Form N-CEN - Annual Report for Registered Investment Companies

13 Octubre 2023 - 12:11PM

Edgar (US Regulatory)

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Shareholders and the Board of Trustees/Directors of BlackRock MuniHoldings New

Jersey Quality Fund, Inc., BlackRock MuniYield Michigan Quality Fund, Inc.,

BlackRock MuniYield New York Quality Fund, Inc., BlackRock MuniYield

Pennsylvania Quality Fund, BlackRock MuniYield Quality Fund III, Inc., and

BlackRock New York Municipal Income Trust:

In

planning and performing our audits of the financial statements of BlackRock

MuniHoldings New Jersey Quality Fund, Inc., BlackRock MuniYield Michigan

Quality Fund, Inc., BlackRock MuniYield New York Quality Fund, Inc., BlackRock

MuniYield Pennsylvania Quality Fund, BlackRock MuniYield Quality Fund III,

Inc., and BlackRock New York Municipal Income Trust (the “Funds”) as of and for the

year ended July 31, 2023, in accordance with the standards of the Public

Company Accounting Oversight Board (United States) (PCAOB), we considered the

Funds’ internal control over financial reporting, including controls over

safeguarding securities, as a basis for designing our auditing procedures for

the purpose of expressing our opinion on the financial statements and to comply

with the requirements of Form N-CEN, but not for the purpose of expressing an

opinion on the effectiveness of the Funds’ internal control over financial

reporting. Accordingly, we express no such opinion.

The management of the Funds is responsible for

establishing and maintaining effective internal control over financial

reporting. In fulfilling this responsibility, estimates and judgments by

management are required to assess the expected benefits and related costs of

controls. A company's internal control over financial reporting is a process

designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in

accordance with generally accepted accounting principles. A company's internal

control over financial reporting includes those policies and procedures that

(1) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of the assets

of the company; (2) provide reasonable assurance that transactions are recorded

as necessary to permit preparation of financial statements in accordance with

generally accepted accounting principles, and that receipts and expenditures of

the company are being made only in accordance with authorizations of management

and directors of the company; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use, or disposition

of a company's assets that could have a material effect on the financial

statements.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions

or that the degree of compliance with the policies or procedures may

deteriorate.

A deficiency in internal control over financial

reporting exists when the design or operation of a control does not allow

management or employees, in the normal course of performing their assigned

functions, to prevent or detect misstatements on a timely basis. A material

weakness is a deficiency, or a combination of deficiencies, in internal control

over financial reporting, such that there is a reasonable possibility that a

material misstatement of the company’s annual or interim financial statements

will not be prevented or detected on a timely basis.

Our consideration of the Funds’ internal control over

financial reporting was for the limited purpose described in the first

paragraph and would not necessarily disclose all deficiencies in internal

control that might be material weaknesses under standards established by the

PCAOB. However, we noted no deficiencies in the Funds’ internal control over

financial reporting and its operation, including controls over safeguarding

securities, that we consider to be a material weakness, as defined above, as of

July 31, 2023.

This report is intended solely for the information and

use of management and the Board of Trustees/Directors of the Funds and the

Securities and Exchange Commission and is not intended to be and should not be

used by anyone other than these specified parties.

/s/Deloitte & Touche

LLP

Boston, Massachusetts

September 22, 2023

BLACKROCK MUNIYIELD QUALITY FUND III, INC.

ARTICLES

OF AMENDMENT

AMENDING

THE ARTICLES SUPPLEMENTARY ESTABLISHING

AND

FIXING THE RIGHTS AND PREFERENCES

OF

VARIABLE RATE DEMAND PREFERRED SHARES

This

is to certify that:

First: The

charter of BlackRock MuniYield Quality Fund III, Inc., a Maryland corporation (the

“Corporation”), is amended by these Articles of Amendment, which amend

the Articles Supplementary Establishing and Fixing the Rights and Preferences

of Variable Rate Demand Preferred Shares, dated as of May 17, 2011 (as amended

to date, the “Articles Supplementary”).

Second: The

charter of the Corporation is hereby amended by deleting the definition of

“Applicable Base Rate” and inserting the following:

“Applicable

Base Rate” means (i) with respect to a Rate Period of fewer than forty-nine

(49) days, the greater of (a) the SIFMA Municipal Swap Index and (b) SOFR plus

0.10%, and (ii) with respect to a Rate Period of forty-nine (49) or more days,

SOFR plus 0.10%. If the Applicable Rate in respect of any Rate Period would

otherwise be less than zero percent (0%), the Applicable Base Rate for such

Rate Period will be deemed to be zero percent (0%).

Third: The

charter of the Corporation is hereby amended by deleting the definition of

“LIBOR Dealer.”

Fourth: The

charter of the Corporation is hereby amended by deleting the definition of

“LIBOR Rate.”

Fifth: The

charter of the Corporation is hereby amended by deleting the definition of

“London Business Day.”

Sixth: The

charter of the Corporation is hereby amended by deleting the definition of

“Reference Banks.”

Seventh: The

charter of the Corporation is hereby amended by adding the definition of

“Relevant Governmental Body”:

“Relevant

Governmental Body” means the Federal Reserve Board and/or the Federal

Reserve Bank of New York, or a committee officially endorsed or convened by the

Federal Reserve Board and/or the Federal Reserve Bank of New York.

Eighth: The

charter of the Corporation is hereby amended by adding the definition for

“SOFR”:

“SOFR” with

respect to any Business Day means the secured overnight financing rate

published for such day by the Federal Reserve Bank of New York, as the

administrator of the benchmark (or a successor administrator) on the Federal

Reserve Bank of New York’s website (or any successor source) at approximately

8:00 a.m. (New York City time) on the immediately succeeding Business Day and,

in each case, that has been selected or recommended by the Relevant

Governmental Body.

Ninth: The

charter of the Corporation is hereby amended by deleting the definition of

“Substitute LIBOR Dealer.”

Tenth: The

amendment to the charter of the Corporation as set forth above in these

Articles of Amendment has been duly advised by the board of directors of the

Corporation and approved by the stockholders of the Corporation as and to the

extent required by law and in accordance with the charter of the Corporation.

Eleventh: As

amended hereby, the charter of the Corporation shall remain in full force and

effect.

Twelfth: These

Articles of Amendment shall be effective as of January 20, 2023.

[Signature

Page Follows]

IN

WITNESS WHEREOF, BlackRock MuniYield Quality Fund III, Inc. has caused

these Articles of Amendment to be signed as of January 19, 2023, in its name

and on its behalf by the person named below who acknowledges that these

Articles of Amendment are the act of the Corporation and, to the best of such

person’s knowledge, information, and belief and under penalties for perjury,

all matters and facts contained in these Articles of Amendment are true in all

material respects.

BLACKROCK MUNIYIELD

QUALITY FUND III, INC.

By:

/s/ Jonathan Diorio

Name:

Jonathan Diorio

Title:

Vice President

ATTEST:

/s/

Janey Ahn

Name:

Janey Ahn

Title:

Secretary

[MYI Signature Page – Amendment to Articles

Supplementary]

BLACKROCK MUNIYIELD QUALITY FUND III, INC.

(THE “FUND”)

SERIES W-7

VARIABLE

RATE DEMAND PREFERRED SHARES (“VRDP SHARES”)

CUSIP

No. 09254E863*

Amendment

to Notice of Special Rate Period

June 16, 2023

BlackRock MuniYield Quality Fund III, Inc.

100 Bellevue Parkway

Wilmington, Delaware 19809

To: Addressees

listed on Schedule 1 hereto

In

accordance with the Fund’s Articles Supplementary Establishing and

Fixing the Rights and Preferences of VRDP Shares, dated May 17, 2011 (the “Articles

Supplementary”), the Fund hereby notifies the Liquidity Provider, the

Remarketing Agent and the Holders of the VRDP Shares of certain amendments to

the Notice of Special Rate Period, dated June 17, 2022 (the “Notice of

Special Rate Period”).

As

of June 16, 2023, the definition of “Ratings Spread” in the Notice of

Special Rate Period is hereby deleted in its entirety and replaced with the

following:

“Ratings

Spread” means, with respect to an SRP Calculation Period, the percentage

per annum set forth below opposite the highest applicable credit rating

assigned to the VRDP Shares, unless the lowest applicable rating is below

A3/A-, in which case the Ratings Spread shall mean the percentage per annum set

forth below opposite the lowest applicable credit rating assigned to the VRDP

Shares by Moody’s, Fitch or any Other Rating Agency, in each case rating the

VRDP Shares at the request of the Fund, on the SRP Calculation Date for such

SRP Calculation Period:

|

Moody’s/Fitch

|

Percentage

|

|

Aa3/AA-

to Aa1/AA+

|

0.87%

|

|

A3/A-

to A1/A+

|

1.60%

|

|

Baa3/BBB-

to Baa1/BBB+

|

2.35%

|

|

Non-investment

grade or Unrated

|

3.35%

|

*

NOTE: Neither the Fund nor the Tender and Paying Agent shall be responsible for

the selection or use of the CUSIP Numbers selected, nor is any representation

made as to its correctness indicated in any notice or as printed on any VRDP

Share certificate. It is included solely as a convenience to Holders of VRDP

Shares.

* The applicable

spread is determined by the higher of the two credit ratings assigned to the

VRDP Shares by Moody’s and Fitch, unless the VRDP Shares are rated at or below

A3/A-, in which case the applicable spread will be based on the lower of the

two credit ratings assigned to the VRDP Shares by Moody’s and Fitch.

Capitalized

terms used but not defined in this Amendment to Notice of Special Rate Period

shall have the meanings given to such terms in the Articles Supplementary and

the Notice of Special Rate Period.

[Signature

Page Follows]

IN

WITNESS WHEREOF, I have signed this Amendment to the Notice of Special Rate

Period as of the date first written above.

BLACKROCK MUNIYIELD QUALITY FUND III, INC.

By: /s/ Jonathan Diorio____________________

Name: Jonathan Diorio

Title: Vice President

[Signature Page – MYI Amendment to

Notice of Special Rate Period]

Schedule 1

Recipients

of this Notice of Special Rate Period

The

Toronto-Dominion Bank, acting through its New York Branch

1 Vanderbilt

Avenue

New York, New York

10017

Attention: Rick

Fogliano, Head of Municipal Products

Telephone: (212)

827-7172

Fax: (212)

827-7173

Email: fundreporting@tdsecurities.com,

muniops@tdsecurities.com,

TDSFinance- NewYork@tdsecurities.com

and td.tdusamunis@tdsecurities.com

TD Securities

(USA) LLC

1 Vanderbilt

Avenue

New York, New York

10017

Attention: Rick

Fogliano, Head of Municipal Products

Telephone: (212)

827-7172

Fax: (212)

827-7173

Email: fundreporting@tdsecurities.com,

muniops@tdsecurities.com

and TDSFinance- NewYork@tdsecurities.com

and td.tdusamunis@tdsecurities.com

The Depository

Trust Company

LensNotice@dtcc.com

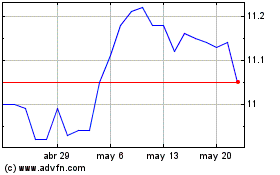

BlackRock MuniYield Qual... (NYSE:MYI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

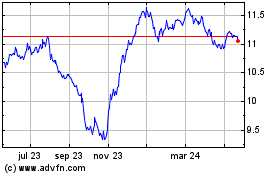

BlackRock MuniYield Qual... (NYSE:MYI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024