UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 30, 2024

SOLARIS OILFIELD INFRASTRUCTURE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-38090 |

81-5223109 |

(State or other jurisdiction

of incorporation) |

(Commission File

Number) |

(IRS Employer

Identification No.) |

| |

9651 Katy Freeway, Suite 300

Houston, Texas 77024 |

|

| |

(Address of principal executive offices)

(Zip Code) |

|

| |

(281) 501-3070 |

|

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common Stock, $0.01 par value |

|

“SOI” |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On July 30, 2024, Solaris Oilfield Infrastructure,

LLC (“SOI LLC”), a wholly-owned subsidiary of Solaris Oilfield Infrastructure, Inc. (“SOI” or the “Company”)

entered into an agreement whereby SOI LLC loaned Twenty Nine Million Seven Hundred Fifty Thousand Dollars ($29,750,000, the “Loan”)

to Mobile Energy Rentals LLC (“MER”) to fund certain progress payments owed to an equipment manufacturer for the purchase

of power generation equipment pursuant to previously executed purchase orders (the “AFE Payments”). The funds that are the

subject of the Loan were paid directly to the manufacturer by SOI LLC for the benefit of MER.

Pursuant to the Form 8-K filed by the Company

on July 10, 2024, the Company has entered into a Contribution Agreement (the “Contribution Agreement”) to purchase all

of the issued and outstanding equity interests of MER in exchange for an aggregate:

| |

· |

|

$60,000,000, subject to certain adjustments; |

| |

· |

|

$140,000,000 in units of SOI LLC, calculated using the 10-day volume-weighted average price of the shares of Company Class A common stock, par value $0.01 per share, as of the close of business on the trading day immediately preceding signing (which was $8.50), and an equivalent number of shares of Company Class B common stock, par value $0.00 per share, subject to certain adjustments. |

Pursuant to the Contribution Agreement, SOI LLC

is responsible for reimbursing the principals of MER for the AFE Payments at closing. Assuming closing of the transactions contemplated

by the Contribution Agreement, the Loan will be cancelled at closing and netted against payments otherwise due for the AFE Payments.

The Loan is evidenced by a demand note bearing

interest at 10% and attached hereto as Exhibit 10.1. The Loan is fully secured by substantially all of the assets of MER. If the

Loan is not called, payment would be due on December 6, 2024.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant. |

The information contained under Item 1.01 of this

Current Report on Form 8-K is hereby incorporated by reference herein.

Forward Looking Statements

The information included

herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A

of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of present or historical fact included

herein, regarding Solaris’ proposed transaction with the equityholders of MER, Solaris’ ability to consummate the transaction,

the benefits of the transaction and Solaris’ future financial performance following the transaction, as well as Solaris’ strategy,

future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management

are forward looking statements. When used herein, including any oral statements made in connection herewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

management’s current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required by applicable law, Solaris disclaims any duty to update any forward-looking

statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date

hereof. Solaris cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are

difficult to predict and many of which are beyond the control of Solaris. These risks include, but are not limited to, Solaris’

business strategy, its industry, its future profitability, the various risks and uncertainties associated with the extraordinary market

environment and impacts resulting from the volatility in global oil markets and the COVID-19 pandemic, expected capital expenditures

and the impact of such expenditures on performance, management changes, current and potential future long-term contracts and Solaris’

future business and financial performance. Should one or more of the risks or uncertainties described herein and in any oral statements

made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially

from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Solaris’

expectations and projections can be found in its periodic filings with the Securities and Exchange Commission (the “SEC”),

including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Solaris’ SEC filings are available

publicly on the SEC’s website at www.sec.gov.

ADDITIONAL INFORMATION ABOUT THE PROPOSED

TRANSACTION AND WHERE TO FIND IT

In connection with the

proposed transaction, Solaris will file a proxy statement with the SEC. Additionally, Solaris will file other relevant materials with

the SEC in connection with its proposed transaction with the equityholders of MER. The materials to be filed by Solaris with the SEC may

be obtained free of charge at the SEC’s web site at www.sec.gov. Investors and security holders of Solaris are urged to read the

proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect

to the proposed transaction because they will contain important information about the transaction and the parties to the transaction.

Solaris, MER and their respective directors, executive

officers, other members of their management and their employees, under SEC rules, may be deemed to be participants in the solicitation

of proxies of Solaris stockholders in connection with the proposed transaction. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of certain of Solaris’ executive officers and directors in the solicitation

by reading the Company’s Definitive Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Stockholders, which was filed

with the SEC on April 4, 2024, and the proxy statement and other relevant materials filed with the SEC in connection with the transaction

when they become available. Information concerning the interests of Solaris’ and MER’s participants in the solicitation, which

may, in some cases, be different than those of Solaris’ stockholders generally, will be set forth in the proxy statement relating

to the transaction when it becomes available.

Item 9.01.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 5, 2024

| SOLARIS OILFIELD INFRASTRUCTURE, INC. |

| | | |

| | By: | /s/ Cynthia M. Durrett |

| | Name: | Cynthia M. Durrett |

| | Title: | Chief Administrative Officer |

Exhibit 10.1

Execution

Version

SECURED DEMAND NOTE

| $29,750,000.00 |

|

July 30, 2024 |

1. For value received, and

on demand, or if no demand be sooner made, then on the Maturity Date, the undersigned, Mobile Energy Rentals LLC, a Texas limited liability

company having an office at 2929 Buffalo Speedway, A1204, Houston, Texas 77098 (the “Maker”), promises to pay

to the order of Solaris Oilfield Infrastructure, LLC, a Delaware limited liability company (the “Payee”), at

its offices at 9651 Katy Freeway, Suite 300, Houston, Texas 77024 or at such other place as the Payee may designate in writing to

the Maker, in lawful money of the United States of America, the principal sum of TWENTY NINE MILLION SEVEN HUNDRED FIFTY THOUSAND US DOLLARS

($29,750,000.00) (the “Principal Amount”), together with interest on the unpaid balance of said Principal Amount

from time to time remaining outstanding, from the date hereof until maturity (howsoever such maturity shall occur), in like money, at

said office, at a rate per annum equal to the Note Rate. The Maker and the Payee acknowledge and agree that the holder hereof may demand

payment at any time and from time to time prior to payment in full by the Maker and for any reason whatsoever (including but not limited

to reasons unrelated to the Maker’s ability to pay any amounts due under or in respect of this Secured Demand Note (this “Note”))

or for no reason whatsoever; provided, however, no payment shall be due and payable under this Note prior to the Maturity Date.

All past due principal of and interest on this Note shall bear interest from the due date thereof (whether by demand or otherwise) until

paid at a per annum rate equal to twelve percent (12%).

This Note evidences the unpaid

principal balance, and accrued unpaid interest thereon, of a loan made by the Payee to the Maker for the purpose of allowing the Maker

to satisfy certain of the Maker’s progress payment obligations for the purchase of generators by the Maker (the “Vendor

Obligations”) from vendors. The Maker acknowledges and agrees that this Note and the indebtedness evidenced hereby are valid

and enforceable obligations of the Maker, regardless of whether the Payee remits the proceeds of the loan described in the preceding sentence

(i) to the Maker or (ii) to any vendor, supplier, contractual counterparty or other third person designated by Maker to whom

Vendor Obligations are owed or payable by the Maker.

2. Interest on the unpaid

principal balance from time to time remaining outstanding shall be payable upon the maturity of this Note, howsoever such maturity may

be brought about, whether on demand, upon the occurrence of the Maturity Date or otherwise.

3. The Maker’s obligations

under this Note are secured by a perfected, first priority security interest in substantially all of the assets of the Maker, which assets

are described as the collateral and specified in the Security Agreement dated as of the date hereof, entered into by the Maker in favor

of the Payee (as amended, restated, supplemented or otherwise modified from time to time in accordance with its terms, the “Security

Agreement”).

4. The Maker shall have the

right and privilege at any time and from time to time of prepaying all or any part of this Note without premium or penalty.

5. As used in this Note, the

following terms have the respective meanings set forth below:

“Governing Law”

shall mean the laws of the State of Texas.

“Highest Lawful Rate”

means the maximum lawful nonusurious rate of interest (if any) which under the Governing Law the Payee is permitted to charge the Maker

on this Note from time to time.

“Maturity Date”

means December 6, 2024.

“Note Rate”

shall mean a per annum rate of interest (computed on the basis of the actual number of days elapsed (including the first but excluding

the last day) over a year of 365 or 366 days, as the case may be), equal to ten percent (10%).

6. It is the intent of Payee

and the Maker in the execution and performance of this Note to remain in strict compliance with the Governing Law from time to time in

effect. In furtherance thereof, Payee and the Maker stipulate and agree that none of the terms and provisions contained in this Note or

any document relating to this Note, shall ever be construed to create a contract to pay for the use, forbearance or detention of money

with interest at a rate or in an amount in excess of the Highest Lawful Rate. The Maker shall never be required to pay interest at a rate

or in an amount in excess of the Highest Lawful Rate, and the provisions of this paragraph shall control over all other provisions of

this Note and of any other instrument pertaining to or securing this Note. If this Note is prepaid or the maturity of this Note is accelerated

for any reason, or if under any other contingency the effective rate or amount of interest which would otherwise be payable under this

Note would exceed the Highest Lawful Rate, or in the event Payee or any holder of this Note shall charge, contract for, take, reserve

or receive monies that are deemed to constitute interest that would, in the absence of this provision, increase the effective rate or

amount of interest payable under this Note to a rate or amount in excess of that permitted to be charged, contracted for, taken, reserved

or received under the Governing Law then in effect, then the Principal Amount of this Note or the amount of interest which would otherwise

be payable under this Note or both shall be reduced to the amount allowed under the Governing Law as now or hereinafter construed by the

courts having jurisdiction, and all such moneys so charged, contracted for, taken, reserved or received that are deemed to constitute

interest in excess of the Highest Lawful Rate shall immediately be returned to or credited to the account of the Maker upon such determination.

All calculations of the rate or amount of interest contracted for, charged, taken, reserved or received under this Note which are made

for the purpose of determining whether such rate or amount exceeds the Highest Lawful Rate or amount, shall be made, to the extent permitted

by the Governing Law, by amortizing, prorating, allocating and spreading during the period of the full stated term of this Note, all interest

at any time contracted for, charged, taken, reserved or received from the Maker or otherwise by Payee or the holders of this Note.

| | 1 | _____[Initials for Indentification] |

7. If this Note is collected

by suit or through the bankruptcy court, or any judicial proceeding, or if this Note is not paid at maturity, however such maturity may

be brought about, and it is placed in the hands of an attorney for collection (whether or not legal proceedings are commenced), then the

Maker agrees to pay, in addition to all other amounts owing hereunder, the collection costs and reasonable attorney’s fees of the

holder hereof.

8. The Maker and all sureties,

endorsers and guarantors of this Note waive demand, presentment for payment, notice of nonpayment, protest, notice of protest, notice

of intent to accelerate maturity, notice of acceleration of maturity and all other notice, filing of suit and diligence in collecting

this Note or enforcing any of the security herefor, and agree to any substitution, exchange or release of any such security or the release

of any party primarily or secondarily liable hereon, and further agree that it will not be necessary for any holder hereof, in order to

enforce payment of this Note by them, to first institute suit or exhaust its remedies against any security herefor, and consent to any

one or more extensions or postponements of time of payment of this Note on any terms or any other indulgences with respect thereto, without

notice thereof to any of them.

9. This Note, the Security

Agreement and any claim, controversy, dispute or cause of action (whether sounding in tort or otherwise) based upon, arising out of or

relating hereto or thereto and the transactions contemplated hereby and thereby shall be governed by and construed and enforced in accordance

with the Governing Law, without regard to principles of conflicts of laws. Venue for any dispute related hereto shall be proper in Harris

County, Texas.

10. This Note and the Security

Agreement constitute the entire agreement between the Maker and the Payee with respect to the subject matter hereof and supersede any

and all previous agreements and understandings, oral or written, with respect thereto. There are no unwritten or oral agreements between

Maker and Payee.

[Signature Page Follows]

| | 2 | _____[Initials for Indentification] |

IN WITNESS WHEREOF, the Maker has executed this

Note as of the date first above written.

| Mobile ENERGY Rentals LLC | |

| | | |

| By: | /s/ C. Ross Bartley | |

| Name: | C. Ross

Bartley | |

| Title: | Chief

Financial Officer | |

| | 3 | _____[Initials for Indentification] |

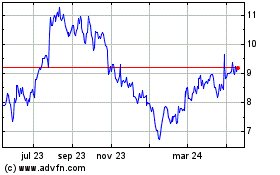

Solaris Oilfield Infrast... (NYSE:SOI)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

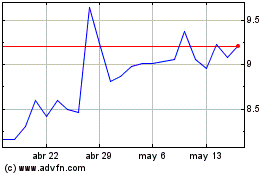

Solaris Oilfield Infrast... (NYSE:SOI)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024