Endeavour Silver Corp. (TSX:EDR)(NYSE:EXK) achieved its ninth consecutive year

of production growth in 2013, reporting record production of 6,813,068 ounces

(oz) silver and 75,578 oz gold. The Company also set a new record for quarterly

silver and gold production in the Fourth Quarter, 2013 from the Company's three

operating silver mines in Mexico: the Guanacevi Mine in Durango State and the

Bolanitos and El Cubo Mines in Guanajuato State.

Silver production in the Fourth Quarter, 2013 was up 56% to 1,931,717 oz and

gold production was up 37% to 17,686 oz compared to the Fourth Quarter, 2012.

Revenue was up 2% to approximately US$67.9 million as a result of the increased

precious metals production, offset by lower metal prices.

Silver production in 2013 was up 52% to 6,813,069 oz and gold production was up

95% to 75,578 oz compared to 2012. Revenue was up 33% to approximately US$276.8

million in 2013 as a result of the increased precious metals production, again

offset by lower metal prices.

Production Highlights for Fiscal 2013 (Compared to Fiscal 2012)

-- Silver production increased 52% to 6,813,069 oz

-- Gold production jumped 95% to 75,578 oz

-- Silver equivalent production escalated 67% to 11.3 million oz (at a 60:1

silver: gold ratio)

-- Revenue rose 33% to an estimated $276.8 million on 7,151,963 silver oz

and 81,119 gold oz sold

-- Realized silver price fell 25% to $23.10 per oz sold

-- Realized gold price fell 18% to $1,375 per oz sold

-- Bullion inventory at year-end included 51,000 oz silver and 198 oz gold

-- Concentrate inventory available for sale at year-end was nil

Production Highlights for Fourth Quarter, 2013 (Compared to Fourth Quarter, 2012)

-- Silver production increased 56% to 1,931,717 oz

-- Gold production jumped 37% to 17,686 oz

-- Silver equivalent production escalated 49% to 3.0 million oz (at a 60:1

silver: gold ratio)

-- Revenue rose 2% to an estimated $67.9 million on 2,155,326 silver oz and

18,960 gold oz sold

-- Realized silver price fell 38% to $20.52 per oz sold

-- Realized gold price fell 28% to $1,246 per oz sold

-- Plant throughputs, ore grades and metal recoveries were higher at all

three mines

-- Bullion and concentrate inventories were sold to avoid the new mining

taxes effective at year-end

Bradford Cooke, CEO and Director, commented, "Endeavour's mining operations

delivered another exceptional year in 2013, significantly outperforming our

production guidance which we revised upwards in September. Each of the three

mines contributed above their mine plans for the year, with higher plant

throughputs, ore grades and metal recoveries across the board. The Bolanitos

mine in particular deserves special mention for delivering more than one million

oz silver above plan in 2013."

"Last year was a challenging one for the mining industry given the sharp

sell-off in precious metals prices, and especially so for Endeavour as we

launched a major mine and plant reconstruction program at El Cubo, which we

completed on time and under budget. We needed to enhance our cash flow to cover

our planned expenditures and we were successful notwithstanding the lower metals

prices."

"Management continues to focus on improving cash-flows by reducing costs and

increasing productivity where possible to offset the still declining precious

metals prices, especially at El Cubo. I would like to thank all of our managers,

employees and contractors for their valuable contributions in helping the

Company navigate these difficult times."

Q4 2013 Highlights

Three Months Ended Dec. 31 Year Ended Dec. 31

% %

2013 2012 Change Production 2013 2012 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Silver ounces

1,931,717 1,235,026 56% produced 6,813,069 4,485,476 52%

17,686 12,917 37% Gold ounces produced 75,578 38,687 95%

Payable silver

1,855,108 1,222,705 52% ounces produced 6,593,805 4,440,619 48%

Payable gold ounces

16,612 12,800 30% produced 72,562 38,311 89%

Silver equivalent

2,992,877 2,010,046 49% ounces produced(1) 11,347,749 6,806,696 67%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenue ($

67.9 66.7 2% millions)(2) 276.8 208.1 33%

2,155,326 1,345,832 60% Silver ounces sold 7,151,963 4,815,073 49%

18,960 13,037 45% Gold ounces sold 81,119 35,167 131%

Realized silver

20.52 32.87 -38% price per ounce 23.10 30.99 -25%

Realized gold price

1,246 1,725 -28% per ounce 1,375 1,674 -18%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Silver equivalent ounces calculated using 60:1 ratio

(2) Revenue from the sale of concentrates is subject to adjustments upon

final settlement. Concentrate sales are subject to mark-to-market

accounting treatments resulting in quarterly closing prices used for a

significant portion of metal sales. Reported revenue and realized prices

include adjustments to prior quarter sales on final settlement.

Fourth Quarter Production Data

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes Grade Grade

Production Tonnes per Ag Au Recovery Recovery Silver Gold

by mine Produced day gpt(1) gpt(1) Ag % Au % Oz Oz

----------------------------------------------------------------------------

Guanacevi 121,008 1,315 272 0.69 81.5% 85.2% 861,495 2,275

Bolanitos(2) 159,294 1,731 152 2.61 89.7% 75.9% 698,098 10,142

El Cubo 99,178 1,078 118 1.77 98.9% 93.4% 372,124 5,269

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated 379,480 4,125 181 1.78 87.3% 81.6% 1,931,717 17,686

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) gpt = grams per tonnes

(2) Includes 16,813 tonnes (183 tpd) processed at El Cubo

2013 Production Data

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Grade Grade

Tonnes Ag Au

Production Tonnes per gpt gpt Recovery Recovery Silver Gold

by mine Produced day (1) (1) Ag % Au % Oz Oz

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Guanacevi 435,922 1,194 253 0.60 78.2% 80.7% 2,772,227 6,784

Bolanitos(3) 710,708 1,947 149 2.63 84.6% 86.0% 2,881,816 51,652

El Cubo 391,354 1,072 107 1.57 86.1% 86.8% 1,159,026 17,142

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Consolidated 1,537,984 4,214 168 1.78 82.1% 85.6% 6,813,069 75,578

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) gpt = grams per tonnes

(3) Includes 150,526 tonnes (412 tpd) processed at El Cubo

At Guanacevi, the plant operated well above plan in the Fourth Quarter, 2013,

processing over 1,300 tonnes per day (tpd) at higher than planned grades and

recoveries. As a result, Guanacevi achieved record silver production in the

Fourth Quarter, 2013 and reported its highest ever annual production.

Throughput, grades and recoveries are expected to pull back closer to plan over

the long term.

At Bolanitos, mine output was reduced in November, 2013 to the 1,600 tpd

capacity of the plant and grades and recoveries continued to exceed plan. As a

result, Bolanitos also set both quarterly and annual production records in the

Fourth Quarter, 2013. No excess mine output is planned from Bolanitos near term

to fill the El Cubo plant to capacity, as the focus is now on expanding the El

Cubo mine output.

At El Cubo, the operational changes implemented over the past year have gained

traction and now appear to be sustainable. Production grades continue to trend

higher as the operation reduces dilution and eliminates production from

uneconomic stopes. Although no new material was fed into the El Cubo leach

circuit during the Fourth Quarter, the plant continued to recover ounces from

residual material in the circuit, resulting in approx. 10% higher recoveries

than expected.

About Endeavour Silver - Endeavour is a mid-tier silver mining company focused

on growing its profits, production, reserves and resources in Mexico. Since

start-up in 2004, Endeavour has posted nine consecutive years of accretive

growth of its silver mining operations. The organic expansion programs now

underway at Endeavour's three silver-gold mines in Mexico combined with its

strategic acquisition and exploration programs should facilitate Endeavour's

goal to become a premier senior silver producer.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of

the United States private securities litigation reform act of 1995 and

"forward-looking information" within the meaning of applicable Canadian

securities legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding Endeavour's anticipated

performance in 2014 and the timing and results of exploration drill programs.

The Company does not intend to, and does not assume any obligation to update

such forward-looking statements or information, other than as required by

applicable law.

Forward-looking statements or information involve known and unknown risks,

uncertainties and other factors that may cause the actual results, level of

activity, performance or achievements of Endeavour and its operations to be

materially different from those expressed or implied by such statements. Such

factors include, among others, changes in national and local governments,

legislation, taxation, controls, regulations and political or economic

developments in Canada and Mexico; operating or technical difficulties in

mineral exploration, development and mining activities; risks and hazards of

mineral exploration, development and mining; the speculative nature of mineral

exploration and development, risks in obtaining necessary licenses and permits,

and challenges to the Company's title to properties; as well as those factors

described in the section "risk factors" contained in the Company's most recent

form 40F/Annual Information Form filed with the S.E.C. and Canadian securities

regulatory authorities.

Forward-looking statements are based on assumptions management believes to be

reasonable, including but not limited to: the continued operation of the

Company's mining operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products will be

completed in accordance with management's expectations and achieve their stated

production outcomes, and such other assumptions and factors as set out herein.

Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements or information, there may be other factors that cause

results to be materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any forward-looking

statements or information will prove to be accurate as actual results and future

events could differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance on

forward-looking statements or information.

FOR FURTHER INFORMATION PLEASE CONTACT:

Endeavour Silver Corp.

Meghan Brown

Director Investor Relations

(604) 640-4804 or Toll free: (877) 685-9775

(604) 685-9744 (FAX)

mbrown@edrsilver.com

www.edrsilver.com

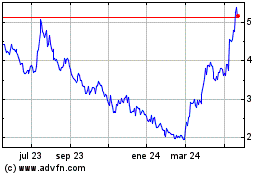

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

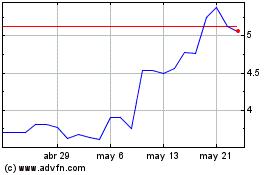

Endeavour Silver (TSX:EDR)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025