0001423902false00014239022024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

WESTERN MIDSTREAM PARTNERS, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-35753 | 46-0967367 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (IRS Employer

Identification No.) |

9950 Woodloch Forest Drive, Suite 2800

The Woodlands, Texas 77380

(Address of principal executive office) (Zip Code)

(346) 786-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of exchange

on which registered |

| Common units | | WES | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Western Midstream Partners, LP issued a press release announcing third-quarter 2024 results. The Partnership also simultaneously made the slide presentation for tomorrow’s earnings call available on the Western Midstream website, www.westernmidstream.com. The press release is included in this report as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | WESTERN MIDSTREAM PARTNERS, LP |

| | |

| | By: | Western Midstream Holdings, LLC,

its general partner |

| | |

| | |

| Dated: | November 6, 2024 | By: | /s/ Kristen S. Shults |

| | | Kristen S. Shults

Senior Vice President and Chief Financial Officer |

EXHIBIT 99.1

WESTERN MIDSTREAM ANNOUNCES

THIRD-QUARTER 2024 RESULTS

•Reported third-quarter 2024 Net income attributable to limited partners of $281.8 million, generating third-quarter Adjusted EBITDA(1) of $566.9 million.

•Reported third-quarter 2024 Cash flows provided by operating activities of $551.3 million, generating third-quarter Free cash flow(1) of $365.1 million.

•Announced a third-quarter Base Distribution of $0.875 per unit, or $3.50 per unit on an annualized basis, which is in-line with the prior-quarter’s Base Distribution.

HOUSTON—(PR NEWSWIRE)—November 6, 2024 – Today Western Midstream Partners, LP (NYSE: WES) (“WES” or the “Partnership”) announced third-quarter 2024 financial and operating results. Net income (loss) attributable to limited partners for the third quarter of 2024 totaled $281.8 million, or $0.74 per common unit (diluted), with third-quarter 2024 Adjusted EBITDA(1) totaling $566.9 million. Third-quarter 2024 Cash flows provided by operating activities totaled $551.3 million, and third-quarter 2024 Free cash flow(1) totaled $365.1 million.

RECENT HIGHLIGHTS

•Gathered record natural-gas and crude-oil and NGLs throughput in the Delaware Basin of 1.9 Bcf/d and 246 MBbls/d, respectively, each representing a 2-percent sequential-quarter increase.

•Gathered record natural-gas and crude-oil and NGLs throughput in the Powder River Basin of 505 MMcf/d and 26 MBbls/d, respectively, representing sequential-quarter increases of 19-percent and 4-percent, respectively.

•Achieved increased produced-water throughput in the Delaware Basin of 1,121 MBbls/d, representing a 2-percent sequential-quarter increase.

•Issued $800.0 million of 5.450% senior notes due 2034, the proceeds from which will be used to repay a portion of the Partnership’s senior notes due in 2025, and for general partnership purposes.

•Maintained strong operational performance and continued flow assurance for our customers,

with system operability above 98-percent, despite multiple plant turnarounds in several of our core operating basins.

•Subsequent to quarter-end, executed agreements to realign the commercial structure of the Mi Vida joint venture, which will provide WES with 100 MMcf/d of dedicated natural-gas processing capacity in the Delaware Basin beginning in mid-2025.

On November 14, 2024, WES will pay its third-quarter 2024 per-unit Base Distribution of $0.875, which is in-line with the prior quarter’s Base Distribution. Third-quarter 2024 Free cash flow(1) after distributions totaled $24.3 million. Third-quarter 2024 capital expenditures(2) totaled $198.1 million.

Third-quarter 2024 natural-gas throughput(3) averaged 5.0 Bcf/d, representing a 1-percent sequential quarter increase. Third-quarter 2024 throughput for crude-oil and NGLs assets(3) averaged 506 MBbls/d, representing a 2-percent sequential-quarter decrease. Third-quarter 2024 throughput for produced-water assets(3) averaged 1,099 MBbls/d, representing a 2-percent sequential-quarter increase.

“We achieved another quarter of record natural-gas and crude-oil and NGLs throughput in the Delaware Basin and experienced continued strong throughput growth in the Powder River Basin as the Meritage Midstream acquisition continues to exceed our expectations,” said Oscar Brown, President and Chief Executive Officer. “However, our profitability declined slightly quarter-over-quarter, primarily due to lower natural-gas liquids recoveries and lower commodity prices in the Delaware Basin, lower distributions from our equity investments, and higher operation and maintenance expense, which is typical in the third quarter.”

Mr. Brown continued, “Looking to the fourth quarter, we estimate increased Adjusted EBITDA primarily driven by continued steady throughput growth from our core operating basins and lower operation and maintenance expense. While we still expect Adjusted EBITDA to be towards the high end of our previously announced $2.2 billion to $2.4 billion guidance range for the year, we are reducing our average year-over-year crude-oil and NGLs and produced-water throughput growth expectations.”

“In August, we issued $800.0 million of new senior notes in a highly successful offering that resulted in the best 10-year credit spread in WES’s history. Our trailing-twelve-month net leverage ratio has comfortably reached our year-end 2024 threshold of 3.0 times, and we will continue to look for the most efficient ways to allocate capital to generate the best returns for our unitholders. Those options continue to include organic growth opportunities to prudently expand the business, accretive M&A similar to the Meritage Midstream acquisition, and increasing the Base Distribution in-line with the growth of the business. Our strong operating model, improved balance sheet, and transparent capital-

return framework, all provide WES with a solid foundation that is well positioned for future success,” concluded Mr. Brown.

CONFERENCE CALL TOMORROW AT 1:00 P.M. CT

WES will host a conference call on Thursday, November 7, 2024, at 1:00 p.m. Central Time (2:00 p.m. Eastern Time) to discuss its third-quarter 2024 results. To access the live audio webcast of the conference call, please visit the investor relations section of the Partnership’s website at www.westernmidstream.com. A small number of phone lines are available for analysts; individuals should dial 800-836-8184 (Domestic) or 646-357-8785 (International) ten to fifteen minutes before the scheduled conference call time. A replay of the live audio webcast can be accessed on the Partnership’s website at www.westernmidstream.com for one year after the call.

For additional details on WES’s financial and operational performance, please refer to the earnings slides and updated investor presentation available at www.westernmidstream.com.

2023 SUSTAINABILITY REPORT

Today WES released its annual sustainability report focused on environmental, social, and governance (ESG) issues. The report details the Partnership’s continued focus on its three core pillars of its ESG approach: supporting sustainable environments, focusing on people, and operating responsibly. To download and read the full report, please click on the Sustainability section of our website at www.westernmidstream.com.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a master limited partnership formed to develop, acquire, own, and operate midstream assets. With midstream assets located in Texas, New Mexico, Colorado, Utah, and Wyoming, WES is engaged in the business of gathering, compressing, treating, processing, and transporting natural gas; gathering, stabilizing, and transporting condensate, natural-gas liquids, and crude oil; and gathering and disposing of produced water for its customers. In its capacity as a natural-gas processor, WES also buys and sells natural gas, natural-gas liquids, and condensate on behalf of itself and its customers under certain gas processing contracts. A substantial majority of WES’s cash flows are protected from direct exposure to commodity price volatility through fee-based contracts.

For more information about WES, please visit www.westernmidstream.com.

This news release contains forward-looking statements. WES’s management believes that its expectations are based on reasonable assumptions. No assurance, however, can be given that such expectations will prove correct. A number of factors could cause actual results to differ materially from the projections, anticipated results, or other expectations expressed in this news release. These factors include our ability to meet financial guidance or distribution expectations; our ability to safely and efficiently operate WES’s assets; the supply of, demand for, and price of oil, natural gas, NGLs, and related products or services; our ability to meet projected in-service dates for capital-growth projects; construction costs or capital expenditures exceeding estimated or budgeted costs or expenditures; and the other factors described in the “Risk Factors” section of WES’s most-recent Form 10-K filed with the Securities and Exchange Commission and other public filings and press releases. WES undertakes no obligation to publicly update or revise any forward-looking statements.

______________________________________________________________

(1)Please see the definitions of the Partnership’s non-GAAP measures at the end of this release and reconciliation of GAAP to non-GAAP measures.

(2)Accrual-based, includes equity investments, excludes capitalized interest, and excludes capital expenditures associated with the 25% third-party interest in Chipeta.

(3)Represents total throughput attributable to WES, which excludes (i) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary and (ii) for natural-gas throughput, the 25% third-party interest in Chipeta, which collectively represent WES’s noncontrolling interests.

# # #

Source: Western Midstream Partners, LP

WESTERN MIDSTREAM CONTACTS

Daniel Jenkins

Director, Investor Relations

Investors@westernmidstream.com

866.512.3523

Rhianna Disch

Manager, Investor Relations

Investors@westernmidstream.com

866.512.3523

Western Midstream Partners, LP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| thousands except per-unit amounts | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues and other | | | | | | | | |

Service revenues – fee based | | $ | 814,319 | | | $ | 695,547 | | | $ | 2,389,366 | | | $ | 2,004,920 | |

Service revenues – product based | | 49,115 | | | 48,446 | | | 177,321 | | | 142,212 | |

| Product sales | | 19,673 | | | 31,652 | | | 109,076 | | | 100,336 | |

| Other | | 255 | | | 368 | | | 957 | | | 800 | |

| Total revenues and other | | 883,362 | | | 776,013 | | | 2,676,720 | | | 2,248,268 | |

| Equity income, net – related parties | | 23,977 | | | 35,494 | | | 84,227 | | | 116,839 | |

| Operating expenses | | | | | | | | |

| Cost of product | | 32,847 | | | 27,590 | | | 132,936 | | | 123,795 | |

| Operation and maintenance | | 231,066 | | | 204,434 | | | 649,324 | | | 562,104 | |

| General and administrative | | 64,726 | | | 55,050 | | | 195,498 | | | 159,572 | |

| Property and other taxes | | 12,635 | | | 14,583 | | | 43,984 | | | 39,961 | |

| Depreciation and amortization | | 166,015 | | | 147,363 | | | 487,438 | | | 435,481 | |

| Long-lived asset and other impairments | | 4,651 | | | 245 | | | 6,204 | | | 52,880 | |

| | | | | | | | |

| Total operating expenses | | 511,940 | | | 449,265 | | | 1,515,384 | | | 1,373,793 | |

| Gain (loss) on divestiture and other, net | | 467 | | | (1,480) | | | 299,426 | | | (3,668) | |

| Operating income (loss) | | 395,866 | | | 360,762 | | | 1,544,989 | | | 987,646 | |

| | | | | | | | |

| Interest expense | | (94,149) | | | (82,754) | | | (279,177) | | | (250,606) | |

| Gain (loss) on early extinguishment of debt | | — | | | 8,565 | | | 5,403 | | | 15,378 | |

| Other income (expense), net | | 9,565 | | | (1,270) | | | 16,124 | | | 2,817 | |

| Income (loss) before income taxes | | 311,282 | | | 285,303 | | | 1,287,339 | | | 755,235 | |

| Income tax expense (benefit) | | 15,390 | | | 905 | | | 17,667 | | | 2,980 | |

| Net income (loss) | | 295,892 | | | 284,398 | | | 1,269,672 | | | 752,255 | |

| Net income (loss) attributable to noncontrolling interests | | 7,412 | | | 7,102 | | | 29,714 | | | 18,393 | |

Net income (loss) attributable to Western Midstream Partners, LP | | $ | 288,480 | | | $ | 277,296 | | | $ | 1,239,958 | | | $ | 733,862 | |

| Limited partners’ interest in net income (loss): | | | | | | | | |

Net income (loss) attributable to Western Midstream Partners, LP | | $ | 288,480 | | | $ | 277,296 | | | $ | 1,239,958 | | | $ | 733,862 | |

| | | | | | | | |

| General partner interest in net (income) loss | | (6,708) | | | (6,453) | | | (28,845) | | | (16,960) | |

| Limited partners’ interest in net income (loss) | | $ | 281,772 | | | $ | 270,843 | | | $ | 1,211,113 | | | $ | 716,902 | |

| Net income (loss) per common unit – basic | | $ | 0.74 | | | $ | 0.71 | | | $ | 3.18 | | | $ | 1.87 | |

| Net income (loss) per common unit – diluted | | $ | 0.74 | | | $ | 0.70 | | | $ | 3.17 | | | $ | 1.86 | |

| Weighted-average common units outstanding – basic | | 380,513 | | | 383,561 | | | 380,343 | | | 384,211 | |

| Weighted-average common units outstanding – diluted | | 382,620 | | | 384,772 | | | 382,189 | | | 385,344 | |

Western Midstream Partners, LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | |

| | |

| | | | |

| thousands except number of units | | September 30,

2024 | | December 31,

2023 |

| Total current assets | | $ | 1,832,688 | | | $ | 992,410 | |

| Net property, plant, and equipment | | 9,695,591 | | | 9,655,016 | |

| Other assets | | 1,452,945 | | | 1,824,181 | |

| Total assets | | $ | 12,981,224 | | | $ | 12,471,607 | |

| Total current liabilities | | $ | 1,646,195 | | | $ | 1,304,056 | |

| Long-term debt | | 6,929,212 | | | 7,283,556 | |

| Asset retirement obligations | | 374,646 | | | 359,185 | |

| Other liabilities | | 653,654 | | | 495,680 | |

| Total liabilities | | 9,603,707 | | | 9,442,477 | |

| Equity and partners’ capital | | | | |

| Common units (380,555,427 and 379,519,983 units issued and outstanding at September 30, 2024, and December 31, 2023, respectively) | | 3,225,855 | | | 2,894,231 | |

| General partner units (9,060,641 units issued and outstanding at September 30, 2024, and December 31, 2023) | | 10,972 | | | 3,193 | |

| | | | |

| Noncontrolling interests | | 140,690 | | | 131,706 | |

| Total liabilities, equity, and partners’ capital | | $ | 12,981,224 | | | $ | 12,471,607 | |

Western Midstream Partners, LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | |

| | |

| | | Nine Months Ended

September 30, |

| thousands | | 2024 | | 2023 |

| Cash flows from operating activities | | | | |

| Net income (loss) | | $ | 1,269,672 | | | $ | 752,255 | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities and changes in assets and liabilities: | | | | |

| Depreciation and amortization | | 487,438 | | | 435,481 | |

| Long-lived asset and other impairments | | 6,204 | | | 52,880 | |

| | | | |

| (Gain) loss on divestiture and other, net | | (299,426) | | | 3,668 | |

| (Gain) loss on early extinguishment of debt | | (5,403) | | | (15,378) | |

| Change in other items, net | | 123,929 | | | (40,872) | |

| Net cash provided by operating activities | | $ | 1,582,414 | | | $ | 1,188,034 | |

| Cash flows from investing activities | | | | |

| Capital expenditures | | $ | (595,087) | | | $ | (536,427) | |

| | | | |

| Acquisitions from third parties | | (443) | | | — | |

| Contributions to equity investments - related parties | | — | | | (1,153) | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 27,560 | | | 31,715 | |

| | | | |

| Proceeds from the sale of assets to third parties | | 792,241 | | | (60) | |

| (Increase) decrease in materials and supplies inventory and other | | (33,118) | | | (32,659) | |

| Net cash provided by (used in) investing activities | | $ | 191,153 | | | $ | (538,584) | |

| Cash flows from financing activities | | | | |

| Borrowings, net of debt issuance costs | | $ | 789,193 | | | $ | 1,801,011 | |

| Repayments of debt | | (143,852) | | | (1,317,928) | |

| Commercial paper borrowings (repayments), net | | (610,312) | | | — | |

| Increase (decrease) in outstanding checks | | (2,282) | | | (241) | |

| Distributions to Partnership unitholders | | (905,155) | | | (754,998) | |

| Distributions to Chipeta noncontrolling interest owner | | (2,228) | | | (5,083) | |

| Distributions to noncontrolling interest owner of WES Operating | | (18,502) | | | (18,260) | |

| | | | |

| Unit repurchases | | — | | | (134,602) | |

| Other | | (28,479) | | | (16,511) | |

| Net cash provided by (used in) financing activities | | $ | (921,617) | | | $ | (446,612) | |

| Net increase (decrease) in cash and cash equivalents | | $ | 851,950 | | | $ | 202,838 | |

| Cash and cash equivalents at beginning of period | | 272,787 | | | 286,656 | |

| Cash and cash equivalents at end of period | | $ | 1,124,737 | | | $ | 489,494 | |

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

WES defines Adjusted gross margin attributable to Western Midstream Partners, LP (“Adjusted gross margin”) as total revenues and other (less reimbursements for electricity-related expenses recorded as revenue), less cost of product, plus distributions from equity investments, and excluding the noncontrolling interest owners’ proportionate share of revenues and cost of product.

WES defines Adjusted EBITDA attributable to Western Midstream Partners, LP (“Adjusted EBITDA”) as net income (loss), plus (i) distributions from equity investments, (ii) non-cash equity-based compensation expense, (iii) interest expense, (iv) income tax expense, (v) depreciation and amortization, (vi) impairments, and (vii) other expense (including lower of cost or market inventory adjustments recorded in cost of product), less (i) gain (loss) on divestiture and other, net, (ii) gain (loss) on early extinguishment of debt, (iii) income from equity investments, (iv) interest income, (v) income tax benefit, (vi) other income, and (vii) the noncontrolling interest owners’ proportionate share of revenues and expenses.

WES defines Free cash flow as net cash provided by operating activities less total capital expenditures and contributions to equity investments, plus distributions from equity investments in excess of cumulative earnings.

Below are reconciliations of (i) gross margin (GAAP) to Adjusted gross margin (non-GAAP), (ii) net income (loss) (GAAP) and net cash provided by operating activities (GAAP) to Adjusted EBITDA (non-GAAP), and (iii) net cash provided by operating activities (GAAP) to Free cash flow (non-GAAP), as required under Regulation G of the Securities Exchange Act of 1934. Management believes that Adjusted gross margin, Adjusted EBITDA, and Free cash flow are widely accepted financial indicators of WES’s financial performance compared to other publicly traded partnerships and are useful in assessing WES’s ability to incur and service debt, fund capital expenditures, and make distributions. Adjusted gross margin, Adjusted EBITDA, and Free cash flow as defined by WES, may not be comparable to similarly titled measures used by other companies. Therefore, WES’s Adjusted gross margin, Adjusted EBITDA, and Free cash flow should be considered in conjunction with net income (loss) attributable to Western Midstream Partners, LP and other applicable performance measures, such as gross margin or cash flows provided by operating activities.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2024 | | June 30,

2024 | | | | |

| Reconciliation of Gross margin to Adjusted gross margin | | | | | | | | |

| Total revenues and other | | $ | 883,362 | | | $ | 905,629 | | | | | |

| Less: | | | | | | | | |

| Cost of product | | 32,847 | | | 54,010 | | | | | |

Depreciation and amortization | | 166,015 | | | 163,432 | | | | | |

| Gross margin | | 684,500 | | | 688,187 | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments | | 29,344 | | | 32,970 | | | | | |

Depreciation and amortization | | 166,015 | | | 163,432 | | | | | |

| Less: | | | | | | | | |

| Reimbursed electricity-related charges recorded as revenues | | 32,379 | | | 28,998 | | | | | |

Adjusted gross margin attributable to noncontrolling interests (1) | | 19,986 | | | 19,741 | | | | | |

Adjusted gross margin | | $ | 827,494 | | | $ | 835,850 | | | | | |

| | | | | | | | |

| Gross margin | | | | | | | | |

Gross margin for natural-gas assets (2) | | $ | 511,244 | | | $ | 516,253 | | | | | |

Gross margin for crude-oil and NGLs assets (2) | | 97,263 | | | 96,786 | | | | | |

Gross margin for produced-water assets (2) | | 83,178 | | | 82,346 | | | | | |

| Adjusted gross margin | | | | | | | | |

Adjusted gross margin for natural-gas assets | | $ | 596,459 | | | $ | 601,443 | | | | | |

Adjusted gross margin for crude-oil and NGLs assets | | 134,253 | | | 138,894 | | | | | |

| Adjusted gross margin for produced-water assets | | 96,782 | | | 95,513 | | | | | |

(1)Includes (i) the 25% third-party interest in Chipeta and (ii) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary, which collectively represent WES’s noncontrolling interests.

(2)Excludes corporate-level depreciation and amortization.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2024 | | June 30,

2024 | | | | |

| Reconciliation of Net income (loss) to Adjusted EBITDA | | | | | | | | |

| Net income (loss) | | $ | 295,892 | | | $ | 387,564 | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments | | 29,344 | | | 32,970 | | | | | |

| Non-cash equity-based compensation expense | | 8,759 | | | 10,391 | | | | | |

| Interest expense | | 94,149 | | | 90,522 | | | | | |

| Income tax expense | | 15,390 | | | 755 | | | | | |

| Depreciation and amortization | | 166,015 | | | 163,432 | | | | | |

| Impairments | | 4,651 | | | 1,530 | | | | | |

| Other expense | | 90 | | | 37 | | | | | |

| Less: | | | | | | | | |

| Gain (loss) on divestiture and other, net | | 467 | | | 59,342 | | | | | |

| Gain (loss) on early extinguishment of debt | | — | | | 4,879 | | | | | |

| Equity income, net – related parties | | 23,977 | | | 27,431 | | | | | |

| | | | | | | | |

| Other income | | 9,565 | | | 4,213 | | | | | |

| | | | | | | | |

Adjusted EBITDA attributable to noncontrolling interests (1) | | 13,411 | | | 13,276 | | | | | |

| Adjusted EBITDA | | $ | 566,870 | | | $ | 578,060 | | | | | |

| Reconciliation of Net cash provided by operating activities to Adjusted EBITDA | | | | | | | | |

| Net cash provided by operating activities | | $ | 551,288 | | | $ | 631,418 | | | | | |

| Interest (income) expense, net | | 94,149 | | | 90,522 | | | | | |

| Accretion and amortization of long-term obligations, net | | (2,221) | | | (2,473) | | | | | |

| Current income tax expense (benefit) | | 1,471 | | | 726 | | | | | |

| Other (income) expense, net | | (9,565) | | | (4,213) | | | | | |

| | | | | | | | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 3,257 | | | 5,270 | | | | | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable, net | | (12,683) | | | (28,436) | | | | | |

| Accounts and imbalance payables and accrued liabilities, net | | (8,161) | | | (13,338) | | | | | |

| Other items, net | | (37,254) | | | (88,140) | | | | | |

Adjusted EBITDA attributable to noncontrolling interests (1) | | (13,411) | | | (13,276) | | | | | |

| Adjusted EBITDA | | $ | 566,870 | | | $ | 578,060 | | | | | |

| Cash flow information | | | | | | | | |

| Net cash provided by operating activities | | $ | 551,288 | | | $ | 631,418 | | | | | |

| Net cash provided by (used in) investing activities | | (190,701) | | | (14,995) | | | | | |

| Net cash provided by (used in) financing activities | | 420,031 | | | (567,550) | | | | | |

(1)Includes (i) the 25% third-party interest in Chipeta and (ii) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary, which collectively represent WES’s noncontrolling interests.

Western Midstream Partners, LP

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (CONTINUED)

(Unaudited)

Free Cash Flow

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| thousands | | September 30,

2024 | | June 30,

2024 | | | | |

Reconciliation of Net cash provided by operating activities to Free cash flow | | | | | | | | |

| Net cash provided by operating activities | | $ | 551,288 | | | $ | 631,418 | | | | | |

| Less: | | | | | | | | |

| Capital expenditures | | 189,434 | | | 211,864 | | | | | |

| | | | | | | | |

| Add: | | | | | | | | |

| Distributions from equity investments in excess of cumulative earnings – related parties | | 3,257 | | | 5,270 | | | | | |

| Free cash flow | | $ | 365,111 | | | $ | 424,824 | | | | | |

| Cash flow information | | | | | | | | |

| Net cash provided by operating activities | | $ | 551,288 | | | $ | 631,418 | | | | | |

| Net cash provided by (used in) investing activities | | (190,701) | | | (14,995) | | | | | |

| Net cash provided by (used in) financing activities | | 420,031 | | | (567,550) | | | | | |

Western Midstream Partners, LP

OPERATING STATISTICS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | |

| | September 30,

2024 | | June 30,

2024 | | Inc/

(Dec) | | | | | | |

| Throughput for natural-gas assets (MMcf/d) | | | | | | | | | | | | |

| Gathering, treating, and transportation | | 388 | | | 438 | | | (11) | % | | | | | | |

| Processing | | 4,298 | | | 4,209 | | | 2 | % | | | | | | |

Equity investments (1) | | 503 | | | 508 | | | (1) | % | | | | | | |

| Total throughput | | 5,189 | | | 5,155 | | | 1 | % | | | | | | |

Throughput attributable to noncontrolling interests (2) | | 173 | | | 167 | | | 4 | % | | | | | | |

| Total throughput attributable to WES for natural-gas assets | | 5,016 | | | 4,988 | | | 1 | % | | | | | | |

| Throughput for crude-oil and NGLs assets (MBbls/d) | | | | | | | | | | | | |

| Gathering, treating, and transportation | | 393 | | | 396 | | | (1) | % | | | | | | |

Equity investments (1) | | 124 | | | 130 | | | (5) | % | | | | | | |

| Total throughput | | 517 | | | 526 | | | (2) | % | | | | | | |

Throughput attributable to noncontrolling interests (2) | | 11 | | | 11 | | | — | % | | | | | | |

| Total throughput attributable to WES for crude-oil and NGLs assets | | 506 | | | 515 | | | (2) | % | | | | | | |

| Throughput for produced-water assets (MBbls/d) | | | | | | | | | | | | |

| Gathering and disposal | | 1,121 | | | 1,102 | | | 2 | % | | | | | | |

Throughput attributable to noncontrolling interests (2) | | 22 | | | 22 | | | — | % | | | | | | |

| Total throughput attributable to WES for produced-water assets | | 1,099 | | | 1,080 | | | 2 | % | | | | | | |

Per-Mcf Gross margin for natural-gas assets (3) | | $ | 1.07 | | | $ | 1.10 | | | (3) | % | | | | | | |

Per-Bbl Gross margin for crude-oil and NGLs assets (3) | | 2.05 | | | 2.02 | | | 1 | % | | | | | | |

Per-Bbl Gross margin for produced-water assets (3) | | 0.81 | | | 0.82 | | | (1) | % | | | | | | |

| | | | | | | | | | | | |

Per-Mcf Adjusted gross margin for natural-gas assets (4) | | $ | 1.29 | | | $ | 1.33 | | | (3) | % | | | | | | |

Per-Bbl Adjusted gross margin for crude-oil and NGLs assets (4) | | 2.88 | | | 2.96 | | | (3) | % | | | | | | |

Per-Bbl Adjusted gross margin for produced-water assets (4) | | 0.96 | | | 0.97 | | | (1) | % | | | | | | |

(1)Represents our share of average throughput for investments accounted for under the equity method of accounting.

(2)Includes (i) the 2.0% limited partner interest in WES Operating owned by an Occidental subsidiary and (ii) for natural-gas assets, the 25% third-party interest in Chipeta, which collectively represent WES’s noncontrolling interests.

(3)Average for period. Calculated as Gross margin for natural-gas assets, crude-oil and NGLs assets, or produced-water assets, divided by the respective total throughput (MMcf or MBbls) for natural-gas assets, crude-oil and NGLs assets, or produced-water assets.

(4)Average for period. Calculated as Adjusted gross margin for natural-gas assets, crude-oil and NGLs assets, or produced-water assets, divided by the respective total throughput (MMcf or MBbls) attributable to WES for natural-gas assets, crude-oil and NGLs assets, or produced-water assets.

Western Midstream Partners, LP

OPERATING STATISTICS (CONTINUED)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30,

2024 | | June 30,

2024 | | Inc/

(Dec) | | | | | | |

| Throughput for natural-gas assets (MMcf/d) |

| Operated | | | | | | | | | | | | |

| Delaware Basin | | 1,889 | | | 1,858 | | | 2 | % | | | | | | |

| DJ Basin | | 1,418 | | | 1,452 | | | (2) | % | | | | | | |

| Powder River Basin | | 505 | | | 426 | | | 19 | % | | | | | | |

| Other | | 874 | | | 898 | | | (3) | % | | | | | | |

| Total operated throughput for natural-gas assets | | 4,686 | | | 4,634 | | | 1 | % | | | | | | |

| Non-operated | | | | | | | | | | | | |

| Equity investments | | 503 | | | 508 | | | (1) | % | | | | | | |

| Other | | — | | | 13 | | | (100) | % | | | | | | |

| Total non-operated throughput for natural-gas assets | | 503 | | | 521 | | | (3) | % | | | | | | |

| Total throughput for natural-gas assets | | 5,189 | | | 5,155 | | | 1 | % | | | | | | |

| Throughput for crude-oil and NGLs assets (MBbls/d) |

| Operated | | | | | | | | | | | | |

| Delaware Basin | | 246 | | | 241 | | | 2 | % | | | | | | |

| DJ Basin | | 87 | | | 91 | | | (4) | % | | | | | | |

| Powder River Basin | | 26 | | | 25 | | | 4 | % | | | | | | |

| Other | | 34 | | | 39 | | | (13) | % | | | | | | |

| Total operated throughput for crude-oil and NGLs assets | | 393 | | | 396 | | | (1) | % | | | | | | |

| Non-operated | | | | | | | | | | | | |

| Equity investments | | 124 | | | 130 | | | (5) | % | | | | | | |

| Total non-operated throughput for crude-oil and NGLs assets | | 124 | | | 130 | | | (5) | % | | | | | | |

| Total throughput for crude-oil and NGLs assets | | 517 | | | 526 | | | (2) | % | | | | | | |

| Throughput for produced-water assets (MBbls/d) |

| Operated | | | | | | | | | | | | |

| Delaware Basin | | 1,121 | | | 1,102 | | | 2 | % | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total operated throughput for produced-water assets | | 1,121 | | | 1,102 | | | 2 | % | | | | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

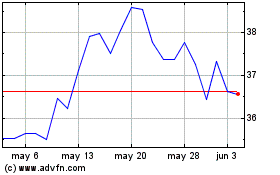

Western Midstream Partners (NYSE:WES)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Western Midstream Partners (NYSE:WES)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025