Rogers to Become Majority Owner of Maple Leaf Sports & Entertainment

18 Septiembre 2024 - 7:30AM

Rogers Communications Inc. (TSX: RCI.A and RCI.B) (NYSE: RCI)

(“Rogers”) today announced it has signed an agreement to buy Bell’s

37.5% ownership stake in Maple Leaf Sports & Entertainment

(MLSE) for C$4.7 billion.

“MLSE is one of the most prestigious sports and entertainment

organizations in the world and we’re proud to expand our ownership

of these coveted sports teams,” said Tony Staffieri, President and

CEO, Rogers. “As Canada’s leading communications and entertainment

company, live sports and entertainment are a critical part of our

core business strategy.”

Will continue to invest to bring championships to

CanadaRogers has invested $14 billion in Canadian sports

over the last decade. With this transaction, Rogers will continue

to invest to bring championships to Canada.

“Winning is everything for fans, and that’s why we’re committed

to investing to bring more championships to Canada,” said Edward

Rogers, Executive Chair, Rogers. “We’re passionate about sports and

we’re passionate about winning.”

Strategic investment will surface value

long-termFinancing for this transaction will not affect

Rogers debt leverage and financing will include private

investors.

“MLSE continues to appreciate significantly, and together with

our sports and media assets, we plan to surface more value for

shareholders long-term,” said Staffieri. “This agreement also

ensures long-term Canadian ownership and investment of these iconic

teams.”

Deepens investment in Canadian sportThis

agreement adds to Rogers existing sports portfolio including

ownership of the Toronto Blue Jays, Rogers Centre and Sportsnet,

the number one sports network in Canada. The company also has

strategic partnerships with the Vancouver Canucks, the Edmonton

Oilers, the Calgary Flames and the NHL. When the transaction

closes, Rogers will be the largest owner of

MLSE with a controlling Interest in 75% of

MLSE.

The deal will provide Bell with the opportunity to renew its

existing MLSE broadcast and sponsorship rights long-term at fair

market value. This includes access to content rights for 50% of

Toronto Maple Leafs regional games and 50% of Toronto Raptors games

for which MLSE controls the rights. The transaction is subject

to league and regulatory approvals.

About Rogers Communications Inc.Rogers is

Canada’s leading communications and entertainment company and its

shares are publicly traded on the Toronto Stock Exchange (TSX:

RCI.A and RCI.B) and on the New York Stock Exchange (NYSE: RCI).

For more information, please visit rogers.com or

investors.rogers.com.

For more

information:Mediamedia@rci.rogers.com1-844-226-1338

Investor

Relationsinvestor.relations@rci.rogers.com1-844-801-4792

About Forward-Looking Information This

news release includes “forward‐looking information” and

“forward-looking statements” within the meaning of applicable

securities laws (collectively, “forward-looking information”)

about, among other things, the transaction and the financing,

including our receipt of any required league or regulatory

approvals and the anticipated benefits of the transaction, and our

debt leverage.

This forward-looking information is based on a number of

expectations and assumptions as of the date of this news release.

Actual events and results may differ materially from what is

expressed or implied by forward‐looking information if the

underlying expectations and assumptions prove incorrect or our

objectives, strategies or intentions change or as a result of

risks, uncertainties and other factors, many of which are beyond

our control, including, the following: the transaction or the

private investor financing may not be completed on the anticipated

terms or at all; we may instead fund all or a portion of the

transaction purchase price through alternate sources, including

debt or equity of Rogers Communications Inc., due to league

requirements, general economic and market conditions, or other

internal and external considerations; the anticipated benefits of

the transaction may not be realized; the transaction is subject to

closing conditions and termination rights; and our exposure to the

risks associated with sports franchises may increase following

completion of the transaction. We are under no obligation to update

or alter any statements containing forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by law.

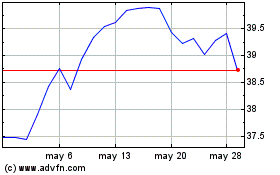

Rogers Communications (NYSE:RCI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Rogers Communications (NYSE:RCI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024