false

0001677576

0001677576

2024-11-06

2024-11-06

0001677576

us-gaap:CommonStockMember

2024-11-06

2024-11-06

0001677576

us-gaap:SeriesAPreferredStockMember

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 6, 2024

Innovative Industrial

Properties, Inc.

(Exact name

of registrant as specified in its charter)

| Maryland |

|

001-37949 |

|

81-2963381 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

1389 Center

Drive, Suite 200

Park City, Utah

84098

(Address of

principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (858) 997-3332

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.001 per share |

|

IIPR |

|

New York Stock Exchange |

| Series A Preferred Stock, par value $0.001 per share |

|

IIPR-PA |

|

New York Stock Exchange |

Item 2.02

Results of Operations and Financial Condition.

On

November 6, 2024, Innovative Industrial Properties, Inc. (the “Company”) issued a press release regarding its financial results

for the third quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by

reference herein.

On

November 6, 2024, the Company posted on its website, www.innovativeindustrialproperties.com, certain supplemental financial information

for the third quarter ended September 30, 2024, which is attached hereto as Exhibit 99.2

and is incorporated by reference herein.

The

information contained in this Current Report, including Exhibits 99.1 and 99.2 referenced herein, is being furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated by reference into any filing under

the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 7, 2024 |

INNOVATIVE INDUSTRIAL PROPERTIES, INC. |

| |

|

| |

By: |

/s/ David Smith |

| |

Name: |

David Smith |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Innovative Industrial Properties Reports Third Quarter 2024 Results

SAN DIEGO, CA – November 6, 2024 – Innovative Industrial

Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S.

cannabis industry, announced today results for the third quarter ended September 30, 2024.

Financial Results, Dividend and Capital Raising Activity

| · | Generated total revenues of $76.5 million and net income attributable to common stockholders of $39.7 million, or $1.37 per share

(all per share amounts in this press release are reported on a diluted basis unless otherwise noted). |

| · | Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $64.3 million and $57.8 million,

respectively. |

| · | Paid a quarterly dividend of $1.90 per common share on October 15, 2024 to stockholders of record as of September 30, 2024 (an AFFO

payout ratio of 84%), representing an annualized dividend of $7.60 per common share. |

| · | Sold 402,673 shares of Series A Preferred Stock under IIP’s “at-the-market” equity offering program for $9.6 million

in net proceeds. |

| · | Subsequent to quarter end, upsized IIP’s revolving credit facility to $87.5 million, which remains undrawn as of today. |

| | |

Three Months Ended September 30, | |

| (Per share) | |

2024 | | |

2023 | | |

$ Change | | |

% Change | |

| Net income attributable to common stockholders | |

$ | 1.37 | | |

$ | 1.45 | | |

$ | (0.08 | ) | |

| (6 | )% |

| Normalized FFO | |

$ | 2.02 | | |

$ | 2.09 | | |

$ | (0.07 | ) | |

| (3 | )% |

| AFFO | |

$ | 2.25 | | |

$ | 2.29 | | |

$ | (0.04 | ) | |

| (2 | )% |

Portfolio – New Investment, Development and Pipeline

| · | Subsequent to quarter end, acquired a Maryland property comprising 23,000 square feet of industrial space for $5.6 million and executed

a long-term lease for the entire property with a subsidiary of Maryland Cultivation and Processing, L.L.C. (MCP) for use as a regulated

cannabis processing facility. |

| · | Completed development of the remaining 104,000 square feet of cultivation space at IIP’s fully leased Davis Highway, Michigan

property, having previously completed development of 97,000 square feet for cannabis processing. |

Balance Sheet Highlights (at September 30, 2024)

| · | 11% debt to total gross assets, with $2.6 billion in total gross assets. |

| · | Total liquidity was $222.4 million as of September 30, 2024, consisting of cash and cash equivalents and short-term investments (each

as reported in IIP’s condensed consolidated balance sheet as of September 30, 2024) and availability under IIP’s revolving

credit facility. |

| · | No debt maturities until May 2026. |

| · | Debt service coverage ratio of 17.0x (calculated in accordance with IIP’s 5.50% Unsecured Senior Notes due 2026). |

Property Portfolio Statistics (as of September 30, 2024)

| · | Total property portfolio comprises 108 properties across 19 states, with 9.0 million RSF (including 618,000 RSF under development

/ redevelopment), consisting of: |

| o | Operating portfolio: 105 properties, representing 8.5 million RSF. |

| o | Under development / redevelopment portfolio consists of three properties expected to comprise 491,000 RSF at completion, of which

236,000 RSF is pre-leased, with the remainder comprised of one property totaling 192,000 RSF in

San Bernardino, California and twelve acres of land to be developed in San Marcos, Texas. The three properties in the development / redevelopment

portfolio are as follows: |

| § | 63795 19th Avenue in Palm Springs, California (pre-leased) |

| § | Inland Center Drive in San Bernardino, California |

| § | Leah Avenue in San Marcos, Texas |

| o | 95.7% leased (triple-net). |

| o | Weighted-average remaining lease term: 14.0 years. |

| o | Total invested / committed capital per square foot: $281. |

| · | By annualized base rent (excluding non-cannabis tenants that comprise less than 1% of annualized base rent in the aggregate): |

| o | No tenant represents more than 17% of annualized base rent. |

| o | No state represents more than 15% of annualized base rent. |

| o | Multi-state operators (MSOs) represent 91% of annualized base rent. |

| o | Public company operators represent 62% of annualized base rent. |

| o | Industrial (cultivation and/or processing), retail (dispensing) and combined industrial/retail represent 92%, 2% and 6% of the operating

portfolio, respectively. |

Financial Results

For the three months ended September 30, 2024, IIP generated total

revenues of $76.5 million, compared to $77.8 million for the same period in 2023, a decrease of 1.7%. The decrease was primarily due to

(i) a $3.0 million decline in contractual rent and property management fees received during the three months ended September 30, 2024

related to properties that IIP regained possession of since June 2023; (ii) a decline of $1.3 million due to rent received but not recognized

in rental revenues resulting from the re-classifications of two sales-type leases starting January 1, 2024; and (iii) $1.3 million of

contractually due rent and property management fees that were not collected during the three months ended September 30, 2024. This decline

was partially offset by a $4.6 million increase to contractual rent and property management fees, which was primarily driven by contractual

rent escalations, amendments to leases for additional improvement allowances at existing properties that resulted in adjustments to rent

and new leases entered into since June 2023.

For the three months ended September 30, 2024, IIP applied $1.4 million

of security deposits for payment of rent on properties leased to 4Front Ventures Corp. (“4Front”) (four properties), TILT

Holdings Inc. (“TILT”) (one property), and Emerald Growth Holdings LLC (“Emerald Growth”) (one property). For

the three months ended September 30, 2023, IIP applied of $2.2 million of security deposits for payment of rent. IIP terminated the lease

with Temescal Wellness of Massachusetts Holdings, LLC and regained possession of the property previously occupied by that tenant on September

30, 2024.

Subsequent to September 30, 2024, IIP applied $0.9 million in security

deposits for the properties leased to 4Front, TILT and Emerald Growth for the payment of rent owing in October 2024, and, including those

security deposits applied, collected $1.4 million of the total contractually due rent and interest of $2.2 million owing for the month

of October for 4Front, Emerald Growth, TILT and a loan secured by a California property portfolio for which IIP is the lender.

While IIP has re-leased several properties taken back since March 2023,

rent commencement on certain of those properties is contingent on the tenants obtaining the requisite approvals to operate, and temporary

rent abatements in certain instances as tenants transition into the properties and commence operations. As a result, IIP does not expect

to recognize rental revenue from those properties until that has occurred.

For the three months ended September 30, 2024, IIP recorded net income

attributable to common stockholders of $39.7 million, or $1.37 per share; funds from operations (FFO) of $57.6 million, or $2.02 per share;

Normalized FFO of $57.8 million, or $2.02 per share; and AFFO of $64.3 million, or $2.25 per share.

For the nine months ended September 30, 2024, IIP recorded net income

attributable to common stockholders of approximately $120.4 million, or $4.16 per share; FFO of approximately $172.5 million, or $6.04

per share; Normalized FFO of approximately $173.1 million, or $6.06 per share; and AFFO of approximately $192.8 million, or $6.75 per

share.

IIP paid a quarterly dividend of $1.90 per common share on October

15, 2024 to stockholders of record as of September 30, 2024, representing an annualized dividend of $7.60 per common share and an AFFO

payout ratio of 84% (calculated by dividing the common stock dividend declared per share by IIP’s AFFO per common share for the

third quarter).

FFO, Normalized FFO and AFFO are supplemental non-GAAP financial measures

used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation

containing adjustments from GAAP net income attributable to common stockholders to FFO, Normalized FFO and AFFO and definitions of terms

are included at the end of this release.

Supplemental Information

Supplemental financial information is available in the Investor Relations

section of IIP’s website at www.innovativeindustrialproperties.com.

Teleconference and Webcast

Innovative Industrial Properties, Inc. will conduct a conference

call and webcast at 10:00 a.m. Pacific Time (1:00 p.m. Eastern Time) on Thursday, November 7, 2024 to discuss IIP’s

financial results and operations for the third quarter ended September 30, 2024. The call will be open to all interested investors

through a live audio webcast at the Investor Relations section of IIP’s website at www.innovativeindustrialproperties.com, or live

by calling 1-877-328-5514 (domestic) or 1-412-902-6764 (international) and asking to be joined to the Innovative Industrial Properties,

Inc. conference call. The complete webcast will be archived for 90 days on IIP’s website. A telephone playback of the conference

call will also be available from 12:00 p.m. Pacific Time on Thursday, November 7, 2024 until 12:00 p.m. Pacific

Time on Thursday, November 14, 2024, by calling 1-877-344-7529 (domestic), 855-669-9658 (Canada) or 1-412-317-0088 (international)

and using access code 2143077.

About Innovative Industrial Properties

Innovative Industrial Properties, Inc. is a self-advised Maryland

corporation focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators

for their regulated cannabis facilities. Innovative Industrial Properties, Inc. has elected to be taxed as a real estate investment trust,

commencing with the year ended December 31, 2017. Additional information is available at www.innovativeindustrialproperties.com.

This press release contains statements that IIP believes to be “forward-looking

statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements

other than historical facts are forward-looking statements. When used in this press release, words such as IIP “expects,”

“intends,” “plans,” “estimates,” “anticipates,” “believes” or “should”

or the negative thereof or similar terminology are generally intended to identify forward-looking statements. Such forward-looking statements

are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, such

statements. Investors should not place undue reliance upon forward-looking statements. IIP disclaims any obligation to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

Innovative

Industrial Properties, Inc.

Condensed

Consolidated Balance SheetS

(Unaudited)

(In thousands, except share and per share amounts)

| | |

September 30, | | |

December 31, | |

| Assets | |

2024 | | |

2023 | |

| Real estate, at cost: | |

| | | |

| | |

| Land | |

$ | 146,043 | | |

$ | 142,524 | |

| Buildings and improvements | |

| 2,209,720 | | |

| 2,108,218 | |

| Construction in progress | |

| 59,998 | | |

| 117,773 | |

| Total real estate, at cost | |

| 2,415,761 | | |

| 2,368,515 | |

| Less accumulated depreciation | |

| (253,165 | ) | |

| (202,692 | ) |

| Net real estate held for investment | |

| 2,162,596 | | |

| 2,165,823 | |

| Construction Loan receivable | |

| 22,000 | | |

| 22,000 | |

| Cash and cash equivalents | |

| 147,128 | | |

| 140,249 | |

| Restricted cash | |

| — | | |

| 1,450 | |

| Investments | |

| 25,315 | | |

| 21,948 | |

| Right of use office lease asset | |

| 1,051 | | |

| 1,355 | |

| In-place lease intangible assets, net | |

| 7,600 | | |

| 8,245 | |

| Other assets, net | |

| 29,641 | | |

| 30,020 | |

| Total assets | |

$ | 2,395,331 | | |

$ | 2,391,090 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Exchangeable Senior Notes, net | |

$ | — | | |

$ | 4,431 | |

| Notes due 2026, net | |

| 297,503 | | |

| 296,449 | |

| Building improvements and construction funding payable | |

| 9,204 | | |

| 9,591 | |

| Accounts payable and accrued expenses | |

| 14,961 | | |

| 11,406 | |

| Dividends payable | |

| 54,817 | | |

| 51,827 | |

| Rent received in advance and tenant security deposits | |

| 61,084 | | |

| 59,358 | |

| Other liabilities | |

| 11,225 | | |

| 5,056 | |

| Total liabilities | |

| 448,794 | | |

| 438,118 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, par value $0.001 per share, 50,000,000 shares authorized: 9.00% Series A cumulative redeemable preferred stock, liquidation preference of $25.00 per share, 1,002,673 and 600,000 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 23,632 | | |

| 14,009 | |

| Common stock, par value $0.001 per share, 50,000,000 shares authorized: 28,331,833 and 28,140,891 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | |

| 28 | | |

| 28 | |

| Additional paid-in capital | |

| 2,119,798 | | |

| 2,095,789 | |

| Dividends in excess of earnings | |

| (196,921 | ) | |

| (156,854 | ) |

| Total stockholders’ equity | |

| 1,946,537 | | |

| 1,952,972 | |

| Total liabilities and stockholders’ equity | |

$ | 2,395,331 | | |

$ | 2,391,090 | |

Innovative

Industrial Properties, Inc.

Condensed

Consolidated STATEMENTS OF INCOME

For the Three and Nine Months Ended September

30, 2024 and 2023

(Unaudited)

(In thousands, except share and per share amounts)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Rental (including tenant reimbursements) | |

$ | 76,052 | | |

$ | 77,286 | | |

$ | 230,219 | | |

$ | 228,734 | |

| Other | |

| 474 | | |

| 540 | | |

| 1,554 | | |

| 1,616 | |

| Total revenues | |

| 76,526 | | |

| 77,826 | | |

| 231,773 | | |

| 230,350 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Property expenses | |

| 7,295 | | |

| 6,318 | | |

| 20,867 | | |

| 17,700 | |

| General and administrative expense | |

| 9,330 | | |

| 10,981 | | |

| 28,553 | | |

| 31,924 | |

| Depreciation and amortization expense | |

| 17,944 | | |

| 16,678 | | |

| 52,567 | | |

| 50,096 | |

| Total expenses | |

| 34,569 | | |

| 33,977 | | |

| 101,987 | | |

| 99,720 | |

| Gain (loss) on sale of real estate | |

| — | | |

| — | | |

| (3,449 | ) | |

| — | |

| Income from operations | |

| 41,957 | | |

| 43,849 | | |

| 126,337 | | |

| 130,630 | |

| Interest income | |

| 2,685 | | |

| 2,075 | | |

| 8,435 | | |

| 6,625 | |

| Interest expense | |

| (4,427 | ) | |

| (4,330 | ) | |

| (13,136 | ) | |

| (13,322 | ) |

| Gain (loss) on exchange of Exchangeable Senior Notes | |

| — | | |

| — | | |

| — | | |

| 22 | |

| Net income | |

| 40,215 | | |

| 41,594 | | |

| 121,636 | | |

| 123,955 | |

| Preferred stock dividends | |

| (564 | ) | |

| (338 | ) | |

| (1,240 | ) | |

| (1,014 | ) |

| Net income attributable to common stockholders | |

$ | 39,651 | | |

$ | 41,256 | | |

$ | 120,396 | | |

$ | 122,941 | |

| Net income attributable to common stockholders per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 1.38 | | |

$ | 1.46 | | |

$ | 4.21 | | |

$ | 4.36 | |

| Diluted | |

$ | 1.37 | | |

$ | 1.45 | | |

$ | 4.16 | | |

$ | 4.32 | |

| Weighted-average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 28,254,565 | | |

| 27,983,004 | | |

| 28,216,946 | | |

| 27,971,544 | |

| Diluted | |

| 28,579,687 | | |

| 28,265,605 | | |

| 28,548,050 | | |

| 28,248,054 | |

Innovative

Industrial Properties, Inc.

FFO,

NORMALIZED FFO AND AFFO

For the Three and Nine Months Ended September

30, 2024 and 2023

(Unaudited)

(In thousands, except share and per share amounts)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income attributable to common stockholders | |

$ | 39,651 | | |

$ | 41,256 | | |

$ | 120,396 | | |

$ | 122,941 | |

| Real estate depreciation and amortization | |

| 17,944 | | |

| 16,678 | | |

| 52,567 | | |

| 50,096 | |

| Disposition-contingent lease termination fee, net of loss on sale of real estate(1) | |

| — | | |

| — | | |

| (451 | ) | |

| — | |

| FFO attributable to common stockholders (basic) | |

| 57,595 | | |

| 57,934 | | |

| 172,512 | | |

| 173,037 | |

| Cash and non-cash interest expense on Exchangeable Senior Notes | |

| — | | |

| 50 | | |

| 28 | | |

| 169 | |

| FFO attributable to common stockholders (diluted) | |

| 57,595 | | |

| 57,984 | | |

| 172,540 | | |

| 173,206 | |

| Litigation-related expense | |

| 210 | | |

| 1,112 | | |

| 520 | | |

| 2,328 | |

| Loss (gain) on exchange of Exchangeable Senior Notes | |

| — | | |

| — | | |

| — | | |

| (22 | ) |

| Normalized FFO attributable to common stockholders (diluted) | |

| 57,805 | | |

| 59,096 | | |

| 173,060 | | |

| 175,512 | |

| Interest income on seller-financed note(2) | |

| 268 | | |

| 402 | | |

| 1,074 | | |

| 939 | |

| Deferred lease payments received on sales-type leases(3) | |

| 1,452 | | |

| — | | |

| 4,370 | | |

| — | |

| Stock-based compensation | |

| 4,316 | | |

| 4,934 | | |

| 13,002 | | |

| 14,647 | |

| Non-cash interest expense | |

| 419 | | |

| 335 | | |

| 1,208 | | |

| 992 | |

| Above-market lease amortization | |

| 23 | | |

| 23 | | |

| 69 | | |

| 69 | |

| AFFO attributable to common stockholders (diluted) | |

$ | 64,283 | | |

$ | 64,790 | | |

$ | 192,783 | | |

$ | 192,159 | |

| FFO per common share – diluted | |

$ | 2.02 | | |

$ | 2.05 | | |

$ | 6.04 | | |

$ | 6.13 | |

| Normalized FFO per common share – diluted | |

$ | 2.02 | | |

$ | 2.09 | | |

$ | 6.06 | | |

$ | 6.21 | |

| AFFO per common share – diluted | |

$ | 2.25 | | |

$ | 2.29 | | |

$ | 6.75 | | |

$ | 6.80 | |

| Weighted average common shares outstanding – basic | |

| 28,254,565 | | |

| 27,983,004 | | |

| 28,216,946 | | |

| 27,971,544 | |

| Restricted stock and RSUs | |

| 299,770 | | |

| 206,919 | | |

| 293,105 | | |

| 193,503 | |

| PSUs | |

| 25,352 | | |

| — | | |

| 25,352 | | |

| — | |

| Dilutive effect of Exchangeable Senior Notes | |

| — | | |

| 75,682 | | |

| 12,647 | | |

| 83,007 | |

| Weighted average common shares outstanding – diluted | |

| 28,579,687 | | |

| 28,265,605 | | |

| 28,548,050 | | |

| 28,248,054 | |

| (1) | Amount reflects the $3.9 million disposition-contingent lease termination fee received concurrently with the sale of IIP’s property

in Los Angeles, California, net of the loss on sale of the property of $3.4 million. |

| (2) | Amount reflects the non-refundable interest received on the seller-financed note issued to IIP by the buyer in connection with IIP’s

disposition of a portfolio of four properties in southern California, which is recognized as a deposit liability and is included in other

liabilities in IIP’s condensed consolidated balance sheet as of September 30, 2024, as the transaction did not qualify for recognition

as a completed sale. |

| (3) | Amount reflects the non-refundable lease payments received on two sales-type leases which are recognized as a deposit liability starting

on January 1, 2024, and is included in other liabilities in IIP’s condensed consolidated balance sheet as of September 30, 2024,

as the transaction did not qualify for recognition as a completed sale. Prior to the lease modifications on January 1, 2024, which extended

the initial lease terms, the leases were classified as operating leases and the lease payments received were recognized as rental revenue

and therefore, included in net income attributable to common stockholders. |

FFO and FFO per share are operating performance

measures adopted by the National Association of Real Estate Investment Trusts, Inc. (NAREIT). NAREIT defines FFO as the most commonly

accepted and reported measure of a REIT’s operating performance equal to net income, computed in accordance with accounting principles

generally accepted in the United States (GAAP), excluding gains (or losses) from sales of property, depreciation, amortization and impairment

related to real estate properties, and after adjustments for unconsolidated partnerships and joint ventures. IIP also excludes from FFO

any disposition-contingent lease termination fee received in connection with a property sale.

Management believes that net income, as

defined by GAAP, is the most appropriate earnings measurement. However, management believes FFO and FFO per share to be supplemental

measures of a REIT’s performance because they provide an understanding of the operating performance of IIP’s properties

without giving effect to certain significant non-cash items, primarily depreciation expense. Historical cost accounting for real

estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably over time. However, real

estate values instead have historically risen or fallen with market conditions. IIP believes that by excluding the effect of

depreciation, FFO and FFO per share can facilitate comparisons of operating performance between periods. IIP reports FFO and FFO per

share because these measures are observed by management to also be the predominant measures used by the REIT industry and industry

analysts to evaluate REITs and because FFO per share is consistently reported, discussed, and compared by research analysts in their

notes and publications about REITs. For these reasons, management has deemed it appropriate to disclose and discuss FFO and FFO per

share.

IIP computes Normalized FFO by adjusting FFO to

exclude certain GAAP income and expense amounts that management believes are infrequent and unusual in nature and/or not related to IIP’s

core real estate operations. Exclusion of these items from similar FFO-type metrics is common within the equity REIT industry, and management

believes that presentation of Normalized FFO and Normalized FFO per share provides investors with a metric to assist in their evaluation

of IIP’s operating performance across multiple periods and in comparison to the operating performance of other companies, because

it removes the effect of unusual items that are not expected to impact IIP’s operating performance on an ongoing basis. Normalized

FFO is used by management in evaluating the performance of its core business operations. Items included in calculating FFO that may be

excluded in calculating Normalized FFO include certain transaction-related gains, losses, income or expense or other non-core amounts

as they occur.

Management believes that AFFO and AFFO per share

are also appropriate supplemental measures of a REIT’s operating performance. IIP calculates AFFO by adjusting Normalized FFO for

certain cash and non-cash items.

For all periods presented other than the three

months ended September 30, 2024, FFO (diluted), Normalized FFO, AFFO and FFO, Normalized FFO and AFFO per diluted share include the dilutive

impact of the assumed full exchange of the Exchangeable Senior Notes for shares of common stock.

Performance share units (“PSUs”) granted

to certain employees were included in dilutive securities to the extent the performance thresholds for vesting of the PSUs were met as

measured as of the end of each respective period.

IIP’s computation of FFO, Normalized FFO

and AFFO may differ from the methodology for calculating FFO, Normalized FFO and AFFO utilized by other equity REITs and, accordingly,

may not be comparable to such REITs. Further, FFO, Normalized FFO and AFFO do not represent cash flow available for management’s

discretionary use. FFO, Normalized FFO and AFFO should not be considered as an alternative to net income (computed in accordance with

GAAP) as an indicator of IIP’s financial performance or to cash flow from operating activities (computed in accordance with GAAP)

as an indicator of IIP’s liquidity, nor is it indicative of funds available to fund IIP’s cash needs, including IIP’s

ability to pay dividends or make distributions. FFO, Normalized FFO and AFFO should be considered only as supplements to net income computed

in accordance with GAAP as measures of IIP’s operations.

Company Contact:

David Smith

Chief Financial Officer

Innovative Industrial Properties, Inc.

(858) 997-3332

Exhibit 99.2

Innovative Industrial Properties Third Quarter 2024 Supplemental Financial Information

Innovative Industrial Properties 2 Overview 3 Forward - Looking Statements 4 Company Overview Financial Information 5 Quarterly Performance Summary 6 Balance Sheet 7 Net Income 8 Statements of Cash Flows 9 FFO, Normalized FFO, and AFFO Reconciliation 10 Historical Net Income 11 Historical FFO, Normalized FFO, and AFFO Reconciliation Portfolio Data 12 Capital Commitments 13 Leasing Summary 14 Top Tenants Overview 15 – 17 Property List 18 Secured Loans Capitalization 19 Capital and Debt Summary 20 – 21 Definitions 22 Analyst Coverage 23 Senior Management Team and Board of Directors Table of Contents

Innovative Industrial Properties 3 Forward - Looking Statements This Supplemental Financial Information Package include "forward - looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended) that are subject to risks and uncertainties . In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward - looking statements . Likewise, our statements regarding anticipated growth in our funds from operations and anticipated market and regulatory conditions, our strategic direction, our dividend rate and policy, demographics, results of operations, plans and objectives are forward - looking statements . Forward - looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events . Forward - looking statements depend on assumptions, data or methods which may be incorrect or imprecise, and we may not be able to realize them . We do not guarantee that the transactions and events described will happen as described (or that they will happen at all) . You can identify forward - looking statements by the use of forward - looking terminology such as "believes“, "expects“, "may“, "will“, "should“, "seeks“, "approximately“, "intends“, "plans“, "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases . You can also identify forward - looking statements by discussions of strategy, plans or intentions . The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward - looking statements : rates of default on leases for our assets ; concentration of our portfolio of assets and limited number of tenants ; the estimated growth in and evolving market dynamics of the regulated cannabis market ; the demand for regulated cannabis facilities ; inflation dynamics ; our ability to improve our internal control over financial reporting, including our inability to remediate an identified material weakness, and the costs and the time associated with such efforts ; the impact of pandemics on us, our business, our tenants, or the economy generally ; war and other hostilities, including the conflicts in Ukraine and Israel ; our business and investment strategy ; our projected operating results ; actions and initiatives of the U . S . or state governments and changes to government policies and the execution and impact of these actions, initiatives and policies, including the fact that cannabis remains illegal under federal law ; availability of suitable investment opportunities in the regulated cannabis industry ; our understanding of our competition and our potential tenants’ alternative financing sources ; the expected medical - use or adult - use cannabis legalization in certain states ; shifts in public opinion regarding regulated cannabis ; the potential impact on us from litigation matters, including rising liability and insurance costs ; the additional risks that may be associated with certain of our tenants cultivating, processing and/or dispensing adult - use cannabis in our facilities ; the state of the U . S . economy generally or in specific geographic areas ; economic trends and economic recoveries ; our ability to access equity or debt capital ; financing rates for our target assets ; our level of indebtedness, which could reduce funds available for other business purposes and reduce our operational flexibility ; covenants in our debt instruments, which may limit our flexibility and adversely affect our financial condition ; our ability to maintain our investment grade credit rating ; changes in the values of our assets ; our expected portfolio of assets ; our expected investments ; interest rate mismatches between our assets and our borrowings used to fund such investments ; changes in interest rates and the market value of our assets ; the degree to which any interest rate or other hedging strategies may or may not protect us from interest rate volatility ; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters ; how and when any forward equity sales may settle ; our ability to maintain our qualification as a real estate investment trust for U . S . federal income tax purposes ; our ability to maintain our exemption from registration under the Investment Company Act of 1940 ; availability of qualified personnel ; and market trends in our industry, interest rates, real estate values, the securities markets or the general economy . The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance . In addition, we discussed a number of material risks in our most recent Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q . Those risks continue to be relevant to our performance and financial condition . Moreover, we operate in a very competitive and rapidly changing environment . New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements . Any forward - looking statement made by us speaks only of the date on which we make it . We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law . Stockholders and investors are cautioned not to unduly rely on such forward - looking statements when evaluating the information presented in our filings and reports . Market and industry data are included in this presentation . We have obtained substantially all of this information from internal studies, public filings, other independent published industry sources and market studies prepared by third parties . We believe these internal studies, public filings, other independent published industry sources and market studies prepared by third parties are reliable . However, this information may prove to be inaccurate . No representation or warranty is made as to the accuracy of such information . All amounts shown in this report are unaudited . This Supplemental Financial Information Package is not an offer to sell or solicitation to buy securities of Innovative Industrial Properties, Inc . Any offers to sell or solicitations to buy securities of Innovative Industrial Properties, Inc . shall be made only by means of a prospectus approved for that purpose .

Innovative Industrial Properties 4 Company Snapshot State Diversification (1) 14.6% Illinois 13.9% Pennsylvania 13.2% Massachusetts 10.9% New York 9.7% Michigan 9.1% Florida 5.9% Ohio 4.6% New Jersey 4.1% California 3.9% Maryland 10.1% Other 100% Total Company Overview Innovative Industrial Properties, Inc. (NYSE “IIPR”) is an internally managed real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized properties leased to experienced, state - licensed operators for their regulated cannabis facilities . Note : As of September 30 , 2024 , values in thousands except for property count, $ /PSF, or otherwise noted . 1) Based on “Annualized Base Rent” . Refer to “Definitions” for additional details . 2) Refer to “Capital and Debt Summary” and “Definitions” for additional details . 3) Reflects annualized common stock dividend paid on October 15 , 2024 of $ 1 . 90 per share . The decision to declare or pay dividends is in the sole discretion of our board of directors in light of conditions then existing, and there can be no assurance that a dividend will be declared or paid for any time period in any amount . 4) Refer to “Definitions” for additional details . 5) Includes 183 , 000 square feet under development or redevelopment . 6) Weighted by Total Committed / Invested Capital . Refer to “Definitions” for additional details . Operating Portfolio (105 Properties) (4) $3,813,465 Market Capitalization (2) 8,507 Total Rentable Square Feet (5) $7.60 / share Current Annualized Dividend ($) (3) $281 Total Committed / Invested Capital per Square Foot Total Portfolio (4) 95.7% % Leased (6) $2,469,546 Total Committed / Invested Capital (4) 14.0 Years Weighted Average Lease Length 108 Total Properties 10 - 15% No Presence 0 - 5% 5 - 10%

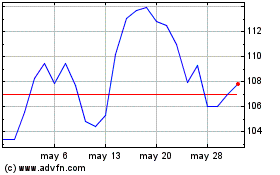

Innovative Industrial Properties 5 Delta 2024 2023 QoQ 3Q2024 2Q2024 1Q2024 4Q2023 3Q2023 Total Revenues $76,526 $79,793 $75,454 $79,156 $77,826 General and administrative expense $9,330 $9,661 $9,562 $10,908 $10,981 General and administrative expense / total revenues 12% 12% 13% 14% 14% Net income attributable to common stockholders $39,651 $41,655 $39,090 $41,295 $41,256 Net income attributable to common stockholders – diluted (“EPS”) $1.37 $1.44 $1.36 $1.45 $1.45 Funds from operations attributable to common stockholders – diluted (“FFO”) (1) $57,595 $58,677 $56,268 $58,443 $57,984 FFO per common share – diluted (1) $2.02 $2.06 $1.98 $2.07 $2.05 Normalized FFO attributable to common stockholders – diluted (“Normalized FFO”) (1) $57,805 $58,841 $56,414 $58,595 $59,096 Normalized FFO per common share – diluted (1) $2.02 $2.06 $1.98 $2.07 $2.09 Adjusted funds from operations attributable to common stockholders – diluted (“AFFO”) (1) $64,283 $65,501 $62,999 $64,338 $64,790 AFFO per common share – diluted (1) $2.25 $2.29 $2.21 $2.28 $2.29 Common stock dividend per share (2) $1.90 $1.90 $1.82 $1.82 $1.80 AFFO Payout Ratio (3) 84% 83% 82% 80% 79% Total Committed / Invested Capital (4) $2.5B $2.5B $2.4B $2.4B $2.4B % Leased – Operating Portfolio (5) 95.7% 95.6% 95.2% 95.8% 98.6% Quarterly Performance Summary Note : Dollars in thousands except for $ /share or otherwise noted . All per share amounts are shown on a diluted basis . 1) Refer to “FFO, Normalized FFO, and AFFO Reconciliation” and “Definitions” for additional details . 2) Reflects quarterly common stock dividend declared in the quarter . 3) Calculated by dividing the common stock dividend declared per share by AFFO per common share – diluted . 4) Dollars in billions, refer to “Definitions” for additional details . 5) Refer to “Definitions” for additional details . $2.29 $2.28 $2.21 $2.29 $2.25 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 AFFO (1) $2.09 $2.07 $1.98 $2.06 $2.02 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 Normalized FFO (1) $77,826 $79,156 $75,454 $79,793 $76,526 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 Total Revenues

Innovative Industrial Properties 6 September 30, December 31, (In thousands, except share and per share amounts) 2024 2023 Assets Real estate, at cost: Land $146,043 $142,524 Buildings and improvements 2,209,720 2,108,218 Construction in progress 59,998 117,773 Total real estate, at cost 2,415,761 2,368,515 Less accumulated depreciation (253,165) (202,692) Net real estate held for investment 2,162,596 2,165,823 Construction Loan receivable 22,000 22,000 Cash and cash equivalents 147,128 140,249 Restricted cash - 1,450 Investments 25,315 21,948 Right of use office lease asset 1,051 1,355 In-place lease intangible assets, net 7,600 8,245 Other assets, net 29,641 30,020 Total assets $2,395,331 $2,391,090 Liabilities and stockholders’ equity Liabilities: Exchangeable Senior Notes, net - $4,431 Notes due 2026, net 297,503 296,449 Building improvements and construction funding payable 9,204 9,591 Accounts payable and accrued expenses 14,961 11,406 Dividends payable 54,817 51,827 Rent received in advance and tenant security deposits 61,084 59,358 Other liabilities 11,225 5,056 Total liabilities 448,794 438,118 Stockholders’ equity: Preferred stock, par value $0.001 per share, 50,000,000 shares authorized: 9.00% Series A cumulative redeemable preferred stock, liquidation preference $25.00 per share, 1,002,673 and 600,000 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively 23,632 14,009 Common stock, par value $0.001 per share, 50,000,000 shares authorized: 28,331,833 and 28,140,891 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively 28 28 Additional paid-in capital 2,119,798 2,095,789 Dividends in excess of earnings (196,921) (156,854) Total stockholders’ equity 1,946,537 1,952,972 Total liabilities and stockholders’ equity $2,395,331 $2,391,090 Balance Sheet

Innovative Industrial Properties 7 For the Three Months Ended For the Nine Months Ended September 30, September 30, (In thousands, except share and per share amounts) 2024 2023 2024 2023 Revenues: Rental (including tenant reimbursements) $76,052 $77,286 $230,219 $228,734 Other 474 540 1,554 1,616 Total revenues 76,526 77,826 231,773 230,350 Expenses: Property expenses 7,295 6,318 20,867 17,700 General and administrative expense 9,330 10,981 28,553 31,924 Depreciation and amortization expense 17,944 16,678 52,567 50,096 Total expenses 34,569 33,977 101,987 99,720 Gain (loss) on sale of real estate - - (3,449) - Income from operations 41,957 43,849 126,337 130,630 Interest income 2,685 2,075 8,435 6,625 Interest expense (4,427) (4,330) (13,136) (13,322) Gain (loss) on exchange of Exchangeable Senior Notes - - - 22 Net income 40,215 41,594 121,636 123,955 Preferred stock dividends (564) (338) (1,240) (1,014) Net income attributable to common stockholders $39,651 $41,256 $120,396 $122,941 Net income attributable to common stockholders per share: Basic $1.38 $1.46 $4.21 $4.36 Diluted $1.37 $1.45 $4.16 $4.32 Weighted-average shares outstanding: Basic 28,254,565 27,983,004 28,216,946 27,971,544 Diluted 28,579,687 28,265,605 28,548,050 28,248,054 Net Income

Innovative Industrial Properties 8 For the Nine Months Ended September 30, (In thousands) 2024 2023 Cash flows from operating activities Net income $121,636 $123,955 Adjustments to reconcile net income to net cash provided by (used in) operating activities Depreciation and amortization 52,567 50,096 Loss (gain) on exchange of Exchangeable Senior Notes - (22) Loss (gain) on sale of real estate 3,449 - Other non-cash adjustments 79 83 Stock-based compensation 13,002 14,647 Amortization of discounts on investments (504) (2,894) Amortization of debt discount and issuance costs 1,214 1,021 Changes in assets and liabilities Other assets, net (2,800) (2,905) Accounts payable, accrued expenses and other liabilities 10,271 5,077 Rent received in advance and tenant security deposits 1,726 404 Net cash provided by (used in) operating activities 200,640 189,462 Cash flows from investing activities Purchases of investments in real estate (13,026) (34,906) Proceeds from sale of real estate asset 9,100 - Funding of draws for improvements and construction (45,642) (129,502) Funding of Construction Loan and other investments - (3,535) Purchases of short-term investments (45,110) (91,772) Maturities of short-term investments 42,247 253,716 Net cash provided by (used in) investing activities (52,431) (5,999) Cash flows from financing activities Issuance of common stock, net of offering costs 11,757 - Issuance of preferred stock, net of offering costs 9,623 - Principal payment on Exchangeable Senior Notes (4,436) - Payment of deferred financing costs (261) - Dividends paid to common stockholders (157,699) (151,969) Dividends paid to preferred stockholders (1,014) (1,014) Taxes paid related to net share settlement of equity awards (750) (568) Net cash provided by (used in) financing activities (142,780) (153,551) Net increase (decrease) in cash, cash equivalents and restricted cash 5,429 29,912 Cash, cash equivalents and restricted cash, beginning of period 141,699 88,572 Cash, cash equivalents and restricted cash, end of period $147,128 $118,484 Supplemental disclosure of cash flow information: Cash paid during the period for interest, net of interest capitalized $7,806 $8,253 Supplemental disclosure of non-cash investing and financing activities: Accrual for current-period additions to real estate $8,574 $10,520 Deposits applied for acquisitions - 250 Accrual for common and preferred stock dividends declared 54,817 51,079 Reclassification from other assets to real estate held for investment 3,152 - Exchange of Exchangeable Senior Notes for common stock - 1,964 Statements of Cash Flows

Innovative Industrial Properties 9 For the Three Months Ended For the Nine Months Ended September 30, September 30, (In thousands, except share and per share amounts) 2024 2023 2024 2023 Net income attributable to common stockholders $39,651 $41,256 $120,396 $122,941 Real estate depreciation and amortization 17,944 16,678 52,567 50,096 Disposition-contingent lease termination fee, net of loss on sale of real estate (1) - - (451) - FFO attributable to common stockholders (basic) 57,595 57,934 172,512 173,037 Cash and non-cash interest expense on Exchangeable Senior Notes - 50 28 169 FFO attributable to common stockholders (diluted) 57,595 57,984 172,540 173,206 Litigation-related expense 210 1,112 520 2,328 Loss (gain) on exchange of Exchangeable Senior Notes - - - (22) Normalized FFO attributable to common stockholders (diluted) 57,805 59,096 173,060 175,512 Interest income on seller-financed note (2) 268 402 1,074 939 Deferred lease payments received on sales-type leases (3) 1,452 - 4,370 - Stock-based compensation 4,316 4,934 13,002 14,647 Non-cash interest expense 419 335 1,208 992 Above-market lease amortization 23 23 69 69 AFFO attributable to common stockholders (diluted) $64,283 $64,790 $192,783 $192,159 FFO per common share – diluted $2.02 $2.05 $6.04 $6.13 Normalized FFO per common share – diluted $2.02 $2.09 $6.06 $6.21 AFFO per common share – diluted $2.25 $2.29 $6.75 $6.80 Weighted average common shares outstanding – basic 28,254,565 27,983,004 28,216,946 27,971,544 Restricted stock and restricted stock units ("RSUs") 299,770 206,919 293,105 193,503 PSUs 25,352 - 25,352 - Dilutive effect of Exchangeable Senior Notes - 75,682 12,647 83,007 Weighted average common shares outstanding – diluted 28,579,687 28,265,605 28,548,050 28,248,054 FFO, Normalized FFO, and AFFO Reconciliation 1) Amount reflects the $ 3 . 9 million disposition - contingent lease termination fee received concurrently with the sale of our property in Los Angeles, California, net of the loss on sale of real estate of $ 3 . 4 million . 2) Amount reflects the non - refundable interest received on the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California, which is recognized as a deposit liability and is included in other liabilities in our condensed consolidated balance sheet as of September 30 , 2024 , as the transaction did not qualify for recognition as a completed sale . 3) In connection with lease amendments executed on January 1 , 2024 that extended the initial terms of the leases, the GAAP lease classifications at two properties switched from operating leases to sales - type leases . While these properties remain wholly owned by IIP, the non - refundable lease payments attributable to these two properties are no longer included in rental revenue and instead, in accordance with the GAAP treatment required for these two leases, recorded as a deposit liability and included in other liabilities on the condensed consolidated balance sheet as of September 30 , 2024 . The amount included here reflects the non - refundable lease payments received on these two sales - type leases for the applicable period . Prior to these lease amendments, the leases were classified as operating leases and the lease payments received were recognized as rental revenue and therefore, included in net income attributable to common stockholders .

Innovative Industrial Properties 10 2024 2023 (In thousands, except share and per share amounts) 3Q2024 2Q2024 1Q2024 4Q2023 3Q2023 Revenues: Rental (including tenant reimbursements) $76,052 $79,253 $74,914 $78,615 $77,286 Other 474 540 540 541 540 Total revenues 76,526 79,793 75,454 79,156 77,826 Expenses: Property expenses 7,295 6,863 6,709 7,193 6,318 General and administrative expense 9,330 9,661 9,562 10,908 10,981 Depreciation and amortization expense 17,944 17,473 17,150 17,098 16,678 Total expenses 34,569 33,997 33,421 35,199 33,977 Gain (loss) on sale of real estate - (3,449) - - - Income from operations 41,957 42,347 42,033 43,957 43,849 Interest income 2,685 3,966 1,784 1,821 2,075 Interest expense (4,427) (4,320) (4,389) (4,145) (4,330) Net income 40,215 41,993 39,428 41,633 41,594 Preferred stock dividends (564) (338) (338) (338) (338) Net income attributable to common stockholders $39,651 $41,655 $39,090 $41,295 $41,256 Net income attributable to common stockholders per share: Basic $1.38 $1.45 $1.37 $1.46 $1.46 Diluted $1.37 $1.44 $1.36 $1.45 $1.45 Weighted-average shares outstanding: Basic 28,254,565 28,250,843 28,145,017 27,996,393 27,983,004 Diluted 28,579,687 28,572,138 28,461,986 28,279,834 28,265,605 Historical Net Income

Innovative Industrial Properties 11 2024 2023 (In thousands, except share and per share amounts) 3Q2024 2Q2024 1Q2024 4Q2023 3Q2023 Net income attributable to common stockholders $39,651 $41,655 $39,090 $41,295 $41,256 Real estate depreciation and amortization 17,944 17,473 17,150 17,098 16,678 Disposition-contingent lease termination fee, net of loss on sale of real estate (1) - (451) - - - FFO attributable to common stockholders (basic) 57,595 58,677 56,240 58,393 57,934 Cash and non-cash interest expense on Exchangeable Senior Notes - - 28 50 50 FFO attributable to common stockholders (diluted) 57,595 58,677 56,268 58,443 57,984 Litigation-related expense 210 164 146 152 1,112 Normalized FFO attributable to common stockholders (diluted) 57,805 58,841 56,414 58,595 59,096 Interest income on seller-financed note (2) 268 403 403 403 402 Deferred lease payments received on sales-type leases (3) 1,452 1,462 1,456 - - Stock-based compensation 4,316 4,371 4,315 4,934 4,934 Non-cash interest expense 419 401 388 383 335 Above-market lease amortization 23 23 23 23 23 AFFO attributable to common stockholders (diluted) $64,283 $65,501 $62,999 $64,338 $64,790 FFO per common share – diluted $2.02 $2.06 $1.98 $2.07 $2.05 Normalized FFO per common share – diluted $2.02 $2.06 $1.98 $2.07 $2.09 AFFO per common share – diluted $2.25 $2.29 $2.21 $2.28 $2.29 Weighted average common shares outstanding – basic 28,254,565 28,250,843 28,145,017 27,996,393 27,983,004 Restricted stock and RSUs 299,770 300,582 278,890 206,667 206,919 PSUs 25,352 20,713 - - - Dilutive effect of Exchangeable Senior Notes - - 38,079 76,774 75,682 Weighted average common shares outstanding – diluted 28,579,687 28,572,138 28,461,986 28,279,834 28,265,605 Historical FFO, Normalized FFO, and AFFO Reconciliation 1) Amount reflects the $ 3 . 9 million disposition - contingent lease termination fee received concurrently with the sale of our property in Los Angeles, California, net of the loss on sale of real estate of $ 3 . 4 million . 2) Amount reflects the non - refundable interest received on the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California, which is recognized as a deposit liability and is included in other liabilities in our condensed consolidated balance sheet as of September 30 , 2024 , as the transaction did not qualify for recognition as a completed sale . 3) In connection with lease amendments executed on January 1 , 2024 that extended the initial terms of the leases, the GAAP lease classifications at two properties switched from operating leases to sales - type leases . While these properties remain wholly owned by IIP, the non - refundable lease payments attributable to these two properties are no longer included in rental revenue and instead, in accordance with the GAAP treatment required for these two leases, recorded as a deposit liability and included in other liabilities on the condensed consolidated balance sheet as of September 30 , 2024 . The amount included here reflects the non - refundable lease payments received on these two sales - type leases for the applicable period . Prior to these lease amendments, the leases were classified as operating leases and the lease payments received were recognized as rental revenue and therefore, included in net income attributable to common stockholders .

Innovative Industrial Properties 12 Capital Commitments Note : Values in thousands . Capital commitments consist of purchase prices of acquisitions and commitments to fund construction and improvements at properties made during the applicable period . Excludes transaction costs and commitments related to senior secured loans . Two Year Capital Commitment History $25,400 $91,000 - - $14,000 $16,000 $49,100 - 4Q2022 1Q2023 2Q2023 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024

Innovative Industrial Properties 13 # of Rentable Square Feet Rentable Square Feet Tenant State Closing / Execution Leases # % of Total Portfolio Verdant California Jun-23 1 23 0% Mitten Extracts Michigan Dec-23 1 201 2% Cottage Inn Michigan Jan-24 1 2 0% Gold Flora California Mar-24 1 236 3% Lume Cannabis Company Michigan Apr-24 1 56 1% Gold Flora California May-24 1 70 1% Total 6 588 7% Note : Rentable square feet values in thousands . 1) The commencement date under certain of these leases is conditioned upon, among other things, the tenant’s receipt of approvals to conduct cannabis operations by the requisite state and local authorities . 2) As a % of annualized base rent for the Operating Portfolio . Refer to “Definitions” for additional details . 3) Includes Pre - Leased Development Properties . Refer to “Definitions” for additional details . Leasing Summary Recent Leasing History through September 30, 2024 (1) - - - 0% 0% 1% 2% 1% 0% 2% 94% 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thereafter Representing $294 Million in A nnualized Base Rent 75 14 1 5 2 2 1 1 - - - Expiring Leases (3) Lease Expiration Schedule as of September 30, 2024 (2)

Innovative Industrial Properties 14 IIP Portfolio Second Quarter 2024 (3) Tenant Information Annualized Base Rent (ABR) (1) ABR # of Adjusted Market MSO #Tenant $ % Square Feet (2) / Square Foot Leases Revenue EBITDA (4) Capitalization (5) / SSO (6) 1PharmaCann $48,608 16.5% 697 $70 11 Private Co. Private Co. Private Co. MSO 2Ascend Wellness Holdings 30,398 10.3% 624 $49 4 $142 $28 $180 MSO 3Green Thumb Industries 21,913 7.5% 664 $33 3 280 94 2,472 MSO 4Curaleaf 20,313 6.9% 578 $35 8 342 73 2,264 MSO 5Trulieve 19,311 6.6% 740 $26 6 303 107 2,310 MSO 6The Cannabist Company 17,955 6.1% 588 $31 21 125 18 111 MSO 7 4Front Ventures (7) 16,960 5.8% 488 $35 4 19 3 44 MSO 8Holistic Industries 16,741 5.7% 298 $56 4 Private Co. Private Co. Private Co. MSO 9Cresco Labs 16,527 5.6% 379 $44 5 184 54 579 MSO 10Parallel 15,744 5.4% 593 $27 2 Private Co. Private Co. Private Co. MSO Top 10 Tenants Total $224,470 76.4% 5,649 $40 68 Top Tenants Overview 1) Dollars in thousands, r efer to “Definitions” for additional details . 2) Square feet in thousands . 3) Dollars in millions, based on each company’s public securities filings and earnings release, available at www . sec . gov, www . sedar . com, or each company’s respective website, for the quarter ended June 30 , 2024 . 4) Adjusted EBITDA is a non - GAAP financial measure utilized in the industry . For definitions and reconciliations of Adjusted EBITDA to net income, see each company’s public securities filings, available at www . sec . gov or www . sedar . com . 5) Dollars in millions, per S&P Capital IQ Pro as of 9 / 30 / 2024 . 6) “MSO” stands for Multi - State Operator which means the tenant (or guarantor) conducts cannabis operations in more than one state . “SSO” stands for Single - State O perator which means the tenant (or guarantor) conducts cannabis operations in a single state . 7) Includes one property acquired in January 2022 for $ 16 . 0 million which did not satisfy the requirements for sale - leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our consolidated balance sheet .

Innovative Industrial Properties 15 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet Operating: Cannabis - Industrial 14Front Ventures Illinois Matteson 8/3/2021 100.0% 250 - 250 $71,684 $66 $71,750 $287 24Front Ventures* Washington Olympia 12/17/2020 100.0% 114 - 114 17,500 - 17,500 154 34Front Ventures* Massachusetts Holliston 1/28/2022 100.0% 57 - 57 16,000 - 16,000 281 44Front Ventures* Massachusetts Georgetown 12/17/2020 100.0% 67 - 67 15,500 - 15,500 231 5Ascend Wellness Holdings Illinois Barry 12/21/2018 100.0% 166 - 166 71,000 - 71,000 428 6Ascend Wellness Holdings Massachusetts Athol 4/2/2020 100.0% 199 - 199 63,900 - 63,900 321 7Ascend Wellness Holdings New Jersey Franklin 2/10/2022 100.0% 114 - 114 55,000 - 55,000 482 8Ascend Wellness Holdings Michigan Lansing 7/2/2019 100.0% 145 - 145 24,150 - 24,150 167 9AYR Wellness Florida Ocala 6/7/2024 100.0% 47 98 145 13,000 30,000 43,000 297 10AYR Wellness Ohio Akron 5/14/2019 100.0% 11 - 11 3,550 - 3,550 323 11Battle Green Ohio Columbus 3/3/2023 100.0% 157 - 157 42,908 3,592 46,500 296 12Calyx Peak Missouri Smithville 9/17/2021 100.0% 83 - 83 28,250 - 28,250 340 13Cresco Labs Michigan Marshall 4/22/2020 100.0% 115 - 115 32,000 - 32,000 278 14Cresco Labs Illinois Kankakee 10/22/2019 100.0% 51 - 51 25,496 104 25,600 502 15Cresco Labs Illinois Joliet 10/22/2019 100.0% 39 - 39 20,950 - 20,950 537 16Cresco Labs Ohio Yellow Springs 1/24/2020 100.0% 50 - 50 12,927 618 13,545 271 17Curaleaf Pennsylvania Chambersburg 12/20/2019 100.0% 179 - 179 60,889 751 61,640 344 18Curaleaf Illinois Litchfield 10/30/2019 100.0% 127 - 127 40,000 - 40,000 315 19Curaleaf New Jersey Blue Anchor 7/13/2020 100.0% 123 - 123 35,000 - 35,000 285 20Curaleaf Massachusetts Webster 9/1/2022 100.0% 104 - 104 21,500 - 21,500 207 21Curaleaf North Dakota Fargo 12/20/2019 100.0% 33 - 33 12,190 - 12,190 369 22Curran Highway Massachusetts North Adams 5/26/2021 - 71 - 71 26,800 - 26,800 377 23Emerald Growth Michigan Harrison Township 6/7/2019 100.0% 45 - 45 10,000 - 10,000 222 24Gold Flora California Desert Hot Springs 10/15/2021 100.0% 204 - 204 63,500 - 63,500 311 25Gold Flora California North Palm Springs 5/12/2020 100.0% 70 - 70 18,027 80 18,107 259 26Green Thumb Industries Pennsylvania Danville 11/12/2019 100.0% 300 - 300 94,600 - 94,600 315 27Green Thumb Industries Illinois Oglesby 3/6/2020 100.0% 266 - 266 50,000 - 50,000 188 28Green Thumb Industries Ohio Toledo 1/31/2020 100.0% 98 - 98 32,200 - 32,200 329 29Holistic Industries Maryland Capitol Heights 5/26/2017 100.0% 72 - 72 33,719 31 33,750 469 30Holistic Industries Pennsylvania New Castle 6/10/2020 100.0% 108 - 108 25,629 21 25,650 238 31Holistic Industries Massachusetts Monson 7/12/2018 100.0% 55 - 55 19,750 - 19,750 359 32Jushi Pennsylvania Scranton 4/6/2018 100.0% 145 - 145 45,800 - 45,800 316 33Lume Cannabis Company Michigan Dimondale 8/2/2018 100.0% 56 - 56 16,853 946 17,799 318 34Maryland Cultivation Processing (MCP) Maryland Hagerstown 4/13/2022 100.0% 84 - 84 25,000 - 25,000 298 35Mitten Extracts Michigan Dimondale 4/16/2021 100.0% 201 - 201 70,420 1,659 72,079 359 36New Beaver Ave.** Pennsylvania Pittsburgh 5/13/2021 10.7% 239 - 239 67,889 43 67,932 284 37Parallel Florida Lakeland 9/18/2020 100.0% 220 - 220 56,400 - 56,400 256 38Parallel Florida Wimauma 3/11/2020 100.0% 373 - 373 51,500 - 51,500 138 39PharmaCann New York Hamptonburgh 12/19/2016 100.0% 234 - 234 128,329 11,171 139,500 596 40PharmaCann Michigan Warren 10/9/2019 100.0% 205 - 205 83,595 - 83,595 408 41PharmaCann Massachusetts Holliston 5/31/2018 100.0% 58 - 58 30,500 - 30,500 526 42PharmaCann Illinois Dwight 10/30/2019 100.0% 66 - 66 28,000 - 28,000 424 43PharmaCann Pennsylvania Olyphant 8/7/2019 100.0% 56 - 56 28,000 - 28,000 500 44PharmaCann Ohio Buckeye Lake 3/13/2019 100.0% 58 - 58 20,000 - 20,000 345 45Sacramento CA (Undisclosed Tenant) California Sacramento 2/8/2019 100.0% 43 - 43 12,710 - 12,710 296 46Texas Original Texas Bastrop 6/14/2022 100.0% - 85 85 19,289 2,711 22,000 259 47The Cannabist Company Pennsylvania Saxton 5/20/2019 100.0% 270 - 270 42,891 109 43,000 159 48The Cannabist Company Virginia Richmond 1/15/2020 100.0% 82 - 82 19,750 - 19,750 241 49The Cannabist Company New Jersey Vineland 7/16/2020 100.0% 50 - 50 11,820 - 11,820 236 Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of September 30 , 2024 . * These properties did not satisfy the requirements for sale - leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our condensed consolidated balance sheet . **Includes two non - cannabis tenants currently occupying 79 , 000 sqft . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . Property List

Innovative Industrial Properties 16 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet 50The Cannabist Company Colorado Denver 10/30/2018 100.0% 58 - 58 $11,250 - $11,250 $194 51The Cannabist Company Colorado Denver 12/14/2021 100.0% 18 - 18 9,917 - 9,917 551 52The Cannabist Company Colorado Denver 12/14/2021 100.0% 12 - 12 3,276 - 3,276 273 53The Pharm Arizona Willcox 12/15/2017 100.0% 358 - 358 20,000 - 20,000 56 54TILT Holdings Pennsylvania White Haven 2/15/2023 100.0% 58 - 58 15,000 - 15,000 259 55Trulieve Massachusetts Holyoke 7/26/2019 100.0% 150 - 150 43,500 - 43,500 290 56Trulieve Florida Alachua 1/22/2021 100.0% 295 - 295 41,650 - 41,650 141 57Trulieve Maryland Hancock 8/13/2021 100.0% 115 - 115 29,515 - 29,515 257 58Trulieve Florida Quincy 10/23/2019 100.0% 120 - 120 17,000 - 17,000 142 59Trulieve*** Nevada Las Vegas 7/12/2019 100.0% 43 - 43 9,600 - 9,600 223 60Trulieve Arizona Cottonwood 4/27/2022 100.0% 17 - 17 5,238 - 5,238 308 61Verdant California Cathedral City 3/25/2022 100.0% 23 - 23 15,010 258 15,269 664 62Vireo New York Perth 10/23/2017 100.0% 389 - 389 80,907 450 81,358 209 63Vireo Minnesota Otsego 11/8/2017 100.0% 89 - 89 9,710 - 9,710 109 Operating: Cannabis - Industrial Subtotal / Wtd. Avg. 96.0% 7,705 183 7,888 $2,127,940 $52,610 $2,180,550 $276 Operating: Cannabis - Retail 64Curaleaf North Dakota Dickinson 12/14/2021 100.0% 5 - 5 $2,045 - $2,045 $409 65Curaleaf North Dakota Devils Lake 12/14/2021 100.0% 4 - 4 1,614 - 1,614 404 66Curaleaf Pennsylvania Bradford 12/14/2021 100.0% 3 - 3 1,058 - 1,058 353 67Green Peak (Skymint) Michigan East Lansing 10/25/2019 100.0% 3 - 3 3,372 28 3,400 1,133 68Green Peak (Skymint) Michigan Lansing 11/4/2019 100.0% 14 - 14 2,225 - 2,225 159 69Green Peak (Skymint) Michigan Flint 11/4/2019 100.0% 6 - 6 2,180 - 2,180 363 70PharmaCann Colorado Commerce City 2/21/2020 100.0% 5 - 5 2,300 - 2,300 460 71PharmaCann Colorado Aurora 12/14/2021 100.0% 2 - 2 1,674 - 1,674 837 72PharmaCann Colorado Berthoud 12/14/2021 100.0% 6 - 6 1,406 - 1,406 234 73PharmaCann Colorado Mancos 12/14/2021 100.0% 4 - 4 1,148 - 1,148 287 74PharmaCann Colorado Pueblo 2/19/2020 100.0% 3 - 3 1,049 - 1,049 350 75Schwazze Colorado Ordway 12/14/2021 100.0% 2 - 2 400 - 400 200 76Schwazze Colorado Rocky Ford 12/14/2021 100.0% 13 - 13 400 - 400 31 77Schwazze Colorado Las Animas 12/14/2021 100.0% 2 - 2 400 - 400 200 78South Mason Drive Michigan Newaygo 11/8/2019 - 2 - 2 995 - 995 498 79The Cannabist Company Colorado Denver 12/14/2021 100.0% 4 - 4 7,338 - 7,338 1,834 80The Cannabist Company Colorado Pueblo 12/14/2021 100.0% 6 - 6 4,878 - 4,878 813 81The Cannabist Company Colorado Aurora 12/14/2021 100.0% 5 - 5 4,229 - 4,229 846 82The Cannabist Company Colorado Glenwood Springs 12/14/2021 100.0% 4 - 4 4,187 - 4,187 1,047 83The Cannabist Company Colorado Fort Collins 12/14/2021 100.0% 5 - 5 3,977 - 3,977 795 84The Cannabist Company Colorado Aurora 12/14/2021 100.0% 4 - 4 3,601 - 3,601 900 85The Cannabist Company New Jersey Vineland 7/16/2020 100.0% 4 - 4 2,165 - 2,165 541 86The Cannabist Company Colorado Aurora 12/14/2021 100.0% 5 - 5 1,991 - 1,991 398 87The Cannabist Company Colorado Englewood 12/14/2021 100.0% 4 - 4 1,778 - 1,778 445 88The Cannabist Company Colorado Trinidad 12/14/2021 100.0% 9 - 9 1,728 - 1,728 192 89The Cannabist Company Colorado Silver Plume 12/14/2021 100.0% 4 - 4 1,444 - 1,444 361 90The Cannabist Company Colorado Black Hawk 12/14/2021 100.0% 4 - 4 1,321 - 1,321 330 91The Cannabist Company Colorado Edgewater 12/14/2021 100.0% 5 - 5 1,089 - 1,089 218 92The Cannabist Company Colorado Sheridan 12/14/2021 100.0% 2 - 2 890 - 890 445 93The Pharm Arizona Phoenix 9/19/2019 100.0% 2 - 2 2,500 - 2,500 1,250 94Verano Pennsylvania Harrisburg 3/23/2022 100.0% 3 - 3 2,750 - 2,750 917 95Wilder Road Michigan Bay City 11/4/2019 - 4 - 4 1,740 - 1,740 435 Operating: Cannabis - Retail Subtotal / Wtd. Avg. 96.1% 148 - 148 $69,870 $28 $69,898 $472 Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of September 30 , 2024 . *** Harvest Health & Recreation Inc . , which is a subsidiary of Trulieve Inc . , executed a lease guaranty in favor of IIP for tenant’s obligations at the property . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . Property List (Continued)

Innovative Industrial Properties 17 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet Operating: Cannabis - Industrial / Retail 96Cresco Labs Massachusetts Fall River 6/30/2020 100.0% 124 - 124 $26,907 $1,843 $28,750 $232 97Holistic Industries Michigan Madison Heights 9/1/2020 100.0% 63 - 63 28,500 - 28,500 452 98Kaya Cannabis Colorado Denver 12/14/2021 100.0% 6 - 6 1,299 - 1,299 217 99Schwazze Colorado Pueblo 12/14/2021 100.0% 8 - 8 2,165 - 2,165 271 100 Sozo Michigan Warren 5/14/2021 100.0% 85 - 85 17,230 - 17,230 203 101 The Cannabist Company Colorado Denver 12/14/2021 100.0% 33 - 33 8,206 - 8,206 249 102 TILT Holdings Massachusetts Taunton 5/16/2022 100.0% 104 - 104 40,000 - 40,000 385 Operating: Cannabis - Industrial / Retail Subtotal / Wtd. Avg. 100.0% 423 - 423 $124,307 $1,843 $126,150 $298 Operating: Non-Cannabis 103 Cottage Inn Michigan Traverse City 11/25/2019 100.0% 2 - 2 $1,272 - $1,272 $636 104 North Anza Road California Palm Springs 4/16/2019 - 24 - 24 6,309 - 6,309 263 105 North Anza Road and Del Sol Road California Palm Springs 4/16/2019 - 22 - 22 5,788 - 5,788 263 Operating: Non-Cannabis Subtotal / Wtd. Avg. 9.5% 48 - 48 $13,369 - $13,369 $279 Operating Portfolio Total / Wtd. Avg. 95.7% 8,324 183 8,507 $2,335,486 $54,480 $2,389,967 $281 Dev. / Redev. Properties (3) 106 Inland Center Drive California San Bernardino 11/16/2020 - - 192 192 $35,819 - $35,819 $187 107 Leah Avenue Texas San Marcos 3/10/2021 - - 63 63 8,231 - 8,231 131 Dev. / Redev. Properties / Wtd. Avg. - - 255 255 $44,050 - $44,050 $173 Pre-Leased Dev. Properties (3) 108 Gold Flora California Palm Springs 4/16/2019 100.0% 56 180 236 $35,530 - $35,530 $151 Pre-Leased Dev. Property / Wtd. Avg. 100.0% 56 180 236 $35,530 - $35,530 $151 Total Portfolio / Wtd. Avg. 94.1% 8,380 618 8,998 $2,415,066 $54,480 $2,469,546 $274 State Subtotal / Wtd. Avg. 1 Pennsylvania 84.3% 1,361 - 1,361 $384,506 $923 $385,430 $283 2 Illinois 100.0% 965 - 965 $307,131 $169 $307,300 $318 3 Massachusetts 91.2% 989 - 989 $304,357 $1,843 $306,200 $310 4 Michigan 99.1% 946 - 946 $294,532 $2,633 $297,164 $314 5 New York 100.0% 623 - 623 $209,236 $11,622 $220,858 $355 6 Florida 100.0% 1,055 98 1,153 $179,550 $30,000 $209,550 $182 7 California 75.2% 442 372 814 $192,693 $338 $193,032 $237 8 Ohio 100.0% 374 - 374 $111,585 $4,210 $115,795 $310 9 New Jersey 100.0% 291 - 291 $103,985 - $103,985 $357 10 Maryland 100.0% 271 - 271 $88,234 $31 $88,265 $326 11 Colorado 100.0% 233 - 233 $83,340 - $83,340 $358 12 Texas 72.8% - 148 148 $27,520 $2,711 $30,231 $204 13 Missouri 100.0% 83 - 83 $28,250 - $28,250 $340 14 Arizona 100.0% 377 - 377 $27,737 - $27,737 $74 15 Virginia 100.0% 82 - 82 $19,750 - $19,750 $241 16 Washington 100.0% 114 - 114 $17,500 - $17,500 $154 17 North Dakota 100.0% 42 - 42 $15,849 - $15,849 $377 18 Minnesota 100.0% 89 - 89 $9,710 - $9,710 $109 19 Nevada 100.0% 43 - 43 $9,600 - $9,600 $223 Property List (Continued) Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of September 30 , 2024 . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . 3) Refer to “Definitions” for additional details .

Innovative Industrial Properties 18 Date Maturity / Wtd. Amount Loan #City State Loan Type Executed Avg. Maturity Outstanding Commitment 1Coachella California Senior Secured 6/25/2021 0.3 Years $22,000 $23,000 2 Needles (1) California Senior Secured 3/3/2023 3.4 Years 16,100 16,100 Loan Portfolio Total / Wtd. Avg. 1.6 Years $38,100 $39,100 Secured Loans Note : Loan list maturity does not include available loan extensions . 1) Relates to the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California . The transaction did not qualify for recognition as a completed sale in accordance with GAAP and therefore, we have not derecognized the assets transferred and have not recognized the seller - financed note on our condensed consolidated balance sheet .

Innovative Industrial Properties 19 Interest Rate / Preferred Rate / Maturity / Wtd. Quarter End (In thousands, except share and per share amounts) Wtd. Avg. Rate Avg. Maturity September 30, 2024 Unsecured debt: Notes due 2026 5.50% 1.6 Years 300,000 Total Unsecured Debt 5.50% 1.6 Years $300,000 Gross Debt 5.50% 1.6 Years $300,000 Series A Preferred Stock: Redemption price per share $25.00 Shares outstanding 1,002,673 Total Preferred Equity 9.00% $25,067 Total Senior Capital 5.77% $325,067 Equity Market Capitalization: Stock Price as of 09/30/2024 $134.60 Shares outstanding 28,331,833 Equity Market Capitalization $3,813,465 Covenant (1) September 30, 2024 Debt / Total Gross Assets <60% 11% Secured Debt <40% - Unencumbered Total Gross Assets / Unsecured Debt >150% 884% Debt Service Coverage Ratio >1.5x 17.0x Egan Jones Credit Rating BBB+ Debt Maturity Schedule Capital and Debt Summary $300.0 Million 2024 2025 2026 2027 2028 Thereafter Notes Due 2026 Capital Overview 1) Calculated in accordance with the indenture governing the Notes due 2026 , included in the Current Report on Form 8 - K filed with the Securities and Exchange Commission on May 25 , 2021 .