Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Noviembre 2023 - 11:47AM

Edgar (US Regulatory)

Nuveen

Real

Estate

Income

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

138.6%

(96.8%

of

Total

Investments)

X

–

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

-

91

.6

%

(

64

.0

%

of

Total

Investments)

X

203,798,491

Data

Center

REITs

-

11.1%

86,459

Digital

Realty

Trust

Inc

$

10,463,268

19,650

Equinix

Inc

14,271,009

Total

Data

Center

REITs

24,734,277

Health

Care

REITs

-

10.3%

238,148

Healthpeak

Properties

Inc

4,372,397

225,085

Ventas

Inc

9,482,831

110,946

Welltower

Inc

9,088,697

Total

Health

Care

REITs

22,943,925

Hotel

&

Resort

REITs

-

2.9%

277,006

Host

Hotels

&

Resorts

Inc

4,451,486

86,240

Sunstone

Hotel

Investors

Inc

806,344

103,127

Xenia

Hotels

&

Resorts

Inc

1,214,836

Total

Hotel

&

Resort

REITs

6,472,666

Industrial

REITs

-

12.5%

88,355

First

Industrial

Realty

Trust

Inc

4,204,815

209,606

Prologis

Inc

23,519,889

Total

Industrial

REITs

27,724,704

Multi-Family

Residential

REITs

-

14.2%

169,672

Apartment

Income

REIT

Corp

5,208,930

35,817

AvalonBay

Communities

Inc

6,151,212

59,049

Camden

Property

Trust

5,584,855

128,109

Equity

Residential

7,521,279

11,910

Essex

Property

Trust

Inc

2,525,992

17,005

Mid-America

Apartment

Communities

Inc

2,187,693

65,155

UDR

Inc

2,324,079

Total

Multi-Family

Residential

REITs

31,504,040

Office

REITs

-

6.8%

52,024

Alexandria

Real

Estate

Equities

Inc

5,207,602

43,268

Boston

Properties

Inc

2,573,581

53,310

Cousins

Properties

Inc

1,085,925

184,895

Douglas

Emmett

Inc

2,359,260

52,680

Kilroy

Realty

Corp

1,665,215

130,760

Paramount

Group

Inc

604,111

41,610

SL

Green

Realty

Corp

1,552,053

Total

Office

REITs

15,047,747

Other

Specialized

REITs

-

1.7%

133,245

VICI

Properties

Inc

3,877,429

Total

Other

Specialized

REITs

3,877,429

Real

Estate

Operating

Companies

-

0.2%

58,990

Tricon

Residential

Inc

436,526

Total

Real

Estate

Operating

Companies

436,526

Retail

REITs

-

12.8%

58,380

Federal

Realty

Investment

Trust

5,290,980

313,206

Kite

Realty

Group

Trust

6,708,873

58,640

Macerich

Co/The

639,762

54,350

Regency

Centers

Corp

3,230,564

94,804

Simon

Property

Group

Inc

10,241,676

Nuveen

Real

Estate

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

Retail

REITs

(continued)

194,895

SITE

Centers

Corp

$

2,403,055

Total

Retail

REITs

28,514,910

Self-Storage

REITs

-

9.0%

194,607

CubeSmart

7,420,365

32,290

Extra

Space

Storage

Inc

3,925,818

33,320

Public

Storage

8,780,487

Total

Self-Storage

REITs

20,126,670

Single-Family

Residential

REITs

-

8.6%

335,632

American

Homes

4

Rent,

Class

A

11,307,442

45,400

Equity

LifeStyle

Properties

Inc

2,892,434

125,965

Invitation

Homes

Inc

3,991,831

7,735

Sun

Communities

Inc

915,360

Total

Single-Family

Residential

REITs

19,107,067

Telecom

Tower

REITs

-

1.5%

7,055

Crown

Castle

Inc

649,272

13,285

SBA

Communications

Corp

2,659,258

Total

Telecom

Tower

REITs

3,308,530

Total

Real

Estate

Investment

Trust

Common

Stocks

(cost

$176,441,977)

203,798,491

Shares

Description

(a)

Coupon

Value

X

–

REAL

ESTATE

INVESTMENT

TRUST

PREFERRED

STOCKS

-

47

.0

%

(

32

.8

%

of

Total

Investments)

X

104,544,555

Data

Center

REITs

-

3.8%

197,465

Digital

Realty

Trust

Inc

5.200%

$

3,998,666

97,500

Digital

Realty

Trust

Inc

5.850%

2,192,775

107,345

Digital

Realty

Trust

Inc

5.250%

2,183,397

Total

Data

Center

REITs

8,374,838

Diversified

REITs

-

1.3%

35,010

Armada

Hoffler

Properties

Inc

6.750%

738,711

10,130

CTO

Realty

Growth

Inc

6.375%

185,278

54,110

DigitalBridge

Group

Inc

7.150%

1,152,543

43,965

DigitalBridge

Group

Inc

7.125%

949,644

Total

Diversified

REITs

3,026,176

Hotel

&

Resort

REITs

-

5.5%

95,245

Chatham

Lodging

Trust

6.625%

1,944,903

141,820

DiamondRock

Hospitality

Co

8.250%

3,614,992

147,075

Pebblebrook

Hotel

Trust

6.375%

2,895,907

57,695

Pebblebrook

Hotel

Trust

5.700%

1,062,742

22,025

Pebblebrook

Hotel

Trust

6.300%

438,738

65,150

Sunstone

Hotel

Investors

Inc

5.700%

1,342,090

41,060

Sunstone

Hotel

Investors

Inc

6.125%

872,935

Total

Hotel

&

Resort

REITs

12,172,307

Industrial

REITs

-

3.2%

59,877

Prologis

Inc

8.540%

3,398,020

159,235

Rexford

Industrial

Realty

Inc

5.625%

3,224,509

23,621

Rexford

Industrial

Realty

Inc

5.875%

500,765

Total

Industrial

REITs

7,123,294

Multi-Family

Residential

REITs

-

0.8%

34,373

Mid-America

Apartment

Communities

Inc

8.500%

1,844,799

Total

Multi-Family

Residential

REITs

1,844,799

Shares

Description

(a)

Coupon

Value

Office

REITs

-

13.0%

12,713

Highwoods

Properties

Inc

8.625%

$

13,587,208

175,808

Hudson

Pacific

Properties

Inc

4.750%

2,187,052

152,510

SL

Green

Realty

Corp

6.500%

2,882,439

229,040

Vornado

Realty

Trust

5.250%

3,339,403

214,604

Vornado

Realty

Trust

5.250%

3,137,511

178,635

Vornado

Realty

Trust

4.450%

2,231,151

107,649

Vornado

Realty

Trust

5.400%

1,555,528

Total

Office

REITs

28,920,292

Other

Specialized

REITs

-

0.2%

21,085

EPR

Properties

5.750%

391,548

Total

Other

Specialized

REITs

391,548

Retail

REITs

-

9.9%

128,290

Agree

Realty

Corp

4.250%

2,147,575

145,990

Federal

Realty

Investment

Trust

5.000%

2,924,180

186,964

Kimco

Realty

Corp

5.250%

4,032,813

165,989

Kimco

Realty

Corp

5.125%

3,513,987

60,825

Regency

Centers

Corp

6.250%

1,490,213

53,645

Regency

Centers

Corp

5.875%

1,281,579

125,180

Saul

Centers

Inc

6.000%

2,641,298

19,985

Saul

Centers

Inc

6.125%

419,685

5,494

Simon

Property

Group

Inc

8.375%

308,131

116,200

SITE

Centers

Corp

6.375%

2,647,036

27,340

Spirit

Realty

Capital

Inc

6.000%

575,780

Total

Retail

REITs

21,982,277

Self-Storage

REITs

-

7.4%

77,946

National

Storage

Affiliates

Trust

6.000%

1,749,888

262,930

Public

Storage

5.600%

6,386,570

119,064

Public

Storage

5.050%

2,753,950

89,715

Public

Storage

4.625%

1,767,385

80,955

Public

Storage

4.875%

1,705,722

73,305

Public

Storage

4.000%

1,271,842

27,485

Public

Storage

4.125%

493,905

12,910

Public

Storage

4.700%

252,649

Total

Self-Storage

REITs

16,381,911

Nuveen

Real

Estate

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Shares

Description

(a)

Coupon

Value

Single-Family

Residential

REITs

-

1.9%

117,810

American

Homes

4

Rent

6.250%

$

2,651,903

65,105

American

Homes

4

Rent

5.875%

1,416,034

12,330

UMH

Properties

Inc

6.375%

259,176

Total

Single-Family

Residential

REITs

4,327,113

Total

Real

Estate

Investment

Trust

Preferred

Stocks

(cost

$126,295,976)

104,544,555

Total

Long-Term

Investments

(cost

$302,737,953)

308,343,046

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

4.5% (3.2%

of

Total

Investments)

X

–

REPURCHASE

AGREEMENTS

-

4

.5

%

(

3

.2

%

of

Total

Investments)

X

10,066,113

$

506

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

9/30/23,

repurchase

price

$506,181,

collateralized

by

$717,700,

U.S.

Treasury

Bonds,

2.875%,

due

5/15/52,

value

$516,239

1.600%

10/02/23

$

506,113

9,560

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

9/30/23,

repurchase

price

$9,564,206,

collateralized

by

$12,240,100,

U.S.

Treasury

Bonds,

3.375%,

due

11/15/48,

value

$9,751,273

5.280%

10/02/23

9,560,000

Total

Repurchase

Agreements

(cost

$10,066,113)

10,066,113

Total

Short-Term

Investments

(cost

$10,066,113)

10,066,113

Total

Investments

(cost

$

312,804,066

)

-

143

.1

%

318,409,159

Borrowings

-

(42.4)%

(b),(c)

(

94,400,000

)

Other

Assets

&

Liabilities,

Net

- (0.7)%

(

1,488,515

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

222,520,644

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(d)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

Capital

Services

LLC

$

72,400,000

Receive

1-Month

LIBOR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

3,895,837

$

3,895,837

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Real

Estate

Investment

Trust

Common

Stocks

$

203,798,491

$

–

$

–

$

203,798,491

Real

Estate

Investment

Trust

Preferred

Stocks

101,146,535

3,398,020

–

104,544,555

Short-Term

Investments:

Repurchase

Agreements

–

10,066,113

–

10,066,113

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

3,895,837

–

3,895,837

Total

$

304,945,026

$

17,359,970

$

–

$

322,304,996

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Borrowings

as

a

percentage

of

Total

Investments

is

29.6%.

(c)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$196,890,392

have

been

pledged

as

collateral

for

borrowings.

(d)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

REIT

Real

Estate

Investment

Trust

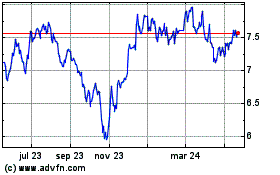

Nuveen Real Estate Income (NYSE:JRS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

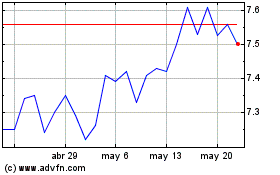

Nuveen Real Estate Income (NYSE:JRS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024