TSX: ASND

www.ascendantresources.com

- Completes Requirement for Project Ownership to Increase to

80%

- Robust economics to drive construction funding

- solid operating basis to drive initial production

- Optimization program commenced to further enhance

economics

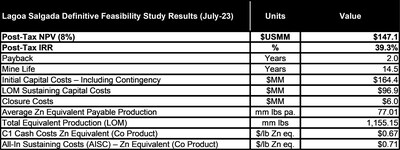

Highlights of the 2023 Definitive Feasibility Study

include:

- Post-tax NPV8% of US$147

million and 39% IRR

- Average annual payable zinc equivalent ("ZnEq") production of

124 million lbs per annum over first 5 years

- Average All-in Sustaining Cost ("AISC") of US$0.59/lb ZnEq over first 5 years

- Robust Average EBITDA of US$75.5

million per annum over the first 5 years

- Upfront capex requirement of US$164

million (including US$12

million of contingency)

- Inaugural NI 43-101 compliant Proven and Probable Reserves in

the North Zone and South Zones of 14.6Mt at an average NSR of

US$66.1/tonne

- Updated NI 43-101 compliant Mineral Resource of:

-

- North Zone: 8.9Mt at 10.52% ZnEq Measured and Indicated

and additional Inferred Resources of 0.5Mt at 6.62% ZnEq

- South Zone: 10.0Mt at 1.22% Copper Equivalent ("CuEq") and

additional Inferred resources of 8.1MT at 1.16% Cu Eq.

- Fulfilled option requirement to deliver 80% indirect ownership

in the Lagoa Salgada Project;

- Metallurgical results confirm strong metal recoveries and

saleable concentrates

- Optimization Program commenced to enhance NPV, IRR and

operational efficiencies targeted for completion by year end.

TORONTO, July 25,

2023 /PRNewswire/ - Ascendant Resources

Inc. (TSX: ASND) (FRA: 2D9) ("Ascendant" or the "Company") is

pleased to announce results of its initial NI 43-101 Feasibility

Study ("FS") for its Venda Nova deposit at its Lagoa Salgada VMS

Project in Portugal, based upon an

updated Mineral Reserves and Resources Estimate. The completion of

the FS satisfies Ascendant's earn-in option requirements to move to

80% ownership, subject to closing documentation with all other

conditions having previously been met.

The FS was completed by QUADRANTE, a multidisciplinary

engineering and consulting company with more than 25 years of

experience in Europe, Africa and the Americas. Mine planning, design

and engineering was undertaken by IGAN INGENIERÍA, an independent

consulting firm specializing in mine planning and engineering for

open pit and underground mining projects and operations based in

Spain. The DFS is based on the NI

43-101 Mineral Resource estimate completed by MICON International

dated May 31, 2023 and Mineral

Reserves estimate completed by IGAN dated June 16, 2023. Golder Associates has been engaged

to provide a comprehensive peer review of the entire report. The FS

report will be posted to the Company's profile on SEDAR

imminently.

Mark Brennan, Executive Chairman

of Ascendant stated, "We are very pleased to have completed this

initial feasibility study for the Venda Nova deposit at Lagoa

Salgada. It is the first comprehensive study covering all aspects

of the operations required for the commercialization of the

project. It will also serve to secure our 80% interest in what is

proving to be a robust project, even at this very early stage in

its development. Lagoa Salgada remains a discovery project with

significant upside potential expected as we optimize these results

and as we continue to expand the resource base."

He added, "We believe the results of the FS demonstrate a

solid, economically robust project for what has always been the

initial development phase for the larger potential we see for the

Lagoa Salgada property. Given the nature of VMS deposits to occur

in clusters on the Iberian Pyrite Belt, we see evidence of

potential for several more deposits to be defined in the coming

years to enhance the overall value proposition at Lagoa.

Furthermore, we expect these results to support our current

financing discussions and construction decision in the coming

months."

Optimization

Opportunities

While completing the FS satisfies the requirements for Ascendant

to earn an 80% interest in the project as required under the Earn

In Option agreement, the Company believes that with additional time

now available, the following near-term optimization opportunities

exist to further enhance the FS prior to commencing development

work over the next six months. The Company's initial focus will be

as follows:

- Optimize mine ore sequencing to maximize revenues in the

initial years.

- Optimization of the mining and processing rate to optimize NPV

and IRR; and

- Undertake further metallurgical test work to enhance metal

recoveries above those already achieved in tests to date

Project Overview

The Lagoa Salgada Project is located within the north-western

section of the prolific Iberian Pyrite Belt ("IBP") in Portugal, approximately 80km southeast of

Lisbon, accessible by national

highways and existing roads. The Project is comprised of a single

exploration permit covering an area of approximately 7,209

hectares. The Project represents a high-grade, polymetallic

zinc-lead-copper development and exploration opportunity in a low

risk, established and prolific jurisdiction where the project has

been accorded a Project of National Interest ("PIN") status.

Figure 1. Project Location

Updated Minerals Reserves and

Resources Estimate

Table 1. below outlines the initial NI 43-101 Proven and

Probable Mineral Reserves Estimate prepared by IGAN Ingenieria upon

which the FS was based. Table 2 provides the updated Mineral

Resource Estimate, prepared by Micon International Limited,

("Micon") identified for the Lagoa Salgada project to date. Infill

drilling in 2022 focused upon upgrading sufficient high-grade

mineralization in the North Zone and part of the mineralization in

the South Zone to the Measured and Indicated categories to support

the completion of the FS.

Future drilling is expected to add additional Resources as the

project moves forward to extend the overall mine life and it should

be noted both the North and South zones remain open to future

expansion along strike and at depth for future exploration. In

addition, several regional exploration targets have been identified

for future exploration work to further increase the known mineral

resources on the property, thereby extending the overall mine life

and/or potentially supporting a future expansion.

The estimated Proven and Probable Reserves total 14.6 million

metric tons (Mt), with 7.0Mt in the North Zone having an NSR of

84.1 $/t, and 7.6Mt in the South Zone with an NSR of 49.6 $/t,

sufficient to support an initial mine life of 14+ years based upon

a throughput rate of 1.2Mtpa through the plant as outlined in the

FS. Reserves were defined using an NSR calculation based upon

current metallurgical recoveries, payability, treatment charges and

mining methods.

The project has converted 77% of its Measured and Indicated

resources into reserves: additionally there are 0.5Mt at a grade of

6.62% ZnEq in the North Zone and 8.13Mt at a grade of 1.16% CuEq in

the South Zone of Inferred Resource. Additional drilling is

required to upgrade these additional resources to the Measured and

Indicated categories.

Table 1: Mineral Reserves

NSR cut-off grades were established following Mortimer's

approach to cut-off grades (Hall, 2014)

Table 1a: NSR cut-off values per mining method and

material

|

|

|

|

|

|

|

|

Mining

Method

|

Material

|

Mining

Cost

|

Processing

Cost

|

Boundary

cut-off

|

G&A

|

Volume

cut-off

|

|

LHOS

|

STWK

|

19.5

|

16.31

|

35.81

|

2.5

|

38.31

|

|

PMS

|

19.5

|

19.62

|

39.12

|

2.5

|

41.62

|

|

TMS

|

19.5

|

14.48

|

33.98

|

2.5

|

36.48

|

|

GOS

|

19.5

|

16.22

|

35.72

|

2.5

|

38.22

|

|

STR

|

19.5

|

16.31

|

35.81

|

2.5

|

38.31

|

|

CF

|

STWK

|

29.98

|

16.31

|

46.29

|

2.5

|

48.79

|

|

PMS

|

29.98

|

19.62

|

49.60

|

2.5

|

52.10

|

|

TMS

|

29.98

|

14.48

|

44.46

|

2.5

|

46.96

|

|

GOS

|

29.98

|

16.22

|

46.20

|

2.5

|

48.70

|

|

STR

|

29.98

|

16.31

|

46.29

|

2.5

|

48.79

|

Table 2: Mineral Resources (Inclusive of Reserves)

North Zone

South Zone

Mining

In line with previous studies, the mine is designed using a

single access ramp from surface and will target the extraction of

ore from the North and South Zones at a rate of 1.2 million tonnes

per annum ("Mtpa").

Mining will be undertaken by targeting the various sub domains

within the ore deposit to maximize metallurgical recovery. As with

most VMS type deposits, the sub domains reflect a precious metal

rich gossan layer above a Massive Sulphide layer (further divided

into a Transition and Primary layer) and a layer of stockwork

mineralization each with its own metallurgical characteristics. The

mining methods defined are a combination of transverse

sublevel stoping and cut & fill. Paste backfill is to be

used for both mining methods to maximize ore recovery and

productivity while minimizing surface tailing disposition. The

initial years will focus on mining the higher-grade gossan and

massive sulphide zones in the North Zone, followed by the

South Zone as underground access is developed in the early years of

the operation to the South zone. Mining will be conducted using an

owner operated electric fleet which will reduce operating

costs.

Figure 2. Underground Mine Design

(In blue the main ramps and accesses and in green and violet the

ore blocks to be mined)

Metallurgy

Metallurgical test work was completed by Grinding Solutions

("GSL") in Cornwall, UK.

Confirmatory test work was developed by Maelgwyn Mineral Services,

South Africa to confirm metal

recoveries and saleable concentrates have been achieved in

principal domains. Further testing is required to confirm and

improve on current results as fully optimized circuit adjustments

are developed. The Company notes that its consultants have

indicated that the actual performance of operating mines in the

region have typically seen an improvement in concentrate quality

once an industrial scale operation is in production as compared to

lab testing.

The approach to flowsheet development was to prepare

representative master composites for each ore type, then proceed

through open circuit to identify and optimize flowsheet conditions

and reagent schemes. Locked cycle tests were then conducted on

principal master composites to demonstrate the anticipated overall

metallurgical performance within a closed circuit.

Tests were completed on blends of Primary Massive Sulphide

(PMS), Stockwork (STW), Gossan (GO), Transition Massive Sulphide

(TMS) and Stringer (STR) ores to allow comparison with individual

composite results and to assess the viability of co‐processing the

ore types.

Mineralogical assessments were undertaken to provide information

to refine the comminution/beneficiation process during

optimization, and to provide reasonable expectations for

metallurgical performance versus mineral liberation and association

within each ore type. Samples from various open and locked cycle

test products were used to characterize final concentrates and

tailings.

The developed metallurgical models were applied to mine

production schedules as part of the financial modelling process.

The resulting average recoveries over the life of the mine (LOM)

are presented in the table below:

Table 3. Achieved Recoveries by Metal and Domain

Table 4 below highlights the concentrate grade profile as

determined by the various metallurgical testwork. These results are

largely inline with other regional producers. The Project will

produce four concentrates, namely Zinc, Lead, Copper and a Tin

concentrate.

Table 4. Concentrate Technical Specifications

Processing

The mineral treatment plant is based on industry standard

methods and will mainly consist of different process areas where

the mineral will be crushed, ground, and then fed to several

flotation processes where Cu, Pb, Zn and Sn concentrates and Au/Ag

dore bars will be produced. Other than crushing, grinding,

dewatering and auxiliary services, common to all mineral domains,

the remaining process areas will be configured depending on the

mineral domain being processed. The mined material goes through a

grizzly feeder and primary jaw crusher, and then onto a grinding

circuit which consists of a SAG mill, ball mill, and vertical mill

in a closed circuit with hydrocyclones. The material is discharged

into a vibrating screen, with rejected pebbles recirculated to a

pebble crusher.

Grinded material will feed the copper and lead flotation

circuit, that includes aeration and conditioning tanks, rougher

cells, regrinding mill, and cleaning stages. The circuit can

produce bulk or separate Cu and Pb concentrates depending on the

mineral domain being processed. The zinc flotation circuit,

downstream process, consists of conditioning tanks, rougher cells,

regrinding mill, and cleaning stages.

Zinc flotation tailings, feed the sulphide flotation circuit to

remove sulphides before concentrating tin minerals. It includes

conditioning tanks, rougher cells, and cleaner stages. Rougher

tailings flow to the next area, while the concentrate is pumped to

the tailings management area. The tin recovery circuit will consist

of flotation and gravimetric concentration technologies. Flotation

includes conditioner and aeration tanks, rougher and cleaner

stages, with intermediate tin concentrate being processed using

multi-gravity separators to increase the final tin grade. A summary

Flowsheet is provided below.

Figure 3. Simplified Process Flow Diagram

Infrastructure

The Lagoa Salgada Project will be developed on a greenfield site

located in close proximity to the Grândola municipality, in the

Setúbal district, which benefits from well-established

infrastructure, including road and rail transport, power, and water

supply services. Transportation of supplies will be facilitated by

trucks from Portugal or Spanish

locations, while concentrate products will initially be shipped to

the Sines port by road (47km) and subsequently by ship to final

destinations.

The project site will have a compact layout that incorporates

essential components such as the tailings storage facility, ore and

waste dumps, water treatment infrastructure, and various buildings,

including administration, warehouse, laboratory, gatehouse, and

mobile equipment workshop. The processing facilities will consist

of a primary crusher building, ore stockpiles on the ROM pad, a

mill building, and a paste plant building.

The mine will be accessed via a portal and the ore will be

brought to the surface and stored as stockpiles, while waste

stockpiles will be utilized for constructing the embankments of the

Tailings Storage Facility.

The mine plan outlines the processing of 14.8 Mt of ore and the

generation of 1.9 Mt of waste rock. After accounting for

concentrate and underground backfill, a total of 11.3 Mt of

tailings, along with 1.0 Mt of development rock, will be deposited

in the TSF.

Figure 4 Site Layout

Capital Costs

Upfront capital costs are estimated at US$164 million inclusive of US$12 million in contingency. A further

US$102.9 million of sustaining

capital is planned over the 14.5 year mine life, including closure

costs. Pay back is in the order of 2 years with an after-tax IRR of

39%.

Table 5. Capital Costs

Operating Costs

Operating costs are summarized in Table 6 below. All costs are

based on a mining rate of 1.2Mtpa and relied on recent quotes from

various vendors which are consistent with other mines in the

region. On a zinc equivalent per pound basis, Life of Mine C1 Cash

Costs are estimated at US$0.67/lb and

All-In Sustaining Costs are US$0.71/lb over the life of mine.

Table 6. Operating Costs

Production and Operating Cost

Profile

The chart below highlights the expected production and AISC

profile at Venda Nova as per the FS. Production and cash flows are

expected to be stronger in the early years as the processing of the

higher-grade massive sulphide and gossan material is

undertaken.

Production over the mine life is expected to average 77 million

lbs of Zinc equivalent production per year but averages

approximately 124 million lbs of Zinc equivalent production over

the first five years. Similarly, AISC will average

US$0.71/lb per year LOM and

US$0.59/lb over the first five years

on a ZnEq basis.

Figure 5. Production and AISC

Overall Project

Economics

The Venda Nova project at Lagoa Salgada shows strong robust

economics with a Post-Tax NPV at an 8% discount rate of

US$147 million and an IRR of 39% for

a payback period of 2 years at long term consensus metal price

assumptions. Project economics are based on the current Proven and

Probable Reserves only for a mine life of 14.5 years and does not

factor in the upgrading of additional resources or potential future

exploration success.

Table 7 Economic Summary

The mine is expected to benefit from regional tax incentives in

Portugal. Contractual fiscal incentives for productive

investment in Portugal offers a

validity period of up to 10 years for investment projects with

relevant expenditures amounting to €3,000,000 or more. The fiscal

benefit corresponds to 10% of the project's relevant expenditures,

and this rate can be increased based on factors like the location

of the project and the creation of jobs. The benefit takes the form

of a tax credit deducted from the corporate income tax liability.

Additionally, there are provisions for exemptions or reductions in

municipal property tax, property transfer tax, and stamp duty.

These contractual fiscal incentives aim to attract productive

investments, boost economic growth, create employment

opportunities, and support strategic sectors in Portugal. The incentives provide companies

with tax benefits, such as tax credits, deductions, and exemptions,

encouraging investment in various sectors and regions.

In the case of Lagoa Salgada, the maximum tax benefit is

determined by considering the lower value between €24.75 million

(Maximum regional aid intensity applicable) or 15% of the initial

investment. The application method for this incentive involves a

50% reduction in income tax (equivalent to 21% of the taxable

income) until the maximum amount of tax benefit is attained.

The chart below demonstrates the robust free cash flow

generation expected, especially in the first five years of

operation. Cash flows during the first five years of production are

estimated to average US$56 million

per annum.

Figure 6. Free Cash Flow

The chart below highlights the NPV sensitivity to changes in

capital costs, various input costs and Zinc price assumptions.

Figure 7. NPV Sensitivity

Optimization

Opportunities

The completion of the Feasibility study completes the

requirements by Ascendant to Earn an 80% ownership in the project

as required under the Option Earn-In agreement. The Company

believes that with additional time now available, the following

near term optimization opportunities exist to further enhance the

FS prior to commencing development work over the next six months.

The Company's initial focus will be as follows:

- Optimize mine ore sequencing to maximize revenues in the

initial years.

- Optimization of the mining and processing rate to optimize NPV

and IRR;

- Undertake further metallurgical test work on available material

to enhance metal recoveries above those already achieved in tests

to date

On a longer-term basis, the Company has identified additional

areas to further increase the value of the Lagao Salgada project

such as;

- Additional metallurgical test work to continue to enhance

recoveries subject to additional new fresh core

- Increase in mineral reserves and resources to enhance the mine

life or support a larger scale operation via upgrading additional

known resources to the Proven and Probable categories, and the

addition of new ore through new exploration to define additional

resources on the numerous follow up targets known on the

property.

Qualified Persons

An NI 43-101 Technical Report supporting the DFS is being

prepared by Quadrante under the guidance of Mr. João Horta (M.Sc.,

MIMMM), who serves as Project Director at QUADRANTE and is a

"Qualified Person" in accordance with National Instrument 43-101 –

Standards of Disclosure for Mineral Projects. Although the

Qualified Person was not responsible for the completion of some of

the sections of the DFS, such as Geology, Mineral Processing and

Metallurgical, Mineral Resource, Reserve, Mining Methods, Recovery

Methods, TSF, Paste Fill, and Hydrogeological Study, the Qualified

Person at Quadrante has relied on the Qualified Persons listed

below who are the specialists in these fields for completion of

their respective portions of the DFS.

The scientific and technical information contained in this

release relating to the Geology and Mineral Resource Estimate has

been approved and verified by Mr. Charley Murahwi (MSc., P.Geo.,

FAusIMM), Senior Economic Geologist with Micon International

Limited, who is a "Qualified Person" in accordance with National

Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Sampling, analytical, and test data underlying the Mineral Resource

Estimate was also approved and verified by Mr. Charley Murahwi.

The Mineral Reserve calculation and the Mining Methods section

was completed by IGAN Ingenieria under the supervision of Mr. Pablo

Gancedo Mínguez (CEng, MIMMM), who is a "Qualified Person" in

accordance with National Instrument 43-101 – Standards of

Disclosure for Mineral Projects.

The Tailings Storage Facility (TSF) study was completed by SLR

under the supervision of Mr. David

Ritchie (P.Eng, Principal Geotechnical Engineer at SLR), who

is a "Qualified Person" in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

Scientific and technical information contained in this release

in relation to metallurgical test work and the Recovery Methods

section has been approved and verified by Mr. David Castro López

(MIMMM), who serves as Process Engineer at Minepro Solutions and is

a "Qualified Person" in accordance with National Instrument 43-101

– Standards of Disclosure for Mineral Projects.

The Hydrogeological Study was completed by Dr. Rafael Fernández

Rubio (PhD, Specialist), which is a Special Consultant at FRASA and

is a "Qualified Person" in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

The Paste Fill study was completed by Mr. Frank Palkovits (P.Eng, B.Eng), Pastefill

Specialist at RMS and a "Qualified Person" in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects.

Review of Technical

Information

The scientific and technical information in this press release

has been reviewed and approved by Clinton Swemmer, Chief Technical

Officer for Ascendant Resources Ltd, who is a Qualified Person as

defined in National Instrument 43-101.

About Ascendant Resources

Inc.

Ascendant Resources is a Toronto-based mining company focused on the

exploration and development of the highly prospective Lagoa Salgada

VMS project located on the prolific Iberian Pyrite Belt in

Portugal. The Lagoa Salgada

project is a high-grade polymetallic project, demonstrating a

typical mineralization endowment of zinc, copper, lead, tin,

silver, and gold. Extensive exploration upside potential lies both

near deposit and at prospective step-out targets across the large

7,209-hectare property concession.

Located just 80km from Lisbon

and surrounded by exceptional infrastructure, Lagoa Salgada offers

a low-cost entry to a significant exploration and development

opportunity, already showing its mineable scale and cashflow

generation potential.

Ascendant currently holds a 50% interest in the Lagoa Salgada

project through its position in Redcorp - Empreendimentos Mineiros,

Lda, ("Redcorp") and has an earn-in opportunity to increase its

interest in the project to 80%. The Company's common shares are

principally listed on the Toronto Stock Exchange under the symbol

"ASND". For more information on Ascendant, please visit our website

at http://www.ascendantresources.com/.

Additional information relating to the Company, including the

Preliminary Economic Assessment referenced in this news release, is

available on SEDAR at www.sedar.com.

Forward Looking

Information

This press release contains statements that constitute

"forward-looking information" (collectively, "forward-looking

statements") within the meaning of the applicable Canadian

securities legislation. All statements, other than statements of

historical fact, are forward-looking statements and are based on

expectations, estimates and projections as at the date of this news

release. Any statement that discusses predictions, expectations,

beliefs, plans, projections, objectives, assumptions, future events

or performance (often but not always using phrases such as

"expects", or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans", "budget", "scheduled", "forecasts",

"estimates", "believes" or "intends" or variations of such words

and phrases or stating that certain actions, events or results

"may" or "could", "would", "might" or "will" be taken to occur or

be achieved) are not statements of historical fact and may be

forward-looking statements.

Forward-looking statements contained in this press release

include, without limitation, statements regarding the business, the

Lagoa Salgada project and timing of completion of studies. In

making the forward- looking statements contained in this press

release, Ascendant has made certain assumptions, including,

but not limited to its ability to enhance value through further

optimisation, the discovery potential of the project and ability to

define further deposits and the support for and ability to obtain

project financing and commence construction. Although

Ascendant believes that the expectations reflected in

forward-looking statements are reasonable, it can give no assurance

that the expectations of any forward-looking statements will prove

to be correct. Known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to general business, economic, competitive, political and

social uncertainties. Accordingly, readers should not place undue

reliance on the forward-looking statements and information

contained in this press release. Except as required by law,

Ascendant disclaims any intention and assumes no obligation to

update or revise any forward-looking statements to reflect actual

results, whether as a result of new information, future events,

changes in assumptions, changes in factors affecting such

forward-looking statements or otherwise. Forward-looking

information is subject to a variety of risks and uncertainties,

which could cause actual events or results to differ from those

reflected in the forward-looking information, including, without

limitation, the risks described under the

heading "Risks Factors" in the Company's Annual Information Form

dated March 31, 2023 and under the

heading "Risks and Uncertainties" in the Company's Management's

Discussion and Analysis for the years ended December 31, 2022 and 2021 and other risks

identified in the Company's filings with Canadian securities

regulators, which filings are available on SEDAR at

www.sedar.com. The risk factors referred to above are not

an exhaustive list of the factors that may affect any of the

Company's forward-looking information. The Company's statements

containing forward-looking information are based on the beliefs,

expectations and opinions of management on the date the statements

are made, and the Company does not assume any obligation to update

such forward-looking information if circumstances or management's

beliefs, expectations or opinions should change, other than as

required by applicable law. For the reasons set forth above, one

should not place undue reliance on forward-looking

information.

View original content to download

multimedia:https://www.prnewswire.com/news-releases/ascendant-resources-announces-post-tax-npv8-of-us147-million-and-39-irr-from-initial-feasibility-study-at-its-lagoa-salgada-project-in-portugal-301885724.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/ascendant-resources-announces-post-tax-npv8-of-us147-million-and-39-irr-from-initial-feasibility-study-at-its-lagoa-salgada-project-in-portugal-301885724.html

SOURCE Ascendant Resources Inc.