Ahead of Wall Street - December 6, 2012 - Ahead of Wall Street

06 Diciembre 2012 - 3:06AM

Zacks

Thursday, December 6, 2012

We have another reassuring read on the nation’s labor market

through a material drop in the weekly Jobless Claims data, which

sets us up for the November non-farm payroll numbers coming out

tomorrow morning. This indicates that the recent weak weakness in

the labor market was mostly due to the effects of Sandy. Elsewhere,

the European Central Bank meeting produced what the market was

expecting – no changes to interest rates.

But the over-riding issue for the market remains the unresolved

‘Fiscal Cliff’ debate and there is no substantive development on

that front at this stage. The opening positions from both sides

appear to provide enough room for some sort of a compromise in the

coming days. But the bottom line is that there is no ‘fresh’

initiative on either side to bridge the gap.

Jobless Claims dropped 25K last week to 370K. The four-week

average, which smoothes out the week-to-week volatility, dropped by

2.3K to 408K. The Jobless Claims data is not entirely where it was

before Sandy distorted it (it was in the 360K vicinity before the

storm), but the storm’s effects are steadily dissipating. Overall

though, the labor market appears to be in the same shape where it

has been in the pre-Sandy months, with weekly jobless claims in the

350K to 400K range. The monthly jobs numbers coming out Friday

morning will also likely confirm what we saw from the ADP jobs

report on Wednesday. Adjusting for Sandy, the average monthly jobs

rate likely remains in the 150K neighborhood at present – that has

been the pace consistently this year.

In corporate news, Lululemon (LULU) came out with

better than expected results for the third quarter, but it’s

guidance for the coming quarter raise doubts about the

sustainability of its growth trajectory. The retailer of high-end

yoga pants and other women’s athletic apparel guided towards same

store sales growth in the ‘high single digits’ in the fourth

quarter, which is a material climb-down from the red-hot growth

pace in recent quarters.

Lululemon’s sales per square foot of retail space has been in

comparable territory to such iconic brands as

Apple (AAPL), Coach (COH), and

Tiffany (TIF). The high-end specialty retailer had

the market all to itself for a while, but Gap

(GPS) has been making a determined foray into that attractive

market through its Athleta brand. The location of many Athleta

stores in close proximity to Lululemon’s may be just a coincidence,

but there is no doubt that Gap is targeting the same audience that

has loyally followed Lululemon thus far.

Sheraz Mian

Director of Research

APPLE INC (AAPL): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

LULULEMON ATHLT (LULU): Free Stock Analysis Report

TIFFANY & CO (TIF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

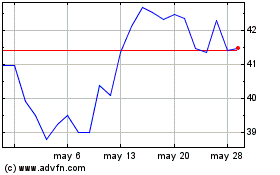

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

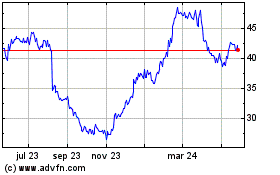

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024