is an independently operated

affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest

commercial real estate services and investment firm (based on 2022

revenue). CBRE has approximately 115,000 employees (excluding

Turner & Townsend employees) serving clients in more than 100

countries. CBRE Investment Management harnesses CBRE’s data and

market insights, investment sourcing and other resources for the

benefit of its clients. For more information, please visit

www.cbreim.com.

*Assets under management (AUM) refers to the fair market value

of real assets-related investments with respect to which CBRE

Investment Management provides, on a global basis, oversight,

investment management services and other advice and which generally

consist of investments in real assets; equity in funds and joint

ventures; securities portfolios; operating companies and real

assets-related loans. This AUM is intended principally to reflect

the extent of CBRE Investment Management’s presence in the global

real assets market, and its calculation of AUM may differ from the

calculations of other asset managers and from its calculation of

regulatory assets under management for purposes of certain

regulatory filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230227005806/en/

Analyst and Press Inquiries: David Leggette +1

610 995 7349 david.leggette@cbreim.com

Investor Relations: +1 888 711 4272

www.cbreim.com/igr

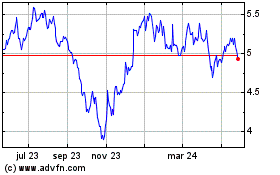

CBRE Global Real Estate ... (NYSE:IGR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

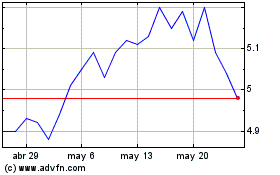

CBRE Global Real Estate ... (NYSE:IGR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025