false000172452100017245212024-08-272024-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 27, 2024

________________________________________________________

Arcus Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38419 | | 47-3898435 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 3928 Point Eden Way | | | | |

Hayward, California | | | | 94545 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 694-6200

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share | | RCUS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On August 27, 2024 (the “Closing Date”), Arcus Biosciences, Inc. (the “Company”) entered into a Loan and Security Agreement (the “LSA”), by and among the Company, the several banks and other financial institutions or entities party thereto, as lenders, and Hercules Capital, Inc. (“Hercules”), as administrative agent and collateral agent.

The LSA provides a secured term loan facility of up to $250.0 million (collectively, the “Term Loans”), consisting of: (a) an initial $50.0 million tranche of term loans, which was funded on the Closing Date; (b) an additional tranche of term loans in an aggregate amount of $50.0 million that is available at the Company's sole option, subject to customary terms and conditions, through June 15, 2025; (c) an additional tranche of term loans in an aggregate amount of $50.0 million that is available at the Company's sole option, subject to customary terms and conditions, through March 15, 2026 (the amounts listed in (a), (b) and (c) above, the "Initial Tranches") and (d) an additional tranche of term loans in an aggregate amount of $100.0 million (the "Final Tranche"), which will be available at the lenders’ sole option, subject to customary terms and conditions, in $25.0 million increments. On the Closing Date, the Company paid an initial facility charge for the Initial Tranches equal to $1.125 million.

Borrowings under the LSA bear interest at a per annum rate equal to: (a) in cash, the greater of either (i) the Prime Rate (as reported in the Wall Street Journal) plus 1.95% and (ii) 10.45%. The Term Loans are repayable in monthly interest-only payments until September 1, 2028 (the “Interest-Only Payment Period”). The Company may extend the Interest-Only Payment Period an additional 12 months if (i) no default or event of default exists under the LSA and (ii) by August 27, 2028, the U.S. Food and Drug Administration has approved either a Biologics License Application or New Drug Application (“Milestone I”). After the expiration of the Interest-Only Payment Period, the Term Loans are repayable in equal monthly payments of principal and accrued interest until maturity.

The Term Loans will mature on September 1, 2029 (the "Maturity Date”). The Company may extend the Maturity Date up to an additional 12 months if (i) no default or event of default exists and (ii) the Company has accomplished two of the following events (“Milestone II”): (a) dosing the first patient in a pivotal phase 3 study of casdatifan for the treatment of renal cell carcinoma; (b) dosing the first patient in a pivotal phase 3 study of quemliclustat in patients with advanced pancreatic cancer; or (c) dosing the first patient in a pivotal phase 3 study of etrumadenant in patients with metastatic colorectal cancer.

At the Company’s option, the Company may prepay all or a portion of the outstanding Term Loans, subject to a prepayment premium equal to (a) 3.0% of the Term Loans being prepaid if the prepayment occurs during the 12 months following the Closing Date; (b) 2.0% of the Term Loans being prepaid if the prepayment occurs after the 12 month anniversary of the Closing Date but on or prior to the 24 month anniversary of the Closing Date; and (c) 1.0% of the Term Loans being prepaid if the prepayment occurs at least 24 months following the Closing Date and prior to the Maturity Date. In addition, the Company will pay an end of term charge of 7.75% upon the prepayment or repayment of the Term Loans and a facility charge of 0.75% upon any draws of the Term Loans from the Final Tranche.

The Term Loans are secured by a lien on substantially all of the assets of the Company other than any assets subject to an option held by Gilead Sciences, Inc. or Taiho Pharmaceutical Co., Ltd. The LSA includes a financial covenant that requires the Company to maintain, at all times during which the Company's market capitalization is at or below $1.20 billion, “Qualified Cash” (defined as cash in accounts subject to control agreements minus any accounts payable not paid after the 120th day) in an amount greater than or equal to the outstanding principal amount of the Term Loans, multiplied by 50% (the "Qualified Cash Requirement Threshold"). The Qualified Cash Requirement Threshold will be decreased (a) to 40% upon accomplishing Milestone I and (b) to 35% upon accomplishing Milestone II.

In addition, the LSA includes customary affirmative and negative covenants and representations and warranties, including a covenant against the occurrence of a “change in control,” financial reporting obligations, and certain limitations on indebtedness, liens, investments, distributions (including dividends), collateral, transfers, mergers or acquisitions, taxes, corporate changes, and bank accounts. The LSA also includes customary events of default, including payment defaults, breaches of covenants following any applicable cure period, the occurrence of certain events that could reasonably be expected to have a “material adverse effect” as set forth in the LSA, cross acceleration to third-party indebtedness and certain events relating to bankruptcy or insolvency. Upon the occurrence of an event of default, Hercules may declare all outstanding obligations immediately due and payable and take such other actions as set forth in the LSA.

The foregoing is only a brief description of the material terms of the LSA does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to such agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2024.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above in Item 1.01 of this Current Report on Form 8-K regarding the Company’s direct financial obligation under the Loan Agreement is incorporated into this Item 2.03 by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ARCUS BIOSCIENCES, INC. |

| | |

| Date: August 27, 2024 | By: | /s/ Terry Rosen, Ph. D. |

| | Terry Rosen, Ph.D. |

| | Chief Executive Officer (Principal Executive Officer) |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

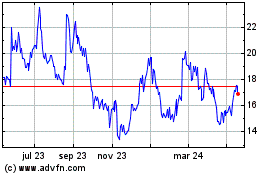

Arcus Biosciences (NYSE:RCUS)

Gráfica de Acción Histórica

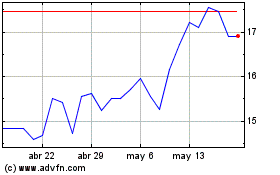

De Nov 2024 a Dic 2024

Arcus Biosciences (NYSE:RCUS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024