Barrett Attains 52-Week High - Analyst Blog

13 Diciembre 2012 - 7:45AM

Zacks

Shares of Barrett Business

Services Inc. (BBSI) reached a new 52-week high of $36.87

on Wednesday, Dec 12, 2012, beating its previous 52-week high of

$36.05. The closing price of this provider of business management

solutions as on Dec 12, 2012, was $36.32, which represented a solid

year-to-date return of 100.1%. Average volume of shares traded over

the last 3 months stands at approximately 42,653.

Growth Drivers

An impressive record of beating the

quarterly earnings expectations, a positive fiscal 2012 outlook,

and a decent dividend yield, are the major growth drivers for the

shares of Barrett Business Services.

With respect to earnings surprise,

Barrett Business Services has been beating the quarterly earnings

expectations for the last three years, most recently topping by

14.1% in its fiscal 2012 third quarter.

On Oct 23, 2012, Barrett Business

Services reported third-quarter earnings per share of 81 cents,

ahead of the Zacks Consensus Estimate of 71 cents. Moreover, it

surged 50% from the year-ago quarter.

Revenues grew 30% year over year to

$111.1 million, driven by strong growth in the Professional

Employer Organization (PEO) client count and strong same-store

sales growth. The company’s professional employer services and

staffing services business segments reported revenue growth of

40.5% and 4.6%, respectively.

Management acknowledged the solid

client base and asserted that client retention was strong. The

company attributed the solid results in the quarter to BBSI's

maturing brand and strong referral channels, which helped drive new

clients along with its ability to retain them.

In the fourth quarter, the company

projects gross revenues of between $585 million and $590 million,

with earnings per share in the range of 75 – 78 cents.

Barrett Business Services rewards

its shareholders through regular quarterly dividends and increasing

the same. In November, the company announced its fourth-quarter

2012 dividend of 13 cents per share, payable on Dec 14, 2012 to the

shareholders of record as on Nov 30, 2012 reflecting an increase of

nearly 18% from the dividend paid in the third quarter of 2012.

This yields a solid 1.43%, while the company has a payout ratio of

39%. We believe that the company’s continuous dividend payment and

increments reflects its earnings growth capacity and cash flow

generation.

Valuation is

Attractive

Currently, Barrett Business

Services trades at a forward P/E of 23.28x, slightly above the peer

group average of 21.77x. Again, its price-to-book and

price-to-sales ratios of 5.23 and 0.68 are at a premium to the peer

group average of 2.55 and 0.62, respectively.

However, the company’s trailing

12-month ROE of 20.0%, against 6.8% for the peer group, suggests

that it actively and efficiently reinvests its earnings compared to

the peer group. In addition, these compelling fundamentals are well

supported by the company’s long-term estimated earnings growth rate

of 35.0% compared with 17.8% of the peer group.

The company’s shares have been

advancing since the beginning of calendar year 2012, gaining a

robust 100.1% year-to-date.

About The

Company

Barrett Business Services has

roughly 47 years of experience in providing business management

solutions. The company offers staffing and professional employer

organization services, which help employers to manage

employment-related issues efficiently while reducing operational

costs to a great extent. The host of service offerings includes

payroll processing, employee benefits and administration, workers’

compensation coverage, effective risk management and workplace

safety programs, and human resource administration. The company has

a market cap of approximately $255 million.

Barrett Business Services, which

competes with Insperity, Inc. (NSP), currently,

holds Zacks #1Rank, implying a short-term Strong Buy rating. We are

also maintaining a long-term ‘Outperform’ recommendation on the

stock.

BARRETT BUS SVS (BBSI): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

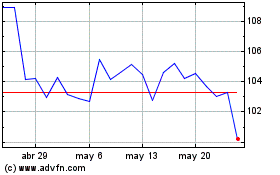

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

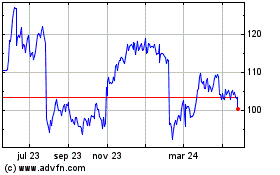

Insperity (NYSE:NSP)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024