Troilus Gold Corp. (TSX: TLG; OTCQX: CHXMF; FSE: CM5R) (“Troilus”

or the “Company”), is pleased to report an updated Mineral Resource

Estimate (“MRE”) for the Troilus Project (the “Project”), located

in northcentral Quebec, Canada, within the Frôtet-Evans Greenstone

Belt.

Highlights of the 2023

MRE include:

- Total Indicated Mineral Resources of

11.21 Moz AuEq (508.3 Mt at 0.69 g/t AuEq), representing an

increase of 126% in ounces and a 187% increase in tonnes compared

to the 2020 MRE.

- Additional Inferred Mineral Resources of 1.80 Moz AuEq (80.5 Mt

at 0.69 g/t AuEq)

- Over 99% of the mineral resources in the Indicated category are

classified as amenable to “Open Pit” from zones Z87, J, X22, and

Southwest, which will form the basis of the Feasibility Study

anticipated for completion in early 2024.

- Significant definition at the Southwest Zone and the new

discovery of Zone X22 were major new contributors to the open pit

MRE, accounting for approximately 28% of the AuEq ounces in the

Indicated category. The breakdown by zone is as follows:

- Z87: 5.04Moz (197.1Mt at 0.80g/t AuEq),

accounting for approximately 45% of open pit Indicated mineral

resources.

- J Zone: 2.98 Moz AuEq (151.9Mt at 0.61g/t

AuEq), contributing 27% to the open pit Indicated mineral

resources.

- Southwest Zone: 1.89Moz AuEq (98.0Mt at 0.60

g/t AuEq), accounting for nearly 17% of the open pit mineral

resources in the Indicated category. A significant increase

compared to the 583,000 oz AuEq (22.6 Mt at 0.80 g/t AuEq) Inferred

ounces in the 2020 MRE.

- Zone X22: Discovered in late 2022, and with

only 23,256 metres drilled, this zone contributed 1.19Moz AuEq

(59.2Mt at 0.62 g/t AuEq) or 11% of total open pit Indicated

mineral resources.

Justin Reid, CEO and Director of Troilus

commented, “The significant growth of this Mineral Resource

Estimate reflects the focused and dedicated efforts of our

exploration team over the past three years, with a remarkable 126%

increase in ounces and a 187% surge in tonnes compared to our 2020

estimate. With an 11.21 Moz AuEq Indicated resource, we believe our

project is firmly positioned among North America's largest

undeveloped gold-copper deposits. The definition of the Southwest

Zone and the recently discovered X22 Zone has been especially

rewarding, with these zones contributing close to 30% of the

increased resource. We are also gratified with the excellent

quality of the resource, with most of our ounces appearing in the

Indicated category. Furthermore, almost the entirety of these

contained ounces are classified as ‘open pit’, which will form a

strong foundation for our upcoming Feasibility Study, expected to

be completed in early 2024. We continue to advance and de-risk our

asset with a clear strategic roadmap toward a production scenario,

with the goal of ultimately delivering the most value to our

shareholders.”

Figure 1. Mineral Resource Growth

in the Indicated Category from 2016-2023 (see Table 1 for complete

results, incl.

grade/tonnes)https://www.globenewswire.com/NewsRoom/AttachmentNg/d74c4348-16d4-465f-b22b-580dd49c6331

Figure 2. Troilus Project

Location Map and Mineral Deposits

Locationshttps://www.globenewswire.com/NewsRoom/AttachmentNg/ccf71f5d-c20f-4ca3-957b-565aaaf19d52

Figure 3. 2023 MRE Wireframes

and Pitshells + Resource Distribution by

Zonehttps://www.globenewswire.com/NewsRoom/AttachmentNg/b9a52c9b-7254-4f05-bb8a-e5f9a311cec9

Troilus Project Mineral Resource

Estimate

This MRE reflects the results of 505 drill holes

(216,502 metres of drilling) completed since the mineral resource

estimate announced in July 2020. Approximately half of the drilling

efforts were focused on the expansion and definition of the

Southwest and X22 zones, the two most recently discovered ore

bodies, which are both drilled to an Indicated level of confidence

and will be included in the Feasibility Study’s mining

scenario.

The updated MRE for the Troilus Project was

prepared by Mr. Paul Daigle, Senior Resource Geologist at AGP

Mining Consultants Inc. (“AGP”) in accordance with the National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and CIM Definition Standards for Mineral Resources and

Mineral Reserves.

Table 1. Total Indicated

and Inferred Mineral Resources,

All Zones

|

Category |

Tonnes (Mt) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

AuEq (g/t) |

Gold (Moz) |

Copper (Mlb) |

Silver (Moz) |

AuEq (Moz) |

|

Indicated |

508.3 |

0.57 |

0.07 |

1.09 |

0.69 |

9.32 |

729.50 |

17.79 |

11.21 |

|

Inferred |

80.5 |

0.58 |

0.07 |

1.47 |

0.69 |

1.49 |

115.41 |

3.81 |

1.80 |

Z87The largest of the two

formerly mined pits, zone Z87 contributed 5.04Moz AuEq (197.1Mt at

0.80g/t AuEq), or approximately 45% of the open pit Indicated

mineral resources.

J Zone The J Zone is the

smaller of the two formerly mined pits, contributing 2.98 Moz AuEq

(151.9Mt at 0.61g/t AuEq) or 27% to the open pit Indicated mineral

resources.

Southwest Zone

Discovered in late 2019, the Southwest Zone is

located ~2.5 kilometres southwest of the formerly mined Z87 pit.

8,500 metres of drill data from this zone was incorporated into the

Company’s 2020 mineral resource estimate, which resulted in

estimated Inferred mineral resources of 583,000 AuEq ounces (22.6

Mt @ 0.80 g/t AuEq). Since then, approximately 100,000 metres (208

holes) of additional drilling were completed in this zone,

resulting in a mineralized footprint with a ~2-kilometre strike

length, and a significantly expanded mineral resource of 1.89 Moz

AuEq (98.0Mt at 0.60 g/t AuEq) in the Indicated category. The

Southwest Zone is a major new contributor to the new updated MRE,

accounting for nearly 17% of the total Indicated mineral resource

of the project.

Zone X22

Zone X22 is a NE-SW deformation corridor that

originates in the western wall of Zone 87 and extends to the

southwest into the Gap Zone. The zone was initially discovered in

October 2022 as part of an ongoing drill program targeting the

extremities of the Z87 2020 pit shell. A total of 23,256 metres (80

drill holes) have been drilled at X22 since its discovery, which

expanded the zone’s footprint to over 1 kilometre and contributed

over 10% of the total open pit Indicated mineral resources of the

project with 1.19Moz AuEq (59.2 Mt at 0.62 g/t AuEq).

The combination of infill drilling at an

increased drill density, and the discovery and expansion of two new

mineralized zones, has resulted in a 126% increase in Indicated

mineral resources compared to the 2020 MRE, and a conversion from

Inferred (2020 MRE) to Indicated (2023 MRE) of nearly 100%. The

mineral resource estimates for Z87, J Zone and the Southwest Zone

contain both open pit and underground resources, while Zone X22

contains solely open pit mineral resources (see Tables 2 and

3).

Figure 4. Open Pit Growth by Zone

in the Indicated Category,

2016-2023https://www.globenewswire.com/NewsRoom/AttachmentNg/db2a87a0-80e8-4280-b38f-41a090ea5a89

Table 2 – Total Indicated Mineral

Resources, by Zone

|

Zones |

Tonnes (Mt) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

AuEq (g/t) |

Gold (Moz) |

Copper (Mlb) |

Silver (Moz) |

AuEq (Moz) |

|

OPEN PIT |

|

|

|

TOTAL OP |

506.2 |

0.57 |

0.07 |

1.09 |

0.68 |

9.23 |

725.66 |

17.67 |

11.11 |

|

|

|

Z87 |

197.1 |

0.67 |

0.07 |

1.21 |

0.80 |

4.21 |

320.69 |

7.67 |

5.04 |

|

|

|

J Zone |

151.9 |

0.50 |

0.06 |

0.96 |

0.61 |

2.45 |

215.71 |

4.71 |

2.98 |

|

|

|

X22 |

59.2 |

0.51 |

0.06 |

1.24 |

0.62 |

0.98 |

79.34 |

2.35 |

1.19 |

|

|

|

Southwest |

98.0 |

0.50 |

0.05 |

0.94 |

0.60 |

1.59 |

109.91 |

2.94 |

1.89 |

|

UNDERGROUND |

|

|

|

TOTAL UG |

2.1 |

1.35 |

0.09 |

1.90 |

1.51 |

0.09 |

3.84 |

0.13 |

0.10 |

|

|

|

Z87 |

0.5 |

1.59 |

0.15 |

0.54 |

1.83 |

0.02 |

1.55 |

0.01 |

0.03 |

|

|

|

J Zone |

0.2 |

1.21 |

0.07 |

1.46 |

1.33 |

0.01 |

0.29 |

0.01 |

0.01 |

|

|

|

Southwest |

1.4 |

1.28 |

0.07 |

2.44 |

1.42 |

0.06 |

2.00 |

0.11 |

0.06 |

|

Total INDICATED (OP + UG) |

|

|

|

TOTAL |

508.3 |

0.57 |

0.07 |

1.09 |

0.69 |

9.32 |

729.50 |

17.79 |

11.21 |

Table 3. Total Inferred Mineral

Resources, by Zone

|

Zones |

Tonnes (Mt) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

AuEq (g/t) |

Gold (Moz) |

Copper (Mlb) |

Silver (Moz) |

AuEq (Moz) |

|

OPEN PIT |

|

|

|

TOTAL OP |

76.5 |

0.53 |

0.06 |

1.12 |

0.65 |

1.31 |

108.66 |

2.75 |

1.59 |

|

|

|

Z87 |

37.1 |

0.59 |

0.06 |

1.11 |

0.70 |

0.71 |

50.17 |

1.33 |

0.84 |

|

|

|

J Zone |

24.2 |

0.46 |

0.07 |

0.94 |

0.57 |

0.35 |

35.37 |

0.73 |

0.44 |

|

|

|

X22 |

13.6 |

0.53 |

0.07 |

1.48 |

0.67 |

0.23 |

21.76 |

0.65 |

0.29 |

|

|

|

Southwest |

1.6 |

0.37 |

0.04 |

0.96 |

0.45 |

0.02 |

1.36 |

0.05 |

0.02 |

|

Underground |

|

|

|

TOTAL UG |

4.0 |

1.36 |

0.08 |

8.21 |

1.58 |

0.18 |

6.75 |

1.06 |

0.20 |

|

|

|

Z87 |

1.1 |

1.99 |

0.12 |

0.46 |

2.19 |

0.07 |

2.96 |

0.02 |

0.08 |

|

|

|

J Zone |

1.0 |

1.25 |

0.05 |

0.99 |

1.34 |

0.04 |

1.13 |

0.03 |

0.04 |

|

|

|

Southwest |

1.9 |

1.05 |

0.06 |

16.62 |

1.37 |

0.06 |

2.66 |

1.01 |

0.08 |

|

Total INFERRED (OP + UG) |

|

|

|

TOTAL |

80.5 |

0.58 |

0.07 |

1.47 |

0.69 |

1.49 |

115.41 |

3.81 |

1.80 |

The MRE sensitivity table (see Table 4) shows

the potential for higher-grade Mineral Resources at higher gold

equivalent cut-offs.

Table 4. Open-Pit MRE Sensitivity

Table

|

Cut-off Grade (g/t AuEq) |

Tonnes (Mt) |

AuEq (g/t) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Gold (Moz) |

Copper (Mlb) |

Silver (Moz) |

AuEq (Moz) |

|

|

|

Indicated |

|

0.50 |

264.9 |

0.95 |

0.80 |

0.08 |

1.33 |

6.85 |

477.86 |

11.30 |

8.08 |

|

0.45 |

311.8 |

0.88 |

0.74 |

0.08 |

1.27 |

7.41 |

532.64 |

12.701 |

8.79 |

|

0.40 |

364.0 |

0.81 |

0.68 |

0.07 |

1.21 |

8.01 |

593.64 |

14.26 |

9.55 |

|

0.35 |

432.7 |

0.74 |

0.62 |

0.07 |

1.15 |

8.63 |

659.96 |

15.96 |

10.34 |

|

0.30 |

506.2 |

0.68 |

0.57 |

0.07 |

1.09 |

9.23 |

725.66 |

17.67 |

11.11 |

|

0.25 |

584.5 |

0.63 |

0.52 |

0.06 |

1.03 |

9.76 |

784.98 |

19.28 |

11.80 |

|

|

|

Inferred |

|

0.50 |

37.8 |

0.91 |

0.77 |

0.08 |

1.38 |

0.94 |

67.03 |

1.68 |

1.11 |

|

0.45 |

45.2 |

0.84 |

0.71 |

0.08 |

1.31 |

1.03 |

75.76 |

1.91 |

1.22 |

|

0.40 |

54.0 |

0.77 |

0.65 |

0.07 |

1.25 |

1.12 |

85.85 |

2.167 |

1.34 |

|

0.35 |

64.3 |

0.71 |

0.59 |

0.07 |

1.19 |

1.22 |

96.97 |

2.45 |

1.47 |

|

0.30 |

76.5 |

0.65 |

0.53 |

0.06 |

1.12 |

1.31 |

108.66 |

2.75 |

1.59 |

|

0.25 |

90.9 |

0.59 |

0.48 |

0.06 |

1.05 |

1.41 |

120.41 |

3.06 |

1.72 |

Figure 5 depicts a linear relationship between

ore tonnes and grade at variable cutoff grades, outlining a robust

resource that has low sensitivity to changing cut-off grades caused

by changing market or economic conditions.

Figure 5. Grade and Tonnage vs.

Cut-off (Indicated Mineral

Resources)https://www.globenewswire.com/NewsRoom/AttachmentNg/0aad28aa-d820-4a2a-aef5-1ca4f7f20c68

Figure 6. 2023 Mineral Resource

Estimate Pit Constrained Block

modelhttps://www.globenewswire.com/NewsRoom/AttachmentNg/583e3af5-9d91-437b-8816-3c9f762e5e29

Figure 7. 2020 vs. 2023 Mineral

Resource Estimate Cross

Sectionshttps://www.globenewswire.com/NewsRoom/AttachmentNg/c35370aa-f929-4439-b24c-fa4add5db52b

Notes Related to the Mineral Resource

Estimate

- The independent and qualified person for the mineral resource

estimate, as defined by NI 43 101, is Paul Daigle, géo., Senior

Resource Geologist at AGP. The effective date of the estimate is

October 2, 2023.

- Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

- Summation errors may occur due to rounding.

- Open pit mineral resources are reported within an optimized

constraining shells.

- Open pit cut-off grade is 0.3 g/t AuEq where the metal

equivalents were calculated as follows:

- Z87 Zone : AuEq = Au grade + 1.5628 * Cu grade + 0.0128 *

Ag grade

- J Zone : AuEq = Au grade + 1.5107 * Cu grade + 0.0119 * Ag

grade

- X22 Zone : AuEq = Au grade + 1.5628 * Cu grade + 0.0128*

Ag grade

- SW Zone : AuEq = Au grade + 1.6823 * Cu grade + 0.0124 *

Ag grade

- Metal prices for the AuEQ formulas are: $US 1,850/ oz Au;

$4.25/lb Cu, and $23.00/ oz Ag; with an exchange rate of US$1.00:

CAD$1.30

- Metal recoveries for the AuEq formulas are:

- Z87 Zone: 95.5% for Au recovery, 94.7% for Cu recovery and

98.2% for Ag recovery

- J Zone: 93.1% for Au recovery, 89.3% for Cu recovery and 88.9%

for Ag recovery

- X22 Zone: 95.5% for Au recovery, 94.7% for Cu recovery and

98.2% for Ag recovery

- SW Zone: 85.7% for Au recovery, 91.5% for Cu recovery and 85.6%

for Ag recovery

- The resource constraining shells were generated with:

- Metal Prices: Gold $US 1,850/oz, Copper $US 4.25/lb, Silver $US

23/oz

- Mining Costs:

- J Zone:

- waste – base $Cdn 2.15/t moved (incremental below 5360 $Cdn

0.039/t moved)

- ore – base $Cdn 2.29/t moved (incremental below 5360 $Cdn

0.036/t moved)

- 87 Zone

- Waste – base $Cdn 1.99/t moved (incremental below 5360 $Cdn

0.041/t moved)

- Ore – base $Cdn 2.10/t moved (incremental below 5360 $Cdn

0.029/t moved)

- SW Zone

- Waste – base $Cdn 2.01/t moved (incremental below 5360 $Cdn

0.036/t moved)

- Ore – base $Cdn 2.37/t moved (incremental below 5360 $Cdn

0.028/t moved)

- X22 Zone

- Waste – base $Cdn 2.15/t moved (incremental below 5360 $Cdn

0.039/t moved)

- Ore – base $Cdn 2.29/t moved (incremental below 5360 $Cdn

0.036/t moved)

- Process and G&A Costs: $Cdn 9.05/t

- Wall slopes: varied between 39 and 49 degrees depending on pit

area and slope sector.

- Overall Metal Recoveries:

- J Zone - 91% Au, 88% Ag, 89% Cu

- 87 Zone - 94% Au, 98% Ag, 94% Cu

- SW Zone - 82% Au, 86% Ag, 91% Cu

- X22 Zone - 93% Au, 98% Ag, 93% Cu (X22 recoveries are estimates

based on J Zone. Metallurgical test work is underway for X22)

- Capping of grades varied between 2.30 g/t Au and 14.60 g/t Au;

between 0.07% cu and 4.36 %Cu, and between 4.90 g/t Ag and 55.00

g/t Ag; on raw assays.

- The density (excluding overburden and fill) varies between 2.64

g/cm3 and 2.93 g/cm3 depending on lithology for each zone.

- Underground cut-off grade is 0.9 g/t AuEq for Z87, J and

SW

The complete technical report associated with

the updated mineral resource estimate (the “Technical Report”) will

be available on SEDAR+ at www.sedarplus.ca under the Company’s

issuer profile, as well as the Company’s website at

www.troilusgold.com within 45 calendar days.

Qualified Persons

The technical and scientific information in this

press release has been reviewed and approved by Nicolas Guest,

P.Geo., Exploration Manager, who is a Qualified Person as defined

by NI 43-101. Mr. Guest is an employee of Troilus and is not

independent of the Company under NI 43-101.

The updated mineral resource estimate disclosed

in this press release was prepared by Mr. Paul Daigle, géo., Senior

Resource Geologist with AGP. Mr. Paul Daigle, who is an independent

Qualified Person as defined under NI 43-101, has reviewed and

approved the mineral resource estimate disclosed in this press

release.

About Troilus Gold Corp.

Troilus Gold Corp. is a Canadian-based junior

mining company focused on the systematic advancement and de-risking

of the former gold and copper Troilus Mine towards production. From

1996 to 2010, the Troilus Mine produced +2 million ounces of gold

and nearly 70,000 tonnes of copper. Troilus’ claims cover 435 km²

in the top-rated mining jurisdiction of Quebec, Canada, within the

Frotêt-Evans Greenstone Belt. Since acquiring the project in 2017,

ongoing exploration success has demonstrated the tremendous scale

potential of the gold system on the property with significant

mineral resource growth. Led by an experienced team with a track

record of successful mine development, Troilus is positioned to

become a cornerstone project in North America.

For more information:

Justin Reid Chief Executive

Officer, Troilus Gold Corp. +1 (647) 276-0050 x 1305

justin.reid@troilusgold.com

Caroline Arsenault VP Corporate

Communications +1 (647) 407-7123 info@troilusgold.com

Cautionary statements

This press release contains “forward‑looking

information” within the meaning of applicable Canadian securities

legislation. Forward‑looking information includes, but is not

limited to, statements about the mineral resource estimate for the

Project; the timing of completion and filing of a National

Instrument 43-101 technical report related to Project and the

impact of the report on the Company; and statements with respect

the timing and other aspects of the Feasibility Study. Generally,

forward-looking statements can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “continue”, “anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, “will”, “might” or “will be taken”, “occur” or

“be achieved”. Forward-looking statements are made based upon

certain assumptions and other important facts that, if untrue,

could cause the actual results, performances or achievements of

Troilus to be materially different from future results,

performances or achievements expressed or implied by such

statements. Such statements and information are based on numerous

assumptions regarding present and future business strategies and

the environment in which Troilus will operate in the future.

Certain important factors that could cause actual results,

performances or achievements to differ materially from those in the

forward-looking statements include, amongst others, currency

fluctuations, the global economic climate, dilution, share price

volatility and competition. Forward-looking statements are subject

to known and unknown risks, uncertainties and other important

factors that may cause the actual results, level of activity,

performance or achievements of Troilus to be materially different

from those expressed or implied by such forward-looking statements,

including but not limited to: the impact the COVID 19 pandemic may

have on the Company’s activities (including without limitation on

its employees and suppliers) and the economy in general; the impact

of the recovery post COVID 19 pandemic and its impact on gold and

other metals; there being no assurance that the exploration program

or programs of the Company will result in expanded mineral

resources; risks and uncertainties inherent to mineral resource

estimates; the high degree of uncertainties inherent to feasibility

studies and other mining and economic studies which are based to a

significant extent on various assumptions; variations in gold

prices and other precious metals, exchange rate fluctuations;

variations in cost of supplies and labour; receipt of necessary

approvals; general business, economic, competitive, political and

social uncertainties; future gold and other metal prices;

accidents, labour disputes and shortages; environmental and other

risks of the mining industry, including without limitation, risks

and uncertainties discussed in the Technical Report, the Company’s

latest annual information form and in other continuous disclosure

documents of the Company available under the Company’s profile at

www.sedarplus.ca. Although Troilus has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Troilus does not undertake

to update any forward-looking statements, except in accordance with

applicable securities laws.

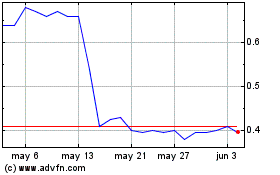

Troilus Gold (TSX:TLG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Troilus Gold (TSX:TLG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025