Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 Octubre 2024 - 6:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

LG Display Co., Ltd.

(Translation of Registrant’s name into English)

LG Twin Towers, 128 Yeoui-daero, Yeongdeungpo-gu, Seoul 07336, Republic of Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submission to furnish a report or other document that the registration foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _____ No X

Q3’24 Earnings Results

I. Performance in Q3 2024 – IFRS Consolidated Financial Data

(Unit: KRW B)

|

|

|

|

|

|

Item |

Q3 23 |

Q2 24 |

Q3 24 |

QoQ |

YoY |

Quarterly Results |

|

|

|

|

|

Revenues |

4,785 |

6,708 |

6,821 |

2% |

43% |

Operating Income |

-662 |

-94 |

-81 |

Deficit decreased |

Deficit decreased |

Income before Tax |

-1,006 |

-433 |

-207 |

Deficit decreased |

Deficit decreased |

Net Income |

-775 |

-471 |

-338 |

Deficit decreased |

Deficit decreased |

II. IR Event of Q3 2024 Earnings Results

1. Provider of Information: IR Team

2. Participants: Domestic and International Institutional investors, Individuals,

Analysts, Media, etc.

3. Purpose: To present Q3’24 Earnings Results of LG Display

4. Date & Time: 02:00PM on October 23, 2024 (KST)

5. Venue & Method: Earnings release conference call in Korean/English

- Please refer to the website of LG Display Co., Ltd. at

www.lgdisplay.com/eng

6. Contact Information

Suk Heo, IR Team Leader (82-2-3777-1010)

2) Main Contact for Disclosure-related Matters:

Jungseob Oh, IR Manager, IR Team (82-2-3777-1010)

3) Relevant Team: IR Team (82-2-3777-1010)

III. Remark

i.Please note that the presentation material for Earnings Results is accessible on the website of

LG Display Co., Ltd. at www.lgdisplay.com/eng

ii. Please note that the financial data included are prepared on a consolidated IFRS basis.

iii. Financial data for Q3’24 are unaudited. They are provided for the convenience of investors and can be subject to change.

Attached: Press Release

FOR IMMEDIATE RELEASE

LG Display Reports Third Quarter 2024 Results

SEOUL, Korea (Oct. 23, 2024) – LG Display today reported unaudited earnings results based on consolidated K-IFRS (International Financial Reporting Standards) for the three-month period ending September 30, 2024.

• Revenues in the thirdquarter of 2024 increased by 2% to KRW 6,821 billion from KRW 6,708 billion in

the secondquarter of 2024 and rose by 43% from KRW 4,785 billion in the thirdquarter of 2023.

• Operating loss in the third quarter of 2024 was KRW 81 billion. This compares with the operating loss of

KRW 94 billion in the second quarter of 2024 and with the operating loss of KRW 662 billion in the third

quarter of 2023.

• EBITDA profit in the third quarter of 2024 was KRW 1,162 billion, compared with EBITDA profit of

KRW 1,287 billion in the second quarter of 2024 and with EBITDA profit of KRW 382 billion in the third

quarter of 2023.

• Net loss in the third quarter of 2024 was KRW 338 billion, compared with the net loss of KRW 471 billion

in the second quarter of 2024 and with the net loss of KRW 775 billion in the third quarter of 2023.

LG Display recorded KRW 6.821 trillion in revenues and KRW 81 billion in operating loss in the third quarter of 2024.

Revenues increased 2% quarter-on-quarter and 43% year-on-year, as the company’s small-sized panel shipments grew, including panels for mobile devices. In particular, the proportion of OLED products rose by 16%p year-on-year to make up 58% of revenues as LG Display continually pursued an advanced business structure centered around its OLED business.

Profitability continued to improve quarter-on-quarter and year-on-year thanks to the expanded achievement of the company’s advanced business structure and its focus on enterprise-wide cost innovation along with operational efficiency activities, although there was some impact from one-off costs due to its efforts to improve manpower management efficiency.

Panels for TVs accounted for 23% of revenues in thethird quarter. Panels for IT devices, including monitors, laptops, and tablet PCs, accounted for 33%, panels for mobiles and other devices accounted for 36%, and panels for automobiles accounted for 8%.

LG Display plans to continue to expand its management performance by improving its structure through the advancement of its OLED-oriented business and focusing its capabilities on improving profitability based on operational efficiency and cost innovation activities.

In its small- and mid-sized OLED business, the company plans to solidify its competitiveness based on stable supply capabilities and technological leadership. It will seek revenue growth and secure profitability for OLED for mobile devices through rising shipments and product diversification by actively utilizing its enhanced production capacity and capabilities. Regarding OLED for IT products, the company is committed to strengthening its leadership in Tandem OLED, which features excellent durability and performance including long life, high luminance, and low power consumption. Also, it will establish an efficient response system such as ways to maximize production infrastructure in line with the changing market environment.

Regarding its large-sized OLED business, LG Display is aiming to pursue qualitative growth by improving profitability. Based on close collaboration with customers, the company will further expand its lineup of differentiated and high-end products that reflect consumer needs. These include not only ultra-large and ultra-high-definition displays but also human-friendly products that offer health benefits to users as well as gaming monitors. It will also seek innovation in its operating structure, including efficient production and sales strategies as well as cost reduction linked to actual demand.

As for its automotive display business, LG Display will continue to pursue orders related to all vehicles, such as internal combustion and electric vehicles, through its differentiated products and technology portfolio comprising P-OLED based on Tandem technology, Advanced Thin OLED (ATO), and high-end LTPS LCD. It plans to build a stable profit structure by continuously expanding its customer base, increasing its proportion of OLED products, and enhancing cost competitiveness.

"We are continually improving our performance by focusing our enterprise-wide capabilities on the advancement of our business structure, cost structure improvement, and cost innovation activities," said Sung-hyun Kim, CFO and Executive Vice President of LG Display. Kim added, "Although we expect ongoing uncertainty in the market and external environment as well as volatility in actual demand, we will continue to improve our performance gradually by focusing on profitability based on the expansion of our business structure advancement and operational efficiency."

# # #

Earnings Conference Call

LG Display will hold a bilingual conference call in English and Korean on October 23rd, 2024 starting at 14:00 PM Korea Standard Time (KST) to announce the third quarter of 2024 earnings results. Investors can listen to the conference call via http://irsvc.teletogether.com/lgdisplay/lgdisplay2024Q3eng.php

About LG Display

LG Display Co., Ltd. [NYSE: LPL, KRX: 034220] is the world’s leading innovator of display technologies, including thin-film transistor liquid crystal and OLED displays. The company manufactures display panels in a broad range of sizes and specifications primarily for use in TVs, notebook computers, desktop monitors, automobiles, and various other applications, including tablets and mobile devices. LG Display currently operates manufacturing facilities in Korea and China, and back-end assembly facilities in Korea, China, and Vietnam. The company has approximately 69,656 employees operating worldwide. For more news and information about LG Display, please visit www.lgdisplay.com.

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Additional information as to factors that may cause actual results to differ materially from our forward-looking statements can be found in our filings with the United States Securities and Exchange Commission.

Investor Relations Contact:

Suk Heo, Head of Investor Relations

Email: ir@lgdisplay.com

Media Contact:

Jun-hyuk Choi, Vice President and Head of Public Relations

Email: junechoi@lgdisplay.com

Joo Yeon Jennifer Ha, Manager, Communication Team

Email: hjy05@lgdisplay.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

LG Display Co., Ltd.

(Registrant)

Date: October 23, 2024 By: /s/ Kyu Dong Kim

(Signature)

Name: Kyu Dong Kim

Title: Vice President, Finance &

Risk Management Division

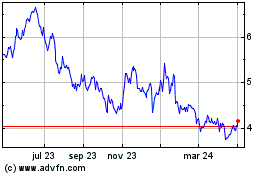

LG Display (NYSE:LPL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

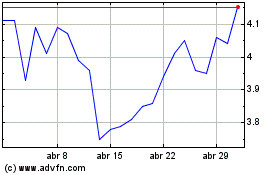

LG Display (NYSE:LPL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024