false

N-2

Liberty All Star Equity Fund

0000799195

0000799195

2023-01-01

2023-12-31

0000799195

USA:InvestmentAndMarketRiskMember

2023-01-01

2023-12-31

0000799195

USA:MarketDiscountRiskMember

2023-01-01

2023-12-31

0000799195

USA:CommonStockRiskMember

2023-01-01

2023-12-31

0000799195

USA:ManagementRiskMember

2023-01-01

2023-12-31

0000799195

USA:GrowthStockRiskMember

2023-01-01

2023-12-31

0000799195

USA:ValueStockRiskMember

2023-01-01

2023-12-31

0000799195

USA:ForeignSecuritiesRiskMember

2023-01-01

2023-12-31

0000799195

USA:TaxRiskMember

2023-01-01

2023-12-31

0000799195

USA:InflationRiskMember

2023-01-01

2023-12-31

0000799195

USA:DeflationRiskMember

2023-01-01

2023-12-31

0000799195

USA:MarketDisruptionAndGeopoliticalRiskMember

2023-01-01

2023-12-31

0000799195

USA:LegislationAndRegulatoryRiskMember

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File No.: 811-04809

Liberty All-Star Equity Fund

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado

80203

(Address of principal executive offices) (Zip code)

Sareena Khwaja-Dixon, Esq.

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including

area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023 -

December 31, 2023

Item 1. Report

of Shareholders.

(a)

Contents

| 1 |

President’s Letter |

| 6 |

Unique Fund Attributes |

| 8 |

Table of Distribution, Tax Credits & Rights Offerings |

| 9 |

Investment Growth |

| 10 |

Stock Changes in the Quarter and Distribution Policy |

| 11 |

Top 20 Holdings and Economic Sectors |

| 12 |

Investment Managers/Portfolio Characteristics |

| 13 |

Manager Roundtable |

| 20 |

Schedule of Investments |

| 28 |

Statement of Assets and Liabilities |

| 29 |

Statement of Operations |

| 30 |

Statements of Changes in Net Assets |

| 32 |

Financial Highlights |

| 34 |

Notes to Financial Statements |

| 43 |

Report of Independent Registered Public Accounting Firm |

| 44 |

Automatic Dividend Reinvestment and Direct Purchase Plan |

| 46 |

Additional Information |

| 47 |

Trustees and Officers |

| 51 |

Board Consideration of the Renewal of the Fund Management & Portfolio Management Agreements |

| 56 |

Summary of Updated Information Regarding the Fund |

| 61 |

Privacy Policy |

| 63 |

Description of Lipper Benchmark and Market Indices Inside Back Cover: Fund Information |

A SINGLE INVESTMENT...

A DIVERSIFIED CORE PORTFOLIO

A single fund that offers:

| · | A diversified, multi-managed portfolio of growth and value stocks |

| · | Exposure to many of the industries that make the U.S. economy one of the world’s most dynamic |

| · | Access to institutional quality investment managers |

| · | Objective and ongoing manager evaluation |

| · | Active portfolio rebalancing |

| · | A quarterly fixed distribution policy |

| · | Actively managed, exchange-traded, closed-end fund listed on the New York Stock Exchange (ticker symbol: USA) |

LIBERTY ALL-STAR® EQUITY FUND

| Liberty All-Star® Equity Fund |

President’s Letter |

(Unaudited)

| Fellow Shareholders: |

February 2024 |

Steady economic data, moderating inflation, improved

corporate earnings and the prospect of lower interest rates in 2024 propelled equity markets higher in 2023, overcoming hurdles that ranged

from regional bank failures domestically to armed conflicts abroad. At year’s end, respective annual returns for the S&P 500®

Index, the Dow Jones Industrial Average (DJIA) and the NASDAQ Composite Index were 26.29 percent, 16.18 percent and 44.64 percent, respectively.

The year’s solid results were a welcome turnaround from 2022, when all three indices tumbled into negative territory.

Throughout the year investors’ primary focus

was on the Federal Reserve and its tightrope walk of combatting inflation without tipping the economy into recession. In this effort the

Fed raised the benchmark federal funds rate seven times in 2022 and four more times in 2023. The last increase, in July, brought the rate

to a range of 5.25 to 5.50 percent—the highest in 22 years. Despite the rising rate regime, U.S. stocks showed resilience, the S&P

500® returning 16.89 percent for the first six months of the year.

The strong six-month return captured the year’s

recurring theme: resilience. While January got the year off to a good start, the Fed raised rates in February while March was upended

by the collapse of Silicon Valley Bank, the second-biggest bank failure in U.S. history. Although another failure, Signature Bank, would

follow, forceful action by regulators staunched a systemic banking crisis. The ensuing late March through July period was highly positive

for stocks, which were buoyed by “The Magnificent Seven1,” investor euphoria over artificial intelligence (AI),

earnings that exceeded expectations and data indicating that inflation was easing.

As August began, that period came to an abrupt

end: U.S. sovereign debt was downgraded, political infighting roiled the Nation’s Capital and consumer prices crept back up, breaking

a string of monthly declines. In announcing the July rate increase Fed Chair Jerome Powell made it clear that the Fed would continue to

monitor data and act to raise rates further if warranted. His remarks— along with surging Treasury bond yields, strong job creation

and low unemployment, soft retail sales, and the Israeli-Hamas war—raised the specter of a “hard landing” for the economy

in 2024— if not an outright recession. The result for stocks: three straight months of decline culminating in the poorest October

since 2020.

Once again, however, stocks reversed course and

surged over the last two months of the year. A key catalyst was Treasury yields: Rising during the third quarter they siphoned money out

of stocks but falling over the last two months they made stocks more attractive. In addition, consumer and producer prices eased, consumer

confidence ticked higher, and the picture for labor—both employment levels and wages—appeared sustainable. More importantly

for stocks, these factors allowed the Fed to assume a more accommodative interest rate posture. For the fourth quarter, the S&P 500®

returned 11.69 percent, the DJIA gained 13.09 percent and the NASDAQ Composite advanced 13.79 percent.

| 1 | Those stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft,

NVIDIA and Tesla. |

| Annual Report | December 31, 2023 |

1 |

| Liberty All-Star® Equity Fund |

President’s Letter |

(Unaudited)

Among the 11 S&P 500® sectors,

information technology led the way with an annual return of 60.79 percent, followed by communication services and consumer discretionary,

returning 56.37 percent and 43.19 percent, respectively. These three sectors accounted for the majority of the S&P 500®

return (87 percent) while returns for each of the remaining eight sectors were all less than the index return, including two sectors that

were negative: utilities (-7.09 percent) and energy (-1.30 percent).

Growth style investing produced higher returns

across the capitalization spectrum than did value style investing. For the year, the broad market Russell 3000® Growth

Index returned 41.21 percent while the corresponding value index returned 11.66 percent.

Liberty All-Star® Equity Fund

Steady performance through three quarters leading

up to a strong move in the fourth quarter, Liberty All-Star® Equity Fund posted good absolute and relative returns

for 2023. For the year, the Fund returned 26.12 percent when shares are valued at net asset value (NAV) with dividends reinvested and

23.39 percent when shares are valued at market price with dividends reinvested. (Fund returns are net of expenses.) The Fund’s NAV

return topped the 24.34 percent gain of its primary benchmark, the Lipper Large-Cap Core Mutual Fund Average, while the market price return

trailed by less than one percentage point. (The Fund’s NAV return exceeded that of the Lipper benchmark for three of the four quarters.)

Fund returns were in line with those of the S&P 500®, exceeded the DJIA and trailed the exceptional return of the NASDAQ

Composite.

In the final quarter the Fund returned 13.87 percent

when shares are valued at NAV with dividends reinvested and 10.36 percent valued at market price with dividends reinvested. The NAV return

was ahead of all relevant benchmarks—the Lipper average, the S&P 500®, DJIA and NASDAQ Composite.

The Fund, being a well-diversified core equity

holding, faced headwinds for most of the year owing to the extreme concentration that shaped the equity market. The return of the S&P

500® was driven largely by a handful of mega-cap growth stocks, i.e., the previously mentioned “Magnificent Seven.”

This extremely narrow market meant that for the year 73 percent of stocks comprising the S&P 500® underperformed the

index. Moreover, the return difference of 31.22 percentage points between large-cap growth and value was the second highest ever—the

Russell 1000® Growth Index returning 42.68 percent versus 11.46 percent for the Russell 1000® Value Index.

Despite being diversified among growth and value stocks and having an average market capitalization smaller than the S&P 500®,

the Fund kept pace through the first nine months. In the final quarter the market rose on the prospect of lower interest rates in 2024

along with the potential for a soft landing for the economy. As the market broadened, the Fund’s greater diversification worked

to its benefit as it closed out the year on a strong note.

During the fourth quarter Fund shares traded at

a discount of -6.3 percent and a premium of 0.7 percent relative to their underlying NAV. For the year, the range went from a discount

of -6.3 percent to a premium of 5.3 percent.

| Liberty All-Star® Equity Fund |

President’s Letter |

(Unaudited)

In accordance with the Fund’s distribution

policy, the Fund paid a distribution of $0.15 per share in the fourth quarter. The Fund’s distribution policy has been in place

since 1988 and is a major component of the Fund’s total return. The Fund has paid distributions of $30.29 per share for a total

of more than $3.6 billion since 1987 (the Fund’s first full calendar year of operations). We continue to emphasize that shareholders

should include these distributions when determining the total return on their investment in the Fund.

Once again in this Annual Report, we present a

Q&A session with the Fund’s five investment managers as a way for shareholders to gain insights into the managers’ thinking.

This year we focused on the fundamentals of their investment style and strategy because regardless of market conditions—tranquil

or volatile—it is adherence to sound principles that best serves investors through time. In a departure from customary practice

in recent years, in my role as President of the Fund I join in the discussion to provide perspective on the role that ALPS Advisors plays

in the overall process. We hope you find this feature, beginning on page 13, to be informative and useful.

Despite the narrow market move driven by mega-cap

growth AI-related stocks, the Fund was able to produce good absolute returns in the 25 percent range and relative returns that held their

own even when some benchmarks became much less diversified (and, hence, riskier). I believe these results speak to the sound structure

of the Fund and our commitment to maintaining a quality core equity holding for long-term investors. We thank you for your confidence

in the Fund and pledge our best efforts on your behalf going forward.

Sincerely,

Mark T. Haley, CFA

President

Liberty All-Star® Equity Fund

The views expressed in the President’s Letter,

Unique Fund Attributes and Manager Roundtable reflect the current views of the respective parties and may not reflect their views on the

date this report is first published or anytime thereafter. These views are not guarantees of future performance and involve certain risks,

uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed.

These views are subject to change at any time based upon economic, market or other conditions, and the respective parties disclaim any

responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Fund

are based on numerous factors, may not be relied on as an indication of trading intent. References to specific company securities should

not be construed as a recommendation or investment advice.

| Annual Report | December 31, 2023 |

3 |

| Liberty All-Star® Equity Fund |

President’s Letter |

(Unaudited)

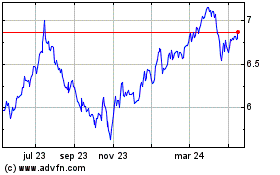

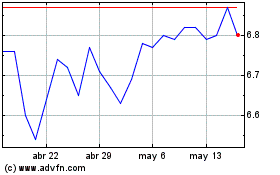

FUND STATISTICS AND SHORT-TERM PERFORMANCE

PERIODS ENDED DECEMBER 31, 2023

FUND STATISTICS:

| Net Asset Value (NAV) |

|

$6.75 |

| Market Price |

|

$6.38 |

| Discount |

|

-5.5% |

| |

Quarter |

2023 |

| Distributions* |

$0.15 |

$0.61 |

| Market Price Trading Range |

$5.62 to $6.46 |

$5.62 to $7.04 |

| Premium/(Discount) Range |

0.7% to -6.3% |

5.3% to -6.3% |

PERFORMANCE:

| Shares Valued at NAV with Dividends Reinvested |

13.87% |

26.12% |

| Shares Valued at Market Price with Dividends Reinvested |

10.36% |

23.39% |

| Dow Jones Industrial Average |

13.09% |

16.18% |

| Lipper Large-Cap Core Mutual Fund Average |

11.54% |

24.34% |

| NASDAQ Composite Index |

13.79% |

44.64% |

| S&P 500® Index |

11.69% |

26.29% |

| * | All

2023 distributions consist of ordinary dividends and long-term capital gains. A breakdown of each 2023 distribution for federal income

tax purposes can be found in the table on page 46. |

| Liberty All-Star® Equity Fund |

President’s Letter |

(Unaudited)

| LONG-TERM PERFORMANCE SUMMARY AND DISTRIBUTIONS PERIODS ENDED DECEMBER 31, 2023 |

ANNUALIZED RATES OF RETURN |

| 3 YEARS |

5 YEARS |

10 YEARS |

| |

|

|

|

| LIBERTY ALL-STAR® EQUITY FUND |

|

|

|

| |

|

|

|

| Distributions |

$2.11 |

$3.40 |

$6.02 |

| Shares Valued at NAV with Dividends Reinvested |

7.69% |

13.90% |

10.27% |

| Shares Valued at Market Price with Dividends Reinvested |

8.03% |

14.69% |

10.94% |

| Dow Jones Industrial Average |

9.38% |

12.47% |

11.08% |

| Lipper Large-Cap Core Mutual Fund Average |

8.74% |

14.64% |

10.86% |

| NASDAQ Composite Index |

6.04% |

18.75% |

14.80% |

| S&P 500® Index |

10.00% |

15.69% |

12.03% |

Performance returns for the Fund are calculated

assuming all distributions are reinvested at actual reinvestment prices and all primary rights in the Fund’s rights offering were exercised.

Returns are net of management fees and other Fund expenses.

The returns shown for the Lipper Large-Cap Core

Mutual Fund Average are based on open-end mutual funds’ total returns, which include dividends, and are net of fund expenses. Returns

for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index and the S&P 500® Index are total returns, including

dividends. A description of the Lipper benchmark and the market indices can be found on page 63.

Past performance cannot predict future results.

Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance

information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment

in the Fund involves risk, including loss of principal.

Closed-end funds raise money in an initial public

offering and shares are listed and traded on an exchange. Open-end mutual funds continuously issue and redeem shares at net asset value.

Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a

number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade

at, below or above net asset value.

| Annual Report | December 31, 2023 |

5 |

| Liberty All-Star® Equity Fund |

Unique Fund Attributes |

(Unaudited)

UNIQUE ATTRIBUTES OF Liberty All-Star®

Equity Fund

Several attributes help to make the Fund a core equity holding for

investors seeking diversification, income and the potential for long-term appreciation.

|

MULTI-MANAGEMENT FOR INDIVIDUAL INVESTORS |

| |

Liberty All-Star® Equity Fund is multi-managed, an investment discipline that is followed by large institutional investors to diversify their portfolios. In 1986, Liberty All-Star® Equity Fund became the first closed-end fund to bring multi-management to individual investors. |

| |

|

|

REAL-TIME TRADING AND LIQUIDITY |

| |

The Fund has a fixed number of shares that trade on the New York Stock Exchange and other exchanges. Share pricing is continuous—not just end-of-day, as it is with open-end mutual funds. Fund shares offer immediate liquidity, there are no annual sales fees and can often be traded commission free. |

| Liberty All-Star® Equity Fund |

Unique Fund Attributes |

(Unaudited)

|

ACCESS TO INSTITUTIONAL MANAGERS |

| |

The Fund’s investment managers invest primarily for pension funds, endowments, foundations and other institutions. Because institutional managers are closely monitored by their clients, they tend to be more disciplined and consistent in their investment process. |

| |

|

|

MONITORING AND REBALANCING |

| |

ALPS Advisors continuously monitors these investment managers to ensure that they are performing as expected and adhering to their style and strategy, and will replace managers when warranted. Periodic rebalancing maintains the Fund’s structural integrity and is a well-recognized investment discipline. |

| |

|

|

ALIGNMENT AND OBJECTIVITY |

| |

Alignment with shareholders’ best interests and objective decision-making help to ensure that the Fund is managed openly and equitably. In addition, the Fund is governed by a Board of Trustees that is elected by and responsible to shareholders. |

| |

|

|

DISTRIBUTION POLICY |

| |

Since 1988, the Fund has followed a policy of paying annual distributions on its shares at a rate that approximates historical equity market returns. The current annual distribution rate is 10 percent of the Fund’s net asset value (paid quarterly at 2.5 percent per quarter), providing a systematic mechanism for distributing funds to shareholders. |

| Annual Report | December 31, 2023 |

7 |

| Liberty All-Star® Equity Fund |

Table of Distributions, Tax Credits &

Rights Offerings |

(Unaudited)

| |

|

RIGHTS OFFERINGS |

|

| YEAR |

PER

SHARE

DISTRIBUTIONS |

MONTH

COMPLETED |

SHARES NEEDED TO

PURCHASE ONE

ADDITIONAL SHARE |

SUBSCRIPTION

PRICE |

TAX CREDITS1 |

| 1987 |

$1.18 |

|

|

|

|

| 1988 |

0.64 |

|

|

|

|

| 1989 |

0.95 |

|

|

|

|

| 1990 |

0.90 |

|

|

|

|

| 1991 |

1.02 |

|

|

|

|

| 1992 |

1.07 |

April |

10 |

$10.05 |

|

| 1993 |

1.07 |

October |

15 |

10.41 |

$0.18 |

| 1994 |

1.00 |

September |

15 |

9.14 |

|

| 1995 |

1.04 |

|

|

|

|

| 1996 |

1.18 |

|

|

|

0.13 |

| 1997 |

1.33 |

|

|

|

0.36 |

| 1998 |

1.40 |

April |

20 |

12.83 |

|

| 1999 |

1.39 |

|

|

|

|

| 2000 |

1.42 |

|

|

|

|

| 2001 |

1.20 |

|

|

|

|

| 2002 |

0.88 |

May |

10 |

8.99 |

|

| 2003 |

0.78 |

|

|

|

|

| 2004 |

0.89 |

July |

102 |

8.34 |

|

| 2005 |

0.87 |

|

|

|

|

| 2006 |

0.88 |

|

|

|

|

| 2007 |

0.90 |

December |

10 |

6.51 |

|

| 2008 |

0.65 |

|

|

|

|

| 20093 |

0.31 |

|

|

|

|

| 2010 |

0.31 |

|

|

|

|

| 2011 |

0.34 |

|

|

|

|

| 2012 |

0.32 |

|

|

|

|

| 2013 |

0.35 |

|

|

|

|

| 2014 |

0.39 |

|

|

|

|

| 20154 |

0.51 |

|

|

|

|

| 2016 |

0.48 |

|

|

|

|

| 20175 |

0.56 |

|

|

|

|

| 2018 |

0.68 |

|

|

|

|

| 2019 |

0.66 |

|

|

|

|

| 2020 |

0.63 |

|

|

|

|

| 2021 |

0.81 |

November |

102 |

7.78 |

|

| 2022 |

0.69 |

|

|

|

|

| 2023 |

0.61 |

|

|

|

|

| Total |

$30.29 |

|

|

|

|

| 1 | The Fund’s net investment income and net realized capital gains exceeded the amount to be distributed

under the Fund’s distribution policy. In each case, the Fund elected to pay taxes on the undistributed income and passed through

a proportionate tax credit to shareholders. |

| 2 | The number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription requests. |

| 3 | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

| 4 | Effective with the second quarter distribution, the annual distribution rate was changed from 6 percent to 8 percent. |

| 5 | Effective with the fourth quarter distribution, the annual distribution rate was changed from 8 percent to 10 percent. |

| Liberty All-Star® Equity Fund |

Investment Growth |

(Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical

$10,000 investment assuming the purchase of shares of beneficial interest at the closing market price (NYSE: USA) of $6.00 on December

31, 1987, and tracking its progress through December 31, 2023. For certain information, it also assumes that a shareholder exercised all

primary rights in the Fund’s rights offerings (see below). This graph covers the period since the Fund commenced its distribution

policy in 1988.

|

The growth of the investment assuming all distributions were received in cash and not reinvested back into the Fund. The value of the investment under this scenario grew to $60,267 (including the December 31, 2023 value of the original investment of $10,633 plus distributions during the period of $48,517 and tax credits on retained capital gains of $1,117). |

| |

|

|

The additional value realized through reinvestment of all distributions and tax credits. The value of the investment under this scenario grew to $382,895. |

| |

|

|

The additional value realized through full participation in all the rights offerings under the terms of each offering. The value of the investment under this scenario grew to $632,985 excluding the cost to fully participate in all the rights offerings under the terms of each offering which was $116,228. |

Past performance cannot predict future results.

Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown.

Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund

shares. An investment in the Fund involves risk, including loss of principal.

| Annual Report | December 31, 2023 |

9 |

| Liberty All-Star® Equity Fund |

Stock Changes in the Quarter

and Distribution Policy |

December 31, 2023 (Unaudited)

The following are the largest ($5 million or more)

stock changes - both purchases and sales - that were made in the Fund’s portfolio during the fourth quarter of 2023.

| |

SHARES |

| SECURITY NAME |

PURCHASE (SALES) |

HELD AS OF 12/31/23 |

| PURCHASES |

|

|

| Baxter International, Inc. |

181,792 |

380,684 |

| Novo Nordisk A/S |

114,323 |

114,323 |

| O’Reilly Automotive, Inc. |

5,840 |

5,840 |

| Skyworks Solutions, Inc. |

64,322 |

64,322 |

| SYSCO Corp. |

82,368 |

241,691 |

| SALES |

|

|

| Booking Holdings, Inc. |

(2,161) |

4,573 |

| CDW Corp. |

(26,769) |

37,838 |

| IQVIA Holdings, Inc. |

(42,544) |

39,883 |

| Regeneron Pharmaceuticals, Inc. |

(12,214) |

0 |

DISTRIBUTION POLICY

The current policy is to pay distributions on

its shares totaling approximately 10 percent of its net asset value per year, payable in four quarterly installments of 2.5 percent of

the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The actual amounts and

sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may

be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides

a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization

(for the full year’s distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary

dividends and long-term capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion,

retain and not distribute capital gains and pay income tax thereon to the extent of such excess.

| Liberty All-Star® Equity Fund |

Top 20 Holdings and Economic Sectors |

December 31, 2023 (Unaudited)

| TOP 20 HOLDINGS* |

PERCENT OF NET ASSETS |

| Microsoft Corp. |

3.66% |

| Alphabet, Inc. |

3.03 |

| Amazon.com, Inc. |

2.42 |

| UnitedHealth Group, Inc. |

2.40 |

| NVIDIA Corp. |

2.22 |

| Visa, Inc. |

1.99 |

| ServiceNow, Inc. |

1.99 |

| S&P Global, Inc. |

1.55 |

| Charles Schwab Corp. |

1.37 |

| Capital One Financial Corp. |

1.37 |

| Sony Group Corp. |

1.36 |

| Adobe, Inc. |

1.33 |

| Salesforce, Inc. |

1.25 |

| Danaher Corp. |

1.24 |

| Autodesk, Inc. |

1.19 |

| Ecolab, Inc. |

1.19 |

| Ferguson PLC |

1.06 |

| Fresenius Medical Care AG |

0.95 |

| SYSCO Corp. |

0.95 |

| Micron Technology, Inc. |

0.90 |

| |

33.42% |

| ECONOMIC SECTORS* |

PERCENT OF NET ASSETS |

| Financials |

21.22% |

| Information Technology |

21.18 |

| Health Care |

13.07 |

| Consumer Discretionary |

12.20 |

| Industrials |

7.93 |

| Materials |

5.53 |

| Communication Services |

5.44 |

| Consumer Staples |

4.79 |

| Energy |

1.99 |

| Real Estate |

1.91 |

| Utilities |

1.40 |

| Other Net Assets |

3.34 |

| |

100.00% |

| * | Because

the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors

in the future. |

| Annual Report | December 31, 2023 |

11 |

| Liberty All-Star® Equity Fund |

Investment Managers/

Portfolio Characteristics |

(Unaudited)

THE FUND’S ASSETS ARE APPROXIMATELY EQUALLY

DISTRIBUTED AMONG

THREE VALUE MANAGERS AND TWO GROWTH MANAGERS:

ALPS Advisors, Inc., the investment advisor to

the Fund, has the ultimate authority (subject to oversight by the Board of Trustees) to oversee the investment managers and recommend

their hiring, termination and replacement.

MANAGERS’ DIFFERING INVESTMENT STRATEGIES

ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a

regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of a multi-managed portfolio.

The characteristics are different for each of the Fund’s five investment managers. These differences are a reflection of the fact

that each pursues a different investment style. The shaded column highlights the characteristics of the Fund as a whole, while the final

column shows portfolio characteristics for the S&P 500® Index.

| |

|

INVESTMENT STYLE SPECTRUM |

|

|

|

| PORTFOLIO CHARACTERISTICS |

VALUE |

|

|

|

GROWTH |

|

|

| AS OF DECEMBER 31, 2023 |

|

|

|

| |

Pzena |

Fiduciary |

Aristotle |

Sustainable |

TCW |

Total

Fund |

S&P 500®

Index |

| Number of Holdings |

36 |

30 |

43 |

28 |

29 |

145* |

503 |

| Percent of Holdings in Top 10 |

42% |

49% |

33% |

46% |

55% |

22% |

31% |

| Weighted Average Market Capitalization (billions) |

$77 |

$213 |

$211 |

$514 |

$677 |

$342 |

$728 |

| Average Five-Year Earnings Per Share Growth |

9% |

8% |

12% |

15% |

17% |

12% |

17% |

| Dividend Yield |

2.5% |

1.2% |

1.8% |

0.7% |

0.5% |

1.3% |

1.5% |

| Price/Earnings Ratio** |

15x |

21x |

21x |

38x |

47x |

24x |

24x |

| Price/Book Value Ratio |

1.6x |

3.6x |

3.2x |

6.7x |

6.4x |

3.3x |

4.2x |

| * | Certain holdings are held by more than one manager. |

| ** | Excludes negative earnings. |

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

MANAGER ROUNDTABLE

After weak returns in 2022 investors’

expectations coming into 2023 were modest. But stocks surprised and delivered a strong year … confirming the value of a consistent

style, strategy and investment process through all markets.

Liberty All-Star Equity Fund’s five investment

managers possess considerable experience, deep knowledge, proven track records and diversified points of view given that they represent

both value and growth styles of investing. These attributes have proven their value through time as equity market results often vary widely

from year to year—2022 (S&P 500® -18.11 percent) and 2023 (S&P 500® +26.29 percent) being

the most recent examples. Thus, this is an opportune time to revisit each manager’s style, strategy and investment process. Fund

President Mark Haley, CFA serves as the moderator of this year’s Roundtable, and he participates in the Q&A by discussing the

role ALPS Advisors plays in the overall management of the Fund. Participating investment management firms, the portfolio manager for each

and their respective styles and strategies are:

ARISTOTLE CAPITAL MANAGEMENT, LLC

Portfolio Manager/Gregory Padilla, CFA

Portfolio Manager and Senior Global Research Analyst

Investment Style/Value – Aristotle

seeks to invest in high quality companies that it believes are selling at a significant discount to their intrinsic value and where catalysts

exist that will lead to a realization by the market of this true value. Aristotle practices a fundamental, bottom-up research-driven process

and invests with a long-term perspective.

FIDUCIARY MANAGEMENT, INC.

Co-Portfolio Managers/Patrick J. English, CFA and Jonathan Bloom

Co-Chief Investment Officers and Portfolio Managers

Investment Style/Value – Fiduciary

utilizes a business owner’s approach to investing by thoroughly examining the economics of the business and the quality of the management

team, seeking to invest in durable business franchises that are selling at a discount to their underlying value.

PZENA INVESTMENT MANAGEMENT, LLC

Portfolio Manager/John J. Flynn

Principal and Portfolio Manager

Investment Style/Value – Pzena uses

fundamental research and a disciplined process to identify good companies with a sustainable business advantage that the firm believes

are undervalued on the basis of current price to an estimated normal level of earnings.

SUSTAINABLE GROWTH ADVISERS, LP

Portfolio Manager/Kishore D. Rao

Principal and Portfolio Manager

Investment Style/Growth – Sustainable

focuses on companies that have unique characteristics that lead to a high degree of predictability, strong profitability and above-average

earnings and cash flow growth over the long term.

TCW INVESTMENT MANAGEMENT COMPANY

Portfolio Manager/Brandon D. Bond, CFA

Managing Director and Portfolio Manager

Investment Style/Growth – TCW invests

in companies that have superior sales growth, leading and/or rising market shares, and high and/or rising profit margins. TCW’s

concentrated growth equity strategy seeks companies with distinct advantages in their business model.

| Annual Report | December 31, 2023 |

13 |

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Haley: Liberty All-Star Equity Fund blends

two primary styles of equity investing: value and growth. Both styles had their moments over the past year. So, let’s begin by revisiting

a definition of value and growth investing for Fund shareholders and ask each manager to articulate how their firm practices its particular

approach. Brandon, start us off please.

Bond (TCW – Growth): Our investment

process is focused on identifying sustainable business model advantages and large addressable market opportunities. Growth is simply the

outcome of the combination. If a market is either large and fragmented or rapidly growing, a competitively advantaged company in that

market will generate above average growth. Valuation is the third pillar of our investment process as the key is not overpaying for that

growth. With higher growth often comes higher price/earnings multiples, hence we get labeled “growth investors.” Just like

our value investing friends though, we are seeking to buy companies below their intrinsic value.

Haley: Kishore, how does Sustainable approach growth style investing?

Rao (Sustainable – Growth): Our investment

approach is focused on owning a select group of quality growth companies that offer strong pricing power; recurring revenue streams; above

average sustainable growth over a 3-5 year period; strong financials driven by attractive free cash flow generation and strong balance

sheets; and, finally, management that can execute the business plan and be good stewards of our clients’ capital. We expect portfolio

companies to compound growth in earnings and cash flow over time in a more predictable manner while generally protecting downside in more

difficult market environments. Historically, the approach has generated mid-teens earnings growth with less variability, outperforming

in markets with stable multiples that focus on fundamentals and underperforming in more cyclically-driven markets and high price momentum

driven environments.

Thank you both. Turning to the value managers. John Flynn, perhaps

you could lead off for Pzena.

Flynn

(Pzena – Value): Value investing has worked empirically because of a very human behavioral bias: most investors don’t

want to invest in companies that are experiencing distress; investing in a business that is out of favor is uncomfortable and emotionally

difficult. As value investors, we believe we can capitalize on this deep-seated pattern of suboptimal investor behavior by separating

fact from emotion through a research-intensive investment approach applied within a consistent framework. Value investing, as we practice

it, involves determining the present value of a business’s future earnings stream and paying significantly less for it. Mechanically,

we estimate companies’ normalized earnings per share (NEPS)— what a business should earn over the course of a full business

cycle—and buy stocks trading in the cheapest quintile on a price/NEPS basis. Importantly, we must also determine that a viable path

to achieving normalized earnings in a reasonable time frame exists.

“Value investing has worked empirically

because of a very human behavioral bias: most investors don’t want to invest in companies that are experiencing distress …

we capitalize on this deep-seated pattern … by separating fact from emotion through a research-intensive investment approach …”

—John Flynn

(Pzena – Value)

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Let’s hear from Aristotle and Fiduciary about how they think

about and practice value investing.

Padilla (Aristotle – Value): Value

investing is often associated with lower quality, but our philosophy is different. We look for high quality companies whose current stock

prices do not reflect the intrinsic value of the enterprise. We believe that sticking to companies with excellent balance sheets, strong

cash flow and proven, predictable business models is the best way to add value for our clients. This is the recipe we have followed for

more than 20 years and one we will continue to follow for the decades ahead.

“Value investing is often associated

with lower quality, but our philosophy is different. We look for high quality companies whose current stock prices do not reflect the

intrinsic value of the enterprise.”

—Gregory Padilla

(Aristotle – Value)

English/Bloom

(Fiduciary – Value): We at Fiduciary take a “business owners” approach to value investing in that we approach

each potential investment as if we were to purchase the company or business outright. Our goal is to invest in 25-35 high quality companies

that are trading below their intrinsic value, or the price a private buyer might pay for the company. We are contrarians and are interested

in a company when there is some sort of controversy over the fundamentals. Our holding period is long term, so we buy a company when there

is a cloud hovering over the business and wait for the uncertainty to lift, the fundamentals to turn and/or the valuation to recover.

We do not buy companies in which the business is broken and there is little-to-no underlying growth.

“We take a ‘business owners’

approach to value investing in that we look at each potential investment as if we were to purchase the company or business outright. Our

goal is to invest in 25-35 high quality companies that are trading below the price a private buyer might pay for the company.”

—Patrick English and Jonathan Bloom

(Fiduciary – Value)

Haley (ALPS): You see very different approaches

reflected in the managers’ comments about their style, either growth or value. Regardless of style, what we at ALPS Advisors look

for in the investment management firms we hire is a strong track record, consistent adherence to their chosen philosophy, a clearly articulated

investment process and an experienced, cohesive management team. These are attributes that could be summed up in one word, quality. It

was interesting that in the managers’ comments that word appeared several times. What we look for in investment managers they look

for in portfolio companies.

Haley: The Fund does not replace investment

managers frequently. A significant consideration in evaluating a manager is continued adherence to their stated philosophy and strategy

… in other words maintaining their discipline and investment process. So, I’ll ask the managers to highlight what they see

as a strong differentiator of their firm’s investment process and how it works to identify stocks to be added to the portfolio or,

for stocks already in the portfolio, to receive a higher weighting. Let’s open this discussion with the value managers and ask Fiduciary

and Aristotle to lead off.

English/Bloom (Fiduciary – Value):

While value investing has more than a 100-year history of success, we are currently in one of the worst periods for value on record. Over

Fiduciary Management’s 43-plus years in business, there were several periods when our strategy was out of favor, but we did not

change our stripes. At Fiduciary, we strive to own all-weather companies that can perform well in most economic backdrops, and at valuations

that embed a significant margin of safety. Companies that meet our business quality and valuation criteria earn a spot in the portfolio,

or a higher weighting depending on their idiosyncratic risk-to-reward characteristics. Conversely, companies are sold or trimmed when

that margin of safety narrows. Nothing is more important to us than providing solid downside protection and avoiding the permanent impairment

of capital.

| Annual Report | December 31, 2023 |

15 |

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Padilla (Aristotle – Value): Some

investors refuse to invest in certain sectors or industries solely on the basis that they are capital intensive, cyclical or highly regulated.

This ideological dogmatism by others can provide a psychological edge to the pragmatic investor who recognizes that quality can come in

many forms. Similarly, some value-oriented investors dismiss some of the world’s greatest businesses because they trade at above-average

price-to-earnings ratios. This can create opportunities for the discerning investor who looks at valuation holistically. What is the predictability

of cash flows? What is the range of outcomes? What are the long-term prospects of the business? These and other questions are items we

consider when determining the normalized earnings power and our resulting estimate of the intrinsic value of an enterprise.

John, what’s the foundation of Pzena’s investment processes?

Flynn (Pzena – Value): The foundation

of our investment process is valuation—specifically, the price-to-normal earnings ratio. We look to buy companies that are trading

at low price-to-normal earnings, where current earnings are usually below historic norms. We necessarily take a long-term view on the

nature of the business we are considering, the company’s current and likely future competitive standing, and the management team’s

strategies for change. Further, we seek to separate fact from emotion through this research-intensive investment approach applied within

a consistent framework. Our buy and sell disciplines rely upon the deep research we do to inform our ranking model. We only buy when a

stock ranks in the cheapest quintile of the universe and sell when a stock ranks at the universe midpoint. We may add to a position if

its valuation becomes more attractive and our long-term investment thesis remains intact, and trim as valuation improves, redeploying

the proceeds into more attractive opportunities.

Growth managers, what do you see as the core strength of your process?

Thoughts, Kishore?

Rao (Sustainable – Growth): We seek

quality businesses that generate above-average earnings and cash flow growth in a more predictable manner over a 3 to 5-year investment

horizon, using that longer-term perspective to our advantage, looking through short-term issues and utilizing volatility to access those

businesses at more attractive cash flow-based valuations. We will hold no more than 30 stocks in the portfolio. This ensures a high degree

of competition for space in the portfolio. We only include our best investment opportunities, building portfolios solely on opportunity

and not relative to an index. We limit risk on a prospective basis, reducing business risk by requiring quality characteristics such as

pricing power, recurring revenues and attractive free cash flow generation. We reduce human risk by assigning a primary and back-up analyst

to research each stock to enhance objectivity in research and a three-person portfolio management team to minimize the risk of philosophical

drift. We also reduce price risk by evaluating each stock’s valuation utilizing multiple cash flow-based metrics.

“We will hold no more than 30 stocks

in the portfolio. This ensures a high degree of competition for space in the portfolio. We only include our best investment opportunities,

building portfolios solely on opportunity and not relative to an index.”

—Kishore Rao

(Sustainable — Growth)

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Brandon, take us inside TCW’s process.

Bond (TCW – Growth): The successful

application of our process can require patience as we leverage our time horizon as a competitive advantage. We believe the market is remarkably

efficient at incorporating current news flow and consensus estimates into stock prices. However, it is less efficient at deciphering the

duration and magnitude of growth that can come from advantaged business models addressing expanding end market opportunities. With patience,

we can enjoy the positive surprises that inevitably come from special companies in attractive markets, while taking advantage of unavoidable

short-term volatility. A deep understanding of what makes a business special, how hard it is to replicate and how big the market opportunity

can be helps us decipher when negative stock reactions are actually opportunities.

“We leverage our time horizon as a competitive

advantage … the market is remarkably efficient at incorporating current news flow and consensus estimates into stock prices. However,

it is less efficient at deciphering the duration and magnitude of growth that can come from advantaged business models …”

—Brandon Bond

(TCW – Growth)

Haley (ALPS): These responses demonstrate

some of the differences that distinguish the growth and value styles of investing. That’s what we at ALPS Advisors want in the managers

we select for the Fund—a clearly articulated and consistently implemented approach to their respective styles. Just as the managers

monitor the companies in their portfolios, so we monitor the managers. We have confidence in our managers, but the due diligence process

and our role as fiduciaries demand that we not only know how the managers are performing, but also how they are achieving their returns.

We have replaced managers from time to time. Performance can be a catalyst for a manager change, but it can also result from personnel

turnover, an ownership change or style drift. Another action we take, one that is less understood, is rebalancing the Fund’s assets. Rebalancing

is the process of taking assets from a manager who has outperformed and giving it to one whose results have lagged. This may be counterintuitive,

but just as investment styles rotate into and out of favor so, too, will managers’ performance and managers who have been through

a recent period of underperformance are often poised for a rebound.

Haley: Now let’s apply your particular

approach to value and growth style investing to 2023. What is a stock in the portion of the Liberty All-Star Equity Fund you manage that

exemplifies your style of value/growth investing and that performed well for the year? Brandon, start us off, please, and then we’ll

ask Kishore to wrap it up for the growth managers.

Bond (TCW – Growth): Our largest

holding, NVIDIA (NVDA), is a great example. When we first purchased shares in 2018, our thesis was that the company could become the “WinTel”

(i.e., Windows + Intel) equivalent in artificial intelligence (AI) and machine learning. The parallel nature of graphic processing units

(GPUs) provides superior performance—over 70x faster than central processing units (CPUs)—in these types of workloads and

NVDA enjoys a sizable lead in the GPU market enabled by its software and large ecosystem. The market’s focus at the time was on

the gaming business and cryptocurrency-related dynamics. Our focus was on the long-term potential of the data center business. While machine

learning was driving solid growth in data center revenue, the emergence of ChatGPT brought GenAI into the public lexicon and has driven

an inflection in demand for NVIDIA’s products. Despite the impressive stock rally in 2023, NVDA’s forward multiple has actually

compressed meaningfully, and we believe we are still in the early innings of a generational computing shift with a highly advantaged enabler.

| Annual Report | December 31, 2023 |

17 |

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Rao (Sustainable – Growth): Workday

(WDAY) is a leader in the human capital management software-as-a-service market (SAAS). Its products are widely recognized for their superiority

in ease of use, ease of installation, innovation upgrades and overall customer satisfaction. The company is rapidly growing its portfolio

of products with finance, planning and analytics solutions. Workday can charge a significant premium over competitive offerings due to

the superiority of its products and the high cost and potential risk involved in switching such products. With the continued expansion

of its new functional modules and the maturation of its financial management product, the company’s value proposition continues

to increase. Workday offers attractive recurring revenues with about 88 percent of its revenues being subscription based with a churn

rate of under 5 percent. It offers numerous runways of growth ahead including the accelerating shift of the enterprise software application

market from on-premises to SAAS, international penetration and the cross-selling of its broadening portfolio of solutions in an expanding

installed base.

Value managers, what’s a solid 2023 performer

that exemplifies your thinking? Let’s go in alphabetical order starting with Aristotle.

Padilla (Aristotle – Value): Blackstone

(BX), a company added to the portfolio in early 2022, was the top performer in Aristotle’s sleeve in 2023. As one of the world’s

largest alternative asset managers, Blackstone benefited from higher asset prices and continued demand for their investment strategies,

crossing the $1 trillion assets under management milestone during the year. Following the conversion from a limited partnership to a corporation

in 2019, Blackstone was added to the S&P 500® index in September 2023, the first major alternative asset manager to

be included in the widely followed index. We continue to believe Blackstone’s track record of investment performance, as well as

first-mover and distribution advantages, position the firm well to further penetrate retail and private wealth channels.

English/Bloom (Fiduciary – Value):

Carrier Global (CARR) was added to the portfolio in 2023. Carrier suffered from years of under-management as part of United Technologies.

Despite that, the business still grew consistently and was nicely profitable due to an oligopolistic industry and Carrier’s strong

competitive position. Carrier was spun out in 2020 and has been reorienting itself to becoming a pure play HVAC business with higher return

on invested capital and organic growth. Carrier’s shares were under pressure earlier this year due to perceptions of choppy execution,

COVID normalization and recessionary fears. Although these risks may come to pass, a modest starting valuation and good industry structure

give us confidence that our downside is relatively minimal. If Carrier can execute on growth, cutting costs and portfolio transformation,

we believe there is significant upside.

Flynn (Pzena – Value): We initiated

a position in Booking Holdings (BKNG)—Europe’s largest online travel agency, or OTA—in mid-2020, taking advantage of

investors’ fears that travel demand would be permanently impaired from the COVID-19 pandemic. Our high-level thesis was predicated

on Booking’s fluid cost structure and strong balance sheet, which would allow it to survive the downturn. We expected Booking to

leverage its scale and profitability to outbid competitors for user traffic, while continuing to acquire travel inventory at great prices.

Despite global travel demand rebounding strongly in 2022, Booking’s shares were caught up (unjustifiably, in our view) in the tech

sell-off and we consequently added to our position on weakness, effectively lowering our cost basis. Booking started exhibiting tangible

market share gains over peers Expedia and Airbnb, posting revenue 40 percent above pre-pandemic levels. Sure enough, Booking’s stock

began to reflect its solid financial performance in 2023, up 65 percent, so we exited the position as it approached our estimate of fair

value.

| Liberty All-Star® Equity Fund |

Manager Roundtable |

(Unaudited)

Haley (ALPS): Once again, we see the differences

between growth and value, this time illustrated in the managers’ stock selections. In recent years, the growth style has generated

higher returns, and the Fund has participated in that outperformance. That said, there have been recent periods when leadership rotated.

A prime example is 2022, a year when equity returns were negative. Two corresponding indices that are reflective of the broader equity

market are the Russell 3000® value and growth. In 2022, the value index returned -7.98 percent, much better than -28.97

percent for its growth counterpart. With exposure to growth and value stocks, the Fund’s structure is designed to capitalize on

the volatility that has occurred in both styles over the last couple of years when investor sentiment shifted rapidly.

Haley: That should wrap it up for this year’s

Roundtable, and we want to thank each of the participants for their thoughtful comments. We hope shareholders have gained deeper insight

into the Fund’s multi-manager structure and the attributes that distinguish each of the managers.

| Annual Report | December 31, 2023 |

19 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (96.66%) | |

| | | |

| | |

| COMMUNICATION SERVICES (5.44%) | |

| | | |

| | |

| Entertainment (1.02%) | |

| | | |

| | |

| Netflix, Inc.(a) | |

| 25,035 | | |

$ | 12,189,041 | |

| Walt Disney Co. | |

| 75,880 | | |

| 6,851,205 | |

| | |

| | | |

| 19,040,246 | |

| Interactive Media & Services (3.03%) | |

| | | |

| | |

| Alphabet, Inc., Class A(a) | |

| 134,470 | | |

| 18,784,114 | |

| Alphabet, Inc., Class C(a) | |

| 267,484 | | |

| 37,696,520 | |

| | |

| | | |

| 56,480,634 | |

| Media (1.39%) | |

| | | |

| | |

| Charter Communications, Inc., Class A(a) | |

| 22,843 | | |

| 8,878,617 | |

| Omnicom Group, Inc. | |

| 115,075 | | |

| 9,955,138 | |

| Trade Desk, Inc., Class A(a) | |

| 100,216 | | |

| 7,211,544 | |

| | |

| | | |

| 26,045,299 | |

| CONSUMER DISCRETIONARY (12.20%) | |

| | | |

| | |

| Automobile Components (1.85%) | |

| | | |

| | |

| Cie Generale des Etablissements Michelin SCA(b) | |

| 420,100 | | |

| 7,544,996 | |

| Lear Corp. | |

| 109,726 | | |

| 15,494,408 | |

| Magna International, Inc., Class A | |

| 194,419 | | |

| 11,486,275 | |

| | |

| | | |

| 34,525,679 | |

| Broadline Retail (2.42%) | |

| | | |

| | |

| Amazon.com, Inc.(a) | |

| 296,893 | | |

| 45,109,922 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure (2.11%) | |

| | | |

| | |

| Booking Holdings, Inc.(a) | |

| 4,573 | | |

| 16,221,437 | |

| Starbucks Corp. | |

| 109,542 | | |

| 10,517,128 | |

| Yum! Brands, Inc. | |

| 96,347 | | |

| 12,588,699 | |

| | |

| | | |

| 39,327,264 | |

| Household Durables (2.43%) | |

| | | |

| | |

| Lennar Corp., Class A | |

| 89,000 | | |

| 13,264,560 | |

| Newell Brands, Inc. | |

| 783,352 | | |

| 6,799,495 | |

| Sony Group Corp.(b) | |

| 268,330 | | |

| 25,408,168 | |

| | |

| | | |

| 45,472,223 | |

| Specialty Retail (1.96%) | |

| | | |

| | |

| CarMax, Inc.(a) | |

| 142,513 | | |

| 10,936,448 | |

| Home Depot, Inc. | |

| 26,075 | | |

| 9,036,291 | |

| O’Reilly Automotive, Inc.(a) | |

| 5,840 | | |

| 5,548,467 | |

| TJX Cos., Inc. | |

| 48,411 | | |

| 4,541,436 | |

| Ulta Beauty, Inc.(a) | |

| 13,455 | | |

| 6,592,815 | |

| | |

| | | |

| 36,655,457 | |

See Notes to Financial Statements.

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Textiles, Apparel & Luxury Goods (1.43%) | |

| | | |

| | |

| Gildan Activewear, Inc. | |

| 293,413 | | |

$ | 9,700,234 | |

| NIKE, Inc., Class B | |

| 69,316 | | |

| 7,525,638 | |

| PVH Corp. | |

| 77,568 | | |

| 9,472,604 | |

| | |

| | | |

| 26,698,476 | |

| CONSUMER STAPLES (4.79%) | |

| | | |

| | |

| Beverages (0.76%) | |

| | | |

| | |

| Coca-Cola Co. | |

| 132,500 | | |

| 7,808,225 | |

| Constellation Brands, Inc., Class A | |

| 26,700 | | |

| 6,454,725 | |

| | |

| | | |

| 14,262,950 | |

| Consumer Staples Distribution & Retail (2.21%) | |

| | | |

| | |

| Costco Wholesale Corp. | |

| 19,754 | | |

| 13,039,220 | |

| Dollar Tree, Inc.(a) | |

| 74,772 | | |

| 10,621,363 | |

| SYSCO Corp. | |

| 241,691 | | |

| 17,674,863 | |

| | |

| | | |

| 41,335,446 | |

| Food Products (0.36%) | |

| | | |

| | |

| Tyson Foods, Inc., Class A | |

| 123,530 | | |

| 6,639,737 | |

| | |

| | | |

| | |

| Household Products (0.39%) | |

| | | |

| | |

| Procter & Gamble Co. | |

| 49,400 | | |

| 7,239,076 | |

| | |

| | | |

| | |

| Multiline Retail (0.58%) | |

| | | |

| | |

| Dollar General Corp. | |

| 79,742 | | |

| 10,840,925 | |

| | |

| | | |

| | |

| Personal Care Products (0.49%) | |

| | | |

| | |

| Unilever PLC(b) | |

| 187,331 | | |

| 9,081,807 | |

| | |

| | | |

| | |

| ENERGY (1.99%) | |

| | | |

| | |

| Energy Equipment & Services (0.67%) | |

| | | |

| | |

| NOV, Inc. | |

| 316,776 | | |

| 6,424,217 | |

| Schlumberger NV | |

| 116,865 | | |

| 6,081,655 | |

| | |

| | | |

| 12,505,872 | |

| Oil, Gas & Consumable Fuels (1.32%) | |

| | | |

| | |

| Coterra Energy, Inc. | |

| 300,600 | | |

| 7,671,312 | |

| Phillips 66 | |

| 61,100 | | |

| 8,134,854 | |

| Shell PLC(b) | |

| 134,846 | | |

| 8,872,867 | |

| | |

| | | |

| 24,679,033 | |

| FINANCIALS (21.22%) | |

| | | |

| | |

| Banks (4.68%) | |

| | | |

| | |

| Bank of America Corp. | |

| 343,426 | | |

| 11,563,153 | |

| Citigroup, Inc. | |

| 311,076 | | |

| 16,001,749 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

21 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Banks (continued) | |

| | | |

| | |

| Commerce Bancshares, Inc. | |

| 77,396 | | |

$ | 4,133,694 | |

| Cullen/Frost Bankers, Inc. | |

| 54,900 | | |

| 5,956,101 | |

| JPMorgan Chase & Co. | |

| 69,655 | | |

| 11,848,316 | |

| Mitsubishi UFJ Financial Group, Inc.(b) | |

| 613,500 | | |

| 5,282,235 | |

| PNC Financial Services Group, Inc. | |

| 45,800 | | |

| 7,092,130 | |

| U.S. Bancorp | |

| 204,301 | | |

| 8,842,147 | |

| Wells Fargo & Co. | |

| 338,730 | | |

| 16,672,291 | |

| | |

| | | |

| 87,391,816 | |

| Capital Markets (6.42%) | |

| | | |

| | |

| Ameriprise Financial, Inc. | |

| 28,600 | | |

| 10,863,138 | |

| BlackRock, Inc. | |

| 9,656 | | |

| 7,838,741 | |

| Blackstone Group LP | |

| 70,600 | | |

| 9,242,952 | |

| Charles Schwab Corp. | |

| 372,630 | | |

| 25,636,944 | |

| Goldman Sachs Group, Inc. | |

| 16,458 | | |

| 6,349,003 | |

| MSCI, Inc. | |

| 23,530 | | |

| 13,309,744 | |

| Northern Trust Corp. | |

| 119,642 | | |

| 10,095,392 | |

| S&P Global, Inc. | |

| 65,754 | | |

| 28,965,952 | |

| UBS Group AG | |

| 242,844 | | |

| 7,503,880 | |

| | |

| | | |

| 119,805,746 | |

| Consumer Finance (1.89%) | |

| | | |

| | |

| American Express Co. | |

| 52,531 | | |

| 9,841,157 | |

| Capital One Financial Corp. | |

| 194,392 | | |

| 25,488,679 | |

| | |

| | | |

| 35,329,836 | |

| Financial Services (5.62%) | |

| | | |

| | |

| Berkshire Hathaway, Inc., Class B(a) | |

| 46,789 | | |

| 16,687,765 | |

| Equitable Holdings, Inc. | |

| 371,413 | | |

| 12,368,053 | |

| FleetCor Technologies, Inc.(a) | |

| 33,067 | | |

| 9,345,065 | |

| Global Payments, Inc. | |

| 73,172 | | |

| 9,292,844 | |

| Mastercard, Inc., Class A | |

| 31,177 | | |

| 13,297,302 | |

| Visa, Inc., Class A | |

| 142,660 | | |

| 37,141,531 | |

| Voya Financial, Inc. | |

| 92,584 | | |

| 6,754,928 | |

| | |

| | | |

| 104,887,488 | |

| Insurance (2.61%) | |

| | | |

| | |

| American International Group, Inc. | |

| 85,780 | | |

| 5,811,595 | |

| Aon PLC, Class A | |

| 42,427 | | |

| 12,347,106 | |

| Arch Capital Group, Ltd.(a) | |

| 98,389 | | |

| 7,307,351 | |

| MetLife, Inc. | |

| 205,815 | | |

| 13,610,546 | |

| Progressive Corp. | |

| 60,112 | | |

| 9,574,639 | |

| | |

| | | |

| 48,651,237 | |

See Notes to Financial Statements.

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| HEALTH CARE (13.07%) | |

| | | |

| | |

| Biotechnology (0.52%) | |

| | | |

| | |

| Amgen, Inc. | |

| 33,500 | | |

$ | 9,648,670 | |

| | |

| | | |

| | |

| Health Care Equipment & Supplies (4.23%) | |

| | | |

| | |

| Alcon, Inc. | |

| 95,200 | | |

| 7,437,024 | |

| Baxter International, Inc. | |

| 380,684 | | |

| 14,717,243 | |

| Boston Scientific Corp.(a) | |

| 152,269 | | |

| 8,802,671 | |

| Dexcom, Inc.(a) | |

| 68,742 | | |

| 8,530,195 | |

| Intuitive Surgical, Inc.(a) | |

| 25,635 | | |

| 8,648,224 | |

| Koninklijke Philips NV(c) | |

| 405,046 | | |

| 9,449,723 | |

| Medtronic PLC | |

| 168,422 | | |

| 13,874,604 | |

| Smith & Nephew PLC(b) | |

| 278,538 | | |

| 7,598,517 | |

| | |

| | | |

| 79,058,201 | |

| Health Care Providers & Services (3.64%) | |

| | | |

| | |

| Cardinal Health, Inc. | |

| 52,166 | | |

| 5,258,333 | |

| Fresenius Medical Care AG(b) | |

| 854,142 | | |

| 17,791,778 | |

| UnitedHealth Group, Inc. | |

| 85,225 | | |

| 44,868,405 | |

| | |

| | | |

| 67,918,516 | |

| Life Sciences Tools & Services (2.39%) | |

| | | |

| | |

| Danaher Corp. | |

| 100,026 | | |

| 23,140,015 | |

| IQVIA Holdings, Inc.(a) | |

| 39,883 | | |

| 9,228,129 | |

| Thermo Fisher Scientific, Inc. | |

| 22,908 | | |

| 12,159,337 | |

| | |

| | | |

| 44,527,481 | |

| Pharmaceuticals (2.29%) | |

| | | |

| | |

| Bristol-Myers Squibb Co. | |

| 171,240 | | |

| 8,786,325 | |

| Merck & Co., Inc. | |

| 78,500 | | |

| 8,558,070 | |

| Novo Nordisk A/S(b) | |

| 114,323 | | |

| 11,826,714 | |

| Pfizer, Inc. | |

| 76,452 | | |

| 2,201,053 | |

| Zoetis, Inc. | |

| 57,874 | | |

| 11,422,591 | |

| | |

| | | |

| 42,794,753 | |

| INDUSTRIALS (7.93%) | |

| | | |

| | |

| Aerospace & Defense (0.41%) | |

| | | |

| | |

| General Dynamics Corp. | |

| 29,400 | | |

| 7,634,298 | |

| | |

| | | |

| | |

| Building Products (2.17%) | |

| | | |

| | |

| Carlisle Cos., Inc. | |

| 40,984 | | |

| 12,804,631 | |

| Carrier Global Corp. | |

| 218,598 | | |

| 12,558,455 | |

| Masco Corp. | |

| 225,229 | | |

| 15,085,839 | |

| | |

| | | |

| 40,448,925 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

23 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Commercial Services & Supplies (0.44%) | |

| | | |

| | |

| Veralto Corp. | |

| 12,100 | | |

$ | 995,346 | |

| Waste Connections, Inc. | |

| 48,789 | | |

| 7,282,734 | |

| | |

| | | |

| 8,278,080 | |

| Electrical Equipment (0.28%) | |

| | | |

| | |

| Eaton Corp. PLC | |

| 21,476 | | |

| 5,171,850 | |

| | |

| | | |

| | |

| Ground Transportation (0.77%) | |

| | | |

| | |

| Canadian Pacific Kansas City, Ltd. | |

| 182,579 | | |

| 14,434,696 | |

| | |

| | | |

| | |

| Industrial Conglomerates (0.72%) | |

| | | |

| | |

| General Electric Co. | |

| 41,112 | | |

| 5,247,124 | |

| Honeywell International, Inc. | |

| 39,000 | | |

| 8,178,690 | |

| | |

| | | |

| 13,425,814 | |

| Machinery (2.08%) | |

| | | |

| | |

| Oshkosh Corp. | |

| 53,600 | | |

| 5,810,776 | |

| Parker-Hannifin Corp. | |

| 28,900 | | |

| 13,314,230 | |

| Wabtec Corp. | |

| 85,663 | | |

| 10,870,635 | |

| Xylem, Inc. | |

| 77,000 | | |

| 8,805,720 | |

| | |

| | | |

| 38,801,361 | |

| Trading Companies & Distributors (1.06%) | |

| | | |

| | |

| Ferguson PLC | |

| 102,590 | | |

| 19,807,051 | |

| | |

| | | |

| | |

| INFORMATION TECHNOLOGY (21.18%) | |

| | | |

| | |

| Electronic Equipment & Instruments (0.39%) | |

| | | |

| | |

| TE Connectivity Ltd. | |

| 51,086 | | |

| 7,177,583 | |

| | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (0.89%) | |

| | | |

| | |

| CDW Corp. | |

| 37,838 | | |

| 8,601,334 | |

| Teledyne Technologies, Inc.(a) | |

| 18,026 | | |

| 8,044,824 | |

| | |

| | | |

| 16,646,158 | |

| IT Services (1.73%) | |

| | | |

| | |

| Amdocs, Ltd. | |

| 67,795 | | |

| 5,958,502 | |

| Cognizant Technology Solutions Corp., Class A | |

| 183,958 | | |

| 13,894,348 | |

| Gartner, Inc.(a) | |

| 18,209 | | |

| 8,214,262 | |

| Snowflake, Inc., Class A(a) | |

| 21,516 | | |

| 4,281,684 | |

| | |

| | | |

| 32,348,796 | |

| Semiconductors & Semiconductor Equipment (5.14%) | |

| | | |

| | |

| ASML Holding N.V. | |

| 13,071 | | |

| 9,893,702 | |

| Microchip Technology, Inc. | |

| 121,800 | | |

| 10,983,924 | |

| Micron Technology, Inc. | |

| 197,465 | | |

| 16,851,663 | |

See Notes to Financial Statements.

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Semiconductors & Semiconductor Equipment (continued) | |

| | | |

| | |

| NVIDIA Corp. | |

| 83,692 | | |

$ | 41,445,952 | |

| QUALCOMM, Inc. | |

| 66,400 | | |

| 9,603,432 | |

| Skyworks Solutions, Inc. | |

| 64,322 | | |

| 7,231,079 | |

| | |

| | | |

| 96,009,752 | |

| Software (13.03%) | |

| | | |

| | |

| Adobe, Inc.(a) | |

| 41,521 | | |

| 24,771,429 | |

| ANSYS, Inc.(a) | |

| 31,000 | | |

| 11,249,280 | |

| Autodesk, Inc.(a) | |

| 90,983 | | |

| 22,152,541 | |

| Crowdstrike Holdings, Inc., Class A(a) | |

| 46,459 | | |

| 11,861,912 | |

| Intuit, Inc. | |

| 19,951 | | |

| 12,469,973 | |

| Microsoft Corp. | |

| 181,873 | | |

| 68,391,523 | |

| Palo Alto Networks, Inc.(a) | |

| 32,109 | | |

| 9,468,302 | |

| Salesforce, Inc.(a) | |

| 88,731 | | |

| 23,348,675 | |

| SAP SE(b) | |

| 60,559 | | |

| 9,361,816 | |

| ServiceNow, Inc.(a) | |

| 52,463 | | |

| 37,064,585 | |

| Workday, Inc., Class A(a) | |

| 47,538 | | |

| 13,123,340 | |

| | |

| | | |

| 243,263,376 | |

| MATERIALS (5.53%) | |

| | | |

| | |

| Chemicals (3.58%) | |

| | | |

| | |

| Corteva, Inc. | |

| 213,500 | | |

| 10,230,920 | |

| Dow, Inc. | |

| 299,505 | | |

| 16,424,854 | |

| Ecolab, Inc. | |

| 111,600 | | |

| 22,135,860 | |

| RPM International, Inc. | |

| 77,800 | | |

| 8,684,814 | |

| Sherwin-Williams Co. | |

| 30,190 | | |

| 9,416,261 | |

| | |

| | | |

| 66,892,709 | |

| Construction Materials (0.64%) | |

| | | |

| | |

| Martin Marietta Materials, Inc. | |

| 24,000 | | |

| 11,973,840 | |

| | |

| | | |

| | |

| Containers & Packaging (1.31%) | |

| | | |

| | |

| Avery Dennison Corp. | |

| 78,934 | | |

| 15,957,297 | |

| Ball Corp. | |

| 146,405 | | |

| 8,421,216 | |

| | |

| | | |

| 24,378,513 | |

| REAL ESTATE (1.91%) | |

| | | |

| | |

| Residential REITs (0.36%) | |

| | | |

| | |

| Equity LifeStyle Properties, Inc. | |

| 95,600 | | |

| 6,743,624 | |

| | |

| | | |

| | |

| Specialized REITs (1.55%) | |

| | | |

| | |

| American Tower Corp. | |

| 45,837 | | |

| 9,895,293 | |

| Crown Castle, Inc. | |

| 53,500 | | |

| 6,162,665 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

25 |

| Liberty All-Star® Equity Fund |

Schedule of Investments |

December 31, 2023

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Specialized REITs (continued) | |

| | | |

| | |

| Equinix, Inc. | |

| 16,028 | | |

$ | 12,908,791 | |

| | |

| | | |

| 28,966,749 | |

| UTILITIES (1.40%) | |

| | | |

| | |

| Electric Utilities (0.94%) | |

| | | |

| | |

| Edison International | |

| 143,112 | | |

| 10,231,077 | |

| Xcel Energy, Inc. | |

| 118,000 | | |

| 7,305,380 | |

| | |

| | | |

| 17,536,457 | |

| Gas Utilities (0.46%) | |

| | | |

| | |

| Atmos Energy Corp. | |

| 75,000 | | |

| 8,692,500 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (COST OF $1,434,858,442) | |

| | | |

| 1,804,585,922 | |

| | |

| | | |

| | |

| SHORT TERM INVESTMENTS (3.40%) | |

| | | |

| | |

| MONEY MARKET FUND (3.39%) | |

| | | |

| | |

| State Street Institutional US Government Money Market Fund, Premier Class, 5.31%(d) | |

| | | |

| | |

| (COST OF $63,260,170) | |

| 63,260,170 | | |

| 63,260,170 | |

| | |

| | | |

| | |

| INVESTMENTS PURCHASED WITH COLLATERAL FROM SECURITIES LOANED (0.01%) | |

| | | |

| | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 5.36% | |

| | | |

| | |

| (COST OF $103,200) | |

| 103,200 | | |

| 103,200 | |

| | |

| | | |

| | |

| TOTAL SHORT TERM INVESTMENTS | |

| | | |

| | |

| (COST OF $63,363,370) | |

| | | |

| 63,363,370 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS (100.06%) | |

| | | |

| | |

| (COST OF $1,498,221,812) | |

| | | |

| 1,867,949,292 | |

| | |

| | | |

| | |