Wilmington Announces First Quarter 2023 Results

09 Mayo 2023 - 4:00PM

Wilmington Capital Management Inc. (“Wilmington” or the

“Corporation”) reported net loss for the three months ended March

31, 2023 of $0.6 million or $(0.05) per share compared to net

income of $0.08 million or $0.07 per share for the same period in

2022.

OPERATIONS REVIEW – For the Quarter

Ended March 31, 2023 As at March 31, 2023, Wilmington had

assets under management in its operating platforms of approximately

$429 million ($100 million representing Wilmington’s share). A

summary of the Corporation and the operations of its investees is

set out below.

MarinasMaple Leaf Partnerships

In Q1 2023, the Maple Leaf Partnerships successfully completed the

acquisition of two marquee marinas in Ontario and now own 20

marinas with over 8,000 boat slips and dry rack slips, all within 2

hours driving time of Toronto, Ontario. This represents a 61%

increase in the number of slips and dry rack slips owned at the

beginning of 2022.Closings of lot sales commenced during the

quarter at Champlain Shores (formerly Bay Moorings) and the first

completed homes are expected in the summer of 2023. To facilitate

the land development and home construction program, the Corporation

funded an additional $2 million under the terms of the revolving

loan facility. Proceeds from the lot sales will repay the loan of

which $1 million was repaid in May 2023.Subsequent to the quarter,

the Maple Leaf Partnerships completed the acquisition of a 358 wet

and dry rack slip marina funded by cash, proceeds from a fixed rate

mortgage and a $7.5 million capital raise (Corporation’s share $1.3

million).Real Estate Bow City Partnership The Bow

City Self Storage facility was successful in increasing occupancy

levels and rental rates in what is historically a slow quarter in

the self storage industry.Sunchaser PartnershipIn Q1 2023, the

Sunchaser Partnership acquired a marquee RV resort and marina in

British Columbia having 156 full service sites and 70 boat slips

situated on 12 acres of waterfront lands. In addition, an expansion

of one of the existing RV resorts is well underway and

approximately 150 new or upgraded sites will be available for

campers later this summer.Private Equity

Northbridge, Northbridge Fund 2016, Northbridge Fund 2021 SP#1 and

Northbridge Fund 2022 SP#2 and Northbridge Fund SP#4 During Q1

2023, Northbridge called the remaining capital for its most recent

fund, Northbridge Fund SP#4. The funds have essentially been

invested and have generated good returns to date.Northbridge

manages approximately $68 million of assets as at March 31, 2023

(December 31, 2022 - $74 million).Outlook The

first quarter of 2023 was an active period for the Corporation

which saw follow-on investments in most of its operating

platforms.The Maple Leaf Partnerships continued to significantly

grow the platform in terms of wet slips and dry rack slip counts

and now owns 20 marinas. Early indications are that the Maple Leaf

Partnerships will have a successful 2023 boating season. Bow City

Self Storage continued to exceed initial expectations in terms of

net absorption and rental rates. The Sunchaser Partnership added a

marquee property and continues to actively seek additional

opportunities while turning its attention to the upcoming

recreational season.Wilmington continues to seek growth

opportunities for each of its platforms and will continue to be

prudent and patient in exploring investment opportunities.

FINANCIAL RESULTS

STATEMENT OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS) (unaudited)

| For the |

|

|

Three months ended March 31, |

|

(CDN $ thousands, except per share amounts) |

|

|

|

2023 |

2022 |

|

|

|

|

|

|

|

| Management fee revenue |

|

|

|

120 |

|

95 |

|

| Interest and other income |

|

|

|

626 |

|

244 |

|

|

|

|

|

|

746 |

|

339 |

|

|

Expenses |

|

|

|

|

|

| General and administrative |

|

|

|

(467) |

|

(468) |

|

| Amortization |

|

|

|

(7) |

|

(7) |

|

| Finance costs |

|

|

|

(2) |

|

(2) |

|

| Stock-based compensation |

|

|

|

(49) |

|

(138) |

|

|

|

|

|

|

(525) |

|

(615) |

|

|

Fair value adjustments and other activities |

|

|

|

|

|

| Fair value adjustments to

investments |

|

|

|

(610) |

|

1,069 |

|

| Equity accounted income

(loss) |

|

|

|

(13) |

|

162 |

|

|

|

|

|

|

(623) |

|

1,231 |

|

|

Income (loss) before income taxes |

|

|

|

(402) |

|

955 |

|

|

Current income tax recovery (expense) |

|

|

|

(120) |

|

44 |

|

|

Deferred income tax expense |

|

|

|

(52) |

|

(133) |

|

|

Provision for income taxes |

|

|

|

(172) |

|

(89) |

|

|

Net income (loss) |

|

|

|

(574) |

|

866 |

|

|

Other comprehensive income |

|

|

|

|

|

| Items that will not

be reclassified to net income (loss): |

|

|

|

|

Fair value adjustments to investments |

|

|

|

(170 |

) |

353 |

|

|

Related income taxes |

|

|

|

34 |

|

(45 |

) |

|

Other comprehensive income (loss), net of income taxes |

|

|

(136 |

) |

308 |

|

|

Comprehensive income (loss) |

|

|

|

(710 |

) |

1,174 |

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

|

|

|

|

|

Basic |

|

|

|

(0.05 |

) |

0.07 |

|

|

Diluted |

|

|

|

(0.05 |

) |

0.07 |

|

BALANCE SHEETS

| (unaudited) |

|

|

March 31, |

December 31, |

|

(CDN $ thousands) |

|

|

2023 |

2022 |

|

|

|

|

|

|

| Assets |

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

| Investment in Maple Leaf

Partnerships |

|

|

21,236 |

18,637 |

| Investment in Bow City

Partnerships |

|

|

3,864 |

3,864 |

| Investment in Sunchaser

Partnership |

|

|

2,911 |

1,806 |

| Investment in Northbridge and

Energy Securities |

|

|

8,493 |

7,284 |

| Right-of-use asset |

|

|

85 |

92 |

|

|

|

|

36,589 |

31,683 |

| CURRENT ASSETS |

|

|

|

|

| Cash |

|

|

1,366 |

4,007 |

| Short term securities |

|

|

19,000 |

22,000 |

| Amounts receivable and other

assets |

|

|

12,927 |

13,083 |

|

Total assets |

|

|

69,882 |

70,773 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| NON-CURRENT LIABILITIES |

|

|

|

|

| Deferred income tax

liabilities |

|

|

1,334 |

1,316 |

| Lease liabilities |

|

|

118 |

116 |

|

|

|

|

1,452 |

1,432 |

| CURRENT LIABILITIES |

|

|

|

|

| Lease liabilities |

|

|

19 |

38 |

| Income taxes payable |

|

|

238 |

118 |

|

Amounts payable and other |

|

|

721 |

790 |

|

Total liabilities |

|

|

2,430 |

2,378 |

|

|

|

|

|

|

| Equity |

|

|

|

|

| Shareholders’ equity |

|

|

51,270 |

51,179 |

| Contributed surplus |

|

|

1,158 |

1,482 |

| Retained earnings |

|

|

6,808 |

7,382 |

| Accumulated other comprehensive

income |

|

|

8,216 |

8,352 |

|

Total equity |

|

|

67,452 |

68,395 |

|

Total liabilities and equity |

|

|

69,882 |

70,773 |

Executive Officers of the Corporation will be

available at 403-705-8038 to answer any questions on the

Corporation’s financial results.

STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS AND OTHER MEASUREMENTSCertain statements

included in this document may constitute forward-looking statements

or information under applicable securities legislation.

Forward-looking statements that are predictive in nature, depend

upon or refer to future events or conditions, include statements

regarding the operations, business, financial conditions, expected

financial results, performance, opportunities, priorities, ongoing

objectives, strategies and outlook of the Corporation and its

investee entities and contain words such as "anticipate",

"believe", "expect", "plan", "intend", "estimate", "propose", or

similar expressions and statements relating to matters that are not

historical facts constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation.

While the Corporation believes the anticipated

future results, performance or achievements reflected or implied in

those forward-looking statements are based upon reasonable

assumptions and expectations, the reader should not place undue

reliance on forward-looking statements and information because they

involve known and unknown risks, uncertainties and other factors,

many of which are beyond the Corporation’s control, which may cause

the actual results, performance and achievements of the Corporation

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information.

Factors and risks that could cause actual

results to differ materially from those contemplated or implied by

forward-looking statements include but are not limited to: the

ability of management of Wilmington and its investee entities to

execute its and their business plans; availability of equity and

debt financing and refinancing within the equity and capital

markets; strategic actions including dispositions; business

competition; delays in business operations; the risk of carrying

out operations with minimal environmental impact; industry

conditions including changes in laws and regulations including the

adoption of new environmental laws and regulations and changes in

how they are interpreted and enforced; operational matters related

to investee entities business; incorrect assessments of the value

of acquisitions; fluctuations in interest rates; stock market

volatility; general economic, market and business conditions; risks

associated with existing and potential future law suits and

regulatory actions against Wilmington and its investee entities;

uncertainties associated with regulatory approvals; uncertainty of

government policy changes; uncertainties associated with credit

facilities; changes in income tax laws, tax laws; changes in

accounting policies and methods used to report financial condition

(including uncertainties associated with critical accounting

assumptions and estimates); the effect of applying future

accounting changes; and other risks, factors and uncertainties

described elsewhere in this document or in Wilmington's other

filings with Canadian securities regulatory authorities.

The foregoing list of important factors that may

affect future results is not exhaustive. When relying on the

forward-looking statements, investors and others should carefully

consider the foregoing factors and other uncertainties and

potential events. Except as required by law, the Corporation

undertakes no obligation to publicly update or revise any

forward-looking statements or information, that may be as a result

of new information, future events or otherwise. These

forward-looking statements are effective only as of the date of

this document.

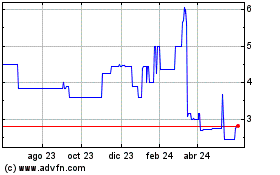

Wilmington Capital Manag... (TSX:WCM.A)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

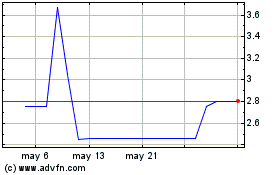

Wilmington Capital Manag... (TSX:WCM.A)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024