U.S. Stocks Climb After Strong Earnings Reports and Earlier Decline

25 Julio 2018 - 2:15PM

Noticias Dow Jones

By Ben St. Clair and Danielle Chemtob

The Dow Jones Industrial Average turned higher Wednesday as

investors balanced trade relations with another wave of strong

corporate-earnings reports.

The blue-chip index climbed 17 points, or less than 0.1%, to

25259 in recent trading, after earlier declining as much as 128

points. The S&P 500 rose 0.3%, and the technology-heavy Nasdaq

Composite gained 0.6%.

European Commission President Jean-Claude Juncker is visiting

the White House later Wednesday, with trade expected to top the

agenda. Shares of Ford and General Motors fell 3% and 6.2%,

respectively, over heightened concerns that President Donald Trump

will proceed with a plan to levy tariffs on auto imports. General

Motors also lowered its 2018 profit outlook based partly on

unexpectedly high raw-materials costs in the wake of U.S. tariffs

on steel and aluminum.

Brad McMillan, chief investment officer for Commonwealth

Financial Network, said investors don't have high expectations for

the meeting.

"If we don't have another confrontation, that will be treated as

a victory," he said.

In a tweet Tuesday, President Donald Trump called tariffs "the

greatest, " reiterating their use as punishment for countries that

fail to negotiate a "fair deal" with the U.S. Later, he suggested

the EU and U.S. drop all tariffs, barriers and subsidies.

Investors are balancing uncertainty over trade conflicts with

what is shaping up to be a strong corporate-earnings season. About

28% of companies in the S&P 500 have reported results for the

latest quarter, and earnings are up 20% so far for companies in the

index that have reported.

Coca-Cola and United Parcel Service both posted

stronger-than-expected revenue growth, pushing their shares up 1.9%

and 6%, respectively.

But Boeing shares slumped 2.3% as its results weren't as strong

as some analysts and investors expected. The aerospace giant,

though, raised its revenue outlook for 2018 despite the trade

tensions the company has said will affect its input costs.

AT&T, meanwhile, reported lower revenue in its latest

quarter as its satellite-TV business suffered major losses. Its

shares dropped 4.5%.

"I think what a lot of people are focused on today is the

question mark of, have we seen peak earnings power because the

first half of 2018 has been so strong?" said Martin Jarzebowski,

vice president and portfolio manager with Federated Investors.

The technology sector rose 1% ahead of Facebook's earnings

report after the closing bell. Investors will be looking for signs

the questions over the social media giant's handling of user data

have affected its business.

David Kelly, chief global strategist at J.P. Morgan Asset

Management, said regulation is a looming threat for technology

companies.

"When profit margins are this high, the temptation for

politicians one way or the other to skim a little bit off the top

is going to grow," he said.

The strengthening dollar is another growing headwind for

technology companies, which derive a significant percentage of

their revenue abroad. The WSJ Dollar Index, which measures the U.S.

currency against a basket of 16 others, slipped 0.3% but is up 2.4%

for the year.

"A stronger dollar is not a beneficial dynamic for a lot of

companies," Mr. Jarzebowski said.

The yield on the 10-year Treasury note fell to 2.937%, according

to Tradeweb, from 2.949% Tuesday. Yields fall as prices rise.

In commodity markets, crude oil added 1.1% to $69.29 a barrel

after government data showed a larger-than-expected drop in crude

inventories.

Elsewhere, the Stoxx Europe 600 fell 0.3%. In Asia, the Shanghai

Composite Index dropped 0.1% and Japan's Nikkei Stock Average added

0.5%.

(END) Dow Jones Newswires

July 25, 2018 15:00 ET (19:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

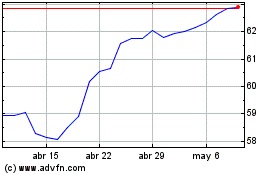

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

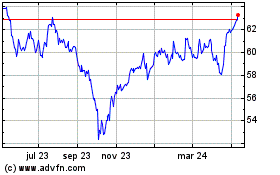

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024