SL Green Announces Anchor Commitment for SLG Opportunistic Debt Fund

05 Diciembre 2024 - 6:30AM

SL Green Realty Corp. (NYSE: SLG), Manhattan's largest office

landlord, today announced that a Canadian institutional investor

has committed to anchor the SLG Opportunistic Debt Fund with a

$250.0 million commitment. The investor has been ranked among the

world’s largest institutional investors that manages public and

parapublic pension plans and insurance programs.

“A world class investor and the ideal anchor has

been secured for the SLG Opportunistic Debt Fund,” said

Harrison Sitomer, Chief Investment Officer at SL

Green. “We look forward to deploying SL Green’s fully

integrated platform and New York market expertise to capitalize on

a robust pipeline of investment opportunities at attractive

risk-adjusted returns. We appreciate our anchor partner’s support

and are excited to welcome additional best-in-class investors to

the fund in the coming weeks.”

The SLG Opportunistic Debt Fund, which launched

earlier this year, will seek to capitalize on current capital

markets dislocation through structured debt investments in

high-quality New York City commercial assets. The SLG Opportunistic

Debt Fund will originate new loans and/or purchase existing loans,

loan portfolios and controlling CMBS securities.

About SL Green Realty Corp.SL

Green Realty Corp., Manhattan's largest office landlord, is a fully

integrated real estate investment trust, or REIT, that is focused

primarily on acquiring, managing and maximizing value of Manhattan

commercial properties. As of September 30, 2024, SL Green held

interests in 55 buildings totaling 31.8 million square feet. This

included ownership interests in 28.1 million square feet of

Manhattan buildings and 2.8 million square feet securing debt and

preferred equity investments.

SLG Opportunistic Debt Fund

DisclaimerAn investment in the Fund involves a high degree

of risk, is suitable only for sophisticated investors and requires

the financial ability and willingness to accept the high risks and

lack of liquidity inherent in an investment in the Fund. This press

release is not an offer to sell to any person, or a solicitation to

any person to buy, securities. To invest in the Fund, each

prospective limited partner will be required to execute certain

other documents and prior to making any investment in the Fund,

such documents should be reviewed carefully.

Forward Looking StatementsThis

press release includes certain statements that may be deemed to be

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and are intended to be

covered by the safe harbor provisions thereof. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that we

expect, believe or anticipate will or may occur in the future,

including such matters as future capital expenditures, dividends

and acquisitions (including the amount and nature thereof),

development trends of the real estate industry and the New York

metropolitan area markets, occupancy, business strategies,

expansion and growth of our operations and other similar matters,

are forward-looking statements. These forward-looking statements

are based on certain assumptions and analyses made by us in light

of our experience and our perception of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate. Forward-looking statements are not

guarantees of future performance and actual results or developments

may differ materially, and we caution you not to place undue

reliance on such statements. Forward-looking statements are

generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press

release are subject to a number of risks and uncertainties, many of

which are beyond our control, that may cause our actual results,

performance or achievements to be materially different from future

results, performance or achievements expressed or implied by

forward-looking statements made by us. Factors and risks to our

business that could cause actual results to differ from those

contained in the forward-looking statements include risks and

uncertainties described in our filings with the Securities and

Exchange Commission. Except to the extent required by law, we

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of future events,

new information or otherwise.

Press Contactslgreen@berlinrosen.com

SLG-A&D

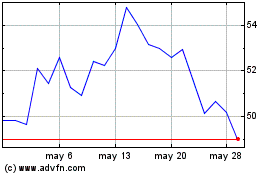

SL Green Realty (NYSE:SLG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

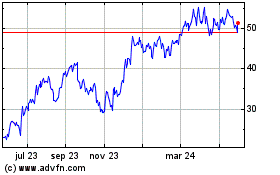

SL Green Realty (NYSE:SLG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025